Professional Documents

Culture Documents

A Tale of Two Situations - Recovery & Resolution Plans

Uploaded by

Lee WerrellCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A Tale of Two Situations - Recovery & Resolution Plans

Uploaded by

Lee WerrellCopyright:

Available Formats

2012

Due to the enormous cost, both financial and reputational, of the increased need for public money to be used to support the largest too big to fail banks and others, the UK authorities have decided that they need to have better control over any possible future institution that falls upon hard times.

Lee Werrell CEI Compliance Limited

A Tale of Two Situations

FSA Recovery & Resolution Plans

Contents

Introduction ............................................................................................................................... 3 So who will qualify as members of this elite club? ................................................................... 6 Where next? .............................................................................................................................. 6 Recovery Plans what is needed? ....................................................................................... 8 Resolution Planning what is needed? .......................................................................... 9 Bailing In .............................................................................................................................. 11 How to Choose a Compliance Consultant ........................................................................... 12

Full Text of the Feedback Statement Paper FS12/01 can be downloaded as a PDF document from here

Go Mobile- Request Other Whitepapers sent to your email;

Balanced Scorecard for SMEs

Compliance Risk Assessment Methodology

Financial Crime 2012

Regulatory Visit Preparation Coaching

S166 Guide for Snr Management

Strategy Setting

TCF Guide

UCIS Sales

Simply scan the QR code for the relevant Whitepaper

A Tale of Two Situations Introduction

FSA Recovery & Resolution Plans

Following the demise of some of the most prestigious financial institutions in recent history, due to the recent financial crisis, issues concerning the recovery and resolution of banks and other significant financial institutions in the UK have been highlighted. Due to the enormous cost, both financial and reputational, of the increased need for public money to be used to support the largest too big to fail banks and others, the UK authorities have decided that they need to have better control over any possible future institution that falls upon hard times. On reviewing the level of control that the UK authorities hold, t his then spawned the realisation that there was a further need, an obvious hole in previous planning. Clearly they needed more effective tools and information to enable the orderly resolution of financial institutions without needing to resort to taxpayer support. Not only were the authorities keen see the potential plans that firms would use on the rocky road to the summit of breakdown and insolvency (predicted by many pundits in the press) but they were keen to see the firms identify and understand their own plans to recover from situations of severe stress. Following the Turner Review Conference in 2009 the UK authorities started a pilot RRP project initially involving four and ultimately involving six of the largest UK firms. RRPs have two aspects. The first, Recovery requires affected firms to identify options to recover their financial strength and viability should a firm come under severe stress. This is work that should be conducted in detail, providing a menu of options under differing situations and the likely solutions that may be available. Secondly, Resolution planning requires firms to submit detailed information about their business and operational structure in the form of a Resolution Pack. The authorities will then write their resolution plans for them, so that they know precisely what, how and when to instruct the Insolvency Practitioner (IP) to do if the time comes to wind down the firm. So essentially, the RRPs aim to ensure that financial institutions: assess and document the recovery options which they believe would normally be available to them in a range of severe stress situations; enable these recovery options to be identified and mobilised quickly and effectively; and supply the regulatory authorities with information and analysis on their businesses, organisation and structures to enable the authorities to ensure that an orderly resolution could be carried out by the authorities should it become necessary. In August 2011 the FSA published a Consultation and Discussion Paper on RRPs (CP 11/16). This document explains the progress made since that publication, summarises the responses received, reviews other UK and international initiatives that are relevant to recovery plans and resolution packs, and sets out the proposed next steps. The progress made so far in data gathering from firms that have started to produce recovery plans and resolution packs has been invaluable for the development of plans to resolve banks without a negative impact on financial stability or recourse to public funds. It has also helped to inform the debate on improving the resolvability of financial institutions. Given the various significant developments that are relevant to RRPs, teh FSA have decid ed to

A Tale of Two Situations

FSA Recovery & Resolution Plans

delay the publication of the final rules. Accordingly, they are publishing their Feedback Statement (FS12/01), along with draft core rules, rather than a formal Policy Statement with final rules. They will make sure that the rules in the UK are, as far as possible, consistent with (i) the proposed European Recovery and Resolution Directive, and (ii) the Financial Stability Boards Key Attributes of Effective Resolution Regimes. They are publishing draft core rules, an updated draft of the Information Pack to show developments in current thinking, and their responses to some Frequently Asked Questions (FAQs), which will help firms understand their approach. The final rules will be published no later than autumn 2012. The FSA are confident that the development and submission of recovery plans and resolution packs will continue as planned. Large firms involved in the pilot exercise will submit their recovery plans and resolution packs by the end of June 2012, as agreed with their supervisors. They expec t firms to continue to work with the authorities on developing recovery plans and resolution packs, taking into account the draft core rules and updated Information Pack. Although principally intended for policymakers and a wider range of authorised firm s, such as insurers, the minimal limit is a 730K CAD firm however it may well become extended to other categories of firms over time, after consultation, as usual. Additionally this is likely to be of interest to policymakers and practitioners involved in the resolution of failed firms, as it discusses the existence and removal of barriers to resolution and the potential costs to taxpayers of a firms failure. New Legislation is planned to be enacted under which the FSA will be reformed into the Prudential Regulation Authority (PRA) and the Financial Conduct Authority (FCA). It is therefore expected that the bulk of the preparation of RRPs will have been implemented by the FSA before the PRA takes on responsibility for supervising the relevant firms. Other large firms are expected to provide sufficient information to their supervisors to meet the timetable set by the Financial Stability Board (FSB). For all other firms, supervisors will agree the timing and content of their materials bi-laterally. Although welcoming discussion, the formal consultation on rules for RRPs and for the CMA proposals found in the CASS Resolution Pack (CASS RP). There are a number of documents which have been published alongside this paper: The proposed Draft Core Rules for RRPs the CASS RP, (PS 12/06) an information Pack on how firms should complete their RRPs, and; The Financial Stability Board Key Attributes of Effective Resolution Regimes for Financial Institutions Oct 2011 Frequently Asked Questions (FAQs)

A Tale of Two Situations

FSA Recovery & Resolution Plans

So what makes a good recovery plan?

The FSA state that a Recovery Plan must be developed and maintained by the firm and should have the following features: a sufficient number of credible options to cope with a range of scenarios, including both idiosyncratic and market-wide stress; (yes, there could well be overlap from the ICAAP document but remember an ICAAP stress test is an immediate and one off stress, whereas a recovery plan is more like a menu of options and mini events may have to play out for further events to take place). options that address capital shortfalls and liquidity pressures and which should aim to return the firm to a stable and sustainable position (this can include bail in which is explained further in Points 2.3 & 5.5 of the FS); and appropriate governance processes, including intervention conditions and procedures, to ensure timely implementation of recovery options in a range of stress situations (which may involve multiple crisis team occurrences in series or parallel) It is very likely in the early iterations that cases are considered where the firm does not currently have credible options to enable it to recover from extreme stress situations. In such cases the Recovery Plan should indicate the preparation measures (and a timetable for such measures) that the firm will take to create such options. There are obviously going to be cases of globally significant financial institutions (G-SIFIs), and in these events the Recovery Plan will also assist discussions among international regulators led by the home authority using the Crisis Management Groups (CMGs), established under the guidance of the Financial Stability Board (FSB). Recovery Plans will help to reassure host regulators that the firm could deal effectively with difficult circumstances. This cooperation should help to discourage host and home regulators from taking pre-emptive actions to protect national interests which could be to the detriment of wider global interests.

When things go awry - Resolution planning

Within the Resolution pack is a host of analysis and information identifiers that will help the UK authorities to prepare a resolution plan with their specific aims: to ensure that resolution can be carried out without public financial support; to seek to minimise the impact on financial stability; to seek to minimise the effect on depositors and consumers; to allow decisions and actions to be taken and executed in a short space of time (for example, over a resolution weekend); to identify those economic functions for which continuity is critical to the economy or financial system; to identify those economic functions which would need to be wound up

A Tale of Two Situations

FSA Recovery & Resolution Plans

in an orderly fashion; to identify and consider ways of removing barriers which may prevent critical functions being resolved successfully; to allow a resolution that separates the identified critical economic functions from non-critical activities which could be allowed to fail; and to enhance international cooperation and crisis management planning between international regulators for G-SIFIs

With full analysis and the information supplied in the pack will allow the authorities to commit firms that fail to meet threshold conditions into resolution smoothly and swiftly with minimal impact on the financial system, regardless of the size or complexity of the firm.

So who will qualify as members of this elite club?

The current basis is that the FSAs RRP requirements will apply to deposit takers in the first instance and also significant investment firms, in particular, to full scope BIPRU 730k investment firms with assets exceeding at least 15 billion on its last accounting reference date. Be warned however, that investment firms that could present significant risks either to the stability of the financial system or to one or more other PRA-regulated entities within their group should be subject to the same RRP requirements as deposit -takers, including supporting their orderly resolution under investment bank Special Administration Regime. We expect such firms will be designated as being subject to regulation by the PRA, but the exact scope of PRA regulation is still being determined. So for now, the current discussion is around the firms that are relating to CMA (CASS RP) apply to all firms subject to CASS 6 or 7 due to their holding of investment business client money or custody assets. See PS12/06 CASS RP for more detail. Also there is the likelihood of international impacts and given the financial and operational interdependencies often found in most financial services group, consideration will be expected, when providing resolution analysis to the authorities, how all significant members of the group (both regulated and unregulated) could be resolved. Recovery Plans should similarly address all significant parts of a group.

Where next?

There are a number of recent and forthcoming national and international developments that are relevant to RRPs and which are likely to be reflected in the final rules. and the ECs Recovery and Resolution Directive is expected soon as the consultation finished in June 2012. Obviously the final rules will need to comply with the draft Directive. The FSB has published, and G20 leaders have agreed to implement, the Key Attributes of Effective Resolution Regimes. In particular, co-operation agreements, recovery and resolution

A Tale of Two Situations

FSA Recovery & Resolution Plans

plans and resolvability assessments must be in place for all global systemically important financial institutions (G-SIFIs) by the end of 2012. Recovery and resolution planning significantly overlaps with some of the recommendations of the Independent Commission on Banking (ICB). HM Treasury proposes a white paper and consultation paper this summer detailing a proposed legislative response to the ICB. Again the rules should be consistent with the legislation brought forward in response t o the ICB report. The UK authorities have made significant progress with resolution planning involving international authorities, particularly with the US (including, for example, on information sharing with the US authorities and considering the application of resolution tools for G-SIFIs, such as bail-in). This work will be developed further and lessons should be incorporated in the final rules and information requests. Work with the G-SIFIs that were part of the pilot exercise will continue as planned i n order to meet FSB deadlines, with key deadlines for those firms remaining, as planned, this summer. This will be extended to G-SIFIs that were not part of the pilot exercise, in particular so that we can meet our obligations as a host regulator to certain G-SIFIs under the FSBs approach.

The information we will be collecting relates both to possible resolution plans where a group wide solution, perhaps based on bailing-in senior creditors, is appropriate and also to resolution or contingency plans in cases where even a large, complex group needs to be broken up or wound down in an orderly manner. For small- and medium-sized firms, there will be no uniform deadlines applying to all firms. However, we would like firms to progress their recovery and resolution planning arrangements; good practice would be to proceed on a best efforts basis and in accordance with the updated Information Pack. Supervisors will discuss individual deadlines with each firm ensuring that requests are on reasonable notice and are proportionate to each firms circumstances and the risks they pose.

A Tale of Two Situations

FSA Recovery & Resolution Plans

RRP and existing capital stress-testing links

So whats wrong with the ICAAP/ILAS stress testing? There are obviously strong links between the Recovery Plan and the existing capital and liquidity stress testing requirements, given their common objective towards maintaining sufficient financial resources for a going-concern firm in a stressed environment. The FSA is keen for any firm not to try and re-invent the wheel. Firms may find that their existing capital and liquidity stress testing can serve as useful inputs in developing their Recovery Plans. However, the Recovery Plan will extend further by asking firms to plan for additional actions when the impact or the speed of a crisis tu rns out to be more severe than the scenarios they had projected in their stress tests. A menu of items including triggers and mitigating actions, set processes at certain times will be required to show all avenues of recovery had been not only mapped and travelled down, but also which of the kerbstones had been painted.

RRP and reverse stress-testing links

The FSAs policy on reverse stress testing used as a risk tool, requires a firm to explicitly identify and assess the scenarios that are most likely to cause its business model to fail, after considering existing, realistic management actions. Where those tests reveal that business failure will occur within the firms existing risk appetite or tolerance, the firm will be required to identify and adopt effective arrangements, processes, systems or other measures to try to prevent those risks from crystallising. Given the roles of reverse stress testing in improving a firms contingency planning as well as in preventing it from failing, there are clear links between reverse stress testing and the RRP requirements. In practice, the development of a firms RRP will inform its reverse stress testing planning and vice-versa, providing the glue to connect all the risk reporting tools together.

Recovery Plans what is needed?

Briefly, recovery plans; are developed and maintained by the firms and the authorities will review their adequacy should include a robust menu of options to deal with a range of stressed situations should have unambiguous triggers which, when breached, will create a strong presumption that the plan will be activated should be reviewed at least annually and approved by the board. The purpose of a Recovery Plan is to enable a firm to plan how they would try to recover from severely adverse conditions that could cause their failure. It will set out in advance a firms menu of options for dealing with a range of severe stress events. These stresses may be caused by an idiosyncratic problem, a market-wide problem or a combination of both, and extend beyond the firms current regulatory stress testing scenarios and remedies. Firms will be required to produce a Recovery Plan that can be readily implemented when necessary and that is integrated within its risk management framework and processes. Firms will need to ensure the necessary measures and preparations are in place in advance for the plan to be effective. The recovery options need to be material in impact and capable of being executed with

A Tale of Two Situations

relative ease and in a timely manner.

FSA Recovery & Resolution Plans

The proposals cover the following key areas: governance framework for the Recovery Plan; key Recovery Plan options; criteria for assessing recovery options; and intervention conditions, i.e. a trigger framework. For a detailed explanation of the expected components of Recovery Plans, see the FSA announcement on May 2012 here.

Disposal options

For any Recovery Plan to be considered robust, it is likely to be necessary for firms to consider radical choices which change the structure of their businesses. These choices are likely to include, but are not limited to, disposal options for part of a firms business or even selling the firm itself. Although it may be difficult accurately to assess the value of such options, firms should be able to provide some broad estimates. Consideration of such options and how they might be executed will form an important part of most Recovery Plans, particularly those of the larger firms. When considering potential disposal options, consideration should be given to the long-term viability of the firm post-transaction. The Resolution Plan is prepared by the authorities based on the Resolution Pack containing extensive information and analysis provided by the firms. Modules 3 to 6 of the RRP Guide explain the work that firms must do. For the Handbook text on Resolution Packs see FINMAR 4.3. A key part of the firms work is a separation or wind -down plan for deposittaking and other critical economic functions. Firms will be expected to identify barriers to resolution and propose changes to remove those barriers. The Resolution Pack must be reviewed at least annually and the board will be responsible for ensuring there are processes in place to produce timely and accurate data. The Resolution Pack must be updated on an ongoing basis to reflect any material developments in a firms business.

Resolution Planning what is needed?

Alternatively, the aim of the Resolution Plan is to provide a clear and detailed strategy roadmap to resolve a failed firm or even a group in such a manner that minimises the impact on financial stability without needing to resort to public sector solvency support. The key element here is that the Resolution Plan is prepared by the UK authorities. However, it is vital that the authorities have the level of understanding

A Tale of Two Situations

FSA Recovery & Resolution Plans

necessary to make the appropriate decisions. They can only implement an effective action plan when resolution is imminent; which requires not only the provision of reasonably current information on the specific business operations, structures and critical economic functions, but also a detailed resolution analysis prepared by firms. Effectively the authorities need to be able to form opinions on the resolvability of each firm. To enable this, firms will need to provide a very significant level of detail and, in particular, the authorities will be asking firms to undertake a separability or wind -down analyses in relation to each of its critical economic functions. The information and analysis to be supplied by firms is called the Resolution Pack.

Economic functions

These refer to the services delivered by a firm and will not always necessarily correspond directly to legal entities within a firms group structure. It may also not be clearly mapped to the business units operated by the firm. What is required is that firms should explain how the economic functions they provide map to the business units through which the group may organise itself. Consequently a further mapping will be necessary to understand how these business units map to the legal entity structure of the group. Typical Economic Functions the financial services sector provides three high-level services to the real economy: payment services, to facilitate transactions between agents in the real economy; intermediation of credit and capital, to allow agents in the real economy to save, invest and borrow efficiently; and risk management products and services, to facilitate risk pooling and protect agents against adverse events. These high-level services can then be broken down into separate economic functions which firms perform. For example, (i) current accounts facilitate the provision of payment services; (ii) mortgage lending contributes to the intermediation of credit; and (iii) market-making activities contribute to the provision of risk management. Sometimes, an economic function may support the provision of more than one of the high-level services to the real economy. Examples of economic functions are as follows: retail current accounts including overdrafts; retail savings/time accounts; retail lending: mortgages/other

secured; retail lending: unsecured personal

loans; retail lending: credit cards issuance and underwriting; corporate deposits; corporate lending; long-term capital investment; credit card merchant acquiring/services;

10

A Tale of Two Situations

payment services; clearing services; cash services; third-party services; derivatives; securities financing; trading portfolio;

FSA Recovery & Resolution Plans

equity and debt capital markets; asset management; brokerage; custody services; prime brokerage and related securities services; general insurance, re-insurance, underwriting and/or broking services; life, pensions, investments and annuities corporate advisory services; and research.

Ongoing maintenance of data by firms

A clear signal and an obvious requirement is that it will be important that, while preparing the initial RRPs, firms plan for their regular maintenance and update. This will surely be a less onerous task than the initial preparation of the plans and, if systems for capturing and recording data are properly established, particularly for resolution information, this should help the firm to provide updated information quickly and efficiently when required. A firm should review its Recovery Plan at least annually and when it has been through a major reorganisation, especially when it involves an acquisition or disposal. The plans should also be refreshed whenever the firm looks likely to encounter a severe stress situation and on request from the FSA.

Bailing In

What is bail-in?

The term Bail-in is provided in this documentation and it usually refers to a process of internal recapitalisation that is triggered once a firm has reached the point of non-viability. There is an automatic Loss imposed on certain of a firms direct stakeholders of a firm by a process of bailing-in, either by writing down their claims or by converting them to equity. As a result, the firm is recapitalised from within and the need for new capital resources to be provided by the public sector (i.e. a bail-out) is avoided.

11

A Tale of Two Situations

FSA Recovery & Resolution Plans

Whilst it all seems a very straightforward arrangement, Bail-in will almost always need to be accompanied by changes in the firms senior management. Coupled with this would be the adoption of a new business plan that addresses the causes of the firms failure. A vital objective of the bail-in process is to secure the continued existence of at least a part or even the entire firm on a going concern basis. If this can be done then disruption of services to customers of the firm should be minimised, while its shareholders and uninsured creditors are subject to going concern losses rather than the much larger gone concern losses that they would suffer if the firm went into insolvency or liquidation. Full details of the Bail-In can be found in Chapter 11 of the FS12/01

12

A Tale of Two Situations

FSA Recovery & Resolution Plans

Companies that CEI have been involved with in the last 10 years;

CEI Compliance can help provide a full compliance support service, reducing required management time, ensuring all areas are up to date and working for your firms long term benefit. Call 0800 689 9 689 today or go online at www.ceicompliance.co.uk

This whitepaper was written

by Lee Werrell FInstSMM Chartered MCSI Cert PFS, founder of CEI Compliance Limited.

Avoid S166 Skilled Persons Reports download our free guide here

or scan the code

13

A Tale of Two Situations

FSA Recovery & Resolution Plans

How to Choose a Compliance Consultant

(Acknowledgements to Alan Weiss, www.summitconsulting.com)

Every financial services business occasionally needs outside help. Even well-run giants such as RBS, Lloyds, Aviva, Barclaycard, and many other firms deliberately choose to bring in compliance consultants on a regular basis. For smaller businesses, an outside consultant can offer the following advantages: Objective advice, not geared toward political advancement or promotion Frame of reference and best practices from other clients Models and methodology to gain results more quickly than internal trial and error Permanent transfer of skills to internal people The problem, however, is that those external consultancies can create as many problems as they solve. (One definition of a consultant: someone who comes to fix a problem and remains to become a part of it.)

These include: Threatening employees by the mere presence of an outsider Reliance on off-the-shelf fixed methods which dont fit the current client very well Lack of sensitivity to the clients business, culture, and environment (a financial adviser practice is not run the same way as an accountancy practice) Solutions that worked for large organisations cannot always be simply scaled down Ideal solutions not really practical for the clients business and have limited or no real value

Ive been in consulting since 2000 and, to my astonishment, I find currently that about 50% of those calling themselves consultants dont really know what theyre doing, but what is worse is that almost 90% of those buying consulting services dont know how to tell the difference! To remedy that, here is a primer on how to hire the best possible consultant for your needs: A good consultant frames an issue quickly but doesnt suggest solutions too quickly, because they realise that they dont know what they dont know until they begin to gather more data. A good consultant will not promise the moon and the stars, and will never base an approach on tests or instruments that are purchased for a few pounds from other companies. (You get what you pay for.) A good consultant is someone youll hate to see go when the project ends on time, and who youll want to invite back at the first appropriate new challenge.

CEI COMPLIANCE works on an alternative basis by collaboration and does not charge per hour, day or week.

Call CEI on

0800 689 9 689 to make your first appointment.

14

You might also like

- New Regulatory Framework For Financial Services Individuals: August 2014Document5 pagesNew Regulatory Framework For Financial Services Individuals: August 2014Lee WerrellNo ratings yet

- FSMA S166 Skilled Persons ReportDocument28 pagesFSMA S166 Skilled Persons ReportLee WerrellNo ratings yet

- Creating Your Conduct Risk FrameworkDocument22 pagesCreating Your Conduct Risk FrameworkLee Werrell50% (2)

- Conduct Risk: How To Build An Effective FrameworkDocument9 pagesConduct Risk: How To Build An Effective FrameworkLee WerrellNo ratings yet

- Operational Risk Roll-OutDocument17 pagesOperational Risk Roll-OutLee WerrellNo ratings yet

- Defining Parallel and Similar Processes For Global Equity Reporting PurposesDocument20 pagesDefining Parallel and Similar Processes For Global Equity Reporting PurposesLee Werrell0% (1)

- Reducing Regulatory CapitalDocument18 pagesReducing Regulatory CapitalLee WerrellNo ratings yet

- Choosing A Consultant OpenDocument4 pagesChoosing A Consultant OpenLee WerrellNo ratings yet

- Social AdvertisementsDocument3 pagesSocial AdvertisementsLee WerrellNo ratings yet

- Compliance Risk AssessmentDocument8 pagesCompliance Risk AssessmentLee Werrell0% (1)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Account StatementDocument1 pageAccount Statementzeeshan kkrNo ratings yet

- S Fin Int PrepDocument8 pagesS Fin Int PrepMoorthy EsakkyNo ratings yet

- Moneylife 2 October 2014Document68 pagesMoneylife 2 October 2014krishnakumarsistNo ratings yet

- 66 Restructure DebtsDocument30 pages66 Restructure DebtsVikas JainNo ratings yet

- Estatement20221213 000475984Document10 pagesEstatement20221213 000475984AHMAD HAFIZUDDIN BIN HASHIM STUDENTNo ratings yet

- Internship Report On Digital PaymentDocument38 pagesInternship Report On Digital PaymentSaurav BoruahNo ratings yet

- Byron Capital TSX.V:AVC Initiation ReportDocument16 pagesByron Capital TSX.V:AVC Initiation ReportRichard J MowatNo ratings yet

- Tsai V CADocument2 pagesTsai V CALotsee ElauriaNo ratings yet

- Personal Financial StatementDocument4 pagesPersonal Financial StatementKent WhiteNo ratings yet

- Current Affairs Q&A PDF Free - September 2018Document35 pagesCurrent Affairs Q&A PDF Free - September 2018shamaNo ratings yet

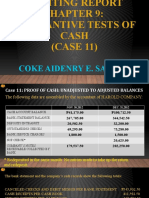

- Auditing Report CASE11Document18 pagesAuditing Report CASE11Coke Aidenry Saludo0% (1)

- Lebanese Crisis PDFDocument4 pagesLebanese Crisis PDFgeorges khairallahNo ratings yet

- XgxyDocument22 pagesXgxyLïkïth RäjNo ratings yet

- TaxDocument8 pagesTaxiamnumberfourNo ratings yet

- Yogesh Kumar - Fps Id 2177Document29 pagesYogesh Kumar - Fps Id 2177Shaminder SinghNo ratings yet

- DocxDocument358 pagesDocxAina AguirreNo ratings yet

- Brgy Reso Availment of Honorarium LoanDocument2 pagesBrgy Reso Availment of Honorarium LoanErnest Aton97% (37)

- NPS LeafletDocument2 pagesNPS LeafletMOHIT GUPTA jiNo ratings yet

- Phone Bill (PLDT)Document1 pagePhone Bill (PLDT)Jayson C. LagareNo ratings yet

- Reviewer MPCBDocument7 pagesReviewer MPCBMJ NuarinNo ratings yet

- Working Full Time Investment Banking Resume TemplateDocument2 pagesWorking Full Time Investment Banking Resume TemplatePoon Long-SanNo ratings yet

- Revenu Mensuel Universel RMU HTTPDocument17 pagesRevenu Mensuel Universel RMU HTTPHIH Princess Edwige Vincent de Bourbon PahlaviNo ratings yet

- LIC PresentationDocument28 pagesLIC PresentationYogesh Gupta100% (2)

- Standard Accounts: IntroducingDocument24 pagesStandard Accounts: IntroducingsathishNo ratings yet

- Audit of Cash Bank ReconDocument8 pagesAudit of Cash Bank ReconPaul Mc AryNo ratings yet

- Chap 3 SplitDocument54 pagesChap 3 Split22124020No ratings yet

- Synopsis Title:-"A Study On Compensation Management in HDFC Bank"Document2 pagesSynopsis Title:-"A Study On Compensation Management in HDFC Bank"saikiabhascoNo ratings yet

- Risk and ReturnDocument3 pagesRisk and ReturnrudrakshiNo ratings yet

- GSIS Housing Loan Preventing Foreclosure of Mortgage Sample Letter To GSIS To Suspend Foreclosure and To Clarify/reconcile AccountsDocument5 pagesGSIS Housing Loan Preventing Foreclosure of Mortgage Sample Letter To GSIS To Suspend Foreclosure and To Clarify/reconcile AccountsShan KhingNo ratings yet

- Clients' Guide To Private Placement Internationally Regulated Project Funding ProgramsDocument50 pagesClients' Guide To Private Placement Internationally Regulated Project Funding ProgramspashazahariNo ratings yet