Professional Documents

Culture Documents

Form ITR2 2012-2013

Uploaded by

N.PalaniappanCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Form ITR2 2012-2013

Uploaded by

N.PalaniappanCopyright:

Available Formats

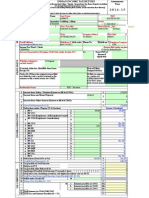

FORM

ITR-2

INDIAN INCOME TAX RETURN

[For Individuals and HUFs not having Income from Business or Profession]

(Please see Rule 12 of the Income-tax Rules,1962) (Also see attached instructions)

Assessment Year

2012 - 13

Part A-GEN

First name

GENERAL

Middle name Last name PAN

Flat/Door/Block No

PERSONAL INFORMATION

Name Of Premises/Building/Village Area/locality

Status (Tick) Individual HUF Date of Birth (DD/MM/YYYY)

( in case of individual)

Road/Street/Post Office

/

Town/City/District State Pin code Male Residential/Office Phone Number with STD code Mobile No.

/

Female

Sex (in case of individual) (Tick) Employer Category(if in employment) (Tick) Govt. PSU Income Tax Ward/Circle

Others

Email Address

FILING STATUS

Return filed (Tick)[Please see instruction number-7] Before due date -139(1) OR In response to notice 139(9) 142(1) If revised, then enter Receipt No and Date of filing original return (DD/MM/YYYY) Residential Status (Tick) Resident Non-Resident Whether this return is being filed by a representative assessee? (Tick) If yes, please furnish following information (a) (b) ( c) Name of the representative Address of the representative Permanent Account Number (PAN) of the representative

After due date -139(4) 148

Revised Return- 139(5) 153A/153C

/

Yes No

Resident but Not Ordinarily Resident

PART-B

Part B - TI Computation of total income 1 Salaries (6 of Schedule S)

2 Income from house property (3c of Schedule HP) (enter nil if loss) 3 Capital gains a Short term TOTAL INCOME i 1 2

Short-term (u/s 111A) (enter nil, if loss) (A5 of Schedule CG)

3ai 3aii 3aiii

ii Short-term (others) (enter nil if loss) (A6 of Schedule CG) iii Total short-term (3ai + 3aii) (A4 of Schedule CG) b

i Long-term with indexation (B 2e of Schedule CG) (enter nil if 3bi loss) ii Long-term without indexation (B 3e of Schedule CG) (enter 3bii nil if loss) 3biii iii Total Long-Term (3bi +3bii)

3c

c Total capital gains (3aiii + 3biii) (enter nil if 3c is a loss) 4 Income from other sources

a from sources other than from owning race horses and Winnings from Lottery (3 of Schedule OS) b from owning race horses (4c of Schedule OS) (enter nil if loss) c Total (a + b) (enter nil if 4c is a loss)

5 Total (1+2+3c +4c) Do not write or stamp in this area (Space for bar code)

4a 4b 4c 5 For Office Use Only Receipt No

Date Seal and Signature of receiving official

6 Losses of current year set off against 5 (total of 2vii and 3vii of Schedule CYLA) 7 Balance after set off current year losses (5-6) (also total of column 4 of Schedule CYLA) 8

6 7 8 9 10 11 12 13 14

Brought forward losses set off against 7 (2vii of Schedule BFLA)

9 Gross Total income (7-8)(also 3viii of Schedule BFLA) 10 Deductions under Chapter VI-A (o of Schedule VIA) 11 Total income (9-10) 12 Net agricultural income/ any other income for rate purpose (4 of Schedule EI) 13 Aggregate income (11+12) 14 Losses of current year to be carried forward (total of row xi of Schedule CFL)

Part B - TTI Computation of tax liability on total income 1 Tax payable on total income a Tax at normal rates b Tax at special rates (11 of Schedule SI) c Tax Payable on Total Income (1a + 1b)

COMPUTATION OF TAX LIABILITY 2 Education cess, including secondary and higher education cess on 1c 3 Gross tax liability (1c+ 2) 4 Tax relief a Section 89 b Section 90/90A ((column 7 of Schedule TR) c Section 91(column 7 of Schedule TR) d Total (4a + 4b+4c) 5 Net tax liability (3 4d) 6 Interest payable a For default in furnishing the return (section 234A) b For default in payment of advance tax (section 234B) c For deferment of advance tax (section 234C) d Total Interest Payable (6a+6b+6c) 7 Aggregate liability (5 + 6d) 8 Taxes Paid TAXES PAID a Advance Tax (from Schedule-IT) b TDS (total of column 5 of Schedule-TDS1 and column 7 8a 8b 8c 8d 9 10 6a 6b 6c 6d 7 4a 4b 4c 4d 5 1a 1b 1c 2 3

of Schedule-TDS2) c Self Assessment Tax(from Schedule-IT)

d Total Taxes Paid (8a+8b+8c) 9 Amount payable (Enter if 7 is greater than 8d, else enter 0) 10 Refund (If 8d is greater than 7)

REFUND

11 Enter your bank account number (mandatory in all cases) 12 Do you want your refund by

cheque, or

deposited directly into your bank account? (tick as applicable Type of Account (tick as applicable

)

13 Give additional details of your bank account

MICR Code 14

Savings Yes

Current No

Do you have,(i) any asset (including financial interest in any entity) located outside India or (ii) signing authority in any account located outside India? [applicable only in case of a resident] [Ensure Schedule FA is filled up if the answer is Yes ]

VERIFICATION

I, son/ daughter of holding permanent account number solemnly declare that to the best of my knowledge and belief, the information given in the return and schedules thereto is correct and complete and that the amount of total income and other particulars shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to Income-tax for the previous year relevant to the Assessment Year 2012-2013.

Place Date 14 If the return has been prepared by a Tax Return Preparer (TRP) give further details as below: Identification No. of TRP Name of TRP Sign here

Counter Signature of TRP 15

If TRP is entitled for any reimbursement from the Government, amount thereof

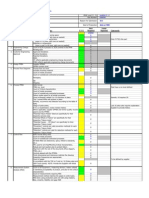

Schedule S Details of Income from Salary Name of Employer Address of employer

SALARIES

PAN of Employer (optional) Town/City State

1

Pin code

1 Salary (Excluding all exempt/ non-exempt allowances, perquisites & profit in lieu of salary as they are shown separately below) 2 Allowances exempt under section 10 (Not to be included in 6 below) 2 3 Allowances not exempt (refer Form 16 from employer) 4 Value of perquisites (refer Form 16 from employer) 5 Profits in lieu of salary (refer Form 16 from employer) 6 Income chargeable under the Head Salaries (1+3+4+5)

3 4 5 6

Schedule HP

1

Details of Income from House Property (Please refer to instructions) Town/ City State PIN Code

Address of property 1

Is the property co-owned?

Yes

No

(if YES please enter following details)

Your percentage of share in the property.

S.No i ii (Tick)

Name of Co-owner(s)

PAN of Co-owner (s) (optional )

Percentage Share in Property (optional)

if let out

Name of Tenant

PAN of Tenant (optional)

HOUSE PROPERTY

Annual letable value/ rent received or receivable (higher if let out for whole of the year, lower if let out for part of the year) 1b b The amount of rent which cannot be realized 1c c Tax paid to local authorities 1d d Total (1b + 1c) e Balance (1a 1d) 1f f 30% of 1e 1g g Interest payable on borrowed capital h Total (1f + 1g) i Income from house property 1 (1e 1h) Address of property 2 Town/ City State

a 2

1a

1e

1h 1i

PIN Code

Is the property co-owned?

Yes

No

(if YES please enter following details)

Your percentage of share in the property.

S.No Name of Co-owner(s) i ii (Tick)

PAN of Co-owner (s) (optional )

Percentage Share in Property (optional)

if let out

Name of Tenant

PAN of Tenant (optional)

Annual letable value/ rent received or receivable (higher if let out for whole of the year, lower if let out for part of the year) 2b b The amount of rent which cannot be realized 2c c Tax paid to local authorities 2d d Total (2b + 2c) e Balance (2a 2d) 2f f 30% of 2e 2g g Interest payable on borrowed capital h Total (2f + 2g) i Income from house property 2 (2e 2h) 3 Income under the head Income from house property a Rent of earlier years realized under section 25A/AA b Arrears of rent received during the year under section 25B after deducting 30% c Total (3a + 3b + 1i + 2i)

a

2a

2e

2h 2i 3a 3b 3c

NOTE

Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head

CAPITAL GAINS

Schedule CG Capital Gains A Short-term capital gain 1 From assets in case of non-resident to which first proviso to section 48 is applicable 2 From assets in the case of others a Full value of consideration 2a b Deductions under section 48 i Cost of acquisition bi ii Cost of Improvement bii iii Expenditure on transfer biii iv Total ( i + ii + iii) biv c Balance (2a biv) 2c d Loss, if any, to be ignored under section 94(7) or 2d 94(8) (enter positive values only) e Deduction under section 54B/54D 2e f Short-term capital gain (2c + 2d 2e) 3 Amount deemed to be short term capital gains under sections 54B/54D/54EC/ 54ED/54G/ 54GA 4 Total short term capital gain (1 + 2f + A3) 5 Short term capital gain under section 111A included in 4 6 Short term capital gain other than referred to in section 111A (A4 A5) B Long term capital gain 1 Asset in case of non-resident to which first proviso to section 48 is applicable 2 Asset in the case of others where proviso under section 112(1) is not exercised a Full value of consideration 2a b Deductions under section 48 i Cost of acquisition after indexation bi ii Cost of improvement after indexation bii iii Expenditure on transfer biii iv Total (bi + bii +biii) biv c Balance (2a biv) 2c d Deduction under sections 54/54B/54D/54EC/54F 2d 54G/54GA e Net balance (2c 2d) 3 Asset in the case of others where proviso under section 112(1) is exercised a Full value of consideration 3a b Deductions under section 48 bi i Cost of acquisition without indexation bii ii Cost of improvement without indexation biii iii Expenditure on transfer biv iv Total (bi + bii +biii) c Balance (3a biv) 3c d Deduction under sections 54/54B/54D/54EC/54F 3d e Net balance (3c-3d) 4 Amount deemed to be long term capital gains under sections 54/54B/54D/54EC/54ED/54F 5 Total long term capital gain 1 + 2e [(enter 2e as nil if loss) + 3e (enter 3e as nil if loss) + 4)]

C Income chargeable under the head CAPITAL GAINS (A4 + B5) (enter B5 as nil, if loss) D Information about accrual/receipt of capital gain

2f A3 A4 A5 A6 1

2e

3e B4 B5 C

Date

1 Long- term where proviso under section 112(1) is

Upto 15/9 (i)

16/9 to 15/12 (ii)

16/12 to 15/3 (iii)

16/3 to 31/3 (iv)

exercised (Without Indexation)Code in SI Schedule is 22, Tax Rate is 10% ; Enter only positive value from Item B3e of Schedule CG AFTER loss adjustment under this category in Schedule CYLA and BFLA, if any. 2 Long- term where proviso under section 112(1) is

NOT exercised (With Indexation)Code in SI Schedule is 21, Tax Rate is 20%; Enter only positive value from Item (B5-B3e) of Schedule CG AFTER loss adjustment under this category in Schedule CYLA and BFLA, if any. 3 Short-term under 111ACode in SI Schedule is 1A, Tax Rate is 15% ; Enter only positive value from Item A7 of Schedule CG AFTER loss adjustment under this category in Schedule CYLA and BFLA, if any.

NOTE

4 Short-term OTHERSTaxed at normal rates; Enter only positive value from Item A8 of Schedule CG AFTER loss adjustment under this category in Schedule CYLA and BFLA, if any. Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head

Schedule OS

Income from other sources

1a 1b 1c 1d 1e fi fii fiii 1g 2 3

OTHER SOURCES

1 Income a Dividends, Gross b Interest, Gross c Rental income from machinery, plants, buildings,

Others, Gross (excluding income from owning race d horses) e Total (1a + 1b + 1c + 1d) f Deductions under section 57:i Expenses / Deductions ii Depreciation iii Total g Balance (1e fiii) 2 Winnings from lotteries, crossword puzzles, races, etc.

3 Income from other sources (other than from owning race horses) (1g + 2) (enter1g as nil, if loss) 4 Income from owning and maintaining race horses a Receipts b Deductions under section 57 in relation to (4) c Balance (4a 4b)

4a 4b

4c 5

Income chargeable under the head Income from other sources (3 + 4c) (enter 4c as nil if loss 5 and take 4c loss figure to Schedule CFL)

NOTE

Please include the income of the specified persons referred to in Schedule SPI while computing the income under this head.

Schedule CYLA

Details of Income after Set off of current year losses

Income of current House property loss of the current year year set off (Fill this column only if income is zero or Total loss (3c of Schedule HP) positive) 1 2 Other sources loss (other than loss from race horses) of the current year set off Total loss (3 of Schedule-OS) 3 Current years Income remaining after set off

Sl.No Head/ Source of Income

CURRENT YEAR LOSS ADJUSTMENT

4=1-2-3

Loss to be adjusted i ii iii iv v Salaries House property Short-term capital gain Long term capital gain Other sources (excluding profit from owning race horses and winnings from lottery) Profit from owning and maintaining race horses Total loss set off

vi vii

viii Loss remaining after set-off out of 2 & 3

Schedule BFLA

BROUGHT FORWARD LOSS ADJUSTMENT

Details of Income after Set off of Brought Forward Losses of earlier years

Income after set off, if any, of current years losses as per 4 of Schedule CYLA 1 Brought forward loss set off 2 Current years income remaining after set off 3

Sl. No.

Head/ Source of Income

i ii

Salaries House property

iii Short-term capital gain iv Long-term capital gain Other sources (excluding profit from owning race horses and winnings from lottery) vi Profit from owning and maintaining race horses vii Total of brought forward loss set off v

viii Current years income remaining after set off Total (i3 + ii3 + iii3 + iv3 + v3+vi3)

Schedule CFL

i ii CARRY FORWARD OF LOSS 2004-05 2005-06

Details of Losses to be carried forward to future years

Assessment Year Date of Filing (DD/MM/YYYY) House property Short-term capital loss loss Long-term Capital loss Other sources loss (from owning race horses)

iii 2006-07 iv 2007-08 v 2008-09

vi 2009-10

vii 2010-11

viii 2011-12 ix Total of earlier year losses x xi Adjustment of above losses in Schedule BFLA 2012-13 (Current year losses)

xii Total loss Carried Forward to future years

Schedule VIA a 80C

TOTAL DEDUCTIONS

Deductions under Chapter VI-A (Section) h 80E i j k l m n 80G 80GG 80GGA 80GGC 80RRB 80U o

b c d e f g o

80CCC 80CCD 80CCF 80D 80DD 80DDB Total deductions (total of a to n)

Schedule 80G Details of donations entitled for deduction under section 80G A Donations entitled for 100% deduction without qualifying limit PAN of Donee Name and address of donee

i ii iii iv v vi Total DETAILS OF DONATIONS B

Amount of donation

Eligible Amount of donation

Donations entitled for 50% deduction without qualifying limit Name and address of donee

i ii iii iv v vi Total C Donations entitled for 100% deduction subject to

PAN of Donee

Amount of donation

Eligible Amount of donation

qualifying limit Name and address of donee

i ii iii iv

PAN of Donee

Amount of donation

Eligible Amount of donation

v vi Total D Donations entitled for 50% deduction subject to

qualifying limit Name and address of donee i ii iii iv v

E

PAN of Donee

Amount of donation

Eligible Amount of donation

vi Total Total donations (Avi + Bvi + Cvi + Dvi)

Schedule SPI

Sl No 1 2 3

Income of specified persons (spouse, minor child etc) includable in income of the assessee (income of the minor child to be included after Rs. 1,500 per child)

Name of person PAN of person (optional) Relationship Nature of Income Amount (Rs)

Schedule SI

SPECIAL RATE Sl No 1 2 3 4 5 11 Section code 1A 22 21 5BB

Income chargeable to Income tax at special rates [Please see instruction No.9(iii) for section code and rate of tax]

Special rate (%) 15 10 20 30 Income i Tax thereon ii Sl No 6 7 8 9 10 Total (1ii to 10 ii) Section code Special rate (%) Income i Tax thereon ii

Schedule EI Details of Exempt Income (Income not to be included in Total Income) 1 Interest income 2 Dividend income 3 Long-term capital gains from transactions on which Securities Transaction Tax is paid 4 Net Agriculture income /any other income for rate purpose 5 Others, including exempt income of minor children 6 Total (1+2+3+4+5)

1 2 3 4 5 6

EXEMPT INCOME

Schedule IT

Sl No (1) TAX PAYMENTS i ii iii iv v

Details of Advance Tax and Self Assessment Tax Payments of Income-tax

BSR Code (2) Date of Deposit (DD/MM/YYYY) (3) Serial Number of Challan (4) Amount (Rs) (5)

NOTE

Enter the totals of Advance tax and Self Assessment tax in Sl No. 8a & 8c of Part B-TTI

Schedule TDS1

TDS ON SALARY Sl No (1) i

Details of Tax Deducted at Source from Salary [As per Form 16 issued by Employer(s)]

Name of the Employer (3) Income chargeable under Salaries (4) Total tax deducted (5)

Tax Deduction Account Number (TAN) of the Employer (2)

ii

NOTE Please enter total of column 5 of Schedule-TDS1 and column 7 of Schedule-TDS2 in 8(b) of Part B-TTI

Schedule TDS2

Sl No TDS ON OTHER INCOME (1) i

Details of Tax Deducted at Source on Income [As per Form 16 A issued by Deductor(s)]

Name of the Deductor Unique TDS Certificate Number (4) Financial Year in which TDS is Deducted (5) Total Tax Deducted Amount out of (6) claimed this Year (7)

Tax Deduction Account Number (TAN) of the Deductor (2)

(3)

(6)

ii

NOTE Please enter total of column 5of Schedule-TDS1 and column 7 of Schedule-TDS2 in 8(b) of Part B-TTI

Schedule TR

DETAILS OF TAX RELIEF Sl No (1) i

Details of Tax Relief claimed under section 90 or section 90A or section 91

Country Code (3) Tax Identification number of the tax payer in respective country (4) Income (in rupees) (5) Tax Paid (in rupees) (6) Total Tax Relief Claimed (in rupees) (7)

Country Name (2)

ii

NOTE Please enter the details of column (7) of Schedule TR in 4b or 4c of Part B TTI

Schedule FA

Sl No (1) i

Details of Foreign Assets

Country Code (3) Name and Address of the Bank (4) Name mentioned in the account (5) Peak Balance During the Year (in rupees) (6)

A Details of Foreign Bank Accounts

Country Name (2)

ii

DETAILS OF FOREIGN ASSETS

B Details of Financial Interest in any Entity

Sl No (i) (ii) Country Name (1) Country Code (2) Nature of entity (3) Name and Address Total Investment (at cost) (in rupees) of the Entity (5) (4)

C Details of Immovable Property

Sl No (1) (i) (ii) Country Name (2) Country Code (3) Address of the Property (4) Total Investment (at cost) (in rupees) (5)

D Details of any other Asset

Sl No (1) (i) (ii) E Country Name (2) Country Code (3) Nature of Asset (4) Total Investment (at cost) (in rupees) (5)

Details of account(s) in which you have signing authority and which has not been included in A to D above.

Sl No (1) (i) (ii)

Name of the Institution in which the account is held (2)

Address of the Institution (3)

Name mentioned in the account (4)

Peak Balance/Investment during the year (in rupees) (5)

You might also like

- Itr 2Document9 pagesItr 2Arvind PaulNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument8 pagesITR-3 Indian Income Tax Return: Part A-GENRahul SharmaNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENmohitsharma1996No ratings yet

- Itr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearDocument7 pagesItr-2 Indian Income Tax Return: (For Individuals and Hufs Not Having Income From Business or Profession) Assessment YearVarun ChhabraNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENAvani GadaNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument7 pagesITR-3 Indian Income Tax Return: Part A-GENSudeha ShirkeNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument10 pagesITR-2 Indian Income Tax Return: Part A-GENNeeraj AgarwalNo ratings yet

- 2011 - ITR2 - r6Document33 pages2011 - ITR2 - r6Bathina Srinivasa RaoNo ratings yet

- ITR-3 Indian Income Tax Return: Part A-GENDocument12 pagesITR-3 Indian Income Tax Return: Part A-GENmehtakvijayNo ratings yet

- Indian Numbering SystemDocument8 pagesIndian Numbering SystemelangomduNo ratings yet

- ITR-2 Indian Income Tax Return: Part A-GENDocument12 pagesITR-2 Indian Income Tax Return: Part A-GENMankamesachinNo ratings yet

- Form2 2007 08Document8 pagesForm2 2007 08api-3850174No ratings yet

- Form3 2008 09Document9 pagesForm3 2008 09api-3850174No ratings yet

- Indian Income Tax Return Assessment Year SahajDocument7 pagesIndian Income Tax Return Assessment Year SahajSubrata BiswasNo ratings yet

- Form3 2007 08Document9 pagesForm3 2007 08api-3850174No ratings yet

- INDIAN INCOME TAX RETURN FOR SALARY AND HOUSE PROPERTY INCOMEDocument6 pagesINDIAN INCOME TAX RETURN FOR SALARY AND HOUSE PROPERTY INCOMEKuldeep HoodaNo ratings yet

- Form8 2007 08Document5 pagesForm8 2007 08api-3850174No ratings yet

- Assessment Year Indian Income Tax Return SahajDocument7 pagesAssessment Year Indian Income Tax Return SahajallipraNo ratings yet

- 2016 Itr4 PR3Document165 pages2016 Itr4 PR3TejasNo ratings yet

- Gross Total Income (1+2+3) 4: System CalculatedDocument8 pagesGross Total Income (1+2+3) 4: System CalculatedShunmuga ThangamNo ratings yet

- 2012 Itr1 Pr21Document5 pages2012 Itr1 Pr21MRLogan123No ratings yet

- SAHAJ ITR-1 FORM FOR INDIVIDUALS WITH INCOME FROM SALARY/PENSION, HOUSE PROPERTY, OTHER SOURCESDocument7 pagesSAHAJ ITR-1 FORM FOR INDIVIDUALS WITH INCOME FROM SALARY/PENSION, HOUSE PROPERTY, OTHER SOURCESrajshri58No ratings yet

- Assessment Year Sahaj Indian Income Tax ReturnDocument1 pageAssessment Year Sahaj Indian Income Tax ReturnAnit SharmaNo ratings yet

- Form2FandInstructions 06062006Document11 pagesForm2FandInstructions 06062006Mnaoj PatelNo ratings yet

- Form ITR-1Document3 pagesForm ITR-1Rajeev PuthuparambilNo ratings yet

- Form VAT-R2: (See Rule 16 (2) ) DdmmyyDocument4 pagesForm VAT-R2: (See Rule 16 (2) ) DdmmyyPRAHLAD_KUMAR8424No ratings yet

- File ITR-1 Form for Individuals with Income from Salary and InterestDocument6 pagesFile ITR-1 Form for Individuals with Income from Salary and InterestManjunath YvNo ratings yet

- Itr U EnglishDocument4 pagesItr U EnglishSHREYASNo ratings yet

- ITR Form 1Document7 pagesITR Form 1gj29hereNo ratings yet

- SAHAJ FORM INDIAN INCOME TAX RETURN FOR SALARY AND HOUSE PROPERTY INCOMEDocument3 pagesSAHAJ FORM INDIAN INCOME TAX RETURN FOR SALARY AND HOUSE PROPERTY INCOMESachin KumarNo ratings yet

- Form No 16Document5 pagesForm No 16Rabiul KhanNo ratings yet

- Form PDF 525102150231123Document10 pagesForm PDF 525102150231123premjyotisingh1990No ratings yet

- For Individuals and Hufs Not Carrying Out Business or Profession Under Any ProprietorshipDocument25 pagesFor Individuals and Hufs Not Carrying Out Business or Profession Under Any ProprietorshipSahil GuptaNo ratings yet

- Form 16Document2 pagesForm 16orkid2100No ratings yet

- Form 16Document3 pagesForm 16api-247505461No ratings yet

- File Return On TimeDocument7 pagesFile Return On TimeAmanat AhmedNo ratings yet

- Form PDF 588379620210723Document10 pagesForm PDF 588379620210723govindadv75No ratings yet

- Tax computation and deductionsDocument9 pagesTax computation and deductionsAkshay Kumar SahooNo ratings yet

- Form PDF 345858330310722Document10 pagesForm PDF 345858330310722narasimhahanNo ratings yet

- INDIVIDUAL INCOME TAX RETURN FORM ITR-1Document22 pagesINDIVIDUAL INCOME TAX RETURN FORM ITR-1rahul srivastavaNo ratings yet

- Form 16Document6 pagesForm 16Pulkit Gupta100% (1)

- Form PDF 170821030270722Document7 pagesForm PDF 170821030270722varalakshmi somaNo ratings yet

- Sugam: (Please See Instruction)Document10 pagesSugam: (Please See Instruction)MAHESHANAND NAUTIYALNo ratings yet

- 2011 Itr4 SpecificeDocument54 pages2011 Itr4 SpecificeAnand ThackerNo ratings yet

- Form 16, Tax Deduction at Source... Income Tax of IndiaDocument2 pagesForm 16, Tax Deduction at Source... Income Tax of IndiaDrAnilkesar GohilNo ratings yet

- ITR Form-1 (Sahaj)Document1 pageITR Form-1 (Sahaj)NDTVNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Dipannita DasNo ratings yet

- Goods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesFrom EverandGoods and Services Tax (GST) Filing Made Easy: Free Software Literacy SeriesNo ratings yet

- J.K. Lasser's Your Income Tax 2024, Professional EditionFrom EverandJ.K. Lasser's Your Income Tax 2024, Professional EditionNo ratings yet

- J.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnFrom EverandJ.K. Lasser's Your Income Tax 2024: For Preparing Your 2023 Tax ReturnNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- CPA Review Notes 2019 - FAR (Financial Accounting and Reporting)From EverandCPA Review Notes 2019 - FAR (Financial Accounting and Reporting)Rating: 3.5 out of 5 stars3.5/5 (17)

- Income Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawFrom EverandIncome Tax Law for Start-Up Businesses: An Overview of Business Entities and Income Tax LawRating: 3.5 out of 5 stars3.5/5 (4)

- Hindu Tamil CalanderDocument11 pagesHindu Tamil CalanderN.PalaniappanNo ratings yet

- Bank of Chettinad in Ceylon in 1929 Nagarathar PerumaiDocument2 pagesBank of Chettinad in Ceylon in 1929 Nagarathar PerumaiN.PalaniappanNo ratings yet

- Screw ThreadsDocument2 pagesScrew ThreadsN.PalaniappanNo ratings yet

- The Current State of Worldwide Standards of Ductile IronDocument8 pagesThe Current State of Worldwide Standards of Ductile IronN.PalaniappanNo ratings yet

- Co-Ordinates HolesDocument1 pageCo-Ordinates HolesN.PalaniappanNo ratings yet

- Explanation of Surface RoughnessDocument8 pagesExplanation of Surface RoughnessN.Palaniappan100% (6)

- Technical Information BoltDocument77 pagesTechnical Information BoltLivian TeddyNo ratings yet

- Select The Country Select The Corresponding Country, You Desire To Watch The TimeDocument2 pagesSelect The Country Select The Corresponding Country, You Desire To Watch The TimeN.PalaniappanNo ratings yet

- Pneumatics Symbols Din ISO 1219 PDFDocument4 pagesPneumatics Symbols Din ISO 1219 PDFN.Palaniappan100% (1)

- PPAP Explained: What is a PPAP and How to Complete OneDocument4 pagesPPAP Explained: What is a PPAP and How to Complete Oneb_bhoopathyNo ratings yet

- SQD-025 PPAP ChecklistDocument7 pagesSQD-025 PPAP ChecklistMadhan RajNo ratings yet

- Material Data BaseDocument22 pagesMaterial Data BaseN.PalaniappanNo ratings yet

- Parallel Groove ClampsDocument5 pagesParallel Groove ClampsN.PalaniappanNo ratings yet

- MOLYBDEUM in DUCTILE IRONDocument5 pagesMOLYBDEUM in DUCTILE IRONN.Palaniappan100% (1)

- GD&T Hierarachy PyramidDocument1 pageGD&T Hierarachy PyramidSunil BaliNo ratings yet

- GTEM Cells For EMC Measurement by NPLDocument53 pagesGTEM Cells For EMC Measurement by NPLN.PalaniappanNo ratings yet

- The Measurement of Surface Texture by NPL LabDocument97 pagesThe Measurement of Surface Texture by NPL LabN.Palaniappan100% (1)

- Posters of Hole Diameter For All Type of ThreadsDocument1 pagePosters of Hole Diameter For All Type of ThreadsN.PalaniappanNo ratings yet

- GTEM Cells For EMC Measurement by NPLDocument53 pagesGTEM Cells For EMC Measurement by NPLN.PalaniappanNo ratings yet

- mgpg11 - A Beginner's Guide To Uncertainty of Measurement by Stephanie BellDocument41 pagesmgpg11 - A Beginner's Guide To Uncertainty of Measurement by Stephanie Bellarylananyla100% (2)

- FITTING HANDBOOK by FORMATYRA INIEZIONE POLIMERIDocument56 pagesFITTING HANDBOOK by FORMATYRA INIEZIONE POLIMERIN.PalaniappanNo ratings yet

- Measurement of Mass and Weight by NPLDocument34 pagesMeasurement of Mass and Weight by NPLN.PalaniappanNo ratings yet

- PPAP ChecklistDocument2 pagesPPAP ChecklistN.Palaniappan50% (2)

- Magic SquareDocument9 pagesMagic SquareN.PalaniappanNo ratings yet

- Valve Material SpecificationDocument5 pagesValve Material Specificationapi-9572051No ratings yet

- Armacoil Catalog HelicoilDocument28 pagesArmacoil Catalog Helicoilmishnator666No ratings yet

- Data Chart For Threads by MARYLANDDocument71 pagesData Chart For Threads by MARYLANDN.Palaniappan100% (6)

- PIPED GAS - SafetyDocument2 pagesPIPED GAS - SafetyN.PalaniappanNo ratings yet

- PPAP Manual Supplier QualityDocument51 pagesPPAP Manual Supplier QualityGuru PrasadNo ratings yet

- PPAPDocument16 pagesPPAPOsvaldo Da Silva Neto100% (1)

- Collection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)Document2 pagesCollection Receipt Cum Adjustment Voucher: The New India Assurance Co. Ltd. (Government of India Undertaking)Mayank GandhiNo ratings yet

- Come Back Soon - . .: Doni Kurniawan, Doni KurniawanDocument1 pageCome Back Soon - . .: Doni Kurniawan, Doni Kurniawandkurnia9999No ratings yet

- City of Boise Idaho Checks 50Document31 pagesCity of Boise Idaho Checks 50Mark ReinhardtNo ratings yet

- ACCO 30033 Quiz 1 and 2: Government Accounting Concepts and ProblemsDocument8 pagesACCO 30033 Quiz 1 and 2: Government Accounting Concepts and ProblemsNicah AcojonNo ratings yet

- Malhotra Rajiv & Co Chartered Accountant: Turnover CertificateDocument3 pagesMalhotra Rajiv & Co Chartered Accountant: Turnover Certificateamit22505No ratings yet

- JP Ip 071715Document49 pagesJP Ip 071715theadvocate.comNo ratings yet

- Cir vs. PhilamlifeDocument2 pagesCir vs. PhilamlifeAnny YanongNo ratings yet

- Chase To Be Input - SanitizedDocument64 pagesChase To Be Input - SanitizedJay TagbuyawanNo ratings yet

- Ra 10963 RRD PDFDocument54 pagesRa 10963 RRD PDFMeAnn TumbagaNo ratings yet

- Interpretation of Statute - ResearchDocument7 pagesInterpretation of Statute - ResearchBlood MoneyNo ratings yet

- Mariposa Properties v. CIR, CTA Case No. 6402, Feb. 13, 2007Document23 pagesMariposa Properties v. CIR, CTA Case No. 6402, Feb. 13, 2007SGNo ratings yet

- Scorpio N (FBD)Document1 pageScorpio N (FBD)Rishabh MahajanNo ratings yet

- Income Tax PakistanDocument2 pagesIncome Tax PakistanMuhammad Ahmad Latif100% (1)

- COM 2021 823 1 EN ACT Part1 v11Document72 pagesCOM 2021 823 1 EN ACT Part1 v11claus_44No ratings yet

- Class AssignmentDocument3 pagesClass AssignmentZen JoaquinNo ratings yet

- What Is An ATM: Automated Teller MachineDocument6 pagesWhat Is An ATM: Automated Teller MachineTilahun GirmaNo ratings yet

- Donors TaxDocument3 pagesDonors TaxMaris Joy BartolomeNo ratings yet

- M PassbookDocument4 pagesM Passbookirfan shaikhNo ratings yet

- L-27, Set Off and Carry Forward of LossesDocument20 pagesL-27, Set Off and Carry Forward of LosseswhoreNo ratings yet

- Einvoice 1661931542084Document1 pageEinvoice 1661931542084Jessica MathisNo ratings yet

- Cases On Estate Tax 1Document5 pagesCases On Estate Tax 1Rikka Cassandra ReyesNo ratings yet

- Eur Maf 696,697,698 2023Document3 pagesEur Maf 696,697,698 2023sonia cutacaNo ratings yet

- VAT Return 2015 SAP LibraryDocument17 pagesVAT Return 2015 SAP LibraryTatyana KosarevaNo ratings yet

- Asaan Remittance Account - FAQsDocument3 pagesAsaan Remittance Account - FAQsqazi12No ratings yet

- Bhupendra Ratilal Mali Pay SlipsDocument3 pagesBhupendra Ratilal Mali Pay SlipsDevenNo ratings yet

- Course Registration Form: Phi Tech SolutionsDocument3 pagesCourse Registration Form: Phi Tech SolutionsAaniozNo ratings yet

- Taxation ProjectDocument15 pagesTaxation ProjectTanya SinglaNo ratings yet

- Details For Order #114-4339910-7829829: Not Yet ShippedDocument1 pageDetails For Order #114-4339910-7829829: Not Yet ShippedSumber PengetahuanNo ratings yet

- Affidavit of Exempt Sale StandardDocument2 pagesAffidavit of Exempt Sale StandardAnna AtienzaNo ratings yet

- Statement of HSBC Red Credit Card Account Red: Page 1 / 4Document4 pagesStatement of HSBC Red Credit Card Account Red: Page 1 / 4Anson LchNo ratings yet