Professional Documents

Culture Documents

A2

Uploaded by

Abhay ShahCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

A2

Uploaded by

Abhay ShahCopyright:

Available Formats

--

.7(.';

,,'

Tc

"l'V;

,,0'

"CI

.. J

I

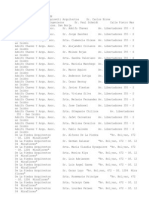

By Discount

" Bad debt recovered

(50% not

in tne past)

By Interest and dividend

By Interest on P.O. Office

Deposit Accounts

5,000

10,000

25,000

25,000

5,000

15,000

9,000

15,000

3,000

10,000

6,000

12,000

3,10,000

6.00;000

Rs.

.1.50.00011 By Gross Profit

'"",

Pmfit 'ltradmissible ,f'XlJenSfS' 0f;1'. .?5,iJoO l:nd dedi

under other fleads "ks; 16.000.)' ,

rofit and Loss Ale o.f Mr. Dhaval .. who is into traq,

.he year cnded 31-3-20li

0,000 paid to Mr. Dhaval.

des Rs. 10,000 for payment made for

aL '

. 9,000 spent on purchase ofnew pecttlanent sign,

des, Rs. 4,000 towards personal pUIpose.

Iludes Rs. 10;000 of Life Insurance Premium.;

as per incOItle-tax Act isRs. 15,000' , ";)'

of Rs.. 20,000 of chemical trade is found

taxable business income for P. Y. 2010-' ui;

, , , .

. Sau. Uni., 2009' & Kutch Uni.,

e:fombuS.iness, s.

etUlcal -/ i,

.llUldmissible La pUl'prietor

+ B.D.!J, R', O,()()() + Personal

. on c . J5,000 + Advance I. T. Rs. 9,

as new signboard Rs. 9,000 = Rs. I,

,.;fJ 'tDxri lllder otlu!r heads :

000 + I -est . 'dend Rs. 5{J,OOO + lrttetfjr 4

75.000; (ii)' ct: Rs. ,OIJO for less deprec'/:atiJ

(i,,) AJd : Un-lU(} business income Rs. 20.Pao;.l

..',

,

.-: .....,.-..

's

'lees

50

:.F' .J__ .J. ..

aHi .0 the owner of the ,

'emaining unpaid at the end of yealj/.vhile

in respect of previous year' has ;rot been

is meant for personal purposes ",

for life ins. policy of the s, of the owner.

'10 as follows : Mac . ery Rs. 80,000,

of Depreciation allowable are 15% and 10%

purchased on 1-12-' 10 or 40,000 on which

%.

DtS purchased but n</put into business use for

under the hea In90me from Business and

.j

12 [Gz(. Uni., 2004 & 2006-modifiedJ

'roJa Rs. 4, ,000.

illudmissib e expenses to Net Profit of Rs. 4,04,000

alary s. 15,000 + local taxes relating to let-out

R 6,000 + BDR Rs. 7,000 + B.D. (as debtor's

,atio Rs. 5,000 + Motor Exps. (40% for personal

00 Excess depreciation (Machinery Rs. 5,000

% Rs. 00) Rs. 19,000 + [merest on capital Rs.

lut to busin s use (wrongly induded in misc. exps.)

rongly debit Rs. 6,000 = Rs. 1,35,000 (3) Items

"eres't and divide dRs. 80.000 + Rent of let-out house

s. 20,000 + Pro on sale of investments Rs. 25,000

P & LAIc Rs. 10, 0 =Rs. 1,35,000 (4) Calculation

inery : WDV Oil 1-4- 0 Rs. 80,000 + Purchases on '

(base): As the new achine has been used for a

ciation is allowed at 1/2 15% =Rs. 3,000 and at.

,000 =Total depreciation . 15,000, which is to be

"CeSS depreciation of Rs. 5,00 is to be added back:

40.000 x 10% =Rs. 4,000 is a wable but P &L

,000 and hence Rs. 8,000 is disallowed.]

ing,Doctor, From the following Cash Account for

his taxable income from profession and deduction

Rs. II Particulars

Rs.

52,750 IBy

1,20.000"

2,12,000"

20.000,,"

.

Hospital Rent

Hospital Exps.

Life Insurance Premium

Investment in Public

Provident Fund

1,54,000

25,000

3,000

: 30,000

' ..

,

:;/:'

.

. i

b

.

" .. ..

'. ...

,""

j.

------'-- 1

JNESS :>R lROFESS[Y,

3,500'1'"

Fire Ins. Premi'Jm :

0,000 Hospital 10,000

0,0001

Residence 5,000

2.200 I"

1,500

'so 1,00,000 + Depreciation Rs.' =

urgical eqllipments :Op. lv.D. V. Rs. 75,000 +

Hospital 5,000

Residence 3,000

"Drawings -. -

" Purchase of Medicines

Purchase of Surgical

Equipments (I-I-'ll)

,. Vehicle Exp. (Personal)

" Balance CIF

6,000 from Medical College.

15,QU(} ,

8,000

30,(){)()

1,10,000

75,000

20,000

71,950

5.41.950

al equipmenls after initial depreciation was

:eciation is 25%.

e was Rs. 35,000 and closing stock was

[GIAj. VIIi., 2008; N.G.V.,2011-modijied]

'Profits and gains of Business or

C) Rs. 33,000 (LIP + PPE '

'so 4,72,000 (Rs. , 0 + 2,12,000 + 20,OQO +

I,ses , 25 (Rs. 1,54,000 + 25,00fi. +.10,000

56/)00 - Sale Rs. 10,000 =Rs. 1,40,000, of

S,OOO 25% ,x 50% on new equipment of

mption of = ,Op. Stock

Rs. 45,000 - Rs. 1,O(J;ooO.. j , " ....

from busilli.:ssfromthe

r ending on 31-3-'11 and '

Particulars :. oKS.

8,000 By Gross Profit 2;97,000

1,000 " Income-tax refund 4;000

5,000 " Dividend H;OO6

4,000 ., House rent 14,000

3,000 Lottery Prize 6,000

3,000 Commission , 8,000

9,000 .." Bad debt recovered 10,000

8,000

7,000

6,000

'".j.

i'

_______1

,

rofit Rs. 2,64,000; Start wit ' tProfit (as

t'll} }X-":' '),,' OH !Ill:

1.000 ij

.2.000'1

3,000 I

4,000 !

5,000 i

12,000 I

9,000 II

'.2

0

,000

50,000 I

3.50,000

s for personal purpose.

Rs.15.000.

overed was not allowed as bad-debt in the earlier

,ment

Rs. 3,000

re not recorded in the above Profit & Loss Nc.:

Rs. 5,000

Rs. 4,000

Rs. 6,000

Rs. 1,20,000

(Guj. Uni., 2008 & Sau. Uni., 2()lO; rna )

'

+ Inadmissible e ses etc. Rs. 1.10,000

63,000 + Rs, + Rs. 9,000 +Rs. +

I . 0 5,000 + 1I3rd motor Expo Rs. 3,000)

.. Rs. :J, .e$3*her exempt or taxable

4,000 + Rs. 000'+ Rs. 14,000 +'Rs. 6,000'

UIowed earlier Rs. 3;, Expenses

13,000 (Rs. 4,000 ofAdvt. +""&5. 6,000 of Audit

'on allowable but not recorded) :::: Rs. 2,64,000.]

oth merchant. Following information is obtained'

ng Year 2010-11.

iltowableExpenses and (2) Disallowable Expenses

'nfrom Business and Profession.

Rs. Name of the Expenses

Rs.

16,000 (13) Donation to recognized

5,000 institution

4,000

14,000(14) Donation to unrecognized

, 3,000 institution

5,000

12.000 (15) Exps. to raise the loan

11,000

21,000 (16) Wealth Tax

2,000

, 17,000 (17) Professional Tax

13,000

8,000 (18) Exps. of Illegal Business

14,000

49,000 (19) Compensation to worker

51,000 for the injury 15,060

12,000 (20) Workers' Welfare Exps. 16,000

;,1 :

3,000 (Go u., 2010; Modified) ,

1-'

I

.

,',.,.;

.

. . I

S OR PROFESSION

Rs. Credit

RS: 11J"L;006:---'"

;s going to be taxable, the expenses relating

inS, such //lcome. j

for the year ended on 31-3-' 11 of

able ir.come from Business and Profession.

By Gross Profit

Profit from the sale of Land

Prize from Horse-race

Birth-day gift

B:::d debt recovered

Bank interest

88,000

28,000

16.000

21,000

5,000

2,000

1,60,000

the Travelling Exps. of his family.

till unpaid.

(stock-inctrade) costing Rs. 7,000 are

to PIL Nc as theft.

tionery is Rs. 2,000.

. 3,000 which is not allowed as bad debt.

,on is Rs. 10,000.

irded in the books. (G. u., 2010; Modified)

Rs.40,000;

'.fit of Rs. 95,000- Rs. 70,000 (incomes which

Har m

llati

;:: Rs. 25,000 + Inadmissible expen . of

, bya wo.-ker) ;:: Rs. 44,000 -Deficit ot predation

'orded audit fee. Rs. 2,000;:: . O/XJO.j

;nery in a factory owne ., ,Mr, Shah. Type A

at a cost of . 12,00,000. Installation,

regard am ted to Rs. 2,00,000, Rs. 75,000

me costing Rs. 5,00,000 was bought

, ..mery was sold for

rate of ,15%.

on 1-5-2010 at a cost of Rs,Sb,oo,oOO but

'rest paid for this period on this machinery

. expenses amou'nted tb Rs. 75,009 aqd

Vof Rs. 1 00,000 was received in this regard.

'rate of depre' ion. .

a

1

.}

}

.s

fi

Q

l

4

c

f

1;

(

(:

"'-.

,:

).:

iJ

..!>': .

#f)",

I .,.

;. :'1

Oft 1ROFESSlON

'and t:luuhter-in-Iaw :w,ho is a co!!Jml':rce

guia.rly and they get sala 6. 15,000

tively (included in Ital I'.xpenses).

s. 10,000 for umily pilgrim:lge and Rs.

sincss pr olion tour to Dubai

f Rs . ,000, for his son Rs. 12,000 and for

ni., 2006; N.W,... 2006; 2008, modified]

Rs. 2,68,200.

. patiellts is considered taxable. ?) Salaries paid

nses. (3) Jllterest on loan taken purchase

business expense. (4) Travelling expe esfor

"el expenses for business. prom(j)tion are allowed

authority (6) Deduction Uls BOC for qualifying

rill be fully allowed from total gross income.]

Cr.

10,50,000

6,000

4,000

30,000

20,00,000

30,000

1,35,000

By Gross Profit

Sundry Income

Bad-debts recovered (4)

" Share dividend

.. Commission

: 5,00011" Rent of let-house

7,500

10,000

140,000

,15,000

1,000

8,000

11,oooi

,12,500

,25,000

,50,000

,, Profit and Loss Account for the year ending

rbhai:

:and Loss Ale

It Particulars I Rs.

9,65,000

35,000

10,000

";;'I' '- .. ' .. ...

("

01

(1)

(2J

(3)

(4)

(5)

(6)

(7)

(8)

(9)

(10

loco

loss.

on T.

Valu

(of J

reco

21.4

(4) (

IfllItit

year

ToS

"L

9t PI

.. B

nSf

" B

tt Bt

"D

"A

" D

" Sf

" PI.!

" D;

" H,

,;;';1

'.;; "':!:.

,:t

i

!woman. Pwfit and Less Nc of her business

;8 as under ;.

r-n- ---'---""1---

s.

'3ttd-debts

. (allowed as loss in

el'Ilier year)

Discount

ByGl't"t (from her husband)

. LOttery Income

Income-tax Refund

3y Gross Profit

6,000

4,000

10,000

10,000

5,000

Rs.

2,15,000

2,60,000

00 II '

rsonal purposes.

lof daughters' college-fees and Rs. 500 of

rule is Rs. 10,000, whiCh includes

'd which has been included in the above

-.... j

S OF BUSINESS OR PROFESSION

i

IIses are Rs. 50,000, which are to be written off in

hana's taxable business income for the assessment year

[Sau. Uni., 2005; Guj.. T.Y.BBA, 2011-modijied}

I .. .

ime under the head 'Profits and Gains of Business or)

. , / .

expellses : B.D. Res., lilt. 011 capital. oWlle s salary, III come:,

Ie of furniture, Discoullt resen'e. Life-' Isurance premiuf1tli

ee.., Penalty for late filillg of 'Retun!', Excess depreciatio

&.2.. ,000), 1I5th of depreciation 0 motor-car (Rs. -1,000);

'IId<:r other heads or exempt from t : Dividend, Gift, lotte .

to be deducted: Besides additio al Rs. 5,000 of Preliminar;

because the)' are to be writt off in 5 annual instalmelUi

the assessee. (3) Defalcati n of cash is an allowable los,

xpenditure Account of,nr. Ramesh Dave for the previou

Income from Nursing

Home (surgical)

Income from operatiQns

Dividend (gross)

Interest of treasury saving cert.

Consultation' fees

Winning from lottery

Birthday gift (of a minor son

Rental income of

house property

.,

I,

1

, . 12,000 paid to. his W!WhO is a qualified nurse.D....

k ends only. . ,

'eciation on surgical' ins ments is 20,000 an4

1,500.

lude the sumofRs. in respect of his prop,

I

,.j

norarium of Rs. 15,000 as a visiting professor. ':'

.;,

::i",

.

',.

1

Wi

,'1.1 .23

Howing .'ansactions for the Ae(:ounting Year

n:

,000

Selling

PriceRs.

1,01,000

3,92,000

1-1-11 I 1,87,000\

,700 1-1-11 25,000

'on 1-4-81 was Rs. 10,000.

Transfer Index

Fee Rs. No.

3,100 100

6,200 305

1,200 I

140

1,000 447

flat for Rs. 1,43,600 on 1-3-'11.

'ear 2010-'11 is 711.

Uni., 2008; G.U.T.Y.,B.B.A., 2010 - Modified)

15)

capital profit Rs. 1,70,400.

nsideratioll = Rs. I - 3,100 = Rs. 97,900

7/11100)- 'able L. T. Capital Profit Rs. 26,800;

- s. 3,92,000 - 6,200 = R:;. 3.85,800 -Indexed

= Rs. 2,43,600 !II: Exemption Vis 54 (for newflat

,

Jewellery Personal Car

1-1-76 1-1-87 1-1-95

s.30,OC<l Rs.42,ooo Rs.80,000

s.40,OOO -

.3,45,000

Rs.4,47,000 I

Rs.50,000

s.25,OOO Rs. 12,000 Rs.2,000

100 140 259

sold during January, 2011.

the Accounting Year 2010-'11 is 711.

(Cuj. Uni., 2009, Modified)

mfit Rs. 2,57,300.

sutera/ion Rs. 3,45,000 - selling expenses Rs. 25,000

x 711/100 = ..

- elling expenses Rs. 12,000 -Indexed

1/140) = Long-te ital profit Rs.2,21,700;

red a 'capital asset " profit or is not

"--;0.'-:..."

(3) Jewellery: Net = Rs. 1,87,000

. 1,42,200 (Rs. 28,000 x 7/11140) = Taxable LT.

car is not treated a capital profit

'lity.] .

gain of Pawankumar for the Accounting Year

s done by Khushali ior 'he year ended on

Ilecapitcl gain.

of

s l Price

jPurchase

Price Rs

I Sellingl Price on

1-4-81 Rs.

Index

No.

10 I

10

to

11

80,000

24,000

25,000

90,000

6,68,000

117,79,000

99.950

1,75,800

60,000

I I,OO,()(){) 100

480

125

491

;ar2010-' 11 is 711. [G. V., 2011-modijiedj

: Rs. 17,79,000 - Indexed cost Rs. 7,11,000

- Exempt VIS 54 Rs. 6,68,000:: Rs. 4,00,000;

cots Rs. 35,550:: Rs. 64,400; (3) Silver: Rs.

I

=33,600; (4) Personal Car is not a 'Capital

ability.]

Jwing details in respect of building

1at Rs. 30,00,000.

1967-'68 for Rs. 80,000.

kted in 1978-'79 for s.I,OO,OOO.

structed in 1988-' forRs.2,00,000"

ilding on 1-4-1 1was Rs. 1,80,000.

ential buildi g immediately after the sale of

,00,000.

Cost inflation index

100

161

711

for the Assessment Year 2011-' 12.

ious year 2011-' 12 for Rs. 21,00,000, compute

Year 2012-' 13.

(N.G.V.,2007-modijied)

.lid in. ihe. Po 'J2/or Rs. 21,00,000 the total

.000000(on sa o/new house/or Rs. 21,00,(00) +

2010-'Ii) :: Rs..,36.970.J

ye<

Sr.

No

-

1

2

3

4

5

Th

sal

TaJ

Lta

Rs.

Sed

XI

sal

(RJ

val

xi

M:

(1)

(2)

(3)

(4)

(5)

_____________ 0 5 J

--

:.Al'lT,'-l- II V.5

the following 'ietails pertaining to previous

he A.. y. 2011-' 12

e financial year 2010-' U.

Date

'rom'" Iem.

of prke Charges. i2

tion

purchase

Rs. Rs.) ex of

year or

purchase

100

1-7-'70

Moo

,.ro;y:

480 1,20,000 400 1-8-'04 0,250

Date of Sales Tran$fer

Sales Price Expense

Rs. Rs.

10-6-10 30,50,000 33,750

1-10-10 1,67,800 1,800

1-10-10 3,76,500 1,500

21-9-10 15,13,000 3,000.

2-2-11 2,42,000

. 2,000

Purchase

Price

Rs.

2.00,000

1,0.3,800

50,000

2,50,000

2,00,000

1-2-'94 1,22, '. 1,500

244

10,000 133

I

I 2,75,O<YJL I

__ ...-:;

(2)

t,

iediately after she sold the residential house.

3,10,000112-12-.0

p,OO,OOC -

year 2094'05 for additional cor.struction

1-4-1981 were as under:

Rs.3,50,000

Rs.4,00,000

Rc;.40,OOO

been paid on sale of X Ltd. Shares.

) has been paid on sale of YLtd. Shares.

100

125

480

519

711

(1)

(2)

(3)

(4)

(5)

Oth

(1)

:ortheA.Y. 2011-' 12.

[N.G.U...)069, modified] .

Profit =Rs. 1,47 '

sales - Transfer Chafg.es

'0 (Rs.}Mf.OOOX 711/100 = Rs. 24,88,500 +

Exemption VIS 54 Rs. 3;83,750 =

'oral sales price Rs. 1.67,800 - Transfer cifarges

000 -Indexed cost (Rs. 1,03,BOO x.71'J/S19) ,

Rs. i

because the transaction is subjeci.tO SIT;

'rn=. ,. :stIles value Rs. 3, 76,500 Trallsfer

(Rs. ,

)() x 711/1 s. 3,55,500 = Taxable L T.

amo

illing Rs. 13,000"" Transfer Rs.

Qgric

- T. Capital prOfit (taxable)

2(14,

':':'Tra er charges Rs, 2,000

Rs. 1

Rs. i

Prop

'J R<. = Profit

LTO

X 71,

othel

"dfor

Cost I Fair

Rs. I of

Value 0.0 Sale

1-4-'81

Rs.

90,JOO I 1,80,000 I 16-8-10 I 20,42,200

1,80,000

1,08,000

90,000

1,26,000 117.10-10

36,000 5-7-10

81,000 6-3-11

21,60,000

1,44,000

7,50,000

1-3-11 I 77,04,400 54,000 I 10,80,000

r the assessment year 2011-' 12.

2010; modified!

,Jm Rs. 1.07,112 (Net

.Rs. 36.000).

: Sales val s. 20,42,2{)() - Indexed cost

Rs. 7, {)():.. Exempt Uls 54B (to the e.xIeni

t. 7, = Taxable LTCG Rs. 42,400; (2) Rural

definition of 'Capital Assets' as per section

. ation purpose; (3) Shares: Sales value

= ST s. 36.(}()(); (4) Gold: Sales Value

'0 x 71JII09) . 5.87,064 = Rs.. 1,62,936 _

1,62,936 x 5,00, 7.50,{)()() Rs. 1,08.624 =

Salesvafue 77,04,400 - In red cost (Rs. 10,80,(}()()

Rs. 25.600, which is against

,000 on 25-62011 in the capital gain account

agricultural land in Urban area.

l, he has invested Rs. 5,00,000 on the purchase

I5-5-L-OJ 1.

are as under:

...... J

nn assets as on lith

Gold I Silver I Diamonds

(Rs.)

(Rs.) (Rs.)

-I

I

8,10,000

2,96,200 I 6,40,200

1,15,000

I 1,78,000 I 4,30,003

81.000 I 6.000 I 32.000

mefortheA.Y. 2011-' 12. is July 31, 2011.

, d 54 EC, Shri A.H. Jadeja has purchased

Date.of Amount

Acquisition Rs.

iuse) March 31,2011. 1,00,000

August 5, 2011 50,000

ion 81,000

July 5, 2011 7,50,000

,.

,es

120) July 10,2011 3,00,000

adeja for the A. Y. 2011,12.

(N.G.u., 2011 -Modified)

,fit Rs. 64,200 .

'efore claiming exemption if. allowll are to

17,5a

cost asgive

iRs. 3,10,000; Gold: . 6,14,000; :

As the qmount " er the

depositedb e the due date o/furnishing the

. dforclaimi/lg exemption; (3) Total

.' + Rs. 3,00,(00) ofRs.10,50,000 only

. ledbeivw: .

fal House

lof land; Rs. 2,10,000

Rs. 6,14,000

Rs. 02,000

Rs. 1,14,000*

"-

Rs. 10,50,000

= Rs. l,14,000J

. .,.... , "

14,

under:

( 1)

sold on

(2)

of the 1

(3)

in the I

Co

Co

[AI

is

within:

NOi

= Rs. 7

'\

of capit

Jev

5-2010.

sale.

On

(NHAI)

Int

instead

111<

-100,21

[AI

-Broke

(1,11,00

Not

expiry C?J

consider.

Opt

house/'"

term cap

,

S29

. -..

..

":[[1

.1

CAPITAL ':';AINSII . 129

/'

'.0 transactions of Shti as

,;.,.il

for personal use was (

.000 (out of sales consideration received)

was 259 and that of 2010-' 11 711.

!i., 20 . 2006; Guj. Uni., 2006-modifiedJ

rain ofRs. 676 the exemption of Rs. 60,000

bfpurchase po of Bonds of NHAI bought

Capital Gain =Rs. 5,676,

les exps. Rs. 4,000 + I exed cost Rs. 2,93,734)

&Jexed -cost is to be compu a ter additiolJ of

[(1,07,000 x 7111259 = Rs. 2,93,73 "

bnofMr. Kapildev calculate the taxable amount

forRs. 1,09;000 was sold for Rs. 8,47,690 on 2

OOrespectively as brokerage for purchase and

rnds of National Highway Authority of India

after 3 years.

<purchased a residential building for Rs. 6,74,552

. t will be the change in answer?

:lleryon 1-4-81 was Rs. 1,11,000. Index: 1981-82

,2009,2011; G.V., T.Y. BBA, 20ll-Modified)

'rofit =Rs. 53,980; Total sales s. 8,47 6

irationRs. 7,89,210

mt Bonds ofNHAI has been made after

.ilrliOt available and hence entire capital profit is

,tal long-term X Investment in residential

:200]'

TG'AA

house for Rs. ";,00,000 during the year

;1,76,250 as additional construction expenses I

house for Rs. 44,08,825 and paid Rs. 8(?),000.

!anolher house for Rs. 8,02,825. Relevant cost

in according to Sec. 54 for the A.Y. 2011-' 12.

[S.G.U., 2009, modified]

Jfit of Rs. 6,49,400 is fully exempt DIs 54.

. profit =Rs. 44,08,825 - (Indexed cos s. 36;79,425

i400; (2) Indexed cost of Purchase onsideration =

Indexed cost of additional construction cost

:35,425; (3) As the assessee ha invested the entire

?use within the prescribed timeI' mit, it isfully. exempt

his investments :

Cost \ Date er

i following particulars

Sale IFair M. V.

Price 00:1-4-'81

Rs.

Safe

Rs. Rs.

72,100 10;000

3,1-16-2010

30-6-2010

1,78,250 1l5,000

30-12-2010 26,000;

31-1-2011

14,(00)

2.41.500\1 30-6-2010 I 12,14,000"

2,32,900

48.300

,is perso,nal resid. ce in Mumbai on 31-10-2010

. - an expenditure 0 s. 5,000 on registration and

!perty at Poona. Secu ..es Transaction Tax was

jltd., C Ltd. andD .

F. the taxable capital gain r the assessment year

nanciaJ years 1981-'82, 198 -'89 and 2010-'11 are

[S.G.U. 1995-modified]

sll

=

oc

co

DI

=

tel

inc

be

the

sll.

2C

0;

(2;

(3;

(4;

(6)

tra

nu

Pre

'!;r(. .'. J ...

GleNS III

-1

at

'\

the sale ta6k ',.

'Ilnce according to the contract. .",

ifore the deal vJas cancelled and the advance

al,"onslruction of this house were Imder :

"7,300 and

,if Rs. 27.52,350 a'1d paid Rs. 25,000 as brokerage.

in Surat at Rs. 20.00,000.

, pl:fchased 1,060 shares at Rs. 66.50 paise per

right shares at Rs. 86 per share at the rate

bare.

(5 with him at Rs. 445.50; and paid Rs. 8,000 as

for Security Transaction Tax (SIT). Relevant

2(0)..'01 =406

2010-'11=711

e years bonds of National HighwaysAuthority

j_

,rthe A. Y. 2011' 12. .

(S. G. Viti.. 2009. Modified)

,on sale of residential house = Rs. 11,98,700,

, capital gain on sale of shares (on which

- Exemption Dis 54EC

i10,COO.

'toJ/he residentia ouse = Rs. 2,34,500 - Advance

! 1,99,500 Q1 Its indexed cost = Rs. 1,99,500 X 7111

?/ad1J1k'nal construction = (Rs. 27.300 X 711/182 =

3.55.500) = Rs. 4.62.150; (3) Total long-term

'sala va!ue Rs. 27,52,350 - Brokerage Rs. 25,000

Indexed costs of additional constructions

elll.ll(as it is ill vested ill another house. (4) Indexed

711/133 =Rs. 3,55,500 alld Indexed cost of

boo>: 71 ft{72 = Rs. 3,55,500; (5) Long-term capital

5.50) =Rs. 8,91.000-Brokerage Rs. 8.000-1ndexed

7,ll,OOO := Rs. 1,80,000 - Exemption Vis 54EC

I

I

i Ltd.

ate pf TDS 30%

'ebentures of Adani Lt

:ion charges of Rs. 150. He

pita! Investment Bonds

[ruts Bonds

S 30%)

e

.

:,',',t,:;'1

R SOURCES

to'.r

'"

to make investment in shares is also not deductible/{

r RP Lld- = Rs. 27,000 x 100190 == Rs. 30,Oog{interes,'

'ucrion); Gross Income from card games ==,RS. 17.500 x: "

rf?spe.::t of card games are not (3) Family;:,

'hIS head subject to a standard de;MCtion @ 33 1/3% or,

ormation of Mr. income from other

Rs.

2,50,000.'

2,00,000'

iance Energy Ltd.

2,00,000

4,00,000 '.

2,10,000

48,000

of Rs. 1,00,000. He ,paid

cei ved interest on above

(Guj. Vni. 2007

m Other sources Rs. 3,78,000 ai1cl,Taxable Income

,s exempt. (2) Gross Lottery Income;::: Rs. 2,07,300 x 100/

's taxable under the head 'Salary Income.J

Ibrmation you are required to compute taxable income

:Income from Other Sources for the Previous Year

Rs.

Fixed Deposit (Gross) 6,800

5,000

. 2,500

bebentures'of Krish Ltd. (TDS 20%) 9,000

17,500

free Debentures of Kanak Ltd. (TDS 20%) 12,000

(G. V., 20ll-Modified)

unde:- the head "Income from Other Sources"

"

vestment Bonds is exempt (ii) Gross int - on

!()OOx 100. 00; (iii) Gross Lottery income

: 25.000;.(iv) Gross interest on

FRs. 15,000]

2010-' 11 Mr. G held the following securities:

. unlisted debentures of M Ltd. (TDSrate 20%)

listed debentures of S Ltd. (IDS Rate 10%)

saving bonds.

I bonds issued by notified public sector company.

m:

mber :i:muaily. He paid Rs. 500 as commission

-':I.OM' OTIJER SOURCES. 169

Rs.

Ii

3,000

10,000

15,000

Ili

28,000 1/:

, 1,000

rom other sources for the A. Y.20ll-'12

(N.G.V.,201D-modified)

Ii

head "Income from other Sources" Rs. 74,000

Ible Income Rs. 73,500.

,II

r

ax

1

r

ee :mlisted debelltures ofM Ltd. = Rs. 56,OQ

?SS 011 10% Tax-free listed debentures S

"

iRs. 4.0W; (3) Interest 011 notified debentuT< of a

'O( 15); (4) Gross Lot'!ty Prize =Rs. 28.0Q x 1001

le following particulars of his in me for the

the head "Income from Other Sources." for

; less-tax debentures of 'o.' (T.D.S. 20%).

!sit Rs. 17,000.

ltd.' Rs. 15,000.

, Rs. lI.200

(N.G.V., 2008, Modified)

,nder :he head .income from other Sources'

-tax debentuds of A Ltd. =Rs. 8,800 x 100180 =

race = R..(1I,200 x 100f70 = Rs. 16.000.]

the details pertaining to previous

\ I

head "Income from other Sources" for

listed-,Redeemable Debentures of AC Ltd.,

t) Rs. 1,57,500 (TDS Rate 30%);

.

and back) for collecting the cheque

. (N.G.v., 2008, Modified)

Inder the head come from other sources

!other sources Rs. ,02,000.

k (2) Gross illterest n Debentures =Rs. 2,700 x

,ncome =Rs. 1,57,5 x 100f70 =Rs. 2,25,000;

, allowed as a specific eduction; (5) Unexplained

1

'j

I

,I

,

. . ... H_n_1

_ER SOURCES

I

g details of Shri Anandbhai Joshi, find out the taxabl

orne fr.>m other SOufcers" for the A. Y. 2011-'12 : '

\S intere>t earned on Gold Deposits Bonds, 1999.

s received on shares of Reliance Power C6:

\

's interesl received on less-tax debentures of "Ashth'

20%)

's interest received on less-tax debentures of "Garde,

(Surat (T.D.S. rate is10%).

h10% Rs. 10,40,000 less tax debentures of "Chenna.

!1O%). On 1-7-2010 these debentures were sold an

pk loan taken to purchase the debentures of

! ,,

IVed as a1 author Rs. 63,000 net (after deduction OJ

, 10% Rs. 5,40,000 tax-free debentures of Delhi Ltd.

rom race is Rs. 35,000 (T.D.S. 30%). , ".

[kposit (Gross) Rs. 68,000.

purchased Rs. 4,80,00012% tax-free debentures ofl

i. (T.D.S. 20%). >I'

he b:mowect a loan from the bank for Rs. 4,00,000

'erest rate.

been received as ground rent.

all the securities was received on 30th June and 31 st

year. Rs. 1,380 Was paid for collection of interest.

(N.G.u., 2011, modified)

the head Income from other sources Rs. 4,85,680; ,,'

furces (afler allowing specific d 'ons ofRs. 4,000 ;i

14,80,3CO. ,

(i) are fuily ex 2) Gross lilt. all Ash/ha Ltd's less-tax

?/80 - '. 43.750; (3) Gross lilt - 011 Gardell warelli's

\ - Rs. 49,000; (4) Gross Illl- Oil debentures o!Chellnai

i6/1 t. 52.000; (5) Net Royalty 00; (6) Gross

Ltd. = J 5.40,000 x 101100 100180 Rs. 67.500;

k =Rs. 35,00 00170 =Rs. 5 , ;)lilt . on Bank

h. on ds!belltures of LId, =Rs. 4,80,000 x 121

) Ground rellt Rs. 25,080.]

Sanyasee's income given below find out the

\. "Ir,come from others sources" for the assessment

on Gold Deposit Bonds, 1999.

!received on shares of Reliance Co. Ltd.

lived on less-tax debentures of 'A' Ltd. (T.D.S. 20%)

teceived on less-tax debentures of 'B' Co. Ltd.,

i I

il!l;

:".

,if!;

CES

'"1.

i

free debenture

!. 32000

'II Vikas Patra 8:000

, 9,000

jbank loan borrowed for purchase of Indian

I

!bank loan borrowed for purchase of Indian'

I ,

!bank for transferring the of dividend

and N.G.U., 2009 with changes illfigures)

the head Income

lather Sources " 1;JU.

f13 . empt: (2) Commission paidjor"transjer

uctible a;; a specific deduction; (3) Gross Loltery

, ross interest on Swati Ltd.s debentures

b) Gross Inte II Sanjay LId. 's debentures =

,lAs dividend on share ndian company is not

,purchase these shares is not a d as deduction.]

!held by Miss Disha during the previous year

I

I

i Rs. 30,000

ovt. Securities Rs. 40,000

I '

i Rs.20,000

anumant Ltd. (1DS Rate: 20%) Rs. 30,000

rtificate Rs. 10,000

pany Rs. 40,000

ase tax free securities of Indian Government,

LThe interest paid on the loan to purchase the

1,1 2,000. She paid the bank commission of Rs.

Rs.

4,500

2,400

2,000

.. ,.

I

I (Sau. Uni., 2011 - modified)

ead 'Income from Other sources =Rs. 10,950;

h

after

allowing specific

,Ks.. 6,92L

fs centificcte is ex U/s (10)( 15); (ii) Gross int

'd = 30/1 100/80 = Rs. 3,750; (iii) As prej.

e is 0 root deductible.]

receives the following incomes during the

ired to calculate the Income chargeable under'

'ces' :

I) to collcet the amount of dividend.

iss Disha under the head "Income from other

J(

;j':

':::-i::

:<;.

n,

I,

It

d,

2

R

L

..

=

x

Ii

Ii

=

e

u

:t

.1/)

-il'

f:.'

~ i i i i i i i i i i i i i l i i i i i i i i i i i i i i l i i i i i i i i i i i i i i l i ~ ~ i i i i i i i i i i i i i I i ~ i i i i i i i i i i i i i l i i i i i i i i i i i i i i i i J

SOLiRCf:<;

r

'ived qn t::Lx-frce Gf')' {..,cd., (T.O.S. 10%)

prd puzzics ('6ross) 'Ks \000 nnd winning from

b (t.O.S. 30%) . 01/ .

ipitaJ [investments Bonds Rs. 4,00 .

Ii Rs. 10.000 of 7

In sub-tenant. /".,

I: securities due 30th June 3nd 31st

'laharashtra Govt's loarv6f Rs. 50,000 was sold at

.same day 15% Bihar Oov1.'s Loan of Rs. 53,000

.uiredbalance of mount for such purchase was

a friend 0 1-8-'10 9% Gujarat Govl's Loan

r yr.D.S. 20%) of Himson PV1. Ltd. of

P% leSS-fr;-t<' debentures of Reliance Pvt. Ltd. of

e purch e

ncurr for cd ection of interest on taxable securities.

i [ G. Uni., 2005 & 2007-modifiedJ

'eI: he head Incon e from other sources Rs. 1,00,245 '.

r (Interest Rs. 90 collection charge Rs. 155) =

j'.

IE

re

exempted illcomes; \ ) Item J : Rs. 80,000 x 12%

::: Rs. 6,600; (3) Ha yearly illt. all 9% Guj. Govt.

debentures of Rimsa Ltd.::: Rs. 40,000 x 15/100

"s into all B Ltd. 's debenture Rs. 6,000; (6) Gross into

100190::: Rs. 1,500; (7) t. on D Lid. 's debentures

'; (8) Gross income from 'ord puzzles Rs. 5,000;

)0 x JO0/70 ::: Rs. 25,000; (9) into on Bihar

Intures of Reliance Ltd. l1een p"chased on 1-1-'11

rest date), no interest would have upto 31

iwed money (Rs. 53,000 - Rs. 51,000) 2,000.x 6%

deductwn. J

following particulars of his investments for the

kt Bonds

of Reliance Co. Ltd. (TOS at 10%)

i :tive PreE Shares of Nobel Co. Ltd.

'ee debentures of Ashapura Co Ltd. (TDS at 20%)

Port Trust Bonds for Rs. 21,000 and purchased

ntures of Krishna Co. Ltd. for Rs. 84,000 (TDS at

% Govt. loan at par.

comes due half-yearly on 1st January and 1st July.

3i-12-201O. .

I

i

~ i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i i l i i l i i i i i i J

i

INCOME "'ROM OTHER SOURCES II 175

ission to his bank for collection ofiriterest on

paid bank commission ofRs. 400for selling

,e st Bonds and Debentures of KrishilaLtd."

,nder the head of "Income from othersources"

i '. ". . .... '. (KutchUni., 2010, Modified)

'!h.. . 1;51.,51)0 s

was sold prior to f st half-yearly

ible. (2) Gross intere,st 011 Redeemable Debelltures =

I .

(3) Gros_s .i.n.. Govt loan (only 6 months)

ble:'(5) Gruss-'.' st 011 debentures ofAshapura

o== Rs. 75.000:, intere bentures of

0/80 = Rs. f2;OOO.] .

You might also like

- Present PhilosophyDocument80 pagesPresent PhilosophyAbhay ShahNo ratings yet

- Shraman Abhyas KramDocument44 pagesShraman Abhyas KramAbhay ShahNo ratings yet

- National Patrons - 2019Document2 pagesNational Patrons - 2019Abhay ShahNo ratings yet

- Ncert VendorDocument112 pagesNcert VendorAbhay ShahNo ratings yet

- Varshitap Ni RahsyayatraDocument36 pagesVarshitap Ni RahsyayatraAbhay ShahNo ratings yet

- Vargodama Jata PahelaDocument32 pagesVargodama Jata PahelaAbhay ShahNo ratings yet

- Before You Get Engaged - Aap Sagai Karo Usse Pehle HindiDocument17 pagesBefore You Get Engaged - Aap Sagai Karo Usse Pehle HindiAbhay ShahNo ratings yet

- Before Eating at Night - Ratre Khata PehlaDocument16 pagesBefore Eating at Night - Ratre Khata PehlaAbhay ShahNo ratings yet

- Welcome To The World of Literature - Sahitya Vishvama SwagatDocument24 pagesWelcome To The World of Literature - Sahitya Vishvama SwagatAbhay ShahNo ratings yet

- Love You DaughterDocument189 pagesLove You DaughterAbhay ShahNo ratings yet

- In The Search of The Self - Atmani AntyatraDocument32 pagesIn The Search of The Self - Atmani AntyatraAbhay ShahNo ratings yet

- Cost Accounting-III March 2014Document8 pagesCost Accounting-III March 2014Abhay ShahNo ratings yet

- Aa Chhe SansarDocument42 pagesAa Chhe SansarAbhay ShahNo ratings yet

- Jain Dharamshala & Bhojanshala - Overseas Jain TempleDocument55 pagesJain Dharamshala & Bhojanshala - Overseas Jain TempleAbhay Shah64% (11)

- Lord of The Flies: by William GoldingDocument24 pagesLord of The Flies: by William GoldingAbhay ShahNo ratings yet

- Wish You All A Very Happy Diwali - Diwali UjvoDocument48 pagesWish You All A Very Happy Diwali - Diwali UjvoAbhay ShahNo ratings yet

- 204 1 Cos School Data 08082016 PDFDocument183 pages204 1 Cos School Data 08082016 PDFAbhay ShahNo ratings yet

- List of Trustees of The Ahmedabad Education SocietyDocument22 pagesList of Trustees of The Ahmedabad Education SocietyAbhay ShahNo ratings yet

- Cost Accounting March 2014Document8 pagesCost Accounting March 2014Abhay ShahNo ratings yet

- UG-560 Begal-2: B.A. Degree Examination - JUNE, 2009Document4 pagesUG-560 Begal-2: B.A. Degree Examination - JUNE, 2009Abhay ShahNo ratings yet

- Bruhad Vahivati ShabdkoshDocument408 pagesBruhad Vahivati Shabdkoshpriteshdave1978100% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Spicejet TicketDocument2 pagesSpicejet TicketAnonymous qEh0BxrNo ratings yet

- Overview of The Hotel IndustryDocument3 pagesOverview of The Hotel IndustryBrandon WaltersNo ratings yet

- CadburyDocument11 pagesCadburyAnkita RajNo ratings yet

- Elements of SCMDocument6 pagesElements of SCMPraveen ShuklaNo ratings yet

- Superior Commercial Vs Kunnan Enterprises - DigestDocument3 pagesSuperior Commercial Vs Kunnan Enterprises - DigestGayeGabrielNo ratings yet

- Econ Practice Exam 2Document15 pagesEcon Practice Exam 2MKNo ratings yet

- Duke Energy Coal AllocationDocument4 pagesDuke Energy Coal AllocationSatish Kumar100% (1)

- 06 GDP and Economic GrowthDocument3 pages06 GDP and Economic GrowthAkash Chandak0% (2)

- 3.1 - Why Businesses Seek International Markets - SHORT NOTESDocument4 pages3.1 - Why Businesses Seek International Markets - SHORT NOTESEmperor SaladinNo ratings yet

- Price Elasticity of Supply (PES)Document23 pagesPrice Elasticity of Supply (PES)SyedNo ratings yet

- TKM Training ManualDocument34 pagesTKM Training ManualRajaraamanSrinivasNo ratings yet

- Prepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldDocument39 pagesPrepared by Iordanis Petsas To Accompany by Paul R. Krugman and Maurice ObstfeldNazish GulzarNo ratings yet

- Quiz 3032Document4 pagesQuiz 3032PG93No ratings yet

- Table of ContensDocument17 pagesTable of ContensEcha SkeskeneweiiNo ratings yet

- Comparative Analysis of VAT and GSTDocument39 pagesComparative Analysis of VAT and GSTsaahilp_10% (5)

- PIT HomeworkDocument2 pagesPIT HomeworkNhi Nguyen0% (1)

- Hilado v. CIRDocument5 pagesHilado v. CIRclandestine2684No ratings yet

- Advantages and Disadvantages of CFSDocument4 pagesAdvantages and Disadvantages of CFSZeebaNo ratings yet

- Internationalisation Process in Developed and Developing CountriesDocument21 pagesInternationalisation Process in Developed and Developing CountriesDiptesh Banerjee100% (1)

- Insurance Company Final AccountsDocument17 pagesInsurance Company Final AccountsKirti_Bhatia_5739No ratings yet

- Lucian A 1Document17 pagesLucian A 1keylaelizabehtNo ratings yet

- The Beer Industry in The NetherlandsDocument2 pagesThe Beer Industry in The NetherlandsAliceLeNo ratings yet

- Chapter11.Flexible Budgeting and The Management of Overhead and Support Activity CostsDocument34 pagesChapter11.Flexible Budgeting and The Management of Overhead and Support Activity CostsStephanie Ann AsuncionNo ratings yet

- Basic Documents and Transactions Related To Bank DepositsDocument15 pagesBasic Documents and Transactions Related To Bank DepositsJessica80% (5)

- 8294 PDFDocument174 pages8294 PDFManjeet Pandey100% (1)

- PL Nov OktDocument2 pagesPL Nov OktKahfiNo ratings yet

- National Review Center (NRC)Document3 pagesNational Review Center (NRC)Malou Almiro SurquiaNo ratings yet

- IRR and NPV Conflict - IllustartionDocument27 pagesIRR and NPV Conflict - IllustartionVaidyanathan RavichandranNo ratings yet

- Economic Cycles: Historical Evidence, Classification and ExplicationDocument29 pagesEconomic Cycles: Historical Evidence, Classification and ExplicationkyffusNo ratings yet

- Roller CoasterDocument3 pagesRoller CoasterDiego Chavez GomezNo ratings yet