Professional Documents

Culture Documents

Bank

Uploaded by

Ashish LakwaniOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Bank

Uploaded by

Ashish LakwaniCopyright:

Available Formats

Origin of bank:

Without a sound and effective banking system in India it cannot have a healthy economy. The banking system of India should not only be hassle free but it should be able to meet new challenges posed by the technology and any other external and internal factors. For the past three decades Indias banking system has several outstanding achievements to its credit. The most striking is its extensive reach. It is no longer confined to only metropolitans or cosmopolitans in India. In fact, Indian banking system has reached even to the remote corners of the country. This is one of the main reasons of India's growth process. new challenges posed by the technology and any other external and internal factors. For the past three decades India's banking system has several outstanding achievements to its credit. The most striking is its extensive reach. It is no longer confined to only metropolitans or cosmopolitans in India. In fact, Indian banking system has reached even to the remote corners of the country. This is one of the main reasons of India's growth process. The government's regular policy for Indian bank since 1969 has paid rich dividends with the nationalization of 14 major private banks of India. Not long ago, an account holder had to wait for hours at the bank counters for getting a draft or for withdrawing his own money. Today, he has choice. Gone are days when the most efficient bank transferred money from one branch to other in two days. Now it is simple as instant messaging or dials a pizza. Money has become the order of the day. The first bank in India, though conservative, was established in 1786. From 1786 till today, the journey of Indian Banking System can be segregated into three distinct phases. They are as mentioned below: set up Phase I (1786- 1969) - Initial phase of banking in India when many small. Banks were

Phase II (1969- 1991) - Nationalization, regularization and growth. Phase III (1991 onwards) - Liberalization and its aftermath.

With the reforms in Phase III the Indian banking sector, as it stands today, is mature in supply, product range and reach, with banks having clean, strong and transparent balance sheets. The major growth drivers are increase in retail credit demand, proliferation of ATMs and debitcards, decreasing NPAs due to Securitization, improved macroeconomic conditions, diversification, interest rate spreads, and regulatory and policy changes (e.g. amendments to the Banking Regulation Act). Certain trends like growing competition, product innovation and branding, focus on strengthening risk management systems, emphasis on technology have emerged in the recent past. In addition, the impact of the Basel. II norms are going to be expensive for Indian banks, with the need for additional capital requirement and costly database creation and maintenance processes. Larger banks would have a relative advantage with the incorporation of the norms. Types of bank Retail banking, dealing directly with individuals and small businesses; business banking, providing services to mid-market business; corporate banking, directed at large business entities; private banking, providing wealth management services to high net worth individuals

and families; Investment banking, relating to activities on the financial markets;

Most banks are profit-making, private enterprises. However, some are owned by government, or are non-profit organizations. Central banks are normally government owned and charged

with quasi-regulatory responsibilities, such as supervising commercial banks, or controlling the cash interest rate. They generally provide liquidity to the banking system and act as the lender of last resort in event of a crisis

An Overview of the Banking System in India

Introduction:

A bank is generally understood as an institution which provides fundamental banking services such as accepting deposits and providing loans. Banks are a subset of the financial system. A banking system is also referred as a system that offers cash management services for customers reporting the transactions of their accounts. All the banks safeguard the money in terms of deposits. Banks are also providing loan, credit and payment services to their customers. Banks also provide investment and insurance products. In fact prior to the establishment of banks, many of financial services were provided by the money lenders and individuals. At that time interest rates were very high. Again there was no security of public savings and no specific norms for obtaining loans. So to overcome such problems the organized banking sector was established, which was fully regulated by the government. Historically, the first bank in India, called as The General Bank of India was established in the year 1796. The East India Company established The Bank of Bengal / Calcutta (1809), Bank of Bombay (1840) and Bank of Madras (1843). The next Bank was Bank of Hindustan which was established in 1870. These three banks (Bank of Calcutta, Bank of Bombay and Bank of Madras) were called as Presidency Banks. Punjab National Bank was set up in 1894. Between 1906 and 1913 many more banks (Bank of India, Central Bank of India, Bank of Baroda, Canara Bank, Indian Bank and Bank of Mysore) were set up.

Presently India has well established banking system. The outline of the Indian Banking Structure which comprises of The Reserve Bank of India a regulator of the banks, commercial and cooperative banks could be summarised as below: Reserve Bank of India Indian Scheduled commercial Banks which include 1. 2. 3. 4. 5. State Bank of India and its associates; Twenty nationalized banks; Regional Rural banks and Other scheduled banks (also known as Private Banks) Foreign banks

Non-scheduled banks (also known as Private banks) Co-operative banks. In the discussion below I present brief overview of the role and activities of the RBI followed by the discussion on the structure of commercial and co-operative banks. This is followed by a brief summary of the banking reform process and the recent credit measures as introduced by the RBI. Reserve Bank of India The Reserve Bank of India is the central bank of India and it was established in April 1935. The Reserve Bank of India was nationalised in 1949. Though originally the RBI was privately owned, since its nationalisation in 1949 it is fully owned by the Government of India RBI is governed by the central board (headed by the governor of the RBI) appointed by the Government of India.

The RBI Act 1934 provides the statutory basis of the functions of the RBI. The Bank was constituted for the needs of following: Functions of the RBI: Issuer of Currency: RBI works as an issuer of currency and coins. RBI also destroys the currency which not fit for circulation. Its main objective is to give the public adequate quantity of supplies of currency notes and coins and in good quality. Frames Monetary Policy: The RBI formulates, implement and monitors the monetary Policy. Its main objectives is maintaining price stability and ensuring adequate flow of credit to the productive sector of the economy. Manager of foreign reserves: The RBI is the custodian of the foreign reserves of the country and facilitates external trade and payment and promotes orderly development and maintenance of foreign exchange market in India. Banker to the Government: RBI performs the banking functions for the central and state governments and also acts as their banker. Banker to banks: RBI maintains accounts of scheduled commercial banks in India. Lender of the last resort: RBI acts as the lender of the last resort by providing rediscount facilities to the Scheduled commercial banks. Supervisory Functions: In addition to its traditional central banking functions, the Reserve Bank of India performs certain non-monetary functions of the nature of supervision of banks and promotion of sound banking in India. RBI maintains control and regulates the functioning of the commercial banks by way of supervision, evolving branch expansion policy, granting licenses to the new banks, etc. The supervisory functions of the RBI have helped to maintain financial stability in the Indian banking system. Presently RBI is very eagerly involved in

ensuring the outreach of banks to all parts of country and has adopted financial inclusion and financial literacy as one of its major objective. Indian Schedule Commercial Banks The commercial banking structure in India consists of scheduled commercial banks and nonscheduled commercial banks. Scheduled Commercial Banks in India constitute those banks which have been included in the second schedule of the RBI act 1934. RBI in turn includes only those banks as schedule banks which satisfy the certain criteria laid down by the RBI. RBI broadly classifies scheduled commercial banks as public sector banks, private sector banks and foreign banks. Thus presently public sector, private sector banks and foreign banks come under the category of scheduled commercial banks. Below diagram represents the structure of the Indian banking system. Fig 1

Public Sector Banks Public sector banks are those in which the majority stake is held by the Government of India. Public sector banks make up the largest category in the Indian banking system. They include

the State Bank of India and its six associate banks, 19 nationalized banks and IDBI Bank Limited. The public sector banks continue to be a dominant part of the banking system. The public sector banks have 58,825 branches, and account for 77.68% of the aggregate deposits and 77.25% of the aggregate advances of all the scheduled commercial banking system as of on March 31, 2010. . The State Bank of India is the largest public sector bank in India. As of March 31, 2010, the State Bank of India and its associate banks had 17,229 branches. List of public sector banks is given appendix 1A. Private Sector Banks In this type of banks, the majority of share capital is held by the private individuals and corporate. In the initial years after nationalisation, entry of private sector banks was completely prohibited. In July 1993, as part of the banking reform process and as a measure to induce competition in the banking sector, the RBI permitted entry of the private sector into the banking system. This resulted in the introduction of nine private sector banks. These banks are collectively known as new private sector banks. As of March 31, 2010, there were 22 private sector banks, of which seven were new private sector banks and 15 were old private sector banks existing prior to January 1993. New private sector banks have seen significant growth in both the assets and infrastructure during the last decade. The entry of new private sector banks has increased the industry competitiveness, enhanced customer service orientation, product innovation and technological advancement. As of March 31, 2010, private sector banks accounted for approximately 17.31% of aggregate deposits and 18.09% of aggregate advances of the scheduled commercial banks. Private sector

banks had a network of 10,027 branches, accounting for 14.50% of the total branch network of scheduled commercial banks in the country. A large part of this branch network is attributable to new private sector banks. List of Private banks is given in appendix.

Foreign Banks Foreign banks are those banks which have registered their head offices in a foreign country but operate their branches in India. The RBI permits these banks to operate either through their branches or through their subsidiaries. As of on March 31, 2010, there were 34 foreign banks with 308 branches operating in India, accounting for 5.0% of aggregate deposits and 4.66% of aggregate advances of scheduled commercial banks. As part of the liberalisation process, the RBI has permitted foreign banks to operate more freely, subject to requirements largely similar to those imposed on domestic banks. List of foreign banks is given in appendix 1C. Regional Rural Banks The necessity of rural banks was felt because the then existing credit agencies the cooperative banks and the commercial banks lacked in certain respects in meeting the needs of the rural areas. Thus, Regional rural banks in India have been set up with the idea of combining the local feel of and familiarity with local problems characteristic of co-operatives with the professionalism and large resource base of commercial banks. Besides it was observed that in the initial years of banking development in India, commercial banks were basically urban-oriented, if they have to play a significant role in rural banking, their methods procedures, training and orientation shall have to be adapted to the rural environment. This was not likely to be achieved easily and quickly. Moreover, the cost of their operations was quite high due to high salary structure, staffing pattern and high establishment

cost. Thus the commercial banks were unable to provide credit at cheap rates to the weaker sections in the rural areas. A Rural Bank was contemplated as an institution to combine the rural touch and local feel, a familiarity with rural problems and attitudinal identification with the rural economy which the co-operatives possess in large degree, with the modern business organization, commercial discipline ability to mobilize resources and access to the central money markets which the commercial banks have. Broadly Regional Rural banks are owned by the Central Government, State government and by the sponsor commercial bank. Co-operative Banks Cooperative banks are small sized units organised in the co-operative sector which operate both in urban and rural areas. These banks traditionally centred around communities, localities and work place groups and they essentially lend to small borrowers and businesses. The term Urban Co-operative Banks (UCBs) though not formally defined refers to primary cooperative banks located in urban and semi-urban areas. While the co-operative banks in rural areas mainly finance agricultural based activities including farming, cattle, milk, hatchery, personal finance along with some small scale industries and self-employment driven activities, the co-operative banks in urban areas mainly finance various categories of people for selfemployment, industries, small scale units and home finances. These banks also provide most services such as savings and current account deposit services to their customers. The co-operative banking structure in India is divided into following main groups: Primary Urban Co-operative Banks Primary Agricultural Societies

District Central Co-operative Banks State Co-operative Banks Land Development Banks Co-operative banks in India are registered in India under the Co-operative Societies Act. Presently RBI is responsible for supervision and regulation of urban co-operative banks, and the NABARD for State Cooperative Banks and District Central Cooperative Banks. (Need to be further strengthened) Competitive Landscape of Banks in India - Other Financial Institutions Banks face competition from a wide range of financial intermediaries in the public and private sectors in the areas of financial intermediation and financial services. Such intermediaries form a diverse group in terms of size and nature of their activities, and play an important role in the financial system by not only competing with banks, but also complementing them in

providing a wide range of financial services. Some of these intermediaries include Long-Term Lending Institutions These institutions provide fund-based and non-fund-based assistance to industry in the form of loans, underwriting, and direct subscription to shares, debentures and guarantees. Although the initial role of these institutions was largely limited to providing a channel for government funding to industry, the reform process required them to expand the scope of their business activities. Their new activities include: Fee-based activities such as investment banking and advisory services Short-term lending activity including corporate finance and issuing working capital loans (Needs to be strengthened list of the long term lending institutions to be include)

Non-Banking Finance Companies The non-bank finance companies may be categorised into entities which take public deposits and those which do not. The companies which accept public deposits are subject to the strict supervision and capital adequacy requirements of the RBI. The scope and activities of non-bank finance companies have grown significantly over the years. The primary activities of the nonbank finance companies are consumer credit, including automobile finance, home finance and consumer durable products finance, wholesale finance products such as bill discounting for small and medium-sized companies, and fee-based services such as investment banking and underwriting. (Needs to be strengthened)

Housing Finance Companies Housing finance companies form a distinct subgroup of the non-bank finance companies. As a result of various incentives given by the Government of India for investing in the housing sector in recent years, the scope of this business has grown substantially. The National Housing Bank Act provides for the securitization of housing loans, foreclosure of mortgages and establishment of the Mortgage Credit Guarantee Scheme. RBI prescribes the limit for housing loan and also mortgage against it. Specialized Financial Institutions In addition to the long-term lending institutions, there are various specialized public sector financial institutions which cater to the specific needs of different sectors. They include: National Bank for Agricultural and Rural Development Export-Import Bank of India

Small Industries Development Bank of India (SIDBI) National Housing Bank

NETWORTH Definition of Net Worth in Accounting In accounting, net worth is defined as assets minus liabilities. Essentially, it is a measure of what an entity is worth. For an individual, it represents the properties owned, less any debt the person has. For a company, net worth is the value of the company. It is an important section of a company's balance sheet and is sometimes called "owner's equity" or "shareholder's equity." Assets To arrive at a company's net worth, one must first calculate the current value of the company's assets. Assets typically include cash, cash equivalents, property, inventory, machinery and buildings. For a bank, assets are loans it has made to other people. For a manufacturing company, the bulk of its assets might lie in property, materials, plants and equipment. For individuals, assets include cash, savings accounts, property like homes and cars, investment accounts and other valuable properties, such as jewelry and antiques. Liabilities The term "liabilities" refers to debt outstanding. It is basically money owed to someone else. It can be bank debt, bonds or promissory notes. It can also be more immediate debts, such as outstanding payments that the company owes to vendors or a line of credit at a bank. For a bank, the liabilities are the amounts the bank owes its depositors, meaning the people who have

money in accounts at that bank. For individuals, credit card debt, car loans and mortgages make up the bulk of liabilities. Equity The term "equity" means ownership. The amount of assets after all liabilities have been subtracted gives you a measure of the company's ownership or value. Net worth and equity basically mean the same thing, the value of the company. Sometimes net worth is called shareholder's equity, if the company is owned by shareholders. Shareholders are sometimes called stockholders and they are the owners of the company's equity. Net worth is very important to them. For individuals, equity in a house is what you own, free and clear of the mortgage holder. For a homeowner, a significant part of net worth comes from the value of the house, minus the amount outstanding on any mortgages. Increasing Net Worth A company can increase its net worth by paying down liabilities or increasing assets. If a company has positive earnings on its income statement at the end of the year, this will increase its net worth in the form of retained earnings. On the other hand, negative earnings (losses) will decrease net worth. Paying out dividends can also decrease a company's net worth.

Advantages It is easy to find out the net worth of a company-simply refer to its latest balance sheet. Net worth provides a simple and straightforward way of measuring a companys breakup value if it were to cease trading.

Disadvantages The balance sheet does not necessarily reflect the current market value of a firm but simply expresses the value at a particular point in time, i.e. when the balance sheet was drawn up. It is also worth remembering that a company may have a different value if it is sold as a going concern. Net worth may underestimate or overestimate the true value of a company by a considerable extent. It does not take into account intangible assets such as goodwill, copyright, patents, and intellectual property. It also ignores how much revenue and profit (or loss) a company is generating. Action Checklist Obtain the companys net worth from its latest balance sheet. Obtain as much other financial information as possible, including figures for revenue and profit (or loss). Look at other indicators, such as the firms order book, and try to assess nonfinancial factors such as goodwill and the competitiveness of the companys goods and services. Dos and Donts Do Obtain an estimate of the intangible assets of a company, such as intellectual property. Look at other measures of corporate health, such as revenues, costs, and profits (or losses), as well as forward indicators such as order books.

Try to obtain estimates of the current value of the companys assets and liabilities, rather than rely on figures from the balance sheets, which may be considerably out of date in volatile market conditions. Dont Dont assume that net worth provides an accurate guide to the current value of a company.

You might also like

- TitleDocument6 pagesTitleAshish LakwaniNo ratings yet

- Ratio Analysis Project ReportDocument80 pagesRatio Analysis Project ReportAshish LakwaniNo ratings yet

- Windows 8 KeysDocument1 pageWindows 8 KeysAshish LakwaniNo ratings yet

- Ashish SMDocument29 pagesAshish SMAshish LakwaniNo ratings yet

- Social Media Effects On YouthDocument29 pagesSocial Media Effects On YouthNitin Singh100% (1)

- 05 - List of ContentsDocument3 pages05 - List of ContentsAshish LakwaniNo ratings yet

- PDFSigQFormalRep PDFDocument1 pagePDFSigQFormalRep PDFJim LeeNo ratings yet

- Current Trends in Strategic Management 1Document25 pagesCurrent Trends in Strategic Management 1Ashish Lakwani0% (1)

- Process CostingDocument29 pagesProcess CostingAshish Lakwani100% (4)

- TJSB PresentationDocument16 pagesTJSB PresentationAshish LakwaniNo ratings yet

- Success in SME FinancingDocument33 pagesSuccess in SME FinancingSachin GuptaNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

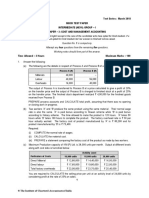

- Paper 3 Cost and Management Accounting PDFDocument6 pagesPaper 3 Cost and Management Accounting PDFMEGHANANo ratings yet

- Court complaint against builder for fraudDocument20 pagesCourt complaint against builder for fraudUtkarsh KhandelwalNo ratings yet

- Why Good Managers Make Bad Ethical ChoicesDocument7 pagesWhy Good Managers Make Bad Ethical Choicesneeraj1412No ratings yet

- Request For NOC To Avail LoanDocument3 pagesRequest For NOC To Avail LoanShirish63% (8)

- Chapter9Solutions (Questions)Document14 pagesChapter9Solutions (Questions)ayaNo ratings yet

- Legal Memo - Collection of Sum of MoneyDocument9 pagesLegal Memo - Collection of Sum of MoneyArnold Cavalida Bucoy100% (3)

- G.R. No. 85733 February 23, 1990 Land Dispute Case Between Original Owners and Successive BuyersDocument5 pagesG.R. No. 85733 February 23, 1990 Land Dispute Case Between Original Owners and Successive BuyersJay-ar TeodoroNo ratings yet

- Chapter 8 Debentures and ChargesDocument2 pagesChapter 8 Debentures and ChargesNahar Sabirah100% (1)

- Singsong vs. SawmillDocument2 pagesSingsong vs. SawmillLilibeth Dee GabuteroNo ratings yet

- Merchant Bank in IndiaDocument14 pagesMerchant Bank in IndiaRk BainsNo ratings yet

- Exotic Options: - Digital and Chooser OptionsDocument8 pagesExotic Options: - Digital and Chooser OptionsKausahl PandeyNo ratings yet

- Quantitative Problems Chapter 12 Mortgage CalculationsDocument9 pagesQuantitative Problems Chapter 12 Mortgage Calculationswaqar hattarNo ratings yet

- Crump - The Phenomenon of Money (1981)Document258 pagesCrump - The Phenomenon of Money (1981)Anonymous OOeTGKMAdD100% (1)

- Sbi-Tripatitie AgreementDocument5 pagesSbi-Tripatitie Agreementbulu_bbsr0375% (4)

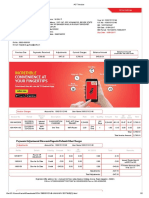

- Explanation of Amount Due: Account Summary Past Payments BreakdownDocument3 pagesExplanation of Amount Due: Account Summary Past Payments BreakdownTribe Of JudahNo ratings yet

- Obligations: A. Solutio Indebiti - Undue Payment. B. Negotiorum Gestio - UnauthorizedDocument21 pagesObligations: A. Solutio Indebiti - Undue Payment. B. Negotiorum Gestio - UnauthorizedJamesCarlSantiago100% (1)

- Common Law Liens InformationDocument1 pageCommon Law Liens InformationRichard Bauarschi100% (2)

- 601 PrivateControlOfMoney1Document7 pages601 PrivateControlOfMoney1hanibaluNo ratings yet

- Bedspace ContractDocument3 pagesBedspace ContractDana100% (1)

- Final Accounts QuestionsDocument6 pagesFinal Accounts QuestionsGandharva Shankara Murthy100% (1)

- A Study On Ratio Analysis at Amararaja BDocument79 pagesA Study On Ratio Analysis at Amararaja Bsiva100% (1)

- Project Report - PNBDocument81 pagesProject Report - PNBabirwadhwa6027100% (1)

- 10000003728Document32 pages10000003728Chapter 11 DocketsNo ratings yet

- 2015 UBS IB Challenge Corporate Finance OverviewDocument23 pages2015 UBS IB Challenge Corporate Finance Overviewkevin100% (1)

- Solved Scanner CA Final Paper 2Document3 pagesSolved Scanner CA Final Paper 2Mayank Goyal0% (1)

- Sitara Chemical Sukuk IssueDocument2 pagesSitara Chemical Sukuk IssueTIN_CUP_87100% (1)

- Atria Convergence Technologies PVT - LTD, Due Date: 15/01/2017Document2 pagesAtria Convergence Technologies PVT - LTD, Due Date: 15/01/2017Vasav Panguluri100% (1)

- Solution of Tata Gold Plus Case StudyDocument11 pagesSolution of Tata Gold Plus Case Studykushalgpt75100% (5)

- Synopsis-Un Paid SellerDocument2 pagesSynopsis-Un Paid SellerVivek RanjanNo ratings yet

- FI/CO Reports GuideDocument4 pagesFI/CO Reports GuideVinoth Kumar PeethambaramNo ratings yet