Professional Documents

Culture Documents

WCM Analysis

Uploaded by

Utsab SenOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

WCM Analysis

Uploaded by

Utsab SenCopyright:

Available Formats

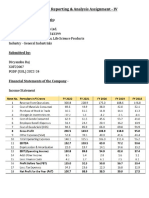

RANBAXY Analysis Of Working Capital Management

Raw Materials Storage Period (RMSP):

This is the time-period when the company starts procuring raw materials including spares parts & stores from suppliers up-to its consumption in the production process. If we take a look at the companys proceedings for the last three years, there is not much to differentiate. On an approximate basis 40 days is the time taken to carry-out the initial process of the cycle.

Work-In-Progress Storage Period (WIPSP):

This is the second phase in working capital management where the company converts the raw materials to semi-finished goods considering all the direct expenses incurred in the production process. Considering the cumulative basis, in 2008 & 2009 the company took approximately 75 days & in 2010 the company took 83 days to do that. If we only consider the WIPSP phase then the company took 34, 35 & 43 days in 2008, 2009 & 2010 respectively. This shows that there was a sudden rise in direct expenditure for the company in 2010 which is a bit of a concern as it will take more time in the production process of semi-finished goods.

Finished Goods Storage Period (FGSP):

This is the third stage in the working capital cycle where the semi-finished goods are converted to the finished goods considering all the indirect expenses incurred during this phase. Taking the cumulative basis into consideration, the company took approximately 115 days in 2008 & 2009 but 123 days in 2010. If only FGSP phase is considered then in 2008, 2009 & 2010 the company took approximately 40 days. It shows that, the company was successful in managing the indirect costs n semi-finished goods throughout. But, taking the cumulative basis into consideration in 2010 the company took a week more to produce the finished goods. This can be justified as a spill-over effect from the WIPSP.

Average Collection Period (ACP):

This is the time period that justifies the realization efficiency of the company after it sells finished goods to the debtors. The first thing we look into this is the Debtor Turnover Ratio (DTR) which was 4.5, 3.5 & 3.7 times for the company in 2008, 2009 & 2010 respectively. Considering cumulative basis, the company took 195, 218 & 221 days in 2008, 2009 & 2010 respectively to collect cash from the debtors after selling the finished goods from the starting point of production. If only ACP is considered, the company took 80, 103 & 98 days in 2008, 2009 & 2010 respectively. It shows that, the company had problems in 2009 for

realizing cash from debtors but it managed it efficiently while 2010 figure is seen. On the overall impact the company has bought down 3 days in the production process in comparison to the week loss it had till FGSP due to the excessive direct expenses incurred on the final year.

Gross Operating Cycle (GOC):

Its the total time-period starting from the point of making first payment to procure raw materials for production to the last realization of cash from the debtors in a fiscal year. The sum-total of RMSP, WIPSP, FGSP and ACP is taken to compute this. The cumulative figures of all these phases for 2008, 2009 & 2010 were 195, 218 & 221 days respectively. It is very evident that in 2009 & 2010 the company had faced problems in production, sales & generation of revenues compared to 2008. This may be due to the effect of the global economic downfall. But the time lag in 2010 was much lesser than it was in 2009 compared to 2008. This also shows a positive sign that the company is recovering well.

Average Payable Period (APP):

It is basically the creditors velocity. For computing this, first thing we consider is the Creditors Turnover Ratio (CTR) which was 3.2, 2.7 & 2 times in 2008, 2009 & 2010 respectively. The APP of the company says that, it took 111, 134 & 180 days in 2008, 2009 & 2010 respectively on an average to pay its creditors for the materials supplied. Its pretty evident that year by year the company is taking more time to pay its creditors. Form the stakeholders point this is not at all a good sign but if the creditors are allowing the company to pay on such time & extending it year by year due to the reputation of the company then its acceptable. But the company must take things seriously as its one of the main issues.

Net Operating Cycle (NOC):

Its the net time period where the payment efficiency of the company is measured after we deduct the APP from the GOC. It shows how much extra time or less time the company is taking in paying off the creditors. Form the computed figures we can infer that in 2008 & 2009 the company took approximately 84 days extra to pay-off its creditors. But one of the real positives from the companys point is that it bought down the extra payment period to 40 days in 2010 which would gain the suppliers confidence. May be as the company had problems in realizing cash from debtors, it used up the extra reserves for paying off the creditors early when can be adjusted once the cash is received from debtors.

Net Working Capital Ratio:

This measure shows how much working capital a company has used on a fiscal year in terms of the total assets or total resources it has. In this case the company has used 11%, 16% & 37% of working capital in 2008, 2009 & 2010 respectively in terms of its total assets or total resources. This also signifies that in 2010 the company had used its current assets more for business operations compared to 2008 & 2009. May be thats the reason the NOC was bought down as the creditors was paid from the instant cash generation from short term activities of the company.

Working Capital Turnover Ratio:

This ratio is used to analyze the relationship between the money used to fund operations and the sales generated from these operations. In a general sense, the higher the working capital turnover, the better because it means that the company is generating a lot of sales compared to the money it uses to fund the sales. In this case the computing figures come to 5, 3.7 & 1.5 times approximately in 2008, 2009 & 2010 respectively. It means that the capacity of the entity is generating sales is declining on year to year basis. This may be due to the effect of the global economic slowdown. But the efficiency of the company should be increased to give better results in future.

Working Capital Management Lupin

Raw Material Conversion Period

This is the time-period when the company starts procuring raw materials including spares parts & stores from suppliers up-to its consumption in the production process. If we look at the trend in 3 years, companys RMCP for 2008 was 45.65, in 2009 it was 83.41, in 2010 it was 86.04. As it is visible that RMCP is continuously increasing, so it is not good for the company. Raw material consumption is increasing from 2008 to 2009 to 2010.

Work-In-Progress Storage Period (WIPSP):

This is the second phase in working capital management where the company converts the raw materials to semi-finished goods considering all the direct expenses incurred in the production process. In 2008 it was 27 days, 2009 47 days and 2009 79 days. This shows that there was a sudden rise in direct expenditure for the company which is a bit of a concern as it will take more time in the production process of semi-finished goods.

Finished Goods Storage Period (FGSP):

This is the third stage in the working capital cycle where the semi-finished goods are converted to the finished goods considering all the indirect expenses incurred during this phase. FGCP in 2008 was 31.39 days, in 2009 57 days and 2010 55 days. As it can be seen there hasnt been much change from 2009 to 2010. But from 2008 to 2009 there has been an increase.

Average Collection Period (ACP):

This is the time period that justifies the realization efficiency of the company after it sells finished goods to the debtors. Considering cumulative basis, the company took 162,301,220 days in 2008, 2009 & 2010 respectively to collect cash from the debtors after selling the finished goods from the starting point of production. If only ACP is considered, the company took 90, 103 & 90 days in 2008, 2009 & 2010 respectively. It shows that, the company had problems in 2009 for realizing cash from debtors but it managed it efficiently while 2010 figure is seen. On the overall impact the company has bought down 3 days in the production process in comparison to the week loss it had till FGSP due to the excessive direct expenses incurred on the final year.

Gross Operating Cycle (GOC):

Its the total time-period starting from the point of making first payment to procure raw materials for production to the last realization of cash from the debtors in a fiscal year. The

sum-total of RMSP, WIPSP, FGSP and ACP is taken to compute this. The cumulative figures of all these phases for 2008, 2009 & 2010 were 194,199,311 days respectively. It is very evident that in 2009 & 2010 the company had faced problems in production, sales & generation of revenues compared to 2008. This may be due to the effect of the global economic downfall. But the time lag in 2010 was much lesser than it was in 2009 compared to 2008. This also shows a positive sign that the company is recovering well.

Average Payable Period (APP):

It is basically the creditors velocity. 122, 75, 235 days. The APP of the company says that, it took 122, 75, 235 days in 2008, 2009 & 2010 respectively on an average to pay its creditors for the materials supplied. Its pretty evident that from 2008 to 2009 companys APP had decreased which is a good sign for the company. But from 2009 to 2010 the company is taking more time to pay its creditors. Form the stakeholders point this is not at all a good sign but if the creditors are allowing the company to pay on such time & extending it year by year due to the reputation of the company then its acceptable. But the company must take things seriously as its one of the main issues.

Net Operating Cycle (NOC):

Its the net time period where the payment efficiency of the company is measured after we deduct the APP from the GOC. It shows how much extra time or less time the company is taking in paying off the creditors. In 2009 it was 71 days, in 2009 it was 187 days, in 2010 it was 76 days. From the computed figures we can infer that in 2008 & 2009 the company took approximately 116 days extra to pay-off its creditors. But one of the real positives from the companys point is that it bought down the payment period to 76 days in 2010 which would gain the suppliers confidence. May be as the company had problems in realizing cash from debtors, it used up the extra reserves for paying off the creditors early when can be adjusted once the cash is received from debtors.

Inter Firm Analysis

Taking the Pharmaceutical Industry of India into consideration, Working Capital Management is an integral part of their operations. This is because this industry always handles a great deal of current assets such as inventories, debtors & they do purchase raw materials on credit from suppliers. The short term resources do go hand in hand with the long term resources in this industry & without working capital management this industry cannot move an inch further. More than 50 companies operate in the bio-technology part of Indian Pharmaceutical Industry & out of that we are analysing the results of three major giants namely Ranbaxy, Cipla & Lupin. By having a broad view on the computed results we can infer how this industry is utilizing the overall working capital they generates. As we move on to inter firm analysis, first of all lets take a look at the RMCP of all the three firms for the year 2008, 2009 & 2010. Ranbaxy maintained on an average of 40 days throughout. Lupin maintained 45 days for 2008 & in 2009 it was 83 days. But finally it came down to 86 days in 2010. Cipla maintained 114 days in 2008 but on 2009 & 2010 it came down to 124 & 81 days respectively. We assume that size of the firms & amount of raw materials consumed as per requirements makes a significant difference in RMSP for each of the firm. But on the contrary Ranbaxy is more efficient than the other two entities which are visible clearly from the computation results. Now lets have a look at the WIPSP for 2008, 2009 & 2010 for the three firms. Ranbaxy took an average of 75 days in 2008 & 2009 but 83 days in 2010 to convert the raw materials into semi-finished goods. During 2008, Lupin performed the same activity in 72 days but it came down to 130 days in 2009 & 165 days in 2010. But Ranbaxy did this in 121, 143 & 136 days taking 2008, 2009 & 2010 respectively. If the size difference & production capacity is not considered, again Ranbaxy is the standout performer among the three in this activity. Another point which we can look into is the direct expenses incurred by each firm which can make a significant impact on these figures but if we do consider that, the size & production capacity do comes in between. Considering FGSP it can be seen, Ranbaxy took approximately 115 days in 2008 & 2009 but 123 days in 2010 to convert raw materials into finished goods. Lupin did the same activity in 103, 187 & 220 days take 2008, 2009 & 2010 respectively. Cipla on the other hand took 156, 180 & 171 days in 2008, 2009 & 2010 respectively. We have clear cut evidence from the results that Ranbaxy is do performing well in terms of the other two entities. In this stage the indirect expenses play a vital role for the companies. It seems Ranbaxy do have a sound managing technique in bringing out the most efficient thought of where to spend & in what amount. Moreover at this stage the piling up of inventories do hampers the companies

which can be a reason Lupin & Cipla covers an extra time period irrespective of the size of the firms & production capacity. It can also be the reason that these two companies got more affected due to the global economic slowdown compared to Ranbaxy as there was less demand in the market at that point. When average collection period is considered which signifies the total time period taken by a company from the point of procuring raw materials to the last realization of cash from the debtors, Ranbaxy took 195, 218 & 221 days in 2008, 2009 & 2010 days respectively whereas Lupin took 193, 199 & 310 days in 2008, 2009 & 2010 respectively. The time period for Cipla was 262, 315 & 298 days in 2008, 2009 & 2010 respectively. From the result we can infer very safely that Ranbaxy maintains a very effective time-period from the point of production to the point of realization of cash from the debtors when compared to Cipla & Lupin. May be Ranbaxy sells goods to debtors who has high credibility & they justifies that by taking less time to pay cash & companies like Lupin & Cipla is not up-to the mark in this aspect Even a company can take some measures in managing the account receivables. If we consider that these three companies do take steps, again Ranbaxy is far better managed compared to the other two. This cumulative result also signifies the GOC for these three companies. The Creditors velocity of Average Payable Period for Ranbaxy is 111, 134 & 180 days in 2008, 2009 & 2010 respectively. Lupins APP in 2008 was 122 days & in 2009 it came down to 78 days. But in 2010, it suddenly increased to 235 days which is not a good sign. Ciplas creditor velocity was 106 days in 2008 but it extended to 111 days in 2009 & again came down to 91 days in 2010. Comparing the three firms its clear that Ranbaxy takes less time to pay its creditors though in 2010 it took some more time compared to its previous records. This is a very important area for the companies as the suppliers do keep an eye on these results. Finally when the NOC is considered, its pretty much visible that Ranbaxys figures came down to 40 days in 2010 from an average of 84 days in 2008 & 2009. Lupins figure for 2008 was 71 days which gradually increased to 188 days in 2009 & again came down to 76 days in 2010 which justifies that the company recovered a lot. Ciplas figure shows that in 2008 it took 155 days but that stretched to 205 days on an average in 2009 & 2010. Actually this is the extra time a company takes to clear its payments to the suppliers. So it does make an impact on the companys credit worthiness. While comparing & analysing the results we can come to a conclusion that Ranbaxy has better credibility while the management of working capital comes into picture though all the companies significantly bought down the NOC in 2010. Although all companies do suffer due to the global economic downfall & there is always a difference in size & production capacity, its really safe to infer that Ranbaxy does have better working capital management in place as compared to Lupin & Cipla.

You might also like

- Guide to Management Accounting CCC (Cash Conversion Cycle) for managersFrom EverandGuide to Management Accounting CCC (Cash Conversion Cycle) for managersNo ratings yet

- Interpretation FinalDocument6 pagesInterpretation FinalFarzana YasminNo ratings yet

- FINANCIAL STATEMENT ANALYSIS OF Nokia Inc LTDDocument4 pagesFINANCIAL STATEMENT ANALYSIS OF Nokia Inc LTDROHIT SETHI100% (2)

- Financial Analysis of Martin Manufacturing Company Highlights Key Liquidity, Activity and Profitability RatiosDocument15 pagesFinancial Analysis of Martin Manufacturing Company Highlights Key Liquidity, Activity and Profitability RatiosdjmondieNo ratings yet

- Financial ManagementDocument6 pagesFinancial ManagementNavinYattiNo ratings yet

- Financial Analysis of Reliance Steel and Aluminium Co. LTDDocument4 pagesFinancial Analysis of Reliance Steel and Aluminium Co. LTDROHIT SETHINo ratings yet

- Ratio Analysis of Petronas Dagangan BerhadDocument13 pagesRatio Analysis of Petronas Dagangan BerhadRishiaendra CoolNo ratings yet

- Fin Statement Analysis - Atlas BatteryDocument34 pagesFin Statement Analysis - Atlas BatterytabinahassanNo ratings yet

- Retail Industry Financial AnalysisDocument15 pagesRetail Industry Financial AnalysisSunil Gopinath PillaiNo ratings yet

- Vladi FAF Financial ReportDocument4 pagesVladi FAF Financial ReportVladi DimitrovNo ratings yet

- Bata Ratio AnalysisDocument44 pagesBata Ratio AnalysisMuhammad AwaisNo ratings yet

- Lucky Cement AnalysisDocument6 pagesLucky Cement AnalysisKhadija JawedNo ratings yet

- Financial Statement Analysis of Nokia and LGDocument35 pagesFinancial Statement Analysis of Nokia and LGeimalmalikNo ratings yet

- Financial Statement Analysis - Bhanero Textile MillsDocument28 pagesFinancial Statement Analysis - Bhanero Textile MillstabinahassanNo ratings yet

- International Standard On Auditing: Option .1 Cross Sectional Analysis - Liquidity Ratios:-Current RatioDocument3 pagesInternational Standard On Auditing: Option .1 Cross Sectional Analysis - Liquidity Ratios:-Current RatioikramunirNo ratings yet

- Performance of Butler Lumber:: Year 1989Document2 pagesPerformance of Butler Lumber:: Year 1989Talha SiddiquiNo ratings yet

- Auditors Report and Financial Analysis of ITCDocument28 pagesAuditors Report and Financial Analysis of ITCNeeraj BhartiNo ratings yet

- IOCL AnalysisDocument3 pagesIOCL Analysisprit6924No ratings yet

- Star River Assignment-ReportDocument15 pagesStar River Assignment-ReportBlessing Simons33% (3)

- Interpretation of Financial StatementsDocument4 pagesInterpretation of Financial StatementsTinashe MashoyoyaNo ratings yet

- Final Report - Jeema Modified - SangeethaDocument43 pagesFinal Report - Jeema Modified - SangeethaTisha ThomasNo ratings yet

- Home Depot Financial Statement Analysis ReportDocument6 pagesHome Depot Financial Statement Analysis Reportapi-301173024No ratings yet

- Análisis EmpresaDocument20 pagesAnálisis EmpresaJorge GrubeNo ratings yet

- Finance Henry BootDocument19 pagesFinance Henry BootHassanNo ratings yet

- FIN3CSF Case Studies in FinanceDocument5 pagesFIN3CSF Case Studies in FinanceDuy Bui100% (2)

- Financial Analysis of du Telecom Company UAEDocument13 pagesFinancial Analysis of du Telecom Company UAELokesh ThadhaniNo ratings yet

- Company AnalysisDocument20 pagesCompany AnalysisRamazan BarbariNo ratings yet

- Star River - Sample ReportDocument15 pagesStar River - Sample ReportMD LeeNo ratings yet

- FM Assignment: Amrutha Sajeevfm-1951MBA, BATCH-18Document8 pagesFM Assignment: Amrutha Sajeevfm-1951MBA, BATCH-18Sasidharan Sajeev ChathathuNo ratings yet

- PCX - Report Al EshanDocument3 pagesPCX - Report Al EshanEshan ChatterjeeNo ratings yet

- Profitability Turnover RatiosDocument32 pagesProfitability Turnover RatiosAnushka JindalNo ratings yet

- Al NoorDocument12 pagesAl NoorRehmatullah Abdul AzizNo ratings yet

- FRA - IV (Tarsons Products)Document9 pagesFRA - IV (Tarsons Products)RR AnalystNo ratings yet

- Transcription Doc Improving LiquidityDocument6 pagesTranscription Doc Improving Liquiditymanoj reddyNo ratings yet

- ACCT 504 MART Perfect EducationDocument69 pagesACCT 504 MART Perfect Educationdavidwarn1223No ratings yet

- Ratio Analysis of ITCDocument22 pagesRatio Analysis of ITCDheeraj Girase100% (1)

- Ratio Analysis DG Khan Cement CompanyDocument6 pagesRatio Analysis DG Khan Cement CompanysaleihasharifNo ratings yet

- Titan Ratio Analysis - IDocument10 pagesTitan Ratio Analysis - INikhil Gulhane0% (1)

- Final Report On Attock - IbfDocument25 pagesFinal Report On Attock - IbfSanam Aamir0% (1)

- Ratio Analysis of Shinepukur Ceremics Ltd.Document0 pagesRatio Analysis of Shinepukur Ceremics Ltd.Saddam HossainNo ratings yet

- UK GDP decline and telecom sector recoveryDocument13 pagesUK GDP decline and telecom sector recoveryprahladtripathiNo ratings yet

- SynopsisDocument5 pagesSynopsischowdaiahsreeNo ratings yet

- WINSEM2020-21 SWE2028 TH VL2020210503406 Reference Material III 30-Mar-2021 5.4 VTOP - Return On Capital EmployedDocument11 pagesWINSEM2020-21 SWE2028 TH VL2020210503406 Reference Material III 30-Mar-2021 5.4 VTOP - Return On Capital EmployedGangadhar VijayNo ratings yet

- Task (3.4) Calculate RatiosDocument7 pagesTask (3.4) Calculate RatiosAnonymous xOqiXnW9No ratings yet

- Cash Conversion Cycle Study of Sundaram PackagingsDocument41 pagesCash Conversion Cycle Study of Sundaram PackagingsRajith RadhakrishnanNo ratings yet

- Star River Electronics.Document5 pagesStar River Electronics.Nguyen Hieu100% (3)

- Massias Teddy 2011: Assignment Submission SheetDocument9 pagesMassias Teddy 2011: Assignment Submission SheetTeddy MassiasNo ratings yet

- Next PLCDocument4 pagesNext PLCBùi Hồng ThảoNo ratings yet

- Bharat Forge AnalysisDocument3 pagesBharat Forge AnalysisKarman DesaiNo ratings yet

- Step 1: Cash Conversion Cycle InventoryDocument5 pagesStep 1: Cash Conversion Cycle InventoryAlege-ti MediulNo ratings yet

- Profitability AnalysisDocument9 pagesProfitability AnalysisAnkit TyagiNo ratings yet

- Ratio Analysis PPLDocument11 pagesRatio Analysis PPLCh Ali TariqNo ratings yet

- Analysis of Annual Report - UnileverDocument7 pagesAnalysis of Annual Report - UnileverUmair KhizarNo ratings yet

- Gul Ahmed ReportDocument1 pageGul Ahmed ReportfahadaijazNo ratings yet

- NPV, IRR and Financial Evaluation for Waste Collection ContractDocument9 pagesNPV, IRR and Financial Evaluation for Waste Collection ContractTwafik MoNo ratings yet

- Assessing Cash Flow and Financial Ratios of Two CompaniesDocument14 pagesAssessing Cash Flow and Financial Ratios of Two CompaniesTatiana Elena CraciunNo ratings yet

- Guide to Management Accounting CCC for managers-Cash Conversion Cycle_2020 EditionFrom EverandGuide to Management Accounting CCC for managers-Cash Conversion Cycle_2020 EditionNo ratings yet

- Guide to Management Accounting CCC for managers 2020 EditionFrom EverandGuide to Management Accounting CCC for managers 2020 EditionNo ratings yet

- Prepare Cost SheetDocument17 pagesPrepare Cost SheetRajuSharmiNo ratings yet

- Technical Anaylsis (Day 8)Document77 pagesTechnical Anaylsis (Day 8)vnbanjanNo ratings yet

- Ratio AnalysisDocument28 pagesRatio AnalysisUtsab SenNo ratings yet

- The Paradigm Dec 2011Document36 pagesThe Paradigm Dec 2011Utsab SenNo ratings yet

- Particulars Year 0 Year 1Document4 pagesParticulars Year 0 Year 1Utsab SenNo ratings yet

- Business Proposals EXDocument2 pagesBusiness Proposals EXUtsab SenNo ratings yet

- Introduction To ResearchDocument5 pagesIntroduction To Researchapi-385504653No ratings yet

- Diagram Illustrating The Globalization Concept and ProcessDocument1 pageDiagram Illustrating The Globalization Concept and ProcessAnonymous hWHYwX6No ratings yet

- 1 Chapter I Translation TheoryDocument19 pages1 Chapter I Translation TheoryAditya FirmansyahNo ratings yet

- इंटरनेट मानक का उपयोगDocument16 pagesइंटरनेट मानक का उपयोगUdit Kumar SarkarNo ratings yet

- Nursing Effective Leadership in Career DevelopmentDocument4 pagesNursing Effective Leadership in Career DevelopmentAlan Divine BNo ratings yet

- Legal Aspect of Business Course Outline (2017)Document6 pagesLegal Aspect of Business Course Outline (2017)Sulekha BhattacherjeeNo ratings yet

- PERDEV - Lesson 3 ReadingsDocument6 pagesPERDEV - Lesson 3 ReadingsSofiaNo ratings yet

- Causes of WWI: Alliances, Militarism & AssassinationDocument4 pagesCauses of WWI: Alliances, Militarism & AssassinationJoshua De Leon TuasonNo ratings yet

- Group Handling - Pre Registration Activity: Submited To-Submitted byDocument12 pagesGroup Handling - Pre Registration Activity: Submited To-Submitted byharshal kushwahNo ratings yet

- BIS Standards in Food SectorDocument65 pagesBIS Standards in Food SectorRino John Ebenazer100% (1)

- Understanding Malaysian Property TaxationDocument68 pagesUnderstanding Malaysian Property TaxationLee Chee KheongNo ratings yet

- 2015 ACI Airport Economics Report - Preview - FINAL - WEB PDFDocument12 pages2015 ACI Airport Economics Report - Preview - FINAL - WEB PDFDoris Acheng0% (1)

- Epitalon, An Anti-Aging Serum Proven To WorkDocument39 pagesEpitalon, An Anti-Aging Serum Proven To Workonæss100% (1)

- Bullish EngulfingDocument2 pagesBullish EngulfingHammad SaeediNo ratings yet

- Traditional Knowledge - The Changing Scenario in India PDFDocument9 pagesTraditional Knowledge - The Changing Scenario in India PDFashutosh srivastavaNo ratings yet

- KPMG The Indian Services Sector Poised For Global AscendancyDocument282 pagesKPMG The Indian Services Sector Poised For Global Ascendancyrahulp9999No ratings yet

- FIN 1050 - Final ExamDocument6 pagesFIN 1050 - Final ExamKathi100% (1)

- TASKalfa 2-3-4 Series Final TestDocument4 pagesTASKalfa 2-3-4 Series Final TesteldhinNo ratings yet

- Cancer of LarynxDocument29 pagesCancer of LarynxQasim HaleimiNo ratings yet

- Credit Suisse AI ResearchDocument38 pagesCredit Suisse AI ResearchGianca DevinaNo ratings yet

- Research Paper On The Hells AngelsDocument6 pagesResearch Paper On The Hells Angelsfvg2xg5r100% (1)

- A Comparative Look at Jamaican Creole and Guyanese CreoleDocument18 pagesA Comparative Look at Jamaican Creole and Guyanese CreoleShivana Allen100% (3)

- HED - PterygiumDocument2 pagesHED - Pterygiumterry johnsonNo ratings yet

- Extra Grammar Exercises (Unit 6, Page 64) : Top Notch 3, Third EditionDocument4 pagesExtra Grammar Exercises (Unit 6, Page 64) : Top Notch 3, Third EditionA2020No ratings yet

- FACS113 MineralswebDocument51 pagesFACS113 MineralswebMohammad Amjad KhanNo ratings yet

- Abhivyakti Yearbook 2019 20Document316 pagesAbhivyakti Yearbook 2019 20desaisarkarrajvardhanNo ratings yet

- Pashmina vs Cashmere: Which Luxury Fiber Is SofterDocument15 pagesPashmina vs Cashmere: Which Luxury Fiber Is SofterSJVN CIVIL DESIGN100% (1)

- EDUC 5240 - Creating Positive Classroom EnvironmentsDocument5 pagesEDUC 5240 - Creating Positive Classroom EnvironmentsMay Phyo ThuNo ratings yet

- Emilia Perroni-Play - Psychoanalytic Perspectives, Survival and Human Development-Routledge (2013) PDFDocument262 pagesEmilia Perroni-Play - Psychoanalytic Perspectives, Survival and Human Development-Routledge (2013) PDFMihaela Ioana MoldovanNo ratings yet

- Susan Oyama The Ontogeny of Information Developmental Systems and Evolution Science and Cultural Theory 2000Document297 pagesSusan Oyama The Ontogeny of Information Developmental Systems and Evolution Science and Cultural Theory 2000Marelin Hernández SaNo ratings yet