Professional Documents

Culture Documents

TH TH ST

Uploaded by

sharathk916Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

TH TH ST

Uploaded by

sharathk916Copyright:

Available Formats

Mark 60

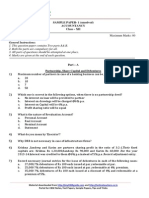

HIGHER SECONDARY MOMEL EXAMINATION FEB 2011 ACCOUNTANCY WITH COMPUTERISED ACCOUNTING Time: 2hrs

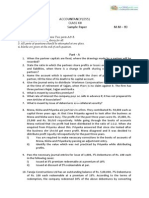

1. A partner is entitled to get 6% pa as a) Profit, b) Interest on capital c) interest on loan d) Remuneration 1 2. find out the odd one a) fixed capital method b)m simple profit method c) super profit method d) capitalization method 1 3. Unless otherwise mentioned , the sacrificing ratio will be a) equal ratio b) old ratio, c) new ratio d) none of these 1 4. The amount due to the deceased partner is transferred to a) his capital a/c b) his loan a/c c) his executers loan a/c d) his executers capital a/c 1 5. The minimum percentage of shares held by a government in a govt. company is a )100% b) 51%, c) 49% d) 25% 1 6. What do you understand by right issue 2 7. A firm has an average profit of Rs. 50,000 during the last certain years. The normal rate of return is 10%. The firm has net tangible asset of Rs. 3,00,000. Calculate the value of goodwill using capitalization method. 2 8. X, Y,Z are partners sharing profits in the ratio 5:3:2. X retires and for this purpose goodwill is valued at Rs. 25000. Continuing partners agrees that their new profit sharing ratio shall be equal. Record necessary journal entries. 2 9. ABC Ltd has issued 1000 shares of Rs. 10 at a premium of 40% on its face value. Pass journal entries for recording the transactions if, a) It has been issued to promoters of the company b) It has been issued in consideration of assets acquired from a vendor 3 10. P,Q and R sharing profit and losses in the ratio of 5:3:2 took out a joint life policy for Rs.15000, paying an annual premium of Rs. 600 starting from Ist January 2005. The surrender value of policy was as follows 2005-nil , 2006- 200, 2007-500, 2008- 850,2009-1500 Q died on 6th October 2008 and insurance company paid Rs. 15800 on 30 th November 2008.The books of the firm was closed on 31 st December each year. Prepare Joint Life Policy assumed as the premium paid is treated as an expense. 3 11. L and M were partners of a firm sharing profit and losses in the ratio of 4:3. Their Balance sheet as on 31st Dec 2009 were as follows: Liabilities Sundry creditors Bills payable General reserve Capital L M Assets 5000 15000 22500 20000 15000 --------77500

20000 10000 7500 25000 15000 -------77500

Cash at bank Sundry Drs. 16500 Less Provision 1500 stock Furniture Machinery

The firm is dissolved as on the Balance sheet date. The assets realized as follows: Sundry Drs. 14000, furniture 17500, Stock 21000, machinery 25000. Sundry Crs were paid at a discount of 15%. The expenses on realization amounted to Rs.2500. Prepare necessary ledger account in respect of dissolutions of the firm. 5 12. Shyam Ltd issued 15000 Equity shares of Rs 10 payable Rs. 2 on application , Rs 4 on allotment , Rs 2 on first call and Rs. 2 on second and final call. All shares were fully subscribed and paid for except call money on 200 shares held by a shareholder while making second call. Pass necessary journal entries. 5 13. X Ltd. buys its own 6% debenture with nominal value of Rs. 20000 on 31st March 2008. Pass necessary journal entries. a) If it was purchased at Rs 96 per debenture, b) If it was purchased at Rs. 110 per debenture. 5 14. Lal ltd. issued 20000Equity shares of Rs. 10 per share at premium of Re 1. each payable as Rs. 3 on application, Rs. 4 on allotment (including premium) and Rs. 4 on first call. Applications were received for 30,000 shares. 7,500 shares were rejected and application money refunded. Allotment were made on pro-rata to the applicants of 22,500 shares and money overpaid on application was adjusted to allotment money. A share holder who holds 2000 shares failed to pay the first call money. His share were later forefeited. Pass the necessary journal entries. 8 OR 14. S and J are partners in a firm sharing profits and losses equally. The following is the balance sheet as on 31.12. 2010. BALANCE SHEET LIABILITIES Bank overdraft Reserve Capital S J 90,000 25,000 75,000 50,000 ASSET Cash in hand Sundry debtors Stock Furniture Machinery P & L A.c

5,000 50,000 30,000 45,000 1,00,000 10,000 2,40,000

2,40,000

On the balance sheet date T is admitted into the partnership on the following basis:i. T should bring in Rs. 60,000 as his capital. ii. Furniture should be revalued at Rs. 50,000 and machinery @ 25% less. iii. Bank overdraft should be decreased to Rs. 75,000. iv. Provision of 10% is to be made for bad debts. v. An unrecorded liability of Rs. 5000 on rent is to be recorded. Prepare necessary ledger accounts and balance sheet. 8

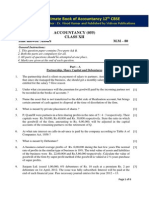

COMPUTERISED ACCOUNTING 1. Find out the odd one:a) wages b) rent c) insurance

TOTAL MARKS : 20 1

2. The function key used to activate the reconciliation statement is ___________ 1 3. Vinu a +2 commerce student identified debit and credit aspects of certain transactions. Help him to choose right voucher types. 2 Sl. No. Debit Credit Voucher Type 1. Canara Bank Cash ? 2. Wages Cash ? 3. Cash Commission ? 4. Depreciation Fixed Assets ? 4. To prepare a pay slip in MS Excel, Mohan entered Basic Pay in Cell D4. DA is 52% and the Professional Tax is calculated as 3% Of BP + DA. Calculate his net salary in Cell G4. Give entries to be made in E4 for DA, F4 for Professional Tax and G4 for Net salary. 2 5. An accountant tried to create budget by using tally. He selected Accounts Info Menu but he could not find Budget option in that menu. You are asked to describe him below:a) How this option be made available. B) Help him by giving path of budget creation. 2 6. Mohammed created three stock categories namely Telcom powder, Toilet soap and Toothpaste. After creating stock categories he viewed them in display mode. Narrate the path used by Mohammed in the creation and display of stock category. 3 7. On 01.01.2010 Megha Ltd. purchased a machinery for Rs. 5 lacs. The company decided to write off depreciation @ 8% on diminishing value of the machinery. You are requested to prepare a statement of depreciation for the first 4 years using MS Excel. 4 8. Mr. Akash decided to implement computerized accounting system by using Tally. He wants to enter all transactions so far occurred into the system. Enter it by using tally. a) Started business with cash Rs. 70,00,000 b) Opened a current account with ICICI Rs. 15,00,000 c) Purchased goods from Alex Rs. 1,50,000 d) Bought furniture and issued cheque Rs. 6,00,000 e) Received cheque from Alex Rs. 1,50,000 f) Purchased computer from Computer Plus, Kozhikode Rs. 25,000. 5 OR 8. Mr. Shinoj wants to create a Bank Reconciliation Statement. Help him to prepare Bank Reconciliation Statement using Tally. 5 Muhammed Basher Zubaida K. Manoj K.P. Sumesh John P.V.

You might also like

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- SAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80Document6 pagesSAMPLE PAPER-1 (Unsolved) Accountancy Class - XII: Time Allowed: 3 Hours Maximum Marks: 80AcHu TanNo ratings yet

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- CBSE Class 12 Accountancy Sample Paper-01 (For 2013)Document7 pagesCBSE Class 12 Accountancy Sample Paper-01 (For 2013)cbsestudymaterialsNo ratings yet

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)From EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Rating: 4.5 out of 5 stars4.5/5 (5)

- XII AccountancyDocument4 pagesXII AccountancyAahna AcharyaNo ratings yet

- CFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)From EverandCFP Certification Exam Practice Question Workbook: 1,000 Comprehensive Practice Questions (2018 Edition)Rating: 5 out of 5 stars5/5 (1)

- CBSE Class 12 Accountancy Sample Paper-03 (For 2014)Document17 pagesCBSE Class 12 Accountancy Sample Paper-03 (For 2014)cbsestudymaterialsNo ratings yet

- Isc Accounts 5 MB: (Three HoursDocument7 pagesIsc Accounts 5 MB: (Three HoursShivam SinghNo ratings yet

- Accountancy: Time Allowed: 3 Hours Maximum Marks: 80Document58 pagesAccountancy: Time Allowed: 3 Hours Maximum Marks: 809chand3No ratings yet

- Corporate Accounting QUESTIONSDocument4 pagesCorporate Accounting QUESTIONSsubba1995333333100% (1)

- Class 12 Accountancy Solved Sample Paper 1 - 2012Document34 pagesClass 12 Accountancy Solved Sample Paper 1 - 2012cbsestudymaterialsNo ratings yet

- 2015 12 SP Accountancy Unsolved 07Document6 pages2015 12 SP Accountancy Unsolved 07BhumitVashishtNo ratings yet

- Sample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General InstructionsDocument8 pagesSample Paper 2013 Class XII Subject Accountancy: Time: 3hours Maximum Marks: 80 General Instructions9chand3No ratings yet

- 29Document3 pages29sharathk916No ratings yet

- Accountancy For Class XII Full Question PaperDocument35 pagesAccountancy For Class XII Full Question PaperSubhasis Kumar DasNo ratings yet

- ACCOUNTANCY AND BUSINESS STATISTICS First Paper: Corporate AccountingDocument12 pagesACCOUNTANCY AND BUSINESS STATISTICS First Paper: Corporate AccountingGuruKPONo ratings yet

- Higher Secondary - Second Year: Padasalai's Centum Coaching Team - Special Question PaperDocument6 pagesHigher Secondary - Second Year: Padasalai's Centum Coaching Team - Special Question PaperACCOUNTS MURUGANNo ratings yet

- Test 1Document105 pagesTest 1PrathibaVenkatNo ratings yet

- Accountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Document7 pagesAccountancy (Accountancy (Accountancy (Accountancy (Delhi) Delhi) Delhi) Delhi)Bhoj SinghNo ratings yet

- Paper 1: AccountingDocument30 pagesPaper 1: Accountingsuperdole83No ratings yet

- Extra AfaDocument5 pagesExtra AfaJesmon RajNo ratings yet

- Accounting For Managers MB003 QuestionDocument34 pagesAccounting For Managers MB003 QuestionAiDLo0% (1)

- Concept of Installment SystemDocument5 pagesConcept of Installment Systemshambhuling ShettyNo ratings yet

- AccountancyDocument0 pagesAccountancyJaimangal RajaNo ratings yet

- Screenshot 2023-11-27 at 1.48.32 PMDocument9 pagesScreenshot 2023-11-27 at 1.48.32 PManupriyakapil85No ratings yet

- Paper 1: AccountingDocument30 pagesPaper 1: AccountingSatyajit PandaNo ratings yet

- XII - Accy. QP - Revision-15.2.14Document6 pagesXII - Accy. QP - Revision-15.2.14devipreethiNo ratings yet

- Accounts Preliminary Paper No 8Document6 pagesAccounts Preliminary Paper No 8AMIN BUHARI ABDUL KHADERNo ratings yet

- Mock Paper - FinalDocument11 pagesMock Paper - FinalNaman ChotiaNo ratings yet

- Part - A Partnership, Share Capital and Debentures: General InstructionsDocument7 pagesPart - A Partnership, Share Capital and Debentures: General InstructionsGaurav JaiswalNo ratings yet

- Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised AccountingDocument3 pagesGhss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accountingsharathk916No ratings yet

- Accounts Question Paper Omtex ClassesDocument8 pagesAccounts Question Paper Omtex ClassesAmin Buhari Abdul KhaderNo ratings yet

- Acc 501 Midterm Preparation FileDocument22 pagesAcc 501 Midterm Preparation FilesephienoorNo ratings yet

- CBSE Class 12 Accountancy Sample Paper-02 (For 2012)Document20 pagesCBSE Class 12 Accountancy Sample Paper-02 (For 2012)cbsesamplepaperNo ratings yet

- Svu Bcom CA Syllabus III and IVDocument19 pagesSvu Bcom CA Syllabus III and IVram_somala67% (9)

- Sample Paper 4Document6 pagesSample Paper 4Ashish BatraNo ratings yet

- CBSE 12th Accountancy 2009 Unsolved Paper Delhi BoardDocument7 pagesCBSE 12th Accountancy 2009 Unsolved Paper Delhi Boardbrainhub50No ratings yet

- WBHSCMock 2Document4 pagesWBHSCMock 2Smita AdhikaryNo ratings yet

- PAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadDocument164 pagesPAC All CAF Subjects Mocks With Solutions Regards Saboor AhmadTajammal CheemaNo ratings yet

- ADL 03 Ver2+Document6 pagesADL 03 Ver2+DistPub eLearning SolutionNo ratings yet

- Corporate Accounting AssignmentDocument22 pagesCorporate Accounting Assignmentscribd345670% (1)

- AccountDocument3 pagesAccountSk SinghNo ratings yet

- Class 12 Cbse Accountancy Sample Paper 2012 Model 2Document20 pagesClass 12 Cbse Accountancy Sample Paper 2012 Model 2Sunaina RawatNo ratings yet

- Bba 3 Sem AccountsDocument9 pagesBba 3 Sem Accountsanjali LakshcarNo ratings yet

- Class 12 Accountancy Solved Sample Paper 2 - 2012Document37 pagesClass 12 Accountancy Solved Sample Paper 2 - 2012cbsestudymaterialsNo ratings yet

- Alagappa University DDE BBM First Year Financial Accounting Exam - Paper2Document5 pagesAlagappa University DDE BBM First Year Financial Accounting Exam - Paper2mansoorbariNo ratings yet

- Prati AccountancyDocument2 pagesPrati AccountancyMohan NjNo ratings yet

- MB 104 Basics of Accounting and FinanceDocument3 pagesMB 104 Basics of Accounting and FinancerajeshpatnaikNo ratings yet

- AccountDocument67 pagesAccountchamalix100% (1)

- Corrporate ModelDocument10 pagesCorrporate Modelnithinjoseph562005No ratings yet

- Accounting I Com 2Document6 pagesAccounting I Com 2Mozam MushtaqNo ratings yet

- Group II AccountsDocument14 pagesGroup II AccountsPardeep GuptaNo ratings yet

- New Model Test Paper 1Document8 pagesNew Model Test Paper 1Harry AryanNo ratings yet

- 03 - Accounts - Prelims 1Document7 pages03 - Accounts - Prelims 1Pawan TalrejaNo ratings yet

- Sardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksDocument3 pagesSardar Patel University BBA (ITM) (NC) II Semester Examination Wednesday, 20 March 2013 3 - 5 PM UM02CBBI02/08 - Corporate Accounting I Total Marks: 60 Note: (A) Figures To The Right Indicate MarksRiteshHPatelNo ratings yet

- Acounts Papaer II Preliminary Examination 2008 - 09Document5 pagesAcounts Papaer II Preliminary Examination 2008 - 09AMIN BUHARI ABDUL KHADERNo ratings yet

- Questions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingDocument27 pagesQuestions Accounting For Departments: Revision Test Paper Cap-Ii: Advanced AccountingcasarokarNo ratings yet

- Financial ManagementDocument16 pagesFinancial ManagementManish FloraNo ratings yet

- 12 Accountancy Sample Paper 2014 04Document6 pages12 Accountancy Sample Paper 2014 04artisingh3412No ratings yet

- 4Document4 pages4sharathk916No ratings yet

- Model Question Paper: EconomicsDocument3 pagesModel Question Paper: Economicssharathk916No ratings yet

- EconomicsDocument5 pagesEconomicssharathk916No ratings yet

- 2 25 EcosyrDocument5 pages2 25 Ecosyrsharathk916No ratings yet

- 2 25 EconomicsDocument3 pages2 25 Economicssharathk916No ratings yet

- System Mechanism To Regulate The Economy: Higher Secondary Examination March - 2011 EconomicsDocument6 pagesSystem Mechanism To Regulate The Economy: Higher Secondary Examination March - 2011 Economicssharathk916No ratings yet

- 29Document3 pages29sharathk916No ratings yet

- 1Document6 pages1sharathk916No ratings yet

- 2 25 EconomicsDocument3 pages2 25 Economicssharathk916No ratings yet

- Accountancy With Accountancy With Accountancy With Accountancy With (Afs and Ca) (Afs and Ca) (Afs and Ca) (Afs and Ca)Document43 pagesAccountancy With Accountancy With Accountancy With Accountancy With (Afs and Ca) (Afs and Ca) (Afs and Ca) (Afs and Ca)sharathk916No ratings yet

- 1Document62 pages1sharathk916No ratings yet

- 15Document5 pages15sharathk916No ratings yet

- Higher Secondary Model Examination-February 2011: EconomicsDocument5 pagesHigher Secondary Model Examination-February 2011: Economicssharathk916No ratings yet

- 30Document4 pages30sharathk916No ratings yet

- 20Document7 pages20sharathk916No ratings yet

- Higher Secondary Examination March 2011: Accoutancy With Computerised AccountingDocument2 pagesHigher Secondary Examination March 2011: Accoutancy With Computerised Accountingsharathk916No ratings yet

- Model Evaluation February 2011 AccountingDocument4 pagesModel Evaluation February 2011 Accountingsharathk916No ratings yet

- 22Document5 pages22sharathk916No ratings yet

- 24Document4 pages24sharathk916No ratings yet

- 25Document6 pages25sharathk916No ratings yet

- 17Document3 pages17sharathk916No ratings yet

- 16Document4 pages16sharathk916No ratings yet

- Ghss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised AccountingDocument3 pagesGhss Koduvayur Higher Secondary Model Examination 2011 Accountancy With Computerised Accountingsharathk916No ratings yet

- 26Document4 pages26sharathk916No ratings yet

- Cluster Centre MGM HSS: Prepared byDocument6 pagesCluster Centre MGM HSS: Prepared bysharathk916No ratings yet

- 8Document2 pages8sharathk916No ratings yet

- 12Document3 pages12sharathk916No ratings yet

- Model Examination Feb 2010-2011: Computerised AccountingDocument3 pagesModel Examination Feb 2010-2011: Computerised Accountingsharathk916No ratings yet

- 11Document2 pages11sharathk916No ratings yet

- FINANCIAL ACCOUNTING Notes (MBA)Document9 pagesFINANCIAL ACCOUNTING Notes (MBA)Najia SiddiquiNo ratings yet

- Kieso Ifrs2e SM Ch13Document84 pagesKieso Ifrs2e SM Ch13christianoNo ratings yet

- Inventory ErrorsDocument8 pagesInventory ErrorsAnonymous LC5kFdtc100% (1)

- Accounting For Lawyers OutlineDocument14 pagesAccounting For Lawyers OutlineKatie F.100% (1)

- Cipla LTD: A Project Report On Financial Statement Analysis of - by Kashish AgarwalDocument57 pagesCipla LTD: A Project Report On Financial Statement Analysis of - by Kashish AgarwalKashish AgarwalNo ratings yet

- Single 287967086580186410492Document13 pagesSingle 287967086580186410492carlNo ratings yet

- Accounting Equation Problems and SolutionDocument7 pagesAccounting Equation Problems and SolutionNilrose EscartinNo ratings yet

- Palmer Cook Productions Manages and Operates Two Rock Bands TheDocument1 pagePalmer Cook Productions Manages and Operates Two Rock Bands TheLet's Talk With HassanNo ratings yet

- 11 Accountancy SP 01Document33 pages11 Accountancy SP 01Abhay ChoudharyNo ratings yet

- Strategic Management: Industry-Aviation Company - IndigoDocument27 pagesStrategic Management: Industry-Aviation Company - IndigoSatwik GinodiaNo ratings yet

- Sales & Receivables JournalDocument627 pagesSales & Receivables JournalRACHEL DAMALERIONo ratings yet

- T8 Homework Solutions-1Document15 pagesT8 Homework Solutions-1Anathi AnathiNo ratings yet

- Sapphire Textile Mills LimitedDocument47 pagesSapphire Textile Mills LimitedAleena Choudry100% (3)

- Preparing SFP of Single Propriertorship BusinessDocument18 pagesPreparing SFP of Single Propriertorship Businessjudith100% (2)

- Introducing Accounting in Business: ACG 2021: Chapter 1Document59 pagesIntroducing Accounting in Business: ACG 2021: Chapter 1Kelvin Jay Sebastian SaplaNo ratings yet

- Prac 1 - First Preboard - P2 65th NewDocument12 pagesPrac 1 - First Preboard - P2 65th NewArianne Llorente100% (1)

- Laaaaaafarge 1st Quarter Report 2021Document24 pagesLaaaaaafarge 1st Quarter Report 2021Ahm FerdousNo ratings yet

- (PWC) Up Jpia Asset Audit Case Xyz Retail CompanyDocument7 pages(PWC) Up Jpia Asset Audit Case Xyz Retail CompanyJoyce BelenNo ratings yet

- Aa2e Hal SM Ch09Document19 pagesAa2e Hal SM Ch09Jay BrockNo ratings yet

- Bestway Cement Annual 15 AccountsDocument49 pagesBestway Cement Annual 15 AccountsM Umar FarooqNo ratings yet

- Modern Slaughter HouseDocument40 pagesModern Slaughter Housesherafghan_97100% (3)

- MCQ Financial Management B Com Sem 5 PDFDocument17 pagesMCQ Financial Management B Com Sem 5 PDFRadhika Bhargava100% (2)

- Project Report: OF M/S Maa Janki Warehouse (Proprietor: Brijlata Chouhan) (Finance Required: 120 Lakhs)Document17 pagesProject Report: OF M/S Maa Janki Warehouse (Proprietor: Brijlata Chouhan) (Finance Required: 120 Lakhs)SHUBHAM SHRIVASTAVANo ratings yet

- DSBM Mcqs of All Chapters PDF. 0815Document26 pagesDSBM Mcqs of All Chapters PDF. 0815gaurang media50% (2)

- Acct 108 Accounting For Business Combinations Quiz 3 - Consolidated Financial StatementsDocument5 pagesAcct 108 Accounting For Business Combinations Quiz 3 - Consolidated Financial StatementsGround ZeroNo ratings yet

- Tire - City AnalysisDocument17 pagesTire - City AnalysisJustin HoNo ratings yet

- CH 4Document20 pagesCH 4Waheed Zafar100% (1)

- Module 2 Cash and Accrual BasisDocument14 pagesModule 2 Cash and Accrual Basischuchu tv50% (2)

- Study of Debt MarketDocument199 pagesStudy of Debt Marketbhar4tp0% (1)

- Exhibit 1 Kendle International Inc. Financial Data Years Ended December 31Document12 pagesExhibit 1 Kendle International Inc. Financial Data Years Ended December 31Kito Minying ChenNo ratings yet

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (13)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- The One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyFrom EverandThe One-Page Financial Plan: A Simple Way to Be Smart About Your MoneyRating: 4.5 out of 5 stars4.5/5 (37)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantFrom EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantRating: 4.5 out of 5 stars4.5/5 (146)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 5 out of 5 stars5/5 (13)

- The Credit Formula: The Guide To Building and Rebuilding Lendable CreditFrom EverandThe Credit Formula: The Guide To Building and Rebuilding Lendable CreditRating: 5 out of 5 stars5/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)From EverandFinance Basics (HBR 20-Minute Manager Series)Rating: 4.5 out of 5 stars4.5/5 (32)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Ledger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceFrom EverandLedger Legends: A Bookkeeper's Handbook for Financial Success: Navigating the World of Business Finances with ConfidenceNo ratings yet

- 7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelFrom Everand7 Financial Models for Analysts, Investors and Finance Professionals: Theory and practical tools to help investors analyse businesses using ExcelNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Accounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)From EverandAccounting Principles: Learn The Simple and Effective Methods of Basic Accounting And Bookkeeping Using This comprehensive Guide for Beginners(quick-books,made simple,easy,managerial,finance)Rating: 4.5 out of 5 stars4.5/5 (5)

- I'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)From EverandI'll Make You an Offer You Can't Refuse: Insider Business Tips from a Former Mob Boss (NelsonFree)Rating: 4.5 out of 5 stars4.5/5 (24)

- The Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingFrom EverandThe Intelligent Investor, Rev. Ed: The Definitive Book on Value InvestingRating: 4.5 out of 5 stars4.5/5 (760)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanFrom EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanRating: 4.5 out of 5 stars4.5/5 (79)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesFrom EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesRating: 5 out of 5 stars5/5 (4)