Professional Documents

Culture Documents

Comprehensive Annual Financial Report-FY2006

Uploaded by

Navarro CollegeOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comprehensive Annual Financial Report-FY2006

Uploaded by

Navarro CollegeCopyright:

Available Formats

Navarro College District

Corsicana, Texas

Comprehensive Annual Financial Report Years Ended August 31, 2006 and 2005

Prepared by: Navarro College District Finance Department

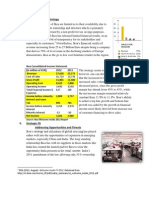

Statement of Net Assets The Statement of Net Assets is divided into three sections: Assets (current and noncurrent) Liabilities (current and noncurrent) and Net Assets (invested in capital, restricted and unrestricted). The footnotes to the financial statements discuss the difference between current and noncurrent.

Assets, Liabilities and Net Assets at August 31, 2006

$18,747,362

$29,197,044

$29,239,899 $8,377,352

$48,066,933

Current Assets Noncurrent Liabilities

Noncurrent Assets Net Assets

Current Liabilities

Total cash and investments for August 31, 2006 were $15,384,167, compared to $12,879,961 at August 31, 2005. The increase was due to additional 2006 Series bond proceeds. Total liabilities increased from $35,067,355 at August 31, 2005 to $37,617,251 at August 31, 2006. The major factor contributing to the increase in liabilities was the issuance of the Series 2006 Revenue Bonds in the amount of $3,550,000. Net assets is divided into three sections: Invested in capital assets, net of debt; restricted net assets and unrestricted net assets. Total net assets increased from $28,492,591 at August 31, 2005 to $29,197,044 at August 31, 2006. Statement of Revenues, Expenses and Changes in Net Assets The Statement of Revenues, Expenses and Changes in Net Assets is the activity that resulted in the change in net assets reflected in the Statement of Net Assets. The Statement of Revenues, Expenses and Changes in Net Assets is divided into five sections: Operating Revenues; Nonoperating Revenues; Operating Expenses; Nonoperating Expenses; and Other Revenues, (expenses), Gains, (losses). The Managements Discussion and Analysis provides detail on the purpose of this statement as well as a condensed version of the statement.

xvi

xxiii

Certificateof Achievement for Excellence in FinanciaL Reporting

Presented to

NavarroCollege Texas

For its Comprehensive Annual Financial Report for theFiscalYearEnded August31,2005

A Certificate of Achievement for Excellence in Financial Reporting is presented by the Government Finance Officers Association of the United States and Canada to goverffnent units and public employee retirement systems whose corrprehensive annual financial reports (CAFRS) achieve the highest standards in government accounting and financial reporting.

Mu

President

%?atuExecutiveDirector

JAYNES, REITMEIER, BOYD & THERRELL, P.C.

Certified Public Accountants

5400 Bosque Blvd., Suite 500, Waco, Texas 76710 P.O. Box 7616 Waco, Texas 76714-7616 Phone 254.776.4190 Fax 254.776.8489 Web www.jrbt.com

Independent Auditors' Report

The Board of Trustees Navarro College District:

We have audited the accompanying financial statements of the business-type activities and the discretely presented component unit of Navarro College District (the District) as of and for the year ended August 31, 2006, which collectively comprise the Districts basic financial statements as listed in the table of contents. These financial statements are the responsibility of the District's management. Our responsibility is to express opinions on these financial statements based on our audits. We did not audit the financial statements of Navarro College Foundation, Inc. (the Foundation), a discretely presented component unit of the District. Those financial statements were audited by other auditors whose reports thereon have been furnished to us, and our opinion on those financial statements, insofar as it relates to the amounts included for the Foundation, was based on the reports of the other auditors. The financial statements of the Foundation were not audited in accordance with Government Auditing Standards. The financial statements of the District as of and for the year ended August 31, 2005, were audited by other auditors whose report dated November 1, 2005, expressed an unqualified opinion on those statements. As discussed in Note 22 to the financial statements, the District has restated its 2005 financial statements during the current year to properly record receivables, capital assets, and long-term debt in conformity with accounting principles generally accepted in the United States of America. The other auditor reports on the 2005 financial statements before the restatement. We conducted our audits in accordance with auditing standards generally accepted in the United States of America and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. Those standards require that we plan and perform the audits to obtain reasonable assurance about whether the financial statements are free of material misstatement. The financial statements of the Foundation were not audited in accordance with Government Auditing Standards. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits and the report of the other auditors provide a reasonable basis for our opinions. 3

An Independent Member of the BDO Seidman Alliance

JAYNES, REITMEIER, BOYD & THERRELL, P.C.

Certified Public Accountants

5400 Bosque Blvd., Suite 500, Waco, Texas 76710 P.O. Box 7616 Waco, Texas 76714-7616 Phone 254.776.4190 Fax 254.776.8489 Web www.jrbt.com

Report on Internal Control Over Financial Reporting and on Compliance and Other Matters Based on an Audit of Financial Statements Performed in Accordance with Government Auditing Standards The Board of Trustees Navarro College District: We have audited the financial statements of the business-type activities and the discretely presented component unit of Navarro College District (the District) as of and for the year ended August 31, 2006, which collectively comprise the Districts basic financial statements, and have issued our report thereon dated November 8, 2006. We conducted our audit in accordance with auditing standards generally accepted in the United States of America and the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States. We did not audit the financial statements of Navarro College Foundation, a discretely presented component unit. Those financial statements were audited by other auditors whose report thereon has been furnished to us, and our opinion on those financial statements, insofar as it relates to the amounts included for Navarro College Foundation (the Foundation), was based solely on the report of the other auditors. The financial statements of the Foundation were not audited in accordance with Government Auditing Standards. Internal Control Over Financial Reporting In planning and performing our audit, we considered the District's internal control over financial reporting in order to determine our auditing procedures for the purpose of expressing our opinions on the financial statements and not to provide an opinion on the internal control over financial reporting. However, we noted certain matters involving the internal control over financial reporting and its operation that we consider to be reportable conditions. Reportable conditions involve matters coming to our attention relating to significant deficiencies in the design or operation of the internal control over financial reporting that, in our judgment, could adversely affect the Districts ability to record, process, summarize, and report financial data consistent with the assertions of management in the financial statements. A reportable condition is described in the accompanying schedule of findings and questioned costs as item 2006-1. A material weakness is a reportable condition in which the design or operation of one or more of the internal control components does not reduce to a relatively low level the risk that misstatements caused by error or fraud in amounts that would be material in relation to the financial statements being audited may occur and not be detected within a timely period by 91

An Independent Member of the BDO Seidman Alliance

JAYNES, REITMEIER, BOYD & THERRELL, P.C.

Certified Public Accountants

5400 Bosque Blvd., Suite 500, Waco, Texas 76710 P.O. Box 7616 Waco, Texas 76714-7616 Phone 254.776.4190 Fax 254.776.8489 Web www.jrbt.com

Report on Compliance with Requirements Applicable to Each Major Federal and State Program and Internal Control Over Compliance in Accordance with OMB Circular A-133 The Board of Trustees Navarro College District: Compliance We have audited the compliance of Navarro College District (the District) with the types of compliance requirements described in the U. S. Office of Management and Budget (OMB) Circular A-133 Compliance Supplement and the Uniform Grant Management Standards that are applicable to each of its major federal and state programs for the year ended August 31, 2006. The Districts major federal and state programs are identified in the summary of auditors results section of the accompanying schedule of findings and questioned costs. Compliance with the requirements of laws, regulations, contracts and grants applicable to each of its major federal and state programs is the responsibility of the Districts management. Our responsibility is to express an opinion on the Districts compliance based on our audit. We conducted our audit of compliance in accordance with auditing standards generally accepted in the United States of America; the standards applicable to financial audits contained in Government Auditing Standards, issued by the Comptroller General of the United States; the OMB Circular A-133, Audits of States, Local Governments, and Non-Profit Organizations; and the Uniform Grant Management Standards. Those standards require that we plan and perform the audit to obtain reasonable assurance about whether noncompliance with the types of compliance requirements referred to above that could have a direct and material effect on a major federal or state program occurred. An audit includes examining, on a test basis, evidence about the Districts compliance with those requirements and performing such other procedures as we considered necessary in the circumstances. We believe that our audit provides a reasonable basis for our opinion. Our audit does not provide a legal determination on the Districts compliance with those requirements. In our opinion, the District complied, in all material respects, with the requirements referred to above that are applicable to each of its major federal and state programs for the year ended August 31, 2006. However, the results of our auditing procedures disclosed instances of noncompliance with those requirements that are required to be reported in accordance with OMB Circular A-133 and the Uniform Grant Management Standards, and which are described in the accompanying schedule of findings and questioned costs as items 2006-2 and 2006-3.

93

An Independent Member of the BDO Seidman Alliance

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Tax RemediesDocument51 pagesTax RemediesBevz23100% (6)

- PhlebotomyDocument2 pagesPhlebotomyNavarro CollegeNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Value Shop and The Value NetworkDocument7 pagesThe Value Shop and The Value NetworkMarinela Tache100% (1)

- Boiler MaintenanceDocument6 pagesBoiler MaintenanceRamalingam PrabhakaranNo ratings yet

- The Rise and Fall of Ramalinga RajuDocument2 pagesThe Rise and Fall of Ramalinga RajuPayal MaskaraNo ratings yet

- Leasing RossDocument15 pagesLeasing Rosstinarosa13No ratings yet

- INDIA INCOME TAX - Doble Taxation Avoidance Agreement With UKDocument22 pagesINDIA INCOME TAX - Doble Taxation Avoidance Agreement With UKDr.SagindarNo ratings yet

- Ikea Strategy AssessmentDocument6 pagesIkea Strategy Assessmentc.enekwe8981100% (1)

- Brilliance Graduate Scholarship PacketDocument2 pagesBrilliance Graduate Scholarship PacketNavarro CollegeNo ratings yet

- Navarro College Dining MenuDocument2 pagesNavarro College Dining MenuNavarro CollegeNo ratings yet

- Application For Brilliance Graduate ScholarshipDocument1 pageApplication For Brilliance Graduate ScholarshipNavarro CollegeNo ratings yet

- Dining Services MenuDocument1 pageDining Services MenuNavarro CollegeNo ratings yet

- Brilliance Graduate Scholarship PacketDocument2 pagesBrilliance Graduate Scholarship PacketNavarro CollegeNo ratings yet

- Academic Vs Career TechDocument1 pageAcademic Vs Career TechNavarro CollegeNo ratings yet

- Dual Credit Testing Requirements 09-10Document1 pageDual Credit Testing Requirements 09-10Navarro CollegeNo ratings yet

- Notice of Board of Trustees Meeting January 17, 2013Document1 pageNotice of Board of Trustees Meeting January 17, 2013Navarro CollegeNo ratings yet

- DCQuickRef RevisedDocument1 pageDCQuickRef RevisedNavarro CollegeNo ratings yet

- Brilliance Scholarship For General AcademicsDocument3 pagesBrilliance Scholarship For General AcademicsNavarro CollegeNo ratings yet

- 2012 - 2013 CrosswalkDocument2 pages2012 - 2013 CrosswalkNavarro CollegeNo ratings yet

- Dual Credit PresentationDocument35 pagesDual Credit PresentationNavarro CollegeNo ratings yet

- Career & Technology Dual Credit RegistrationDocument1 pageCareer & Technology Dual Credit RegistrationNavarro CollegeNo ratings yet

- Navarro College Dual Credit Admissions ApplicationDocument2 pagesNavarro College Dual Credit Admissions ApplicationNavarro CollegeNo ratings yet

- Dual Credit Application PacketDocument4 pagesDual Credit Application PacketNavarro CollegeNo ratings yet

- Presidential Search Memorandum January 2013Document1 pagePresidential Search Memorandum January 2013Navarro CollegeNo ratings yet

- Certified Logistics ClassesDocument1 pageCertified Logistics ClassesNavarro CollegeNo ratings yet

- Academic Dual Credit RegistrationDocument1 pageAcademic Dual Credit RegistrationNavarro CollegeNo ratings yet

- Navarro College 2012-2013 - CatalogDocument201 pagesNavarro College 2012-2013 - CatalogNavarro CollegeNo ratings yet

- Oil and Gas Technology CertificateDocument1 pageOil and Gas Technology CertificateNavarro CollegeNo ratings yet

- Comprehensive Annual Financial Report 2012Document136 pagesComprehensive Annual Financial Report 2012Navarro CollegeNo ratings yet

- Continuing Education ClassesDocument1 pageContinuing Education ClassesNavarro CollegeNo ratings yet

- A.A.S. Petroleum Technology Degree PlanDocument1 pageA.A.S. Petroleum Technology Degree PlanNavarro CollegeNo ratings yet

- Navarro College 2012 Investment PolicyDocument13 pagesNavarro College 2012 Investment PolicyNavarro CollegeNo ratings yet

- Dual Credit Scholarship ApplicationDocument3 pagesDual Credit Scholarship ApplicationNavarro CollegeNo ratings yet

- General Academic Scholarship ApplicationDocument2 pagesGeneral Academic Scholarship ApplicationNavarro CollegeNo ratings yet

- CPR ClassesDocument1 pageCPR ClassesNavarro CollegeNo ratings yet

- Certified Nurse AideDocument1 pageCertified Nurse AideNavarro CollegeNo ratings yet

- Computer ClassesDocument1 pageComputer ClassesNavarro CollegeNo ratings yet

- AUSL LMT TaxDocument16 pagesAUSL LMT TaxMaria GarciaNo ratings yet

- Problem No. 1: Accounting For Partnership Do-It - Yourself: Problem SetsDocument3 pagesProblem No. 1: Accounting For Partnership Do-It - Yourself: Problem Setstide podsNo ratings yet

- Cost SheetDocument4 pagesCost SheetAuthentic StagNo ratings yet

- Enhanced cash flow analysis of replacement printing pressesDocument37 pagesEnhanced cash flow analysis of replacement printing pressesRiangelli Exconde100% (1)

- 0452 s18 QP 21 PDFDocument20 pages0452 s18 QP 21 PDFIG UnionNo ratings yet

- Cost of Debt CalculationDocument10 pagesCost of Debt CalculationMihael Od SklavinijeNo ratings yet

- Budgeting Process On OngcDocument78 pagesBudgeting Process On Ongcvipul tandonNo ratings yet

- Description of The BusinessDocument113 pagesDescription of The BusinessAngelica Beleo MadalangNo ratings yet

- The Market MechanismDocument2 pagesThe Market MechanismJanna Marie CalabioNo ratings yet

- Mayr-Melnhof: A Dark Quarter Ahead in Q2Document10 pagesMayr-Melnhof: A Dark Quarter Ahead in Q2Camila CalderonNo ratings yet

- Chapter 26.1Document2 pagesChapter 26.1Nicki Lyn Dela CruzNo ratings yet

- Practice Multiple Choice Test 8Document8 pagesPractice Multiple Choice Test 8api-3834751No ratings yet

- Residential Status and Tax IncidenceDocument3 pagesResidential Status and Tax Incidenceambarishan mrNo ratings yet

- PFRS for SMEs vs Full PFRS: Key DifferencesDocument14 pagesPFRS for SMEs vs Full PFRS: Key DifferencesAnthon GarciaNo ratings yet

- Co-Op Financial Statement: Understanding ADocument8 pagesCo-Op Financial Statement: Understanding ARJ Randy JuanezaNo ratings yet

- Buyers Attitude Towards J.K.tyres ProjectDocument51 pagesBuyers Attitude Towards J.K.tyres ProjectSourav Coomar Doss100% (1)

- Accounting 214 Take Home AssignmentDocument3 pagesAccounting 214 Take Home AssignmentJulia JohnsonNo ratings yet

- PAS EIP MansionizationDocument473 pagesPAS EIP MansionizationQQuestorNo ratings yet

- Unit 5Document15 pagesUnit 5Ramesh Thangavel TNo ratings yet

- Memorandum of Understanding Land Bank AuthorityDocument6 pagesMemorandum of Understanding Land Bank AuthorityBrandon ReeseNo ratings yet

- Sample of Proposal Letter Bidding For ADocument12 pagesSample of Proposal Letter Bidding For AMohd Naim MazlanNo ratings yet

- Financial Ratio Analysis AssignmentDocument10 pagesFinancial Ratio Analysis AssignmentRahim BakhshNo ratings yet