Professional Documents

Culture Documents

Ca Final Nov 2011 Qustion Paper 2

Uploaded by

Asim DasOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ca Final Nov 2011 Qustion Paper 2

Uploaded by

Asim DasCopyright:

Available Formats

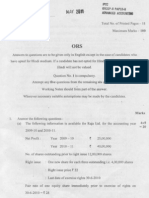

Roll No. ............................. NOV '2011 Total No.

of Questions - 7 Time Allowed - 3 Hours

FINAL GROUP-I PAPER-2 STRATEGIC FIN A"'::[ <\ T MANAGEMENT

Total No: of Printed Pages - 8 Maximum Marks - 100

'JAC

Answers to questions are to be given only in English except in the case of candidates who have opted for Hindi Medium. If a candidate has not opted for Hindi medium, his answers in Hindi will not be valued. Question No.1 is compulsory. Answer any five questions from the remaining six questions. Working notes should form part ofthe answer.

Marks

1.

(a)

Orange' purchased 200 units of Oxygen Mutual Fund at ~ 45 per unit on 31st December, 2009. In 2010, he received ~ 1.00 as dividend per unit and a capital gains distribution of ~ 2 per unit. Required: (i) Calculate the return for the period of one year assuming that the NAVas

on 31st December2010was ~ 48 per unit.

(ii) Calculate the return for the period of one year assuming that the NAVas

on 31st December2010 was ~ 48 per unit and all 'dividendsand capital gains distributionshave been reinvestedat an averagepri~e of ~ 46.00

per unit. Ignore taxation. An importer is due to pay the exporter on 28th January 2010, Singapore Dollars of 25,00,000 under an irrevocable letter of credit. It directed the bank to pay the amount on the due date.

.. ,

(b)

Due to go-slow and strike procedures adopted by its staff, the bank was not in a position to remit the amount due. The amount was actually remitted on 4thFebruary 2010. On the transaction, the bank wants to retain an exchange margin of 0.125 per cent.

JAC

\,',

P.T.O.

(2) JAC Marks

The following were the rates prevalent in the exchange market on the relevant dates:

28th January

4th February

RupeelUS $1 London PoundIDollars

~ 45.851 45.90 $ 1.7840/1.7850

~ 45.91/45.97 $ 1.7765/1.7775

Pound Sing $ 3.1575 13.1590 Sing $ 3.1380/3.1390 What is the effect on account of the delay in remittance? Calculate rate in multiples of .0001.

'(c)

A company has a book value per share of~ 137.80. Its return on equity is 15% and follows a policy of retaining 60 percent of its annual earnings. If the opportunity cost of capital is 18 percent, what is the price of its share? [adopt the perpetual growth model to arrive at your solution].

(d)

The six months forward price of a security is ~ 208.18. The rate of borrowing is 8 percent per annum payable at monthly rates. What will be,the spot price?

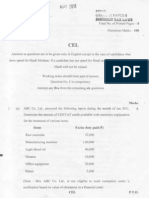

2.

(a)

Using the chop-shop approach (or Break-up value approach), assign a value for Cranberry Ltd. whose stock is currently trading at a total market price of 4 million. For Cranberry Ltd, the accounting data set forth three business segments: consumer wholesale, retail and general centers. Data for the firm's three segments are as follows: Business Segment Wholesale Retail General Segment Sales 225,000 720,000 2,500,000 Segment Assets 600,000 500,000 4,000,000 Segment Operating Income 75,000 150,000 700,000

Industry data for "pure-play" firms have been compiled and are summarized as follows: Capitalizationl Sales Segment Wholesale 0.85 1.2 Retail General 0.8

\.

Business

Capitalizationl Assets 0.7 0.7 0.7 JAC

Capitalization/. Operating Income 9 8 4

(3) JAC (b) Marks

Nitrogen Ltd, a UK company is in the process of negotiating an order amounting to 4 million with a large German retailer on 6 months credit. If successful, this will be the first time that Nitrogen Ltd has exported goods into the highly competitive German market. The following three alternatives are being considered for managing the transaction risk before the order is finalized. (i) Invoice the German firm in Sterling using the current exchange rate to calculate the invoice amount. (ii) Alternat~ve of invoicing the German firm in and using a forward foreign exchange contract to hedge the transaction risk. (iii) Invoice the German first in and use sufficient 6 months sterling future contracts (to the nearly whole number) to hedge the transaction risk. Following data is available: Spot Rate 6 months forward premium 6 months further contract is current!y trading at 6 months future contract size is Spot rate and 6 months future rate Required: (a) Calculate to the nearest "the receipt for Nitrogen Ltd, Under each of the three proposals. (b) In your opinion, which alternative would you consider to be the m~st appropriate and the reason therefor. JAC P.T.D. 4 4

1.1750 - 1.1770/

0.60-0.55 Euro Cents 1.1760/ 62500 1.1785/

\.

(4) JAC 3. (a) Marks 10

Helium Ltrl has evolved a new sales strategy for the next 4 years. The

followinginformationis given:

Income Statement Sales Gross Margin at 30%

in thousands

40,000

12,000

6,000 6,000 1,800 4,200

Accounting, administration and distribution expense at 15% Profit before tax Tax at 30% Profit after tax

Balance sheet information Fixed Assets Current Assets Equity 10,000 6,000 15,000

As per the new strategy, sales will grow at 30 percent per year for the next four years. The gross margin ratio will increase to 35 percent. The Assets turnover ratio and income tax rate will remain unchanged. Depreciation is to be at 15 percent on the value of the net fixed assets at the beginning of the year. Company's target rate of return is 14%. Determine if the strategy is financially viable giving detaned workings. (b) Pineapple Ltd has issued fully convertible 12 percent debentures of ~ 5,000 face value, convertible into 10 equity shares. The current market price of the debentures is ~ 5,400. The present market price of equity shares is ~ 430. Calculate:

(i) (ii) the conversion percentage premium, and the conversion value JAC 3 3

(5) JAC 4. (a) Marks 8

Based on the credit rating of the bonds, A has decided to apply the following discount rates for valuing bonds: Discount rate Credit rating AAA AA A 364-day T-bill rate + 3% spread AAA + 2% spread AAA + 3% spread

He is considering to invest in a AA rated f 1,000 face value bond currently selling at f 1,025.86. The bond has five years to maturity and the coupon rate on the bond .is 15 percent per annum payable annually. The next interest . payment is due one year from today and the bond is redeemable at par. (Assume the 364-day T.;billrate to be 9 percent). You are required to : (i) (ii) (b) Calculate the intrinsic value of the bond for A. Should he invest in the bond? Calculate the C1.lITent Yield (CY) and the Yield to Maturity (YTM) of the bond. XYZ Ltd. is considering to acquire an additional computer to supplement its time-share computer services to its clients. It has two options:

(i) (ii)

8 ,

To purchase the computer for f 22,00,000 To lease the computer for three years from a leasing cohIpany for f 5,00,000 as annual lease rent' plus 10 percent of gross time-share service revenue. The agreement also requires an additional payment of . , f 6,00,000 at the end of the third year. Lease rent is payable 'at the year end, and the computer reverts to the lessor after the contract period. The company estimates that the computer under' review now will be . worth no,oo,OOOat the end of third year. Forecast revenues are: Year 1 2 3 f 22,50,000 25,00,000 27,50,000 JAC

\'.

P.T.O.

,-

(6) JAC Marks

Annual operating costs (excluding depreciation/lease rent of computer) are estimated at ~ 9,00,000 with Ian additional ~ 1,00,000 for start-up and training cost at the beginning of the first year. These costs are to be borne by the lessee. XYZ Ltd. will borrow at 16% interest to finance acquisition of computer; repayments are to be made according to the following schedule: Year-end Principal Interest Total

.,

1 2 3

() 5,00,000 8,50,000 8,50,000

() 3,52,000 2,72,000 1,36,000

() 8,52,000 11,22,000 9,86,000

The company uses straight line method to depreciate its assets and pays 50 percent tax on its income. The management of XYZ Ltd. approaches you for advice. Which alternative would you recommend and why?

5.

(a)

The following is the Balance-sheet of Grape Fruit Company Ltd as at March 31st,2011. Liabilities. Equity shares of 100 each 14% preference shares of 100/- each 13% Debentures Debenture interest accrued and payable Loan from bank Trade creditors Assets (in lakhs) 600 Land and Building Plant and Machinery 200 ' 200 Furniture and Fixtures 26 Inventory 74 "340 Sundry debtors Cash at bank Preliminary expenses Cost ofissue of debentures Profit and Loss Account 1440 JAC

\."

(in lakhs) 200 300 50 150 70 130 10 5 525 1440

(7) JAC

Marks

The Company did not perform well and has suffered sizable losses during the last few years. However, it is felt that the company could be nursed back to health by proper financial restructuring. Consequently the following scheme of reconstruction has been drawn up :

(i) (ii)

Equity shares are to be reduced to f 25/- per share, fully paid up; Preference shares are to be reduced (with coupon rate of 10%) to equal number of shares of f 50 each, fully paid up.

.(iii) Debenture holders have agreed to forgo the accrued interest due to them. In the future, the rate of interest on debentures is to be reduced to 9 percent. (iv) Trade creditors will foreg025 percent of the amount due to them. (v) The company issues 6 lakh of equity shares at f 25 each and the entire sum was to be paid on application. The entire amount was fully subscribed by promoters. (vi) Land and Building was to be revalued at f 450 lakhs, Plant and Machinery was to be written down by f 120 lakhs and a provision of f 15 lakhs had to be made for bad and doubtful debts. Required: (i) (ii)

(b)

, An

Show the impact of financial restructuring on the company's activities. Prepare the fresh balance sheet after the reconstructi,on is completed on the basis of the above proposals. Indian importer has to settle an import bill for $ .1,30,000. The exporter has Pay immediately without any interest charges. Pay after three months with interest at 5 percent per annum.

6 4 6

given the Indian exporter two options: (i) (ii)

The importer's bank charges 15 percent per annum on overdrafts. The exchange rates in the market are as follows: Spot rate (f /$) : 48.35 / 48.36 3-Months forward rate (f /$) : 48.81 /48.83 The importer seeks your advice. Give your advice. JAC

\

P.T.O.

(8) JAC 6. (a) A Portfolio Manager (PM) has the following four stocks in his portfolio: Marks 8

Security,

VSL CSL SML APL

No. of Shares

10,000 5,000 8,000 2,000

Market Price Per Share (f)

50 20 25 200

Il

0.9 1.0 1.5 1.2

Compute the following: (i) (ii) .Portfolio beta. If the PM seeks to reduce the beta to 0.8, how much risk free investment should he bring in ? (iii) If the PM seeks to increase the beta to 1.2, how much risk free investment should he bring in ? (b) ABC established the following spread on the Delta Corporation's,stock : (i) (ii) Purchased one 3-month call option with a premium of ~ 30 and an exercise price of ~ 550. Purchased one 3-month put option with a premium of ~ 5 and an exercise price of~ 450. 8

The current price of Delta Corporation's stock is ~ 500. JDetermine ABC's profit or loss ifthe price of Delta Corporation's stock. (a) stays at ~ 500 after 3 months. (b) (c) 7.

'"'-

falls to ~ 350 after 3months. rises to ~ 600.

Write short notes on any four of the followings: (a) Capital Rationing (b) (c) (d) (e) (f) Embedded derivatives Depository participant Money market mutual fund Leading and lagging Take over by reverse bid

4 x 4 = 16

\.'.

JAC

You might also like

- Ca Ipcc Nov 2011 Qustion Paper 1Document11 pagesCa Ipcc Nov 2011 Qustion Paper 1Asim DasNo ratings yet

- Ca Ipcc Nov 2011 Qustion Paper 7Document8 pagesCa Ipcc Nov 2011 Qustion Paper 7Asim DasNo ratings yet

- Ca Ipcc Nov 2011 Qustion Paper 3Document16 pagesCa Ipcc Nov 2011 Qustion Paper 3Asim DasNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 2Document8 pagesCa Ipcc May 2011 Qustion Paper 2Asim DasNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 6Document4 pagesCa Ipcc May 2011 Qustion Paper 6Asim DasNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 5Document11 pagesCa Ipcc May 2011 Qustion Paper 5Asim DasNo ratings yet

- Ca Ipcc Nov 2011 Qustion Paper 6Document4 pagesCa Ipcc Nov 2011 Qustion Paper 6Asim DasNo ratings yet

- Ca Ipcc Nov 2011 Qustion Paper 4Document11 pagesCa Ipcc Nov 2011 Qustion Paper 4Asim DasNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 1Document11 pagesCa Ipcc May 2011 Qustion Paper 1Asim DasNo ratings yet

- Ca Ipcc Nov 2010 Qustion Paper 7Document12 pagesCa Ipcc Nov 2010 Qustion Paper 7Asim DasNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 3Document16 pagesCa Ipcc May 2011 Qustion Paper 3Asim DasNo ratings yet

- Ca Ipcc May 2011 Qustion Paper 4Document11 pagesCa Ipcc May 2011 Qustion Paper 4Asim DasNo ratings yet

- Ca Ipcc Nov 2010 Qustion Paper 3Document16 pagesCa Ipcc Nov 2010 Qustion Paper 3Asim DasNo ratings yet

- Ca Ipcc Nov 2010 Qustion Paper 6Document8 pagesCa Ipcc Nov 2010 Qustion Paper 6Asim DasNo ratings yet

- Ca Ipcc Nov 2010 Qustion Paper 4Document11 pagesCa Ipcc Nov 2010 Qustion Paper 4Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 8Document8 pagesCa Final Nov 2011 Qustion Paper 8Asim DasNo ratings yet

- Ca Ipcc Nov 2010 Qustion Paper 1Document16 pagesCa Ipcc Nov 2010 Qustion Paper 1Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 6Document3 pagesCa Final Nov 2011 Qustion Paper 6Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 7Document11 pagesCa Final Nov 2011 Qustion Paper 7Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 1Document12 pagesCa Final Nov 2011 Qustion Paper 1Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 3Document7 pagesCa Final Nov 2011 Qustion Paper 3Asim DasNo ratings yet

- Ca Final Nov 2011 Qustion Paper 4Document7 pagesCa Final Nov 2011 Qustion Paper 4Asim DasNo ratings yet

- Ca Final May 2011 Qustion Paper 8Document8 pagesCa Final May 2011 Qustion Paper 8Asim DasNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Portfolio Management and Invesrment AnalysisDocument3 pagesPortfolio Management and Invesrment AnalysisGyan PokhrelNo ratings yet

- Investor Behaviour and Factors Influencing DecisionsDocument44 pagesInvestor Behaviour and Factors Influencing DecisionsSajoy P.B.100% (1)

- Infosys Case StudyDocument10 pagesInfosys Case StudySuhas KandNo ratings yet

- Gillete DealDocument2 pagesGillete DealManjunathan MohanNo ratings yet

- Exam (30 MCQ and 2 Problems)Document13 pagesExam (30 MCQ and 2 Problems)Dan Saul KnightNo ratings yet

- 3one4 Capital (1)Document4 pages3one4 Capital (1)Arkojit KolayNo ratings yet

- Andrews Pitchforks AftafinalDocument31 pagesAndrews Pitchforks AftafinalReico Hyd100% (1)

- The Us 64 Case StudyDocument5 pagesThe Us 64 Case StudyDhrubojyoti Dey100% (1)

- Current Account: Payments For Merchandise and ServicesDocument1 pageCurrent Account: Payments For Merchandise and Servicessurya prakash sharmaNo ratings yet

- GIS Form for JSF Skylink Lending CorporationDocument9 pagesGIS Form for JSF Skylink Lending Corporationmarianne capina de jesus100% (1)

- Faj v72 n6 3Document18 pagesFaj v72 n6 3VuNo ratings yet

- Bank Management and Financial Services: Lecture and Presentation GuidelinesDocument6 pagesBank Management and Financial Services: Lecture and Presentation GuidelinesPhạm Thúy HằngNo ratings yet

- Justice Too: FrontpageDocument12 pagesJustice Too: FrontpageFrontPageAfricaNo ratings yet

- (KMBN-308) : Summer Internship ReportDocument106 pages(KMBN-308) : Summer Internship ReportNeetika TripathiNo ratings yet

- Update On Provisional Freeze of Current Account With HDFC Bank (The Bank) (Company Update)Document1 pageUpdate On Provisional Freeze of Current Account With HDFC Bank (The Bank) (Company Update)Shyam SunderNo ratings yet

- All 20courses PDFDocument10 pagesAll 20courses PDFS NNo ratings yet

- Tax.3105 - Capital Asset VS Ordinary Asset and CGTDocument10 pagesTax.3105 - Capital Asset VS Ordinary Asset and CGTZee QBNo ratings yet

- Total Assets: Filinvest Land - IncDocument7 pagesTotal Assets: Filinvest Land - IncKim Suzaine SumilhigNo ratings yet

- Khalil, M. A., Khalil, R (2022) - Environmental, Social and Governance (ESG) - Augmented Investments in Innovation and Firms' ValueDocument27 pagesKhalil, M. A., Khalil, R (2022) - Environmental, Social and Governance (ESG) - Augmented Investments in Innovation and Firms' ValueShahmalaraniNo ratings yet

- PH Protocol For RainsDocument30 pagesPH Protocol For RainsprachiNo ratings yet

- ABM1 - 11-Module Jan11-29Document12 pagesABM1 - 11-Module Jan11-29Roz Ada100% (1)

- Dividend Month Premium in The Korean Stock MarketDocument34 pagesDividend Month Premium in The Korean Stock Market찰리 가라사대No ratings yet

- CAPMDocument51 pagesCAPMDisha BakshiNo ratings yet

- Session11 - Bond Analysis Structure and ContentsDocument18 pagesSession11 - Bond Analysis Structure and ContentsJoe Garcia100% (1)

- Thesis On Ghana Stock ExchangeDocument4 pagesThesis On Ghana Stock Exchangeggzgpeikd100% (2)

- 142a Banknifty Weekly Options StrategyDocument6 pages142a Banknifty Weekly Options StrategyudayNo ratings yet

- 231025+ +JBS+3Q23+Earnings+Preview VFDocument3 pages231025+ +JBS+3Q23+Earnings+Preview VFgicokobayashiNo ratings yet

- Balance Sheet of Canara BankDocument17 pagesBalance Sheet of Canara BankSathish KumarNo ratings yet

- FOI PPT Investor ProtectionDocument14 pagesFOI PPT Investor ProtectionPalzer SherpaNo ratings yet

- Business Plan For The Small ManufacturerDocument32 pagesBusiness Plan For The Small ManufacturerRam ShewaleNo ratings yet