Professional Documents

Culture Documents

Paudyal Tek Bahadur Carried Out A Research On

Uploaded by

adhikari,suboh044Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Paudyal Tek Bahadur Carried Out A Research On

Uploaded by

adhikari,suboh044Copyright:

Available Formats

Paudyal Tek Bahadur (2005) carried out a research on A Comparative study on Dividend Policy of Banks and Insurance Companies

in Nepal. The main objective of this study was to compare dividend policy between banks and insurance companies where, the specific objectives were to study various aspects of dividend policies of banks and insurance companies in Nepal, to examine the relationship between dividend and market price of stock, to analyze factor affecting dividend policy decision of banks and insurance companies and to provide suggestion on the basis of finding. Both primary and secondary data were used to analyse the dividend policy relationship of banks and insurance companies and examine the rel;ationship between dividend and market price of stock of banks and insurance companies. The datas were obtained from financial statement of listed companies and annual reports of concerned banks and insurance companies. Further, the secondary data were taken from various newspaper and magazines, related document and journals. Multiple regression models were used for the analysis of this study where the dividend is dependent variable. The model was: Div.= a+b1 div(t-1) + b2 Liq. +b3 Ear. Where, Div= Dividend A= Intercept or constant B= coefficient of variable Div (t-1) = Dividend per share in time t-1

Liq= current ratio (CR) or Quick Ratio Ear = Earning

or return on asset

Likewise, the multiple regression models of MPS depending upon earning, dividend and net worth was: MPS = a+ b1 Ear + b2 Div (t-1) + b3 NW

Where, MPS= market price of stock Ear = Earning Div (t-1) = Last year dividend NW = Net worth B= Coefficient of Variable The major findings obtained from the general and some specific analysis of secondary data of three banks and three insurance companies analyzed were with respect to factor affecting dividend policy the corporation gave the first priority to earning, second to liquidity and third to past dividend. the majority of the company paid the cash dividend but company paid stock dividend when they had no cash to pay dividend. Sometimes company paid cash and stock dividend both.

Paudel Bharat Raj (2004) carried out a research on Dividend Policy of Commercial Banks in Nepal. The main objective of this study was to identify whether it was possible to affect shareholders wealth by changing the firms dividend payout ratio. This research carried out the sampling technique in selecting sample from the population.The sources of data were taken form the Nepal Stock Exchange Ltd. Only secondary data related to dividend policy were considered under the study. Reghression analysis model was used to calculate and interpret the result of the study. The model was as follows:

1. DPS on EPS Y= a+ bx where: y= dividend per share a= Regression constant b= Regression coefficient x= Earning per share

2.

DPS on NP Y= a=bx where, y= dividend per share a= Regression constant b= Regression coefficient x= Net Profit

3.

MPPS on DPS Y= a+ bx where: y= dividend per share a= Regression constant b= Regression coefficient x= Dividend per share

The major findings of this study were the prevelance of of dividend pattern of commercial banks seemed uneven and fluctuating in Nepal. Commercial banks do not have any stable and consistent dividend practice. Dividend payment is not regular phenomenon in Nepalese Commercial banks.

Ghimire Gokarna (2005) carried out a research on Dividend Behaviour of Nepalese Commercial Bank. The main objectives of this study were to highlight the dividend behavior of Nepalese commercial , to analyze the relationship of dividend with earning per share and to provide the suggestion and recommendation to concerned authority in making their policy decisions relating in dividend pay out ratio. The research design followed the comparative evaluation of dividend policy in the sample firms and their effect on stock prices. Secondary data were used and the financial statement of five years from 1994/96 to 1999/99 were taken for commercial banks and from 1994/95 to 1998/99 taken for insurance companies from respective firms and websites. . The sources of data were collected from insurance board, , Nepal Stock Exchange, websites and respective firms central office. Simple and multiple- linear regression analysis were used to study the relationship .

The major findings of this study was a change in dividend per share affects the market price per share in stock market differently in different commercial banks, a change in dividend per share affected the net worth different in different commercial banks in Nepal, the dividend behavior of commercial banks in Nepal was not uniform and the earning per share and net profit affects the dividend behavior differently in different commercial banks.

REFERENCES:

Bibliography Ghimire, G. (July, 2005). Dividend Behaviour of Nepalese Commercial Bank. Paudel, B. R. (Feb., 2004). Dividend Policy of Commercial Banks in Nepal. Paudyal, T. B. (Sept., 2005). A Comparative study on Dividend Policy of Banks and Insurance Companies in Nepal.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ERPDocument9 pagesERPWindadahri PuslitkaretNo ratings yet

- 4strategic Analysis ToolsDocument14 pages4strategic Analysis ToolsHannahbea LindoNo ratings yet

- Subsequent SettlementDocument26 pagesSubsequent Settlementapi-3708285No ratings yet

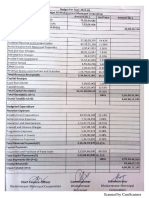

- Form 1 - Illustration Income Tax: For Individuals Earning Purely Compensation Income Accomplish BIR Form No. - 1700Document3 pagesForm 1 - Illustration Income Tax: For Individuals Earning Purely Compensation Income Accomplish BIR Form No. - 1700Rea Rose TampusNo ratings yet

- Accounting Concepts: Unit 11Document24 pagesAccounting Concepts: Unit 11LuhenNo ratings yet

- 274-B-A-A-C (2683)Document10 pages274-B-A-A-C (2683)Ahmed Awais100% (2)

- Forces of Excellence in Kanji S Business Excellence Model PDFDocument15 pagesForces of Excellence in Kanji S Business Excellence Model PDFChar AzNo ratings yet

- ASEAN - Civil Society:: A People-Centred ASEAN'?Document10 pagesASEAN - Civil Society:: A People-Centred ASEAN'?andi adnanNo ratings yet

- CustomInvoice 7295107013Document1 pageCustomInvoice 7295107013Remz Printing Services LaoagNo ratings yet

- Ocean ManufacturingDocument5 pagesOcean ManufacturingАриунбаясгалан НоминтуулNo ratings yet

- A Nexteer (34200865SMT) KEPSDocument6 pagesA Nexteer (34200865SMT) KEPSmonutilisation0No ratings yet

- LW Lamb Weston Investor Day Deck Final Oct 2016Document85 pagesLW Lamb Weston Investor Day Deck Final Oct 2016Ala Baster100% (1)

- Advocacy For The Modernization of The Jeepneys in The PhilippinesDocument1 pageAdvocacy For The Modernization of The Jeepneys in The PhilippinesblimcastroNo ratings yet

- A Study On Corporate Social Responsibility (CSR) of Ncell: Raj Kumar Karki UNIVERSITY ROLL NO.: 1411001540Document8 pagesA Study On Corporate Social Responsibility (CSR) of Ncell: Raj Kumar Karki UNIVERSITY ROLL NO.: 1411001540Raj0% (1)

- CIR vs. ALGUE INC. G.R. No. L 28896. February 17 1988 PDFDocument10 pagesCIR vs. ALGUE INC. G.R. No. L 28896. February 17 1988 PDFZenith EuropaNo ratings yet

- Unit Test 6 Market Leader Intermediate Unit 6 Test Answer Key in PDF Market Leader IntermediateDocument3 pagesUnit Test 6 Market Leader Intermediate Unit 6 Test Answer Key in PDF Market Leader IntermediateSonia Del Val CasasNo ratings yet

- ASAL Business WB Chapter 9 AnswersDocument3 pagesASAL Business WB Chapter 9 AnswersElgin LohNo ratings yet

- Internship Report On: Weatherford International PakistanDocument32 pagesInternship Report On: Weatherford International Pakistanayub shahNo ratings yet

- 5 Hari StrategiDocument116 pages5 Hari StrategiMohd Noor Yusoff100% (2)

- SSDCourse Curriculum PUCDocument5 pagesSSDCourse Curriculum PUCBDT Visa PaymentNo ratings yet

- Revisiting Human Capital Theory: Progress and ProspectsDocument29 pagesRevisiting Human Capital Theory: Progress and ProspectsTembo U KondwelaniNo ratings yet

- Budget 2019-20Document21 pagesBudget 2019-20Pranati ReleNo ratings yet

- Mutual Fund Galat Hai PDFDocument23 pagesMutual Fund Galat Hai PDFNarendar KumarNo ratings yet

- S-MATH311LA BSM31 1st Sem (2021-2022) - 1st Sem AY2021-2022Document2 pagesS-MATH311LA BSM31 1st Sem (2021-2022) - 1st Sem AY2021-2022Von Andrei MedinaNo ratings yet

- Community Driven Development Vs Community Based Development 1 FinalDocument19 pagesCommunity Driven Development Vs Community Based Development 1 FinalDona Ameyria75% (4)

- Chapter 1Document4 pagesChapter 1Kim Ericka Bautista100% (2)

- Job Hunting Is Getting Worse by Alana SemuelsDocument4 pagesJob Hunting Is Getting Worse by Alana SemuelsKal LamigoNo ratings yet

- How Does Recession Affect Fashion IndustryDocument22 pagesHow Does Recession Affect Fashion Industrysrishtikharb2579No ratings yet

- Assignment 1: University of Foreign Trade UniversityDocument11 pagesAssignment 1: University of Foreign Trade UniversityĐông ĐôngNo ratings yet

- Fabm Quiz1Document1 pageFabm Quiz1Renelino SacdalanNo ratings yet