Professional Documents

Culture Documents

Untitled

Uploaded by

perkisasOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Untitled

Uploaded by

perkisasCopyright:

Available Formats

Discuss & give comments on operational issues of BBA Home-financing in Malaysia or any other countries 2.

Comparisons between housing Loan, BBA and MM home financing 3. The importance of deposits mobilization in Islamic 4. What do you understand by Ar-Rahn? Explain banks

5. Describe the practices of Islamic trades finance in Malaysia or any other Isl amic countries that you know

Bai Bithman Ajil or BBA, is an Islamic financing product involving sale of goods where the sale price is payable on instalment basis. This type of transaction i s best referred to as "deferred payment sale". However, in easy to understand, i t's just a purchase of good on credit on the fixed assets e.g. houses, shophouse s, factories and other fixed assets. Under conventional banking perspective, banks do not engage in the business of s elling goods but grant loans repayable by monthly instalment where interest is c harged until the original loan amount is fully repaid. But, in Islam, interest c harge is considered as usury or riba, and it is Haram. BBA is widely applied by the Malaysian Islamic banking, but it seems they try to change into the better product such as Musyaraqah Mutanaqisah. In fact, it is a lso popular in Brunei and Bangladesh. Nevertheless, this concept is not accepted Islamic banks in the Middle East and Pakistan. This is because the majority of Shariah scholars in the region consider this con cept does not meet the original concept BBA. In fact, the Malaysian version of B BA is also seen as a combination of two concepts of Bai 'Inah (sale and buy-back ) and Bai Muajjal (sales to delay payment and installments). Hence, Islamic banks in the Middle East prefer other more emphasizes the concept of sharia by ijtihad meet their objectives such as Ijarah, Musharakah and other s. Put simply, BBA Malaysia version works like this: When looking to buy a house co sting RM200,000, a person will pay a sum of money to the seller / developer as a booking and then pay 10 percent, as a deposit. After gaining a sale and purchase agreement (S & P agreement) between buyer and seller, customer will find the Islamic banks that can provide financing him. When meet all the stated requirements, the bank agreed to buy the house for the customer for RM180, 000 by cash. Accordingly, the houses will be owned banks and bank ownership mark on the house is through the 'declaration of trust' and a 'charge' as a sign of the right for the bank on the house.Then, the Islamic banks will sell the house is the new pr ice to the customer For example, the new price is RM350,000 which can be paid by the customer in mon thly installments for 25 years or more, depending on the agreement. Before a person decide to buy a house, there are few consideration that they hav e to look at, first is the intereset rate charge or according to Islamic bank us ed as their profit rate,secondly the margin of financing, which how much loan th

ey can take, the loan tenure, which how long the allowed to settle the loan and the lock-in period which how much penalty they will imposed if they manage to se ttle the loan earlier that period they supposed to settle. Nowadays, People are in dilemma to find the suitable housing loan, which they co mpare among the Islamic and conventional financing. As for conventional, the ban k will charge interest depend on the OPR (Overnight Policy Rate) set by Bank Neg ara Malaysia (BNM). Bai Bithman Ajil or BBA, is an Islamic financing product involving sale of goods where the sale price is payable on instalment basis. This type of transaction i s best referred to as "deferred payment sale". However, in easy to understand, i t's just a purchase of good on credit on the fixed assets e.g. houses, shophouse s, factories and other fixed assets. BBA is popular in countries like Malaysia, Indonesia and Brunei. The MM or dimin ishing partnership is widely practiced in the Middle East, the United States, Ca nada, England and Australia. Shariah scholars from the Middle East generally dis approve of the BBA partnership contract. This is because the majority of Shariah scholars in the region consider this con cept does not meet the original concept BBA. In fact, the Malaysian version of B BA is also seen as a combination of two concepts of Bai 'Inah (sale and buy-back ) and Bai Muajjal (sales to delay payment and installments). In Malaysia, where the BBA, the voices of discontent were beginning to emerge fr om its customers. BBA criticized as unjust trading instruments compared to conve ntional system. What appears to be a problem in practice BBA is customer must sign the Sale and Purchase Agreement (S & P) and the developer / seller and pay a 10% deposit befo re getting bank financing. Then the bank will buy the right customer through the S & P and then pay the ful l price of the house to the developer / buyer before selling it back to the cust omer at the grace including the rate of profit. The fact of the situation in Malaysia, although a project is completed or abando ned fails, customers still need to pay monthly installment or pay a profit rate on the payment already made the bank to the developer / seller. Musharakah Mutanaqisah or MM also there are 2 parts, the first bank and the buye r will be partners in the ownership of a house owned bank's largest shareholder, while customers become minority owners. For example, banks 90%, while the remaining 10% is on the customer. Customers wi ll gradually dominate the share of bank-owned homes through monthly payments to own bank shares and at the end of the contract period, the house will become a w holly-owned by the customers. Besides, on the second part, banks, through the concept of Ijarah (lease. Under lease concept, the customer will pay rent to the bank along the monthly installm ent. The payment of house rental stock ownership decreases as the ratio of bank ownership shares purchased by the customer. In conclusion, based on the comparison of these three product, the customer must

make the choice for the sake of this world and also in the hereafter. it seems that MM have better advantages which have lower total of payment, and the custo mer also have potential to pay more and increase the shareholding and have great er potential to owns the house quicker than other product. But for BBA, also have owns advantages, such as, fixed selling price, by having fixed mark up monthly payment, and the customer actually still can get a discoun t when they pay earlier than the exact period.

http://www.zaharuddin.net/content/view/192/63/ http://ms.wikipedia.org/wiki/Bai%27_Bithaman_Ajil Islamic Home Financing through Musharakah Mutanaqisah and al-Bay racts: A Comparative Analysis by Ahamed Kameel Mydin Meera & Dzuljastri Abdul Razak Bithaman Ajil Cont

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Islamic Bank MicroDocument2 pagesIslamic Bank MicroperkisasNo ratings yet

- Maqasid Shariah and Islamic Fin PDFDocument30 pagesMaqasid Shariah and Islamic Fin PDFperkisasNo ratings yet

- Full Mikro PDFDocument15 pagesFull Mikro PDFperkisasNo ratings yet

- Deposit MobiliziationDocument454 pagesDeposit MobiliziationperkisasNo ratings yet

- Maqasid Shariah and Islamic Fin PDFDocument30 pagesMaqasid Shariah and Islamic Fin PDFperkisasNo ratings yet

- Wealth ManagementDocument40 pagesWealth ManagementperkisasNo ratings yet

- Supermax PDFDocument7 pagesSupermax PDFperkisasNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tachycardia Algorithm 2021Document1 pageTachycardia Algorithm 2021Ravin DebieNo ratings yet

- BECIL Registration Portal: How To ApplyDocument2 pagesBECIL Registration Portal: How To ApplySoul BeatsNo ratings yet

- Ymrtc LogDocument26 pagesYmrtc LogVinicius Silveira0% (1)

- UnixDocument251 pagesUnixAnkush AgarwalNo ratings yet

- Journal of Atmospheric Science Research - Vol.5, Iss.4 October 2022Document54 pagesJournal of Atmospheric Science Research - Vol.5, Iss.4 October 2022Bilingual PublishingNo ratings yet

- A Review of Stories Untold in Modular Distance Learning: A PhenomenologyDocument8 pagesA Review of Stories Untold in Modular Distance Learning: A PhenomenologyPsychology and Education: A Multidisciplinary JournalNo ratings yet

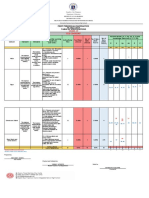

- Revised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10Document6 pagesRevised Final Quarter 1 Tos-Rbt-Sy-2022-2023 Tle-Cookery 10May Ann GuintoNo ratings yet

- ISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)Document9 pagesISO - 21.060.10 - Bolts, Screws, Studs (List of Codes)duraisingh.me6602No ratings yet

- Le Chatelier's Principle Virtual LabDocument8 pagesLe Chatelier's Principle Virtual Lab2018dgscmtNo ratings yet

- Rockwell Collins RDRDocument24 pagesRockwell Collins RDRMatty Torchia100% (5)

- Buildingawinningsalesforce WP DdiDocument14 pagesBuildingawinningsalesforce WP DdiMawaheb ContractingNo ratings yet

- List of The Legend of Korra Episodes - Wikipedia PDFDocument27 pagesList of The Legend of Korra Episodes - Wikipedia PDFEmmanuel NocheNo ratings yet

- Using The Monopoly Board GameDocument6 pagesUsing The Monopoly Board Gamefrieda20093835No ratings yet

- Asus Test ReportDocument4 pagesAsus Test ReportFerry RiantoNo ratings yet

- 200150, 200155 & 200157 Accelerometers: DescriptionDocument16 pages200150, 200155 & 200157 Accelerometers: DescriptionJOSE MARIA DANIEL CANALESNo ratings yet

- Student Exploration: Digestive System: Food Inio Simple Nutrien/oDocument9 pagesStudent Exploration: Digestive System: Food Inio Simple Nutrien/oAshantiNo ratings yet

- Meriam Mfc4150 ManDocument40 pagesMeriam Mfc4150 Manwajahatrafiq6607No ratings yet

- Christena Nippert-Eng - Watching Closely - A Guide To Ethnographic Observation-Oxford University Press (2015)Document293 pagesChristena Nippert-Eng - Watching Closely - A Guide To Ethnographic Observation-Oxford University Press (2015)Emiliano CalabazaNo ratings yet

- Freshers Jobs 26 Aug 2022Document15 pagesFreshers Jobs 26 Aug 2022Manoj DhageNo ratings yet

- Intervensi Terapi Pada Sepsis PDFDocument28 pagesIntervensi Terapi Pada Sepsis PDFifan zulfantriNo ratings yet

- QuinnmcfeetersresumeDocument1 pageQuinnmcfeetersresumeapi-510833585No ratings yet

- Vedic Maths Edited 2Document9 pagesVedic Maths Edited 2sriram ANo ratings yet

- Pt. Trijaya Agro FoodsDocument18 pagesPt. Trijaya Agro FoodsJie MaNo ratings yet

- 10 Essential Books For Active TradersDocument6 pages10 Essential Books For Active TradersChrisTheodorou100% (2)

- PDF of Tally ShortcutsDocument6 pagesPDF of Tally ShortcutsSuraj Mehta100% (2)

- Toi Su20 Sat Epep ProposalDocument7 pagesToi Su20 Sat Epep ProposalTalha SiddiquiNo ratings yet

- Unit 4Document15 pagesUnit 4David Lopez LaraNo ratings yet

- Oracle SOA Suite 11g:buildDocument372 pagesOracle SOA Suite 11g:buildMohsen Tavakkoli100% (1)

- GTA IV Simple Native Trainer v6.5 Key Bindings For SingleplayerDocument1 pageGTA IV Simple Native Trainer v6.5 Key Bindings For SingleplayerThanuja DilshanNo ratings yet

- The Minimum Means of Reprisal - China's S - Jeffrey G. LewisDocument283 pagesThe Minimum Means of Reprisal - China's S - Jeffrey G. LewisrondfauxNo ratings yet