Professional Documents

Culture Documents

Navarro College 2011 Investment Policy

Uploaded by

Navarro College0 ratings0% found this document useful (0 votes)

28 views12 pagesThis policy does not apply to investments donated to the College for a particular purpose or donated according to the terms specified by a donor. This policy reconfirms the investment policy and strategy reaffirmed by the Board on January 21,2010. The Investment Officer shall designate the Comptroller as Deputy Investment Officer in the event circumstances require timely action and the Chief Investment Officer is not available.

Original Description:

Copyright

© Attribution Non-Commercial (BY-NC)

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis policy does not apply to investments donated to the College for a particular purpose or donated according to the terms specified by a donor. This policy reconfirms the investment policy and strategy reaffirmed by the Board on January 21,2010. The Investment Officer shall designate the Comptroller as Deputy Investment Officer in the event circumstances require timely action and the Chief Investment Officer is not available.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

0 ratings0% found this document useful (0 votes)

28 views12 pagesNavarro College 2011 Investment Policy

Uploaded by

Navarro CollegeThis policy does not apply to investments donated to the College for a particular purpose or donated according to the terms specified by a donor. This policy reconfirms the investment policy and strategy reaffirmed by the Board on January 21,2010. The Investment Officer shall designate the Comptroller as Deputy Investment Officer in the event circumstances require timely action and the Chief Investment Officer is not available.

Copyright:

Attribution Non-Commercial (BY-NC)

Available Formats

Download as PDF, TXT or read online from Scribd

You are on page 1of 12

NAVARRO COLLEGE

INVESTMENT POLICY AND STRATEGY

Pursuant to the Public Funds Investment Act, Texas Government Code Section

2256, House Bill 2799, Acts of 75

th

Legislature, and House Bill 3009, Acts of 76

th

Legislature, the Board of Trustees of Navarro College District adopts the following

policies and strategies in regard to its investments. This investment policy does not

apply to investments donated to the College for a particular purpose or donated

according to the terms specified by a donor. This exception is authorized by H.B. 3009,

(1999). This policy reconfirms the investment policy and strategy reaffirmed by the

Board on January 21,2010.

The Board of Trustees of Navarro College recognizes the requirement for the

Chief Executive Officer to delegate authority for the overall direction and management

of fiscal responsibility to the Vice-President for Finance and Administration. This

resolution provides direction for the execution of these duties.

Delegation of Authority

The Vice-President for Finance and Administration, as Chief Financial Officer of

the College District, is designated as the Investment Officer and is responsible for the

overall investment management decisions and activities. The Vice-President is

responsible for considering the quality and capability of the staff, investment advisors,

and consultants involved in investment management and procedures. All participants in

the investment process shall seek to act responsibly as custodians of the public trust.

The Investment Officer shall develop and maintain administrative procedures for the

operation of the investment program that are consistent with this investment policy. The

Investment Officer shall be responsible for all transactions undertaken and shall

establish a system of controls to regulate the activities of subordinate officials and staff.

The Investment Officer shall designate the Comptroller as Deputy Investment Officer in

the event circumstances require timely action and the Chief Investment Officer is not

available. The Deputy Investment Officer shall be a key member of the investment team

and will act on behalf of the Investment Officer in his/her absence.

No officer or designee may engage in an investment transaction except as

provided under the terms of this policy. The policy will be established by the Investment

Officer and recommended by the President to the Board of Trustees for final approval.

This authority is effective until rescinded by the Board of Trustees or until the

termination of employment.

Scope

This investment policy applies to all the financial assets and funds held by the

Navarro College District. Navarro College consolidates its funds into one investment

fund for investment purposes for efficiency and maximum investment opportunity.

These funds are defined in Navarro College's Annual Financial Report and include:

Educational and General Fund, Debt Service Fund, Plant Fund, Auxiliary

Fund, Agency Fund, Student Financial Aid Funds and any other funds

held by Navarro College unless specifically exempted by the Board of

Trustees and this policy.

OBJECTIVES

Safety

Safety of principal is the foremost objective of the investment program.

Investments shall be undertaken in a manner that seeks to ensure the preservation of

capital in the overall portfolio.

There are various types of investment risks faced by the College's portfolio. In

compliance with Governmental Accounting Standards Board (GASB) Statement 40, the

College addresses these various types of risk.

Custodial Risk

Custodial Risk is defined as deposits that are uninsured and either (a)

uncollateralized or collateralized but not in the government's name or (b) investments

that are uninsured and unregistered.

In accordance with the collateralization policy for deposits and certificates of

deposits, all of Navarro College's investments are fully collateralized by FDIC insurance,

pledged securities and/or a surety bond in the name of the College District.

Credit Risk

Credit Risk is the risk of loss due to the failure of the security or backer to

perform due diligence. In order to disclose credit risk, credit ratings from a national

statistical organization will be reported on the year-end investment report. Obligations of

or guaranteed by the U.S. Government do not require disclosure of credit quality.

2

Certificates of Deposit are fully collateralized and do not require a credit risk rating. If an

investment is unrated, that fact must be disclosed.

Concentration of Credit Risk

In accordance with GASB 40, governments need to disclose by amount and

issues any concentration in one issuer that represents five percent (5%) or more of the

total assets in the portfolio for that business activity.

Investments issued or explicitly guaranteed by the U.S. Government and

investments in mutual funds or pools are excluded. Navarro College's auditors classify

short-term Certificates of Deposit as "Deposits" and do not require disclosure. Long

term Certificates of Deposit are fully collateralized and do not require disclosure.

Interest Rate Risk

Navarro College needs to disclose its interest rate sensitivity of its investments.

Individual investment maturities will be listed in the investment report and a Maturity

Schedule will be presented for the Navarro College Board of Trustees' review in the

quarterly investment report. Variable interest rate instruments are discouraged since

these items are highly sensitive to interest rate changes. In addition, maturities of

investments generally should be five years or less.

Liquidity

The investment portfolio shall remain sufficiently liquid to meet all operating

requirements that may be reasonably anticipated. This is accomplished by structuring

the portfolio so that securities mature concurrent with cash needs to meet anticipated

demands. Since all possible cash demands cannot be anticipated, the portfolio should

consist largely of securities with active secondary or resale markets.

The investment portfolio shall be designed with the objective of attaining a

market rate of return throughout budgetary and economic cycles, taking into account the

investment risk constraints and liquidity needs. Return on investment is of least

importance compared to the safety and liquidity objectives described above. The core

of investments is limited to relatively low risk securities in anticipation of earning a fair

3

return relative to the risk being assumed. Securities shall not be sold prior to maturity,

with the following exceptions:

a declining credit security could be sold early to minimize loss of principal;

a security swap would improve the quality, yield, or target duration in the

portfolio; or liquidity needs of the portfolio require that the security be sold.

INTERNAL CONTROL PROCEDURES

Internal control is the process by which Navarro College's Board of Trustees and

management obtain reasonable assurance as to achievement of specified objectives. It

consists of interrelated components, with integrity, ethical values and competence, and

the control environment serving as the foundation for establishing objectives, risk

assessment, information systems, control procedures, communication, managing

change, and monitoring.

Prudence

The standard of prudence to be used by investment officials shall be the "prudent

person" standard and shall be applied in context of managing an overall portfolio.

Investment officers acting in accordance with procedures and this investment policy and

exercising due diligence shall be relieved of personal responsibility for an individual

security's credit risk or market price changes, provided deviations from expectations are

reported in a timely fashion and the liquidity and the sale of securities are carried out in

accordance with the terms of this policy.

Investments shall be made with the judgment and care, under circumstances

then prevailing, that persons of prudence, discretion and intelligence exercise in the

management of their own affairs, not for speculation, but for investment, considering the

probable safety of their capital as well as the probable income to be derived.

Ethics and Conflicts of Interest

Officers and employees involved in the investment process shall refrain from

personal business activity that could conflict with the proper execution and m ~ n a g e m e n t

of the investment program, or that could impair the ability to make impartial decisions.

Employees and investment officials shall disclose any material interests in financial

4

institutions with which they conduct business. They shall further disclose any personal

financial/investment positions that could be related to the performance of the investment

portfolio. Employees and officers shall refrain from undertaking personal investment

transactions with the same individual with whom business is conducted on behalf of

their entity. An investment officer who has a personal business relationship with any

entity seeking to sell an investment to Navarro College or who is related in the second

degree by marriage (affinity) or blood relations (consanguinity) to an individual seeking

to sell an investment to Navarro College is required to file a statement disclosing the

relationship with the Texas Ethics Commission and the Navarro College Board of

Trustees.

Delegation of Authority

Authority to manage the investment program is granted to the Vice-President for

Finance and Administration, and derived responsibility for the operation of the

investment program is hereby delegated to the Investment Officer. No person may

engage in an investment transaction except as provided under the terms of this policy

and its procedures. The Investment Officer shall be responsible for all transactions

undertaken and shall establish a system of controls to regulate the activities of

subordinate officials.

Quality and Capability of Investment Management: Training

Each member of the Board of Trustees, the President, and the investment

officers shall attend at least one training session, provided by the Texas Higher

Education Coordinating Board, relating to the person's responsibilities under the Public

Funds Investment Act, within six months after taking office or assuming duties. The

training must include education in: investment controls, security risks, market risks, and

compliance with the Public Funds Investment Act.

The investment officers shall attend a training session not less than once in a

two-year period and may receive training from any independent source such as Texas

Higher Education Coordinating Board, other governmental agencies, or non-profit

organizations. The investment officers shall prepare a report on the Public Funds

5

Investment Act and deliver it to the Board no later than the 180

th

day after the last day of

each regular session of the legislature.

SAFEKEEPING AND CUSTODY

Authorized Financial Dealer and Institution

A list will be maintained of financial institutions authorized to provide investment

services. In addition, a list will be maintained of approved security broker/dealers

selected by credit worthiness. These may include "primary" dealers or regional dealers.

An annual review of the -financial condition and registration of qualified bidders will be

conducted.

For fiscal year 2010-11, the Board approves Community National Bank and Trust

as its primary dealer for purchase of securities and all financial institutions servicing the

College service area as banks for purchase of certificates of deposit and other interest

bearing accounts if the institution can provide appropriate deposit insurance and/or

pledged collateral or surety bonds.

The College will solicit at least three (3) competitive quotes when it purchases

Certificates of Deposit and similar investments. The primary depository bank has

provided a "floor" rate for these investments. Competitive rates will be solicited by

telephone from at least two other financial institutions before a Certificate or similar

investment is purchased. A bid file will be maintained of those bids. The institution

providing the best rate in the opinion of the investment officers will be selected.

The Investment Officer is responsible for establishing and maintaining an internal

control structure desjgned to ensure that the assets of Navarro College are protected

from loss, theft or misuse. The internal control structure shall be designed to provide

reasonable assurance that these objectives are met. The concept of reasonable

assurance recognizes that (1) the cost of the control should not exceed the benefits

likely to be derived; and (2) the valuation of costs and benefits requires estimates and

judgments by management.

Accordingly, the President shall establish a process of annual independent

review by an external auditor to assure compliance with policies and procedures. The

internal controls shall address the following points:

6

a. Control of collusion. Collusion is a situation in which two or more

employees are working in conjunction to defraud their employer.

b. Separation of transaction authority from accounting and record keeping.

By separating the person who authorizes or performs the transaction from

the people who record or otherwise account for the transaction, a

separation of duties is achieved. All investment transactions, with the

exception of investment pools and mutual funds, will be settled on a

delivery versus payment basis.

c. Custodial safekeeping. Securities purchased from any bank or dealer,

including appropriate collateral (as defined by State law), shall be placed

with an independent third party for custodial safekeeping.

d. Avoidance of physical delivery securities. Book entry securities are much

easier to transfer and account for since actual delivery of a document

never takes place. Delivered securities must be properly safeguarded

against loss or destruction. The potential for fraud and loss increases with

physically delivered securities.

e. Clear delegation of authority to subordinate staff members. Subordinate

staff members must have a clear understanding of their authority and

responsibilities to avoid improper action. Clear delegation of authority also

preserves the internal control structure that is contingent on the various

staff positions and their respective responsibilities.

SUITABLE AND AUTHORIZED INVESTMENTS

Investment Types

The following investments will be permitted by this policy:

a. U.S. Government obligations such as Treasury Bills, Treasury Notes,

Treasury Bonds, Discount Notes and Debentures

b. U.S. Government agency obligations such as Farm Credit System,

Farmers Home Administration, Federal Home Loan Bank, Federal Home

Loan Mortgage Corporation, Government National Mortgage Association,

Small Business Administration, Student Loan Marketing Association; and

Tennessee Valley Authority

c. Certificates of deposit

7

d. Savings and loan association deposits

e. Prime commercial paper that has a stated maturity of 270 days or less and

is rated not less than A-1 or P-1 by at least two nationally recognized

credit rating agencies

f. Investment-grade obligations of state and local governments and public

authorities

The following investments are not authorized by this policy:

Obligations whose payments represent the coupon payments on the

outstanding principal balance of the underlying mortgage-backed

security collateral and pay no principal

Obligations whose payments represent the principal stream of cash flow

from the underlying mortgage-backed security collateral and bear

no interest

Collateralized mortgage obligations that have a stated final maturity date

of greater than 10 years

Collateralized mortgage obligations the interest rate of which is

determined by an index that adjusts to opposite to the changes in a

market index

Col/ateralization

In accordance with state law, full collateralization will be required on certificates

of deposit and cash held in the College's depository bank. Collateralization of

certificates of deposit and cash balances will be in accordance with Chapter 2257 of

Vernon's Texas Codes Annotated. The total value of eligible collateral to secure the

College's deposit of public funds must be in an amount not less than the amount of

public funds increased by the amount of any accrued interest. The value of investment

security shall be its market value.

Investment securities to collateralize deposits of Navarro College shall be U.S.

Government debt obligations, U.S. Agency debt obligations, State of Texas, local

municipalities and district debt obligations. All investment securities will be held at the

Federal Reserve Bank, the Federal Home Loan Bank or at a third-party bank as

approved by the College.

8

All substitution of security collateral shall be approved by the Investment

Committee, composed of the Vice-President for Finance and Administration and/or the

Comptroller.

In accordance with H.B. 3459, the College requires the collateral pledged on

mortgage-backed securities pledged to the District be in an amount of not less than

110% of the market value of the securities.

Navarro College depository banks shall maintain a separate, accurate and

complete record relating to pledged investment securities, deposits of public funds and

transactions related to each pledged investment security. It is the College's

responsibility to inform the depository banks of any significant change in the amount of

activity of its deposits.

According to Section 2257.048 of the Government code, a security interest arises

out of a depository's bank pledge at the time that the custodian identifies the pledge of

the security on its books and records and issues the trust receipt.

INVESTMENT STRATEGY

Diversification

The investments will be diversified by security type and maturity. The buy and

sell decisions in regard to investments entered into the portfolio will be made by the

investment team. The investment team shall be composed of the Vice-President for

Finance and Administration and the Comptroller.

Buy and sell decisions will be influenced primarily by cash flow in each of the

respective funds listed previously. The fundamental investment strategy of Navarro

College will be to buy an investment and hold it until its maturity. However, because of

changes in market conditions and changes in anticipated cash flow, there may be

instances where decisions will need to be made to liquidate the investment prior to its

maturity.

When the investment team makes decisions in regard to purchasing securities

for the portfolio, the team must interpret the interest rate cycle and may choose to make

relatively long-term purchases for the purpose of "locking in" a favorable interest rate or

may choose to make shorter term purchases if they anticipate interest rates to be more

favorable in the future.

9

The investment team is given the responsibility for putting into place an

investment portfolio that serves the College's financial requirements and also attempts

to protect the College against market condition changes. It is the intent of this document

to give the investment team the latitude to purchase investments within the scope

outlined and to change strategies within the confines of the stated objectives of this

policy.

Maximum Maturities

Navarro College will normally limit final maturities on any securities to five years

or less. To the extent possible, Navarro College will attempt to match its investments

with anticipated cash flow requirements. Unless matched to a specific cash flow,

Navarro College will not directly invest in securities maturing more than five (5) years

from the date of purchase. The Investment Officer will analyze each fund and determine

what the appropriate average weighted maturity of the portfolio should be.

The following funds will require investments that are shorter term in maturity.

These funds will require investments that generally mature in one year or less:

Educational and General Fund

Plant Fund

Auxiliary Enterprises Fund

Agency Fund

Smaller amounts of the above funds may be invested for longer than one year if this

investment is consistent with cash flow requirements. The following funds will normally

allow for maturities of longer than one year:

Debt Service Fund

Student Financial Aid Fund

The Investment Officer will provide for a diversified maturity schedule for all

investments. In addition, diversification of security types, i.e. Federal Home Loan

Mortgage Notes, U. S. Treasury Bills, etc., is required. For Agency securities, normally

no more than 10 percent (10%) of the total portfolio shall be in one type of security

issued by one agency. There is no restriction on U.S. Treasury Notes.

10

REPORTING

Methods

The Investment Officer shall prepare an investment report at least quarterly,

including a succinct management summary that provides a clear picture of the status of

the current investment portfolio and transactions made over the last quarter. This

management summary will be prepared in a manner that will allow Navarro College to

ascertain whether investment activities during the reporting period have conformed to

the investment policy. The report should be provided to the President and the Board of

Trustees. The report must:

a. describe in detail the investment position of Navarro College on the date

of the report;

b. be prepared jointly by all investment officers of Navarro College;

c. be signed by the Investment Officer and Deputy Investment Officer;

d. contain a summary statement of each pooled fund group that includes the:

1. beginning market value for the reporting period;

2. additions and changes to market value during the period;

3. ending market value for the period;

e. state the book value and market value of each separately invested asset

that has a maturity date;

f. state the account or fund or pooled group fund for which each individual

investment was acquired;

g. state the compliance of the investment portfolio with Navarro College's

investment policy, investment strategy and the provision of the Public

Funds Investment Act as amended: and

h. be posted to the Navarro College website in accordance with State

Auditor's Office requirements.

In accordance with H.B. 2799, there will be a formal annual review of the quarterly

reports by an independent auditor, with results reported to the governing body. The

auditors should also report assurances regarding compliance with the Public Funds

I nvestment Act.

11

Petformance Standards

The investment portfolio will be managed in accordance with the parameters

specified within this policy. The portfolio should obtain a market average rate of return,

and its performance should be compared to appropriate benchmarks on a regular basis.

The investment officers will use the Wall Street Journal to monitor and report the market

prices of the investments acquired. Corrective action will be taken if an investment

consistently under-performs as compared to its appropriate benchmark.

Amendment

This policy shall be reviewed on an annual basis. In accordance with H.B. 2799,

the Board of Trustees will take formal action annually, stating that this policy and

strategy has been reviewed, and will record any changes in the document. Any

changes must be approved by the Board of Trustees, as well as the individual(s)

charged with maintaining internal controls. However, as changes occur in financial

markets, the Board of Trustees may amend this policy as often as needed.

STATE OF TEXAS

COUNTY OF NAVARRO

NAVARRO COLLEGE DISTRICT

I, the undersigned, Secretary-Treasurer of the Board of Trustees of Navarro

College District, do hereby certify that the attached is a true, full and correct copy of a

resolution adopted by the Board of Trustees on the 20th day of January, 2011,

reaffirming an investment policy for all col/ege funds.

WITNESS MY HAND AND SEAL of said District on this 20th day of

January, 2011.

SecretaryfTreasurer, Board of Trustees

Navarro College District

12

You might also like

- Navarro College 2010 Investment PolicyDocument13 pagesNavarro College 2010 Investment PolicyNavarro CollegeNo ratings yet

- Port Folio ManagementDocument16 pagesPort Folio ManagementanjanigolchhaNo ratings yet

- Takafulink Fund Fact SheetDocument31 pagesTakafulink Fund Fact SheetCikgu AbdullahNo ratings yet

- Villages MACM InvestmentPolicy NSCUDD 8-14-14Document13 pagesVillages MACM InvestmentPolicy NSCUDD 8-14-14hNo ratings yet

- Product Highlights Sheet Principal Islamic Lifetime Sukuk FundDocument8 pagesProduct Highlights Sheet Principal Islamic Lifetime Sukuk FundMAKK Business SolutionsNo ratings yet

- En Principal Islamic Money Market Fund D PHSDocument8 pagesEn Principal Islamic Money Market Fund D PHSnirmala sundrarajNo ratings yet

- Eastspring Investments Dinasti Equity Fund Product HighlightsDocument8 pagesEastspring Investments Dinasti Equity Fund Product HighlightsGrab Hakim RazakNo ratings yet

- Investment Policy for 12 Financial InstrumentsDocument14 pagesInvestment Policy for 12 Financial InstrumentsHamis Rabiam MagundaNo ratings yet

- Project Report On Portfolio ManagementDocument6 pagesProject Report On Portfolio Managementanunazanu100% (1)

- Investment Policy1Document8 pagesInvestment Policy1Hamis Rabiam MagundaNo ratings yet

- Content: Sr. No. Particulars NODocument21 pagesContent: Sr. No. Particulars NORANG2812No ratings yet

- What Is An Investment Policy Statement (IPS) ?Document3 pagesWhat Is An Investment Policy Statement (IPS) ?Helen TuberaNo ratings yet

- Affin Hwang Flexible Maturity Incvome Fund IV - Prospectus (TMF Trustees)Document82 pagesAffin Hwang Flexible Maturity Incvome Fund IV - Prospectus (TMF Trustees)kairNo ratings yet

- Introduction To Portfolio ManagementDocument84 pagesIntroduction To Portfolio ManagementRadhika SivadiNo ratings yet

- Portfolio ManagmentDocument30 pagesPortfolio ManagmentMitali AmagdavNo ratings yet

- Summary of A Primer For Investment TrusteesDocument7 pagesSummary of A Primer For Investment TrusteesjonathanwsmithNo ratings yet

- Your Investment Policy Statement (IPS) in 40 CharactersDocument6 pagesYour Investment Policy Statement (IPS) in 40 CharactersAjay KumarNo ratings yet

- Investment Policy StatementDocument8 pagesInvestment Policy StatementTomi Adeyemi100% (3)

- Portfolio ManagementDocument65 pagesPortfolio ManagementAasthaNo ratings yet

- Security AnalysisDocument21 pagesSecurity AnalysisCharishma KarumanchiNo ratings yet

- Chapter 7 - Portfolio inDocument12 pagesChapter 7 - Portfolio intemedebereNo ratings yet

- Module 1-Introduction-MergedDocument99 pagesModule 1-Introduction-MergedKevin MehtaNo ratings yet

- Submitted By: Prince Sharma M.B.A-II ROLL NO.-22 Submitted To: - Prof. Harpreet KaurDocument4 pagesSubmitted By: Prince Sharma M.B.A-II ROLL NO.-22 Submitted To: - Prof. Harpreet KaurShubhamNo ratings yet

- Investment Policy Objectives and ConstraintsDocument7 pagesInvestment Policy Objectives and ConstraintsPatrick ChibabulaNo ratings yet

- SVP Cap Solutions Fund II & Banner Ridge Secondary Fund VDocument61 pagesSVP Cap Solutions Fund II & Banner Ridge Secondary Fund Vgeorgi.korovskiNo ratings yet

- A. Purpose: Number: A2509 Maricopa County PolicyDocument7 pagesA. Purpose: Number: A2509 Maricopa County Policytonygoprano2850No ratings yet

- Schroder International Opportunities Portfolio - Schroder Asian Income (The "Fund'')Document4 pagesSchroder International Opportunities Portfolio - Schroder Asian Income (The "Fund'')Yang Cai De DerekNo ratings yet

- Investment Analysis and Portfolio Management Chapter 7Document15 pagesInvestment Analysis and Portfolio Management Chapter 7Oumer ShaffiNo ratings yet

- Loyola University Maryland Investment Policy StatementDocument12 pagesLoyola University Maryland Investment Policy StatementhNo ratings yet

- Investment PolicyDocument23 pagesInvestment Policyrj5307No ratings yet

- Fort Worth CIO Position SpecificationDocument5 pagesFort Worth CIO Position SpecificationMarshay HallNo ratings yet

- Subject: - : Special Studies in FinanceDocument18 pagesSubject: - : Special Studies in Financeshahnikita96No ratings yet

- Neo Special Credit Fund Talking Points 2pg RevDocument2 pagesNeo Special Credit Fund Talking Points 2pg RevDrupad N DivyaNo ratings yet

- Corporate Strategic Change & Alternative Investment Strategies ChapterDocument11 pagesCorporate Strategic Change & Alternative Investment Strategies ChapterYisfalem AlemayehuNo ratings yet

- Portfolio Management Objectives and ImportanceDocument71 pagesPortfolio Management Objectives and ImportanceFaizan Sir's TutorialsNo ratings yet

- Portfolio Management Study at Angel Stock BrokingDocument30 pagesPortfolio Management Study at Angel Stock Brokingarjunmba119624No ratings yet

- Portfolio ManagementDocument40 pagesPortfolio ManagementSayaliRewaleNo ratings yet

- Id 49 BMDocument13 pagesId 49 BMMd Majedul HaqueNo ratings yet

- Abercrombie FundDocument12 pagesAbercrombie FundTravis SatnarineNo ratings yet

- RHB-OSK Malaysia DIVA Fund Responsibility StatementDocument5 pagesRHB-OSK Malaysia DIVA Fund Responsibility StatementNur Hidayah JalilNo ratings yet

- Introduction To Alternative InvestmentsDocument44 pagesIntroduction To Alternative Investmentscdietzr100% (1)

- Introduction To The Study: Aim of Doing The ProjectDocument64 pagesIntroduction To The Study: Aim of Doing The ProjectBeing Sumit Sharma100% (1)

- The Portfolio Management ProcessDocument9 pagesThe Portfolio Management ProcessPanashe MachekepfuNo ratings yet

- A Course Material On Security Analysis and Portfolio ManagementDocument22 pagesA Course Material On Security Analysis and Portfolio Managementabid hussainNo ratings yet

- A Course Material On Security Analysis and Portfolio ManagementDocument22 pagesA Course Material On Security Analysis and Portfolio ManagementMantosh SharmaNo ratings yet

- Kiidoc 2020 07 20 en CH 2020 07 30 Lu0337271356Document2 pagesKiidoc 2020 07 20 en CH 2020 07 30 Lu0337271356Isabelle ChapuysNo ratings yet

- Key Investor Information Document SummaryDocument2 pagesKey Investor Information Document SummaryIsabelle ChapuysNo ratings yet

- Portfolio ManagementDocument86 pagesPortfolio ManagementSenelwa AnayaNo ratings yet

- Investment Policy for Young InvestorDocument8 pagesInvestment Policy for Young InvestorDaniyal NasirNo ratings yet

- Objectives & Scope of Portfolio ManagementDocument4 pagesObjectives & Scope of Portfolio ManagementGourav BaidNo ratings yet

- Basics of Investment (Part-II)Document23 pagesBasics of Investment (Part-II)Ariful Haidar MunnaNo ratings yet

- Chapter - 1Document69 pagesChapter - 1111induNo ratings yet

- PDF - Investment Policy Statement ReviewDocument12 pagesPDF - Investment Policy Statement Reviewmungufeni amosNo ratings yet

- Institutional Investment Management NotesDocument13 pagesInstitutional Investment Management NotesFineman TlouNo ratings yet

- Portfolio Mangemnt Services Draft 28-7-14Document14 pagesPortfolio Mangemnt Services Draft 28-7-14Yash GaonkarNo ratings yet

- Sunlife Balanced Fund KFDDocument4 pagesSunlife Balanced Fund KFDPaolo Antonio EscalonaNo ratings yet

- 2 Investment ProcessDocument30 pages2 Investment ProcessharshitdayalNo ratings yet

- Lecture Presentation Software: Investment Analysis and Portfolio ManagementDocument31 pagesLecture Presentation Software: Investment Analysis and Portfolio ManagementOptimistic EyeNo ratings yet

- Portfolio ConstructionDocument5 pagesPortfolio Constructionajayuseless100% (1)

- Brilliance Graduate Scholarship PacketDocument2 pagesBrilliance Graduate Scholarship PacketNavarro CollegeNo ratings yet

- Navarro College Dining MenuDocument2 pagesNavarro College Dining MenuNavarro CollegeNo ratings yet

- Dining Services MenuDocument1 pageDining Services MenuNavarro CollegeNo ratings yet

- Dual Credit PresentationDocument35 pagesDual Credit PresentationNavarro CollegeNo ratings yet

- Brilliance Graduate Scholarship PacketDocument2 pagesBrilliance Graduate Scholarship PacketNavarro CollegeNo ratings yet

- Brilliance Scholarship For General AcademicsDocument3 pagesBrilliance Scholarship For General AcademicsNavarro CollegeNo ratings yet

- Application For Brilliance Graduate ScholarshipDocument1 pageApplication For Brilliance Graduate ScholarshipNavarro CollegeNo ratings yet

- Notice of Board of Trustees Meeting January 17, 2013Document1 pageNotice of Board of Trustees Meeting January 17, 2013Navarro CollegeNo ratings yet

- Academic Dual Credit RegistrationDocument1 pageAcademic Dual Credit RegistrationNavarro CollegeNo ratings yet

- DCQuickRef RevisedDocument1 pageDCQuickRef RevisedNavarro CollegeNo ratings yet

- 2012 - 2013 CrosswalkDocument2 pages2012 - 2013 CrosswalkNavarro CollegeNo ratings yet

- Career & Technology Dual Credit RegistrationDocument1 pageCareer & Technology Dual Credit RegistrationNavarro CollegeNo ratings yet

- Academic Vs Career TechDocument1 pageAcademic Vs Career TechNavarro CollegeNo ratings yet

- Dual Credit Testing Requirements 09-10Document1 pageDual Credit Testing Requirements 09-10Navarro CollegeNo ratings yet

- Dual Credit Application PacketDocument4 pagesDual Credit Application PacketNavarro CollegeNo ratings yet

- Presidential Search Memorandum January 2013Document1 pagePresidential Search Memorandum January 2013Navarro CollegeNo ratings yet

- Continuing Education ClassesDocument1 pageContinuing Education ClassesNavarro CollegeNo ratings yet

- PhlebotomyDocument2 pagesPhlebotomyNavarro CollegeNo ratings yet

- Comprehensive Annual Financial Report 2012Document136 pagesComprehensive Annual Financial Report 2012Navarro CollegeNo ratings yet

- Oil and Gas Technology CertificateDocument1 pageOil and Gas Technology CertificateNavarro CollegeNo ratings yet

- Certified Nurse AideDocument1 pageCertified Nurse AideNavarro CollegeNo ratings yet

- Navarro College 2012-2013 - CatalogDocument201 pagesNavarro College 2012-2013 - CatalogNavarro CollegeNo ratings yet

- Navarro College 2012 Investment PolicyDocument13 pagesNavarro College 2012 Investment PolicyNavarro CollegeNo ratings yet

- Navarro College Dual Credit Admissions ApplicationDocument2 pagesNavarro College Dual Credit Admissions ApplicationNavarro CollegeNo ratings yet

- A.A.S. Petroleum Technology Degree PlanDocument1 pageA.A.S. Petroleum Technology Degree PlanNavarro CollegeNo ratings yet

- Dual Credit Scholarship ApplicationDocument3 pagesDual Credit Scholarship ApplicationNavarro CollegeNo ratings yet

- CPR ClassesDocument1 pageCPR ClassesNavarro CollegeNo ratings yet

- Computer ClassesDocument1 pageComputer ClassesNavarro CollegeNo ratings yet

- General Academic Scholarship ApplicationDocument2 pagesGeneral Academic Scholarship ApplicationNavarro CollegeNo ratings yet

- Certified Logistics ClassesDocument1 pageCertified Logistics ClassesNavarro CollegeNo ratings yet

- Planner Approval For Move Order RequisitionsDocument7 pagesPlanner Approval For Move Order RequisitionsSrimannarayana KasthalaNo ratings yet

- Review of Banking Services in The Falkland IslandsDocument101 pagesReview of Banking Services in The Falkland IslandsMercoPressNo ratings yet

- Asm1 - Bee - Ha Thi VanDocument25 pagesAsm1 - Bee - Ha Thi VanVân HàNo ratings yet

- (COBIT 2019) Introduction and MethodologyDocument69 pages(COBIT 2019) Introduction and Methodology31.0930No ratings yet

- Airport Urbanism Max HirshDocument4 pagesAirport Urbanism Max HirshMukesh WaranNo ratings yet

- Dec Salary SlipsDocument1 pageDec Salary Slipsrakeshsingh9811No ratings yet

- Finance, Marketing & HR courses in MBA 2nd yearDocument28 pagesFinance, Marketing & HR courses in MBA 2nd yearGaneshRathodNo ratings yet

- Project Report On HR Policies and Its Implementation at Deepak Nitrite LimitedDocument64 pagesProject Report On HR Policies and Its Implementation at Deepak Nitrite LimitedRajkumar Das75% (4)

- Risk Management in PT. Maja Ruang Delapan PDFDocument43 pagesRisk Management in PT. Maja Ruang Delapan PDFDea BonitaNo ratings yet

- (N-Ab) (1-A) : To Tariffs)Document16 pages(N-Ab) (1-A) : To Tariffs)Amelia JNo ratings yet

- SAP Agricultural Contract ManagementDocument14 pagesSAP Agricultural Contract ManagementPaulo FranciscoNo ratings yet

- Procurement Workshop Invite 8th April 2013 PDFDocument2 pagesProcurement Workshop Invite 8th April 2013 PDFDurban Chamber of Commerce and IndustryNo ratings yet

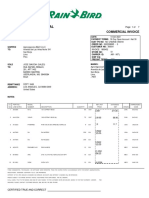

- Rain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Document7 pagesRain Bird International: 6991 E. Southpoint Road Tucson, AZ 85756 United States Fed Tax ID: 95-2402826Alejandra JamboNo ratings yet

- CPD Part-Time or Semi-RetiredDocument1 pageCPD Part-Time or Semi-RetiredUsman AftabNo ratings yet

- Go-to-Market & Scale - 2020-01-09 - Emin, Patrick, TessaDocument58 pagesGo-to-Market & Scale - 2020-01-09 - Emin, Patrick, TessaFounderinstituteNo ratings yet

- HIPPADocument5 pagesHIPPAAsmita Wankhede MeshramNo ratings yet

- IBM Network and Service Management Solutions Help SBB Keep Trains On ScheduleDocument2 pagesIBM Network and Service Management Solutions Help SBB Keep Trains On ScheduleIBMTransportationNo ratings yet

- Managing Human Resources: Chapter # 12Document17 pagesManaging Human Resources: Chapter # 12Malaika Maryam CNo ratings yet

- Risks of Material Misstatement at Financial Statement and Assertion LevelsDocument5 pagesRisks of Material Misstatement at Financial Statement and Assertion Levelskris mNo ratings yet

- FPC ManualDocument8 pagesFPC ManualAdnan KaraahmetovicNo ratings yet

- Account Analysis Statement GuideDocument6 pagesAccount Analysis Statement GuideCr CryptoNo ratings yet

- Ampeloquio v. Jaka Distribution, Inc.Document10 pagesAmpeloquio v. Jaka Distribution, Inc.AnnieNo ratings yet

- Unit 1 Concept of Human Resources ManagementDocument2 pagesUnit 1 Concept of Human Resources ManagementPrajita ShresthaNo ratings yet

- 12 Accountancy Lyp 2017 Foreign Set3Document41 pages12 Accountancy Lyp 2017 Foreign Set3Ashish GangwalNo ratings yet

- Study Guide 7 Entrepreneurship 1Document43 pagesStudy Guide 7 Entrepreneurship 1Cathlyne Mejia NatnatNo ratings yet

- New AFU 07407 CF Slides 2022Document73 pagesNew AFU 07407 CF Slides 2022janeth pallangyoNo ratings yet

- Solved Twelve Accounting and Financial Services Professionals Opt To Form ADocument1 pageSolved Twelve Accounting and Financial Services Professionals Opt To Form AAnbu jaromiaNo ratings yet

- Higher Education Financing Agency BrochureDocument6 pagesHigher Education Financing Agency BrochuremidhunnobleNo ratings yet

- Rox and Inclusive Music Analysis Questions PDFDocument4 pagesRox and Inclusive Music Analysis Questions PDFShaib Hassan Alvi50% (2)

- FMar Financial Markets Formulas Rob NotesDocument8 pagesFMar Financial Markets Formulas Rob NotesEvelyn LabhananNo ratings yet