Professional Documents

Culture Documents

Daily Agri Report Nov 30

Uploaded by

Angel BrokingOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Daily Agri Report Nov 30

Uploaded by

Angel BrokingCopyright:

Available Formats

Commodities Daily Report

Friday| November 30, 2012

Agricultural Commodities

Content

News & Market Highlights Chana Sugar Oilseed Complex Spices Complex Kapas/Cotton

Research Team

Vedika Narvekar - Sr. Research Analyst vedika.narvekar@angelbroking.com (022) 2921 2000 Extn. 6130 Anuj Choudhary - Research Analyst anuj.choudhary@angelbroking.com (022) 2921 2000 Extn. 6132

Angel Commodities Broking Pvt. Ltd. Registered Office: G-1, Ackruti Trade Centre, Rd. No. 7, MIDC, Andheri (E), Mumbai - 400 093. Corporate Office: 6th Floor, Ackruti Star, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 2921 2000 MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX: Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

Disclaimer: The information and opinions contained in the document have been compiled from sources believed to be reliable. The company does not warrant its accuracy, completeness and correctness. The document is not, and should not be construed as an offer to sell or solicitation to buy any commodities. This document may not be reproduced, distributed or published, in whole or in part, by any recipient hereof for any purpose without prior permission from Angel Commodities Broking (P) Ltd. Your feedback is appreciated on commodities@angelbroking.com

www.angelcommodities.com

Commodities Daily Report

Friday| November 30, 2012

Agricultural Commodities

News in brief

Food Ministry puts on hold PDS sugar price hike

The Food Ministry has decided to put on hold its proposal to hike retail price of sugar sold through the ration shops as the government is considering the Rangarajan report on sugar decontrol. Since 2002, sugar is being sold at Rs 13.50 per kg in ration shops, while the government buys it from mills at about Rs 22-23 per kg. According to a senior government official, The Food Ministry has started examining the recommendations of the Rangarajan report on sugar decontrol. The issue of raising the central issue price (retail price) of sugar would be discussed along with the reports suggestion on removal of levy sugar mechanism.

(Source: Business Line)

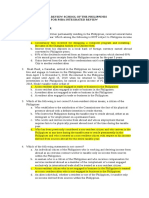

Market Highlights (% change)

Last Prev. day

as on Nov 29, 2012

WoW MoM YoY

Sensex Nifty INR/$ Nymex Crude Oil - $/bbl Comex Gold - $/oz

19171 5825 54.72 88.07 1727

1.75 1.70 -1.33 1.02 -0.86

3.85 3.74 -0.72 0.79 -0.04

4.02 4.06 1.40 2.79 0.98

18.90 20.55 4.97 -12.25 -1.05

.Source: Reuters

Ukraine may increase maize area by 11 pct in 2013

Ukrainian farmers are likely to increase the area sown for maize by 11 percent to about 5.0 million hectares in 2013 due to stable foreign demand and expected high prices, Kiev-based analyst UCAB said on Thursday. Ukraine, the world's fourth-biggest maize exporter in 2011/12, raised the area to 4.5 million hectares in 2012 from 3.6 million hectares a year earlier. The former Soviet republic, which harvested about 5 million tonnes of maize 10 years ago, boosted production to 22.7 million tonnes in 2011 and plans to harvest about 21 million tonnes this year. "Farmers plan to sow about 5 million hectares of maize next year. But a possible shortage of high quality seeds might ruin this plan," UCAB President Dr. Alex Lissitsa said. (Source: Reuters)

Cabinet nod for more wheat, rice exports

The Cabinet Committee on Economic Affairs has approved the continuation of the unrestricted export of wheat and non-basmati rice. This is in view of the adequate availability of wheat and non-basmati rice in the domestic market, an official statement said. The proposal was moved by the Department of Commerce. Sources said additional wheat exports of up to 2.5 million tonnes (mt) would be allowed from the Governments stocks. The Government is sitting on a huge pile of wheat stocks pegged at 40.57 mt as of November 1 about thrice the buffer and strategic reserve at this point in time. The Governments latest move would help fetch better realisations as global wheat prices have firmed up as drought in countries such as Russia, Ukraine, the United States and Australia has slashed output hurting supplies. (Source: Business Line)

China grain imports to rise as food demand surges

China will increasingly depend on overseas markets for its grain supplies as domestic production falls behind growing demand, the country's top agriculture official said on Thursday. Chen Xiwen, director of the Chinese Communist Party's top policy making body for rural affairs, said the country would need an additional 40 million hectares of sowing areas, 25 percent of its current total, in order to replace current import volumes with domestic production. The migration of as many as 230 million farm workers to the cities since the turn of this century has eroded the country's self-sufficiency in grains, Chen told a forum in Beijing. (Source:

Reuters)

US agency sees moderate chance for a Bay storm

The Climate Prediction Centre (CPC) of the US National Weather Services continues to track behaviour of a low-pressure area over Andaman Sea. There has been convection (cloud-building leading to storm development) over the Bay and the Andaman Sea in recent times, CPC said in its latest weather analysis. In its forecast for the week ending December 4, it said that there is a moderate chance of storm development in the region. It also noted weather systems in the sea have not been getting the required feedback from upper levels to develop into full strength as storms. IMD has warned of the possibility of heavy rainfall at one or two places over Andaman and Nicobar Islands during next two days. A circulation over Southeast Arabian Sea Rain may bring thundershowers at one or two places over south Tamil Nadu, Kerala and Lakshadweep during this period. (Source: Business Line)

IGC trims forecast for 2012/13 global wheat crop

The International Grains Council on Thursday cut its forecast for global wheat production in 2012/13, widening an anticipated year-on-year decline, but noted high prices should trigger a rise in plantings for the following season. The IGC, in a monthly report, forecast a global wheat crop of 654 million tonnes in 2012/13, down one million tonnes from its previous estimate and now 41 million below the prior season after drought cut output in the Black Sea region. The latest cut reflected minor revisions for Australia (21.5 million tonnes from 22.0 million) and the European Union (130.3 million from 130.6 million). Prices of wheat Wc1 have risen by around one-third since the beginning of this year buoyed by lower production in the former Soviet Union as well as drought in the U.S. which cut maize production and tightened global grain stocks."Given high prices, the total wheat harvested area for 2013/14 is set to increase by 2 percent, although conditions for parts of the U.S. are a concern," the IGC said. (Source: Reuters)

Govt rice buying up 8%

Rice procurement by Government agencies has crossed 12 million tonne (mt) so far in the kharif marketing season (KMS) 2012-13, starting October. This is about 8 per cent higher than 11.08 mt in the corresponding period last year. Total paddy procurement in the first two months of KMS 2012-13 stood at 17.63 mt, up by a tenth over last years 16 mt. This increase is led by higher procurement in the key States of Punjab and Haryana. In Punjab, paddy procurement was up by 11 per cent at 12.66 million tonnes. The procurement process is still on in Punjab, whereas in neighbouring Haryana it is almost complete. Haryana has procured about 31 per cent more paddy this year at 3.81 mt against 2.91 mt in corresponding last year. (Source: Business Line)

Cardamom export likely to be just half of last years

Cardamom export this year is expected to see a fall of at least 50 per cent, due to lower production. About 2,000 tonnes is available for export and even if more stocks meant for local consumption is diverted, it will be around half of last years export of 4,650 tonnes (worth Rs. 363 crore). Apart from lower output, pricing is an issue. The export price of the major competitor, Guatemala, is lower than Indias. The Spices Board of India has fixed an export target of 4,000 tonnes for 2012- 13, split between 3,000 tonnes of the small variety and 1,000 tonnes of the large one. (Source: Business Standard)

India's PEC gets highest bid at $328/T in wheat export tender

India's state-run trading company PEC Ltd has received the highest bid at $328 per tonne from Dubai-based trading firm Transcom DMCC in its wheat export tender, trade sources said on Thursday. Earlier this month, PEC floated a tender offering 125,000 tonnes of milling wheat for shipments by Jan. 15 from government warehouses located on the west coast. On Tuesday, state-run MMTC Ltd received the highest bid at $322.13 per tonne from global trading firm Toepfer for its 50,000 tonnes wheat export tender. (Source: Reuters)

www.angelcommodities.com

Commodities Daily Report

Friday| November 30, 2012

Agricultural Commodities

Chana

Chana futures declined 0.9% on Thursday on expectations Rabi sowing progress data to be released on Friday, may show further improvement in chana sowing across India. Higher import expectations also supported the weak market sentiments. Total pulses acreage as on 23rd November is down by 8% to 85.1 lakh ha from 92.49 lakh ha last season. Acreage was down by almost 17% till the previous week and thus shown some recovery in the sowing. In Maharashtra Chana acreage is up by 39% at 6.8 lakh ha as on 23rd Nov. While in AP it is up by 35% at 4.93 lakh ha. However, in Rajasthan, sowing is down by 11% at 11.36 lakh ha. Except for Wheat, minimum support price of all other Rabi crops has been increased by CCEA for 2012-13 season. MSP of Chana/Gram is raised by Rs 400 per qtl for 2012-13 season to Rs 3200. Higher returns and favorable soil condition will definitely boost acreage in the coming season. The Commission for Agriculture Costs and Prices (CACP) has suggested 10 per cent import duty on pulses to encourage domestic production. in the first six months of the new fiscal that is from April to September this year, imports were an estimated 12 lakh tonnes.

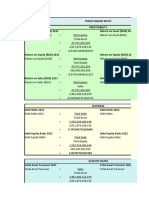

Market Highlights

Unit Rs/qtl Rs/qtl Last 4437 4237 Prev day 0.51 -0.87

as on Nov 29, 2012 % change WoW MoM 0.83 -4.59 -0.05 -10.16 YoY 40.85 36.55

Chana Spot - NCDEX (Delhi) Chana- NCDEX Dec'12 Futures

Source: Reuters

Technical Chart - Chana

NCDEX Dec contract

Sowing progress and demand supply fundamentals

Improved rains towards the end of monsoon season coupled with hike in MSP have raised prospects of Chana sowing in the 2012-13 season. Also, farm ministry has targeted 7.9 mn tn chana output for 2012-13 season, higher compared to 7.58 mn tn in 2011-12. According to the Ministry of Agriculture 99.81 Lakh hectare area has been planted under Kharif pulses in 2012-13 compared to 108.28 lakh hectare (ha) in the previous year. According to the first advance estimates of 2012-13 season, kharif pulses output is estimated lower by 14.6% at 5.26 million tonnes compared with 6.16 mn tn last year. Kharif pulses harvesting would commence from next month. Assocham estimates, 21 mn tn of pulses demand in 2012-13 and is likely to reach at 21.42 mn tn in 2013-14 and 21.91 MT in 2014-15. (Source: Agriwatch)

Source: Telequote

Technical Outlook

Contract Chana Dec Futures Unit Rs./qtl Support

valid for Nov 30, 2012 Resistance 4280-4325

4150-4180

Outlook

Expectations of ease in supplies amid higher shipments coupled with subdued demand will keep bearishness intact. Prices may also take cues from sowing progress of Rabi pulses which is expected to gain momentum in the coming days.

www.angelcommodities.com

Commodities Daily Report

Friday| November 30, 2012

Agricultural Commodities

Sugar

Sugar futures gained sharply during the early part of the session on delayed cane crushing in UP and expectations of hike in import duty on white sugar. However, sufficient supplies amid higher quota capped the upside and prices settled marginally higher by 0.85% on Thursday. In a move to curb any further spike in sugar prices considering lower sugar production for the marketing year 2012-13, Government has allocated total 70 lac tons of non-levy sugar quota for Dec-March 201213 period which is higher from 59.5 lac tons sugar quota allocated by government last year same period . Out of total 70 lac tons, Government released 66 lac tons non-levy sugar quota and 2 lac tons levy conversion sugar quota. Also, there is an extension of around 2 lac tons from October, 2012 - November, 2012 which the millers have to release upto 10th December, 2012. Liffe white sugar as well as ICE sugar settled higher by 0.73% and 0.94% respectively, in line with firm commodity markets on U.S budget deal optimism. Prices have traded on a weak note over the last couple of days on account of higher pace of crushing in Brazil coupled with higher sugar surplus forecast for fourth straight year, which has led to a sharp decline in international sugar prices.

Market Highlights

Unit Sugar Spot- NCDEX (Kolhapur) Sugar M- NCDEX Dec '12 Futures Rs/qtl Last 3446

as on Nov 29, 2012 % Change Prev. day WoW 0.83 -0.12 MoM -1.27 YoY 11.16

Rs/qtl

3318

0.85

1.47

-1.66

10.53

Source: Reuters

International Prices

Unit Sugar No 5- LiffeMar'13 Futures Sugar No 11-ICE Mar '13 Futures $/tonne $/tonne Last 513.3 429.78

as on Nov 29, 2012 % Change Prev day WoW 0.73 0.94 -1.74 #N/A MoM -5.76 -1.12 YoY -16.83 -18.02

.Source: Reuters

Technical Chart - Sugar

NCDEX Dec contract

Domestic Production and Exports

According to the first advance estimates by agriculture ministry, Sugarcane output is pegged at 335.3 mn tn, down by 6.2% compared to 357.6 mn tn last year. 9.84 lakh tons of sugar has been produced in the current sugar season 2012-13 upto 15th November, 2012 that is 2 lakh tons higher to the production in the same period last year of 7.76 lakh tons. (Source: PIB) Despite of higher acreage, the producers body has estimated next years sugar output lower at 24 mn tn, down by 2mn tn compared to the current year. Industry body ISMA has estimated 6 mn tn stocks for the new season beginning October 01, 2012 compared to 5.5 mn tn year ago. India may export 2.5-3 mn tn sugar in 2012-13. With the opening stocks of 6 mn tn, domestic Sugar supplies are estimated at 30mn tn against the domestic consumption of around 22.523 mln tn for 2012-13.

Source: Telequote

Technical Outlook

Contract Sugar Dec NCDEX Futures Unit Rs./qtl Support

valid for Nov 30, 2012 Resistance 3335-3350

Global Sugar Updates

Sugar output in brazil which was lower compared to last year since the beginning of the crushing season in May, is now up marginally by 0.1% at 29.3 mn tn. Thailand, the world's second-largest exporter after Brazil, has slashed its output forecast in the year to October 2013 to 9.4 million tonnes from 10 million due to poor rain. About 1 mn tn of cane have been crushed in Thailand as the harvest progresses, producing up to 56,000 tn of sugar so far, a 28% increase from the same year-ago period. The International Sugar Organization said it expected a global sugar surplus of 5.86 million tonnes in the season running from October 2012 to September 2013, up from the prior season's surplus of 5.19 million tonnes. The ISO said the stocks/consumption ratio could rise to around 40 percent in 2012/13, from 37.6 percent in 2011/12. (Source: Reuters)

3280-3300

Outlook

Sugar prices may remain range bound as sufficient supplies available may offset the positive markets sentiments cause d by delay in cane crushing in UP.

www.angelcommodities.com

Commodities Daily Report

Friday| November 30, 2012

Agricultural Commodities

Oilseeds

Soybean: Soybean December futures recovered sharply from its low of Rs 3252 per qtl level and settled marginally higher by 0.38% amid good demand both soy meal as well as edible oil. Downside was mainly on account of weak CPO prices which declined on expectations of higher stocks.

Arrivals remained around 3-3.5 lakh bags on Monday while, demand from solvent extractors is robust to meet the soy meal export commitment. Soy meal exports during October are down 49,840 tn in October, the seventh consecutive month of fall in the current fiscal year, from 223,594 tn a year ago. This is because; most export commitments were done for forward trade like Nov-Dec amid uncertainty over supplies in October. According to first advance estimates, Soybean output is pegged at 126.2 lakh tn for 2012-13.

Market Highlights

Unit Soybean Spot- NCDEX (Indore) Soybean- NCDEX Dec '12 Futures Ref Soy oil SpotNCDEX(Indore) Ref Soy oil- NCDEX Dec '12 Futures Rs/qtl Rs/qtl Rs/10 kgs Rs/10 kgs Last 3291 3271 742 730.8

as on Nov 29, 2012 % Change Prev day 0.00 0.38 -0.36 0.68 WoW 0.64 1.58 1.85 2.88 MoM 1.11 0.63 4.77 6.27 YoY 47.98 45.80 17.49 15.15

Source: Reuters

as on Nov 29, 2012 International Prices Soybean- CBOTNov'12 Futures Soybean Oil - CBOTDec'12 Futures Unit USc/ Bushel USc/lbs Last 1448 49.77 Prev day 0.12 -0.68 WoW 2.82 2.56 MoM -5.59 -0.64

Source: Reuters

YoY 28.00 1.01

International Markets

CBOT soybean prices closed higher by 0.12% on Thursday due to firm US soy products exports. Prices have risen this week taking cues from the dwindling supplies from South American nations coupled with increasing demand for crushing in US. South American exports of soybeans to China are now dwindling, probably falling to only 0.30.4 Mn T in November. As per Argentina's Agriculture Ministry weekly crop progress report, farmers have planted 31% of the estimated acreage for soybean to 5.921 mn ha , down 13% from the previous year. The National Oilseed Processors Association (NOPA) reported the U.S. soybean crush for October at 153.536 million bushels, the largest monthly figure since January 2010 and the highest for October since 2009. According to the USDA November monthly report, The U.S. Department of Agriculture on Friday raised its estimate for soybean production by 4% from its forecast last month, saying that rainfall late in the growing season softened the impact of the U.S. drought. th Brazil's government on 8 Nov 2012 edged up its forecast for a record 2012/13 soybean crop to between 80.1 and 83 mn tn.

Crude Palm Oil

as on Nov 29, 2012 % Change Prev day WoW 0.46 -1.33 -5.65 -2.72

Unit

CPO-Bursa Malaysia Dec '12 Contract CPO-MCX- Nov '12 Futures

Last 2170 422.8

MoM -13.20 -0.75

YoY -29.04 -17.00

MYR/Tonne Rs/10 kg

Source: Reuters

RM Seed

Unit RM Seed SpotNCDEX (Jaipur) RM Seed- NCDEX Dec'12 Futures Rs/100 kgs Rs/100 kgs Last 4225 4214 Prev day 0.72 1.86

as on Nov 29, 2012 WoW -1.74 0.64 MoM -2.31 -0.68

Source: Reuters

YoY 36.68 33.91

Refined Soy Oil: Ref soy oil as well as CPO declined on account of

weak international BMD futures on the back of soaring Malaysian stocks amid lower exports. Malaysian will announce details of its proposed cut to crude palm oil export taxes by the end of December which will come into effect from Jan 01, making their exports competitive. Palm oil output in the world's biggest producer Indonesia is expected to climb 7% next year to 27 mn tn.

Technical Chart Soybean

NCDEX Dec contract

Rape/mustard Seed: Rm seed futures recovered and settled

higher by 1.9% on account of short coverings amid lower supplies in the near term. Prices have corrected on prospects of better sowing. Indias rapeseed output is expected to rise by 5% to 6.5 mn tn from 6 mn tn last year. So far, mustard has been covered on 52.2 lakh ha up from last seasons 50.7. MSP for Mustard seed is increased to Rs 3000/qtl.

Outlook

Edible oil prices will take cues analyst view covering the palm oil sector 2013 price forecasts for the tropical oil at the Indonesias two-day conference. Fundamentally, prices are expected to trade on a positive note during the intraday on account of good demand from solvent extractors for soybean and strong demand soy oil amid lower availability of mustard oil to meet the winter season demand. Mustard prices may remain under downside pressure on prospects of higher sowing and thereby better output next year.

Source: Telequote

Technical Outlook

Contract Soy Oil Dec NCDEX Futures Soybean NCDEX Dec Futures RM Seed NCDEX Dec Futures CPO MCX Dec Futures Unit Rs./qtl Rs./qtl Rs./qtl Rs./qtl

valid for Nov 30, 2012 Support 722-727 3200-3230 4115-4165 420-424 Resistance 735-738 3300-3340 4250-4275 432-440

www.angelcommodities.com

Commodities Daily Report

Friday| November 30, 2012

Agricultural Commodities

Black Pepper

Pepper futures recovered sharply from lower levels yesterday due to festive as well as winter demand. Stocks are also reported to be low. Prices have corrected sharply over the last one month over reports that FMC has launched probe into complaints against pepper market movement. Prices have also corrected on expectations of better output in the domestic as well as the international markets. Farmers are trying to liquidate their stocks ahead of the commencement of arrivals of the fresh crop. Exports demand for Indian pepper in the international markets is also weak due to price parity. The Spot as well as the Futures settled 0.55% and 2.66% higher on Thursday. Pepper prices in the international market are being quoted at $7,400/tn(C&F) while Vietnam was offering Austa at $7,000/tn, Brazil Austa at $6,700/tn, and Indonesia Austa at $6,500/tn (FOB).

Market Highlights

Unit Pepper SpotNCDEX (Kochi) Pepper- NCDEX Dec '12 Futures Rs/qtl Rs/qtl Last 38294 38265 % Change Prev day 0.55 2.66

as on Nov 29, 2012 WoW -0.65 0.39 MoM -10.64 -13.61 YoY 10.46 8.60

Source: Reuters

Technical Chart Black Pepper

NCDEX Dec contract

Exports

According to Spices Board of India, exports of pepper in April 2012 fell by 47% and stood at 1,200 tonnes as compared to 2,266 tonnes in April 2011. India imported 1,848 tonnes of pepper till March 2012 and has become the third country to import such large quantity after UAE and Singapore. (Source: Agriwatch) According to Vietnam Ministry of Agriculture and Rural Development (MARD) exports of black pepper in 2012 are forecasted at around 1,25,000 tonnes. Exports of Pepper from Vietnam during January till September 2012 is estimated around 80,433 mt, higher by 4.3% in volume and 31.7% in value compared to corresponding year last year. Exports of Pepper from Brazil during January till May 2012 are estimated around 13369 mt. (Source: Peppertradeboard). Pepper imports by U.S. the largest consumer of the spice declined 26% during January-September 2012 period to 41,923 tn as compared to 52,489 tn in the same period previous year. Exports from Indonesia posted significant decrease of 42% as compared to previous year. Exports stood at 36,500 tonnes as compared to 62,599 tonnes in the last year. During May 2012 Brazil exported 1,705 tonnes of pepper as against 1600 tn in May 2011.

Source: Telequote

Technical Outlook

Contract Black Pepper NCDEX Dec Futures Unit Rs/qtl

valid for Nov 30, 2012 Support 36350-37300 Resistance 38900-39550

Production and Arrivals

The arrivals in the spot market were reported at 20 tonnes while no offtakes were reported on Thursday. As per IPC, Global pepper production in 2012 is projected at 3.27 lk tn, up by 12.7% compared with 2.98 lk tn in 2011. Indonesian pepper output Is expected to rise by 24% and in Vietnam by 10%. According to previous estimates, report pepper output in Vietnam is estimated to be 1.35 lakh tonne as compared to 1.10 lakh tonne estimated early in the beginning of year (2012). Brazil is also expected to produce 22,000 tn this year. Domestic consumption of Pepper in the world is expected to grow by 3.03% to 1.25 lakh tonnes while exports are likely to grow by 1.48% to 2.46 lakh tonnes in 2012. (Source: Pepper trade board) Pepper production in 2012-13 is expected around 60,000-63,000 tonnes. Currently, pepper is in the fruit formation stage in Kerala.

Outlook

Pepper is expected to trade on a sideways to positive note today. Festive demand coupled with winter buying may support prices at lower levels. However, higher output expectations as well as reports that FMC is probing into complaints against price movement may cap sharp gains. Liquidation pressure from farmers as well as low export demand may pressurize prices.

www.angelcommodities.com

Commodities Daily Report

Friday| November 30, 2012

Agricultural Commodities

Jeera

Jeera Futures traded on a negative note yesterday due to sluggish demand in the domestic market. Currently, sowing in Gujarat is lower by 25-30%, but it is expected to gain momentum in the coming days. Sluggish demand coupled with higher stocks for delivery on the exchange warehouses has pressurized prices. However, export demand has supported prices in the spot markets. Exporters are buying due to tensions between Syria and Turkey as they are not offering. The spot settled 1.03% higher while the Futures settled 0.78% lower on Thursday. According to markets sources about 75% exports target has already been achieved due to a supply crunch in the global markets. Supply concerns from Syria and Turkey still exists. Expectations are that export orders may still be diverted to India from the international markets due to lack of supplies from Syria on back of the ongoing civil war. Production in Syria and Turkey is being reported around 17,000 tonnes and around 4,000-5,000 tonnes, lesser than expectations. Jeera prices of Indian origin are being offered in the international market at $2,825 tn (c&f) while Syria and Turkey are not offering. Carryover stocks of Jeera in the domestic market is expected to be around 6-7 lakh bags compared with 5-6 lakh bags last year.

Market Highlights

Unit Jeera SpotNCDEX(Unjha) Jeera- NCDEX Dec '12 Futures Rs/qtl Rs/qtl Last 15103 14313 Prev day 1.03 -0.78

as on Nov 29, 2012 % Change WoW -0.66 -3.60 MoM 0.40 0.09 YoY 5.70 6.40

Source: Reuters

Technical Chart Jeera

NCDEX Dec contract

Production, Arrivals and Exports

Unjha markets witnessed arrivals of 4,000 bags, while off-takes stood at 4,000 bags on Thursday. Production of Jeera in 2011-12 is expected around 40 lakh bags as against 29 lakh bags in 2010-11 (each bag weighs 55 kgs). (Source: spot market traders). According to Spices Board of India, exports of Jeera in April 2012 stood at 2,500 tonnes as compared to 2,369 tonnes in April 2011, an increase of 6%.

Source: Telequote

Market Highlights

Prev day -0.60 -2.05

as on Nov 29, 2012 % Change

Unit Turmeric SpotNCDEX (N'zmbad) Turmeric- NCDEX Dec '12 Futures Rs/qtl Rs/qtl

Last 5018 4976

WoW -1.34 -5.83

MoM 1.98 -2.09

YoY -6.67 10.73

Outlook

Jeera futures are expected to continue to trade downwards. Higher stocks for delivery on the exchange warehouses may pressurize prices. However, sharp downside may be capped due to export demand. In the medium term (November-December 2012), prices are likely to stay firm as there are limited stocks with Syria and Turkey.

Turmeric

Turmeric Futures continued to trade lower yesterday after market sources expect Turmeric production to increase to 64-65 lakh bags from their earlier estimates of 61-62 lakh bags. They attribute the increase in the estimates due to improved weather conditions in Andhra Pradesh and Karnataka. Also, the upcountry as well as overseas demand is reported to be weak. Stockists also have good carryover stocks with them. There are reports that Turmeric Farmers Association of India have decided to fix their own Minimum Support price or Rs.10000/qtl. Sowing is also reported 30-35% lower during the sowing period. The Spot as well as the Futures settled 0.6% & 2.05% lower on Thursday. Production, Arrivals and Exports Arrivals in Erode and Nizamabad mandi stood at 5,000 bags and 700 bags respectively on Thursday. Turmeric production in 2012-13 is expected around 64-65 lakh bags. Production in 2011-12 is projected at historical high of 10.62 lakh tns. According to Spices Board of India, exports of Turmeric in April 2012 increased by 1% at 7,300 tn as compared to 7,230 tn in April 2011. Outlook Turmeric prices are expected to trade downwards today. Higher production estimates coupled with weak upcountry demand may pressurize prices. However, prices may find support at lower levels as farmers may be unwilling to sell their stocks at lower prices and the Turmeric Association has decided to fix their own MSP at Rs.10000/qtl.

Technical Chart Turmeric

NCDEX Dec contract

Source: Telequote

Technical Outlook

Unit Jeera NCDEX Dec Futures Turmeric NCDEX Dec Futures Rs/qtl Rs/qtl

Valid for Nov 30, 2012

Support 14090-14180 4870-4916 Resistance 14460-14630 5040-5120

www.angelcommodities.com

Commodities Daily Report

Friday| November 30, 2012

Agricultural Commodities

Kapas

NCDEX Kapas settled marginally higher on short coverings. Sentiments remain weak on account of increasing arrival pressure. As on 18th November 2012, 22.66 lakh bales of Cotton has arrived so far, down by 29% compared to last year 31.97 lakh bales during the same period. Cotton export registrations for the 2012-13 season stood at 4.5 lakh bales as of November 5, 2012. Cotton exports are currently on Open General License subject to a prescribed procedure of registration. ICE cotton markets settled higher 0.73% tracking firm commodity markets. Cotton harvesting 84% is harvested completed, versus 85% same period a year ago. Cotton crop condition is 43% in Good/Excellent state th compared to 29% same period a year ago as on 20 Nov 2012.

Market Highlights

Unit Rs/20 kgs Rs/Bale Last 962.5 16210

as on Nov 29, 2012 % Change Prev. day WoW 0.05 -0.10 -0.55 0.12 MoM -4.23 0.12 YoY #N/A -2.99

NCDEX Kapas Futures MCX Cotton Futures

Source: Reuters

International Prices

ICE Cotton Cot look A Index Unit Usc/Lbs Last 71.75 81.35

as on Nov 29, 2012 % Change Prev day WoW 0.73 -0.87 0.00 0.00 MoM 1.17 0.00 YoY -20.89 -29.20

Domestic Production and Consumption

According to Cotton Advisory Boards (CAB) latest estimates for 2012-13 season that commenced in October, domestic cotton production is pegged 334 lakh bales, down 5.6% from the previous years estimates of 353 lakh bales. Lower opening stocks coupled with estimated lower output will result in lower supplies this season at 374 lakh bales, a decline of 8.7% compared with last years 410.77 lakh bales. On the consumption front, domestic consumption is estimated higher at 270 lakh bales on the back of higher mill consumption. However, after witnessing record exports in 2011-12 season, Indian exports could witness significant fall this season on the back of lower availability along with unattractive domestic cotton prices. CAB estimates cotton exports at 70 lakh bales this season, compared with 128.8 lakh bales last year.

Source: Reuters

Technical Chart - Kapas

NCDEX April contract

Global Cotton Updates

The U.S. government has raised its 2012/13 forecast for global cotton inventory to above 80 million 480-pound bales for the first time due to larger-than-expected output in the United States, the world's third largest producer, and falling demand from China, the world's largest consumer. In its monthly crop report, the U.S. Department of Agriculture increased its estimate for 2012/13 ending stocks for a fourth straight month to a new all-time high of 80.27 million bales. Higher global ending stocks are seen capping the upside in the cotton prices this year too. However, downside is also limited as prices are again nearing its 12 year average price of 65 cents per pound. Markets will now take cues from the Chinese demand for cotton and trade policies of India with respect to cotton exports. In its November monthly demand supply report, the Agriculture Department (USDA) raised its cotton crop for 2012/13 cotton crop season to 17.45 mln bales (Prev 17.29) along with upward revision in end stocks 5.80 mln 480 pounds/bales (Prev 5.60). Exports were unchanged at 11.60 mln 480 pounds/bales.

Source: Telequote

Technical Chart - Cotton

MCX Dec contract

Source: Telequote

Technical Outlook

Contract Kapas NCDEX April Cotton MCX December Unit Rs/20 kgs Rs/bale

valid for Nov 30, 2012 Support 940-955 16050-16150 Resistance 980-990 16400-16510

Outlook

Cotton prices might trade sideways with negative bias as arrival pressure is weighing on the prices. However, no major downside is expected in the domestic markets as farmers will not sell their stocks at very low prices. Also, CCI procurement at MSP levels may support prices from falling sharply.

www.angelcommodities.com

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Metal and Energy Tech Report November 12Document2 pagesMetal and Energy Tech Report November 12Angel BrokingNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- WPIInflation August2013Document5 pagesWPIInflation August2013Angel BrokingNo ratings yet

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDocument4 pagesRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Special Technical Report On NCDEX Oct SoyabeanDocument2 pagesSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingNo ratings yet

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Oilseeds and Edible Oil UpdateDocument9 pagesOilseeds and Edible Oil UpdateAngel BrokingNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Technical & Derivative Analysis Weekly-14092013Document6 pagesTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Commodities Weekly Outlook 16-09-13 To 20-09-13Document6 pagesCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Daily Agri Tech Report September 14 2013Document2 pagesDaily Agri Tech Report September 14 2013Angel BrokingNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- International Commodities Evening Update September 16 2013Document3 pagesInternational Commodities Evening Update September 16 2013Angel BrokingNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Daily Agri Report September 16 2013Document9 pagesDaily Agri Report September 16 2013Angel BrokingNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Daily Agri Tech Report September 16 2013Document2 pagesDaily Agri Tech Report September 16 2013Angel BrokingNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- MetalSectorUpdate September2013Document10 pagesMetalSectorUpdate September2013Angel BrokingNo ratings yet

- Daily Metals and Energy Report September 16 2013Document6 pagesDaily Metals and Energy Report September 16 2013Angel BrokingNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Currency Daily Report September 16 2013Document4 pagesCurrency Daily Report September 16 2013Angel BrokingNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Derivatives Report 8th JanDocument3 pagesDerivatives Report 8th JanAngel BrokingNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Document4 pagesDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Commodities Weekly Tracker 16th Sept 2013Document23 pagesCommodities Weekly Tracker 16th Sept 2013Angel BrokingNo ratings yet

- Technical Report 13.09.2013Document4 pagesTechnical Report 13.09.2013Angel BrokingNo ratings yet

- Sugar Update Sepetmber 2013Document7 pagesSugar Update Sepetmber 2013Angel BrokingNo ratings yet

- Derivatives Report 16 Sept 2013Document3 pagesDerivatives Report 16 Sept 2013Angel BrokingNo ratings yet

- IIP CPIDataReleaseDocument5 pagesIIP CPIDataReleaseAngel BrokingNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDocument1 pagePress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingNo ratings yet

- TechMahindra CompanyUpdateDocument4 pagesTechMahindra CompanyUpdateAngel BrokingNo ratings yet

- Market Outlook: Dealer's DiaryDocument13 pagesMarket Outlook: Dealer's DiaryAngel BrokingNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Market Outlook 13-09-2013Document12 pagesMarket Outlook 13-09-2013Angel BrokingNo ratings yet

- MarketStrategy September2013Document4 pagesMarketStrategy September2013Angel BrokingNo ratings yet

- Metal and Energy Tech Report Sept 13Document2 pagesMetal and Energy Tech Report Sept 13Angel BrokingNo ratings yet

- Daily Agri Tech Report September 06 2013Document2 pagesDaily Agri Tech Report September 06 2013Angel BrokingNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (120)

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDocument6 pagesTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingNo ratings yet

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDocument4 pagesJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingNo ratings yet

- MBA711 - Chapter11 - Answers To All Homework ProblemsDocument17 pagesMBA711 - Chapter11 - Answers To All Homework ProblemsGENIUS1507No ratings yet

- Cpa Review School of The Philippines For Psba Integrated ReviewDocument13 pagesCpa Review School of The Philippines For Psba Integrated ReviewKathleenCusipagNo ratings yet

- Content Problem Sets 4. Review Test Submission: Problem Set 08Document8 pagesContent Problem Sets 4. Review Test Submission: Problem Set 08gggNo ratings yet

- NSS Central Audit Report User Manual - 16.032020Document48 pagesNSS Central Audit Report User Manual - 16.032020Manoj TribhuwanNo ratings yet

- GSRTCDocument1 pageGSRTCRaju PatelNo ratings yet

- Internship Report On "Human Resource Managemet Practices of NCC Bank Ltd.Document57 pagesInternship Report On "Human Resource Managemet Practices of NCC Bank Ltd.Arefin RidwanNo ratings yet

- Financial Analysis Model:: Enter Data in Black Cells Are Computer GeneratedDocument2 pagesFinancial Analysis Model:: Enter Data in Black Cells Are Computer GeneratedAnkit ChaudharyNo ratings yet

- Collection of Sum of Money - Assignment BDocument5 pagesCollection of Sum of Money - Assignment BMark ValenciaNo ratings yet

- BP2313 Audit With Answers)Document44 pagesBP2313 Audit With Answers)hodgl1976100% (4)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- L& T Buy BackDocument4 pagesL& T Buy BackteammrauNo ratings yet

- Proyeksi INAF - Kelompok 3Document43 pagesProyeksi INAF - Kelompok 3Fairly 288No ratings yet

- VAT Guidance For Retailers: 375,000 / 12 MonthsDocument1 pageVAT Guidance For Retailers: 375,000 / 12 MonthsMuhammad Suhaib FaryadNo ratings yet

- Syllabus - GEC004-Math in The Modern WorldDocument2 pagesSyllabus - GEC004-Math in The Modern WorldRachel PetersNo ratings yet

- Chapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Document9 pagesChapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Dyan Novia67% (3)

- All Sections of Companies Act 2013Document66 pagesAll Sections of Companies Act 2013RICHA SHARMANo ratings yet

- Acct 284 Clem Exam One - Doc Fall 2004Document3 pagesAcct 284 Clem Exam One - Doc Fall 2004noranycNo ratings yet

- MMMMMM: MMMMMMMMMMMMMMMM MMMMMMMMMMMMMMMMMM M MM MMMMMMM M M MDocument55 pagesMMMMMM: MMMMMMMMMMMMMMMM MMMMMMMMMMMMMMMMMM M MM MMMMMMM M M MRuby ButiNo ratings yet

- 1st Quarter - Fundamentals of Accounting 2 - ANSWER KEYDocument7 pages1st Quarter - Fundamentals of Accounting 2 - ANSWER KEYDin Rose Gonzales50% (2)

- Container Market PDFDocument3 pagesContainer Market PDFDhruv AgarwalNo ratings yet

- Final Project Report of Summer Internship (VK)Document56 pagesFinal Project Report of Summer Internship (VK)Vikas Kumar PatelNo ratings yet

- L6M5 Tutor Notes 1.0 AUG19Document22 pagesL6M5 Tutor Notes 1.0 AUG19Timothy Manyungwa IsraelNo ratings yet

- The Rule in Clayton's Case Revisited.Document20 pagesThe Rule in Clayton's Case Revisited.Adam Channing100% (2)

- Worksheet 1.2 Simple and Compound Interest: NameDocument6 pagesWorksheet 1.2 Simple and Compound Interest: NameRenvil Igpas MompilNo ratings yet

- Multi-Level Trading-Recovery Trading: ND RDDocument11 pagesMulti-Level Trading-Recovery Trading: ND RDAkram BoushabaNo ratings yet

- CashflowDocument3 pagesCashflowsikandar aNo ratings yet

- R.A. 9147 Wildlife Resources Conservation and Protection ActDocument17 pagesR.A. 9147 Wildlife Resources Conservation and Protection ActDennis S. SiyhianNo ratings yet

- SBT PDFDocument9 pagesSBT PDFrijulalktNo ratings yet

- Matrix Footwear CaseDocument10 pagesMatrix Footwear CaseRohan KaushikNo ratings yet

- Assignment FA2 May 2012 QuestionDocument4 pagesAssignment FA2 May 2012 Questionsharvin_94No ratings yet

- Investment Theory Body Kane MarcusDocument5 pagesInvestment Theory Body Kane MarcusPrince ShovonNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)