Professional Documents

Culture Documents

Comptroller Kevin Lembo

Uploaded by

urbnanthonyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comptroller Kevin Lembo

Uploaded by

urbnanthonyCopyright:

Available Formats

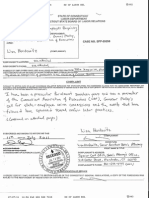

To: Office of The State Comptroller, State of Connecticut Attn: State Comptroller Kevin Lembo From: Anthony McKnight

Sr. Date: August 6, 2012 Re: Hazardous Duty Retirement Application, August 2009 Submitted to Mark Ojakian Replied by Attorney Helen Kemp Dear Mr. Lembo, The Office of the State Comptroller has not, to date, forwarded to me the proper adjustments in regards to my application for Hazardous Duty Retirement which was applied to through the office of the comptroller. This application was submitted pursuant to the Connecticut General Statutes regarding workers injured while in the performance of their guard duties, Chapters 65 and 66 of the Connecticut General Statutes. As I have made mention in previous correspondences, The public officials assigned to the Office of the Comptroller made errors In calculating my benefits and service credits, and refused to process my application as they have in the matters involving Similarly Situated White Corrections Officers. I did ask Attorney Helen Kemp along with other public officials to correct this error. I have also provided the example, as in the Retirement of Michael Cozzolino, a White Corrections Officer similarly situated. He did have his benefits and credit services calculated correctly by the same public officials in the Comptrollers Office. However, they refused to process my retirement papers. Also, correspondence has been sent to Mr. Woodruff of the Office of the Comptrollers Benefits Division. However, no resolve has been forthcoming relating to the issues addressed in the following opinion, and him referring to health benefits. In 1990 it was the position of the Comptroller, that payroll for injured state workers whom became injured as a result of Hazardous Duty, the obligation of those workers salary and deductions are to be managed by the Comptrollers Office. Please check my payroll history, as I was injured in my hazardous duty employment during the Caldwell Administration, and The Office of the State Comptroller issued my paycheck, which I picked up from the payroll office of then DMR. It was not a TPA check.

My physical rehabilitation worked well and I began back to work, and took all the physical requirements tests to become a corrections officer. The question was answered then, as credit of service continues until the hazardous duty employee elects to retire. In 1993, the state of Connecticut through the Comptrollers Office and the Workers Compensation Commission began keeping two sets of records. You can get a better understanding through the language used by Representative Cafero during the 2011 House Session. One being a record through the Workers Compensation Commission relating to Third Party Administration/the Alexis Insurance Company and the Department of Administrative Services for PPD. This did not limit or supersede the obligation of the Comptrollers Office. This in fact was the beginning of the fraud and corruption. As you may know, the Surpluses taunted in the Chairman of the Workers Compensation Commission 2004-5 Report, was actually a reconciliation of the benefits not paid to injured black workers such as myself and encoded as savings. These were payments defrauded from people such as myself through the knowledge of Comptroller Wyman, and Attorney General Blumenthal, Chairman Frankl, as they employed the help of various attorneys throughout the state like Deborah Nemeth, enlisting them deceptively to defraud their clients as they were actually Assistant Attorney Generals on behalf of the state. Mr. Dzrundsa(sic) of your Retirement Trustee Board/DOC can affirm the fraud as he was a member of the Task Force set up to defraud injured workers, as In the incident at the Staples parking lot. They were to plant drugs and such to discredit me, and defraud me of my rights to benefits. You can ask him yourself. He worked in internal affairs with then Commissioner Murphy of DOC. You can follow reference the previous email I sent last week. Although the majority of these defrauded funds, or as stated in SEBAC IV: unfunded liabilities or SEBAC 2011-section H: Artificially reduced, as in the case of workers compensation benefits.(sic). The obligation remains with the Office of the State Comptroller. These questions, as to payments and obligations of the Comptroller, were given and made by a previous administration prior to the fraud and deception. It states as follows: The Comptroller approves and records all obligations against the State. The Comptroller maintains all official accounting records and is responsible for the employee payrolls of all State agencies, departments, and institutions. The office administers all Retirement Systems other than Teacher's retirement. Additionally, by direction of the General Assembly, the Comptroller administers numerous miscellaneous appropriations of the State. {State of Connecticut, Office of the Comptroller, Comptroller J. Edward Caldwell.} This opinion of then Comptroller Caldwell, was supported by Comptroller William E. Curry Jr., during his term in office. The fraud as it relates to the issue began with the Wyman term and SEBAC IV. The laws establishing benefits in Chapter 65 and 66 had not changed. Moreover, the injuries I suffered occurred prior to any change in law or policy. So, once again, Attorneys Helen Kemp, and Linda Yelmini, along with Mark Ojakian and Mr. Thomas Woodruff are all in error. In addition, they applied the same standard of credit for service to Mr. Michael Cozzolino, which was prescribed by both the Caldwell and

Curry administration when I had first inquired about service credit. Then Representative Dyson of New Haven was also in agreement with the following opinion. The Department of Corrections nor the Office of the Comptroller transferred this obligation to the Office of the Treasurer and the Second Injury Fund prior to 1995. Therefore, as being separate and distinct benefits as ruled by the State Supreme Court, the obligation of Chapter 65, and 66 benefits remain with your Office of the Comptroller. Upon your office reconciling this matter, the Workers Compensation Commission can reconcile the Chapter 568 issues, and the Office of Treasurer can settle this matter once and for all. Finally, please inform Attorney Yelmini, and Kemp that as an injured hazardous duty employee, I didnt just go away and come back after 15 years or so. It was the responsibility of the offices in which they work to equally apply the laws to similarly situated White and Black hazardous duty workers. It was their failures that causes this, as the record indicates, I did my job and almost lost my life. Unlike them, they have the privilege of not being attacked by murders and such in their day to day. I would therefore appreciate my hazardous duty retirement papers and benefits being processed. Thank you for your time and consideration into this matter Mr. Lembo, and I hope to hear from either you personally, or someone in your office regarding my retirement. I do not wish to file criminal charges, that is a matter of your concern and discretion. I simply want my issue with the state dealt with honestly, in a more timely manner, and consistent with the laws in effect at the time of my injuries. Once again, thank you for your time.

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------------** The following is the opinion of the State of Connecticut Office of Attorney General pertaining to injured employees entitled to certain statutory benefits. It has been modified since the original opinion was issued. The modifications reflects the changes in the statutory language which differs from the language on my date of injury. (See C.G.S 5-142(a), 5-169(i), 5-257, and 31-284, as enacted in 1993). Please note: the following opinion has been modified to reflect the changes in the statutes and policies since its original issuance in 1990.

Attorney General's Opinion Attorney General, Richard Blumenthal

June 8, 1990 Honorable J. Edward Caldwell State Comptroller 55 Elm Street Hartford, CT 06106 Dear Mr. Caldwell: You have asked for our opinion "as to the application of group life insurance to State employees retired under the disability provisions of the State Employees Retirement Act and an employee receiving a disability benefit." Specifically, you have asked the following two questions: 1. A qualified employee may receive a Normal Retirement, Early Retirement or Disability Retirement. Do the provisions of Section 5-257 apply to employees retired in accordance with provisions of Chapter 66? 2. Do the provisions of Section 5-257 apply to employees out of work in accordance with the disability benefits of Chapter 65? If not, does Section 5-257 apply when such permanent disabled employee receives a pension under the State Employee Retirement Act? As to your first question, we believe the provisions of Conn. Gen. Stat. e 5-257 apply to employees retired in accordance with the provisions of chapter 66 of the General Statutes. With regard to your second question, the provisions of e 5-257 apply to those employees specified in e 5-142(a), amended by 1989 Conn. Pub. Acts 89-82 and e 5-145a, amended by 1989 Conn. Pub. Acts 89-82 who are out of work due to an injury sustained in the performance of their official duties and who receive disability compensation under chapter 65 of the General Statutes. I Chapter 66 "The purpose of statutory construction is to ascertain the intent of the legislature." State v. Ellis, 197 Conn. 436, 445, 497 A.2d 974 (1985). The intent of the legislature is expressed in the language it uses so the proper place to begin in construing a statute is with the language of the statute itself. Id. at 445; Baston v. Ricci, 174 Conn. 522, 528, 391 A.2d 161 (1978). All employees in active state service are provided the option of purchasing personal life insurance coverage under a group life insurance policy procured by the Comptroller

pursuant to the authority of Conn. Gen. Stat. e 5-257(a).1 Subsection (d) of e5-257 provides: (d) The insurance of any employee insured under this section shall cease on termination of employment, and of any member of the general assembly at the end of his term of office, subject to any conversion privilege provided in the group life insurance policy or policies. Notwithstanding anything to the contrary in this section, the amounts of life insurance of insured employees retired in accordance with any retirement plan for state employees shall be as follows: ... In no case shall a retired employee be required to contribute to the cost of any such reduced insurance.... (Emphasis added). Section 5-257(d) states that employees who were insured under e 5-257 and who "retired in accordance with any retirement plan for state employees" shall have life insurance coverage in the amounts specified therein. Chapter 66 of the General Statutes is the State Employees Retirement Act. Conn. Gen. Stat. e 5-152. This chapter includes, inter alia, the State's basic retirement plan. See Conn. Gen. Stat. e 5-160 to 5-172a, inclusive. Sections 5169 and 5-192p also make provision for disability retirement payments to members of the respective Tier I and Tier II plans of the state employees retirement system who while in state service, become permanently disabled from continuing to render the service in which they have been employed. Since chapter 66 establishes a retirement plan for state employees, it is clear that such plan is contemplated within the meaning of e 5-257(d). Thus, the provisions of e 5-257 apply to employees retired in accordance with the provisions of chapter 66. II Chapter 65 You have also asked whether the provisions of e 5-257 apply to employees who are collecting disability benefits in accordance with chapter 65 of the General Statutes. Chapter 65 establishes rights to and procedures for the administration of disability compensation and death benefits to specified employees, including so-called hazardous duty personnel, who sustain injury while in the actual performance of their duties. See generally Conn. Gen. Stat. ee 5-142, as amended by 1989 Conn. Pub. Acts 89-82, and 5-145a, as amended by 1989 Conn. Pub. Acts 89-82. Section 5-142(a), as amended, provides in part: ...If total incapacity results from such injury such person shall be removed from the active payroll the first day of incapacity, exclusive of the day of injury, and placed on an inactive payroll. He shall continue to receive the full salary which he was receiving at the time of injury subject to all salary_benefits of_active_employees, including annual increments, and all salary adjustments, including salary deductions required in the case of active employees,

for a period of two hundred sixty weeks from the date of the beginning of such incapacity. Thereafter, such person shall be removed from the payroll and shall receive compensation at the rate of fifty per cent of the salary which he was receiving at the expiration of said two hundred sixty weeks so long as he remains so disabled.... All other provisions of the workers' compensation law not inconsistent herewith, including the specific indemnities and provisions for hearing and appeal, shall be available to any such state employee or the dependents of such a deceased employee. (Emphasis added). The foregoing provision grants all salary benefits and deductions which normally pertain to all active employees to employees who receive disability compensation under chapter 65 during the first two hundred sixty weeks of their disability. As noted above, all employees in active state service may exercise their option to enroll in the state's group life insurance plan established under e 5-257(a). Payment of the employee's share of the premium for coverage under such plan must be made by payroll deduction.2 It is clear that participation in the State's life insurance program is a salary benefit available to active employees. Hence, the insurance benefits under e 5-257 are applicable to employees compensated under e 5-142(a). Furthermore, e 5-142(a) expressly provides that all other provisions of the workers' compensation law not inconsistent with it shall apply to any state employee who is within the purview of this statute.3 Conn. Gen. Stat. e 31-284b(a), a provision of the workers' compensation act, expressly requires employers to provide equivalent life insurance coverage for employees who receive compensation under a provision for sick leave payments for time lost due to an employment-related injury. This provision states: (a) In order to maintain, as nearly as possible, the income of employees who suffer employment-related injuries, any employer, as defined in section 31-275, who provides accident and health insurance or life insurance coverage for any employee or makes payments or contributions at the regular hourly or weekly rate for full-time employees to an employee welfare fund, as defined in section 31-53, shall provide to such employee equivalent insurance coverage or welfare fund payments or contributions while the employee is eligible to receive or is receiving workers' compensation payments pursuant to this chapter, or while the employee is receiving wages under a provision for sick leave payments for time lost due to an employment-related injury. (Emphasis added). Under Conn. Gen. Stat. ee 5-142 and 5-145a an employee is placed on the inactive payroll as the result of a work related disability and continues to receive full salary although not working; these payments clearly fall within the intent of Conn. Gen. Stat. e 31-284b(a) which refers to "a provision for sick leave payments for time lost due to an employment related injury." Thus, on its face the requirement for the provision of life insurance coverage under Conn. Gen. Stat. e 31-284b(a) applies to employees receiving disability

compensation under ee5-142 and 5-145a and is clearly consistent with the terms of those statutes. Therefore, we conclude that the life insurance provisions of e 5-257 for active state employees apply to those inactive employees receiving disability compensation under chapter 65 of the General Statutes. Lastly, you ask whether e 5-257 applies to permanently disabled employees who retire under chapter 66. Although you ask us to answer this question only if our answer to the immediately preceding question were negative, we will provide you with our opinion on this final issue. Chapter 66 contemplates and addresses disability retirement for employees receiving disability compensation under e 5-142. Section 5-169(i), as amended by 1989 Conn. Pub. Acts 89-52 states in part: (i) If a member qualifies for disability compensation under section 5-142, such member shall continue to be credited with service hereunder, and shall not be deemed to have retired until he elects to retire. While the member is receiving compensation under section 5-142, the disability retirement benefits under this section shall be payable only if greater than the compensation paid under section 5-142. In such event, the benefits under this section shall be temporarily reduced by the amount of benefits payable under section 5-142 for the period of receipt of benefits under section 5-142.... In other words, employees who are compensated under e 5-142 of chapter 65 may retire under chapter 66, provided they meet all of the requirements for such retirement. As stated in part I of this opinion, e 5-257 applies to all employees insured under said statute who retire under chapter 66. In short, e 5-257 will also apply when inactive employees who are receiving compensation under e 5-142 retire under chapter 66. We trust the foregoing answers your questions. Very truly yours, CLARINE NARDI RIDDLE ATTORNEY GENERAL William J. Prensky Assistant Attorney General CNR/WJP/pp 1 Section 5-257(a) specifies: "Each employee in active state service shall be eligible for insurance under this section, provided he shall have completed more than six months' continuous state service, and each member of the general assembly shall be eligible for insurance under this section, six months after taking office." 2 Section 5-257(c) provides:

(c) Each employee and each member of the general assembly insured under subsection (b) of this section shall contribute to the cost of the life insurance a sum equal to twenty cents biweekly for each thousand dollars of life insurance. The state comptroller shall deduct such amount from the employees' or members' pay and shall pay the premiums on such policy or policies. Any other refunds or rate credits shall inure to the benefit of the state and shall be applied to the cost of such insurance. (Emphasis added). 3 We note there is a similar provision in e 5-142(b) which applies to state employees disabled during the performance of their duties as a result of contact with persons or animals afflicted with any communicable disease or organisms producing any communicable disease. The following discussion in the text also applies to those employees receiving compensation under e 5-142(b). 4 Section 31-275(6) defines "employer" to include the State. Back to the 1990 Opinions Page Back to Opinions Page Content Last Modified on 6/2/2005 12:38:12 PM

You might also like

- What An Idiot Looks LikeDocument3 pagesWhat An Idiot Looks LikeURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- Eat Mor' Chick'in (Edited)Document3 pagesEat Mor' Chick'in (Edited)URBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- NovaDocument3 pagesNovaURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- Untitled Unedited DocumentDocument3 pagesUntitled Unedited DocumentURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- The Roman Slave Law in CourtDocument3 pagesThe Roman Slave Law in CourturbnanthonyNo ratings yet

- Honorable People in GovernmentDocument2 pagesHonorable People in GovernmentURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- The Black Pope...... The Watchers FileDocument10 pagesThe Black Pope...... The Watchers FileURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- Voting, A Matter of TrustDocument2 pagesVoting, A Matter of TrustURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- California/Connecticut Fraud Is FraudDocument3 pagesCalifornia/Connecticut Fraud Is FraudURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- Individual Capacity Versus Official CapacityDocument1 pageIndividual Capacity Versus Official CapacityurbnanthonyNo ratings yet

- Try PuddingDocument2 pagesTry PuddingURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- Food Stamp AppendixDocument3 pagesFood Stamp AppendixURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- Fraternity or CultDocument3 pagesFraternity or CulturbnanthonyNo ratings yet

- Conspiracy of FraudDocument5 pagesConspiracy of FraudurbnanthonyNo ratings yet

- Individual Capacity in DepthDocument2 pagesIndividual Capacity in DepthURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- Opinions and EditorialsDocument3 pagesOpinions and EditorialsURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- SEBAC Chart Republicans Updated 8-1-11Document4 pagesSEBAC Chart Republicans Updated 8-1-11Helen BennettNo ratings yet

- Herskowitz Complaint 1Document4 pagesHerskowitz Complaint 1Helen BennettNo ratings yet

- Summary of TA DifferencesDocument2 pagesSummary of TA DifferencesPatricia Dillon100% (1)

- Rep. Cafero OFA LTR Updated Savings Analysis of Sebac AgreementDocument1 pageRep. Cafero OFA LTR Updated Savings Analysis of Sebac AgreementURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- Connecticut Department of LaborDocument2 pagesConnecticut Department of LaborURBNAnthony.com is NOW at No4sale.net Still Urbn Just No4SaleNo ratings yet

- 1995 Original Rowland SEBAC LawsuitDocument42 pages1995 Original Rowland SEBAC LawsuiturbnanthonyNo ratings yet

- Lisa Herskowitz Senior Assistant State's Attorney Complaint 2Document5 pagesLisa Herskowitz Senior Assistant State's Attorney Complaint 2urbnanthonyNo ratings yet

- OPM Commisoner Letter Re SEBAC Outcome 081211Document3 pagesOPM Commisoner Letter Re SEBAC Outcome 081211urbnanthonyNo ratings yet

- SEBACInjunction FiledDocument2 pagesSEBACInjunction FiledurbnanthonyNo ratings yet

- SEBAC Injunction FiledDocument1 pageSEBAC Injunction FiledurbnanthonyNo ratings yet

- SEBAC AgreementDocument6 pagesSEBAC AgreementHour NewsroomNo ratings yet

- SEBAC 2011 InjunctionDocument19 pagesSEBAC 2011 InjunctionurbnanthonyNo ratings yet

- Revised Sebac 2011 Agreement Between State of Connecticut and State Employees Bargaining Agent Coalition Sebac See Below For Sebac InjuctDocument28 pagesRevised Sebac 2011 Agreement Between State of Connecticut and State Employees Bargaining Agent Coalition Sebac See Below For Sebac InjucturbnanthonyNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Principles of Risk Management and Insurance: Global EditionDocument18 pagesPrinciples of Risk Management and Insurance: Global EditionAHMAD ALINo ratings yet

- SBI Life - Saral Jeevan Bima - BrochureDocument9 pagesSBI Life - Saral Jeevan Bima - BrochureH.O. Rajendra TiwariNo ratings yet

- Transfer Tax QuizDocument3 pagesTransfer Tax QuizMary Grace SalcedoNo ratings yet

- TB16 Income Taxes - TAX 2Document21 pagesTB16 Income Taxes - TAX 2scrapped princeNo ratings yet

- D. Setting Up KU Band VSAT NetworkDocument19 pagesD. Setting Up KU Band VSAT NetworkniharikaNo ratings yet

- Recruitment Selection Process in HDFCDocument102 pagesRecruitment Selection Process in HDFCaccord123100% (2)

- Income Tax Rates FY 2022-23 SummaryDocument16 pagesIncome Tax Rates FY 2022-23 Summaryrabin khatriNo ratings yet

- FAAN13 Exam Notice 30 Dec 2016Document48 pagesFAAN13 Exam Notice 30 Dec 2016trishitalalaNo ratings yet

- Annual Report 2014-15Document195 pagesAnnual Report 2014-15Narasimharaju KandulaNo ratings yet

- A Project Study Report On Titled "Comparative Study of HDFC Standard Life With Tata - Aig Life Insurance"Document114 pagesA Project Study Report On Titled "Comparative Study of HDFC Standard Life With Tata - Aig Life Insurance"garish009100% (1)

- Section 10 of The Income Tax ActDocument10 pagesSection 10 of The Income Tax ActVANSHIKA SINGHNo ratings yet

- A Project Report On Risk Analysis and RiDocument42 pagesA Project Report On Risk Analysis and RiJyoti ShuklaNo ratings yet

- Customer Satisfaction Regarding Kotak Mahindra Life InsuranceDocument73 pagesCustomer Satisfaction Regarding Kotak Mahindra Life Insurancevikaschugh2013No ratings yet

- Presented by - Hitesh KumarDocument35 pagesPresented by - Hitesh KumarSurbhi MittalNo ratings yet

- Spring 2023 - Insurance Law & Practice Course ManualDocument24 pagesSpring 2023 - Insurance Law & Practice Course ManualRavi VedyaNo ratings yet

- A Study On Sbi Life InsuranceDocument40 pagesA Study On Sbi Life InsuranceprabhuNo ratings yet

- G.R. No. L-l0874 Andres vs. Crown LifeDocument4 pagesG.R. No. L-l0874 Andres vs. Crown Lifechristopher d. balubayanNo ratings yet

- Sampoorna Raksha Supreme (SRS) Brochure V3Document10 pagesSampoorna Raksha Supreme (SRS) Brochure V3Praveen KumarNo ratings yet

- Elite Advantage BrochureDocument17 pagesElite Advantage BrochureG.S.M.R BharathNo ratings yet

- FPDocument20 pagesFPHetviNo ratings yet

- PNB MetLife Mera Term Plan Sales IllustrationDocument4 pagesPNB MetLife Mera Term Plan Sales IllustrationShreelekha PradeepNo ratings yet

- Heirs dispute over insurance proceedsDocument24 pagesHeirs dispute over insurance proceedsNicole SantoallaNo ratings yet

- For ApprovalDocument10 pagesFor ApprovalPaulo VillarinNo ratings yet

- Premium Receipt: Chandrahas Naik Contact Number: 9518968435Document1 pagePremium Receipt: Chandrahas Naik Contact Number: 9518968435Chandrahas NaikNo ratings yet

- What Is An Extrajudicial Settlement of EstateDocument13 pagesWhat Is An Extrajudicial Settlement of EstateAnonymous NsXevyNo ratings yet

- Loan Money: Big % Interest Zero% InterestDocument26 pagesLoan Money: Big % Interest Zero% InterestJonathan DelaCruz ReNo ratings yet

- Sun Life Canada Vs Ma. Daisy Et AlDocument2 pagesSun Life Canada Vs Ma. Daisy Et AlLouie SalazarNo ratings yet

- Insurance Reviewer Atty GapuzDocument6 pagesInsurance Reviewer Atty GapuzJohn Soap Reznov MacTavishNo ratings yet

- Ratio Analysis of Life Insurance Companies in BangladeshDocument32 pagesRatio Analysis of Life Insurance Companies in Bangladeshtauhidult71% (7)

- MMUrepo 6Document27 pagesMMUrepo 6GERALD NOEL CHIKEREMANo ratings yet