Professional Documents

Culture Documents

Abstract

Uploaded by

mohammedakbar88Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abstract

Uploaded by

mohammedakbar88Copyright:

Available Formats

Abstract

Portfolio Management is used to select a portfolio of new product development projects to achieve the following goals: Maximize the profitability or value of the portfolio, Provide balance and Support the strategy of the enterprise. Portfolio Management is the responsibility of the senior management team of an organization or business unit. This team, which might be called the Product Committee, meets regularly to manage the product pipeline and make decisions about the product portfolio. Often, this is the same group that conducts the stage-gate reviews in the organization.

A logical starting point is to create a product strategy - markets, customers, products, strategy approach, competitive emphasis, etc. The second step is to understand the budget or resources available to balance the portfolio against. Third, each project must be assessed for profitability (rewards), investment requirements (resources), risks, and other appropriate factors.

The weighting of the goalsServices in the form of business services or IT-enabled (Web) Services have become a corporate asset of high interest in striving towards the agile organisation. However, while the design and management of a single service is widely studied and well understood, little is known about how a set of services can be managed. This gap motivated this paper, in which we explore the concept of Service Portfolio Management. In particular, we propose a Service Portfolio Management Framework that explicates service portfolio goals, tasks, governance issues, methods and enablers. The Service Portfolio Management Framework is based upon a thorough analysis and consolidation of existing, wellestablished portfolio management approaches. From an academic point of view, the Service Portfolio Management Framework can be positioned as an extension of portfolio management conceptualisations in the area of service management. Based on the framework, possible directions for future research are provided. From a practical point of view, the Service Portfolio Management Framework provides an organisation with a novel approach to managing its emerging service portfolios. Keywords Service, Serviceorientation, Service Portfolio Management, Business/IT alignment

ABSTRACT SOURCES AND APPLICATION OF FUNDS Finding funding sources is very difficult in these times, especially since banks are becoming tighter in their lending practices. Here are a few tips that will help you learn where you can go to get money for your business.

The first place everyone thinks of when searching for funding sources is the bank. Of course, your local bank may be willing to supply you with money flow, but it usually denies new business owners looking for a startup loan. This is because you have no business credit. Before you try going to a bank for money make sure you have good personal credit, business credit, and an excellent business plan.

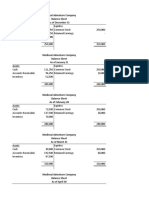

Many people also seek investors when starting their businesses. Many investors won't invest in a new business for the same reasons banks dont, they are just too risky. However, there are some specific types of companies that are highly sought after by investors. Sources and Uses of funds is a fund flow statement which explains the various sources from which funds have been raised and the uses these funds were put to. This statement is similar to a balance sheet since liabilities and assets are themselves sources and uses of funds respectively. The major difference however, between a Sources and Uses of funds statement and balance sheet is the former captures the movements in funds, while the latter merely presents a static picture of the sources and uses of funds.

On account of this property, the Sources and Uses of funds would enable one to analyze how the banks financed its fixed assets, discharged its liabilities, paid its dividends and taxes and so on. Thus in this report I have explained the theoretical concepts of sources and applications of funds along with the practicality of the subject in an organization.

You might also like

- OT Quizzer 6 Planning Answer KeyDocument7 pagesOT Quizzer 6 Planning Answer Keykat c58% (12)

- Samsung Culture SampleDocument25 pagesSamsung Culture Samplemohammedakbar8850% (2)

- 11-1 Medieval Adventures CompanyDocument8 pages11-1 Medieval Adventures CompanyWei DaiNo ratings yet

- MFS - JAIBB - Some Previous Year Qution & AnswerDocument31 pagesMFS - JAIBB - Some Previous Year Qution & AnswerAhsan Zaman43% (7)

- International Business Management AssignmentDocument1 pageInternational Business Management Assignmentmohammedakbar88No ratings yet

- Vaishak - AmulDocument22 pagesVaishak - AmulVaishak Nair75% (4)

- Shareholders EquityDocument2 pagesShareholders EquityAudrey LiberoNo ratings yet

- 05.C ArteaDocument4 pages05.C ArteaCahyo Ady NugrahaNo ratings yet

- City Bank W. Cap Mgt.Document16 pagesCity Bank W. Cap Mgt.Midul KhanNo ratings yet

- Mercantile Bank Working Capital ManagementDocument20 pagesMercantile Bank Working Capital ManagementMidul Khan100% (1)

- Business Finance Assignment..1Document10 pagesBusiness Finance Assignment..1Mohsin IqbalNo ratings yet

- Thesis Proposal Capital StructureDocument7 pagesThesis Proposal Capital Structuregloriayoungdesmoines100% (4)

- Financial Performance Analysis Thesis PDFDocument8 pagesFinancial Performance Analysis Thesis PDFCassie Romero100% (2)

- Thesis On Free Cash FlowDocument6 pagesThesis On Free Cash Flowjessicafinsonmanchester100% (2)

- Thesis On Working Capital ManagementDocument6 pagesThesis On Working Capital Managementgingermartinerie100% (2)

- Corporate Finance - Lesson 1 (A)Document5 pagesCorporate Finance - Lesson 1 (A)Ajay AjayNo ratings yet

- Research Paper of Financial ManagementDocument5 pagesResearch Paper of Financial Managementqyptsxvkg100% (1)

- New EditedDocument49 pagesNew EditedcityNo ratings yet

- Financial Aspects IntroductionDocument5 pagesFinancial Aspects IntroductionSef Getizo Cado67% (3)

- Term Paper Topics For Financial ManagementDocument5 pagesTerm Paper Topics For Financial Managementc5r0qjcf100% (1)

- Title: Lending and Investing Framework and Its Relevance To A Corporate EntityDocument3 pagesTitle: Lending and Investing Framework and Its Relevance To A Corporate Entitykalaimani25No ratings yet

- Thesis Financial Statement AnalysisDocument5 pagesThesis Financial Statement Analysisheatheredwardsmobile100% (1)

- Sme Finance: Best-Practice GuidelineDocument16 pagesSme Finance: Best-Practice GuidelinesgdfgfdfNo ratings yet

- Sample Thesis On Working Capital ManagementDocument8 pagesSample Thesis On Working Capital ManagementWhoCanWriteMyPaperForMeSingapore100% (2)

- Literature Review On Financial Statement Analysis of BanksDocument8 pagesLiterature Review On Financial Statement Analysis of Banksc5nc3whzNo ratings yet

- How To Write Business Plan ChapterDocument24 pagesHow To Write Business Plan ChapterZANo ratings yet

- Cash Flow Research PaperDocument7 pagesCash Flow Research Papervvjrpsbnd100% (1)

- Project Report For Bank Loan - Format: o o o o o o o o o o o oDocument6 pagesProject Report For Bank Loan - Format: o o o o o o o o o o o omayurraimule1985No ratings yet

- Portfolio Management Services Literature ReviewDocument8 pagesPortfolio Management Services Literature Reviewea3f29j7No ratings yet

- Literature Review On Analysis of Financial StatementsDocument4 pagesLiterature Review On Analysis of Financial Statementsea98skahNo ratings yet

- Dissertation Working Capital ManagementDocument8 pagesDissertation Working Capital ManagementPayToWriteMyPaperHuntsville100% (1)

- Financial Management Research PapersDocument4 pagesFinancial Management Research Papersefgncpe8100% (1)

- Cash Management Literature ReviewDocument6 pagesCash Management Literature Reviewea89aa3z100% (1)

- Cash Flow Analysis Research PaperDocument5 pagesCash Flow Analysis Research Paperyscgudvnd100% (1)

- Mangerial Finance FinalDocument17 pagesMangerial Finance FinalSakshi SharmaNo ratings yet

- Research Paper in Finance ManagementDocument8 pagesResearch Paper in Finance Managementggsmsyqif100% (1)

- New Venture Financing Lecture Note (Ch-2)Document30 pagesNew Venture Financing Lecture Note (Ch-2)BeamlakNo ratings yet

- Financial Reporting Thesis PDFDocument6 pagesFinancial Reporting Thesis PDFUK100% (2)

- Term Paper On Cash Flow StatementDocument4 pagesTerm Paper On Cash Flow Statementfuhukuheseg2100% (1)

- What Is A Business Plan ?Document2 pagesWhat Is A Business Plan ?Wendy AntonioNo ratings yet

- Name: Gohar Afshan Id: 10841 Course: Financial ManagementDocument6 pagesName: Gohar Afshan Id: 10841 Course: Financial ManagementGohar AfshanNo ratings yet

- Preparing For Corporate Finance InterviewsDocument14 pagesPreparing For Corporate Finance InterviewsNabeel QureshiNo ratings yet

- Cash Management Technioques - H.O. AraghoDocument11 pagesCash Management Technioques - H.O. AraghoKABIRADONo ratings yet

- Literature Review of Financial Statement Analysis PaperDocument6 pagesLiterature Review of Financial Statement Analysis Paperc5qj4swhNo ratings yet

- Assign 1Document6 pagesAssign 1RAMESH K (DC2152305010024)No ratings yet

- Vce ST 1Document25 pagesVce ST 1bhumika adlakNo ratings yet

- Finance Coursework ExampleDocument8 pagesFinance Coursework Examplegbfcseajd100% (2)

- FM - Assignment 1 (Part 2)Document4 pagesFM - Assignment 1 (Part 2)Layla AfidatiNo ratings yet

- Articile Write UpDocument7 pagesArticile Write UpKeehara ParkNo ratings yet

- Isl Engineerng College: Master of Business AdministrationDocument17 pagesIsl Engineerng College: Master of Business Administrationammukhan khanNo ratings yet

- Project Report1Document136 pagesProject Report1Anonymous NNTKn2No ratings yet

- Smart Task 3 OF Project Finance by (Vardhan Consulting Engineers)Document7 pagesSmart Task 3 OF Project Finance by (Vardhan Consulting Engineers)devesh bhattNo ratings yet

- Cash Flow StatementDocument103 pagesCash Flow StatementMBA BoysNo ratings yet

- PWC Business Plan WritingDocument67 pagesPWC Business Plan WritingZsolt OláhNo ratings yet

- Investment Management Thesis TopicsDocument5 pagesInvestment Management Thesis Topicsshannonjoyarvada100% (2)

- Corporate Finance Coursework ExampleDocument4 pagesCorporate Finance Coursework Examplevyp0wosyb1m3100% (2)

- Thesis On Cash Flow ManagementDocument6 pagesThesis On Cash Flow Managementpamelacalusonewark100% (2)

- A Study On Cash Mangement at Dabur India PVT LTDDocument25 pagesA Study On Cash Mangement at Dabur India PVT LTDSanthu SaravananNo ratings yet

- Working Capital MGMTDocument23 pagesWorking Capital MGMTvidushigargeNo ratings yet

- Literature Review On Capital Budgeting PDFDocument7 pagesLiterature Review On Capital Budgeting PDFc5g10bt2100% (1)

- Hema Project Cash FlowDocument6 pagesHema Project Cash Flowkannan VenkatNo ratings yet

- Portfolio Assignment-01-BUS-5110 Manegerial AccountingDocument5 pagesPortfolio Assignment-01-BUS-5110 Manegerial AccountingRasel SakilNo ratings yet

- Capital Catalyst: The Essential Guide to Raising Funds for Your BusinessFrom EverandCapital Catalyst: The Essential Guide to Raising Funds for Your BusinessNo ratings yet

- Protect Your Assets: Strategically Oriented, Metrics-Centered Credit ManagementFrom EverandProtect Your Assets: Strategically Oriented, Metrics-Centered Credit ManagementNo ratings yet

- Starbucks Capabilities and CompetenciesDocument2 pagesStarbucks Capabilities and Competenciesmohammedakbar880% (1)

- Triumphant Education For Accounts and Management - Team EducationDocument4 pagesTriumphant Education For Accounts and Management - Team Educationmohammedakbar88No ratings yet

- 2 Hsc/Iti/Diploma 3 2 Hsc/Iti/Diploma 3 4 Hsc/Iti/Diploma 2Document1 page2 Hsc/Iti/Diploma 3 2 Hsc/Iti/Diploma 3 4 Hsc/Iti/Diploma 2mohammedakbar88No ratings yet

- Dance Teacher ResumeDocument2 pagesDance Teacher Resumemohammedakbar88100% (1)

- Meck InfoDocument3 pagesMeck Infomohammedakbar88No ratings yet

- Fin RefDocument1 pageFin Refmohammedakbar88No ratings yet

- Financial AnalysisDocument4 pagesFinancial Analysismohammedakbar88No ratings yet

- Insurance Company Customer RetentionDocument15 pagesInsurance Company Customer Retentionmohammedakbar88No ratings yet

- Dissertation Topic Selection FormDocument2 pagesDissertation Topic Selection Formmohammedakbar88No ratings yet

- Tender Document SampleDocument19 pagesTender Document Samplemohammedakbar88No ratings yet

- Uk Unemployment by Bell BlanchflowerDocument23 pagesUk Unemployment by Bell BlanchflowerSharjeel FarooqNo ratings yet

- Excel 2014 CalendarDocument5 pagesExcel 2014 Calendarmohammedakbar88No ratings yet

- Lecture - 8 (Tender Process)Document28 pagesLecture - 8 (Tender Process)mohammedakbar88No ratings yet

- Heinz 2012 Annual ReportDocument104 pagesHeinz 2012 Annual Reportmohammedakbar88No ratings yet

- Negative Impacts of International TourismDocument2 pagesNegative Impacts of International Tourismmohammedakbar88No ratings yet

- Clostridium Difficile in EuropeDocument11 pagesClostridium Difficile in Europemohammedakbar88No ratings yet

- ISM Seminar Questions: Topics Exam Question(s) NoDocument2 pagesISM Seminar Questions: Topics Exam Question(s) Nomohammedakbar88No ratings yet

- It 1Document3 pagesIt 1mohammedakbar88No ratings yet

- It 2Document3 pagesIt 2mohammedakbar88No ratings yet

- Chap 005Document58 pagesChap 005tamannaminiNo ratings yet

- New File On Investment in SrilankaDocument4 pagesNew File On Investment in Srilankamohammedakbar88No ratings yet

- Analysisofunileverfinancialreports1 130617045408 Phpapp01Document15 pagesAnalysisofunileverfinancialreports1 130617045408 Phpapp01mohammedakbar88No ratings yet

- MBA SemesterDocument21 pagesMBA Semestermohammedakbar88No ratings yet

- ManagementDocument4 pagesManagementmohammedakbar88No ratings yet

- Instructions To Candidates Answer THREE (3) Questions Only. All Questions Carry 25 Marks Each. Draw Diagrams Where AppropriateDocument2 pagesInstructions To Candidates Answer THREE (3) Questions Only. All Questions Carry 25 Marks Each. Draw Diagrams Where Appropriateahi52001No ratings yet

- References Strategic ManagementDocument2 pagesReferences Strategic Managementmohammedakbar88No ratings yet

- To Use The Demised Premises For The Running of The Business ofDocument2 pagesTo Use The Demised Premises For The Running of The Business ofmohammedakbar88No ratings yet

- Glass CeilingDocument11 pagesGlass Ceilingmohammedakbar88No ratings yet

- Operations and Warehouse ManagementDocument3 pagesOperations and Warehouse ManagementJaiprakash RajpurohitNo ratings yet

- Analysis of Product OptionsDocument3 pagesAnalysis of Product OptionsSayak MondalNo ratings yet

- 12.2 L15 Exchange Rates Systems Gerber F14Document19 pages12.2 L15 Exchange Rates Systems Gerber F14Valerie PriadkinaNo ratings yet

- Basic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)Document22 pagesBasic Financial Accounting and Reporting (Bfar) : Philippine Based (Summary and Class Notes)LiaNo ratings yet

- PENgarap-FS RedjDocument43 pagesPENgarap-FS RedjAndrea AtonducanNo ratings yet

- ECON 1050 Midterm 2 2013WDocument20 pagesECON 1050 Midterm 2 2013WexamkillerNo ratings yet

- Achievement Test QuestionsDocument3 pagesAchievement Test QuestionsglamfactorsalonspaNo ratings yet

- FisherDocument13 pagesFisherrainbabe50% (2)

- Social Marketing Seeks To Develop and Integrate Marketing Concepts With Other Approaches To InfluenceDocument2 pagesSocial Marketing Seeks To Develop and Integrate Marketing Concepts With Other Approaches To InfluenceMitrofan AnaNo ratings yet

- Tactical Decision MakingDocument41 pagesTactical Decision Makingvania_sabrinaNo ratings yet

- Delos Santos - John Marquin - Prefinal-Ia3Document18 pagesDelos Santos - John Marquin - Prefinal-Ia3Delos Santos, John Marquin S.No ratings yet

- So Now Lets Have A Look at The Marketing Mix of FabindiaDocument6 pagesSo Now Lets Have A Look at The Marketing Mix of FabindiaMohit3107No ratings yet

- CRC Ace Mas First PBDocument10 pagesCRC Ace Mas First PBJohn Philip Castro100% (2)

- Fixed Asset Process Control QuestionnaireDocument2 pagesFixed Asset Process Control QuestionnaireSwathi Dutta50% (2)

- Canada GooseDocument7 pagesCanada GooseMohammed Omer Elgindi100% (1)

- Assignment Number 4Document8 pagesAssignment Number 4AsadNo ratings yet

- ACTS Business PlanDocument15 pagesACTS Business PlanZsoltNo ratings yet

- Retail Clothing Store ProjectDocument20 pagesRetail Clothing Store ProjectAbdul RehmanNo ratings yet

- Vouching and VerificationDocument10 pagesVouching and VerificationSaloni AgarwalNo ratings yet

- IBM Case Study Solution PDFDocument14 pagesIBM Case Study Solution PDFmdjfldmNo ratings yet

- Supply Chain of ArrowDocument26 pagesSupply Chain of ArrowNamanJainNo ratings yet

- Syllabus of Introduction of Commerce For Economic & Finance PDFDocument7 pagesSyllabus of Introduction of Commerce For Economic & Finance PDFNaveed Whatsapp StatusNo ratings yet

- NLKTDocument25 pagesNLKTBá Thiên Kim NguyễnNo ratings yet

- Assessment E - Bistro Reports - V2-2Document3 pagesAssessment E - Bistro Reports - V2-2Yongjun MaNo ratings yet

- Cost Accounting Individual Assignmnet ECSUDocument5 pagesCost Accounting Individual Assignmnet ECSUGETAHUN ASSEFA ALEMUNo ratings yet