Professional Documents

Culture Documents

Daily Agri Report Aug 23

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Agri Report Aug 23

Uploaded by

Angel BrokingCopyright:

Available Formats

Commodities Daily Report

Thursday| August 23, 2012

Agricultural Commodities

Content

News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Mentha Potato

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narveker@angelbroking.com (022) 2921 2000 Extn. 6130 Anuj Choudhary - Research Associate anuj.choudhary@angelbroking.com (022) 2921 2000 Extn. 6132

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Thursday| August 23, 2012

Agricultural Commodities

News in brief

Heavy monsoon spell over north, east India

would continue to lash parts of these regions over the next couple of days. Two back-to-back typhoons, Tembin and Bolaven, have been churning up the East China Sea to sustain the monsoon flows over the past few days. Models forecast persist with the already articulated view that a comparatively drier climes over central India would migrate to north India by the weekend (August 25). Ongoing rains in the north are expected to lose intensity and withdraw themselves to the fringes of the north India adjoining the Himalayan foothills. Rains would also have lifted from west Rajasthan and adjoining Gujarat, even beginning to sign off from these regions marking end of the season here. In the meantime, some rain would find its way into peninsular India. It is expected to be more pronounced towards the east coast along Chennai and adjoining south coastal Andhra Pradesh. (Source: Business Line)

Market Highlights (% change)

Last Prev. day

as on Aug 22, 2012

WoW MoM YoY

Sensex Nifty INR/$ Nymex Crude Oil - $/bbl Comex Gold - $/oz

17847 5413 55.5 97.84 1659

-0.21 -0.15 -0.31 1.91 2.64

1.21 1.21 0.28 4.72 3.71

3.29 3.25 0.61 #N/A #N/A

5.97 7.05 22.22 18.77 -8.81

Source: Reuters

China Economys Harsh Winter to Hurt Cotton, Commodities

otton consumption in China, the worlds largest user, may shrink 11 percent this year as a deteriorating economy hurts demand and causes a buildup in commodities, according to Weiqiao Textile Co. (2698) Futures fell. The Chinese economy is only at the beginning of a harsh winter, Zhang Hongxia, chairman of Chinas largest cotton- textile maker, said in an interview in Hong Kong on Aug. 20. Cotton usage may drop to 8 million metric tons this year, compared with consumption of about 9 million tons in 2011, according to Zhang, who had forecast in March that 2012 demand may increase to as much as 9.5 million tons. China accounts for about 40 percent of global cotton consumption. Cotton production in China doesnt meet demand and the government distributes import quotas. Through an industry association, the company has urged the government either to release additional import quotas, enabling textile makers to benefit from cheaper shipments, or to sell off state stockpiles at a discount, Zhang said. The government has more than 4 million tons held in reserves, she said. (Source: Bloomberg)

Now, soyabean farmers in M.P. pray for sunshine

Farmers in Madhya Pradesh, who have planted a record area under soyabean, are now looking up to the Sun god to reap a good harvest. The prevailing cloud conditions in central India for the past few weeks have triggered some concerns among the farming community, which is anticipating better prices than last year. The crop is currently in the flowering stage in Madhya Pradesh, the largest growing State, which saw an excess downpour of 15%, especially in the western parts. The trickle is still on and the cloud condition has been there for almost a month. Unless there is some sunshine in the next 8-10 days, plant growth could be stunted, said Rabindra Thakur, a farmer in his mid-50s from Semlya Chau in Indore district. However, scientists at the Indore-based Directorate of Soyabean Research (DSR), said the cloud condition in central India is not unusual during this time of the year. The crop is in good condition so far, as the rainfall is very well-distributed. There is no major threat of any pest attack, but a sunny grace will definitely help the crop, said V.S. Bhatia, Principal Scientist at DSR. (Source: Business Line)

Cotton Advisory Board may lower output estimate

The Cotton Advisory Board (CAB) may lower the production estimate of cotton for the October-September (2011-12) season to 34-34.5 mln bales from the earlier estimate of 35.2 mln bales. This is due to the commoditys lower arrivals in the market, mainly affected by erratic rains, especially in Gujarat, the leading cotton producing state in the country. CAB will meet this week to review the output estimates. Industry sources, however, said the meeting is too early for predicting the production estimate for the 2012-13 season. Sources said the estimate for the 2012-13 was expected to be not more than 32-32.5 mln bales based on the total area of production which is around 10 per cent less at 11 mln ha this year. While Gujarat is yet to receive sufficient rainfall, cotton growing parts of Vidarbha (Maharashtra) and Karnataka are receiving excess moisture due to delayed rains. (Source: Business Standard)

Current rains to have no impact on drought situation: Pawar

As the southwest monsoon showed signs of revival, agriculture minister Sharad Pawar on Wednesday said though the overall rainfall across the country has definitely improved in the last few weeks, it has not changed the prevailing drought-like situation in Karnataka, central Maharashtra, Saurashtra and Kutch, and also in western Rajasthan. We are still concerned about protecting the standing crop and planning to call another meeting of the empowered group of ministers (EGoM) on drought next week, Pawar told reporters on Wednesday. He said overall rainfall deficit has narrowed from 36 per cent earlier to 15 per cent in the last few days, which has pushed up sowing of rice and cotton over their normal acreage. As on August 8, the total shortfall in area under kharif crops came down from 5.2 million hectares to 0.8 million hectares, Pawar said. He said the water levels in 84 major reservoirs has also improved in the last few days. (Source: Business Standard)

Sugar output may slip by 3 mt in 2012-13: Thomas

Sugar output could fall by 3 million tonne (mt) to 23 mt in the 2012-13 marketing year starting October on account of poor rains, but supply would be enough to meet demand, food minister K V Thomas said.

(Source: Financial Express)

India govt should press China on rapeseed meal ban-industry

India's vegetable oils industry has called on the government to press China to lift a ban on imports of Indian rapeseed meal, the chief of a leading industry body said on Wednesday, ahead of the arrival by endAugust of a delegation from Beijing. The Indian government should also lift a freeze on the base import price, or tariff value, on all refined palm oils, Sushil Goenka, president of the Solvent Extractors' Association, said in a statement. India vegoils industry asks new delhi not to ban oilmeal exports and calls for effective increase in import costs of rbd palm oil

(Source: Reuters)

Recent rains wash away drought possibility

With moderate to heavy rains in Rajasthan and parts of Gujarat, Punjab and Karnataka during the last week, the countrys overall rain deficiency on Wednesday declined to -15% from the -22% reported a fortnight back. With the recent rains and the Met departments prediction of more showers next week, the possibility of a drought-like situation seems largely to have been avoided.During the last three days, the entire state of Rajasthan received heavy rainfall. North Gujarat and parts of Punjab have also received scattered rains giving relief to the standing crops, reducing water demand and lowering the temperature, the latest agriculture ministry advisory stated.Agricultural scientists say recent rains, especially in the northwestern parts of the country, would boost kharif sowing of pulses, soyabean and maize. (Source: Financial Express)

Malaysia's Aug 1-20 palm oil exports up 6 pct-ITS

Exports of Malaysian palm oil products Aug 1-20 rose 6 percent to 809,814 tonnes from 764,273 tonnes shipped during July 1-20, cargo surveyor Intertek Testing Services said on Wednesday. (Source: Reuters)

www.angelcommodities.com

Commodities Daily Report

Thursday| August 23, 2012

Agricultural Commodities

Chana

Chana Spot and September futures declined by 1.41% and 0.86% respectively on improved rains that have raised hopes for rabi sowing. Also, expectations government may intervene to curb the spiraling prices of Agri commodities led to selling pressure on Tuesday. Monsoon is seen recovering gradually in the month of August reveals the th latest report from IMD, wherein monsoon as on 16 August 2012 were seen 15% below normal. Central, southern and northwest region has received good rains in the last 2 weeks. This has aided sowing in the last one week. Also this may prove beneficial for the chana sowing. The Cabinet Committee on Economic Affairs approved the Minimum Support Prices (MSP) for Arhar (Tur) and Moong for 2012-13 season. The MSP for Arhar has been fixed at Rs.3850 per quintal and of Moong at Rs.4400 per quintal marking an increase of Rs.650 per quintal and Rs.900 per quintal respectively. Government released fourth advance estimates wherein it revised upward Chana output at 7.58 mn tn from 7.4 mn tonnes estimated in the third advance estimates and 8.22 mn tn in 2010-11.

Market Highlights

Unit Rs/qtl Rs/qtl Last 4799 4751 Prev day -1.41 -0.86

as on Aug 22, 2012 % change WoW MoM -2.07 0.49 -1.43 2.88 YoY 42.39 42.08

Chana Spot - NCDEX (Delhi) Chana- NCDEX Sept '12 Futures

Source: Reuters

Technical Chart - Chana

NCDEX Sept contract

Sowing progress and demand supply fundamentals

According to the Ministry of Agriculture 85.32 Lakh hectare area has th been planted under Kharif pulses as on 17 August, 2012 compared to 97.38 lakh hectare (ha) same period last year, a decline of 12.4% . Sowing is reported lower mainly in Rajasthan. Rajasthan Agriculture Department states that, planted area under Kharif Pulses is down at 15.33 lakh hectares ha compared to 24.14 lakh ha same th period last year. (Dated 17 August, 2012). Sowing which was down by more than 55% has gained momentum after improvement in rainfall in the last one week and is now down by 35%. In Maharashtra, Kharif Pulses sowing is down by 7% at 18.63 lakh hectares. While in AP it is up by 5% at 6.98 lakh hectares. According to the Fourth advance estimates, Pulses output is pegged at 17.21 mn tn in 2011-12 compared with 18.24 mn tn produced in the year 2010-11. While Chana output in 2011-12 is estimated at 7.58 million tones, Tur is estimated at 2.65 million tones, Urad is estimated at 1.83 million tones, Moong is estimated at 1.71 million tones. As per the latest release, Ministry of Commerce & Industry revealed that 20.23 lakh tones of peas, 2.03 lakh tons of Chana, 4.32 lakh tons of Urad & Moong, 1.12 lakh tons of Masoor and 4.26 lakh tons of Tur has been imported by India during April11-March 12. India's consumption of pulses is on the rise with an annual growth of around 5% but production is seen lower, which may lead to increase in imports this year. However, rupee weakness may turn import costlier. Around 74% of Indian chickpea imports come from Australia.

Source: Telequote

Technical Outlook

Contract Chana Sept Futures Unit Rs./qtl

valid for Aug 23, 2012 Support 4675-4715 Resistance 4820-4850

Outlook

Chana futures may remain sideways as supply shortage may be over shadowed by improved rains in the last 2 weeks. In the medium term to long term, the trend remains positive as supplies may not be sufficient to meet the rising demand of the commodity. Also lower sowing of kharif pulses may support chana prices.

www.angelcommodities.com

Commodities Daily Report

Thursday| August 23, 2012

Agricultural Commodities

Sugar

Sugar spot and September futures declined by 0.45% and 0.15% respectively on account of sufficient supplies to meet the festive season demand after government released additional quota. Industry body has estimated 7 mn tn stocks for the new season beginning October 01, 2012 compared to 5.5 mn tn year ago. India may exports 2.53 mn tn sugar in 2012-13. India will likely produce 25 million tonne of sugar in 2012-13 factoring in dry spells in biggest producer Maharashtra as well as Karnataka. The Central Government has released additional 4 lakh ton of non-levy sugar for the month of August, 2012. With the earlier release of 45 lakh ton in July and 2.66 lakh ton in July the total 51.66 lakh ton non-levy sugar will be available. After the prices fell sharply for past few days ICE sugar and Liffe Sugar closed up by 0.81% and 0.62% respectively on account of short coverings by market participants. With international prices trading at such low levels, the exports from India is not viable as domestic prices being quoted much higher.

Market Highlights

Unit Sugar Spot- NCDEX (Kolkata) Sugar M- NCDEX Sept '12 Futures Rs/qtl Last 3673

as on Aug 22, 2012 % Change Prev. day WoW -0.45 -1.39 MoM 2.59 YoY 22.45

Rs/qtl

3406

-0.15

-3.76

2.44

21.95

Source: Reuters

International Prices

Unit Sugar No 5- LiffeOct'12 Futures Sugar No 11-ICE Oct '12 Futures $/tonne $/tonne Last 551.3 443.11

as on Aug 22, 2012 % Change Prev day WoW 0.62 0.81 -2.48 -1.72 MoM -14.61 -16.53 YoY -28.51 -32.77

Domestic Production and Exports

As on 9 August, 2012, the area under sugarcane is estimated at 52.88 lakh ha, up from 50.59 lakh ha on same period a year ago. Despite of higher acreage, the producers body has estimated next years output lower at 25mn tn, down by 1mn tn compared to the current year. Sugar production in India the worlds second-biggest producer touched 26 million tonne since October 1, 2011. IMD has so far predicted normal rains in August. However, rains in the first week of august are still 1% below average. If monsoon recover in the month of August, then there would not be much downward revision in the output and vice a versa. With the opening stocks of 7 mn tn, domestic Sugar supplies are estimated at 32mn tn against the domestic consumption of around 22.523 mln tn for 2012-13. Thus, no curbs on exports are seen as of now.

th

Source: Reuters

Technical Chart - Sugar

NCDEX Sept contract

Global Sugar Updates

According to Unica, the 2012/13 sugarcane crop is seen at 596.6 mn tn, down 1 percent from the April estimate of 602.18 mn tn, according to the second estimate of the crop this season from the agriculture ministry's supply agency Conab. Despite the drop in the cane crop estimate from April, sugar output -- now forecast at 38.99 mn tn -- is virtually stable with the 38.85 million tonnes forecast four months ago. The global sugar surplus remains on target to fall in 2012/13 season, though declines will be less than previously suggested, while adverse weather in several producers may stop prices dropping far below recent levels. (Source: Reuters) According to the International Sugar Organization (ISO), the global sugar surplus is forecast to halve to around 3 mln tn in 2012/13 (OctoberSeptember) from a surplus of 6.5 million tonnes in 2011/12).

Source: Telequote

Technical Outlook

Contract Sugar Sept NCDEX Futures Unit Rs./qtl

valid for Aug 23, 2012 Support 3355-3380 Resistance 3430-3450

Outlook

Sugar prices in the domestic markets may decline further due to sufficient supplies in the market to meet the festive demand. Medium term outlook for sugar would depend on the monsoon in the current month and in September and thereby output estimates for next season that will begin in October.

www.angelcommodities.com

Commodities Daily Report

Thursday| August 23, 2012

Agricultural Commodities

Oilseeds Soybean:

Soybean spot as well as futures remained firm on Tuesday on account of supply tightness in the domestic as well as global markets till the arrival of fresh crop in mid September. CBOT Soybean settled lower by 0.31% on Wednesday on profit booking. Markets had a strong (monthly U.S.) crush report and another strong week of export sales last week has provided support to soybean prices in the last few sessions. According to weekly crop progress report, the condition of U.S. corn crops was unchanged last week, and soybeans improved to 31% during last week from 30% in good to excellent condition as cooler weather eased plant stress from the worst drought in half a century. th USDA released its monthly crop report on 10 August wherein its cut U.S. 2012/13 soybean production forecast to 2.692 billion bushels, from 3.05 billion in July. India's oil meal exports fell to 2.75 lakh tn in July from 2.82 lakh tn a year earlier led by a sharp drop in the overseas sales of rapeseed meal. Soy meal exports rose to 1.68 lakh tn in July, from 1.39 tn a year ago. In the domestic markets, as on 17 August Oilseeds have been sown in 160.77 lakh hectares so far, compared with 167 lakh hectares same period last year. Soybean area is higher at 106.4 lakh hectares. In 2011-12 season, soybean was sown under 102.9 lakh hectares area and recorded 12.28 million tonne output, down from 12.73 mn tn in 2010-11 season.

th

Market Highlights

% Change Unit Soybean Spot- NCDEX (Indore) Soybean- NCDEX Oct '12 Futures Ref Soy oil SpotNCDEX(Indore) Ref Soyoil- NCDEX Aug '12 Futures Rs/qtl Rs/qtl Rs/10 kgs Rs/10 kgs Last 4575 4018 788 802.6 Prev day 1.24 0.44 0.73 1.22

as on Aug 22, 2012

WoW 2.30 -11.34 1.49 2.88

MoM -3.11 -13.33 0.59 1.92

YoY 92.96 68.10 18.34 20.79

Source: Reuters

as on Aug 22, 2012 International Prices Soybean- CBOTSept'12 Futures Soybean Oil - CBOTSept '12 Futures Unit USc/ Bushel USc/lbs Last 1748 56.17 Prev day -0.31 1.08 WoW 5.32 5.84 MoM 6.65 3.75

Source: Reuters

YoY 26.71 -1.97

Crude Palm Oil

% Change Unit

CPO-Bursa Malaysia Sept '12 Contract CPO-MCX- Aug '12 Futures

as on Aug 22, 2012

Refined Soy Oil: NCDEX Soy Oil & MCX CPO settled higher on

Wednesday taking cues from the firm domestic oilseeds prices. India imported 112,611 tonnes of refined palm oil in July, down 9.28 percent from June. Total vegetable oil imports in July were 870,328 tonnes, up from 783,315 tonnes in the previous month (Source: Sea of India). Malaysian palm oil Production has risen consistently since March 2012 and expected to go as high as 1.9 mn tn in September. On the other hand, exports have fallen 14.8 percent in July to below 1.23mn tonnes compared to 1.45mn tonnes a month ago due to a lull in Asian demand. Although, Malaysia's July palm oil stocks rose 17.6 percent to 1,998,870 tn from a revised 1,699,117 tn in June, the development of El nino pattern might hamper palm oil yield and support the upside in the prices. Indonesia, the world's top palm oil producer, has lowered its earlier output forecast by 8 percent to 23.6 million tonnes this year

Last 3008 563

Prev day 3.80 1.00

WoW 6.78 2.21

MoM -0.56 -0.21

YoY -11.53 12.33

MYR/Tonne Rs/10 kg

Source: Reuters

RM Seed

Unit RM Seed SpotNCDEX (Jaipur) RM Seed- NCDEX Sept '12 Futures Rs/100 kgs Rs/100 kgs Last 4150 4392 Prev day -1.61 0.30

as on Aug 22, 2012 WoW -3.61 1.15 MoM -4.04 -0.48

Source: Reuters

YoY 41.53 49.90

Technical Chart Soybean

NCDEX Oct contract

Rape/mustard Seed: Mustard seed spot prices declined 1.6%,

while futures settled marginally higher by 0.3% taking cues form the entire edible oil complex. Mustard output this season has declined significantly and deficient rains in Rajasthan would not provide proper moisture for mustard sowing next season. This would keep the downside restricted. According to a circular issued by NCDEX, existing Special Cash Margin of 5% on the Long side shall be increased to 15% on all the running and yet to be launched contracts w.e.f beginning of 18/07/2012.

Outlook

Oilseed may trade sideways with negative bias amid higher soybean acreage in the domestic markets couple with improved rains in the past few weeks. Sentiment remains cautious on possibility of an El Nino returning to Southeast Asia that could hamper output in top producers Indonesia and Malaysia.

Source: Telequote

Technical Outlook

Contract Soy Oil Sept NCDEX Futures Soybean NCDEX Oct Futures RM Seed NCDEX Sept Futures CPO MCX Sept Futures Unit Rs./qtl Rs./qtl Rs./qtl Rs./qtl

valid for Aug 23, 2012 Support 795-799 3925-3975 4336-4360 558-561.50 Resistance 807-811 4055-4095 4430-4463 572-575

www.angelcommodities.com

Commodities Daily Report

Thursday| August 23, 2012

Agricultural Commodities

Black Pepper

Pepper Futures extended its previous days losses yesterday due to lack of buying interest seen in the domestic markets. Demand for Indian pepper in the international markets is also low due to huge price parity. Prices also corrected due to good rainfall in Pepper growing regions in Kerala and Karnataka over the last few days. Good supplies from Indonesia have also pressurized the prices. Many countries are importing pepper from Brazil and Indonesia than from India due to lower quotations. The Spot as well as the Futures settled 0.97% and 0.43% lower on Wednesday. th According to the circular released on June 13 2012 the existing Special margin of 10% (cash) on the long side stands withdrawn on all running contracts and yet to be launched contracts in Pepper from beginning of day Friday June 15, 2012. Pepper prices in the international market are being quoted at $8,0008,100/tonne(C&F) while Vietnam was offering its produce at $6,000/tonne for 500 GL. Brazil was offering its pepper at $6,150/tonne for the B-Asta grade. As per circular dt. 29/06/2012 issued by NCDEX, Hassan will be available as an additional delivery centre for all the yet to be launched contracts. (not applicable to the currently available contracts-till Dec 2012 expiry).

Market Highlights

% Change Unit Pepper SpotNCDEX (Kochi) Pepper- NCDEX Sept '12 Futures Rs/qtl Rs/qtl Last 40995 41770 Prev day -0.97 -0.45

as on Aug 22, 2012 WoW -4.14 -6.36 MoM -2.84 -4.18 YoY 25.56 24.10

Source: Reuters

Technical Chart Black Pepper

NCDEX Sept contract

Exports

According to Spices Board of India, exports of pepper in April 2012 fell by 47% and stood at 1,200 tonnes as compared to 2,266 tonnes in April 2011. India imported 1,848 tonnes of pepper till March 2012 and has become the third country to import such large quantity after UAE and Singapore. (Source: Agriwatch) According to Vietnam Ministry of Agriculture and Rural Development (MARD) exports of black pepper in 2012 are forecasted at around 1,25,000 tonnes. Exports of Pepper from Vietnam during January till June 2012 is estimated around 73000 mt 73,000 mt, higher by 4.3% in volume and 31.7% in value compared to corresponding year last year. Exports of Pepper from Brazil during January till May 2012 are estimated around 13369 mt. (Source: Peppertradeboard). Pepper imports by U.S. the largest consumer of the spice declined 14.8% in the first 2 months of the year (2012) to 8810 tn as compared to 10344 tn in the same period previous year. Imports of Pepper in the month of February declined by 16.8% to 3999 tn as compared to 4811 tn in the month of January 2012. Exports from Indonesia posted significant decrease of 42% as compared to previous year. Exports stood at 36,500 tonnes as compared to 62,599 tonnes in the last year. During May 2012 Brazil exported 1,705 tonnes of pepper as against 1600 tn in May 2011.

Source: Telequote

Technical Outlook

Contract Black Pepper NCDEX Sept Futures Unit Rs/qtl

valid for Aug 23, 2012 Support 41100-41570 Resistance 42100-42400

Production and Arrivals

There were no arrivals of pepper in domestic market and no subsequent offtakes reported on Wednesday. Global Pepper production in 2012 is expected to increase 7.2% to 3.20 lakh tonnes as compared to 2.98 lakh tonnes in 2011 with sharp rise of 24% in Indonesian pepper output and in Vietnam by 10%. According to latest report pepper output in Vietnam is estimated to be 1.35 lakh tonne as compared to 1.10 lakh tonne estimated early in the beginning of year (2012). Domestic consumption of Pepper in the world is expected to grow by 3.03% to 1.25 lakh tonnes while exports are likely to grow by 1.48% to 2.46 lakh tonnes in 2012. (Source: Pepper trade board) On the other hand production of pepper in India in 2011-12 is expected to decline further by 5% to 43 thousand tonnes as compared to 48 thousand tonnes in the last year. Production is lowest in a decade.

Outlook

Pepper prices are expected to trade lower due to lower demand at higher levels in the domestic as well as international markets. However, low stocks in the domestic markets may support prices at lower levels.

www.angelcommodities.com

Commodities Daily Report

Thursday| August 23, 2012

Agricultural Commodities

Jeera

Jeera Futures corrected sharply yesterday due to reports of good rains in Gujarat, the main Jeera growing belt. Good rains will improve moisture levels which may increase prospects of better yield next season. Even the farmers were unwilling to sell at lower levels However, Supply concerns from Syria and Turkey still exists. The Spot as well as the Futures settled 1.34% and 2.54% lower on Wednesday. Expectations are that large export orders may be diverted to India from the international markets due to the ongoing civil war in Syria which is hampering supplies. There are reports that there has been an increase in demand from Bangladesh for Indian Jeera. Production in Syria and Turkey is being reported around 17,000 tonnes and around 5,000 tonnes, lesser than expectations. Jeera prices in the international market of Indian origin are being offered at $2,950 tn (c&f) while Syria and Turkey are not offering their produce. Carryover stocks of jeera in the domestic market is expected to be around 7-8 lakh bags as compared to 4-5 lakh bags in the last year.

Market Highlights

Unit Jeera SpotNCDEX(Unjha) Jeera- NCDEX Sept '12 Futures Rs/qtl Rs/qtl Last 16007 15400 Prev day -1.34 -2.65

as on Aug 22, 2012 % Change WoW -0.85 -1.42 MoM -1.90 -5.16 YoY 2.88 1.16

Source: Reuters

Technical Chart Jeera

NCDEX Sept contract

Production, Arrivals and Exports

Unjha markets witnessed arrivals of 3,000 bags, while off-takes stood at 3,000 bags on Wednesday. Production of jeera in 2011-12 is expected to be around 40 lakh bags as compared to 29 lakh bags in 2010-11 (each bag weighs 55 kgs). (Source: spot market traders). According to Spices Board of India, exports of Jeera in April 2012 stood at 2,500 tonnes as compared to 2,369 tonnes in April 2011, an increase of 6%.

Source: Telequote

Outlook

Jeera prices are expected to trade lower. Good rains in Gujarat may pressurize the prices. However, good export demand and lower arrivals in the domestic markets may also support prices at lower levels. In the medium to long term (Aug-September 2012) prices are likely to witness a bounce back as there are limited stocks with Syria and Turkey and crop there is 30% short as compared to last year.

Market Highlights

Prev day -0.49 0.10

as on Aug 22, 2012 % Change

Unit Turmeric SpotNCDEX (N'zmbad) Turmeric- NCDEX Sept '12 Futures Rs/qtl Rs/qtl

Last 5439 5846

WoW -0.34 2.74

MoM -6.21 -6.55

YoY -4.28 15.31

Turmeric

Turmeric Futures traded lower yesterday, extending its previous days losses due to sufficient stocks with the farmers/stockists. The Spot also traded lower as farmers were unwilling to sell their produce at lower levels. Rainfall in Nizamabad is 29% lower than the normal as on 14/8/2012. Turmeric has been sown in 0.47 lakh hectares in A.P as on th 14 August 2012. The Spot as well as the Futures settled 0.49% and 0.21% lower respectively on Wednesday. The pre expiry margin on Turmeric has been increased to 5% for last 7 trading days increased on a daily basis on both buy and sell side from the existing 3% on daily basis for last 5 days.

Technical Chart Turmeric

NCDEX Sept contract

Production, Arrivals and Exports

Arrivals in Erode and Nizamabad mandi stood at 4,000 bags and 1,500 bags respectively on Wednesday. Turmeric production for the year 2011-12 is projected at historical high of 90 lakh bags (1 bag= 70 kgs) compared to 69 lakh bags in 201011. Erode is expected to produce 55 lakh bags of turmeric a rise of 29% as compared to previous year. According to Spices Board of India, exports of Turmeric in April 2012 increased by 1% at 7,300 tn as compared to 7,230 tn in April 2011.

Source: Telequote

Technical Outlook

Unit Jeera NCDEX Sept Futures Turmeric NCDEX Sept Futures Rs/qtl Rs/qtl

valid for Aug 23, 2012 Support 15180-15305 5660-5740 Resistance 15555-15740 5910-6000

Outlook

Turmeric prices are expected to continue to trade sideways with a negative bias in the intraday. Reports of export demand from Pakistan may lend support to the prices. Traders also expect fresh export orders in the coming days. In the medium to long term (Aug to September) prices may take cues from the sowing figures.

www.angelcommodities.com

Commodities Daily Report

Thursday| August 23, 2012

Agricultural Commodities

Mentha Oil

Mentha oil prices traded on a positive note yesterday due to buying by stockists at lower levels. The spot as well as the Futures settled 0.91% and 3.17% higher on Tuesday. Total Special Cash margin of 25% on the long side of Mentha Oil has been reduced to 10% in the May contract and 5% in June contract onwards from May 5, 2012. For detailed reference please refer to the Circular No: MCX/T&S/180/2012 dated 03/05/2012.

Market Highlights

Unit Mentha Oil- MCX Spot (Chandausi) Mentha Oil MCX Aug Futures Rs/qtl Rs/qtl Last 1520 1327 Prev day -0.41 -0.93

as on Aug 22, 2012 % Change WoW -0.80 -0.51 MoM 2.43 -0.04 YoY 27.05 10.92

Production, Arrivals and Exports

According to spot market sources, the overall acreage is estimated to increase from 1.75 lakh ha to 2.1 lakh ha this year. The overall production of Mentha is expected to increase by 30% - 40% as compared to last year. Arrivals of the fresh crop are going on in the mandis and currently stand around 1200 drums (each drum weighs 180 kgs). Exports of Mentha during April 2011 to January 2012 witnessed a decline of 6% to 12,850 tonnes as compared to 13,550 tonnes in the same period last year.

Source: Reuters

Technical Chart Mentha Oil

MCX Sep contract

Outlook

In the intraday trading session Mentha oil is expected to trade sideways with a positive bias in the intraday. However, buying at lower levels may emerge from stockists anticipating good demand from pharmaceutical companies in the coming days. In long to medium term (July-September) prices are likely to remain under pressure due to peak arrival period.

Source: Telequote

Potato

Potato Futures settled 1.3% lower due to dull demand. Commodity market regulator Forward Markets Commission (FMC) has banned launch of new Tarkeshwar potato contracts. Also From 01-08-2012 no fresh positions shall be allowed during the Staggered Delivery period in all running contracts of Potato in MCX and NCDEX. Only squaring off of existing positions will be allowed during the Staggered Delivery period.

Market Highlights

Prev day -0.35 -1.30

as on Aug 22, 2012 % Change

Unit Potato SpotNCDEX (Agra) Potato- NCDEX Sept '12 Futures Rs/qtl Rs/qtl

Last 1155 1150

WoW -0.18 -2.31

MoM -1.43 -9.72

YoY 176.75 223.44

Production and Arrivals Scenario

Around 200-220 lakh MT potato had been stored in the country in different cold storages during the current season. Although 27-30% of the cold storage stocks are released so far from overall producing belts, they are much lower compared to normal 35-38% every year. According to NHRDF, The sowing of potato seed for Kharif production in Karnataka completed but the area sown is adversely affected due to less and delayed rains. The sowing in hills of Himachal Pradesh, Uttarakhand and Jammu and Kashmir are also completed. The seed sowing in Maharashtra for Kharif is continued, which is delayed due to delay arrival of monsoon, which is still scanty. The area for Kharif is expected to be less or may be same with delayed planting compared to last year, but it depends on further rains. With reports of crop damages in Karnataka, the supplies from this region to other states may also be affected as the overall output is expected to decline by 70-75%. In fact, the state may have to rely on the supplies from the north Indian markets.

Technical Chart Potato

NCDEX Sept contract

Source: Telequote

Outlook

Potato futures in intraday may trade sideways to down weak demand in the market. Also Upcoming festive season might provide support to the prices in Medium term.

Technical Outlook

Unit Mentha Oil Aug Futures Potato NCDEX Sept Futures Potato MCX Sept Futures Rs/kg Rs/qtl Rs/qtl

valid for Aug 23, 2012 Support 1300-1312 1122-1135 1162-1180 Resistance 1340-1355 1162-1180 1203-1215

www.angelcommodities.com

You might also like

- Cab&Chaissis ElectricalDocument323 pagesCab&Chaissis Electricaltipo3331100% (13)

- Alternate Tuning Guide: Bill SetharesDocument96 pagesAlternate Tuning Guide: Bill SetharesPedro de CarvalhoNo ratings yet

- CALCULUS PHYSICS MIDTERMDocument41 pagesCALCULUS PHYSICS MIDTERMMACARIO QTNo ratings yet

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- GP Rating GSK Exit ExamDocument108 pagesGP Rating GSK Exit ExamMicle VM100% (4)

- Prac Res Q2 Module 1Document14 pagesPrac Res Q2 Module 1oea aoueoNo ratings yet

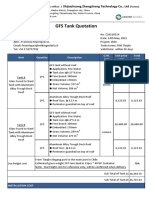

- GFS Tank Quotation C20210514Document4 pagesGFS Tank Quotation C20210514Francisco ManriquezNo ratings yet

- Daily Agri Report Aug 28Document8 pagesDaily Agri Report Aug 28Angel BrokingNo ratings yet

- Daily Agri Report Sep 14Document8 pagesDaily Agri Report Sep 14Angel BrokingNo ratings yet

- Daily Agri Report Oct 31Document8 pagesDaily Agri Report Oct 31Angel BrokingNo ratings yet

- Daily Agri Report, August 23 2013Document9 pagesDaily Agri Report, August 23 2013Angel BrokingNo ratings yet

- Daily Agri Report Aug 10Document8 pagesDaily Agri Report Aug 10Angel BrokingNo ratings yet

- Daily Agri Report Aug 29Document8 pagesDaily Agri Report Aug 29Angel BrokingNo ratings yet

- Daily Agri Report Sep 21Document8 pagesDaily Agri Report Sep 21Angel BrokingNo ratings yet

- Daily Agri Report Aug 27Document8 pagesDaily Agri Report Aug 27Angel BrokingNo ratings yet

- Daily Agri Report, June 10Document7 pagesDaily Agri Report, June 10Angel BrokingNo ratings yet

- Daily Agri Report Aug 17Document8 pagesDaily Agri Report Aug 17Angel BrokingNo ratings yet

- Daily Agri Report Nov 7Document8 pagesDaily Agri Report Nov 7Angel BrokingNo ratings yet

- Daily Agri Report Oct 3Document8 pagesDaily Agri Report Oct 3Angel BrokingNo ratings yet

- Daily Agri Report Sep 24Document8 pagesDaily Agri Report Sep 24Angel BrokingNo ratings yet

- Daily Agri Report Sep 10Document8 pagesDaily Agri Report Sep 10Angel BrokingNo ratings yet

- Daily Agri Report, June 06Document7 pagesDaily Agri Report, June 06Angel BrokingNo ratings yet

- Daily Agri Report Aug 31Document8 pagesDaily Agri Report Aug 31Angel BrokingNo ratings yet

- Daily Agri Report Oct 1Document8 pagesDaily Agri Report Oct 1Angel BrokingNo ratings yet

- Daily Agri Report, April 18Document8 pagesDaily Agri Report, April 18Angel BrokingNo ratings yet

- Daily Agri Report Aug 24Document8 pagesDaily Agri Report Aug 24Angel BrokingNo ratings yet

- Daily Agri Report Aug 18Document8 pagesDaily Agri Report Aug 18Angel BrokingNo ratings yet

- Daily Agri Report Sep 11Document8 pagesDaily Agri Report Sep 11Angel BrokingNo ratings yet

- Daily Agri Report Oct 23Document8 pagesDaily Agri Report Oct 23Angel BrokingNo ratings yet

- Daily Agri Report Sep 13Document8 pagesDaily Agri Report Sep 13Angel BrokingNo ratings yet

- Daily Agri Report Sep 20Document8 pagesDaily Agri Report Sep 20Angel BrokingNo ratings yet

- Daily Agri Report Aug 13Document8 pagesDaily Agri Report Aug 13Angel BrokingNo ratings yet

- Daily Agri Report Sep 29Document8 pagesDaily Agri Report Sep 29Angel BrokingNo ratings yet

- Daily Agri Report Nov 20Document8 pagesDaily Agri Report Nov 20Angel BrokingNo ratings yet

- Daily Agri Report September 03 2013Document9 pagesDaily Agri Report September 03 2013Angel BrokingNo ratings yet

- Daily Agri Report, February 23Document8 pagesDaily Agri Report, February 23Angel BrokingNo ratings yet

- Daily Agri Report September 12 2013Document9 pagesDaily Agri Report September 12 2013Angel BrokingNo ratings yet

- Daily Agri Report Sep 4Document8 pagesDaily Agri Report Sep 4Angel BrokingNo ratings yet

- Daily Agri Report Oct 4Document8 pagesDaily Agri Report Oct 4Angel BrokingNo ratings yet

- Daily Agri Report, June 08Document7 pagesDaily Agri Report, June 08Angel BrokingNo ratings yet

- Daily Agri Report, May 24Document7 pagesDaily Agri Report, May 24Angel BrokingNo ratings yet

- Daily Agri Report Oct 6Document8 pagesDaily Agri Report Oct 6Angel BrokingNo ratings yet

- Daily Agri Report, August 12 2013Document9 pagesDaily Agri Report, August 12 2013Angel BrokingNo ratings yet

- Daily Agri Report, June 12Document7 pagesDaily Agri Report, June 12Angel BrokingNo ratings yet

- Daily Agri Report Sep 25Document8 pagesDaily Agri Report Sep 25Angel BrokingNo ratings yet

- Agri Commodity Daily Report Sept 24Document8 pagesAgri Commodity Daily Report Sept 24Abhinav JainNo ratings yet

- Daily Agri Report Sep 15Document8 pagesDaily Agri Report Sep 15Angel BrokingNo ratings yet

- Daily Agri Report Oct 13Document8 pagesDaily Agri Report Oct 13Angel BrokingNo ratings yet

- Daily Agri Report, June 19Document9 pagesDaily Agri Report, June 19Angel BrokingNo ratings yet

- Daily Agri Report Nov 19Document8 pagesDaily Agri Report Nov 19Angel BrokingNo ratings yet

- Daily Agri Report, July 19 2013Document9 pagesDaily Agri Report, July 19 2013Angel BrokingNo ratings yet

- Daily Agri Report Oct 29Document8 pagesDaily Agri Report Oct 29Angel BrokingNo ratings yet

- Daily Agri Report Nov 1Document8 pagesDaily Agri Report Nov 1Angel BrokingNo ratings yet

- Daily Agri Report Sep 26Document8 pagesDaily Agri Report Sep 26Angel BrokingNo ratings yet

- Daily Agri Report Aug 30Document8 pagesDaily Agri Report Aug 30Angel BrokingNo ratings yet

- Daily Agri Report, June 11Document7 pagesDaily Agri Report, June 11Angel BrokingNo ratings yet

- Daily Agri Report Dec 3Document8 pagesDaily Agri Report Dec 3Angel BrokingNo ratings yet

- Daily Agri Report, April 26Document8 pagesDaily Agri Report, April 26Angel BrokingNo ratings yet

- Daily Agri Report 10th JanDocument8 pagesDaily Agri Report 10th JanAngel BrokingNo ratings yet

- Daily Agri Report, June 05Document7 pagesDaily Agri Report, June 05Angel BrokingNo ratings yet

- Daily Agri Report Oct 10Document8 pagesDaily Agri Report Oct 10Angel BrokingNo ratings yet

- Daily Agri Report, May 13Document7 pagesDaily Agri Report, May 13Angel BrokingNo ratings yet

- Daily Agri Report, 30th January 2013Document8 pagesDaily Agri Report, 30th January 2013Angel BrokingNo ratings yet

- Daily Agri Report Nov 26Document8 pagesDaily Agri Report Nov 26Angel BrokingNo ratings yet

- Daily Agri Report Nov 10Document8 pagesDaily Agri Report Nov 10Angel BrokingNo ratings yet

- Daily Agri Report September 06 2013Document9 pagesDaily Agri Report September 06 2013Angel BrokingNo ratings yet

- Cambodia Agriculture, Natural Resources, and Rural Development Sector Assessment, Strategy, and Road MapFrom EverandCambodia Agriculture, Natural Resources, and Rural Development Sector Assessment, Strategy, and Road MapNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- There Is There Are Exercise 1Document3 pagesThere Is There Are Exercise 1Chindy AriestaNo ratings yet

- Money Laundering in Online Trading RegulationDocument8 pagesMoney Laundering in Online Trading RegulationSiti Rabiah MagfirohNo ratings yet

- The Dominant Regime Method - Hinloopen and Nijkamp PDFDocument20 pagesThe Dominant Regime Method - Hinloopen and Nijkamp PDFLuiz Felipe GuaycuruNo ratings yet

- Jesd8 15aDocument22 pagesJesd8 15aSridhar PonnurangamNo ratings yet

- Chromate Free CoatingsDocument16 pagesChromate Free CoatingsbaanaadiNo ratings yet

- Guia de Usuario GPS Spectra SP80 PDFDocument118 pagesGuia de Usuario GPS Spectra SP80 PDFAlbrichs BennettNo ratings yet

- Google Earth Learning Activity Cuban Missile CrisisDocument2 pagesGoogle Earth Learning Activity Cuban Missile CrisisseankassNo ratings yet

- Statistical Quality Control, 7th Edition by Douglas C. Montgomery. 1Document76 pagesStatistical Quality Control, 7th Edition by Douglas C. Montgomery. 1omerfaruk200141No ratings yet

- Inventory ControlDocument26 pagesInventory ControlhajarawNo ratings yet

- October 2009 Centeral Aucland, Royal Forest and Bird Protecton Society NewsletterDocument8 pagesOctober 2009 Centeral Aucland, Royal Forest and Bird Protecton Society NewsletterRoyal Forest and Bird Protecton SocietyNo ratings yet

- Paper 4 (A) (I) IGCSE Biology (Time - 30 Mins)Document12 pagesPaper 4 (A) (I) IGCSE Biology (Time - 30 Mins)Hisham AlEnaiziNo ratings yet

- Condition Based Monitoring System Using IoTDocument5 pagesCondition Based Monitoring System Using IoTKaranMuvvalaRaoNo ratings yet

- An Introduction To Ecology and The BiosphereDocument54 pagesAn Introduction To Ecology and The BiosphereAndrei VerdeanuNo ratings yet

- Todo Matic PDFDocument12 pagesTodo Matic PDFSharrife JNo ratings yet

- What Is A Problem?: Method + Answer SolutionDocument17 pagesWhat Is A Problem?: Method + Answer SolutionShailaMae VillegasNo ratings yet

- Flowmon Ads Enterprise Userguide enDocument82 pagesFlowmon Ads Enterprise Userguide ennagasatoNo ratings yet

- CENG 5503 Intro to Steel & Timber StructuresDocument37 pagesCENG 5503 Intro to Steel & Timber StructuresBern Moses DuachNo ratings yet

- Peran Dan Tugas Receptionist Pada Pt. Serim Indonesia: Disadur Oleh: Dra. Nani Nuraini Sarah MsiDocument19 pagesPeran Dan Tugas Receptionist Pada Pt. Serim Indonesia: Disadur Oleh: Dra. Nani Nuraini Sarah MsiCynthia HtbNo ratings yet

- Meet Joe Black (1998) : A Metaphor of LifeDocument10 pagesMeet Joe Black (1998) : A Metaphor of LifeSara OrsenoNo ratings yet

- SOP-for RecallDocument3 pagesSOP-for RecallNilove PervezNo ratings yet

- Week 15 - Rams vs. VikingsDocument175 pagesWeek 15 - Rams vs. VikingsJMOTTUTNNo ratings yet

- Techniques in Selecting and Organizing InformationDocument3 pagesTechniques in Selecting and Organizing InformationMylen Noel Elgincolin ManlapazNo ratings yet

- Uses and Soxhlet Extraction of Apigenin From Parsley Petroselinum CrispumDocument6 pagesUses and Soxhlet Extraction of Apigenin From Parsley Petroselinum CrispumEditor IJTSRDNo ratings yet

- Display PDFDocument6 pagesDisplay PDFoneoceannetwork3No ratings yet