Professional Documents

Culture Documents

Ackman MCD

Uploaded by

Sam YuOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Ackman MCD

Uploaded by

Sam YuCopyright:

Available Formats

A Value Menu for McDonalds

Pershing Square Capital Management

DISCLAIMER

Pershing Square Capital Management's ("Pershing") analysis and conclusions regarding McDonald's Corporation ("McDonald's") are based on publicly available information. Pershing recognizes that there may be confidential information in the possession of the Company and its advisors that could lead them to disagree with the approach Pershing is advocating. The analyses provided include certain estimates and projections prepared with respect to, among other things, the historical and anticipated operating performance of the Company. Such statements, estimates, and projections reflect various assumptions by Pershing concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations, express or implied, are made as to the accuracy or completeness of such statements, estimates or projections or with respect to any other materials herein. Actual results may vary materially from the estimates and projected results contained herein. Pershing manages funds that are in the business of trading - buying and selling - public securities. It is possible that there will be developments in the future that cause Pershing to change its position regarding the Company and possibly reduce, dispose of, or change the form of its investment in the Company. Pershing recognizes that the Company has a stock market capitalization of approximately $42bn, and that, accordingly it could be more difficult to exert influence over its Board than has been the case with smaller companies.

1

Table of Contents

I. II. III. IV. V.

Overview of McDonald's Pershings View of McDonald's Pershings Proposal to McDonald's: McOpCo IPO Company Response to Pershing Developing a Response to the Company Appendix A. Pershings Proposal: Assumptions B. PF McDonald's Financial Analysis C. McOpCo Financial Analysis

3 11 23 39 43 58 59 66 74

I. Overview of McDonald's

I.

Overview of McDonalds

Pershings Involvement with McDonalds

On September 22nd, Pershing Square Capital Management (Pershing) presented a proposal for increasing shareholder value (the Proposal) to McDonalds management Pershing commends McDonalds management for its strong operational execution over the past two years Pershing appreciates the willingness and openness of McDonalds management to discuss the Proposal Management has taken our Proposal seriously our Proposal was presented to McDonalds Board of Directors Pershing had a follow-up meeting with McDonalds management on October 31 when the Company communicated its response to our Proposal Pershing is pleased to have the opportunity to share the details of our Proposal with the broader investment community

I.

Overview of McDonalds

Review of McDonalds

Worlds largest foodservice franchisor and retailer $42 billion equity market value $55 billion in estimated system wide sales 32,000 system wide restaurants, globally Serves 50 million customers daily in 119 countries Everyday 1 out of 14 Americans eats at a McDonalds One of the worlds most recognized brands Consistently named in the top 10 global brands along with Coke and Disney One of the largest retail property owners in the world Estimated owned and controlled real estate market value of $46 billion (1) Estimated 18,000 restaurants where McDonalds owns land and/or building Significant free cash flow business

________________________________________________ (1) Based on Pershings assumptions. See

page 64 in the appendix.

5

I.

Overview of McDonalds

Historical Financial Performance

Following declines in same-store sales and profitability in 2001 and 2002, Management has improved operations through product innovation, capital discipline and strong execution. As a result, the Companys profitability has increased.

McDonalds Historical Revenue and EBITDA Performance

($ in millions)

$20,000

(1)

$19,065 $17,141 $14,243 $14,870 $15,406

30.0%

Revenue / EBITDA

$15,000

28.5% EBITDA Margin

$10,000

27.0%

$5,000 $4,144 $0 $4,041 $3,997 $4,512 $5,183

25.5%

24.0%

Same-store Sales Growth

2000

2001

2002

2003

2004

0.6%

(1.3%)

EBITDA

(2.1%)

Revenue

6

2.4%

EBITDA Margin

6.9%

________________________________________________ (1) EBITDA is adjusted for certain non-recurring

and non-cash items.

I.

Overview of McDonalds

Historical Financial Performance (Contd)

As a result of the Companys improved capital allocation, pre-tax unlevered free cash flow has increased from a five-year low of $2.0 billion in 2002 to $3.5 billion in 2004.

Historical Pre-Tax Unlevered Free Cash Flow(1) Performance

($ in millions)

$4,000 $3,483 $3,205 26%

$3,000 EBITDA CapEx

22% Margin (%)

$2,000

$2,199

$2,134

$1,994

18.7%

18.3%

18%

$1,000

15.4%

14.4% 12.9%

14%

$0 2000A 2000 2001A 2001 EBITDA CapEx 2002A 2002 2003A 2003 Margin % 2004A 2004

10%

_______________________________________________ (1)

Denotes Adjusted EBITDA CapEx. Adjusted EBITDA is adjusted for certain non-recurring and non-cash expenses.

7

I.

Overview of McDonalds

Stock Price Performance

Although McDonald's stock has rebounded from its 2003 lows, it has been range bound in the low $30s for the past five years and is significantly off of its high of $48 per share reached in 1999.

McDonalds Stock Price Performance

($ per share)

$50.00

High of $48.32 11/12/99

$40.00

$30.00

$20.00

$10.00 11/12/99

07/12/00

03/12/01

11/10/01

07/11/02

03/11/03

11/09/03

07/09/04

03/09/05

11/07/05

I.

Overview of McDonalds

5-Year Indexed Stock Performance

Over the past five years, McDonalds has only slightly outperformed the S&P 500 while its QSR peer group has vastly outperformed the index.

McDonald's 2.4% S&P 500 (9.6%) QSR Index 177.3%

5-Year Indexed Stock Performance

350 300 250 200 150 100 50 0 11/10/00

5 Year Indexed Performance

QSR

MCD S&P

06/01/01

12/21/01

07/12/02

01/31/03

08/22/03 QSR Comp

(1)

03/12/04 S&P 500

10/01/04

04/22/05

11/11/05

McDonald's

________________________________________________ (1) Includes YUM and WEN.

I.

Overview of McDonalds

McDonalds versus its Peers

Despite McDonalds strong real estate assets, number one QSR market position and leading brand, McDonalds trades at a discount to its peers. We believe this discount is due to a fundamental misconception about McDonalds business.

EV / 06E EBITDA

10.0x 9.5x 9.0x 8.5x 8.0x 7.5x 30-Day Average Trailing

(1)

9.3x 8.7x 8.9x

W EN

YUM

P / 06E EPS

2 5 .0 x 2 0 .4 x 2 0 .0 x 1 5 .6 x 1 5 .0 x 1 0 .0 x 5 .0 x 0 .0 x 3 0 -D a y A v e ra g e T ra ilin g

(1 )

1 6 .7 x

W EN

YUM

Long-Term EPS Growth

________________________________________________ (1)

9%

12%

12%

McDonalds stock price is based on a 30-day average trailing price as of 11/11/05.

10

II. Pershings View of McDonald's

II.

Pershings View of McDonald's

McDonalds: How the System Works

Landlord, Franchisor, Restaurant Operator

Franchisor: Franchises brand and collects fee Operator: Operates 9,000 McDonalds restaurants Landlord: Buys and develops real estate and leases to its franchisees Real Estate and Franchise estimated pre-tax ROI of 17.5%(1):

Cost of Land Cost of Building Total Cost Est. Average Unit Sales Rent as a % of Sales Franchise Income as % of sales Rental Income Franchise Income Total Income Unlevered Pre Tax ROIC

________________________________________________

Franchisees

Franchise Fee: 4% of restaurant sales Rent: greater of a minimum rent or a percentage of restaurant sales (current avg. ~9% of sales) Franchisee bears all maintenance capital costs

$650k 650k $1,300k $1,750k 9.0% 4.0% $158 70 $228 17.5%

(1)

Illustrative return based on Pershings assumptions for the cost of land and building and approximate average unit sales in 2004. 12

II.

Pershings View of McDonald's

A Landlord, Franchisor and Restaurant Operator

Real Estate and Franchise Business

McOpCo

Landlord

McDonalds controls substantially all of its systemwide real estate Estimated 11,700 restaurants where McDonalds owns both the land and buildings and 7,000 restaurants where McDonalds owns only the buildings (1) Estimated $1.3 billion of income generated from subleases Estimated real estate value: $46 billion or ~94% of current Enterprise Value (2)

________________________________________________

Franchisor

Approximately 32,000 restaurants where McDonalds receives 4% of unit sales

Restaurant Operator

Approximately 9,000 Companyoperated restaurants

Reported financials have overstated margins due to a lack of transfer pricing Currently not charged a franchise fee Currently not charged a market rent

(1) (2)

Assumes that McDonalds owns the land and buildings of 37% of its system wide units and owns the buildings of 22% of its system wide units. Valuation based on Pershing estimates. See page 64 for more detail on real estate valuation. 13

II.

Pershings View of McDonald's

Characteristics of Cash Flow Streams

Real Estate and Franchise Business

McOpCo

Landlord

Maintenance Capital Requirements: Risk Profile Minimal Triple net leases Very Stable / Minimal Risk Generates the greater of a minimum rent or a % of sales (current average ~ 9%) 70%90% Margins Some real estate development expenses Minimal: 5.75%-6.5% Real estate holding companies typical asset beta: ~.40 Hard asset collateral Low

Franchisor

High

Restaurants

Significant maintenance capex Medium Risk High operating leverage Sensitivity to food costs 7%10% Margins (1) High food, paper and labor costs Rent Franchise fee Medium: 8%-9% Mature QSR typical asset beta: ~.80-.90

Limited remodel subsidies as well as corporate capex Stable / Low Risk Low operating leverage Diverse and global customer base 30%50% Margins

Typical EBITDA Margin: Typical average cost of capital:(2)

________________________________________________

Low: 6.5%-7.5% Choice Hotels, Coke and Pepsi typical asset beta: ~.50-.60 Highly leveragable

(1) (2)

Typical margins are illustrative restaurant EBITDA margins and assume the payment of a market rent and franchisee fee, similar to a franchisee. Typical betas are Pershing approximations based on selected companies Barra predictive betas. Average cost of capital estimates are illustrative estimates based on average asset betas. 14

II.

Pershings View of McDonald's

Adjusting for Market Rent and Franchise Fees

In 2004, McDonalds company-operated restaurants appeared to contribute 46% of total EBITDA. However, once adjusted for a franchise fee and a market rent fee, McOpCo constituted only 22% of total EBITDA, with the higher multiple Real Estate and Franchise businesses contributing 78% of total EBITDA.

2004 Total EBITDA As Reported

2004 Total EBITDA Adjusted for Market Rent and Franchise Fees

46% 54%

McOpCo

22%

McOpCo

55%

78%

Real Estate and Franchise

2004 EBITDA $2.4bn 2.8bn $5.2bn % 46% 54% 100%

Real Estate and Franchise

McOpCo Real Estate and Franchise Total

McOpCo Real Estate and Franchise Total

2004 EBITDA $1.1bn 4.0bn $5.2bn

% 22% 78% 100%

________________________________________________

Note: The analysis assumes that 75% of the total G&A is allocated to the Real Estate and Franchise business and 25% is allocated to McOpCo. McDonalds management has indicated this is a conservative assumption regarding the Real Estate and Franchise business. Analysis excludes $441 mm of non-recurring other net operating expenses. . 15

II.

Pershings View of McDonald's

Adjusting for Market Rent and Franchise Fees (Contd)

Once adjusted for market rent and franchise fees, McOpCo would be contributing only 14% of total EBITDA-Maintenance Capex, with the Real Estate and Franchise business contributing 86% of total EBITDA-Maintenance Capex ,based on FY 2005E projections.

2005E Total EBITDA Capex As Reported

Real Estate and Franchise McOpCo

2005E Total EBITDA Capex Adjusted for Market Rent and Franchise Fees

Real Estate and Franchise McOpCo

14%

53%

47% 86%

'05 EBITDAMaint. Capex $1.9bn 2.2bn $4.1bn '05 EBITDAMaint. Capex $0.6bn 3.5bn $4.1bn

McOpCo PF McDonald's Total

% 47% 53% 100%

McOpCo PF McDonald's Total

% 14% 86% 100%

________________________________________________

The analysis assumes that 75% of the total G&A is allocated to the Real Estate and Franchise business and 25% is allocated to McOpCo. McDonalds management has indicated this is a conservative assumption regarding the real estate and franchise business. In addition, we note that 2005E maintenance capex includes certain one-time capital expenditures related to systemwide remodeling program. Please see appendix for full reconciliation .

16

II.

Pershings View of McDonald's

Reconciling McDonalds 2004A P&L

Set forth below is a table which reconciles McOpCos, the Real Estate and Franchise businesses and stand-alone McDonalds FY 2004A income statements, assuming McOpCo pays a market rent and franchise fee. The analysis demonstrates that the Real Estate and Franchise business contributed approximately 78% of total EBITDA.

(U.S. $ in millions) 2004 Income Statement Sales by Company Operated Restaurants Rent from Franchise and Affiliate Rest. Rent From Company Operated Rest. Franchise Fees From Franchise and Affiliate Rest. Franchise Fees From Company Operated Rest. Total Revenue Company Operated Expenses: Food and Paper Compensation & Benefits Non-Rent Occupancy and Other Expenses (excl. D&A) Company Operated D&A Company-Operated Rent Expense Additional Rent Payable to PropCo Franchise Fee Payable to FranCo Total Company Operated Expenses Franchised Restaurant Occupancy Costs Franchise PPE D&A Corporate G&A EBIT Depreciation & Amortization EBITDA % of Total EBITDA

________________________________________________

McOpCo P&L $14,224

Real Estate and Franchise P&L 3,336 1,280 1,505 569 $6,690 347 583 $930 576 427 1,485 3,272 774 $4,046 78%

Inter-Company Eliminations

2004 Consolidated Sum of Parts $14,224 3,336 1,505 $19,065 4,853 3,726 2,164 774 583 $12,100 576 427 1,980 3,982 1,201 $5,183 100%

$14,224 3,336 1,505 $19,065 4,853 3,726 2,164 774 583 $12,100 576 427 1,980 3,982 1,201 $5,183 100%

(1,280) (569) ($1,849) (583) (697) (569) ($1,849) -

$14,224 4,853 3,726 2,164 427 583 697 569 $13,019 495 710 427 $1,137 22%

$0

The analysis assumes that 75% of the total G&A is allocated to the Real Estate and Franchise business and 25% is allocated to McOpCo. McDonalds management has indicated this is a conservative assumption regarding the real estate and franchise business. Note: Analysis excludes $441 mm of non-recurring other net operating expenses. 17

II.

Pershings View of McDonald's

Historical EBITDA by Business Type: As Currently Reported

Assuming 75% of G&A is allocated to the Real Estate and Franchise business, an allocation that McDonalds management indicates is conservative, we indicate below the EBITDA for McOpCo and the Real Estate and Franchise businesses, as depicted in the reported financials. We note that McOpCo has historically appeared to contribute approximately ~45% of consolidated EBITDA.

McDonalds Consolidated EBITDA

($ in millions)

$6.0 $5.0 $4.0 $3.0 $2.0 $1.0 $0.0

$5,183 $4,144 $1,995 $4,041 $1,893 $3,997 $1,841 $4,512 $2,072 $2,403

McOpCo

~45%

$2,780

$2,149 2000

$2,148 2001

$2,156 2002

Real Estate and Franchise McOpCo

$2,440

Real Estate and Franchise

~55%

2003 2004

________________________________________________

Assumes McOpCo G&A to be 25% of consolidated G&A and Real Estate and Franchise G&A to be 75% of consolidated G&A. Management has indicated this is a conservative assumption regarding the Real Estate and Franchise business.

18

II.

Pershings View of McDonald's

Historical EBITDA by Business Type: Adjusted for a Market Rent and Franchise Fee

Despite an economic recession in 2001-2003, significant dips in McDonalds system wide samestore sales growth and declines in McDonalds stock prices, the Real Estate and Franchise business has grown every year over the last five years.

McDonalds Consolidated EBITDA ($ in millions)

$6.000 $5.000 $4.000 $3.000 $2.000 $1.000 $0.000 Real Estate and Franchise McOpCo

$5,183 $4,041 $900 $3,997 $828 $4,512 $944 $1,137

$4,144 $1,006

$3,138

$3,142

$3,169

$3,568

$4,046

Real Estate and Franchise ~80%

2000

Samestore sales McOpCo Growth 0.6% (1.1%)

2001

2002

2003

2004

(1.3%) (10.6%) 0.1%

(2.1%) (7.9%) 0.9%

2.4% 14.0% 12.6%

6.9% 20.4% 13.4%

RE/Franchise Growth (0.5)%

________________________________________________

Notes: Assumes McOpCo G&A to be 25% of consolidated G&A and Real Estate and Franchise G&A to be 75% of consolidated G&A. Assumes McOpCo pays franchise fees of 4% of sales and rent of 9% of sales. 19

II.

Pershings View of McDonald's

Real Estate and Franchise Business: Stable and Growing

McDonalds Consolidated EBITDA

($ in billions)

Based on Pershing Assumptions

$6.0 $5.0 $4.0 $3.0 $2.0 $1.0 $0.0

Based on Reported Financials

$0.5 $1.5 1990

$0.5 $1.6 1991

2.3%

$0.6 $1.8 1992

18.1%

$0.6 $1.9 1993

(2.2%)

$0.7 $2.1

$0.7 $2.5

$0.8

$0.8

$1.0

$1.0

$1.0

$0.9

$0.8

$0.9

$1.1

McOpCo

$2.6

$2.7

$2.9

$3.2

$3.1

$3.1

$3.2

$3.6

$4.0

Real Estate and Franchise

1994

17.0%

1995

14.1%

1996

3.6%

1997

6.3%

1998

18.0%

1999

5.1%

2000

(1.1%)

2001

(10.6%)

2002

(7.9%)

2003

14.0%

2004

20.4%

McOpCo EBITDA Growth Real Estate & Franchise EBITDA Growth: Change in Year-End Stock Price: (15.6%)

4.9%

11.7%

8.5%

10.4%

15.3%

4.0%

4.3%

10.1%

7.4%

(0.5%)

0.1%

0.9%

12.6%

13.4%

30.5%

28.3%

16.9%

2.6%

54.3%

0.6%

5.2%

60.9%

5.0%

(15.7%)

(22.1%)

(39.3%)

54.4%

29.1%

________________________________________________

Notes: Assumes McOpCo G&A to be 25% of consolidated G&A and Real Estate and Franchise G&A to be 75% of consolidated G&A. Assumes McOpCo pays franchise fees of 4% of sales and rent of 9% of sales. 20

II.

Pershings View of McDonald's

Historical Perspectives on McOpCo

McDonalds did not historically operate restaurants The Company initially entered the business of operating restaurants only as a defensive measure

Limited number of restaurants The idea emerged that we should operate a base of ten or so stores as a company. This would give us a firm base of income in the event the McDonald brothers claimed default on our contract (1) --Ray Kroc / Founder

Expansion of McOpCo units first occurred in the late 1960s

Veteran franchisees were approaching retirement and needed liquidity McDonalds stock was provided as a tax-free exchange for the restaurants Some of our operators had tremendous wealth but no money. And we were using McDonalds stock that was trading at 25 times earnings to buy restaurants for seven times earnings (2) --Fred Turner / Former President and CEO

Turner realized in the mid 70s that owning too many McOpCo units was not in the best interest of the Company

________________________________________________

(1) (2)

From Grinding It Out: The Making of McDonalds, p. 108. From McDonalds: Behind the Golden Arches, pgs. 288 - 291.

21

II.

Pershings View of McDonald's

Superior Franchisee Economics

Running a McDonalds is a 363-day-a-year business and an owner/operator, with his personal interests and incentives, can inherently do a better job than a chain manager. (1)

--Fred Turner / Former President and CEO

Illustrative Characteristics of Company Operated versus Franchisee Operated Restaurants (2)

Company Operated

Structure Taxes Leverage Levered Returns General manager

________________________________________________

Franchisee Operated

C-Corporation Corporate level tax 10% - 30% Low teens Salaried employee/ corporate manager

22

LLC / Partnership No corporate level tax 75% - 90% 40% and higher Owner / Entrepreneur

(1) (2)

From McDonalds: Behind the Golden Arches, pgs. 288 - 291. Illustrative leverage and equity return figures. Not based on company data.

III. Pershings Proposal to McDonald's: McOpCo IPO

III. Pershings Proposal to McDonald's: McOpCo IPO

Pershings Proposal: McOpCo IPO

Step 1: IPO of 65% McOpCo IPO 65% of McOpCo IPO generates estimated $3.27bn of after tax proceeds Assumes a 7x EV/FY06E EBITDA multiple Assumes $1.35 bn of Net Debt allocated to McOpCo

Step 2: Issue Debt and Pursue Leveraged Self Tender Issue $14.7bn of financing secured against PF McDonalds real estate Debt financing and IPO proceeds used to Refinance all of the existing $5 bn of net debt at Pro Forma McDonalds Repurchase 316mm shares at $40 per share Pay $300mm in fees and transaction costs

24

III. Pershings Proposal to McDonald's: McOpCo IPO

Pershings Proposal: McOpCo IPO (contd)

Pro Forma

IPO 65%

McOpCo

At the time of IPO, McOpCo signs market lease and franchise agreements with Pro Forma McDonalds (PF McDonalds)

PropCo

FranCo

Resulting Pro Forma McDonalds is a world-class real estate and franchise business McOpCo financials deconsolidated from PF McDonalds Leverage is placed only on PropCo FranCo is unlevered, maximizing its credit rating

25

III. Pershings Proposal to McDonald's: McOpCo IPO

McOpCo IPO: A Transformational Transaction

An IPO of McOpCo would have several positive strategic and financial implications for both Pro Forma McDonalds as well as McOpCo.

Significant value creation for shareholders

PF McDonalds would trade at an approximate 37%52% premium over where it trades today, in the range of approximately $4550 per share (1)

Creates investor transparency

Deconsolidation provides investors with transparent insight into PF McDonalds profitability (60% EBITDA margins), attractive FCF profile (35% levered FCF margins) and world-class real estate/franchise assets Separation of McOpCo highlights the significant value of rental income and franchise fees currently eliminated in consolidation

Enhances management focus and incentives at both entities

Enhances ability to attract and retain top McOpCo management Allows PF McDonalds management team to focus on new product innovation, improved marketing efforts, stronger real estate development programs and higher quality franchisee performance monitoring / training

________________________________________________ (1)

Based on recent stock price of $33 per share.

26

III. Pershings Proposal to McDonald's: McOpCo IPO

A Transformational Transaction (Cont'd)

Improves operating and financial metrics at every level Significantly improves PF McDonalds EBITDA and free cash flow margins Enhances return on capital and overall capital allocation for the PF McDonalds Improves ability of PF McDonalds to pay significant ongoing dividends

Typical Standalone

$ in millions

Pro Forma FY 2006E

Mature QSR

FY 2006E

Revenue EBITDA EBITDA Margin EBITDA-Capex EBITDA-Capex Margin EBITDA-Maintenance Capex EBITDA - Maint. Capex Margin FCF FCF Margin

________________________________________________

$20,816 5,594 26.9% 4,335 20.8% 4,651 22.3% 3,059 14.7%

27

$7,393 4,464 60.4% 3,739 50.6% 4,025 54.4% 2,440 33.0%

15% - 20%

7.5% - 12.5% 10% - 15%

(1)

5% - 10%

We note that CapEx projections are net of proceeds obtained from store closures. (1) Typical QSR margin based on Wall Street estimates for YUM! Brands and Wendys.

III. Pershings Proposal to McDonald's: McOpCo IPO

A Transformational Transaction (Cont'd)

An IPO of McOpCo would have several positive strategic and financial implications for both Pro Forma McDonalds as well as McOpCo.

Will likely lead to improved operating margins at McOpCo

Separation from PF McDonalds will make margin improvement an imperative

Improves capital structure while maintaining investment grade credit rating Low-cost secured debt to replace current debt or issued incrementally on current structure Cheap CMBS structured financing issued at PropCo could judiciously utilize strong real estate collateral CMBS financing is non-recourse to McDonalds (parent) FranCo remains unlevered and is at least a AA credit PF McDonalds, the holding company, remains investment grade Improves alignment with franchisees

(1)

Allows for share buybacks of higher return business

Separation of McOpCo allows for share buybacks to be targeted predominantly at PF McDonalds, the stronger free cash flow business

________________________________________________ (1)

Will be discussed at length later in the presentation.

28

III. Pershings Proposal to McDonald's: McOpCo IPO

A Transformational Transaction (Cont'd)

An IPO of McOpCo would have several positive strategic and financial implications for both McDonalds as well as McOpCo.

Allows for a voice in McOpCo through governance

Given its 35% stake in McOpCo post spin-off, PF McDonalds will be able to elect several Board seats to the new entity Governance affords visibility in McOpCo operations, which will help in: managing the McDonalds brand extending new products through the franchisee system remaining in touch with unit-level economics and issues

Supported by highly similar, successful precedent transactions

Coca Cola Company carved-out its owned bottling operations in 1986 in what is widely viewed as one of the most successful restructurings of all time PepsiCo followed suit in a similar transaction in 1999, with unanimous support from the Wall Street research analyst community

Allows for an accelerated McOpCo refranchising program Increases overall size of PF McDonalds investor base

Strong potential to attract both dividend / income-focused investors and real estate-focused investors

29

III. Pershings Proposal to McDonald's: McOpCo IPO

Publicly Traded Comparable Companies

PF McDonalds operating metrics are much closer to a typical Real Estate C-Corporation or a high branded intellectual property business such as PepsiCo or Coca-Cola than they are a typical mature QSR.

Pro Forma Typical Mature (1) QSR

~15% - 20% ~7.5 % - 12.5% ~10% - 12%

Typical Real Estate C-Corp

~70% - 80% ~65% - 75% NA

High Branded Intangible Property Choice Hotels

66% 61% 16% 23% 18% 11% 31% 27% 9%

2005E Operating Metrics: EBITDA Margins EBITDA CapEx Margins EPS Growth Trading Multiples Adjusted Enterprise Value CY 2006E EBITDA CY 2006E EBITDA CapEx Price / CY 2006E EPS CY 2006E FCF

(3) (2)

60% 50% 9%

/ ~8.5x - 9.5x ~12x - 15x ~13x - 16x ~17x - 20x 15.1x 16.0x 12.3x 15.5x 12.6x 14.2x

~15x - 19x ~16x - 20x

NA ~20x - 25x

24.3x 24.0x

20.1x 20.8x

18.8x 18.9x

Leverage Multiples Net Debt / EBITDA Total Debt / Enterprise Value

________________________________________________

~0.5x - 1.8x ~7.5% - 20%

~5x - 10x ~35% - 60%

1.7x 11%

0.0x 4%

NM 4%

Stock prices as of 11/11/05. Projections based on Wall Street estimates. (1) Typical mature QSR based on YUM! Brands and Wendys. (2) Adjusted for unconsolidated assets. (3) FCF denotes Net Income plus D&A less CapEx.

30

III. Pershings Proposal to McDonald's: McOpCo IPO

REITs: Typical Trading Multiples

We believe REITs trade in the range of 13x-17x EV/06E EBITDA, depending on the type of real estate and the businesses the properties support.

EV / '06E Company Health Care Industrial Multifamily Office Regional Mall Self Storage Strip Center Triple Net Lease REIT Industry Total / Wtd. Avg. EBITDA 14.7x 16.3x 17.0x 15.2x 16.3x 17.5x 15.5x 13.1x 15.7x

Div. Yield 6.3% 4.2% 4.8% 4.7% 3.8% 3.8% 4.5% 6.4% 4.8%

P / '06E FFO 12.6x 13.9x 16.6x 13.8x 14.2x 16.7x 14.4x 12.8x 14.4x

P / '06E AFFO 13.3x 17.2x 19.4x 19.6x 16.9x 18.3x 16.5x 13.4x 16.8x

________________________________________________ Based on Wall Street research estimates at the time of Pershings initial Proposal to the Company.

31

III. Pershings Proposal to McDonald's: McOpCo IPO

Significant Value Creation for Shareholders

$ in millions

Based on relevant publicly traded comparable companies, including several real estate holding CCorporations, Pro Forma McDonalds would trade in the range of 12.5x 13.5x EV/CY 06E EBITDA. We believe PF McDonalds would trade at a 37%52% premium over where it trades today.

Low 12.5x $55,799

(1)

High 13.5x $60,263 14,650 2,493 $48,106 957.3 $50 52.3%

22.2x

EV/'06E EBITDA Multiple Range Enterprise Value Less: Net Debt (12/31/05E) Equity Value Ending Shares Outstanding (12/31/05E) (3) Price Per Share Premium to recent price (4)

Implied P/FY 2006 EPS Multiple

14,650 2,097 $43,247 957.3 $45 36.9%

19.9x

Plus: Remaining Stake in McOpCo (2)

Implied P/FY 2006 FCF Multiple (5)

Implied FCF / Dividend Yield

19.8x

5.1%

21.9x

4.6%

________________________________________________ (1) Assumes $1.35 bn of net debt allocated (2) (3) (4) (5)

to McOpCo and $5.0 bn of net debt allocated to PF McDonalds. In addition, assumes $9.7 bn of incremental leverage placed on PF McDonalds. Represents 35% of the market equity value of McOpCo. Assumes incremental leverage and the after-tax proceeds from McOpCo IPO (net of fees and expenses) are used to buy back approximately 316 mm shares at an average price of $40. Assumes a recent stock price of $33. P / FY 06E FCF multiple adjusted for Pro Forma McDonalds 35% stake in McOpCo.

32

III. Pershings Proposal to McDonald's: McOpCo IPO

McOpCo Valuation Summary and Potential IPO Proceeds

McOpCo would likely be valued at $6.0 billion to $7.1 billion of equity market value or 6.5x7.5x EV/06E EBITDA.

McOpCo Financial Summary

$ in millions McOpCo Financial Summary Company operated revenues Segment EBITDA, pre G&A EBITDA Margin, pre G&A Assumed G&A for McOpCo Assumed G&A as a Percentage of Total G&A EBITDA post G&A EBITDA Margins Net Income EPS FY 2006E $15,429 1,690 11.0% 560 25.0% $1,130 7.3% $308 $0.24

$ in millions

McOpCo Valuation Summary

Low 6.5x $7,343 1,350 $5,993 1,274 $4.70 $3,042 High 7.5x $8,472 1,350 $7,122 1,274 $5.59 $3,497 EV/'06E EBITDA Multiple Range McOpCo Enterprise Value Net Debt (12/31/05) Equity Value of McOpCo Ending Shares Outstanding Price per share Estimated After-Tax IPO Proceeds (1) See appendix for after-tax IPO proceeds schedule

________________________________________________ (1)

See appendix for McOpCo IPO after-tax proceeds schedule.

33

III. Pershings Proposal to McDonald's: McOpCo IPO

Pro Forma McDonalds: Valuation Summary

The valuation of PF McDonalds suggests a valuation range of $45$50 per share. Based on the midpoint of the valuation analysis, PF McDonalds could be worth $47.50 per share, a 44% premium over where it trades today.

PF McDonald's Summary Financials

$ in millions Financial Summary Franchise Revenue Real Estate Revenue Total Revenue Franchise EBITDA, Pre G&A Real Estate EBITDA, Pre G&A Less: Allocated G&A Assumed G&A as a Percentage of Total G&A Total EBITDA EBITDA Margins Net Income EPS FY 2006E $2,275 5,118 $7,393 $2,275 3,869 1,680 75.0% $4,464 60.4% 2,141

$2.27

$ in millions

PF McDonald's Valuation

Low 12.5x $55,799

(1) (2)

High 13.5x $60,263 14,650 2,493 $48,106 957.3 $50 52.3%

22.2x

EV/'06E EBITDA Multiple Range Enterprise Value Less: Net Debt (12/31/05E) Equity Value Ending Shares Outstanding (12/31/05E) Price Per Share Premium to recent price (4)

Implied P/FY 2006 EPS Multiple

(3)

14,650 2,097 $43,247 957.3 $45 36.9%

19.9x

Plus: Remaining Stake in McOpCo

Implied P/FY 2006 FCF Multiple

Implied FCF / Dividend Yield

(5)

19.8x

5.1%

21.9x

4.6%

Memo:Share Buyback: Incremental Debt Issued Less Transaction Fees and Expenses (6) Approximate Cash Received From IPO, after Tax Total Funds Available for Repurchase # of shares repurchased (mm) Average price of stock purchased

$9,685 ($300) $3,270 $12,654 316 $40

________________________________________________ (1)

(2) (3)

(4) (5) (6)

Assumes $1.35 billion of net debt allocated to McOpCo and $5.0 billion of net debt allocated to PF McDonalds. In addition, assumes $9.7 billion of incremental leverage placed on PF McDonalds. Represents 35% of the market equity value of McOpCo. Assumes incremental leverage and the after-tax proceeds from McOpCo IPO (net of fees and expenses) are used to buy back approximately shares 316 million shares at an average price of $40. Assumes a recent stock price of $33. P / FY 06E FCF multiple adjusted for Pro Forma McDonalds 35% stake in McOpCo. Fees and expenses associated with the IPO and financing transactions. 34

III. Pershings Proposal to McDonald's: McOpCo IPO

Capitalization and Credit Profile of Pro Forma McDonalds

Set forth below are the sources and uses of proceeds associated with a $14.7 bn issuance of secured collateralized financing (net of cash on hand), or an incremental $9.7 of net debt, based on expected net debt as of FY 2005E. We have assumed a 5% fixed rate for this collateralized financing. After this transaction, Pro Forma McDonalds would be leveraged approximately 3.5x Total Debt/EBITDA or at a 25% Debt to Enterprise Value ratio. Proceeds from this issuance would be used to repay existing debt, buyback shares and pay financing fees and expenses.

$ in millions

Sources

New CMBS Financing (net of cash) Percentage Loan to Value Total $14,650 44% $14,650

PF McDonald's Capital Structure

Total Net Debt at Stand-alone McDonalds Less: Net Debt Allocated to McOpCo Net Debt at PF McDonalds Incremental Debt Issued through CMBS Total Net Debt Total Debt / EBITDA Net Debt / EBITDA Assumed Corporate Credit

Total Debt / Total Capitalization

FY2005E $6,315 (1,350) $4,965 9,685 $14,650 3.5x 3.4x Investment Grade

24.5%

Uses

Repay Existing Net Debt at PF McDonald's Buyback Shares Fees and Expenses Total $4,965 9,535 150 $14,650

35

III. Pershings Proposal to McDonald's: McOpCo IPO

Total Debt / 05E EBITDA

12.0x 9.0x 6.0x 3.0x 0.0x 3.5x

(1)

Comparing PF McDonalds Credit Stats with Comparable Real Estate Holding C-Corporations

11.3x 8.1x 6.1x

10.2x

Brookfield Properties

British Land

Land Securities

Forest City Enterprises

Pro Forma

Debt / Enterprise Value

100% 75% 50% 25% 0% Brookfield Properties British Land Land Securities Forest City Enterprises 25% 48% 56% 35% 59%

Pro Forma

EBITDA/Interest: Rating:

________________________________________________ (1) (2)

5.8x (2)

2.3x BBB

36

1.5x BBB

2.5x NR

NA BB+

Based on Wall Street research estimates. Pro Forma McDonalds EV assumes a valuation multiple of 13x EV/FY06 EBITDA. Assumes an average 5% fixed rate on PF McDonalds debt.

III. Pershings Proposal to McDonald's: McOpCo IPO

Credit Ratings of Large Public REITs

A review of large REITs indicates that these businesses support investment grade ratings with a debt to enterprise value of 36% on average, as compared to Pro Forma McDonalds which would have a debt to enterprise value of 25%.

Company Name Simon Property Group Inc. Equity Office Properties Trust Vornado Realty Trust Equity Residential Prologis Archstone-Smith Trust Boston Properties Inc. Kimco Realty Corp. AvalonBay Communities Inc.

Total Debt/ Enterprise Value 47.2% 50.9% 37.4% 38.4% 31.5% 33.5% 36.0% 25.2% 27.3%

Moody's Rating Baa2 Baa3 Baa3 Baa1 Baa1 Baa1 NR Baa1 Baa1

Moody's Outlook Stable Stable Stable Stable Stable Stable NR Stable Stable

S&P Rating BBB+ BBB+ BBB+ BBB+ BBB+ BBB+ BBB+ ABBB+

S&P Outlook Stable Stable Stable Stable Stable Stable Stable Stable Stable

Median Total Debt/EV Average Total Debt/EV PF McDonald's Total Debt/EV

36% 36% 25%

________________________________________________

Notes: Stock prices as of 11/11/2005. PF McDonalds EV assumes a valuation multiple of 13x EV/FY06 EBITDA. Total Debt includes Preferred.

37

III. Pershings Proposal to McDonald's: McOpCo IPO

Pro Forma McDonalds Has A Superior Credit Profile to a Typical REIT

Despite being a C-Corp and lacking the tax advantages of a REIT, PF McDonalds has several superior credit characteristics REITs are required to pay 90% of earnings through dividends, whereas Pro Forma McDonalds has much more credit flexibility PF McDonalds has significant brand value to support its cash flows and overall credit

38

IV. Company Response to Pershing

IV. Company Response to Pershing

Company Response to Pershing

McDonalds asked its Advisors to help review the Proposal Goal was to review the proposal to assess 4 critical areas:

Advisors reported back with judgments on (1) Valuation (2) Credit Impact McDonalds Management reviewed the Proposal to assess (3) Friction Costs (4) Governance / Alignment Issues

40

IV. Company Response to Pershing

Management Concerns: Friction Costs, Credit Impact and Governance Issues

Friction Costs

Some friction costs associated with the CMBS financing structure, but not a gating issue

Credit Impact

Incremental $9bn of leverage as proposed may put pressure on credit rating

Alignment Issues

Separation of McOpCo from PF McDonalds may cause alignment issues in the system

Potential property tax revaluations Legal costs Large transaction for CMBS market Mostly driven by CMBS financing

Rating agency consolidation of McOpCo Lease commitments viewed as leverage

McDonalds management stated that, assuming adequate value creation, none of these issues would prevent a restructuring

41

IV. Company Response to Pershing

Valuation: Judgments Made by Advisors

Advisors were assigned to review the Proposal In general, Advisors agreed with Pershing on: McOpCo valuation Relative allocation of EBITDA between McOpCo and PF McDonalds However, their judgment was that PF McDonalds would not enjoy significant multiple expansion

PF McDonalds would trade like a restaurant stock

42

V. Developing a Response to the Company

V.

Developing a Response to the Company

Pershings Response Regarding Friction Costs and Credit Impact

Friction Costs Friction costs immaterial in the context of value creation Friction costs and transaction delays were driven by CMBS financing Similar transaction could be effected with corporate debt

Credit Impact Stability of PF McDonalds cash flow stream and robust asset base should allow it to incur additional debt without a material adverse change in rating YUMs credit rating is BBB-

44

V.

Developing a Response to the Company

Franchisee Alignment: Skin in the Game

Franchisor/Franchisee Conflict

Top Line (percent of sales) vs. Bottom Line

Some believe this conflict is mitigated by owning and operating units However, many of the most successful franchisors operate few, if any, units

Historical McDonalds Subway Dunkin Donuts Tim Hortons

McDonalds current skin in the game is overstated due to lack of transfer pricing

We believe McOpCo represents ~10% of McDonalds total value

PF McDonalds role as landlord, franchisor, 35% shareholder and board member, leaves them with ample skin in the game

45

V.

Developing a Response to the Company

Franchisee Alignment: Benefits to Franchisees of an independent McOpCo

McOpCo IPO would shift some power to the franchise baseA good thing

Franchisees know whats best operationally Franchisees have been the source of most product innovations (i.e. Big Mac, Egg McMuffin, Filet-o-Fish, Apple Pie) Driving force behind current process innovations (call centers at drivethru) IPO would sharpen focus on being best in class franchisor

Level the playing field: McOpCo should compete on the same basis as franchisees

Pay market rent and franchise fees Be focused on bottom-line profitability Be run by equity compensated management

Opportunity for Franchisees to expand unit count

Heavy demand among operators to acquire/manage additional units McOpCo should refranchise units better managed by franchisees

46

V.

Developing a Response to the Company

What It Boils Down To: Valuation of PF McDonalds

Although there are some differences in opinion regarding friction costs, leverage and potential alignment issues, the key disparity between Pershing and the Companys views was regarding the Valuation of Pro Forma McDonalds

47

V.

Developing a Response to the Company

PF McDonalds FY2005E EBITDA pre-G&A Contribution

Pro Forma McDonalds is Not a Restaurant Company

Brand Royalty 37%

63% Real Estate

48

V.

Developing a Response to the Company

Comparable Companies

PF McDonalds operating metrics are much closer to a typical Real Estate C-Corporation or a high branded intellectual property business such as PepsiCo or Coca-Cola than they are a typical QSR.

Assumes PF McDonalds price of ~$47.50

2005E Operating Metrics: EBITDA Margins EBITDA CapEx Margins EPS Growth Trading Multiples Adjusted Enterprise Value (2) / CY 2006E EBITDA CY 2006E EBITDA CapEx Price / CY 2006E EPS CY 2006E FCF

(3)

Pro Forma

Typical Real Estate C-Corp

~70% - 80% ~65% - 75% NA

High Branded Intangible Property Choice Hotels

66% 61% 16% 23% 18% 11% 31% 27% 9%

Typical Mature QSR

~15% - 20% ~7.5 % - 12.5% ~10% - 12%

60% 50% 9%

13.0x 15.5x

~13x - 16x ~17x - 20x

15.1x 16.0x

12.3x 15.5x

12.6x 14.2x

~8.5x - 9.5x ~12x - 15x

21.1x 20.9x

NA ~20x - 25x

24.3x 24.0x

20.1x 20.8x

18.8x 18.9x

~15x - 19x ~16x - 20x

Leverage Multiples Net Debt / EBITDA Total Debt / Enterprise Value

________________________________________________

3.4x 24%

~5x - 10x ~35% - 60%

1.7x 11%

0.0x 4%

NM 4%

~0.5x - 1.8x ~7.5% - 20%

Stock prices as of 11/11/05. Projections based on Wall Street estimates. (1) Typical mature QSR based on YUM! Brands and Wendys. (2) Adjusted for unconsolidated assets. (3) FCF denotes Net Income plus D&A less CapEx.

49

V.

Developing a Response to the Company

Significant Free Cash Flow Yield / Dividend Yield Assuming No Incremental Debt

At McDonalds current price of approximately $33 per share, we estimate Pro Forma McDonalds dividend / FCF yield would be approximately 6.7%. (1)

McDonald's Stock Price McOpCo Share Price (7x EV / EBITDA Multiple) Implied Pro Forma McDonald's Share Price Yield on Pro Forma McDonald's

Memo: Pro Forma McDonald's Free Cash Flow 2006E EBITDA Less: Maintenance Capital Expenditures Less: Growth Capital Expenditures Plus / Less: Decreases / (Increases) in Working Capital Less: Interest (1) Less: Cash Taxes Free Cash Flow PFMcDonald's Shares Out (assuming no self-tender) Free Cash Flow per Share

________________________________________________ (1)

$33.00 $5.15 27.85 6.7%

$37.00 $5.15 31.85 5.9%

$41.00 $5.15 35.85 5.2%

$45.00 $5.15 39.85 4.7%

$49.00 $5.15 43.85 4.3%

$53.00 $5.15 47.85 3.9%

$57.00 $5.15 51.85 3.6%

$4,464.0 (438.6) (285.9) 6.2 (250.0) (1,112.7) $2,383.0 1,273.7 $1.87

Assuming PF McDonalds pays out 100% of its FCF as dividends. (2) Assumes no incremental leverage and an average cost of debt of 5% on the existing $5 bn of net debt at Pro Forma McDonalds.

50

V.

Developing a Response to the Company

Pro Forma McDonalds: Stable and Growing

Pershing believes the best way to think about Pro Forma McDonalds is as a growing annuity.

Real Estate and Franchise EBITDA ($ in billions) Based on Pershing Assumptions

$4.0

Based on Reported Financials

$3.0

$2.0

$1.0

$1.5

$0.0

$1.6

$1.8

$1.9

$2.1

$2.5

$2.6

$2.7

$2.9

$3.2

$3.1

$3.1

$3.2

$3.6

$4.0

1990

Real Estate & Franchise EBITDA Growth:

________________________________________________

1991

4.9%

1992

11.7%

1993

8.5%

1994

10.4%

1995

15.3%

1996

4.0%

1997

4.3%

1998

10.1%

1999

7.4%

2000

(0.5%)

2001

0.1%

2002

0.9%

2003

12.6%

2004

13.4%

Notes: Assumes McOpCo G&A to be 25% of consolidated G&A and Real Estate and Franchise G&A to be 75% of consolidated G&A. Assumes McOpCo pays franchise fees of 4% of sales and rent of 9% of sales. 51

V.

Developing a Response to the Company

Which Would You Rather Own: Pro Forma McDonalds or a Large Retail REIT?

McDonald's Stock Price McOpCo Stock Price PF McDonald's Stock Price Scenario 1: No Sharebuyback No Incremental Leverage Pre-Tax Yield (2) After-Tax Investor Yield (3) Estimated LT Dividend Growth

$33.15 5.15 $28.00 6.7% 5.7%

$35.15 5.15 $30.00 5.9% 5.0%

$40.15 5.15 $35.00 5.2% 4.4% 3% - 4%

$45.15 5.15 $40.00 4.7% 4.0%

$50.15 5.15 $45.00 4.3% 3.6%

$55.15 5.15 $50.00 3.9% 3.3%

$60.15 5.15 $55.00 3.6% 3.1%

Typical Large Retail REIT (1) 4.0% 2.6% 3%- 6%

Scenario 2 Proposed Sharebuyback

PF McDonald's Stock Price Pre-Tax Yield

(4)

$28.00 8.5% 7.2%

$30.00 7.9% 6.7%

$35.00 6.7% 5.7% 3% - 4%

$40.00 5.8% 4.9%

$45.00 5.1% 4.3%

$50.00 4.6% 3.9%

$55.00 4.1% 3.5%

After-Tax Investor Yield (4) Estimated LT Dividend Growth

________________________________________________

Note: Assumes a 7x EV / FY 06E EBITDA multiple on McOpCo. (1) Retail / REIT dividend yield based on Simon Property Group. Illustrative LT Dividend growth based on Pershings estimates. (2) Assumes full payout of free cash flows for PF McDonalds. (3) Assumes 15% tax rate on PF McDonalds dividend and a 35% tax rate on the REIT dividend. (4) Scenario 2 Pre-Tax and After-Tax Yields are adjusted for a 35% stake in McOpCo.

52

V.

Developing a Response to the Company

Which Would You Rather Own: Pro Forma McDonalds or 10-Year U.S. Treasury?

McDonald's Stock Price McOpCo Stock Price PF McDonald's Stock Price Scenario 1: No Sharebuyback No Incremental Leverage Pre-Tax Yield

(1)

$33.15 5.15 $28.00 6.7% 5.7%

$35.15 5.15 $30.00 5.9% 5.0%

$40.15 5.15 $35.00 5.2% 4.4% 3% - 4%

$45.15 5.15 $40.00 4.7% 4.0%

$50.15 5.15 $45.00 4.3% 3.6%

$55.15 5.15 $50.00 3.9% 3.3%

$60.15 5.15 $55.00 3.6% 3.1% 3% - 4%

10 Year Treasury 4.6% 3.0% 0%

After-Tax Investor Yield (2) Estimated LT Dividend Growth

Scenario 2 Proposed Sharebuyback

PF McDonald's Stock Price Pre-Tax Yield

(3)

$28.00 8.5% 7.2%

$30.00 7.9% 6.7%

$35.00 6.7% 5.7% 3% - 4%

$40.00 5.8% 4.9%

$45.00 5.1% 4.3%

$50.00 4.6% 3.9%

$55.00 4.1% 3.5% 3% - 4%

After-Tax Investor Yield (3) Estimated LT Dividend Growth

________________________________________________

Note: Assumes a 7x EV / FY 06E EBITDA multiple on McOpCo. (1) Assumes full payout of free cash flows for PF McDonalds. (2) Assumes 15% tax rate on PF McDonalds dividend and a 35% tax rate on the 10-Year Treasury dividend. (3) Scenario 2 Pre-Tax and After-Tax Yields are adjusted for a 35% stake in McOpCo.

53

V.

Developing a Response to the Company

Which Would You Rather Own: Pro Forma McDonalds or a Treasury Inflation Protected Security (TIPS)?

McDonald's Stock Price McOpCo Stock Price PF McDonald's Stock Price Scenario 1: No Sharebuyback No Incremental Leverage Pre-Tax Yield (1) After-Tax Investor Yield (2) Estimated LT Dividend Growth

$33.15 5.15 $28.00 6.7% 5.7%

$35.15 5.15 $30.00 5.9% 5.0%

$40.15 5.15 $35.00 5.2% 4.4% 3% - 4%

$45.15 5.15 $40.00 4.7% 4.0%

$50.15 5.15 $45.00 4.3% 3.6%

$55.15 5.15 $50.00 3.9% 3.3%

$60.15 5.15 $55.00 3.6% 3.1%

10 Year TIPS 2.1% 3.0% 2.5%

Scenario 2 Proposed Sharebuyback

PF McDonald's Stock Price Pre-Tax Yield

(3)

$28.00 8.5% 7.2%

$30.00 7.9% 6.7%

$35.00 6.7% 5.7% 3% - 4%

$40.00 5.8% 4.9%

$45.00 5.1% 4.3%

$50.00 4.6% 3.9%

$55.00 4.1% 3.5%

After-Tax Investor Yield (3) Estimated LT Dividend Growth

________________________________________________

Note: Assumes a 7x EV / FY 06E EBITDA multiple on McOpCo. (1) Assumes full payout of free cash flows for PF McDonalds. (2) Assumes 15% tax rate on PF McDonalds dividend and a 35% tax rate on the TIPS dividend. (3) Scenario 2 Pre-Tax and After-Tax Yields are adjusted for a 35% stake in McOpCo.

54

V.

Developing a Response to the Company

Valuation of McDonalds as a Growing Annuity

Based on a review of the cost of capital of Real Estate holding corporations and Intangible Property / Franchise businesses like Coca Cola and Choice Hotels, we believe that Pro Forma McDonalds levered FCF could have a discount rate in the area 7.25% - 7.75%. As such, we believe PF McDonalds would have a FCF Yield of 4.25% - 5.25%. This implies a midpoint equity valuation range of $48 per share.

Estimated Discount Rate Implied Perpetuity Growth Rate Implied FCF Yield Implied FCF Multiple FY'06E Free Cash Flow per Share (1) (Note: FCF Assumes Proposal Scenario)

Low 7.75% 2.50% 5.25% 19.0x $2.17

High 7.25% 3.00% 4.25% 23.5x $2.17

Midpoint of PF McDonalds Equity Value per Share(2): $48

________________________________________________ (1) (2)

Assumes no dividend paid in FCF calculation. Includes the value of PF McDonalds 35% equity stake in McOpCo (approx. $2 per share). Assumes a 7x EV / FY 06E EBITDA McOpCo valuation multiple.

55

V.

Developing a Response to the Company

Conclusions

McDonalds is significantly undervalued today Over 80% of its cash flows comes from real estate income and franchise income Proposal creates value for several reasons Increases shareholder value Improves management focus Increases transparency Improves capital allocation Improves franchise alignment There are multiple ways to unlock value Pershings Initial Proposal Variations on Pershings Initial Proposal

56

V.

Developing a Response to the Company

Next Steps

Engage constituents regarding proposal Shareholders Franchisees Broad investment community Incorporate your feedback Consider revised proposal

57

V.

Developing a Response to the Company

Q&A

58

Appendix

A. Pershings Proposal: Assumptions

A. Pershings Proposal: Assumptions

McOpCo IPO: General Assumptions

Pershing has assumed the following structural and tax assumptions with respect to an IPO spin-off of McOpCo.

65% of McOpCo shares are IPOed in the transaction 35% stake retained by PF McDonalds allows for McOpCos business to be deconsolidated McOpCo is assumed to be essentially a debt free subsidiary Immediately prior to the IPO, $1.35bn of McDonalds consolidated FY 05E net debt is allocated to McOpCo $1.5 billion of total debt allocated $150mm of cash and cash equivalents allocated The remaining $5bn of FY 05E net debt is allocated to PF McDonalds $5.15bn of total debt $150mm of cash and cash equivalents McOpCos tax basis is assumed to be approximately $1.65 billion Tax basis is equal to $3 billion of initial assumed basis (based on an assessment of net equipment and other property at McDonalds) less $1.35 billion of allocated net debt To the extent that the IPO distribution exceeds PF McDonalds tax basis in McOpCo, then the tax cost for the IPO would be the amount by which the IPO distribution exceeds McDonald's basis multiplied by McDonalds corporate and state/local tax rate

61

A. Pershings Proposal: Assumptions

McOpCo IPO: Structural And Tax Observations

Step 1: McOpCo dividends a $4.2bn Note to McDonalds (parent)

Step 2: IPO of McOpCo and Tax Costs

Equity Markets

IPO of McOpCo Shares

Step 3: Leveraged Self-Tender at Pro Forma McDonalds

Pro Forma

PF McDonalds performs a leveraged self-tender $4.2 bn cash received

$4.2bn Note

McOpCo

McDonalds retains 35% stake

McOpCo

McOpCo repays $4.2 bn Note to McDonalds

PropCo

Issues CMBS financing, or $9.7bn of incremental debt

FranCo

No debt at FranCo

McOpCo declares and pays a dividend to McDonalds (parent) in the form of a Note in an amount equal to the anticipated proceeds from an initial public offering of McOpCo For illustrative purposes, we assume the Note is for $4.2bn, or 65% of the equity market value of McOpCo (assumed to be $6.5bn)

McOpCo undertakes the IPO and uses the proceeds to repay the dividend note. The tax cost for the IPO would be the amount by which the IPO distribution exceeded McDonald's basis in the McOpCo stock multiplied by McDonalds corporate and state/local tax rate Assuming a $4.2bn of IPO distribution, the tax cost would be approximately $1bn Tax cost equals $4.2 billion of distribution less $1.65 billion of basis multiplied by the tax rate of 38% As such, after tax proceeds of the McOpCo IPO will be approximately $3.2 billion

62

PF McDonalds is organized as a real estate business (PropCo) and a franchise business (FranCo) PropCo issues secured financing with proceeds used for Repaying existing debt at PF McDonalds Buying back shares PF McDonalds performs a self tender using proceeds from: New CMBS financings After tax proceeds of IPO

A. Pershings Proposal: Assumptions

McOpCo IPO Proceeds

McOpCo IPO After Tax Proceeds

Set forth herein is a schedule of the after-tax proceeds from the McOpCo IPO.

Low Taxes payable McOpCo Equity Market Value IPO Percentage Distribution to PF McDonald's $5,993 65% $3,895 $7,122 65% $4,630 $6,558 65% $4,262 High Average

Book Basis of McOpCo Net Debt Allocated to McOpCo Adjusted Basis in McOpCo

3,000 (1,350) 1,650

3,000 (1,350) 1,650

3,000 (1,350) 1,650

Taxable Gain Tax Rate Taxes payable

$2,245 38% $853

$2,980 38% $1,132

$2,612 38% $993

After Tax Proceeds Distribution Taxes Payable After Tax Distributions

63

$3,895 (853) $3,042

$4,630 (1,132) $3,497

$4,262 (993) $3,270

A. Pershings Proposal: Assumptions

Collateralized Financing

Assuming PF McDonalds owns the land and building of 37% of its system wide units and owns the buildings of 22% of its system wide units, then a preliminary valuation of McDonalds real estate suggests a value of $33 billion.

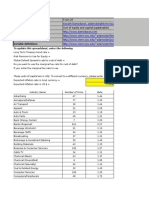

Avg. Annual Rev. Per Unit Est. Market Rent % Est. Market Rent $ Est. # of Units Est. Rent Income Cap Rate Total Real Estate Value

$ in million

Property Value Owns Land and Building Owns Building (Leases Land)

1.75 1.75

9.0% 4.5%

0.16 0.08

11,709 6,962

1,844.2 548.3 Estimated Property Value

7.0% 8.0%

$26,346 $6,854 $33,200

$ in million

Est. Rent Spread Per Avg unit

Est. # of Units

Est. Rent Income, Net

Cap Rate

Total Real Estate Value

Leasehold Value Leaseholds

0.10

12,975

1,322.8 Estimated Leasehold Value

10.0%

$13,228 $13,228 $46,428

Total Real Estate Collateral Value

64

A. Pershings Proposal: Assumptions

PF McDonalds: Cost of Capital

We estimated the asset betas of several Real Estate holding C-Corporations and several high branded intellectual property businesses.

High Branded Intangible Property Business Betas (Dollar values in millions)

Adjusted Equity Beta 0.49 0.46 0.86 0.60 0.49 Cost of Equity 7.3% 7.2% 9.3% 7.9% 7.3% Equity Value $101,776.1 99,498.9 2,285.7 $67,853.6 99,498.9 Total Debt $4,200.0 4,607.0 296.7 $3,034.6 4,200.0 Preferred Stock 41.0 $13.7 Marginal Tax Rate 38.0% 38.0% 38.0% 38.0% 38.0% Unlevered Beta 0.48 0.45 0.79 0.57 0.48 Total Debt & Preferred / TEV 4.2% 4.7% 11.7% 6.8% 4.7%

Company Coca Cola Co. Pepsico Inc. Choice Hotels Mean Median

Real Estate Business Betas (Dollar values in millions)

Adjusted Equity Beta 0.62 0.80 0.66 0.55 0.66 0.64 Cost of Equity 8.0% 9.0% 8.2% 7.7% 8.2% 8.1% Equity Value $8,913.9 6,805.9 3,863.9 12,279.2 $7,965.7 7,859.9 Total Debt $11,391.1 6,208.0 5,566.0 6,484.2 $7,412.3 6,346.1 Preferred Stock 1,477.0 $369.3 Marginal Tax Rate 38.0% 38.0% 38.0% 38.0% 38.0% 38.0% Unlevered Beta 0.34 0.45 0.35 0.42 0.39 0.38 Total Debt & Preferred / TEV 56.8% 60.5% 59.3% 34.6% 52.8% 58.0%

Company British Land Brookfield Properties Forest City Enterprises Land Securities Mean Median

Note: Market information as of 11/10/05. Utilized treasury stock method. Sources: Barra, company reports, Factset, and Wall Street Equity research.

65

A. Pershings Proposal: Assumptions

PF McDonalds: Cost of Capital (Contd)

Based on a blended asset beta calculation we determined a range of values for the WACC of PF McDonalds.

Blended Asset Beta Calculation

Asset Beta Average Real Estate Unlevered Asset Beta

Main Target Assumptions PreTax Cost of Debt Risk-Free Rate Equity Risk Premium Tax Rate WACC Calculation Unlevered Asset Beta Releverd Beta Levered Cost of Equity Equity Weight AfterTax Cost of Debt Target Debt & Pref. / TEV Implied Debt / Equity WACC

% Contribution from Real Estate 60.0%

6.0% 4.6% 5.0% 38.0%

Asset Beta Average High Branded Intellectual Property Unlevered Asset Beta 0.57

% Contribution from High Branded Intellectual Property 40.0%

Blended Average Unlevered Asset Beta 0.45

0.38

WACC Sensitivity Analysis Levered Beta 0.55 6.1% 6.5% 6.9% 7.3%

Equity Risk Premium

0.46 0.56 7.4% 75.0% 3.7% 25.0% 33.3% 6.5% Debt / TEV

4.0% 5.0% 6.0% 7.0%

0.45 5.8% 6.1% 6.4% 6.8%

0.50 5.9% 6.3% 6.7% 7.0%

0.60 6.2% 6.7% 7.1% 7.6%

0.65 6.4% 6.8% 7.3% 7.8%

15.0% 20.0% 25.0% 30.0% 35.0%

0.45 6.4% 6.2% 6.1% 5.9% 5.8%

0.50 6.6% 6.4% 6.3% 6.1% 5.9%

Levered Beta 0.55 6.8% 6.6% 6.5% 6.3% 6.1%

0.60 7.0% 6.8% 6.7% 6.5% 6.3%

0.65 7.3% 7.0% 6.8% 6.6% 6.4%

Note: Market information as of 11/10/05. Utilized treasury stock method. Sources: Barra, company reports, Factset, and Wall Street Equity research.

66

B. PF McDonald's Financial Analysis

B. PF McDonald's Financial Analysis

Pro Forma McDonalds: Model Key Drivers

Set forth herein are the assumptions for the Pro Forma McDonalds business.

Net Unit Growth Approximates 1.5% - 2.0% of total franchise system unit growth annually or 1.0% - 1.5% of systemwide unit growth Revenue drivers: Average systemwide same-store sales CAGR of ~2.5% annually Rental revenue from franchisees of 9.0% of franchise & affiliated system sales Rental revenue from McOpCo of 9.0% of McOpCo sales Franchise revenue from franchisees of 4.0% of franchise & affiliated system sales Franchise revenue from McOpCo of 4.0% of McOpCo sales Cost drivers: Franchise rental expense based on a historical % of rental revenue from franchisees McOpCo rental expense based on a historical % of rental revenue from McOpCo D&A calculated assuming a 20-year useful life for existing net depreciable PP&E of approximately $12.5 billion (excluding land), and a 20-year useful life for depreciable PP&E purchased in the future 75% of SG&A allocated to Pro Forma McDonalds Net CapEx drivers: All CapEx is net of proceeds received from store closures $1.3 million of CapEx for each new unit where Pro Forma McDonalds owns the land and the building in 2005 and 2006, growing at an inflationary rate of 2.0% thereafter $650K million of CapEx for each new unit where Pro Forma McDonalds owns the building but not the land in 2005 and 2006, growing at an inflationary rate of 2.0% thereafter Run-rate maintenance CapEx of approximately $320 million, implying approximately $10K per system wide unit, growing at 2% Allocation of 75% of consolidated McDonalds corporate CapEx Consolidated corporate CapEx held constant at 0.7% of sales Other Incremental total debt of $9.7 billion, resulting in total debt of approximately $14.8 billion (net debt of $14.65bn) Free cash used to buy back shares and pay dividends $150 mm minimum cash balance Tax rate of 32% Minimal working capital requirements 25% Debt to Cap ratio increasing to 30% in 2008 Assumes an illustrative 30% dividend payout ratio to match current consolidated McDonalds

68

B. PF McDonald's Financial Analysis

2004 McDonalds P&L As Reported McDonalds

Set forth below is table which reconciles McOpCos, the Real Estate and Franchise businesses and stand-alone McDonalds FY 2004 income statements, as they are currently reported. The analysis demonstrates how McOpCo is paying neither a market rent nor a franchise fee.

(U.S. $ in millions) 2004 Income Statement Sales by Company Operated Restaurants Rent from Franchise and Affiliate Rest. Franchise Fees From Franchise and Affiliate Rest. Total Revenue Company Operated Expenses: Food and Paper Compensation & Benefits Occupancy and Other Expenses (excl. D&A) Company Operated D&A Total Company Operated Expenses Franchised Restaurant Occupancy Costs Franchise PPE D&A Corporate G&A EBIT Depreciation & Amortization EBITDA % of Total EBITDA

________________________________________________

McOpCo P&L $14,224

Real Estate and Franchise P&L 3,336 1,505 $4,841 347 $347 576 427 1,485 2,006 774 $2,780 54%

2004 Consolidated Sum of Parts $14,224 3,336 1,505 $19,065 4,853 3,726 2,747 774 $12,100 576 427 1,980 3,982 1,201 $5,183 100%

$14,224 3,336 1,505 $19,065 4,853 3,726 2,747 774 $12,100 576 427 1,980 3,982 1,201 $5,183 100%

$14,224 4,853 3,726 2,747 427 $11,753 495 1,976 427 $2,403 46%

The analysis assumes that 75% of the total G&A is allocated to the Real Estate and Franchise business and 25% is allocated to McOpCo. To the extent that there should be more G&A allocated to McOpCo, then there would be a greater percentage of total EBITDA at the Real Estate and Franchise business than what is shown here. Note: Analysis excludes $441 mm of non-recurring other net operating expenses. 69

B. PF McDonald's Financial Analysis

2005E P&L Reconciliation

Set forth below is a table which reconciles McOpCos, Pro Forma McDonalds and standalone McDonalds FY 2005E income statements. The analysis demonstrates the flow of rent income, franchise income and rent expense upon separation of the businesses.

(U.S. $ in millions) 2005 Projected Income Statement Sales by Company Operated Restaurants Rent from Franchise and Affiliate Rest. Rent From Company Operated Rest. Franchise Fees From Franchise and Affiliate Rest. Franchise Fees From Company Operated Rest. Total Revenue Company Operated Expenses: Food and Paper Compensation & Benefits Non-Rent Occupancy and Other Expenses (excl. D&A) Company Operated D&A Company-Operated Rent Expense Additional Rent Payable to PropCo Franchise Fee Payable to FranCo Total Company Operated Expenses Franchised Restaurant Occupancy Costs Franchise PPE D&A Corporate G&A EBIT Depreciation & Amortization EBITDA % of Total EBITDA Maintenance Capex EBITDA - Maintenance Capex % of Total EBITDA - Maintenance Capex

________________________________________________ (1)

McOpCo P&L $15,042

Pro Forma McDonald's P&L 3,578 1,354 1,590 602 $7,124 214 616 $830 600 499 1,631 3,564 712 $4,277 80% 749 3,528 86%

Inter-Company Eliminations

2005 Consolidated Sum of Parts $15,042 3,578 1,590 $20,211 5,132 3,926 2,400 789 616 $12,863 600 499 2,174 4,075 1,288 $5,362 100% 1,250 4,113 100%

$15,042 3,578 1,590 $20,211 5,132 3,926 2,400 789 616 $12,863 600 499 2,174 4,075 1,288 $5,362 100% 1,250 4,113 100%

(1,354) (602) ($1,956) (616) (737) (602) ($1,956) -

$15,042 5,132 3,926 2,400 576 616 737 602 $13,989 544 510 576 $1,086 20% 501 585 14%

$0

Assumes total PF McDonalds D&A of approximately $712 million, which is composed of $499 million (or 70%) of franchise PP&E and $214 million (or 30%) of D&A associated with company-operated units. 70

B. PF McDonald's Financial Analysis

2006E P&L Reconciliation

Set forth below is a table which reconciles McOpCos, Pro Forma McDonalds and standalone McDonalds FY 2006E income statements. The analysis demonstrates the flow of rent income, franchise income and rent expense upon separation of the businesses.

(U.S. $ in millions)

(U.S. $ in millions)

Sales by Company Operated Restaurants Rent from Franchise and Affiliate Rest. Rent From Company Operated Rest. Franchise Fees From Franchise and Affiliate Rest. Franchise Fees From Company Operated Rest. Total Revenue Company Operated Expenses: Food and Paper Compensation & Benefits Non-Rent Occupancy and Other Expenses (excl. D&A) Company Operated D&A Company-Operated Rent Expense Additional Rent Payable to PropCo Franchise Fee Payable to FranCo Total Company Operated Expenses Franchised Restaurant Occupancy Costs Franchise PPE D&A Corporate G&A EBIT Depreciation & Amortization EBITDA from Operations % of Total EBITDA Maintenance Capex EBITDA - Maintenance Capex % of Total EBITDA - Maintenance Capex

________________________________________________ (1) Assumes total PF McDonalds D&A

2006 Projected Income Statement

$15,429 3,730 1,658 $20,816 5,264 4,012 2,458 808 632 $13,174 617 516 2,240 4,269 1,324 $5,594 100% 943 4,651 100%

McOpCo P&L

$15,429 $15,429 5,264 4,012 2,458 587 632 756 617 $14,327 560 542 587 $1,130 20% 504 626 13%

Pro Forma McDonald's P&L

3,730 1,389 1,658 617 $7,393 221 632 $853 617 516 1,680 3,727 737 $4,464 80% 439 4,025 87%

Inter-Company Eliminations

(1,389) (617) ($2,006) (632) (756) (617) ($2,006) $0

2006 Consolidated Sum of Parts

$15,429 3,730 1,658 $20,816 5,264 4,012 2,458 808 632 $13,174 617 516 2,240 4,269 1,324 $5,594 100% 943 4,651 100%

of approximately $737 million, which is composed of $516 million (or 70%) of franchise PP&E and $221 million (or 30%) of D&A associated with

71

company-operated units.

B. PF McDonald's Financial Analysis

2006E Net Capital Expenditures Reconciliation

Set forth herein is a table which demonstrates net capital expenditures by category for McOpCo, PF McDonalds and the standalone (consolidated) McDonalds. Note: Our Free Cash Flows are derived using Net Capital Expenditures, net of proceeds received from closures. We note that the Company typically generates $300 - $400mm of proceeds annually from closings.

2006E Net Capital Expenditures (U.S. $ in millions) Consolidated McDonald's New Restaurants, Net Existing Restaurants Corporate/Other Net Capital Expenditures $316 787 156 $1,259 McOpCo $30 465 39 $534 Pro Forma McDonald's $286 322 117 $724

72

B. PF McDonald's Financial Analysis

PF McDonalds: Summary Income Statement

Below are the summary projections for Pro Forma McDonalds based on the assumptions detailed on page 68.

($ in millions, except per share data) 2002A Income Statement Data Revenue % Growth EBITDA % Margin EBITDA - CapEx % Margin D&A EBIT % Margin Net Interest Expense Equity Income from OpCo Net Income EPS Average Shares Outstanding 35.0% $5,401.0 2003A $6,008.5 11.2% $3,568.2 59.4% 2004A $6,690.0 11.3% $4,046.0 60.5% 4,046.0 60.5% 774.0 $3,272.0 48.9% 2005E $7,124.1 6.5% $4,276.7 60.0% 3,312.7 46.5% 712.3 $3,564.4 50.0% 2006E $7,393.1 3.8% $4,464.0 60.4% 3,739.5 50.6% 736.9 $3,727.0 50.4% (736.6) 107.9 $2,141.4 $2.27 945.4 2007E $7,676.7 3.8% $4,653.4 60.6% 3,909.2 50.9% 768.5 $3,884.9 50.6% (801.5) 121.9 $2,218.6 $2.47 897.8 2008E $7,969.9 3.8% $4,849.3 60.8% 4,085.0 51.3% 794.5 $4,054.8 50.9% (889.7) 137.5 $2,289.8 $2.72 842.8 2009E $8,276.2 3.8% $5,054.9 61.1% 4,258.5 51.5% 821.5 $4,233.4 51.2% (932.5) 151.7 $2,396.3 $2.97 806.4 2010E $8,596.2 3.9% $5,270.8 61.3% 4,440.1 51.7% 849.6 $4,421.2 51.4% (971.8) 162.4 $2,507.9 $3.24 773.3 2011E $8,930.9 3.9% $5,497.5 61.6% 4,630.1 51.8% 878.8 $4,618.6 51.7% (1,012.7) 171.9 $2,623.9 $3.54 741.8 4.1% 9.3% 2006 - 2011 CAGR 3.9%

$3,168.7 58.7%

4.3% 4.4%

$2,492.7 46.2%

$2,827.4 47.1%

4.4%

73

B. PF McDonald's Financial Analysis

PF McDonalds: Summary Cash Flow and Balance Sheet

Below are the summary cash flow projections for Pro Forma McDonalds based on the assumptions detailed on page 68.

($ in millions, except per share data) 2002A Cash Flow Data EBITDA less: Cash Taxes less: Cash Interest Expense less: Dividends less: Change in Working Capital less: Growth CapEx less: Maintenance CapEx plus: After-tax Dividends from McOpCo Free Cash Flow (post dividends) Free Cash Flow (pre dividends) FCF per Share (pre dividends) Illustrative Stock Price at 20x LTM FCF 20 Balance Sheet Data Cash Revolver Long-Term Debt Total Debt / Capitalization Total Debt / EBITDA Net Debt / EBITDA 150.0 0.0 $14,800.0 24.5% 3.5x 3.4x 150.0 0.0 14,800.0 26.8% 3.3x 3.3x 150.0 0.0 17,393.4 30.0% 3.7x 3.7x 150.0 0.0 18,331.6 30.0% 3.8x 3.7x 150.0 0.0 19,104.0 30.0% 3.8x 3.7x 150.0 0.0 19,904.5 30.0% 3.8x 3.7x 150.0 0.0 20,740.4 30.0% 3.8x 3.7x 2003A 2004A 2005E 2006E $4,464.0 (956.9) (736.6) (653.2) 6.2 (285.9) (438.6) 0.0 $1,398.9 2,052.1 $2.17 $43.41 2007E $4,653.4 (986.7) (801.5) (676.8) 6.5 (291.6) (452.6) 0.0 $1,450.8 2,127.6 $2.37 $47.40 2008E $4,849.3 (1,012.8) (889.7) (698.5) 6.7 (297.4) (466.9) 0.0 $1,490.7 2,189.2 $2.60 $51.95 2009E $5,054.9 (1,056.3) (932.5) (731.0) 7.0 (314.7) (481.7) 0.0 $1,545.7 2,276.7 $2.82 $56.47 2010E $5,270.8 (1,103.8) (971.8) (765.0) 7.2 (333.5) (497.2) 0.0 $1,606.7 2,371.7 $3.07 $61.34 2011E $5,497.5 (1,153.9) (1,012.7) (800.4) 7.5 (354.0) (513.4) 0.0 $1,670.6 2,471.0 $3.33 $66.63 2006 - 2011 CAGR

8.9%

74

C. McOpCo Financial Analysis

C. McOpCo Financial Analysis

McOpCo: Model Key Drivers

Set forth herein are the assumptions for the McOpCo business.

Net Unit Growth 90 net new owned restaurants in 2005 Net unit growth thereafter only in the franchised system. Assumes 200 new gross units and 200 closed units annually. Revenue drivers: Average same-store sales growthof 2.5% -2.7% annually on a total company basis Average unit sales of $1.6mm on a global basis in FY 2005 Cost drivers: Food and paper costs held constant at 34.1% of sales, based on historicals Payroll and employee costs of 26.1% in 2005, stepping down to 25.5% percent by 2011 Occupancy and other costs (excluding D&A) held constant at 20.5% of sales D&A calculated as 110% of capex in 2006 trailing to approximately 107% of CapEx by 2015 4.0% of sales paid to Pro Forma McDonalds as a franchise fee 25% of consolidated SG&A allocated to McOpCo CapEx drivers: Average maintenance CapEx per unit of approximately $50k in 2005 and 2006, growing at an inflationary rate of 2.0% thereafter Allocation of 25% of consolidated McDonalds corporate CapEx Consolidated corporate CapEx held constant at 0.7% of sales Other No dividends Total Debt of $1.5 billion allocated (Net Debt of $1.35bn) Free cash used to pay down debt and then buy back shares $150 mm minimum cash balance Tax rate of 32% Minimal working capital requirements

76

C. McOpCo Financial Analysis

McOpCo Summary Income Statement

Set forth below are the summary projections for McOpCo based on the assumptions detailed on page 76.

(U.S. $ in millions) 2004A Income Statement Data Revenue % Growth EBITDA % Margin EBITDA - CapEx % Margin D&A EBIT % Margin Net Interest Expense Net Income EPS Average Shares Outstanding $14,223.8 11.2% $1,136.7 8.0% 1,136.7 8.0% 427.0 $709.7 5.0% 2005E $15,042.4 5.8% $1,085.7 7.2% 562.5 3.7% 575.5 $510.2 3.4% 2006E $15,428.9 2.6% $1,129.6 7.3% 595.6 3.9% 587.4 $542.2 3.5% (90.9) $306.9 $0.24 1,273.7 2007E $15,838.3 2.7% $1,173.3 7.4% 628.1 4.0% 599.6 $573.6 3.6% (68.5) $343.5 $0.27 1,273.7 2008E $16,259.2 2.7% $1,218.5 7.5% 662.0 4.1% 609.3 $609.2 3.7% (43.9) $384.4 $0.30 1,273.7 2009E $16,692.0 2.7% $1,265.4 7.6% 697.3 4.2% 622.0 $643.3 3.9% (17.0) $425.9 $0.33 1,273.7 2010E $17,136.9 2.7% $1,313.9 7.7% 734.0 4.3% 635.0 $678.9 4.0% 0.2 $461.8 $0.37 1,248.1 2011E $17,594.4 2.7% $1,364.2 7.8% 772.2 4.4% 645.2 $718.9 4.1% 3.4 $491.2 $0.41 1,191.9 9.9% 11.3% 2006 - 2011 CAGR 2.7%

3.8% 5.3%

5.8%

77

C. McOpCo Financial Analysis

McOpCo Summary Cash Flow and Balance Sheet

Set forth below are the summary cash flow projections for McOpCo based on the assumptions detailed on page 76.

2006 - 2011 CAGR

2004A Cash Flow Data EBITDA less: Cash Taxes less: Cash Interest Expense less: Dividends less: Change in Working Capital less: Growth CapEx less: Maintenance CapEx Free Cash Flow (after dividends) Free Cash Flow per share (before dividends) Balance Sheet Data Cash Revolver Long-Term Debt Total Debt / EBITDA Net Debt / EBITDA

2005E

2006E $1,129.6 (145.1) (88.7) 0.0 6.2 (30.0) (504.0) $367.9 $0.29

2007E $1,173.3 (163.9) (61.5) 0.0 6.5 (30.6) (514.5) $409.3 $0.32

2008E $1,218.5 (184.9) (31.4) 0.0 6.7 (31.2) (525.3) $452.5 $0.36

2009E $1,265.4 (203.9) (6.1) 0.0 7.0 (31.8) (536.2) $494.3 $0.39

2010E $1,313.9 (218.3) 3.4 0.0 7.2 (32.5) (547.4) $526.3 $0.44

2011E $1,364.2 (231.1) 3.4 0.0 7.5 (33.1) (558.8) $552.0 $0.49

8.5% 11.1%

150.0 0.0 1,500.0 1.4x 1.2x

150.0 0.0 1,132.1 1.0x 0.9x

150.0 0.0 722.8 0.6x 0.5x

150.0 0.0 270.3 0.2x 0.1x

150.0 0.0 0.0 0.0x -0.1x

150.0 0.0 0.0 0.0x -0.1x

150.0 0.0 0.0 0.0x -0.1x

78

Final Revised Proposal.ppt

A Plan to Win / Win

January 18, 2006

Pershing Square Capital Management

Confidential

Final Revised Proposal.ppt

DISCLAIMER

Pershing Square Capital Management's ("Pershing") analysis and conclusions regarding McDonald's Corporation ("McDonald's or the Company) are based on publicly available information. Pershing recognizes that there may be confidential information in the possession of the Company and its advisors that could lead them to disagree with Pershings conclusions or the approach Pershing is advocating. The analyses provided include certain estimates and projections prepared with respect to, among other things, the historical and anticipated operating performance of the Company. Such statements, estimates, and projections reflect various assumptions by Pershing concerning anticipated results that are inherently subject to significant economic, competitive, and other uncertainties and contingencies and have been included solely for illustrative purposes. No representations, express or implied, are made as to the accuracy or completeness of such statements, estimates or projections or with respect to any other materials herein. Actual results may vary materially from the estimates and projected results contained herein. Pershing manages funds that are in the business of trading - buying and selling - public securities. It is possible that there will be developments in the future that cause Pershing to change its position regarding the Company and possibly reduce, dispose of, or change the form of its investment in the Company. Pershing recognizes that the Company has a stock market capitalization in excess of $40bn, and that, accordingly, it could be more difficult to exert influence over its Board than has been the case with smaller companies.

2

Final Revised Proposal.ppt

A Revised Proposal for Creating Value at McDonalds

Agenda

Background of our involvement What are our objectives? Brief review of our Initial Proposal Our Revised Proposal Benefits of our Revised Proposal Company Franchisees Shareholders Q&A

3

Final Revised Proposal.ppt

A Revised Proposal for Creating Value at McDonalds

Pershings Involvement with McDonalds

September 22, 2005: Pershing Square Capital Management (Pershing) presented a proposal for increasing shareholder value (Initial Proposal) to McDonalds management October 31, 2005: McDonalds management communicated its response to our Initial Proposal

Management believed that our Initial Proposal (1) would result in potential frictional costs; (2) could have an unfavorable credit impact; and (3) could create system issues McDonalds believed, based on its advisors valuation, that there was not enough value creation to outweigh frictional costs and other concerns