Professional Documents

Culture Documents

Chapter 1

Uploaded by

srinivasnagunuriOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 1

Uploaded by

srinivasnagunuriCopyright:

Available Formats

CHAPTER-1 INTRODUCTION

INTRODUCTION: Capital budgeting means planning for capital assets. The finance manager has various tools and techniques by means of which he assists the management in taking a proper capital budgeting decisions. Capital Budgeting is concerned with planning and development of available capital for the purpose of maximizing the long term profitability of the concern. Capital budgeting is finance terminology for the process of deciding whether or not to undertake an investment project.

In capital budgeting, we fix our total investment in best project which will provide us higher return. For capital budgeting, we use different techniques for evaluating different projects. All techniques are called capital budgeting techniques. Capital budgeting uses in all the area like construction business, defence and other large scale business because without capital budgeting, our investment will not give better return and we may get risk of loss of return. FUNCTIONS OF FINANCIAL MANAGEMENT: Financial decisions refer to decisions concerning financial matters of a business firm. There are many kinds of financial management decisions that the firm makes in pursuit of maximizing shareholders wealth, viz., kind of assets to be acquired, pattern of capitalization, distribution of firms income etc. We can classify these decisions into three major groups: Investment decision Financing decision Dividend decision

Investment Decision

Financing Decision

Dividend Decision

I) Investment Decision:

The investment decisions can be classified under two broad groups : (i) (ii) Long-term investment decision and Short-term investment decision, The long-term investment decision referred to the capital budgeting and the short-term investment decision referred to working capital management.

II Financing Decisions:

Once the firm has taken the investment decision and committed itself to new investment, it must decide the best means of financing these commitments. Since, firms regularly make new investments, the needs for financing and financial decisions are on going. Hence, a firm will be continuously planning for new financial needs. The financing decision is not only concerned with how best to finance new assets but also concerned with the best overall mix of financing for the firm.

II)

Dividend Decisions:

The establishment of dividend policy is another important function of finance manager which involves the determination of the percentage of profits earned by the enterprise which is to be paid to its shareholders. The dividend decision is concerned with the quantum of profits to be distributed among shareholders. A decision has to be taken whether all the profits to be distributed, to retain all the profits in business or to keep a part of profits in the business and distribute other among shareholders.

NEED FOR THE STUDY

In a perfect world there would be no necessity for current assets and current liabilities because there would be no uncertainty, no transaction costs, information search costs, scheduling costs, or production and technology constraints. However the world in which we live is not perfect.

So organization may be faced with an uncertainty regarding availability of sufficient quantity of critical inputs in future at reasonable price. This may necessitate the holding of critical inputs in future at reasonable price. This may necessitate the holding of Inventory i.e., current assets.

To ensure that each of the current assets is efficiently managed to ensure the overall liquidity of the unity and at the same time not keeping too high a level of any one of them Capital Budgeting management is a must.

Capital Budgeting management ensures smooth working of the unit without any production held ups due to the paucity of funds.

Thus as capital budgeting is the life blood and nerve center of a business. It is managed in order to attain a smooth running of the business.

OBJECTIVES OF THE STUDY To Know how the companiy Capital Expenditure has planned To study the relevance of copies of Capital budgeting in evaluating the Project. To Study the technique of Capital budgeting for decision making. To offer some useful suggestions in capital budgeting process for improving the financial position if the organization

SCOPE OF THE STUDY The present study is undertaken with an intention that it would be helpful in assessing the Capital Budgeting position in the organization and to make recommendations for the improvement of the Capital Budgeting requirements of Nagarjuna Fertilizers And Chemicals Limited. The Study also highlights the present scenario of the Fertilizers And Chemicals Industry in the global market as a whole and the contribution of Nagarjuna Fertilizers And Chemicals Limited in the Indian Market & State Market in Particular. The

Study

includes

various

aspects

regarding

the

future

plans

and

diversification activities of Nagarjuna Fertilizers And Chemicals Limited in Directors Report.

Thus a good deal of ground is covered in the study, including the trends of various components of Capital budgeting, so as to find the effect of each component on Capital Budgeting decision.

RESEARCH METHODOLOGY

The study of Capital Budgeting in Nagarjuna Fertilizers And Chemicals Limited, has been carried out of studying the companies project reports, budget and revenue estimates. The study can broadly divided into two phase.

1) Primary Data 2) Secondary Data

Primary Data

The data which is collected at first had for the purpose of the study is known as primary data. Primary data which is collected through interaction with the assistant financial manager of Nagarjuna Fertilizers And Chemicals Limited

Secondary Data

The data which is corrected by some one previously is called by secondary Data. It is already available in the form of internal records of the company and other publications.

Collecting relevant Annual Reports Analyzing the Collected data Drafting the report Updating the Final report Collecting the general information about Capital Budgeting from various standard text books Studying the project report of Nagarjuna Fertilizers And Chemicals Limited.,

LIMITAIONS OF THE STUDY

The topic for the study is very exhaustive and covers several crucial aspects of financial management for which the availabilities of the time is very much limited. Under the pretext of confidentiality the organization has not disclosed the total information. The study is made by secondary data collection and the calculation of various ratios depend on the information in the annual reports of the company. Through this study of the Capital Budgeting position in Nagarjuna Fertilizers And Chemicals Limited., the sources of funds have affected a lot due to major fluctuation in the Capital Budgeting decision. 1) The analysis made on the basis of secondary data 2) The availability of data is only pertaining to four years is one of the constraints. 3) As there is more dependency is secondary data realistic conclusion may not be possible to be made. 4) Even through there are no if indicates for analyzing the financial performance the study includes about liquidity position. 5) There may be approximations 6) The study was carried in Nagarjuna Fertilizers And Chemicals Limited., for a period of 8 weeks.

CHAPTERIZATION PLAN

Chapter 1 Introduction Need For the study Objectives of the study Scope of the study Research Methodology Chapter 2 - Review Of literature Chapter3 - Company Profile Chapter4 - Data Presentation, Analysis and Interpretation Chapter5 - Findings of the study Suggestions of the study Conclusion Bibliography Annexure

You might also like

- Personal Selling - DefinedDocument55 pagesPersonal Selling - DefinedsrinivasnagunuriNo ratings yet

- Complete List of Indian Online Shopping Websites by CategoryDocument4 pagesComplete List of Indian Online Shopping Websites by CategorysrinivasnagunuriNo ratings yet

- Bank Challan of NetDocument1 pageBank Challan of NetsoumenmukherjeeskailNo ratings yet

- Personal Selling - DefinedDocument55 pagesPersonal Selling - DefinedsrinivasnagunuriNo ratings yet

- Chapter 2Document16 pagesChapter 2srinivasnagunuriNo ratings yet

- Personal Selling - DefinedDocument55 pagesPersonal Selling - DefinedsrinivasnagunuriNo ratings yet

- Complete List of Indian Online Shopping Websites by CategoryDocument4 pagesComplete List of Indian Online Shopping Websites by CategorysrinivasnagunuriNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Introduction To Corporate Finance 4th Edition Booth Test Bank DownloadDocument36 pagesIntroduction To Corporate Finance 4th Edition Booth Test Bank DownloadJudy Snell100% (21)

- Chapter 7Document4 pagesChapter 7Melody BautistaNo ratings yet

- TranscribedDocument5 pagesTranscribedAldrin ZolinaNo ratings yet

- Terminal ReportDocument3 pagesTerminal ReportVince YuNo ratings yet

- Arabian Construction Company: Projected Cash FlowDocument8 pagesArabian Construction Company: Projected Cash FlowJule LobresNo ratings yet

- Crypto Currency and Block ChainDocument38 pagesCrypto Currency and Block ChainShabeel ShabuNo ratings yet

- Grade 11 Accounting QuestionsDocument4 pagesGrade 11 Accounting QuestionsJericko LianNo ratings yet

- Amazon Sellers in IndiaDocument68 pagesAmazon Sellers in IndiaSwapnil Dubale0% (1)

- Principles and Practices of Management: Leader: Nagavara Ramarao Narayana MurthyDocument12 pagesPrinciples and Practices of Management: Leader: Nagavara Ramarao Narayana MurthyForam SukhadiaNo ratings yet

- Godrej Group Portfolio AnalysisDocument16 pagesGodrej Group Portfolio AnalysisEina GuptaNo ratings yet

- Guntur Municipal Corporation: ReceiptDocument1 pageGuntur Municipal Corporation: ReceiptSqaure PodNo ratings yet

- Export-Import Pricing Factors (40Document13 pagesExport-Import Pricing Factors (40873 jannatul FerdausNo ratings yet

- PRC- Section 1 Economics TestDocument3 pagesPRC- Section 1 Economics Testmuhammad hasnanNo ratings yet

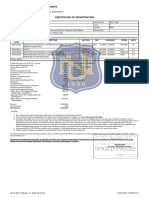

- CertificateOfRegistration 2021 130369Document1 pageCertificateOfRegistration 2021 130369miguel soncuanNo ratings yet

- Juho Makkonen Cristóbal Gracia The Lean Marketplace A PracticalDocument187 pagesJuho Makkonen Cristóbal Gracia The Lean Marketplace A PracticalAnwar Ali100% (1)

- Electricity Generation Cost Report 2020Document72 pagesElectricity Generation Cost Report 2020Sanuwar RahmanNo ratings yet

- Letter HeadDocument1 pageLetter HeadJudeRamosNo ratings yet

- Letter of EnrolmentDocument1 pageLetter of Enrolmentkatherine muñozNo ratings yet

- Working Capital ManagementDocument13 pagesWorking Capital ManagementMichael Paul GabrielNo ratings yet

- Florida Palms Country Club Adjusts Its Accounts Monthly Club MembersDocument1 pageFlorida Palms Country Club Adjusts Its Accounts Monthly Club Memberstrilocksp SinghNo ratings yet

- Ch. 14 Payout PolicyDocument68 pagesCh. 14 Payout PolicyRiyan DarmawanNo ratings yet

- The Mathematics of Credit DerivativesDocument64 pagesThe Mathematics of Credit DerivativesMartin Martin MartinNo ratings yet

- Case Lecture 6 e Sourcing StrategyDocument18 pagesCase Lecture 6 e Sourcing StrategyAakanksha Gulabdhar MishraNo ratings yet

- Chase Sapphire Case AnalysisDocument2 pagesChase Sapphire Case AnalysisManuel Omar MatosNo ratings yet

- Education Access DebateDocument2 pagesEducation Access DebateShreyansh TripathiNo ratings yet

- Marketing segmentation and customer needsDocument27 pagesMarketing segmentation and customer needsEllie HousenNo ratings yet

- A Study On Customer Satisfaction at CielDocument87 pagesA Study On Customer Satisfaction at Cielganesh rajNo ratings yet

- Applied Econ-Lesson8Document28 pagesApplied Econ-Lesson8Vanessa Joy BaluyutNo ratings yet

- Financial Performance of Icici Bank by Stewartraj Dharmaraj Project Guide-Prof: - Evonne SakhraniDocument14 pagesFinancial Performance of Icici Bank by Stewartraj Dharmaraj Project Guide-Prof: - Evonne SakhraniStewart DuraiNo ratings yet

- Problem 1. Req. 1-Adjusted Capital of Yvonne Is P18,000 ComputationDocument3 pagesProblem 1. Req. 1-Adjusted Capital of Yvonne Is P18,000 ComputationKendiNo ratings yet