Professional Documents

Culture Documents

Michael Dichiro JR

Uploaded by

Angus Davis0 ratings0% found this document useful (0 votes)

10 views4 pagesJohnston Municipal Court Judge - Johnston. Narragansett Bay Commission (Commissioner) State

Original Title

Michael Dichiro Jr

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentJohnston Municipal Court Judge - Johnston. Narragansett Bay Commission (Commissioner) State

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views4 pagesMichael Dichiro JR

Uploaded by

Angus DavisJohnston Municipal Court Judge - Johnston. Narragansett Bay Commission (Commissioner) State

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

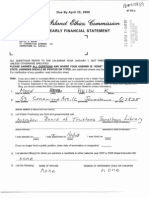

Due By April 28, 2006 a

2005 YEARLY FINANCIAL STATEMENT

te 7

MICHAEL DICHIRO JR

1405 PLAINFIELD STREET

JOHNSTON RI 02919

L oon

ALL QUESTIONS REFER TO THE CALENDAR YEAR JANUARY 1, 2005 THROUGH DECEMBER 31, 2005

UNLESS OTHERWISE SPECIFIED.

Please answer all questions and where your answer is "none" or "not applicable" so state. ANSWERS SHOULD BE

PRINTED OR TYPED, and additional sheets may be used if more space is needed. For clarification of any question,

read instruction sheet.

Note: If you are a state or municipal official or employee that is required to file a Yearly Financial Statement, a failure

to file the Statement is a violation of the law and may subject you to substantial penalties, including fines. If

you received 2 2005 Yearly Financial Statement in the mail but believe you did not hold @ public position in

2005 or 2006 that requires such filing, you should contact the Ethics Commission (See Instruction Sheet for

‘contact information).

: DiChiro Michae/ 7

Tao OFFAL ay Retr aay

2 LU Su wre Dr, Toluston RE O2Z,

ow RoE eRe TenviToE TP CODE

Los Plamtielh St — Tohnston, RE O24

‘WR ADDRESS (eae Rome SAT

3. List Public Position(s) you hold and governmental unit: h

Jahncton Municipal Courr Sodge Jahns ton

vse sss SS

Nat asansg Lt Ba, Conn. (epsisiener) ele

use Foray ‘HORSE, STATE OR RESORT

was elected in "ea Iwas appointed in tg 4 7 |Lwas hired in

Gear) ‘weary wear)

Ifyou no longer hold a public position, state year of termination or resignation

4. List elected office(s) for which you were/are a candidate in either calendar year 2006 or 2006 (Read instruction #4)

NONE

5. List the following: NAME OF SPOUSE NAME(S) OF DEPENDENT CHILD OR CHILDREN

Qe eph anie Di Chiro NONE |

6. List the names of any employer from which you, your spouse, or dependent child received $1,000 or more gross

income during calendar year 2005. If self-employed, list any occupation from which $1,000 or more gross income

was received. If employed by a state or municipal agency, or if self-employed and services were rendered to a

state or municipal agency for an amount of income in excess of $250.00, list the date and nature of services

rendered. If the public position or employment listed in #3, above, provides you with an amount of gross income in

excess of $250.00 it must be listed here. (Do Not List Amounts.)

wae oF Fam suse ve Acne shee Amo NATURE

wee, orewptoven on ocepmaTIOn oF MoRnceS RENDERED

Michso| DiChwo Ja. Town of Sohusty — Municypal Covet Tedeg

1994 to Presenf-

Stephanie DIChwo Cty of Cranston — [9S Eo presen

7. List the address or legal description of any real estate, other than your principal residence, in which you, your

spouse, or dependent child had a financial interest.

NAMES NATURE OF INTEREST ADDRESS OR DESCRIPTION

Michael Di'Chiro 20 owner sbi 1465 PlamliclhS1

OT Belding Tohusyon ¢ (Ot

8. List the name of any trust, name and address of the trustee of any trust, from which you, your spouse, or

dependent child or children individually received $1,000 or more gross income. List assets if known. (Do Not List

Amounts.)

sae oF rust NODE

[NAME OF TRUSTEE AND ADDRESS:

NAME OF FAMILY MEMBER

RECEIVING TRUST INCOME:

ASSETS:

9. List the name and address of any business, profit or non-profit, in which you, your spouse, or dependent child held

a position as a director, officer, partner, trustee, or a management position,

Michael DiChirg HOS Plantre ld Mente

Strevt Realty, Lue

Ouner of Law

OF ice Bus ling

10. List the name and address of any interested person, or business entity, that made total gifts or total contributions in

excess of $100 in cash or property during calendar year 2005 to you, your spouse, or dependent child. Certain

gifts from relatives and certain campaign contributions are excluded. (See instruction #10)

NAME OF PERSON RECEIVING NAME AND ADDRESS OF PERSON OR ENTITY

(GIFT OR CONTRIBUTION MAKING GIFT OR CONTRIBUTION

NONE

11. List the name and address of any business in which you, your spouse, or dependent child individually or

collectively holds a 10% or greater ownership interest, or @ $5,000 or greater ownership or investment interest.

NAME OF FAMILY MEMBER NAME AND ADDRESS OF BUSINESS

Michae! Di Chivo 1405 Plant ell Sf.

Realty , LLc.

12. If any business listed in #11, above, did business in excess of a total of $250 in calendar year 2005 with a state or

‘municipal agency, AND you are a member or employee of the agency or exercise direct or legislative control over

the agency, lst the following

NAME AND ADDRESS NAME OF AGENCY DATE AND NATURE

‘OF BUSINESS: (OF TRANSACTION

NONE-

13. If any business listed in #11, above, was a business entity subject to direct regulation by a state or municipal

agency, and you are a member or employee of the agency or exercise direct or legislative control over the agency,

list the following:

NAME AND ADDRESS OF BUSINESS NAME OF REGULATING AGENCY

N ONE

You might also like

- Robert L MushenDocument4 pagesRobert L MushenAngus DavisNo ratings yet

- George C MooreDocument5 pagesGeorge C MooreAngus DavisNo ratings yet

- 2009 Top 75Document6 pages2009 Top 75Angus DavisNo ratings yet

- Stephen MurrayDocument4 pagesStephen MurrayAngus DavisNo ratings yet

- Hal MorganDocument4 pagesHal MorganAngus DavisNo ratings yet

- Christopher J MontalbanoDocument4 pagesChristopher J MontalbanoAngus DavisNo ratings yet

- James V MurrayDocument4 pagesJames V MurrayAngus DavisNo ratings yet

- Robert P MurrayDocument4 pagesRobert P MurrayAngus DavisNo ratings yet

- Peter J MurrayDocument4 pagesPeter J MurrayAngus DavisNo ratings yet

- Heidi K MoonDocument4 pagesHeidi K MoonAngus DavisNo ratings yet

- David A MurrayDocument4 pagesDavid A MurrayAngus DavisNo ratings yet

- David S MorrisonDocument4 pagesDavid S MorrisonAngus DavisNo ratings yet

- Francis J MurrayDocument4 pagesFrancis J MurrayAngus DavisNo ratings yet

- Jeffrey J MurrayDocument4 pagesJeffrey J MurrayAngus DavisNo ratings yet

- Patricia L MorganDocument4 pagesPatricia L MorganAngus DavisNo ratings yet

- Thomas H MongeauDocument4 pagesThomas H MongeauAngus DavisNo ratings yet

- Vincent MonafoDocument4 pagesVincent MonafoAngus DavisNo ratings yet

- Bruce Q MorinDocument4 pagesBruce Q MorinAngus DavisNo ratings yet

- Robert P MulliganDocument4 pagesRobert P MulliganAngus DavisNo ratings yet

- E Pierre MorenonDocument4 pagesE Pierre MorenonAngus DavisNo ratings yet

- Mildred S MorrisDocument4 pagesMildred S MorrisAngus DavisNo ratings yet

- Carylon A MorrisonDocument4 pagesCarylon A MorrisonAngus DavisNo ratings yet

- Kelley N MorrisDocument4 pagesKelley N MorrisAngus DavisNo ratings yet

- John J MullaneyDocument4 pagesJohn J MullaneyAngus DavisNo ratings yet

- William W MuesselDocument4 pagesWilliam W MuesselAngus DavisNo ratings yet

- John J Mulhearm JRDocument4 pagesJohn J Mulhearm JRAngus DavisNo ratings yet

- Stephen S MuellerDocument4 pagesStephen S MuellerAngus DavisNo ratings yet

- Barbara C RaoDocument4 pagesBarbara C RaoAngus DavisNo ratings yet

- Larry V MouradjianDocument4 pagesLarry V MouradjianAngus DavisNo ratings yet

- Kenneth W MottDocument4 pagesKenneth W MottAngus DavisNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)