Professional Documents

Culture Documents

10000001099

Uploaded by

Chapter 11 Dockets0 ratings0% found this document useful (0 votes)

35 views14 pages) Cordillera GOLF CLUB, LLC, v. ALPINE BANK, (case No. 12-11893) Plaintiff seeks to determine validity, priority,. Extent of lien, for declaratory relief and for avoidance of lien. Venue for this proceeding is The United States Bankruptcy Court for the District of Delaware.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document) Cordillera GOLF CLUB, LLC, v. ALPINE BANK, (case No. 12-11893) Plaintiff seeks to determine validity, priority,. Extent of lien, for declaratory relief and for avoidance of lien. Venue for this proceeding is The United States Bankruptcy Court for the District of Delaware.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

35 views14 pages10000001099

Uploaded by

Chapter 11 Dockets) Cordillera GOLF CLUB, LLC, v. ALPINE BANK, (case No. 12-11893) Plaintiff seeks to determine validity, priority,. Extent of lien, for declaratory relief and for avoidance of lien. Venue for this proceeding is The United States Bankruptcy Court for the District of Delaware.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 14

IN THE UNITED STATES BANKRUPTCY COURT

FOR THE DISTRICT OF DELAWARE

In re: )

)

CORDILLERA GOLF CLUB, LLC

1

dba

The Club at Cordillera,

) Case No. 12-11893 (CSS)

)

Debtor.

) Chapter 11

)

______________ )

CORDILLERA GOLF CLUB, LLC,

Plaintiff,

v.

ALPINE BANK,

Defendant.

)

)

)

)

) Adv. Pro. No.: 12-

)

)

)

)

__________________________ )

----

COMPLAINT TO DETERMINE VALIDITY, PRIORITY, PERFECTION AND EXTENT

OF LIEN; FOR DECLARATORY RELIEF; AND AVOIDANCE OF LIEN

The Plaintiff, Cordillera Golf Club, LLC ("Plaintiff' or "Debtor"), pursuant to 11

U.S.C. 544(a)(l), 550, and 551, hereby files its Complaint against defendant, Alpine Bank

("Defendant") to determine validity, priority and extent of lien, for declaratory relief and for

avoidance of lien, stating and alleging as follows:

JURISDICTION AND VENUE

1. The United States Bankruptcy Court for the District of Delaware (the

"Bankruptcy Court") has jurisdiction over the parties and subject matter of this proceeding

1

The Debtor in this chapter 11 case, and the last four digits of its employer tax identification number, is

XX-X:XX1317. The corporate headquarters address for the Debtor is 97 Main Street, Suite E202, Edwards,

Colorado 81632.

01:12258036.1

pursuant to 28 U.S.C. 157 and 1334, and the Amended Standing Order of Reference from the

United States District Court for the District of Delaware dated as of February 29,2012.

2. This proceeding is a core proceeding pursuant to 28 U.S.C. 157(b )(1) and

157(b)(2).

3.

1409(a).

4.

Venue for this proceeding is proper in this District pursuant to 28 U.S.C.

The statutory predicates for the relief requested herein are 506, 544, 550 and

551 of the United States Bankruptcy Code, 11 U.S.C. 101-1330 (the "Bankruptcy Code") and

Rule 7001 of the Federal Rules of Bankruptcy Procedure.

THE PARTIES

5. The Debtor is a limited liability company duly organized under and existing

pursuant to the laws of the State of Delaware and is operating its business and to managing its

properties as a debtor-in-possession under sections 11 07(a) and 1108 of the Bankruptcy Code.

6. The Defendant, Alpine Bank, is a Colorado banking corporation organized under

and pursuant to the laws of Colorado. The Defendant provided a business loan to the Debtor as

further described below.

FACTUAL BACKGROUND

7. The Debtor is the owner and operator of "The Club at Cordillera" (the "Club")

located in Edwards (Eagle County), Colorado. The Club facilities consist of, among other

property, three (3) full length golf courses (the "Courses"), four distinct clubhouses, real estate

surrounding the Courses, a Dave Pelz short course, an athletic club offering indoor lap pool and

fitness facilities, a tennis and swim club, and a winter nordic center with groomed tracks

(collectively, the "Facilities").

01:12258036.1

2

A. The Alpine Bank Loan

8. Or about June 26, 2009, the Defendant and the Debtor entered into that certain

Business Loan Agreement (the "Alpine Loan Agreement"), pursuant to which Alpine loaned to

the Debtor the original principal amount of$13,700,000 (the "Alpine Loan").

9. The Alpine Loan is evidenced by a Promissory Note dated June 29, 2009 (the

"Alpine Note"). The Note matured on June 26, 2012. The Alpine Loan purports to be secured

pursuant to a Deed of Trust dated June 26, 2009 and recorded in Eagle County Record's Office

on June 29, 2009 as Document No. 200912623 (the "Alpine Deed of Trust").

10. As security for the Debtor's obligations under the Alpine Note, the Alpine Deed

of Trust purports to encumber the real property described therein, including all or a portion of the

debtor's Facilities (the "Real Property").

11. The Alpine Deed of Trust also purports to encumber certain personal property

described therein, including "all equipment, fixtures, and other articles of personal property now

or hereafter owned by Grantor, and now or hereafter attached or affixed to the Real Property."

The Alpine Note also purports to be secured pursuant to a Collateral Assignment of Contracts

dated June 26, 2009 purporting to encumber certain water rights, and related contracts as listed

therein; a Collateral Assignment and Security Agreement Covering Agreements, Permits and

Contracts dated June 26, 2009, purporting to encumber the "Collateral" as defined therein,

including contracts, licenses, and other agreements as described therein; a Collateral Assignment

and Security Agreement Covering Golf Membership Revenues dated June 26, 2009, purporting

to encumber "Net Sales Revenues" and "Income from Dues" as defined therein, including

revenues from the sale of golf course memberships with respect to the Courses and dues,

assessments, fees or other charges on account of memberships in the Club; a Commercial Pledge

01:12258036.1

3

Agreement dated June 26, 2009 purporting to encumber all memberships in the Club; and a

Commercial Security Agreement dated June 26, 2009 purporting to encumber furniture, fixtures,

equipment, inventory, accounts receivable, general intangibles, contracts and contract rights,

permits, goods, instruments, investment property, letter of credit rights, chattel paper,

commercial tort claims, and all proceeds from the disposition thereof (all of the personal

property purporting to be collateral for the Alpine Note) (collectively, the "Personal Property").

The above described documents and other documents entered into in connection with the Alpine

Loan are collectively referred to as the "Alpine Loan Documents," and the documents referred to

above have been filed with the Court in the Chapter 11 Case (defined below) at Docket No. 11.

12. Pursuant to the Alpine Loan Documents, the Defendant purports to have a secured

lien over the Real Property and Personal Property (the "Prepetition Lien").

13. On June 30, 2009, Alpine filed a UCC Financing Statement (the "Alpine

Financing Statement") with the Delaware Secretary of State purporting to perfect its security

interest in the Personal Property. A copy of the Alpine Financing Statement is attached hereto as

Exhibit A.

14. The description of collateral in the Alpine Financing Statement states in Item 4:

"This FINANCING STATEMENT covers the following collateral: PDF ATTACHED."

However, the attached pdf exhibit referred was not attached to the original Alpine Financing

Statement.

15. On or about June 30,2010, almost one (1) year later, apparently recognizing its

mistake, Alpine caused to be filed a "UCC Form Correction Statement" (the "Alpine Correction

Statement") checking Item 2a: "RECORD is inaccurate," and stating: "Item 4 of the UCC

Financing Statement stated the collateral was attached in a PDF, but when filed the PDF did not

01:12258036.1

4

attach. Attached to this document is the missing PDF that needs to be added to the original filing

effective as of the original filing date." A personal property description was attached to the

Alpine Correction Statement. Item 4 of the Alpine Correction Statement referring to the person

authorizing the Alpine Correction Statement, refers to "Alpine Bank." The Alpine Correction

Statement is attached hereto as Exhibit B.

B. The Debtor's Chapter 11 Filing

16. On June 26, 2012 (the "Petition Date"), the Debtor filed a voluntary petition for

relief under chapter 11 of the Bankruptcy Code, thereby initiating Case No. 12-11893 with the

Bankruptcy Court (the "Chapter 11 Case").

COUNT I:

DECLARATORY JUDGMENT THAT PREPETITION LIEN WITH REGARD TO

PERSONALPROPERTYISUNPERFECTED

17. The Debtor repeats and realleges the allegations contained in Paragraphs 1

through 16 above as though fully set forth herein.

18. The Debtor is entitled to a determination ofthe validity, priority, perfection and

extent of the Prepetition Lien alleged by the Defendant.

19. The Debtor is deemed located in the State of Delaware pursuant to the Uniform

Commercial Code as in effect in the State of Colorado and the State of Delaware for purposes of

the law governing perfection of the Prepetition Lien in the Personal Property capable of being

perfected by the filing of a financing statement under the Delaware Uniform Commercial Code

(the "Code").

20. In order to perfect the Prepetition Lien in the Personal Property capable of being

perfected by the filing of a financing statement under the Code, the Defendant was required to

01:12258036.1

5

file a sufficient financing statement with the Delaware Secretary of State under the Debtor's

name meeting the requirements set forth in Sections 9-502 and 9-504 of the Code.

21. Inasmuch as there was no description at all of any Personal Property attached to

the Alpine Financing Statement, the original Alpine Financing Statement does not have a

sufficient description of the Personal Property within the meaning of and as required by

Delaware UCC Sections 9-502 and 9-504 for perfection purposes and is therefore defective and

inadequate to perfect Alpine's asserted lien in any of the Personal Property.

22. The filing of a "Correction Statement" by the Defendant attaching a personal

property description in an attempt fix the deficiency in the original Alpine Financing Statement

does not cure any defect in the Alpine Financing Statement.

23. As a result, the Defendant's Prepetition Lien in any Personal Property in which

perfection must be accomplished by the filing of a financing statement under the Code or other

applicable law is unperfected.

24. Prior to the Petition Date, the Debtor is informed and believes that Alpine Bank

did not take any action permitted or required by the Code or other applicable law to perfect its

Prepetition Lien in any of the Personal Property which may be or is required to be perfected by a

method other than the filing of a sufficient financing statement with the Delaware Secretary of

State.

25. None of the Defendant's Prepetition Lien in portions of the Personal Property

which may be or is required to be perfected by means other than the filing of a financing

statement with the Delaware Secretary of State is perfected.

26. None of the Defendant's Prepetition Liens in the Personal Property is perfected.

01:12258036.1

6

27. There is an actual controversy between the parties as to whether the Defendant's

Prepetition Lien in any Personal Property is perfected.

28. Entry of a declaratory judgment as to whether the Defendant's Prepetition Lien in

any Personal Property is perfected will settle the controversy currently existing between the

parties.

29. A declaratory judgment or order determining the validity, priority, perfection and

extent of the Prepetition Lien in any Personal Property alleged by the Defendant is therefore

warranted.

COUNT II:

A VOIDANCE OF UNPERFECTED LIEN PURSUANT TO 544(A)(l) OF THE

BANKRUPTCY CODE

30. The Debtor repeats and realleges the allegations contained in Paragraphs 1

through 29 above as though fully set forth herein.

31. Where a creditor has failed to perfect a security interest in property under

applicable state law, the security interest is avoidable under Bankruptcy Code section 544.

32. The Defendant failed to properly perfect its Prepetition Lien in the Personal

Property as required by applicable state law.

33. The Defendant's unperfected Prepetition Lien in the Personal Property is

avoidable by the Debtor pursuant to Bankruptcy Code section 544(a)(l).

34. The Defendant's avoided security interest is preserved for the benefit of the

Debtors' bankruptcy estate pursuant to Bankruptcy Code section 5 51.

35. Pursuant to sections 544 and 550 ofthe Bankruptcy Code, the Debtor, as debtor in

possession, has a right to avoid the Defendant's Prepetition Lien in any Personal Property.

01:12258036.1

7

36. Accordingly, the Debtor hereby requests that the Defendant's asserted Prepetition

Lien in any Personal Property be avoided; that such avoided lien be preserved for the benefit of

the Debtor's estate; and the Court award such costs and fees which the Court in its power may

award pursuant to sections 544, 550 and/or other applicable provisions of the Bankruptcy Code.

WHEREFORE, the Debtor requests that this Court enter a judgment in favor of the

Debtor and against the Defendant:

01:12258036.1

a. Declaring that the Defendant's Prepetition Lien m the Personal Property 1s

unperfected;

b. A voiding the Defendant's Prepetition Lien in any Personal Property pursuant to

sections 544 and 550 of the Bankruptcy Code;

c. Preserving the security interest for the benefit of the Debtor's bankruptcy estate

pursuant to Bankruptcy Code section 5 51;

d. Preserving all of the Debtor's rights to raise any other claims regarding validity,

extent, priority, enforceability, perfection or otherwise against the Defendant;

e. Awarding such costs and fees to the Debtor which the Court in its power may

award pursuant to sections 544, 550 and/or other applicable provisions of the

Bankruptcy Code or applicable law; and

f. Awarding the Debtor such other and further relief as this Court deems just and

proper.

8

Dated: Wilmington, Delaware

July 2, 2012

01:12258036.1

FOLEY & LARDNER LLP

Christopher Celentino (CA No. 131688)

Mikel Bistrow (CA No. 1 02978)

Erika Morabito (VA No. 44369)

402 West Broadway, Suite 2100

San Diego, California 92101

Telephone: (619) 234--6655

Facsimile: (619) 234-3510

-and-

YOUNG CONAWAY STARGATT & TAYLOR, LLP

( Z h ~ ~

Michael R. Nes(N0:3526)

Joseph M. Barry (No. 4221)

Donald J. Bowman, Jr. (No. 4383)

Kenneth J. Enos (No. 4544)

Rodney Square

1 000 N. King Street

Wilmington, Delaware 19801

Telephone: (302) 571-6600

Facsimile: (302) 571-1253

Proposed Counsel for Debtor and Debtor in Possession

9

EXHIBIT A

Alpine Financing Statement

01:12258036.1

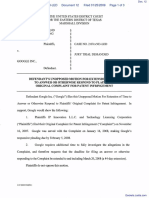

UCC FINANCING STATEMENT

FOLLOW INSTRUCTIONS (front and back) CAREFULLY

A. NAME & PHONE OF CONTACT AT FILER [optional]

Kursten canada Esq_:., =::::--::-:------:--:-:--:---:-------"-9.:.c70::.:9:.;;4:.;:9c.:::0.:..70::..7:.._-i

B. SEND ACKNOWLEDGMENT TO: (Name and Address)

DELAWARE DEPARTMENT OF STATE

U.C.C. FILING SECTION

FILED 05:27 PM 06/30/2009

INITIAL FILING # 2009 2098165

I SRV: 090663504

GliRFIEID & HECHT, P.C.

P.O. BOX 5450

L=:_voN oo 81620

_j

1. DEBTOR'S EXACT FULL LEGAL NAME insert only one debtor name (Ia or lb)- do not abbreviate or combine names

-

la. ORGANIZATION'S NAME

OORDI:r.I.ERA GOLF CIJJB, LLC

OR

1 b. INDIVIDUAL'S LAST NAME FIRST NAME MIDDLE NAME SUFFIX

lc. MAILING ADDRESS CITY STATE

I POSTAL CODE

COUNTRY

P.O. BOX 988 EDW11RDS co 81632 U'S

11e. TYPE OF ORGANIZATION 1f. JURISDICTION OF ORGANIZATION

I LTD LIABILITY OOMPliNY: I DE

2 ADDITIONAL DEBTOR'S EXACT FULL LEGAL NAME insert only !1M debtor name (2a or 2b) do not abbreviate or combine names

2a. ORGANIZATION'S NAME

OR

OORDI:r.I.ERA F&B, LLC

2b. INDIVIDUAL'S LAST NAME FIRST NAME MIDDLE NAME SUFFIX

2c. MAILING ADDRESS CITY STATE

I POSTAL CODE

COUNTRY

P.O. BOX 988 EDW11RDS 00 81632 U'S

12e. TYPE OF ORGANIZATION 2f. JURISDICTION OF ORGANIZATION

!LTD LIABILITY OOMPANY: DE

3 SECURED PARTY'S NAME (or NAME ofTOTAL ASSIGNEE of ASSIGNOR SIP)- insert only llllll secured party name (3a or 3b)

3a. ORGANIZATION'S NAME

ALPINE BliNK, A OOIDRI\DO BliNKING OORPORATION

OR

3b. INDIVIDUAL'S LAST NAME FIRST NAME MIDDLE NAME SUFFIX

3c. MAILING ADDRESS CITY STATE

rOSTALCODE

COUNTRY

12 VAIL ROAD SU'ITE 200 VAIL co 81657 U'S

4. T h ~ s FINANCING STATEMENT covers the follow1ng collateral:

PDF ATTACHED

Debtor 2

EXHIBIT B

Alpine Correction Statement

01:12258036.1

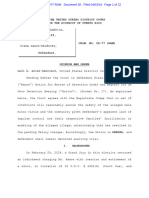

JUN. 23.2010 9:49AM

GARFIELD & HECHT, P. C. (AVON)

NO. 2877 P. 3/4

CORREC'riON STATEMENT

FOLLOW INSTRUCTIONS (front and back) CAREFULLY

A. NAME & PHONE OF PERSON FlUNG THIS STATEMENf (optiona[)

Kursten Canada, Esq.

DELAWARE DEPAR1MENT OF S:rJU'E

U. C. C. FILING SECTION

FILED 11 :57 AM 06/23/2010

INITIAL FILING # 2009 2098165

AMENDMENT # 2010 2394041

SRV: 100682761

B. SEND ACKNOWLEDGMENT TO: (Name and Address)

r

L

Garfield and Hecht, P .C.

P.O. Box 5450

Eagle, CO 81620

1

.J

TIIE AOVE SPACt lS FOR FILING OFF1CE USE ONLY

1. Idemlficntion ofthe RECORD to which this CORRECTION STATEMENT relates.

la. TYPE OF RECORD lb. FILE# Ol' INITIAL FINANCING STATEMENT

UCC Financing Statement 2009 2098165

2a. RECORD is inaccurate.

2b.

0

l?rovicle the basis for the belhlf of the person identified in item 4 that the RECORD identified in item 1 is lnaceuratc and indicate the manner

in which the persort believes the RECORD should be amended to the inaccuracy.

Item 4 of the UCC Financing Statement stated the collateral was attached in a PDF, but when filed the PDF did not

attach. Attached to this document is the missing collateral PDF that needs to be added to the original fili11g effective as

of the original filing date.

RECORD was WJ:ongfully filed.

Provide the basis for the belief of me perSon identifie.;i in item 4 that the RECORD identified in item 1 was wrongfully filed .

.3. If this CORRECTION STATEMENI relates to a RECORD filed [or recorded] in a filing office described in Section 9-:50l(a)(l) and this

CORRECTION STATEMENT is filed in such a filing offiee, provide the date [and time] on which the INITIAL FINANCING STATEMENT

identified in item 1 b above was filed or recorded .

3a. DATE 3b. TIME

4. NAME OF PERSON AUTHORIZJNG THE FILING OF TIIIS CORRECTION STA TBMe:NT- TI1e RECORD lA i\i!m 1 muat be indexed name.

4a. ORGANIZATION'S NAME:

Al ine Bank, a Colorado bankin

No.1204. Rev. 5-01. COJUU;CTION STATEMENT (FORM UCCS)

(I) FILING OFfiCE COPY (2) ACKNOVVLEDGMENT COPY (3) DEBTOR COPY (4) SECURED PARTY COPY

JUN. 23.2010 9:49AM GARFIELD & HECHT, P. C. (AVON) NO. 2877 P. 4/4

Attachment to UCC Filing

ALL FURNITURE, FIXTURES, EQUIPMENT, INVENTORY, ACCOUNTS

RECEIVABLE, GENERAL INTANGIBLES, CONTRACTS, AND CONTRACT

RIGHTS, PERMITS, GOODS, INSTRUMENTS, INVESTMENT PROPERTY,

LETTER OF CREDIT RIGHTS, CHATIEL PAPER. COMMERCIAL TORT CLAIMS,

AND ALL PROCEEDS FROM THE DISPOSITION THEREOF, TOGETHER WITH

ALL DUES, ASSESSMENTS, FEES OR OTHER CHARGES PAY ABLE TO DEBTOR

BY OR ON ACCOUNT OF ALL GOLF COURSE MEMBERSHIPS OF ALL

CATEGORIES AND ALL PRlVlLEGES WITH RESPECT TO ALL GOLF COURSE

PROPERTIES AND FACILITIES NOW OR HEREAFTER OWNED BY DEBTOR

INCLUDING BUT NOT LIMITED TO MEMBERSHIPS ISSUED PURSUANT TO

THE MEMBERSHIP PLAN FOR THE CLUB AT CORDILLERA AMENDED AND

RESTATED NOVEMBER 30, 2007 AND ANY AMENDMENTS, MODIFICATIONS,

SUPPLEMENTS OR RESTATEMENTS THEREOF (THE ''MEMBERSHIPS"), AND

ALL REVENEUES, WHETHER IN THE FORM OF A LUMP SUM PAYMENT OR

ANY INSTALLMENTS OR ON ANY OTHER CREDIT TERMS, FROM THE SALE,

EXCHANGE OR UPGRADE OF MEMBERSHIPS, INCLUDING, BUT NOT

LIMITED TO, PREMIER MEMBERSHIPS, LESS ALL REFUND PAYMENTS PAID

OR PAYABLE IN CONNECTION WITH THE SALE) EXCHANGE OR UPGRADE

OF ANY MEMBERSHIPS NOW EXISTING OR HEREAFTER ISSUED.

509913vl

You might also like

- Appellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document28 pagesAppellant/Petitioner's Reply Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Wochos V Tesla OpinionDocument13 pagesWochos V Tesla OpinionChapter 11 DocketsNo ratings yet

- Appellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document69 pagesAppellees/Debtors' Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Ultra Resources, Inc. Opinion Regarding Make Whole PremiumDocument22 pagesUltra Resources, Inc. Opinion Regarding Make Whole PremiumChapter 11 DocketsNo ratings yet

- Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document38 pagesAppellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- SEC Vs MUSKDocument23 pagesSEC Vs MUSKZerohedge100% (1)

- Appendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Document47 pagesAppendix To Appellant/Petitioner's Brief (In Re: Ocean Rig UDW Inc., Second Circuit Court of Appeals Case No. 18-1374)Chapter 11 DocketsNo ratings yet

- Roman Catholic Bishop of Great Falls MTDocument57 pagesRoman Catholic Bishop of Great Falls MTChapter 11 DocketsNo ratings yet

- NQ LetterDocument2 pagesNQ LetterChapter 11 DocketsNo ratings yet

- City Sports GIft Card Claim Priority OpinionDocument25 pagesCity Sports GIft Card Claim Priority OpinionChapter 11 DocketsNo ratings yet

- Republic Late Filed Rejection Damages OpinionDocument13 pagesRepublic Late Filed Rejection Damages OpinionChapter 11 Dockets100% (1)

- NQ Letter 1Document3 pagesNQ Letter 1Chapter 11 DocketsNo ratings yet

- National Bank of Anguilla DeclDocument10 pagesNational Bank of Anguilla DeclChapter 11 DocketsNo ratings yet

- Zohar 2017 ComplaintDocument84 pagesZohar 2017 ComplaintChapter 11 DocketsNo ratings yet

- PopExpert PetitionDocument79 pagesPopExpert PetitionChapter 11 DocketsNo ratings yet

- United States Bankruptcy Court Voluntary Petition: Southern District of TexasDocument4 pagesUnited States Bankruptcy Court Voluntary Petition: Southern District of TexasChapter 11 DocketsNo ratings yet

- Energy Future Interest OpinionDocument38 pagesEnergy Future Interest OpinionChapter 11 DocketsNo ratings yet

- Kalobios Pharmaceuticals IncDocument81 pagesKalobios Pharmaceuticals IncChapter 11 DocketsNo ratings yet

- Home JoyDocument30 pagesHome JoyChapter 11 DocketsNo ratings yet

- Zohar AnswerDocument18 pagesZohar AnswerChapter 11 DocketsNo ratings yet

- Licking River Mining Employment OpinionDocument22 pagesLicking River Mining Employment OpinionChapter 11 DocketsNo ratings yet

- APP CredDocument7 pagesAPP CredChapter 11 DocketsNo ratings yet

- Quirky Auction NoticeDocument2 pagesQuirky Auction NoticeChapter 11 DocketsNo ratings yet

- District of Delaware 'O " !' ' ' 1 1°, : American A Arel IncDocument5 pagesDistrict of Delaware 'O " !' ' ' 1 1°, : American A Arel IncChapter 11 DocketsNo ratings yet

- APP ResDocument7 pagesAPP ResChapter 11 DocketsNo ratings yet

- GT Advanced KEIP Denial OpinionDocument24 pagesGT Advanced KEIP Denial OpinionChapter 11 DocketsNo ratings yet

- Fletcher Appeal of Disgorgement DenialDocument21 pagesFletcher Appeal of Disgorgement DenialChapter 11 DocketsNo ratings yet

- Farb PetitionDocument12 pagesFarb PetitionChapter 11 DocketsNo ratings yet

- Special Report On Retailer Creditor Recoveries in Large Chapter 11 CasesDocument1 pageSpecial Report On Retailer Creditor Recoveries in Large Chapter 11 CasesChapter 11 DocketsNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- TCreplyDocument8 pagesTCreplyCircuit MediaNo ratings yet

- Municipal court jurisdiction over property disputeDocument11 pagesMunicipal court jurisdiction over property disputepa0l0sNo ratings yet

- Binder PDDocument2 pagesBinder PDFranco GrisafiNo ratings yet

- G.R. No. L-50008Document4 pagesG.R. No. L-50008Rene ValentosNo ratings yet

- 23-Olivares Vs MarquezDocument2 pages23-Olivares Vs MarquezCyrus Santos Mendoza100% (1)

- Essentials of Contract Law 2nd Edition Frey Test Bank DownloadDocument4 pagesEssentials of Contract Law 2nd Edition Frey Test Bank DownloadWilliam Martin100% (23)

- Promoter of A CompanyDocument2 pagesPromoter of A Companyanyonecanaccess100% (1)

- PPA Vs Cipres StevedoringDocument3 pagesPPA Vs Cipres StevedoringMaraWin JS100% (1)

- Pardon Application GuideDocument9 pagesPardon Application GuideCBCPolitics100% (1)

- Taxation Law 2 Reviewer (Long)Document44 pagesTaxation Law 2 Reviewer (Long)Gertz Mayam-o Pugong100% (21)

- 4Document70 pages4Soumik PurkayasthaNo ratings yet

- Crim Cases CompilationDocument45 pagesCrim Cases CompilationmichaelNo ratings yet

- IP Innovation LLC Et Al v. Google, Inc. - Document No. 12Document3 pagesIP Innovation LLC Et Al v. Google, Inc. - Document No. 12Justia.comNo ratings yet

- Romero v. PeopleDocument5 pagesRomero v. PeopleG Ant MgdNo ratings yet

- Polygraph y KoDocument20 pagesPolygraph y KoArjay LadianaNo ratings yet

- Affidavit of LossDocument2 pagesAffidavit of LosskristineNo ratings yet

- Taylor v. Sturgell, 553 U.S. 880 (2008)Document30 pagesTaylor v. Sturgell, 553 U.S. 880 (2008)Scribd Government DocsNo ratings yet

- 2457 Sepviva Sheriffs SaleDocument3 pages2457 Sepviva Sheriffs SaleCristóbal Sawyer0% (1)

- ORDENAN CARCEL HASTA JUICIO KIARA RAMOS MELENDEZDocument22 pagesORDENAN CARCEL HASTA JUICIO KIARA RAMOS MELENDEZVictor Torres MontalvoNo ratings yet

- CrimRev 5th AssignmentDocument9 pagesCrimRev 5th AssignmentLorenzo Luigi GayyaNo ratings yet

- Vda. de Esconde v. CA 253 SCRA 66 (1996)Document4 pagesVda. de Esconde v. CA 253 SCRA 66 (1996)Marianne Shen PetillaNo ratings yet

- Stephen Larkin v. Dan Reynolds, Warden, and Mr. Morgan, Unit Manager - H Unit, 39 F.3d 1192, 10th Cir. (1994)Document4 pagesStephen Larkin v. Dan Reynolds, Warden, and Mr. Morgan, Unit Manager - H Unit, 39 F.3d 1192, 10th Cir. (1994)Scribd Government DocsNo ratings yet

- Upreme ( .Ourt L, Flflanila: L/.epublit .Of Tbe LlbilippineDocument10 pagesUpreme ( .Ourt L, Flflanila: L/.epublit .Of Tbe LlbilippineAdrem Magtibay RabinoNo ratings yet

- (DLB) (PC) Lewis v. Cavazos Et Al - Document No. 4Document2 pages(DLB) (PC) Lewis v. Cavazos Et Al - Document No. 4Justia.comNo ratings yet

- CDI 01 Fundamentals of Invest. Week 1 3Document34 pagesCDI 01 Fundamentals of Invest. Week 1 3Jof piusNo ratings yet

- Allied Bank Vs CIR, GR 175097Document2 pagesAllied Bank Vs CIR, GR 175097katentom-1No ratings yet

- Alternative Dispute Resolution (ADR) - RA 9285Document4 pagesAlternative Dispute Resolution (ADR) - RA 9285Danny FentomNo ratings yet

- United States v. Sammy Parker Flynt, 15 F.3d 1002, 11th Cir. (1994)Document8 pagesUnited States v. Sammy Parker Flynt, 15 F.3d 1002, 11th Cir. (1994)Scribd Government DocsNo ratings yet

- Tabora vs Carbonell RulingDocument3 pagesTabora vs Carbonell RulingMariel100% (1)

- Recent Amendments On Karnataka Rent Control Act.Document3 pagesRecent Amendments On Karnataka Rent Control Act.Guidance ValueNo ratings yet