Professional Documents

Culture Documents

Motion For Summary Judgement Memo KMPG

Uploaded by

ny1davidOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Motion For Summary Judgement Memo KMPG

Uploaded by

ny1davidCopyright:

Available Formats

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 1 of 48

UNITED STATES DISTRICT COURT DISTRICT OF COLUMBIA

In re Federal National Mortgage Association Securities, Derivative, and ERISA Litigation

MDL No. 1668

In re Fannie Mae Securities Litigation

Consolidated Civil Action No. 1:04-cv-01639 Judge Richard J. Leon

MEMORANDUM OF LAW IN SUPPORT OF DEFENDANTS JOINT MOTION FOR SUMMARY JUDGMENT FOR FAILURE TO PROVE LOSS CAUSATION

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 2 of 48

TABLE OF CONTENTS I. II. INTRODUCTION ............................................................................................................. 1 STATEMENT OF UNDISPUTED MATERIAL FACTS ................................................ 3 A. B. III. JARRELLS OPINIONS FOR THE PERIOD APRIL 17, 2001 THROUGH SEPTEMBER 30, 2004..................................................................... 4 JARRELLS OPINIONS FOR THE PERIOD OCTOBER 1, 2004 THROUGH DECEMBER 23, 2004 ...................................................................... 6 SUMMARY JUDGMENT .................................................................................... 8 LOSS CAUSATION IN SECURITIES FRAUD CASES..................................... 9 PLAINTIFFS CANNOT ESTABLISH THAT THE ALLEGED MISSTATEMENTS OR OMISSIONS CONCERNING FANNIE MAES ACCOUNTING PRACTICES INFLATED FANNIE MAES STOCK PRICE .................................................................................................................. 12 1. 2. Plaintiffs concede that Fannie Maes financial statements and earnings announcements did not inflate Fannie Maes stock price ......... 12 Even where he specifically identifies Inflationary Days, Professor Jarrell Fails to Prove that Any Allegedly Fraudulent Statements Created Inflation on June 16, 2003 and July 30, 2003............................. 14 a. b. B. June 16, 2003 ............................................................................... 15 July 30, 2003................................................................................ 17

LEGAL STANDARDS ..................................................................................................... 8 A. B.

IV.

ARGUMENT................................................................................................................... 12 A.

PLAINTIFFS FAILED TO PROVE THAT THE ECONOMIC LOSS THEY SUFFERED WHEN THE STOCK PRICE DECLINED IN SEPTEMBER 2004 WAS CAUSED BY THE REVELATION OF THE ALLEGED FRAUD............................................................................................. 18 1. Professor Jarrell fails to disentangle declines caused by noncorrective disclosures due to his erroneous application of a selfdefined foreseeable consequences standard ......................................... 20 a. b. The decline in Fannie Maes stock price was drenched in politics and influenced by other non-corrective disclosures ...... 20 Plaintiffs cannot recover for declines caused by the political developments or the other company-specific events simply by calling them direct and foreseeable consequences of a fraud ............................................................................................. 24 Plaintiffs new theory demands damages unavailable in a private securities action................................................................ 30

c.

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 3 of 48

TABLE OF CONTENTS (continued) 2. 3. C. Professor Jarrell fails to disentangle declines caused by allegations concerning events prior to the beginning of the class period................... 32 Professor Jarrell fails to disentangle declines caused by allegations that proved untrue .................................................................................... 33

PLAINTIFFS ALSO FAIL TO PROVE THAT ANY ALLEGEDLY FRAUDULENT STATEMENTS IN OCTOBER 2004 CAUSED PLAINTIFFS LOSSES IN DECEMBER 2004.................................................. 34 1. 2. Professor Jarrell fails to show new inflation was created by statements made on October 6 and 7, 2004 ............................................. 34 Professor Jarrell fails to show that the stock price declines on December 16 and 23, 2004, were causally connected to the alleged inflation in October 2004 ......................................................................... 36

V.

CONCLUSION................................................................................................................ 40

ii

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 4 of 48

TABLE OF AUTHORITIES Page(s) CASES Anderson v. Liberty Lobby, Inc., 477 U.S. 242 (1986).................................................................................................................8, 9 Bender v. Jordan, 570 F. Supp. 2d 37 (D.D.C. 2008)...........................................................................................8, 9 Celotex Corp. v. Catrett, 477 U.S. 317 (1986).....................................................................................................................9 Cheeks v. Fort Myer Constr. Co., 722 F. Supp. 2d 93 (D.D.C. 2010).............................................................................................31 Cowin v. Bresler, 741 F.2d 410 (D.C. Cir. 1984)...................................................................................................31 Diamond v. Atwood, 43 F.3d 1538 (D.C. Cir. 1995).....................................................................................................8 * Dura Pharmaceuticals, Inc. v. Broudo, 544 U.S. 336 (2005)........................................................................................................... passim Erica P. John Fund, Inc v. Halliburton, Co., 131 S. Ct. 2179 (2011).........................................................................................................10, 18 Fener v. Operating Engrs Constr. Indus. & Miscellaneous Pension Fund, 579 F.3d 401 (5th Cir. 2009) .....................................................................................................19 Green v. Occidental Petroleum Corp., 541 F.2d 1335 (9th Cir. 1976) ..................................................................................................10 Greene v. Dalton, 164 F.3d 671 (D.C. Cir. 1999).....................................................................................................9 Harpole Architects, P.C. v. Barlow, 668 F. Supp. 2d 68 (D.D.C. 2009).............................................................................................31 In re Avista Corp. Sec. Litig., 415 F. Supp. 2d 1214 (E.D. Wash. 2005)..................................................................................28 In re BankAtlantic Bancorp. Inc. Sec. Litig., No. 07-61542-CIV, 2011 WL 1585605 (S.D. Fla. April 25, 2011) ..............................11, 18, 20 In re Bridgestone Sec. Litig., 430 F. Supp. 2d 728 (M.D. Tenn. 2006)....................................................................................10 In re Cigna Corp. Sec. Litig., 459 F. Supp. 2d 338 (E.D. Pa. 2006) .........................................................................................10 In re Dell Inc. Sec. Litig., 591 F. Supp. 2d 877 (W.D. Tex. 2008) .....................................................................................28

iii

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 5 of 48

TABLE OF AUTHORITIES (continued) In re DVI Inc. Sec. Litig., No 2:03-cv-05336, 2010 U.S. Dist. LEXIS 92888 (E.D. Pa. Sept. 3, 2010).......................16, 39 In re IBM Corporate Sec. Litig., 163 F.3d 102 (2nd Cir. 1998) ..............................................................................................14, 32 In re Ikon Office Solutions, Inc. Sec. Litig., 131 F. Supp. 2d 680 (E.D. Pa. 2001) .............................................................................10, 20, 33 In re Imperial Credit Indus., Inc. Sec. Litig., 252 F. Supp. 2d 1005 (C.D. Cal. 2003) .....................................................................................10 In re IPO Sec. Litig., 383 F. Supp. 2d 566 (S.D.N.Y. 2005) .................................................................................10, 13 In re IPO Sec. Litig., 399 F. Supp. 2d 261 (S.D.N.Y. 2005) .......................................................................................26 In re MIVA, Inc. Sec. Litig., No. 2:05-cv-201-FtM-29DNF, 2009 U.S. Dist. LEXIS 127748 (M.D. Fla. Aug. 25, 2009) .............................................................................................10, 13, 20 * In re Moodys Corp. Sec. Litig., No. 07-cv-8375 (GBD), 2011 U.S. Dist. LEXIS 36023 (S.D.N.Y. March. 31, 2011) ...................................10, 13, 27, 28 In re Mutual Sav. Bank Sec. Litig., 166 F.R.D. 377 (E.D. Mich. 1996) ............................................................................................10 In re Nuveen Funds/City of Alameda Sec. Litig., No. C 08-4575 SI, 2011 WL 1842819 (N.D. Cal. May 16, 2011) ............................................20 * In re Omnicom Group, Inc. Sec. Litig., 597 F.3d 501 (2nd Cir. 2010) ..................................................................................12, 15, 25, 39 In re Oracle Corp. Sec. Litig., t627 F.3d 376 (9th Cir. 2010) ....................................................................................................26 In re REMEC Inc. Sec. Litig., 702 F. Supp. 2d 1202 (S.D. Cal. 2010)......................................................................................39 In re The Warnaco Grp., Inc. Sec. Litig., 388 F. Supp. 2d 307 (S.D.N.Y. 2005) .................................................................................14, 32 In re Williams Sec. Litig., 496 F. Supp. 2d 1275 (N.D. Okla. 2007)...................................................................................37 * In re Williams Sec. Litig., 558 F.3d 1130 (10th Cir. 2009) ......................................................................................... passim Janus Capital Group, Inc. vs First Derivative Traders, 131 S.Ct. 2296 (2011)................................................................................................................15

iv

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 6 of 48

TABLE OF AUTHORITIES (continued) Labovitz v. Wash. Times Corp., 172 F.3d 897 (D.C. Cir. 1999)...................................................................................................30 LaSala v. Bordier et Cie, 519 F.3d 12 (3d Cir. 2008) ........................................................................................................30 * Lattanzio v. Deloitte & Touche LLP, 476 F.3d 147 (2nd Cir. 2007) ..................................................................................14, 19, 32, 33 Metzler Inv. Gmbh v. Corinthian Colls., Inc., 540 F.3d 1049 (9th Cir. 2008) ...................................................................................................28 Oscar Private Equity Invs. v. Allegiance Telecom, Inc., 487 F.3d 261 (5th Cir. 2007) ...............................................................................................11, 19 Parisi v. Sinclair, No. 10-897 (RJL), 2011 U.S. Dist. LEXIS 34710 (D.D.C. Mar. 31, 2011) ................................9 Berks Cnty. Emps. Ret. Fund v. First Am. Corp., 734 F. Supp. 2d 533 (S.D.N.Y. 2010) ...........................................................................19, 26, 28 Robbins v. Koger Props., Inc., 116 F.3d 1441 (11th Cir. 1997) .................................................................................................30 Rudolph v. Utstarcom, 560 F. Supp. 2d 880 (N.D. Cal. 2008) .......................................................................................28 Semerenko v. Cendant Corp., 223 F.3d 165 (3d Cir. 2000) ................................................................................................10, 13 Siegel v. Ridgewells, Inc., 511 F. Supp. 2d 188 (D.D.C. 2007).............................................................................................9 Stoneridge Inv. Partners, LLC, v. Scientific Atlanta, Inc., 552 U.S. 148 (2008)...................................................................................................................15 Teachers Ret. Sys. of La. v. Hunter, 477 F.3d 162 (4th Cir. 2007) ...............................................................................................25, 26 Tooley v. Donaldson, Lufkin, & Jenrette, Inc., 845 A.2d 1031 (Del. 2004) ........................................................................................................30 STATUTES 12 U.S.C. 4616............................................................................................................................40 15 U.S.C. 78u-4(b)(4) ...................................................................................................................9 RULES Fed. R. Civ. P. 56(c) ........................................................................................................................8

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 7 of 48

TABLE OF AUTHORITIES (continued) OTHER AUTHORITIES Bradford Cornell and R. Gregory Morgan, Using Finance Theory to Measure Damages in Fraud on the Market Cases, 37 UCLA L. Rev. 883 (1990)..................................................10

vi

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 8 of 48

I.

INTRODUCTION In Dura Pharmaceuticals, Inc. v. Broudo, the Supreme Court held that the loss causation

element of a private securities fraud claim requires the plaintiff to prove that the defendants misrepresentation . . . proximately caused the plaintiffs economic loss. 544 U.S. 336, 346 (2005). To do this, a plaintiff must prove two fundamental facts, neither of which Plaintiffs do here. First, a plaintiff must show that the defendants misrepresentations caused the stock price to be artificially inflated. Second, a plaintiff must show that the correction of the misrepresentation caused the artificial inflation to be removed from the stock price. If the correction of the misrepresentation did not cause the stock price to fall, then the plaintiff cannot show that it was harmed by the misrepresentation. In this case, Plaintiffs have utterly failed to come forward with the evidence needed to establish either aspect of loss causation. In fact, the testimony of their expert, Professor Gregg A. Jarrell, affirmatively disproves their case. First, Professor Jarrell admitted that he could not affirmatively link any artificial inflation in Fannie Maes stock price to any of the Defendants allegedly false financial statements. Rather than identifying particular false statements and measuring the amount of inflation in the companys stock price created by those statements, he simply assumed that the stock price was artificially inflated by the amount that the price dropped following the release in September 2004 of an interim report by Fannie Maes primary regulator, the Office of Federal Housing Enterprise Oversight (OFHEO), regarding Fannie Maes accounting (OFHEO Report). In other words, he began his analysis by assuming the very answer he wanted to reach (i.e., that the stock drops in September must represent inflation in the stock caused by the alleged fraud), and then worked backward to attempt to determine the amount of inflation in the stock at various times throughout the class period. However, other than two dates on which the stock price increasedneither of which involved the release of a financial statement by Fannie MaeJarrell cannot identify the 1

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 9 of 48

source of the inflation. Instead, he simply concludes, without explanation as to the source of the inflation, that the inflation already existed at the beginning of the class period. This approach has no basis in law or logic. Second, Professor Jarrell assumed, without any factual or legal basis, that the entirety of the stock price declines following the release of the OFHEO Report was attributable to Fannie Maes supposed misapplication of certain complex accounting policies.1 But it is undisputed that many other pieces of relevant information were released to the market at the same time, most notably information concerning the highly charged political and regulatory environment facing Fannie Mae. Whatever impact the disclosure of Fannie Maes alleged failure to comply with technical accounting standards had on the stock price, it is undisputed that these other factors contributed significantly to the decline, but Professor Jarrell did not even attempt to disentangle the negative price impacts. Therefore, Plaintiffs have not met their burden of proving that the losses suffered by investors were caused by any revelation that Defendants prior statements about Fannie Maes accounting practices were false as opposed to the release of other negative information unrelated to the alleged fraud. Because Professor Jarrell fails to show both that the alleged misstatements created the artificial inflation and that the revelation of the falsity of those statements caused the stock price to decline, Plaintiffs cannot prove loss causation under Dura and summary judgment is required.

1 For purposes of this motion, the Court need not determine whether Defendants were in fact compliant with the generally accepted accounting principles (GAAP). In any event, the Fannie Mae executives dispute the allegations by OFHEO concerning Fannie Maes accounting.

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 10 of 48

II.

STATEMENT OF UNDISPUTED MATERIAL FACTS The facts on which Defendants move for summary judgment are straightforward and

undisputed. The parties agree that this litigation is driven largely by the release of a Report of Findings to Date by OFHEO in September of 2004. The parties also agree that Fannie Maes stock price declined on certain dates in September and December 2004. The parties do not disputenor could theythe occurrence of various factual events over the class period or the existence and content of the various analyst reports and news articles that were released on the days at issue, all of which reflect the mix of information in the market affecting Fannie Maes stock price. Similarly, the dates on which Fannie Mae released various financial statements over the class period, and the content of those statements, are not in dispute. These undisputed events over the class period are set forth in Defendants Statement of Undisputed Material Facts in Support of Their Joint Motion for Summary Judgment for Failure to Prove Loss Causation (SUMF), filed herewith in accordance with LCvR 7(h) of the Rules of the United States District Court for the District of Columbia. It is also undisputed that to prove loss causation, Plaintiffs offer the opinions of their expert, Professor Gregg Jarrell. And it is undisputed by both Plaintiffs and Defendantsand their respective expertsthat an intricate tangle of factors affected Fannie Maes stock price. Such factors include regulatory and political risk, management turnover, compliance with state and federal regulations, regulatory investigations, concerns over solvency, and even alleged preclass period misconduct. It also is undisputed that Professor Jarrell did not account for these factors separately or attempt to gauge their impact on Fannie Maes stock price.

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 11 of 48

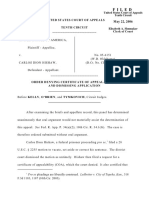

As described more fully below, Professor Jarrells report claims two distinct periods of alleged inflation: April 17, 2001 to September 30, 2004, and October 6, 2004 to December 23, 2004.2 SUMF 3 (Ex. 1, Jarrell Report 239-45).3 A. JARRELLS OPINIONS FOR THE PERIOD APRIL 17, 2001 THROUGH SEPTEMBER 30, 2004.

Professor Jarrells analysis of inflation and loss causation begins at the end, with four dates in September 2004September 30, 24, 23, and 22on which Fannie Maes stock price declined after the announcement of the OFHEO Report. SUMF 4 (Ex. 1, Jarrell Report 12728, 143-44, 153, 169). Professor Jarrell assumes that the entire residual decline he calculates for each of those dates$2.08 on September 30, $1.80 on September 24, $2.23 on September 23, and $3.03 on September 22represents the total amount of inflation in the stock price caused by the alleged fraud. Thus, as of the day before the first decline on September 22, Professor Jarrell opines that the stock price was inflated by a total of $9.10. SUMF 4-5 (Ex. 1, Jarrell Report 127-28, 143-44, 153, 169, 243-45). Professor Jarrell then moves backward in time, attempting to identify a statistically significant stock price increase that could account for the inflation he calculated in September 2004. When he could not determine when or how the inflation was created, he simply assumed the inflation previously existed and continued to move backward in search of a cause for the inflation. Professor Jarrell finds no evidence of the creation of inflation from September 22, 2004 through the summer of 2003. SUMF 21 (Ex. 1, Jarrell Report 95, 245). Then on July

2 To analyze these periods, Professor Jarrell conducts an event study, which attempts to isolate, through the use of a regression model, the changes in daily stock prices that are related to company-specific information from changes related to market- and industry-related events. The remaining portion of the actual stock price movement represents only that movement caused by the release of the company-specific information and is called the residual price movement or residual stock price return. When that residual return is statistically significant, it suggests that the price movement is not due to chance but is instead causally related to the release of the company-specific information. SUMF 2 (Ex. 1, Jarrell Report 32-38). 3 All citations to exhibits refer to the exhibits identified in the accompanying Declaration of Michael J. Walsh, Jr., dated August 16, 2011.

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 12 of 48

30, 2003, and earlier on June 16, 2003, Professor Jarrell identifies two stock price increases, which he opines contributed to the inflation. SUMF 21, 23 (Ex. 1, Jarrell Report 92, 95, 245). Professor Jarrell attributes the entire residual stock price increase he calculates on those two dates to the allegedly fraudulent statements reportedly made by Raines rather than to any other company-specific information. SUMF 22, 24 (Ex. 1, Jarrell Report 91-95, 245). As a result, he deducts his residual stock price increase on those dates from the prior amount of inflation he had calculated from the September 2004 declines to determine the inflation in the stock price before those two statements were made. SUMF 21, 23 (Ex. 1, Jarrell Report 92, 95, 245). These statements reduce his alleged inflation to $7.99 (prior to July 30) and then to $5.52 (prior to June 16). Id. Professor Jarrell does not find any other inflationary dates during the class period, including those dates on which Fannie Mae released its financial statements or other earnings announcements. He therefore concludes not only that the inflation remained at $5.52 prior to June 16, 2003 but that $5.52 in inflation must have existed on the first day of the class period, April 17, 2001 (or before). SUMF 25 (Ex. 1, Jarrell Report 245). Professor Jarrell does not identify any statement causing the $5.52 of inflation on the first day of the period and testified that some portion of this amount existed prior to that time. SUMF 26 (Ex. 4, Jarrell Dep. 270:10-272:11). These movements are represented in the following graph.

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 13 of 48

Jarrells Asserted Per-Share Inflation 4/17/01 9/30/04

Asserted Inflation $10 $9 $8 $7 $6 $5 $4 $3 9/24/04 Change: $1.80 7/30/03 Change: $1.11 4/17/01 Asserted Inflation: $5.52 6/16/03 Change: $2.47 Start of Class Period 4/17/01

9/22/04 Change: $3.03

9/23/04 Change: $2.23

Fannie Mae Earnings Announcements or Financial Statements

$2 $1 $0

9/30/04 Change: $2.04

1/ 1/ 01

9/ 30 /0 1

3/ 31 /0 3

12 /3 1/ 02

3/ 31 /0 1

6/ 30 /0 2

3/ 31 /0 2

9/ 30 /0 2

6/ 30 /0 3

3/ 31 /0 4

12 /3 1/ 01

9/ 30 /0 3

Inflation as of Market Close

Source: Ex. 2 (Jarrell Rep. Exhibit 8)

B.

JARRELLS OPINIONS FOR THE PERIOD OCTOBER 1, 2004 THROUGH DECEMBER 23, 2004

Under Professor Jarrells analysis, the entirety of the inflation due to the alleged fraud was removed from the stock price by September 30, 2004. Accordingly, as of market close on September 30, 2004, Professor Jarrell opines that there was zero inflation in Fannie Maes stock price. SUMF 30 (Ex. 1, Jarrell Report 244). Professor Jarrell then opines, however, that inflation was reintroduced into the stock price as a result of statements reportedly made by Franklin Raines, Ann Korologos, and others during a congressional hearing on October 6 and 7, 2004. SUMF 31-32 (Ex. 1, Jarrell Report 170-82, 241-42). Professor Jarrell adds up his residual stock price increase on those two datesonce again assuming the entire increase was

12 /3 1/ 03

6/ 30 /0 1

6/ 30 /0 4

9/ 30 /0 4

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 14 of 48

due to the allegedly fraudulent statementsto conclude that the stock price was inflated by $3.09 after October 7, 2004. SUMF 31 (Ex. 1, Jarrell Report 174-76, 180-82, 241-42). For this period, instead of working backward, Professor Jarrell chooses to move forward in time, opining that the $3.09 of inflation remained in the stock price until December 16, 2004, at which time Professor Jarrell concludes that an announcement by the SEC requiring Fannie Mae to restate removed a portion of that inflation. SUMF 36-37 (Ex. 1, Jarrell Report 18693). According to Professor Jarrell, the remainder of the inflation from the October 2004 statements was removed from the stock price by a second allegedly corrective disclosure on December 23, 2004. SUMF 41-42 (Ex. 1, Jarrell Report 215-23). As with the September 2004 declines, Professor Jarrell attributes the entire declines on these dates to the allegedly corrective disclosures. The cumulative residual stock price declines on those two disclosure dates, however, was slightly higher than the total amount of inflation Professor Jarrell measured on October 6 and 7, 2004. SUMF 47 (Ex. 1, Jarrell Report 240-42 and n.204). As a result, Professor Jarrell assumes that only that portion of the December declines equal to the October increases (roughly 82% of the December declines) was the correction of inflation, leaving the remainder of the residual declines on those dates unexplained. Id. At his deposition, Professor Jarrell admitted that this calculation was just a plug intended to reduce[] the amount of the corrective decline so that those two numbers match up. SUMF 48 (Ex. 4, Jarrell Dep. 76:118). The following graph depicts this second period of inflation.

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 15 of 48

Jarrells Asserted Per-Share Inflation 9/30/04 12/23/04

Asserted Inflation $4

Actual Residual Stock Price Decline $1.82

$3

82%

10/7/04 Change: $1.80 $2

12/16/04 Change: $1.49

Actual Residual Stock Price Decline $1.96

82%

$1 10/6/04 Change: $1.29 $0 9/30/04 12/23/04 Change: $1.60

10/30/04 10/31/04

Inflation as of Market Close

11/30/04

12/31/04

Source: Ex. 2 (Jarrell Rep. Exhibit 8)

III.

LEGAL STANDARDS A. SUMMARY JUDGMENT

Under Rule 56 of the Federal Rules of Civil Procedure, summary judgment must be granted when the pleadings, depositions, answers to interrogatories, and admissions on file, together with the affidavits, if any, show that there is no genuine issue as to any material fact and that the moving party is entitled to a judgment as a matter of law. Fed. R. Civ. P. 56(c); Anderson v. Liberty Lobby, Inc., 477 U.S. 242, 247 (1986); see also Diamond v. Atwood, 43 F.3d 1538, 1540 (D.C. Cir. 1995); Bender v. Jordan, 570 F. Supp. 2d 37, 42 (D.D.C. 2008). Moreover, summary judgment is properly granted against a party that, after adequate time for discovery and upon motion . . . fails to make a showing sufficient to establish the existence of an

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 16 of 48

element essential to that partys case, and on which that party will bear the burden of proof at trial. Celotex Corp. v. Catrett, 477 U.S. 317, 322 (1986); Bender, 570 F. Supp. 2d at 42. In ruling on a motion for summary judgment, the court must draw all justifiable inferences in the nonmoving partys favor and accept the nonmoving partys evidence as true. Anderson, 477 U.S. at 255; Parisi v. Sinclair, No. 10-897 (RJL), 2011 U.S. Dist. LEXIS 34710, at *11 (D.D.C. Mar. 31, 2011). A nonmoving party, however, must establish more than the mere existence of a scintilla of evidence in support of its position. Anderson, 477 U.S. at 252; Parisi, 2011 U.S. Dist. LEXIS 34710, at *11. Rather, the nonmoving party must present specific facts that would enable a reasonable jury to find in its favor. Greene v. Dalton, 164 F.3d 671, 675 (D.C. Cir. 1999); Siegel v. Ridgewells, Inc., 511 F. Supp. 2d 188, 193 (D.D.C. 2007). If the evidence is merely colorable, or is not significantly probative, summary judgment may be granted. Anderson, 477 U.S. at 249-50 (citations omitted); Bender, 570 F. Supp. 2d at 42; Parisi, 2011 U.S. Dist. LEXIS 34710, at *11. B. LOSS CAUSATION IN SECURITIES FRAUD CASES

The Private Securities Litigation Reform Act of 1995 requires that [i]n any private action arising under this title, the plaintiff shall have the burden of proving that the act or omission of the defendant alleged to violate this title caused the loss for which the plaintiff seeks to recover damages. 15 U.S.C. 78u-4(b)(4); see Dura, 544 U.S. at 342. To satisfy the burden of proving loss causation, a plaintiff must show both that the alleged misrepresentation caused the stock price to be artificially inflated at the time of purchase and that the same inflation was removed from the price when the truth about the misrepresentation became known to investors, thus causing a loss to investors. See Dura, 544 U.S. at 342-43. Indeed, last term the Supreme Court unanimously affirmed that loss causation requires a plaintiff to show that a misrepresentation both affected the integrity of the market price for a stock and also caused a 9

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 17 of 48

subsequent economic loss. Erica P. John Fund, Inc v. Halliburton, Co., 131 S. Ct. 2179, 2186 (2011) (emphasis in original). With respect to the first aspect of loss causation, courts have consistently held that to establish loss causation a plaintiff must show that she purchased a security at a market price that was artificially inflated due to a fraudulent misrepresentation. Semerenko v. Cendant Corp., 223 F.3d 165, 184 (3d Cir. 2000).4 Artificial inflation is defined as the difference between the actual share price and the true value that would have prevailed absent the alleged misrepresentations. See Green v. Occidental Petroleum Corp., 541 F.2d 1335, 1344 (9th Cir. 1976) (Sneed, J., concurring); In re Imperial Credit Indus., Inc. Sec. Litig., 252 F. Supp. 2d 1005, 1014 (C.D. Cal. 2003); In re Bridgestone Sec. Litig., 430 F. Supp. 2d 728, 738 (M.D. Tenn. 2006); In re Mutual Sav. Bank Sec. Litig., 166 F.R.D. 377, 383 n.10 (E.D. Mich. 1996); Bradford Cornell and R. Gregory Morgan, Using Finance Theory to Measure Damages in Fraud on the Market Cases, 37 UCLA L. Rev. 883, 885 (1990). For the second aspect of loss causation, a plaintiff cannot prove the inflation was removed from the stock price due to the truth being released to the market merely by pointing to a stock price decline on the corrective disclosure dates. In Dura, the Supreme Court also made clear that an inflated purchase price will not itself constitute or proximately cause the relevant economic loss. 544 U.S. at 342.

4 See also In re Moodys Corp. Sec. Litig., No. 07-cv-8375 (GBD), 2011 U.S. Dist. LEXIS 36023, at *34 (S.D.N.Y. March. 31, 2011) (The fraud on the market presumption is based upon the notion that the market was fed misinformation, absorbed that information and the stock price increased because of that misinformation.); In re Cigna Corp. Sec. Litig., 459 F. Supp. 2d 338, 349 (E.D. Pa. 2006) (holding a plaintiff may establish loss causation by showing that he or she purchased a security at a market price that was artificially inflated due to a fraudulent misrepresentation); In re IPO Sec. Litig., 383 F. Supp. 2d 566, 580 (S.D.N.Y. 2005) (requiring proof of artificial inflation in addition to dissipation as a result of disclosing events); In re Ikon Office Solutions, Inc. Sec. Litig., 131 F. Supp. 2d 680, 687 (E.D. Pa. 2001) (plaintiff must show that he or she purchased a security at market price that was artificially inflated due to a fraudulent misrepresentation) (citation omitted), affd, 277 F.3d 658 (3d Cir. 2002); In re MIVA, Inc. Sec. Litig., No. 2:05-cv-201-FtM-29DNF, 2009 U.S. Dist. LEXIS 127748, at *20-22 (M.D. Fla. Aug. 25, 2009) (Plaintiffs must offer evidence showing that the challenged conduct artificially maintained or inflated the companys stock price.).

10

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 18 of 48

If the purchaser sells later after the truth makes its way into the marketplace, an initially inflated purchase price might mean a later loss. But that is far from inevitably so. When the purchaser subsequently resells such shares, even at a lower price, that lower price may reflect, not the earlier misrepresentation, but changed economic circumstances, changed investor expectations, new industryspecific or firm-specific facts, conditions, or other events, which taken separately or together account for some or all of that lower price. To touch upon a loss is not to cause a loss, and it is the latter that the law requires. Id. at 343-44 (emphasis in original). Thus, Dura also requires plaintiffs to show that the correction of the fraud, rather than some other factor, caused the stock price decline that plaintiffs claim injured them. Id. at 342-43. In sum, a plaintiff cannot recover more than the portion of any stock price decline that is caused by the correction of an earlier materially false or misleading statement that caused the stock price to become artificially inflated. The news that causes the stock price to decline must remove the original inflation caused by the alleged fraud; otherwise that news is only one of the tangle of factors affecting a companys stock price and not curative of the alleged fraud. Id. at 343-44; see also Oscar Private Equity Invs. v. Allegiance Telecom, Inc., 487 F.3d 261, 271 (5th Cir. 2007), revd on other grounds, Erica P. John Fund, Inc. v. Halliburton Co., 131 S. Ct. 2179 (2011) (holding that simply establishing that the price reacted to the entire bundle of negative information ... suggests only market efficiency, not loss causation, for there is no evidence linking the culpable disclosure to the stock-price movement) (emphasis in original); In re BankAtlantic Bancorp. Inc. Sec. Litig., No. 07-61542-CIV, 2011 WL 1585605, at *19 (S.D. Fla. April 25, 2011) ([W]here a fraud is revealed contemporaneously with the announcement of other negative, but non-fraud-related information, plaintiffs bear the burden of disaggregating the effect of the unrelated negative information on the stock price.).

11

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 19 of 48

Accordingly, summary judgment is appropriate where the plaintiff does not suffice to draw the requisite causal connection between [the corrective disclosure] and the fraud alleged in the complaint. In re Omnicom Grp., Inc. Sec. Litig., 597 F.3d 501, 512-13 (2nd Cir. 2010). IV. ARGUMENT A. PLAINTIFFS CANNOT ESTABLISH THAT THE ALLEGED MISSTATEMENTS OR OMISSIONS CONCERNING FANNIE MAES ACCOUNTING PRACTICES INFLATED FANNIE MAES STOCK PRICE. 1. Plaintiffs concede that Fannie Maes financial statements and earnings announcements did not inflate Fannie Maes stock price.

Plaintiffs not only fail to identify when inflation entered Fannie Maes stock price, but their expert affirmatively denies that Fannie Maes financial statements, earnings press releases, and KPMGs audit opinions published during the class period caused any inflation to enter into Fannie Maes stock price. According to Professor Jarrell, inflation in Fannie Maes stock was constant for months, even years, on endunchanged between April 17, 2001 and June 16, 2003, and between July 30, 2003 and September 22, 2004. SUMF 21, 23, 25 (Ex. 1, Jarrell Report 92, 95, 245); 29 (Ex. 4, Jarrell Dep. 265:15-20, 267:12-270:9). Plaintiffs complaint, on the other hand, sets out 150 pages of alleged material misstatements throughout the class period, and Plaintiffs allege that Defendants published false financial reports on no fewer than 22 occasions during the class period. SUMF 166 (SAC 210-315; Ex. 9, Summary of Days Related to Fannie Mae Earnings Announcements or Fin. Statements 4/17/01 12/23/04). But Professor Jarrell opines that not a single one of these financial reports caused any additional inflation to enter Fannie Maes stock price. SUMF 28 (Ex. 4, Jarrell Dep. 272:17-273:21). In fact, the only two dates on which Professor Jarrell affirmatively identifies an increase in inflation were dates on which no financial statements were released. SUMF 21-24, 28 (Ex. 1, Jarrell Report 91-95, 240-45). Professor Jarrell even concedes that his calculated inflation of $5.52 per

12

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 20 of 48

share did not enter the stock price on the first day of the class period, and denies that there was any movement in the stock price on that date. SUMF 26 (Ex. 4, Jarrell Dep. 270:10-272:11). Not surprisingly, courts have found that such a disconnect between the calculated inflation and the alleged misrepresentations is sufficient to warrant summary judgment. One court noted that the link between the misrepresentation and the price in a fraud-on-the-market case is severed by showing that the allegedly false information the market was absorbing was not causing the stock price to artificially inflate. Moodys, 2011 U.S. Dist. LEXIS 36023, at *35. Where the expert opinion showed no statistically significant price increase on the dates of the claimed misrepresentations, the court concluded that [b]y Plaintiffs own admission, the misinformation [defendant] allegedly provided the market did not cause any such inflation. Id. at *34. Another court found no loss causation where the plaintiffs failed to tie any loss to these particular statements, because the inflationary rate of the stock remained the same before and after the alleged fraudulent statements were made. Miva, 2009 U.S. Dist. LEXIS 127748, at *19-22. Indeed, courts have repeatedly held that to prove loss causation, a plaintiff must specifically identify the inflation associated with the alleged fraud. Dura, 544 U.S. at 342; see also Semerenko, 223 F.3d at 184 (requiring the purchase of a security at a price that is inflated due to an alleged misrepresentation as a necessary prerequisite for proving loss causation); IPO, 383 F. Supp. 2d at 580 (requiring proof of artificial inflation in addition to dissipation as a result of disclosing events); Miva, 2009 U.S. Dist. LEXIS 127748, at *21 (concluding the plaintiffs expert provided no analysis as to how much inflation may be attributable to either or both of the allegedly fraudulent statements and fails to analyze the effect of each particular misrepresentation). Here, Professor Jarrell claims that the $5.52 of inflation was somehow in

13

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 21 of 48

the stock price by the first day of the class period, but he does not opine that any of this inflation was caused by the release of an allegedly fraudulent financial statement (or any other fraudulent statement for that matter) on that day.5 SUMF 28 (Ex. 1, Jarrell Report 240-45; Ex. 4, Jarrell Dep. 272:17-273:21). Without evidence that the alleged misstatements in the financial statements were the source of the artificial inflation in Fannie Maes stock price, Plaintiffs cannot prove that the correction of those alleged misstatements were the cause of the stock price decline. Summary judgment should be granted in favor of defendants. 2. Even where he specifically identifies inflationary days, Professor Jarrell fails to prove that any allegedly fraudulent statements created inflation on June 16, 2003 and July 30, 2003.

As noted, Professor Jarrell does not tie any of the inflation he calculates to any of the allegedly fraudulent financial statements. In fact, he does not tie the majority of the inflation to any specific misrepresentation. He does identify two datesJune 16, 2003 and July 30, 2003 on which he concludes positive statements attributed to Raines resulted in residual increases in Fannie Maes stock price that contributed to the inflation.6 Professor Jarrells treatment of these two dates, however, is seriously flawed, as he merely assumes, without analysis (much less proof), that the stock price movement on these dates stemmed from the allegedly fraudulent

5 Plaintiffs experts analysis also fails to the extent he opines that part of the inflation that he concludes came out of the stock price in September 2004 existed before the class period began. Plaintiffs simply cannot recover for inflation incurred before the class period. See In re IBM Corporate Sec. Litig., 163 F.3d 102, 107 (2nd Cir. 1998) ([A] defendant . . . is liable only for those statements made during the class period); Lattanzio v. Deloitte & Touche LLP, 476 F.3d 147, 154 (2nd Cir. 2007) (defendant accounting firms failure to correct a statement preclass period was not actionable); In re The Warnaco Grp., Inc. Sec. Litig., 388 F. Supp. 2d 307, 315 (S.D.N.Y. 2005) (same). 6 Specifically, Professor Jarrell attributes $2.47 of inflation on June 16, 2003 to a public statement reportedly issued by Franklin Raines after the market closed on June 13, 2003, in which Raines expressed that Fannie Mae has done its derivatives accounting properly. SUMF 23-24 (Ex. 1, Jarrell Report 91-92, 245); SUMF 59 (Ex. 18, Dow Jones Bus. News, June 13, 2003, 5:25 PM). Professor Jarrell opines that a statement reportedly made by Raines during a teleconference on July 30, 2003, in which Raines allegedly stated that Fannie Mae did not engage in the same improper accounting as Freddie Mac, caused Fannie Maes stock price to be inflated by an additional $1.11. SUMF 21-22 (Ex. 1, Jarrell Report, 93-95, 245); SUMF 65 (Ex. 21, Event Tr., CCBN StreetEvents, July 30, 2003, 11:30 AM).

14

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 22 of 48

statements.7 But an actual analysis of news on these dates shows that the information released was not new and that the release of other company-specific information was likely responsible for, and at the very least contributed to, the residual stock price increase Professor Jarrell calculated. Because Professor Jarrell cannot prove that his calculated inflation on June 16 and July 30, 2003 was caused by any alleged fraud on those dates, summary judgment is appropriate with respect to any losses allegedly resulting from statements on those dates.8 a. June 16, 2003

Numerous problems plague Professor Jarrells assumption that an alleged statement by Raines on June 16, 2003, in which he assured investors that the company had properly done its accounting, caused the stock price increase.9 First, Professor Jarrell does not consider that Fannie Mae had recently made similar statements. For example, as Plaintiffs admit in their Complaint, Fannie Mae confirmed on June 10, 2003 it did not have accounting issues similar to those being experienced by Freddie Mac. SUMF 57 (Ex. 17, Wall St. J., June 10, 2003, at A1; SAC 270). But in an efficient market, the reiteration of week-old information would not cause a stock price change on June 16. See Omnicom, 541 F. Supp. 2d at 551 (holding that [a] recharacterization of previously disclosed facts is not new information); In re DVI Inc. Sec.

7 Indeed, even Professor Jarrell admits that there may have been confounding news released on both dates and that his analysis of these dates is not rigorous. SUMF 27 (Ex. 3, Jarrell Rebuttal Report 83; Ex. 4, Jarrell Dep. 288:16-293:11). 8 Because only Franklin Raines spoke on these dates, Defendants KPMG, Tim Howard and Leanne Spencer cannot be liable for the introduction of any inflation on these dates, even if Professor Jarrells and Plaintiffs analyses were otherwise correct. Janus Capital Grp., Inc. v. First Derivative Traders, 131 S. Ct. 2296, 2301 (2011) (holding defendant must have made the misstatement to be liable under 10(b)); Stoneridge Inv. Partners, LLC, v. Scientific Atlanta, Inc., 552 U.S. 148, 161-63 (2008) (holding defendants could not be held liable where they did not make or cause to be made the allegedly fraudulent statements). 9 Notably, the alleged misrepresentation on June 13, 2003 appears nowhere in the 300-plus pages of Plaintiffs Second Amended Consolidated Complaint (or in the pleadings that preceded it), or in any response by Plaintiffs to Defendants interrogatories. Indeed, Mr. Raines was not even asked about this statement at his deposition. Professor Jarrell is the first one to identify the statement, and the only one to claim it was a misrepresentation. But the deadline for amending pleadings and conducting discovery has long since passed in this case, and it is far too late in the day for Plaintiffs to raise new claims about additional misrepresentations. Trying to do so through their damages expert smacks of an attempt to find an injury and then go in search of a claim.

15

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 23 of 48

Litig., No 2:03-cv-05336, 2010 U.S. Dist. LEXIS 92888, at *90-91 (E.D. Pa. Sept. 3, 2010) (granting partial summary judgment for defendants because alleged corrective disclosure was merely a recharacterization of previously disclosed information and revealed nothing new about the alleged fraud). Even more, Professor Jarrells own model showed that the market reacted to the news when it was originally released on June 10, as Fannie Maes stock price suffered a statistically significant decline on that day. SUMF 58 (Ex. 2, Jarrell Report Ex. 11). Second, Professor Jarrell ignores the fact that Fannie Mae Chief Economist David Berson commented on June 16 that the shake-up at Freddie Mac had little effect on the secondary mortgage market. SUMF 60 (Ex. 19, Dow Jones Intl News, June 16, 2003, 1:52 PM). Notably, the Berson article was published just before 2:00 PM, and the stock price increased an additional $1.57 after 2:00 PM. SUMF 61 (Ex. 5, Kleidon Report Ex. 6B). Rainess alleged statement, on the other hand, was issued after the market closed on Friday, June 13, yet Fannie Maes stock price opened on June 16 only one penny higher. Id. Although the timing of these movements demonstrates that the stock price increase in the afternoon of June 16, 2003 was caused not by Rainess reported statement but by Bersons, Professor Jarrell makes no attempt to disentangle the impact of each statement. See, e.g., In re Williams Sec. Litig., 558 F.3d 1130, 1137 (10th Cir. 2009) (requiring plaintiffs to [show] that his losses were attributable to the . . . fraud and not the myriad of other factors that affect a companys stock price). Thus, instead of considering the previous disclosures or the impact of the Berson statement, Professor Jarrell assumes a causal relationship between the inflation and Rainess reported statement. This failure to engage in even a rudimentary independent analysis does not satisfy Plaintiffs burden to affirmatively prove causation.

16

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 24 of 48

b.

July 30, 2003

Professor Jarrells conclusions with respect to the alleged inflation on July 30, 2003, are likewise insufficient. Professor Jarrell once again fails to consider the other information disclosed that day that could have affected the stock price. For example, he does not address the fact that Raines reportedly discussed on the teleconference multiple topics important to investors besides the accounting issues, among them (i) the current interest rate environment and Fannie Maes risk-management tools and (ii) the regulatory and legislative environment around Fannie Mae and Freddie Mac. SUMF 65 (Ex. 21, Event Tr., CCBN StreetEvents, July 30, 2003, 11:30 AM). In particular, Raines reportedly stated that Fannie Maes risk management strategies had held up well and that we are quite pleased with the results. Id. Professor Jarrell makes no attempt to separate out any residual price increase caused by such positive statements, which are unrelated to the alleged fraud, from that caused by statements that did concern the accounting, thus leaving this Court or a jury no way to determine which portion of the residual stock price increase, if any, is actually connected to the allegedly fraudulent statements. And, most importantly, Plaintiffs own accounting expert, John Barron, testified that Rainess alleged July 30, 2003 statement was not false. SUMF 49 (Ex. 6, Barron Dep. 613:4614:5). Plaintiffs cannot on the one hand admit that a statement was not fraudulent, but on the other, attempt to recover for inflation allegedly caused by the statement. Accordingly, Plaintiffs have failed to prove that Rainess purported statement on July 30 created any inflation. * * *

Plaintiffs have therefore not met their burden of proving the inflation was created by any alleged fraud, either in the financial statements or in any of the statements made in June and July of 2003. Summary judgment is warranted.

17

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 25 of 48

B.

PLAINTIFFS FAILED TO PROVE THAT THE ECONOMIC LOSS THEY SUFFERED WHEN THE STOCK PRICE DECLINED IN SEPTEMBER 2004 WAS CAUSED BY THE REVELATION OF THE ALLEGED FRAUD.

Plaintiffs also fail to prove, as they must, that the inflation was removed from the stock price by the disclosure of the alleged fraud. Professor Jarrell opines that the entirety of the residual price declines he calculated on September 22, 23, 24, and 30, 2004 was precipitated by the revelation of the fraud and thus concludes those declines establish loss causation. But Professor Jarrells conclusions are merely assumptions, and they do not prove causality. The Supreme Court in Dura made clear that a plaintiff must do more than simply point to a price decline and claim damages; a plaintiff must prove that the losses were actually caused by disclosures correcting the alleged fraud and not other factors. Dura, 125 S. Ct. at 342, 344-46. Where a stock price decline is due to changed economic circumstances, for instance, or changed investor expectations, such losses are not recoverable damages. Id. at 343. Accordingly, Plaintiffs and their expert must distinguish the effects of the alleged fraud from the tangle of other factors that affect a stocks price. Id.; Halliburton, 131 S. Ct. at 2186; In re BankAtlantic, 2011 WL 1585605, at *19 (holding that plaintiffs bear the burden of disaggregating the effect on the stock price of negative information unrelated to the fraud). Plaintiffs and their expert even agree that the declines in Fannie Maes stock price were caused by a variety of events and news on each day. SUMF 11 (Ex. 4, Jarrell Dep. 179:22181:1). Nonetheless, Professor Jarrell concludes the there was no confounding information on any of the disclosure days that could have contributed to the decline. SUMF 10 (Ex. 1, Jarrell Report 128, 144, 153, 169). Professor Jarrells failure to disentangle the confounding factors is fatal to Plaintiffs claims in at least three, independent ways.

18

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 26 of 48

First, Professor Jarrell did not disentangle the effect of company-specific information that might have caused the stock price to decline but that is not corrective of the alleged fraud. Such information includes news regarding significant, negative changes in the political and regulatory environment faced by Fannie Maea circumstance noted by all the damages experts in this actionand extends to other events such as changes in management, regulatory investigations, and even the filing of this lawsuit. Second, Professor Jarrell has failed to disentangle declines caused by events not related to this lawsuit. Such factors include alleged inflation that predates the class period and any declines associated with the claimmuch discussed in the press, but not at issue in this caseregarding allegations by OFHEO about accounting judgments in 1998, several years before the class period begins. Third, Professor Jarrell has failed to disentangle information that proved false, such as concerns the market had about the Companys solvency.

Because Professor Jarrell admittedly fails to disentangle the recoverable declines caused by the revelation of fraud from those caused by other factors, Plaintiffs are unable to sustain their burden of proof on loss causation. See Oscar Private Equity Invests., 487 F.3d at 271 (holding that where plaintiffs expert does detail[ed] event studies supporting a finding that [the stock] reacted to the entire bundle of negative information . . . this reaction suggests only market efficiency, not loss causation, for there is no evidence linking the culpable disclosure to the stock price movement) (emphasis in original); Fener v. Operating Engrs Constr. Indus. & Miscellaneous Pension Fund, 579 F.3d 401, 410 (5th Cir. 2009) (We reject any event study that shows only how a stock reacted to the entire bundle of negative information, rather than examining the evidence linking the culpable disclosure to the stock-price movement.) (emphasis in original); Lattanzio, 476 F.3d at 158 (Plaintiffs have not alleged facts to show that Deloittes misstatements, among others (made by Warnaco) that were much more consequential and numerous, were the proximate cause of plaintiffs loss; nor have they alleged facts that would allow a factfinder to ascribe some rough proportion of the whole loss to Deloittes misstatements.); Ikon, 131 F. Supp. 2d at 690 (finding there is no evidence that the alleged

19

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 27 of 48

misstatements caused the loss, as opposed to or in addition to other factors); In re Nuveen Funds/City of Alameda Sec. Litig., No. C 08-4575 SI, 2011 WL 1842819, at *8 (N.D. Cal. May 16, 2011) (excluding plaintiffs experts opinions on loss causation and granting summary judgment in favor of defendants where the expert did not perform any investigation or analysis to support his conclusion that plaintiffs losses were caused by defendants fraud). Accordingly, Defendants deserve judgment as a matter of law.10 1. Professor Jarrell fails to disentangle declines caused by non-corrective disclosures due to his erroneous application of a self-defined foreseeable consequences standard. a. The decline in Fannie Maes stock price was drenched in politics and influenced by other non-corrective disclosures.

Over the course of the four dates in September 2004 on which Professor Jarrell opines the alleged inflation was removed from Fannie Maes stock price, the market was reacting not just to news of alleged accounting errors but also to other events directly affecting the company. SUMF 11 (Ex. 4, Jarrell Dep. 179:22-181:1). Experts on both sides agreed that, as a governmentsponsored entity (or GSE), Fannie Mae was subject to significant intervention by political and regulatory authorities and to the varying views of members of Congress as to Fannie Maes role and appropriate charter. See SUMF 12, 14 (Ex. 4, Jarrell Dep. 102:17-106:19; 107:5-109:16); SUMF 50 (Ex. 7, Ruback Report 44-47); SUMF 51 (Ex. 8, James Report 37-61). Not

10 It is worth noting that besides failing to disentangle the price impacts associated with the three types of nonfraud related information mentioned above, Professor Jarrell also did not disentangle the price impacts caused by one allegedly fraudulent statement from those caused by another; he instead lumps all of the declines together and attributes them to fraud generally, without regard to the specific allegations in the complaint. Thus, should Defendants prevail, for example, on their Motion for Partial Summary Judgment on the alleged misstatements concerning FAS 133 (or any other motion for summary judgment regarding a specific alleged misstatement), Professor Jarrells loss causation analysis could not be used to support any of Plaintiffs claims, regardless of the specific alleged misrepresentation or omission those claims are based on. See In re BankAtlantic, 2011 WL 1585605, at *18-20 (holding that plaintiff could not establish loss causation for any claim of fraud where the experts analysis did not distinguish between the effects of various different alleged misrepresentations and the jury had found that at least one of the alleged misrepresentations were not fraudulent); Miva, 2009 U.S. Dist. LEXIS 127748, at *21 (noting that plaintiffs expert provided no analysis as to how much inflation may be attributable to either or both of the allegedly fraudulent statements and fail[ed] to analyze the effect of each particular misrepresentation).

20

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 28 of 48

surprisingly, after Korologoss statement on September 22, 2004 previewing the OFHEO report, there was significant political pressure affecting Fannie Mae: Treasury Secretary John Snow stated, [I]t is important to have a strong GSE regulator and [t]hat strong regulator ought to have more authority than the current regulator. That strong regulator needs to have greater authority over capital standards, over capital levels. It needs to have greater authority over new lines of business that these entities can go into, because the lines of business affect foundations of safety and risk levels. SUMF 76 (Ex. 27, Bloomberg, Sept. 22, 2004, 12:28 PM). U.S. Senator Richard Shelby, one of Fannie Maes most vocal congressional critics, indicated his intent to continue pressing for legislation this year overhauling the companys oversight. SUMF 77 (Ex. 28, Dow Jones Intl News, Sept. 22, 2004, 12:53 PM, at 1). One analyst noted that regulatory uncertainty creates a situation that is difficult to quantify. SUMF 80 (Ex. 31, Susquehanna Fin. Grp., Sept. 22, 2004, no time, at 1).11

The market continued to speculate about the political implications of the report on the following day, September 23, after the OFHEO report was released. For example: The Wall Street Journal noted that [t]he issue is drenched in politics. SUMF 93 (Ex. 40, Wall St. J., Sept. 23, 2004, at A1) The Washington Post reported, Yesterdays disclosure that government regulators have raised safety and soundness questions about mortgage finance giant Fannie Mae has given new ammunition to critics of the company and its sister firm, Freddie Mac. It continued, noting that critics including Federal Reserve Chairman Alan Greenspan and Treasury Secretary Snow have called for tighter regulation and restrictions on further growth. SUMF 94 (Ex. 41, Wash. Post, Sept. 23, 2004, at E01). Morgan Stanley noted that the risk of regulatory intervention warrants a reduction in our target price but stated that a derivatives-related write down would not necessarily indicate any impairment in the economic value of the company. SUMF 97 (Ex. 45, Morgan Stanley & Co., Sept. 23, 2004, no time at 1-3).

11 See also SUMF 75 (Ex. 26, Dow Jones Cap. Mkts. Rep., Sept. 22, 2004, 9:27 AM, at 2); SUMF 78 (Ex. 29, Dow Jones Intl News, Sept. 22, 2004, 3:26 PM, at 1).

21

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 29 of 48

Citigroup Smith Barney reported that [s]ome investors have worried that missteps by [Fannie Mae] would finally give Congress the urgency to act to reign [sic] in the GSEs at the same time the companies influence in the process is greatly reduced. Investors have worried that a Congressional overhaul of the GSEs regulator could result in slower growth and higher capital requirements. SUMF 96 (Ex. 42, Citigroup Global Mkts., Sept. 23, 2004, no time, at 3). Market analysts also discussed whether OFHEO might impose a capital surcharge on Fannie Mae, as it did with Freddie Mac after the accounting issues at that firm. SUMF 85 (Ex. 34, Dow Jones Intl News, Sept. 22, 2004, 4:14 PM); SUMF 92 (Ex. 39, Sanford C. Bernstein & Co., Sept. 23, 2004, no time, at 1).12

On September 24, 2004, the media continued to discuss potential action that regulators might take with regard to Fannie Mae. For example, The Wall Street Journal reported that investors are starting to fret again that the stumbles will force real regulatory change that could hurt earnings. [T]here may be a renewed push for legislation in Congress to crimp the companies ability to dominate the mortgage market. SUMF 107 (Ex. 59, Wall St. J., Sept. 24, 2004, at C1). Likewise, an analyst at Capital Research observed, It seems to me that the real question for the stock is not fundamental, but political: how will the Board respond to the charges and what will the impact be in the regulatory bill sitting in Congress. SUMF 108 (Ex. 60, Capital Res., Sept. 24, 2004, no time).13 Professor Jarrell concedes that, in addition to responding to the political developments, investors were also reacting during the September 2004 disclosure days to the release of other news about the company. SUMF 11-12 (Ex. 4, Jarrell Dep. 102:17-106:19; 179:22-181:1). For example, after the market closed on September 23, Fannie Mae disclosed that it had amended agreements with its top three officers. SUMF 104 (Ex. 12, Fannie Mae, Current Report (Form 8-K), Sept. 23, 2004, 5:23 PM). Market participants quickly noted that the

12 See also SUMF 94 (Ex. 36, N.Y. Times, Sept. 23, 2004, at C%; Ex. 41, Wash. Post, Sept. 23, 2004, at E01); SUMF 95 (Ex. 43, A.G. Edwards & Sons, Inc., Sept. 23, 2004, no time, at 2). 13 See also SUMF 106 (Ex. 58, Reuters News, Sept. 24, 2004, 11:56 AM); SUMF 109 (Ex. 57, N.Y. Times, Sept. 24, 2004, at C5).

22

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 30 of 48

amendments toughened the language on what constituted grounds for dismissal and questioned the implications of such action for a possible management shake-up. SUMF 104 (Ex. 55, Wall St. J., Sept. 24, 2004, no time); SUMF 105 (Ex. 56, N.Y. Times, Sept. 24, 2004, no time, at C5). Professor Jarrell opines that the news of these amendments affected the stock price. SUMF 8 (Ex. 1, Jarrell Report 145-46, 152-53; Ex. 4, Jarrell Dep. 175:4-11). In addition, several class action lawsuits were filed against the company on September 24, 2004. See SUMF 103 (Ex. 50, Press Release (Sept. 23, 2004, 4:26 PM) (Schiffrin & Barroway LLP); Ex. 51, Press Release (Sept. 23, 2004, 7:03 PM) (Lerach Coughlin Stoia Geller Rudman & Robbins LLP); Ex. 52, Press Release (Sept. 24, 2004, 12:12 PM) (Cohen, Milstein, Hausfeld & Toll, P.L.L.C.); Ex. 53, Press Release (Sept. 24, 2004, 1:07 PM) (Milberg Weiss Bershad & Schulman LLP)). Professor Jarrells report lists various news articles reporting on the filing of the lawsuits, suggesting that the lawsuits may have impacted Fannie Maes share price. Furthermore, the market reacted during these days to the announcement of various regulatory investigations. First, before the market opened on September 22, it was announced that the SEC had decided to investigate the allegations in the OFHEO report. See SUMF 73 (Ex. 25, Press Release (Sept. 22, 2004, 8:04 AM)). The market continued to react to this news after the market closed that day and on the following day. SUMF 88 (Ex. 34, Dow Jones Intl News, Sept. 22, 2004, 4:14 PM; Ex. 36, N.Y. Times, Sept. 23, 2004, no time). And before the market opened on September 30, 2004, press reports indicated that the Department of Justice had launched a criminal investigation into possible accounting fraud at Fannie Mae. SUMF 112 (Ex. 61, Wall St. J., Sept. 30, 2004, at A2). Later that day, Bloomberg clarified that the Department of Justice was considering whether to conduct a criminal investigation into

23

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 31 of 48

accounting fraud at Fannie Mae. SUMF 115 (Ex. 64, Bloomberg, Sept. 30, 2004, 12:01 PM).14 Professor Jarrell concedes that the news of each investigation contributed to the stock price declines on their respective disclosure dates. SUMF 6, 9 (Ex. 1, Jarrell Report 11617, 124-128, 160-64, 168-69). All of these events, which did not disclose the alleged fraud, clearly were being considered by market participants and, as Plaintiffs admit, likely impacted the companys stock price. b. Plaintiffs cannot recover for declines caused by the political developments or the other company-specific events simply by calling them direct and foreseeable consequences of a fraud.

As noted, Professor Jarrell does not disentangle the stock price effect of any of the above confounding events. He claims he does not need to engage in such an analysis because all of the confounding eventsthe political developments, management issues, class action lawsuits, and regulatory investigationsare direct and foreseeable consequences of the fraud, and any stock price reaction to the consequence is, in effect, a recoverable stock price reaction to the revelation of the fraud.15 SUMF 17 (Ex. 3, Jarrell Rebuttal Report 13, 20; Ex. 4, Jarrell Dep. 55:2157:9, 179:22-181:20). There is abundant case law rejecting this approach. Courts have consistently rejected the notion that any impact on stock price caused by a consequence of the alleged fraudeven one that is foreseeablenecessarily shows that the stock price was reacting

14 The Department of Justice ultimately dropped its investigation without bringing any charges. SUMF 118 (Ex. 68, Wall St. J., Aug. 25, 2006, at A3). 15 Professor Jarrell acknowledged that the losses caused by stock price declines from such consequences were different in kind from losses arising from the removal of inflation created by fraud. He illustrated the difference with a hypothetical in his Rebuttal Report, SUMF 19 (Ex. 3, Jarrell Rebuttal Report at 12-13), and at his deposition referred to inflation created by the alleged accounting misrepresentation as Category A and stock price effects due to increased political and regulatory risks and the release of other non-corrective information as Category B, SUMF 19, (Ex. 4, Jarrell Dep. 43:6-47:6).

24

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 32 of 48

to the disclosure of the alleged fraud.16 But Professor Jarrell just assumes, without analysis, that the stock price declines in response to the foreseeable consequences are the same as stock price declines in response to the fraud and includes in his calculations the entire residual declines for each date, even that portion of the declines attributable to the foreseeable consequences. As a result, Professor Jarrells analysis does not prove the declines on the September disclosure dates were caused by the alleged fraud, and thus he cannot establish loss causation. Courts have continuously declined to find loss causation where the evidence suggests the market is reacting to the impact of alleged frauda foreseeable consequencerather than a corrective disclosure revealing the true facts. In Omnicom, the plaintiffs expert had opined that a directors resignation and the ensuing negative media attention were foreseeable risks of the alleged fraud. 597 F.3d at 513. The Second Circuit did not question foreseeability: Fraud may lead to a directors resignation and to negative stories by the media. Id. at 513-14. However, these negative stories did not cause recoverable securities fraud damages because they revealed nothing new about the alleged fraud. The court held, none of these matters even purported to reveal some then-undisclosed fact with regard to the specific misrepresentations alleged in the complaint . . . . Id. at 511. The Fourth Circuit in Teachers Retirement System of Louisiana v. Hunter likewise held that the plaintiffs failed to show loss causation where a stock price decline was due to the filing of a lawsuit. 477 F.3d 162, 187-88 (4th Cir. 2007). The court concluded that the market was not reacting to new facts . . . that revealed [defendants] previous

16 Testimony from Plaintiffs own expert shows why no court has adopted his direct and foreseeable standard: there is no standard. For instance, the risk that the accounting issues would lead to a change in the political environment in Congress, which would cause the market to fear new (and unspecified) limitations on the companys operations, and therefore reduce its value, is called direct. Asked what makes the factors he cites foreseeable, Professor Jarrell supported a wide variety of formulations, including: (i) a 50% likelihood; (ii) something that several people would think of who are knowledgeable and expert in the field; (iii) highly likely; (iv) potentially foreseeable; and (v) but for. SUMF 20 (Ex. 4, Jarrell Dep. 50:11-51:22; 53:16-18; 56:2-57:4; 101:2-17; 251:16). Professor Jarrells varying descriptions provide no insight into what his opinion on foreseeability actually is, and none of his various formulations satisfy the standards set forth in the relevant cases. See., e.g., Williams, 558 F.3d at 1142-43 (dismissing damages that were not the companys legally foreseeable destiny).

25

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 33 of 48

representations to have been fraudulent but only to fears of a period of instability and discord that could disrupt the companys operations. Id; see also Berks Cnty. Emps. Ret. Fund v. First Am. Corp., 734 F. Supp. 2d 533, 541 (S.D.N.Y. 2010) (rejecting plaintiffs claim for damages arising from a stock price decline allegedly prompted by announcement that defendants major customer (which happened to be Fannie Mae) was questioning its business relationship with defendant because that announcement disclosed no new information regarding defendants). In In re Oracle Corporation Securities Litigation, the Ninth Circuit rejected the plaintiffs argument that loss causation could be established by pointing to the markets reaction to an earnings missthe consequence of the alleged fraudrather than to the markets reaction to the revelation of the fraudulent acts. 627 F.3d 376, 392 (9th Cir. 2010). In reaching this conclusion, the Ninth Circuit cited the opinion in Dura, noting that [t]o touch upon a loss is not to cause a loss, and it is the latter that the law requires. Id. (citing Dura, 544 U.S. at 343); see also In re IPO Sec. Litig., 399 F. Supp. 2d 261, 266 (S.D.N.Y. 2005) (concluding that a negative market reaction to the impact of the alleged fraud, such as failure to meet earnings forecasts or a statement foreshadowing such failure, does not mean that the event disclosed the alleged scheme to the market). In In re Williams Securities Litigation, the Tenth Circuit rejected an earlier stock decline as hopelessly confounded, concluding that the filing of the very lawsuit at issue was at least one factor that was certainly at play that the plaintiffs expert had failed to consider. 558 F.3d at 1141-42 (citing Hunter, 477 F.3d at 187-88). The court observed: This is another manifestation of [the experts] belief that all negative information about [defendant company] was a revelation of the fraud- he saw no need to separate fraud-related from non-fraud-related losses, because he assumed any and all losses were of the former variety. Id. at 1142. The

26

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 34 of 48

court also concluded that another stock price decline upon the announcement of the defendant companys bankruptcy was not causally connected to the alleged fraud, even if [b]ankruptcy might have been a possibility from the moment [the alleged fraud occurred], and might even have been a likely possibility. Id. at 1143. But a likely possibility that results from the revelation of the fraud is not loss causation. The court reasoned that there are simply too many potential intervening causes to say that bankruptcy was [a] legally foreseeable destiny such that the stock price after the decline caused by the bankruptcy represented the stocks true value at the time of the initial fraud. Id. The recent decision in the Moodys securities litigation further demonstrates the courts aversion to finding loss causation by looking at the reaction to a foreseeable consequence. There the court refused to allow damages allegedly caused by the statement of a politician. Plaintiffs claimed that Moodys had falsely claimed its ratings were independent despite undisclosed conflicts of interest and sought, in part, to recover losses allegedly caused by a statement made by the ranking member of the U.S. Senate Banking Committee, Senator Shelby, the same Senator whose comments on Fannie Mae Professor Jarrell cites. SUMF 12 (Ex. 1, Jarrell Report 119 and n.88, 138; Ex. 3, Jarrell Rebuttal Report 44). The plaintiffs alleged that Senator Shelbys announcement that Moodys was facing Congressional scrutiny and that increased regulation of the credit rating agencies enjoyed bipartisan support had an immediate negative impact on the companys stock price. Moodys , 2011 U.S. Dist. LEXIS 36023, at *1314. The court rejected plaintiffs argument. It held that whether or not the call for Congressional action resulted from the alleged fraud, it did not reveal any information about that fraud, and thus did not establish loss causation. Id. at *14-15.

27

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 35 of 48

The necessity of distinguishing between losses caused by foreseeable consequences and those caused by revelation of the actual fraud is no more apparent than in the context of declines resulting from the announcement of a regulatory investigation. As a number of courts have held, such an announcement may have an understandably negative impact on a companys stock price, but that does not make it a corrective disclosure and cannot show loss causation. See, e.g., Metzler Inv. Gmbh v. Corinthian Colls., Inc., 540 F.3d 1049, 1063-64 (9th Cir. 2008) (concluding loss causation not adequately pleaded by referring to disclosure of government investigation because disclosure only revealed a risk or potential for fraudulent conduct); In re Dell Inc. Sec. Litig., 591 F. Supp. 2d 877, 910 (W.D. Tex. 2008) (holding that the announcement of an investigation, absent a revelation of prior misrepresentations, is not a curative disclosure); Berks Cnty Emps Ret. Fund, 734 F. Supp. 2d at 540-41 (denying class certification in part because of failure to establish loss causation, finding that a Bloomberg article announcing state attorney generals subpoenas was not curative); In re Avista Corp. Sec. Litig., 415 F. Supp. 2d 1214, 1220-21 (E.D. Wash. 2005) (announcements about investigation by a regulatory commission were not corrective because they didnt make the misrepresentations public and thus are insufficient to show a causal link); Rudolph v. Utstarcom, 560 F. Supp. 2d 880, 888 (N.D. Cal. 2008) (The Court therefore agrees with the other courts that have reached this question that the announcement of an internal investigation cannot support an allegation of loss causation.) (citing cases). These cases make clear that a decline caused by a foreseeable consequence to the alleged fraud cannot itself establish loss causation; the consequence of a fraud reveals nothing new about the alleged fraud, and thus does not amount to a corrective disclosure. To the extent a decline is the result of the markets reaction to the impact of the alleged fraudsuch as political reform,

28

Case 1:04-cv-01639-RJL Document 939-1 Filed 08/22/11 Page 36 of 48

management turnover, regulatory investigations, or even the filing of this very litigationthat decline does not prove that the market reacted to the disclosure of the facts that had been misrepresented. Accordingly, Professor Jarrell should have disentangled the residual stock price declines caused by a reaction to the foreseeable consequence from those caused by the revelations of the alleged misrepresentations. But Professor Jarrell admitted that he did not undertake this analysis, instead lumping all of the negative reactions together in his assessment of the September declines. SUMF 17 (Ex. 3, Jarrell Rebuttal Report 13, 20; Ex. 4, Jarrell Dep. 55:21-57:9; 179:22-181:20) (admitting that he did not exclude the effects of foreseeable consequences). Neither this court nor a jury could determine, based on Professor Jarrells incomplete analysis, that the stock price declines in September were caused by the disclosure of the alleged fraud. And for September 30, the only cause of the stock price decline identified by Professor Jarrell was the foreseeable consequencei.e., the announcement of the DOJ investigation; he does not point to any other statements revealing the alleged fraud on that day.17 SUMF 9 (Ex. 1, Jarrell Report 160-64, 168-69; Ex. 4, Jarrell Dep. 189:15-189:18). Thus his analysis on that day fails not simply because he did not disentangle the effect of the foreseeable consequence but because he did not identify any decline caused by the alleged fraud, and he cannot recover for those caused by the foreseeable consequence. Plaintiffs have thus not proven loss causation with respect to any of the September 2004 disclosure dates. The court should reject Plaintiffs request to change well established precedent

17 In fact, shortly after news broke regarding the DOJ investigation on September 30, 2004, OFHEO clarified that it had not made a criminal referral to the DOJ, and ultimately, the DOJ ultimately dropped its investigation. SUMF 123 (Ex. 11, Hearing Before the S. Comm. on Cap. Mkts., Ins. & Govt Sponsored Enters. of the H. Comm. on Fin. Servs., 108th Cong. 40, Oct. 6, 2004); SUMF 118 (Ex. 68, Wall St. J., Aug. 25, 2006, at A2). The days on which both of those positive announcements were made had statistically significant stock price increases according to Professor Jarrells analysis. SUMF 118, 128 (Ex. 2, Jarrell Report Ex. 11).

29