Professional Documents

Culture Documents

Kelley N Morris

Uploaded by

Angus Davis0 ratings0% found this document useful (0 votes)

10 views4 pagesTown Council District 3 Cumberland

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentTown Council District 3 Cumberland

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

0 ratings0% found this document useful (0 votes)

10 views4 pagesKelley N Morris

Uploaded by

Angus DavisTown Council District 3 Cumberland

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF or read online from Scribd

You are on page 1of 4

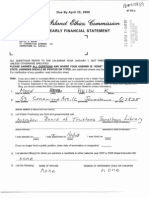

TOA 10 P76

07 FS-1

Due By April 25, 2008 ,

2007 YEARLY FINANCIAL STATEMENT

ee all

KELLEY N MORRIS

60 COUNTRY HILL ROAD

CUMBERLAND RI 02864-

3

L |

ALL QUESTIONS REFER TO THE CALENDAR YEAR JANUARY 1, 2007 THROUGH DECEMBER 31, 2007

UNLESS OTHERWISE SPECIFIED.

PLEASE ANSWER ALL QUESTIONS AND WHERE YOUR ANSWER IS “NONE” OR “NOT APPLICABLE” SO

‘STATE. ANSWERS SHOULD BE PRINTED OR TYPED, and additional sheets may be used if more space is needed

For clarification of any question, read instruction sheet,

Note: If you are a state or municipal oficial or employee that is required to file a Yearly Financial Statement, a failure to fle the

‘Statement is a violation of the law and may subject you to substantial penalties, including fines. Ifyou received a 2007 Year-

ly Financial Statement in the mail but believe you did not hold a public position in 2007 or 2008 that requires such

fling, you should contact the Ethics Commission (See Instruction Sheet for contact information),

Oe ee a ———————Es 1 2¥ —

aC OF OF ro ‘ra ‘mara

2 Be aantey—Hi 11 Road srgeep G29 — $< APES

n/a

‘WAICING RODRESS arnt om Wa

aaa)

3, List Public Position(s) you hold and governmental unit:

= pRRMBEGQUNC—Distriet-3(Nov. 6 =-Present) —__ Cumberland

‘BURETPRLT, SATE OM REGIONAL

Bon ‘HONIG, STE OR RECOM

I was elected on__2008 | was appointed on _®/@ | was hired on

(Gate) (Gate) (aie)

If you no longer hold a public position, state date of termination or resignation _n/a_.

4, List elected olfice(s) for which you were/are a candidate in either calendar year 2007 or 2008 (Read instruction #4)

“Bown Council, District 3

5. List the following: NAME OF SPOUSE NAME(S) OF DEPENDENT CHILD OR CHILDREN

Philip J. Morris Anna Catherine

6. List the names of any employer from which you, your spouse, or dependent child received $1,000 or more gross

income during calendar year 2007. If self-employed, list any occupation from which $1,000 or more gross income was

received. If employed by a state or municipal agency, or if self-employed and services were rendered to a state or

municipal agency for an amount of income in excess of $260, list the date and nature of services rendered. If the

public position or employment listed in #3, above, provides you with an amount of gross income in excess

‘of $250 it must be listed here. (Do Not List Amounts.)

NAME OF FAMILY NAME AND ADDRESS DATES AND NATURE

NENBEREMPLOYED (OF EMPLOYER OR OCCUPATION oF SERVICES RENDERED

Kelley N. Morris Moses Afonso:dackvony, Ltd. 2009

170 Westminster St. . Attorney/Associates

Suite 201

Providence, RI 02503

Boston, MA

Philip J. Morris 2007

7. List the address or legal description of any real estate, other than your principal residence, in which you, your spouse,

or dependent child had a financial interest.

NAMES NATURE OF INTEREST ADDRESS OR DESCRIPTION

n/a

8. List the name of any trust, name and address of the trustee of any trust, from which you, your spouse, or dependent

child or children individually received $1,000 or more gross income. List assets if known, (Do Not List Amounts.)

NAME OF TRUST: J: -

NAME OF TRUSTEE AND ADDRESS: _/@

NAME OF FAMILY MEMBER

RECEIVING TRUST INCOME

n/a ——

ASSETS: -

9. List the name and address of any business, profit or non-profit, in which you, your spouse, or dependent child held

a position as a director, officer, partner, trustee, or a management position.

NAME OF FAMILY MEMBER NAME AND ADDRESS OF BUSINESS POSITION

n/a

o (

10. List the name and address of any interested person, or business entity, that made total gifts or total contribu-

tions in excess of $100 in cash or property during calendar year 2007 to you, your spouse, or dependent child.

Certain gifts from relatives and certain campaign contributions are excluded. (See instruction #10)

NAME OF PERSON RECEIVING NAME AND ADDRESS OF PERSON OR ENTITY

GIFTOR CONTRIBUTION MAKING GIFT OR CONTRIBUTION,

n/a

11. List the name and address of any business in which you, your spouse, or dependent child individually or

collectively holds a 10% or greater ownership interest, or a $6,000 or greater ownership or investment interest,

NAME OF FAMILY MEMBER [NAME AND ADDRESS OF BUSINESS

n/a

12. Ifany business listed in #11, above, did business in excess of a total of $250 in calendar year 2007 with a state or

municipal agency, AND you are a member or employee of the agency or exercise direct or legislative control over

the agency, list the following:

NAME AND ADDRESS NAME OF AGENCY DATE AND NATURE,

‘OFBUSINESS ‘OF TRANSACTION

n/a

13. If any business listed in #11, above, was a business entity subject to direct regulation by a state or municipal

agency, AND you are a member or employee of the agency or exercise direct or legislalive control over the

agency, list the following

NAME AND ADDRESS OF BUSINESS NAME OF REGULATING AGENCY

You might also like

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- 2009 Top 75Document6 pages2009 Top 75Angus DavisNo ratings yet

- Stephen MurrayDocument4 pagesStephen MurrayAngus DavisNo ratings yet

- David A MurrayDocument4 pagesDavid A MurrayAngus DavisNo ratings yet

- Heidi K MoonDocument4 pagesHeidi K MoonAngus DavisNo ratings yet

- Robert P MurrayDocument4 pagesRobert P MurrayAngus DavisNo ratings yet

- Patricia L MorganDocument4 pagesPatricia L MorganAngus DavisNo ratings yet

- James V MurrayDocument4 pagesJames V MurrayAngus DavisNo ratings yet

- Robert L MushenDocument4 pagesRobert L MushenAngus DavisNo ratings yet

- Peter J MurrayDocument4 pagesPeter J MurrayAngus DavisNo ratings yet

- Francis J MurrayDocument4 pagesFrancis J MurrayAngus DavisNo ratings yet

- Christopher J MontalbanoDocument4 pagesChristopher J MontalbanoAngus DavisNo ratings yet

- Jeffrey J MurrayDocument4 pagesJeffrey J MurrayAngus DavisNo ratings yet

- Bruce Q MorinDocument4 pagesBruce Q MorinAngus DavisNo ratings yet

- Thomas H MongeauDocument4 pagesThomas H MongeauAngus DavisNo ratings yet

- David S MorrisonDocument4 pagesDavid S MorrisonAngus DavisNo ratings yet

- Hal MorganDocument4 pagesHal MorganAngus DavisNo ratings yet

- Carylon A MorrisonDocument4 pagesCarylon A MorrisonAngus DavisNo ratings yet

- George C MooreDocument5 pagesGeorge C MooreAngus DavisNo ratings yet

- Mildred S MorrisDocument4 pagesMildred S MorrisAngus DavisNo ratings yet

- Vincent MonafoDocument4 pagesVincent MonafoAngus DavisNo ratings yet

- John J Mulhearm JRDocument4 pagesJohn J Mulhearm JRAngus DavisNo ratings yet

- E Pierre MorenonDocument4 pagesE Pierre MorenonAngus DavisNo ratings yet

- Stephen S MuellerDocument4 pagesStephen S MuellerAngus DavisNo ratings yet

- Robert P MulliganDocument4 pagesRobert P MulliganAngus DavisNo ratings yet

- William W MuesselDocument4 pagesWilliam W MuesselAngus DavisNo ratings yet

- Kenneth W MottDocument4 pagesKenneth W MottAngus DavisNo ratings yet

- John J MullaneyDocument4 pagesJohn J MullaneyAngus DavisNo ratings yet

- Larry V MouradjianDocument4 pagesLarry V MouradjianAngus DavisNo ratings yet

- Barbara C RaoDocument4 pagesBarbara C RaoAngus DavisNo ratings yet