Professional Documents

Culture Documents

Wesleyan Media Project Release4 Final

Uploaded by

Helen BennettOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Wesleyan Media Project Release4 Final

Uploaded by

Helen BennettCopyright:

Available Formats

For Immediate Release: Obama Dominates Advertising in Key States

President Holds Advantage in 14 of 15 Top Markets; Only 7.8 Percent of Presidential Ads Positive; FCC electronic disclosure leaves out more than 50% of federal ads (MIDDLETOWN, CT) Oct. 3, 2012 In the three-week period since the parties national conventions, Barack Obama and his party and interest group allies have continued to dominate the airwaves in the battleground presidential states. From September 9 to September 30, Obama held an ad advantage in 14 of the 15 most advertised media markets in the key states of Virginia, Ohio, and Florida (Table 1). In the top 15 markets, pro-Romney advertising outpaced pro-Obama advertising only in Las Vegas, Nevada. (At the end of this report is a listing of advertising in all battleground media markets, Table 15.) The heavy advertising from the Obama campaign has challenged the assumption that Romneyfriendly outside groups would saturate and dominate the airwaves in key markets, said Erika Franklin Fowler, co-director of the Wesleyan Media Project. In fact, Obama and his allies aired 1,800 more ads than Romney and his allies in Denver; 1,700 more in Norfolk, Virginia; and 1,500 more in Orlando--all in the last three weeks. The heavy Obama advantage may be one reason why polling in battleground states has moved against Romney in recent weeks, Fowler said. Indeed, Romney was heavily reliant on outside groups to sponsor his advertising. For instance, one reason pro-Romney ads outnumbered pro-Obama ads in Las Vegas was that outside groups sponsored over 2,900 ads in that media market in the last three weeks (more than double the number sponsored by the Romney campaign). The Democratic National Committee did not purchase broadcast advertising in these top media markets in the past three weeks, while the Republican National Committee has made some limited purchases backing Romney. The absence of party support in the air war for both candidates may have to do with a few key factors, said Michael Franz, co-director of the Project. First, the DNC is likely spending most of its energy on base mobilization off the air, such as with voter contact drives. Second, the RNC coordinated on a significant amount of advertising with Romney, and independently supported him as well, throughout the first part of the general election. The Republican Party may have shifted its focus to congressional ads in the fall campaign, or may be conserving resources for a late push. (See Table 3 for Republican Party ad totals in the full general election period.)

Table 1: Advertising in Presidential Race (September 9-30) Dem GOP Dem Market Total Obama DNC Groups Romney RNC Groups Adv. Denver 7,770 4,001 0 790 1,470 116 1,393 1,812 Las Vegas 7,360 2,909 0 111 1,251 159 2,930 -1,320 Cleveland 6,583 3,052 0 705 1,649 48 1,117 943 Tampa 6,361 3,064 0 685 1,648 24 940 1,137 Washington, DC 6,354 3,301 0 181 1,706 58 1,108 610 Orlando 6,144 3,146 0 687 1,387 49 875 1,522 Columbus, OH 5,224 2,255 0 776 1,382 54 757 838 Cincinnati 5,104 2,305 0 365 1,416 47 971 236 Reno 4,993 2,826 0 0 1,013 0 1,154 659 Norfolk 4,880 2,900 0 397 833 68 682 1,714 Colorado Springs 4,878 2,259 0 341 1,218 0 1,060 322 Grand Junction 4,661 2,677 0 0 1,047 0 937 693 Toledo 4,467 1,931 0 585 1,476 51 424 565 Richmond 4,449 2,345 0 348 843 45 868 937 Ft. Myers 4,039 2,024 0 387 1,250 29 349 783 Numbers include broadcast television. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. Party airings also include some candidate-party coordinated ads. The Obama campaign has topped all other spenders in the presidential race over the past three weeks, though it has received some help from Priorities USA Action (Obamas SuperPAC), SEIU COPE and the Planned Parenthood Action Fund. In addition to the Romney campaign, American Crossroads and Crossroads GPS have aired substantial advertising in support of Romney.

Table 2: Top Spenders in Ad Race (September 9-30) Sponsor Party Est. Cost Ads Barack Obama Dem $40,185,030 83,080 Mitt Romney Rep $19,234,000 36,406 American Crossroads Rep $9,464,430 14,154 Crossroads Grassroots Policy Strategies Rep $5,514,270 7,046 Priorities USA Action Dem $3,939,520 9,024 Americans for Job Security Rep $2,986,050 4,320 Restore Our Future, Inc. Rep $1,967,870 2,642 Americans for Prosperity Rep $1,397,370 721 Republican Jewish Coalition Rep $1,384,180 1,622 American Future Fund Rep $776,820 1,269 SEIU Cope Dem $573,830 479 Planned Parenthood Action Fund Dem $442,820 674 RNC Rep $287,830 726 RNC & Mitt Romney Rep $218,850 463 Ending Spending Fund Rep $189,460 57 Numbers include broadcast television and national cable advertising. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. Since the start of the general election campaign in April, when Romney effectively secured the Republican nomination, the biggest spender on presidential advertising, by far, has been the Obama campaign, which has invested an estimated $164 million into 363,000 ads (Table 3). The Romney campaign, by contrast, has spent only about a third of that total, $57 million, on 127,000 ads.

Table 3: Top Spenders in Ad Race (General Election Campaign) Sponsor Party Est. Cost Ads Obama, Barack Dem $163,763,350 363,010 Romney, Mitt Rep $57,272,390 126,748 Crossroads Grassroots Policy Strategies Rep $41,478,930 68,857 Americans For Prosperity Rep $35,936,070 43,088 Restore Our Future, Inc. Rep $33,945,950 41,159 American Crossroads Rep $17,859,310 28,474 Republican National Committee Rep $17,658,350 26,059 RNC & Mitt Romney Rep $15,962,220 23,861 DNC & Barack Obama Dem $15,309,000 7,210 Priorities USA Action Dem $14,592,420 31,707 Concerned Women For America Rep $4,400,360 3,132 American Future Fund Rep $3,775,150 3,929 Americans For Job Security Rep $2,986,050 4,320 Republican Jewish Coalition Rep $1,384,180 1,622 Planned Parenthood Action Fund Dem $1,369,800 1,751 Totals are from April 25 through September 30. Numbers include broadcast television and national cable advertising. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. Table 4 provides some historical context, comparing ad totals and costs for the September 9-30, 2012, period with the same period in 2008. Note that both the Democratic and Republican candidates this year are airing more ads and spending more on those ads than did their counterparts in 2008. Ad spending supporting the Democratic candidate is up 20 percent over 2008, while ad dollars supporting the Republican are up 93 percent over 2008 level. In both years, however, Obama had significant advantages, though the gap between Romney and Obama is smaller than that between McCain and Obama. Moreover, whereas McCain relied heavily on coordinated ads with the Republican Party, Romney has relied far more on outside groups. Spending by groups in support of the GOP nominee in 2012 is up over 3,000 percent from 2008.

Table 4: Ad Totals and Spending in 2008 and 2012 (September 9-30) Candidates 2008 Dems Ads aired Row % Cost 2008 GOP Ads aired Row % Cost 2012 Dems Ads aired Row % Cost % cost change from 2008 74,982 91.44% $35,030,818 14,839 30.01% $7,788,077 Parties 535 0.65% $98,564 924 1.87% $424,586 Coordinated 1,607 1.96% $495,313 32,407 65.54% $13,703,048 Groups 4,877 5.95% $1,840,263 1,279 2.59% $638,079 Total 82,001 $37,464,958 49,449 $22,553,790

83,080 88.96% $40,185,030 14.7%

0 0.00% $0 -

58 0.06% $7,260 -98.5%

10,251 10.98% $4,999,280 171.7%

93,389 $45,191,570 20.6%

2012 GOP Ads aired 36,406 726 463 31,957 69,552 Row % 52.34% 1.04% 0.67% 45.95% Cost $19,234,000 $287,830 $218,850 $23,809,600 $43,550,280 % cost change 147.0% -32.2% -98.4% 3631.5% 93.1% from 2008 Numbers include broadcast television and national cable advertising. Data from 2008 come from the Wisconsin Advertising Project. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. Indeed, Figure 1 shows that total ad volumes in the 2012 presidential general election have already greatly exceeded ad volumes to this point in 2004 and 2008. If advertising in the presidential race continues at its current pace, the number of presidential ads aired this year will eclipse 2004 and 2008 totals by the second week of October, said Travis Ridout, co-director of the Wesleyan Media Project. The sky is the limit here on what the final number will be by November 6th.

Figure 1. Volume of Presidential Advertising in 2004, 2008 and 2012

800,000 700,000 600,000 500,000 400,000 300,000 200,000 100,000 0 2004 2008 2012 10/1 to election 6/1 to 9/30

Numbers include broadcast television and national cable advertising. Data from 2004 and 2008 come from the Wisconsin Advertising Project. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. Most Negative Campaign Since 2000 By recent historical standards, the race for the presidency in 2012 has been an extremely negative one. Table 5 shows that in the past three weeks, only 7.8 percent of ads aired in the presidential race have been positivementioning solely the favored candidate. This compares to 30 percent positive in 2000 and 2008 and 19 percent positive in 2004. Fully 60 percent of ads over the past three weeks have been negativementioning solely the opposition candidate. The remaining 32 percent of ads have been contrast ads, those that mention both the favored candidate and the opposition candidate. Going back to June 1, the relative negativity of the 2012 presidential campaign is even starker. Just 14 percent of presidential ads so far this year have been positive, down from 54 percent in 2000, 35 percent in 2004 and 32 percent in 2008. Fully 62 percent of ads this year have been pure attacks. It will come as no surprise to those who have been bombarded with advertising in key markets, but 2012 is another record-setting year in terms of the amount of negativity were seeing in the presidential race, said Erika Franklin Fowler, co-director of the Wesleyan Media Project. The rise in negativity also means that there is a lot of substantive policy-based information on the air to help inform voters.

Table 5: Tone of Presidential Race (2000-2012) September 9-30 June 1-September 30 Contrast Positive Negative Contrast Positive Negative 47.3% 30.0% 22.7% 27.2% 54.4% 18.4% 50.4% 19.1% 30.5% 30.3% 35.3% 34.3% 14.7% 29.2% 56.2% 28.5% 31.7% 39.7% 29.5% 7.8% 62.8% 23.5% 13.6% 62.9%

2000 2004 2008 2012

Percentages are based on an analysis of broadcast television and national cable spots. Totals in 2012 are based on ongoing Wesleyan Media Project coding of Kantar Media/CMAG presidential ad airings. 2000, 2004 and 2008 totals are from the Wisconsin Advertising Project. Table 6 shows the partisan breakdown of tone for the September 9-30 period, comparing 2012 with previous election years. This year, pro-Obama spots are more likely to use pure attacks than pro-Romney spots, and pro-Romney spots are slightly more likely than pro-McCain ads were in 2008 to use pure attacks (and much more likely to use contrast spots than McCain). Table 6: Tone in Presidential Advertising by Favored Candidate (2000-2012) Promote Contrast Attack 2012 pro-Obama 2.5% 33.7% 63.8% pro-Romney 15.4% 23.3% 61.3% 2008 pro-Obama pro-McCain 2004 pro-Kerry pro-Bush 2000 pro-Gore pro-Bush 27.7% 31.6% 56.8% 43.1% 22.7% 70.5% 18.4% 8.5% 41.9% 17.3% 33.6% 12.5% 53.9% 59.9% 1.3% 39.6% 43.7% 17.0%

Percentages based on an analysis of broadcast television and national cable spots aired from Sept 9 - Sept 30 for each year. Totals in 2012 are based on ongoing Wesleyan Media Project coding of Kantar Media/CMAG presidential airings. 2000-2008 percentages are from the Wisconsin Advertising Project.

Parties Similarly Armed in Battle for Senate, House Ad spending during the past three weeks on races for the U.S. House and U.S. Senate is nearly even across the parties. Spending by or on behalf of Republican Senate candidates was $26.8 million, which edged out spending by or on behalf of Democratic Senate candidates at $25.5

million. Ad spending on behalf of Republican and Democratic candidates for the House was almost even, at $24 million for each side. Table 7: Ad Spending in House and Senate Races (September 9-30) Democratic Republican U.S. House $23,996,920 $24,075,790 U.S. Senate $25,473,550 $26,845,170 Numbers include broadcast television and national cable advertising. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. Looking at individual Senate races, the races in Ohio, Massachusetts and Virginia garnered the most ad spending over the past three weeks. Notably, the Republican candidates in Ohio, Connecticut, and Pennsylvania are benefiting from large advantages in ad spending, while Democratic candidates in Arizona and Missouri have benefited from considerably more ad spending. The last column shows the percentage of advertising in the race sponsored by outside groups. This is over 50 percent in Ohio and Virginia and over 40 percent in Florida, Nevada, Indiana and Wisconsin. The Warren-Brown pact in the Massachusetts Senate race was still holding as of the end of September; it was the second most expensive Senate race in the last three weeks but had no spending by outside groups. Table 8: Top Senate Races by Spending (September 9-30) Race Ohio Massachusetts Virginia Florida Nevada Connecticut Indiana Wisconsin Pennsylvania Arizona New Mexico Montana Missouri North Dakota Nebraska Total $ $6,006,570 $5,920,670 $4,996,680 $4,573,340 $4,142,620 $3,724,510 $3,716,230 $3,636,860 $3,049,390 $1,868,990 $1,813,060 $1,738,280 $1,599,730 $1,021,470 $933,450 Dem $ $2,588,710 $2,990,630 $2,496,410 $1,946,940 $1,997,510 $921,810 $1,573,450 $1,982,070 $823,480 $1,462,270 $840,490 $813,980 $1,370,550 $517,780 $546,300 Rep $ $3,417,860 $2,930,040 $2,500,270 $2,626,400 $2,145,110 $2,802,700 $2,142,780 $1,654,790 $2,225,910 $406,720 $972,570 $924,300 $229,180 $503,690 $387,150 % IG 53.2% 0.0% 52.3% 47.7% 45.4% 4.1% 44.0% 48.3% 0.0% 5.6% 12.1% 29.9% 6.0% 37.5% 24.4%

Numbers include broadcast television. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. Table 9 organizes the Senate races by the total number of ads aired (by candidates, parties and outside group sponsors) over the past three weeks. Montana is at the top of the list, with over 19,000 ads aired. The state is followed by Wisconsin, Ohio, Massachusetts and Indiana. Table 9: Top Senate Races by Ad Counts (September 9-30) Race Total ads Dem ads Rep ads Montana 19,047 8,362 10,685 Wisconsin 11,337 6,933 4,404 Ohio 10,059 4,669 5,390 Massachusetts 9,971 4,148 5,823 Indiana 9,159 3,719 5,440 Nevada 8,998 4,399 4,599 Virginia 7,409 3,873 3,536 Florida 6,907 3,889 3,018 North Dakota 5,859 3,090 2,769 Pennsylvania 5,076 1,583 3,493 New Mexico 3,902 1,970 1,932 Missouri 3,765 3,282 483 Connecticut 3,588 1,564 2,024 Arizona 3,569 2,781 788 Maine 3,338 192 2,360 Numbers include broadcast television. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. Top House races in terms of spending are shown in Table 10. The race to serve Ohios 16th congressional district, which features an incumbent versus incumbent matchup thanks to new district lines, tops the list with almost $2.2 million worth of spending in the past three weeks.

Table 10: Top House Races by Spending (September 9-30) Race Ads Spending Dem spending Rep spending Ohio 16 1,944 $2,199,590 $944,090 $1,255,500 Pennsylvania 12 2,645 $1,897,220 $931,190 $966,030 Colorado 7 2,389 $1,791,240 $1,035,500 $755,740 Arizona 1 2,381 $1,762,070 $1,100,520 $661,550 Minnesota 8 2,168 $1,752,800 $948,800 $804,000 California 52 3,145 $1,734,010 $875,500 $858,510 Massachusetts 6 1,091 $1,689,790 $663,340 $1,026,450 California 10 3,061 $1,593,690 $887,860 $705,830 Florida 18 2,585 $1,536,950 $696,350 $840,600 Utah 4 2,968 $1,424,430 $825,470 $598,960 Nevada 3 2,149 $1,382,370 $757,860 $624,510 Illinois 17 4,299 $1,255,930 $712,260 $543,670 Numbers include broadcast television. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project. Table 11 shows the top 20 outside groups involved in House and Senate races the past three weeks, along with the races in which they were involved. Crossroads GPS was the most heavily involved outside group, spending almost $6 million in 8 closely-contested Senate races. The House Majority PAC, U.S. Chamber of Commerce and AFSCME were also involved in multiple races.

10

Table 11: Spending and Ad Totals of Top 20 Outside Groups (September 9-30) Sponsor Crossroads GPS House Majority PAC Spending Ads $5,983,000 10,774 $3,087,030 4,365 Races VA, OH, ND, NV, MT, WI, NY, IN Sen CA10, WV03, OH16, WA01, FL18, CA07, AZ01, AZ09, IL17, IA04, NY27, VA02, NH02, OH06, CO07, UT04, MN08, NV03, WI, VA, HI, MT, OH, ME, ND, NM, FL Senate, CA10, CA07, CA09, CA52, CA24, IL10, IL13 MT, HI, WI, NV Senate, OH16, MN08, PA12, CA07, CO07 IL12, FL22, GA12, PA12, MA06, NC07 IN Sen, GA12, UT04 NY21, UT04, KY06, NY24, NV04, IA03 FL Sen MN08, CA10, IL13 TX23, OH16 IN, ND, MT, WI, VA Sen PA12, VA02, IA04, IL17, CA07, WI Sen IL08 OH Sen

U.S. Chamber Of Commerce

$2,921,480 5,158

AFSCME YG Action Fund Center Forward Center For Individual Freedom American Crossroads American Action Network Congressional Leadership Fund Majority PAC SEIU COPE

$2,323,860 3,569 $1,741,450 1,493 $1,511,230 2,692 $1,331,700 2,572 $1,295,830 $1,167,310 $1,106,340 $926,680 $712,110 1,268 948 902 1,347 1,066

Now Or Never PAC $675,620 334 NEA Fund For Children & Public $572,620 821 Education Club For Growth $503,710 782 IN Sen Patriot Majority USA $440,960 1,168 IA03, ND, NV Sen Freedom PAC $403,570 379 FL Sen Treasure Coast Jobs Coalition $367,320 483 FL18 Women Vote $315,880 702 HI, MO, WI Sen National Fed. Of Ind. Businesses $292,260 727 IA04, NY25 Numbers include broadcast television. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project.

11

Online Disclosure Misses Many Ads Recent FCC rules require that certain television stations in the 50 largest media markets in the United States make their public files, which detail ad spending by sponsor, available online. While such a requirement goes some way toward increasing transparency about who is paying for political advertising, it still misses a lot. Indeed, there are 160 media markets that are not covered by the disclosure requirement, which went into effect in early August. The Wesleyan Media Project looked to see what was not easily available online and found that there were 447,000 ads aired in the presidential, Senate and House races, at an estimated cost over $140.6 million that were not covered under the electronic disclosure requirements (Table 12). Table 12: Costs and Ad Volumes in Disclosure and NonDisclosure Media Markets Market Est. Cost Ads Not top 50 market 140,577,920 447,120 Top 50 market 297,454,560 357,857 Totals are from August 2 through September 30. Numbers include broadcast television and national cable advertising. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project.

Ads Focus on a Variety of Issues and Themes Since the Wesleyan Media Projects mid-September release, the focus of presidential advertising on both sides has shifted. Table 13 shows the top 15 issues in pro-Romney and pro-Obama ads. Nearly every pro-Romney spot (93 percent) has mentioned jobs, while just over one in three (37 percent) of pro-Obama ads mention the topic. Almost one out of every two (48 percent) proObama ads have mentioned taxes, while a similar percentage of pro-Romney spots mention health care (47 percent) and taxes (41 percent). China has dropped out of the top 15 issues on the Democratic side while the mention of China increased on the Republican side (from 4 percent in the general through 9/8 to 32 percent in the last three weeks). Similarly, pro-Obama spots have increased their focus on energy policy, previously not among the top 15 issues, while pro-Romney ads have decreased their focus on energy (from 8 to 2 percent).

12

Table 13: Top 15 Issues Mentioned by Political Party in Presidential Race (September 930) Pro-Obama Ads Pro-Romney Ads

Taxes 47.8% Jobs 93.3% Jobs 36.9% Health care 46.6% Education 21.4% Taxes 41.4% Econ disparity 18.0% Deficit 34.4% Health care 17.0% China 31.8% Trade 16.1% Business 30.1% Deficit 16.1% Govt Spending 27.7% Medicare 11.7% Trade 14.9% Energy Policy 10.8% Recession/Econ Stimulus 9.6% Recession/Econ Stimulus 9.4% Housing 2.6% Business 8.2% Poverty 2.6% Housing 6.4% Israel 2.5% Childcare 6.2% Energy Policy 2.3% Women's Health 5.8% Welfare 2.3% Abortion 5.6% Local Issues 2.1% Totals based on ongoing Wesleyan Media Project coding of Kantar Media/CMAG presidential ad airings. Not only is 2012 the most negative campaign in recent history, but it also has featured an overwhelming number of appeals to anger. Table 14 displays the top emotional appeals addressed in presidential advertising. Its clear there is a lot of anger out there this year, said Travis Ridout, co-director of the Wesleyan Media Project. Anger was the most common emotional appeal made in presidential advertising in the last three weeks, and that was true for Obama and Romney ads, said Ridout. Table 14: Emotional Appeals in Presidential Advertising (September 9-30) Pro-Obama ads Pro-Romney ads Anger 96.0% 68.6% Fear 34.9% 41.2% Enthusiasm 29.6% 25.1% Pride 3.9% 17.0% Sadness 32.9% 27.9% Totals based on ongoing Wesleyan Media Project coding of Kantar Media/CMAG presidential ad airings. Totals include any ads that coders assessed as making some or strong appeal to the emotion.

13

Sizable percentages of GOP-leaning interest group ads in the last three weeks have also discussed hope (17 percent) and change (15 percent), and Republican Party ads have all featured the word change (100 percent) while pro-Obama ads have notably avoided either term. Pro-Democratic interest groups describe Obama as hard working in nearly one out of every three of their ads (29 percent). Romneys own ads have tried to tap into empathy, conveying a sense that the candidate cares about average Americans in more than a quarter of all airings (28 percent). GOP-leaning interest groups have painted Obama as dishonest (19 percent of airings). And it is not just GOP presidential airings that are going after the president; more than a quarter (25.2 percent) of U.S. House and U.S. Senate advertising this year has featured Obama in a way to show disapproval or opposition.

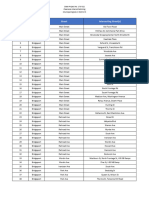

Table 15: Volume and Cost of Advertising in Battleground States (September 9-30)

Market Colorado Denver Colo. Springs Grand Junction Florida Tampa Orlando Ft. Myers W. Palm Beach Miami Jacksonville Tallahassee Gainesville Panama City Dothan Iowa Davenport Des Moines Cedar Rapids Sioux City Rochester, MN Omaha Ottumwa Quincy

Total 7,770 4,878 4,661 6,361 6,144 4,039 3,690 3,603 3,391 997 931 509 173 3,779 3,634 3,310 2,523 1,794 1,106 427 425

ProObama 4,791 2,600 2,677 3,749 3,833 2,411 2,191 1,907 1,388 748 692 457 140 2,275 2,186 1,923 1,659 1,222 619 357 335

ProRomney 2,979 2,278 1,984 2,612 2,311 1,628 1,499 1,696 2,003 249 239 52 33 1,504 1,448 1,387 864 572 487 70 90

Dem Adv. 1,812 322 693 1,137 1,522 783 692 211 (615) 499 453 405 107 771 738 536 795 650 132 287 245

Est Dem Cost (Ms) 3.26 0.55 0.18 2.81 2.53 0.62 1.06 1.61 0.38 0.15 0.12 0.06 0.04 0.91 0.56 0.44 0.34 0.22 0.28 0.04 0.04

Est Rep Cost (Ms) 2.55 0.56 0.17 2.61 2.44 0.58 0.93 1.88 0.74 0.07 0.09 0.01 0.03 0.73 0.57 0.43 0.22 0.09 0.26 0.01 0.01

% Contrast 36% 29% 20% 39% 37% 40% 42% 15% 21% 42% 28% 58% 44% 36% 40% 38% 36% 48% 21% 39% 24%

% Negative 58% 64% 70% 52% 56% 50% 52% 41% 67% 58% 53% 42% 56% 57% 54% 57% 59% 52% 71% 60% 74%

14

North Carolina Charlotte Raleigh Greensboro Greenville, NC Greenville, SC Wilmington New Hampshire Burlington Portland, ME Boston Manchester, NH Nevada Las Vegas Reno Ohio Cleveland Columbus, OH Cincinnati Toledo Dayton Youngstown Charleston, WV Lima Wheeling Zanesville Parkersburg Virginia Washington, DC Norfolk Richmond Roanoke Charlottesville Tri-Cities Wisconsin Milwaukee Madison Green Bay La Crosse Wausau

3,378 2,286 2,279 1,807 810 661 1,876 1,866 1,672 1,404 7,360 4,993

1,593 963 1,109 685 382 650 1,429 1,422 1,247 840 3,020 2,826

1,785 1,323 1,170 1,122 428 11 447 444 425 564 4,340 2,167

(192) (360) (61) (437) (46) 639 982 978 822 276 (1,320) 659

0.85 0.61 0.24 0.14 0.14 0.10 0.36 0.40 1.26 0.34 1.73 0.43

1.33 1.10 0.40 0.31 0.19 0.00 0.15 0.20 0.90 0.29 3.54 0.46

26% 10% 11% 12% 0% 0% 43% 42% 45% 26% 16% 28%

65% 81% 80% 77% 100% 100% 56% 55% 46% 61% 71% 60%

6,583 5,224 5,104 4,467 3,858 2,514 942 869 601 405 375 6,354 4,880 4,449 3,456 1,489 969 3,472 2,978 2,674 1,480 1,051

3,757 3,031 2,670 2,516 2,112 1,958 515 704 295 374 199 3,482 3,297 2,693 1,806 1,243 615 2,019 1,693 1,382 228 241

2,826 2,193 2,434 1,951 1,746 556 427 165 306 31 176 2,872 1,583 1,756 1,650 246 354 1,453 1,285 1,292 1,252 810

931 838 236 565 366 1,402 88 539 (11) 343 23 610 1,714 937 156 997 261 566 408 90 (1,024) (569)

2.93 1.82 1.18 0.76 0.70 0.53 0.15 0.07 0.06 0.08 0.06 4.50 1.06 0.76 0.45 0.17 0.17 0.94 0.57 0.29 0.06 0.04

2.68 1.55 1.48 0.57 0.79 0.19 0.12 0.02 0.05 0.01 0.04 5.27 0.82 0.84 0.55 0.06 0.10 0.99 0.51 0.35 0.44 0.20

26% 20% 28% 22% 27% 27% 41% 35% 49% 36% 42% 23% 21% 21% 42% 37% 38% 28% 29% 34% 32% 38%

67% 73% 64% 69% 66% 70% 41% 63% 31% 61% 43% 68% 75% 74% 53% 57% 53% 66% 65% 60% 57% 50%

Numbers include broadcast television. Tone percentages based on ongoing Wesleyan Media Project coding of Kantar Media/CMAG presidential ad airings. CITE SOURCE OF DATA AS: Kantar Media/CMAG with analysis by the Wesleyan Media Project.

15

About This Report Data reported here do not cover local cable buys, only broadcast television and national cable buys. All cost estimates are precisely that: estimates. Content information is based on ongoing Wesleyan Media Project coding of Kantar Media/CMAG video, which is 95.5 percent complete for presidential ads between 9/9 and 9/30/12 and 96.8 percent complete for the general election period from 4/25 through 9/30/12. Intercoder reliability checks on coding found 97 percent agreement between independent assessments of tone for a Kappa score of 0.89. The Wesleyan Media Project provides real-time tracking and analysis of all political television advertising in real-time. Housed in Wesleyans Quantitative Analysis Center part of the Allbritton Center for the Study of Public Life the Wesleyan Media Project is the successor to the Wisconsin Advertising Project, which disbanded in 2009. It is directed by Erika Franklin Fowler, assistant professor of government at Wesleyan University, Michael M. Franz, associate professor of government at Bowdoin College and Travis N. Ridout, associate professor of political science at Washington State University. The Wesleyan Media Project is supported by grants from The John S. and James L. Knight Foundation, the Rockefeller Brothers Fund, and Wesleyan University. Data provided by Kantar Media/CMAG with analysis by the Wesleyan Media Project using Academiclip, a web-based coding tool. Periodic releases of data will be posted on the projects website and dispersed via Twitter @wesmediaproject. To be added to our email update list, click here. For more information contact: Heather Tolley-Bauer at 860-685-2768, 860-918-1868 (cell) or htolleybauer at wesleyan.edu Lauren Rubenstein at 860-685-3813, 203-644-7144 (cell) or lrubenstein at wesleyan.edu Wesleyan University, in Middletown, Conn., is known for the excellence of its academic and co-curricular programs. More than 2,700 undergraduates and over 200 graduate students from around the world pursue their classroom studies, research projects, and co-curricular interests in ways that are demanding and intensely rewarding. The John S. and James L. Knight Foundation supports transformational ideas that promote quality journalism, advance media innovation, engage communities and foster the arts. We believe that democracy thrives when people and communities are informed and engaged. For more, visit www.knightfoundation.org. The Rockefeller Brothers Fund advances social change that contributes to a more just, sustainable, and peaceful world. The Funds grantmaking is organized in three thematic programs that support work in the United States and at the global level: Democratic Practice, Sustainable Development, and Peacebuilding; and in three pivotal place programs that address these themes in specific contexts: New York City, Southern China, and the Western Balkans. For more, visit www.rbf.org.

16

###

17

You might also like

- The Smith Generator BlueprintsDocument36 pagesThe Smith Generator BlueprintsZoran AleksicNo ratings yet

- Working Class Memo FINALDocument6 pagesWorking Class Memo FINALFox News100% (1)

- Be Jar Whistleblower DocumentsDocument292 pagesBe Jar Whistleblower DocumentsHelen BennettNo ratings yet

- Campaign Finance & American Democracy: What the Public Really Thinks and Why It MattersFrom EverandCampaign Finance & American Democracy: What the Public Really Thinks and Why It MattersNo ratings yet

- B.C. NDP Campaign Post-Mortem June 18 2013Document45 pagesB.C. NDP Campaign Post-Mortem June 18 2013The ProvinceNo ratings yet

- Brand Obama - How Barack Obama Revolutionized Political Campaign MDocument82 pagesBrand Obama - How Barack Obama Revolutionized Political Campaign MMiko Bayu AjiNo ratings yet

- Smith MemoDocument2 pagesSmith Memoapi-377396283No ratings yet

- Agency Profiles Yearbook 07Document107 pagesAgency Profiles Yearbook 07moresubscriptionsNo ratings yet

- Extrajudicial Settlement of Estate Rule 74, Section 1 ChecklistDocument8 pagesExtrajudicial Settlement of Estate Rule 74, Section 1 ChecklistMsyang Ann Corbo DiazNo ratings yet

- Done - NSTP 2 SyllabusDocument9 pagesDone - NSTP 2 SyllabusJoseph MazoNo ratings yet

- Hurley Employment Agreement - Final ExecutionDocument22 pagesHurley Employment Agreement - Final ExecutionHelen BennettNo ratings yet

- MoveOn in The 2012 ElectionDocument12 pagesMoveOn in The 2012 Electionmoveonorg100% (2)

- Business Case PresentationDocument27 pagesBusiness Case Presentationapi-253435256No ratings yet

- PEZZOLO Melissa Sentencing MemoDocument12 pagesPEZZOLO Melissa Sentencing MemoHelen BennettNo ratings yet

- Mass MarketingDocument21 pagesMass MarketingZahoor SoomroNo ratings yet

- ROI On Political MarketingDocument6 pagesROI On Political MarketingFarhan Zafar ShahNo ratings yet

- Kathy Davis - Dancing Tango - Passionate Encounters in A Globalizing World-New York University Press (2015)Document236 pagesKathy Davis - Dancing Tango - Passionate Encounters in A Globalizing World-New York University Press (2015)Csongor KicsiNo ratings yet

- The Persuasive Power of Campaign AdvertisingFrom EverandThe Persuasive Power of Campaign AdvertisingRating: 4.5 out of 5 stars4.5/5 (2)

- Finn Dixon Herling Report On CSPDocument16 pagesFinn Dixon Herling Report On CSPRich KirbyNo ratings yet

- Lewis Corporation Case 6-2 - Group 5Document8 pagesLewis Corporation Case 6-2 - Group 5Om Prakash100% (1)

- CT State of Thebirds 2023Document13 pagesCT State of Thebirds 2023Helen Bennett100% (1)

- UD150L-40E Ope M501-E053GDocument164 pagesUD150L-40E Ope M501-E053GMahmoud Mady100% (3)

- University of Connecticut Audit: 20230815 - FY2019,2020,2021Document50 pagesUniversity of Connecticut Audit: 20230815 - FY2019,2020,2021Helen BennettNo ratings yet

- Qad Quick StartDocument534 pagesQad Quick StartMahadev Subramani100% (1)

- The Shift Occurring in Paid MediaDocument11 pagesThe Shift Occurring in Paid MediaMichel André BreauNo ratings yet

- Campaigning in The Twenty-First Century: Dennis W. Johnson George Washington University Washington, D.CDocument19 pagesCampaigning in The Twenty-First Century: Dennis W. Johnson George Washington University Washington, D.CgpnasdemsulselNo ratings yet

- The Forum: Advertising Trends in 2010Document18 pagesThe Forum: Advertising Trends in 2010tmcnulty8452No ratings yet

- The Impact of Television Advertising on US Election OutcomesDocument49 pagesThe Impact of Television Advertising on US Election OutcomesaaronbstraussNo ratings yet

- Campaign RecommendationsDocument3 pagesCampaign Recommendationsapi-307054469No ratings yet

- Thorson 2019Document18 pagesThorson 2019bushNo ratings yet

- Super PacsDocument3 pagesSuper Pacsapi-98469116No ratings yet

- FD 6282013Document3 pagesFD 6282013Celeste KatzNo ratings yet

- Full Disclosure Newsletter: NYC Campaign Finance BoardDocument5 pagesFull Disclosure Newsletter: NYC Campaign Finance BoardCeleste KatzNo ratings yet

- Understanding The Effect of Political AdvertisingDocument8 pagesUnderstanding The Effect of Political AdvertisingAries FloresNo ratings yet

- Apg&P Unit II Ch. 8 Elections & Campaigns Reading QuestionsDocument4 pagesApg&P Unit II Ch. 8 Elections & Campaigns Reading QuestionsIan StantonNo ratings yet

- Ch. 10 - Elections and Campaigns (Class)Document16 pagesCh. 10 - Elections and Campaigns (Class)Mark DarketNo ratings yet

- Roman Larson Research Proposal Major Grant - How Political Advertisements Delegitimize The GovernmentDocument12 pagesRoman Larson Research Proposal Major Grant - How Political Advertisements Delegitimize The GovernmentRoman Michael Gregory LarsonNo ratings yet

- How Parties Used Segmentation in Election CampaignDocument14 pagesHow Parties Used Segmentation in Election CampaignMiko Bayu AjiNo ratings yet

- Does Advertising Impact Voter Turnout in Battleground StatesDocument21 pagesDoes Advertising Impact Voter Turnout in Battleground Statesnikola-avramov-8934No ratings yet

- Over-Promising and Under-Delivering Political Marketing Academic EssayDocument10 pagesOver-Promising and Under-Delivering Political Marketing Academic EssayFelix de JonghNo ratings yet

- TruthcampaignadDocument8 pagesTruthcampaignadapi-263932656No ratings yet

- Midterm Project Part 3 Campaign RecomendationsDocument3 pagesMidterm Project Part 3 Campaign Recomendationsapi-309984384No ratings yet

- How parties used segmentation in the 2005 UK general electionDocument14 pagesHow parties used segmentation in the 2005 UK general electionpardocamiloNo ratings yet

- TG and ObjectiveDocument1 pageTG and ObjectiveJenabai DaruwaliNo ratings yet

- Cpac Discussion Diffuse and Varied... : Mitt RomneyDocument2 pagesCpac Discussion Diffuse and Varied... : Mitt Romneyapi-176790058No ratings yet

- ProjectDocument4 pagesProjectapi-334944907No ratings yet

- Micro Tar GettingDocument41 pagesMicro Tar GettingEugenia MitchelsteinNo ratings yet

- COM-92-Campaign and MediaDocument27 pagesCOM-92-Campaign and MediaRosemarie InclanNo ratings yet

- Campaign Reccommendations Memorandum: Analysis of Campaign VideosDocument4 pagesCampaign Reccommendations Memorandum: Analysis of Campaign Videosapi-285727975No ratings yet

- Billion Dollar DemocracyDocument38 pagesBillion Dollar DemocracylikealionroaringNo ratings yet

- Campañas UsDocument12 pagesCampañas UsPAULA LEIVA SERRANONo ratings yet

- TECHNOLOGY'S IMPACT ON POLITICAL ADVERTISINGDocument8 pagesTECHNOLOGY'S IMPACT ON POLITICAL ADVERTISINGFarhanNo ratings yet

- Black Lives Matter:: Honors - Project - Pdf?sequence 1Document2 pagesBlack Lives Matter:: Honors - Project - Pdf?sequence 1AngelaNo ratings yet

- 2012 CRP CostOfElectionDocument7 pages2012 CRP CostOfElectionOpenSecrets.orgNo ratings yet

- Exit Report - Project Moon RakerDocument36 pagesExit Report - Project Moon RakerAbbey B. CanturiasNo ratings yet

- Corporate Financing and Media Coverage of Political CampaignsDocument4 pagesCorporate Financing and Media Coverage of Political CampaignsTaylor PinckneyNo ratings yet

- Winners and Losers in International Trade: The Effects On US Presidential VotingDocument35 pagesWinners and Losers in International Trade: The Effects On US Presidential VotingGuramiosNo ratings yet

- CCNY Housekeeping Report 2013Document39 pagesCCNY Housekeeping Report 2013jspectorNo ratings yet

- Trump Campaign Floods Web With Ads, Raking in Cash As Democrats Struggle ImageDocument7 pagesTrump Campaign Floods Web With Ads, Raking in Cash As Democrats Struggle ImageHans MeierNo ratings yet

- TargetSmart Factory Towns ReportDocument25 pagesTargetSmart Factory Towns ReportAmerican Family VoicesNo ratings yet

- Exposure To Political Advertising PDFDocument26 pagesExposure To Political Advertising PDFJane SampianoNo ratings yet

- Effectiveness of Negative Political AdvertisingDocument14 pagesEffectiveness of Negative Political AdvertisingRalu MicleaNo ratings yet

- Ama Final PosterDocument1 pageAma Final Posterapi-316722729No ratings yet

- The ROI of PR FinalDocument14 pagesThe ROI of PR FinalTed GriffithNo ratings yet

- Media Plan Okcupid 2Document10 pagesMedia Plan Okcupid 2api-529985336No ratings yet

- HKSBP 45Document62 pagesHKSBP 45haiNo ratings yet

- EDC 0124 Online Advertising 5 Jan14 NexttofinalediteddraftDocument12 pagesEDC 0124 Online Advertising 5 Jan14 NexttofinalediteddraftMiddle class GamerNo ratings yet

- Comparing Reception From TV CommercialsDocument23 pagesComparing Reception From TV CommercialsSupun GunarathneNo ratings yet

- Demographics in Swing States Colorado and OhioDocument3 pagesDemographics in Swing States Colorado and Ohioapi-294533467No ratings yet

- I. Presidential Versus Congressional Campaigns: Study OutlineDocument5 pagesI. Presidential Versus Congressional Campaigns: Study OutlineL.w. Constance KangNo ratings yet

- Aeron Davis - Living in 'Promotional Times'Document4 pagesAeron Davis - Living in 'Promotional Times'Christian Pillalaza PiguaveNo ratings yet

- Corporate PAC Campaign Contributions in PerspectiveDocument14 pagesCorporate PAC Campaign Contributions in PerspectiveSigmoun95No ratings yet

- M6 AssignmentDocument5 pagesM6 Assignmentjsuy1No ratings yet

- Gale Researcher Guide for: Presidential Elections in the United StatesFrom EverandGale Researcher Guide for: Presidential Elections in the United StatesNo ratings yet

- 17-12-03 RE04 21-09-17 EV Motion (4.16.2024 FILED)Document22 pages17-12-03 RE04 21-09-17 EV Motion (4.16.2024 FILED)Helen BennettNo ratings yet

- 75 Center Street Summary Suspension SignedDocument3 pages75 Center Street Summary Suspension SignedHelen BennettNo ratings yet

- West Hartford Proposed budget 2024-2025Document472 pagesWest Hartford Proposed budget 2024-2025Helen BennettNo ratings yet

- National Weather Service 01122024 - Am - PublicDocument17 pagesNational Weather Service 01122024 - Am - PublicHelen BennettNo ratings yet

- Hunting, Fishing, And Trapping Fees 2024-R-0042Document4 pagesHunting, Fishing, And Trapping Fees 2024-R-0042Helen BennettNo ratings yet

- TBL Ltr ReprimandDocument5 pagesTBL Ltr ReprimandHelen BennettNo ratings yet

- PURA 2023 Annual ReportDocument129 pagesPURA 2023 Annual ReportHelen BennettNo ratings yet

- Analysis of Impacts of Hospital Consolidation in Ct 032624Document41 pagesAnalysis of Impacts of Hospital Consolidation in Ct 032624Helen BennettNo ratings yet

- Pura Decision 230132re01-022124Document12 pagesPura Decision 230132re01-022124Helen BennettNo ratings yet

- 20240325143451Document2 pages20240325143451Helen BennettNo ratings yet

- South WindsorDocument24 pagesSouth WindsorHelen BennettNo ratings yet

- Commission Policy 205 RecruitmentHiringAdvancement Jan 9 2024Document4 pagesCommission Policy 205 RecruitmentHiringAdvancement Jan 9 2024Helen BennettNo ratings yet

- 2024 Budget 12.5.23Document1 page2024 Budget 12.5.23Helen BennettNo ratings yet

- Hartford CT Muni 110723Document2 pagesHartford CT Muni 110723Helen BennettNo ratings yet

- Crime in Connecticut Annual Report 2022Document109 pagesCrime in Connecticut Annual Report 2022Helen BennettNo ratings yet

- District 4 0174 0453 Project Locations FINALDocument6 pagesDistrict 4 0174 0453 Project Locations FINALHelen BennettNo ratings yet

- District 3 0173 0522 Project Locations FINALDocument17 pagesDistrict 3 0173 0522 Project Locations FINALHelen BennettNo ratings yet

- District 1 0171 0474 Project Locations FINALDocument7 pagesDistrict 1 0171 0474 Project Locations FINALHelen BennettNo ratings yet

- Final West Haven Tier IV Report To GovernorDocument75 pagesFinal West Haven Tier IV Report To GovernorHelen BennettNo ratings yet

- District 3 0173 0522 Project Locations FINALDocument17 pagesDistrict 3 0173 0522 Project Locations FINALHelen BennettNo ratings yet

- Voices For Children Report 2023 FinalDocument29 pagesVoices For Children Report 2023 FinalHelen BennettNo ratings yet

- District 1 0171 0474 Project Locations FINALDocument7 pagesDistrict 1 0171 0474 Project Locations FINALHelen BennettNo ratings yet

- PEZZOLO Melissa Govt Sentencing MemoDocument15 pagesPEZZOLO Melissa Govt Sentencing MemoHelen BennettNo ratings yet

- Equilibruim of Forces and How Three Forces Meet at A PointDocument32 pagesEquilibruim of Forces and How Three Forces Meet at A PointSherif Yehia Al MaraghyNo ratings yet

- ArDocument26 pagesArSegunda ManoNo ratings yet

- Rapport DharaviDocument23 pagesRapport DharaviUrbanistes du MondeNo ratings yet

- Ofper 1 Application For Seagoing AppointmentDocument4 pagesOfper 1 Application For Seagoing AppointmentNarayana ReddyNo ratings yet

- Public Private HEM Status AsOn2May2019 4 09pmDocument24 pagesPublic Private HEM Status AsOn2May2019 4 09pmVaibhav MahobiyaNo ratings yet

- SNC 2p1 Course Overview 2015Document2 pagesSNC 2p1 Course Overview 2015api-212901753No ratings yet

- Alignment of Railway Track Nptel PDFDocument18 pagesAlignment of Railway Track Nptel PDFAshutosh MauryaNo ratings yet

- Returnable Goods Register: STR/4/005 Issue 1 Page1Of1Document1 pageReturnable Goods Register: STR/4/005 Issue 1 Page1Of1Zohaib QasimNo ratings yet

- Hipotension 6Document16 pagesHipotension 6arturo castilloNo ratings yet

- IQ CommandDocument6 pagesIQ CommandkuoliusNo ratings yet

- Bala Graha AfflictionDocument2 pagesBala Graha AfflictionNeeraj VermaNo ratings yet

- United States Bankruptcy Court Southern District of New YorkDocument21 pagesUnited States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- SDS OU1060 IPeptideDocument6 pagesSDS OU1060 IPeptideSaowalak PhonseeNo ratings yet

- KPUPDocument38 pagesKPUPRoda ES Jimbert50% (2)

- Cover Letter PDFDocument1 pageCover Letter PDFAli EjazNo ratings yet

- I Will Be Here TABSDocument7 pagesI Will Be Here TABSEric JaoNo ratings yet

- British Universal Steel Columns and Beams PropertiesDocument6 pagesBritish Universal Steel Columns and Beams PropertiesjagvishaNo ratings yet

- Master SEODocument8 pagesMaster SEOOkane MochiNo ratings yet

- Dolni VestoniceDocument34 pagesDolni VestoniceOlha PodufalovaNo ratings yet

- LEARNING ACTIVITY Sheet Math 7 q3 M 1Document4 pagesLEARNING ACTIVITY Sheet Math 7 q3 M 1Mariel PastoleroNo ratings yet

- Gapped SentencesDocument8 pagesGapped SentencesKianujillaNo ratings yet