Professional Documents

Culture Documents

McDonald's (MCD) - Earnings Quality Report

Uploaded by

Instant AnalystCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

McDonald's (MCD) - Earnings Quality Report

Uploaded by

Instant AnalystCopyright:

Available Formats

MCDONALDS CORP (MCD) NYSE

January 16, 2013

| Stock Price

$91.10 | YTD Price Change

$2.89 | YTD % Change

3.28%

McDonald's Corporation, the registrant, together with its subsidiaries, is referred to herein as the "Company." a. General development of business During 2010, there have been no material changes to the Company's corporate structure or in its method of conducting business. In 2010, the Company has continued the process it began in 2005 to realign certain subsidiaries to develop a corporate structure within its geographic segments that better reflects the operation of the McDonald's worldwide business. b. Financial information about segments Segment data for the years ended December 31, 2010, 2009, and 2008 are included in Part II, Item 8, page 40 of this Form 10-K. c. Narrative description of business General The Company franchises and operates McDonald's restaurants in the global restaurant industry. These restaurants serve a varied, yet limited, value-priced menu (see Products) in more than 100 countries around the world.ONE MCDONALD'S PLAZA OAK BROOK, Illinois 60523

High/Low Price

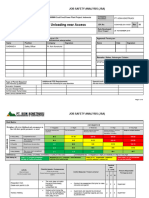

MCD - Areas of Strength and Weakness

Income Statement

Revenue* 8Qtr

Balance Sheet

Inventory* 8Qtr

Cash Flow Statement

CFFO* 8Qtr

-0.2% 10 11 SG&A to Sales* 12 8Qtr -0.1% 10 11 12

-5.1% 10 11 8Qtr 12

-7.8%

120

Accounts Receivable*

Net Working Cptl*

8Qtr

101.74 High 100 91.10

6.1% 80 10 11 60 12 8Qtr 10 11 12 8Qtr 10 11 12

108.6%

Operating Margin*

Accounts Payable*

Free Cash Flow Margin*

8Qtr

42.93 Low 40

2007 2008 2009 2010 2011 2012 2013

11.1% -0.8% 10 11 Net Income* 12 8Qtr 10 11 Net Debt* 12 8Qtr 18.9% 10 11 CFFO/Net Income 1.4 12 8Qtr -47.2%

Fundamentals 52-Week Range Market Cap ($ in Billions) Earnings Per Share (ttm) Price/Earnings (ttm) Price to Book (ttm) Price/Sales (ttm) Earnings Quality Analysis Revenue (QoQ%) Gross Margin (QoQ%) Operating Margin (QoQ%) Net Income (QoQ%) Deferred Revenue (QoQ%) Deferred Taxes (QoQ%) Days Sales Outstanding (DSOs) Days of Inventory (DSI) Days Sales Payable (DSP) Cash Sales Operating Margin (%) Tax Rate (%) Free Cash Flow to the Firm Debt-to-Equity Annual Free Cash Flow Growth Sales per Employee Q3 2012 3.42% -0.43% -1.18% 8.02% --16.50 2.46 17.37 1.48% 31.08% 31.89% $1.21B 95.53% -45.13% $65,328

$83.31-$102.22 $92.31 $5.31 17.28 6.71 3.40 Q2 2012 5.64% -0.13% -0.44% 6.34% --16.88 2.49 16.86 3.84% 31.45% 32.16% $830.76M 96.71% -28.87% $65,361 Q1 2012 -4.05% 0.05% 0.03% -7.98% --15.93 2.46 15.51 10.05% 31.59% 31.86% $1.12B 87.17% -2.49% $65,336

EV/EBITDA Times Interest Earned Return on Equity Degree of Combined Leverage Altman Z-Score Beneish M-Score F-Score Q4 2011 -4.79% -0.03% 0.83% -8.67% --16.99 2.54 21.31 9.38% 31.58% 31.32% $933.40M 86.87% 0.70% $64,300 Q3 2011 3.78% -0.40% 0.35% 6.89% --15.33 2.50 15.41 13.05% 31.32% 30.83% $1.45B 87.82% 15.59% $65,994 Q2 2011 12.99% -0.53% 0.58% 16.64% --15.82 2.48 15.27 11.98% 31.21% 29.75% $1.16B 76.14% 16.78% $63,840 Q1 2011 -1.65% -0.20% -0.03% -2.68% --15.52 2.61 14.51 5.33% 31.03% 29.08% $1.13B 79.17% -2.75% $61,440

10.43 16.56 39.22% 0.36 5.93 -2.62 0.34 Q4 2010 -1.44% 0.25% -0.61% -10.52% --16.98 2.73 19.97 4.30% 31.04% 29.34% $1.02B 78.62% 15.01% $60,187

-3.5% 10 11 12 8Qtr -2.5% 10 11 12 8Qtr 1.5% 10.3% 10 11 12 8Qtr

# Shares Outstanding*

Othr Assets/Tot Assets*

CapEx to Sales ratio*

10 11

12

10 11

12

10 11

12

* Indicates chart is Year-Over-Year change.

This report is for information purposes only and should not be the basis for any investment decision. ERO, Inc. disclaims liability for damages of any sort (including lost profits) arising out of the use or inability to use this report. ERO, Inc. is not an investment advisor and this report is not investment advice. This information is neither a solicitation to buy nor an offer to sell securities. Copyright Equity Research Online, Inc./Short Ideas/Instant Analyst 2013. Instant Analyst and Short Ideas are registered trademarks of Equity Research Online, Inc.

2013 Instant Analyst

You might also like

- SBI Capital Markets Limited Cement Grinding Project Financial ModelDocument34 pagesSBI Capital Markets Limited Cement Grinding Project Financial Modelrishav digga0% (1)

- 333893Document12 pages333893Char MonNo ratings yet

- Cfroi HoltDocument7 pagesCfroi Holtamro_baryNo ratings yet

- NYSF Practice TemplateDocument22 pagesNYSF Practice TemplaterapsjadeNo ratings yet

- BAV Model v4.7Document26 pagesBAV Model v4.7jess236No ratings yet

- KTML Annual 2011Document364 pagesKTML Annual 2011Mian Asif BashirNo ratings yet

- IBIG 06 01 Three Statements 30 Minutes CompleteDocument12 pagesIBIG 06 01 Three Statements 30 Minutes CompletedarylchanNo ratings yet

- Ch. 9 Production and ProductivityDocument6 pagesCh. 9 Production and ProductivityHANNAH GODBEHERENo ratings yet

- 72Ho-Singer Model V3Document28 pages72Ho-Singer Model V3aqwaNo ratings yet

- 3 Financial Statements Interview QuestionsDocument4 pages3 Financial Statements Interview QuestionsShikharNo ratings yet

- Fundamental Equity Analysis - S&P ASX 100 Members Australia)Document200 pagesFundamental Equity Analysis - S&P ASX 100 Members Australia)Chris HuangNo ratings yet

- Chapter (4) TVMDocument5 pagesChapter (4) TVMMohamed DiabNo ratings yet

- Chapter 12Document17 pagesChapter 12Faisal SiddiquiNo ratings yet

- Eclerx Services (Eclser) : Chugging Along..Document6 pagesEclerx Services (Eclser) : Chugging Along..shahavNo ratings yet

- Basics of Financial Statement Analysis Tools of AnalysisDocument30 pagesBasics of Financial Statement Analysis Tools of AnalysisNurul MuslimahNo ratings yet

- 1cr4dm8kl 930744Document4 pages1cr4dm8kl 930744DGLNo ratings yet

- Micro Eportfolio Monopoly Spreadsheet Data - SPG 18 1Document3 pagesMicro Eportfolio Monopoly Spreadsheet Data - SPG 18 1api-334921583No ratings yet

- Chapter 8Document78 pagesChapter 8Faisal SiddiquiNo ratings yet

- Company ValuationDocument68 pagesCompany ValuationXinyi SunNo ratings yet

- Chapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesDocument21 pagesChapter 21. Tool Kit For Mergers, Lbos, Divestitures, and Holding CompaniesJITIN ARORANo ratings yet

- Worldwide Paper DCFDocument16 pagesWorldwide Paper DCFLaila SchaferNo ratings yet

- LBO Model Cash Flow AnalysisDocument38 pagesLBO Model Cash Flow AnalysisBobbyNicholsNo ratings yet

- 20.06.26 Nano II Model - SentDocument309 pages20.06.26 Nano II Model - SentAdrian KurniaNo ratings yet

- Blu Containers Worksheet - IntermediateDocument13 pagesBlu Containers Worksheet - Intermediateahmedmostafaibrahim22No ratings yet

- 2022 - Chapter02 To 05 - ValueDrivers - UpdatedDocument38 pages2022 - Chapter02 To 05 - ValueDrivers - UpdatedElias MacherNo ratings yet

- Income Statement Vertical Analysis TemplateDocument2 pagesIncome Statement Vertical Analysis TemplateSope DalleyNo ratings yet

- 2019-057-JSA-Loading Unloading Near Access RoadDocument8 pages2019-057-JSA-Loading Unloading Near Access RoadUD. Gunung JatiNo ratings yet

- Small Bank Pro Forma Model: Balance Sheets Thousand $Document5 pagesSmall Bank Pro Forma Model: Balance Sheets Thousand $jam7ak3275No ratings yet

- Risk and Return - PresentationDocument75 pagesRisk and Return - PresentationMosezandroNo ratings yet

- Synopsis of Many LandsDocument6 pagesSynopsis of Many Landsraj shekarNo ratings yet

- Sample Model Training | 25.8% IRRDocument282 pagesSample Model Training | 25.8% IRRKumar SinghNo ratings yet

- EMI Calculator With Prepayment OptionDocument8 pagesEMI Calculator With Prepayment Optionsharad_mumNo ratings yet

- DCF Template BofA - VFDocument1 pageDCF Template BofA - VFHunter Hearst LevesqueNo ratings yet

- Variance Analysis: Assignment Line ItemDocument18 pagesVariance Analysis: Assignment Line Itemfatima khurramNo ratings yet

- Income Statement Horizontal Analysis TemplateDocument2 pagesIncome Statement Horizontal Analysis TemplateSope DalleyNo ratings yet

- Tata Steel - Financial Model - 2016-2025Document95 pagesTata Steel - Financial Model - 2016-2025Prabhdeep DadyalNo ratings yet

- Case 1 SwanDavisDocument4 pagesCase 1 SwanDavissilly_rabbit0% (1)

- In These Spreadsheets, You Will Learn How To Use The Following Excel FunctionsDocument78 pagesIn These Spreadsheets, You Will Learn How To Use The Following Excel FunctionsFaisal SiddiquiNo ratings yet

- Ch05 Mini CaseDocument8 pagesCh05 Mini CaseSehar Salman AdilNo ratings yet

- Portfolio Risk and Return ModelsDocument35 pagesPortfolio Risk and Return ModelsAdamNo ratings yet

- New Assessment SchemeDocument6 pagesNew Assessment SchemeaakashkagarwalNo ratings yet

- Type Answers On This Side of The Page OnlyDocument40 pagesType Answers On This Side of The Page Only嘉慧No ratings yet

- Assignment - Corporate Finance Capital Budgeting Case Study Project Details Year Project A Project BDocument4 pagesAssignment - Corporate Finance Capital Budgeting Case Study Project Details Year Project A Project BAnshum SethiNo ratings yet

- Master Template v1Document79 pagesMaster Template v1KiranNo ratings yet

- Assessment SchemesDocument8 pagesAssessment SchemesaakashkagarwalNo ratings yet

- Qatar National Bank Upgrade to Buy on Strong Growth and ProfitabilityDocument6 pagesQatar National Bank Upgrade to Buy on Strong Growth and ProfitabilityMichael KiddNo ratings yet

- CAT ValuationDocument231 pagesCAT ValuationMichael CheungNo ratings yet

- SML 9179 SML 21531 SML: Daily Daily WeeklyDocument3 pagesSML 9179 SML 21531 SML: Daily Daily WeeklysamNo ratings yet

- 50 AAPL Buyside PitchbookDocument22 pages50 AAPL Buyside PitchbookkamranNo ratings yet

- CH 6 Model 14 Free Cash Flow CalculationDocument12 pagesCH 6 Model 14 Free Cash Flow CalculationrealitNo ratings yet

- L&T 4Q Fy 2013Document15 pagesL&T 4Q Fy 2013Angel BrokingNo ratings yet

- Balaji AminesDocument32 pagesBalaji AminesManu GuptaNo ratings yet

- Valuation - CocacolaDocument14 pagesValuation - CocacolaLegends MomentsNo ratings yet

- Valuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsDocument89 pagesValuation - DCF+LBO - Master - VS - 09-01-2012 EB CommentsJames MitchellNo ratings yet

- Merger Analysis APV MethodDocument22 pagesMerger Analysis APV MethodPrashantKNo ratings yet

- Financial Decision Making: AssignmentDocument19 pagesFinancial Decision Making: AssignmentMutasem AmrNo ratings yet

- OSIMDocument6 pagesOSIMKhin QianNo ratings yet

- New Malls Contribute: Capitamalls AsiaDocument7 pagesNew Malls Contribute: Capitamalls AsiaNicholas AngNo ratings yet

- Preference Shares BangladeshDocument5 pagesPreference Shares BangladeshBangladesh Foreign Investment PolicyNo ratings yet

- Kbank enDocument356 pagesKbank enchead_nithiNo ratings yet

- Copia de FCXDocument16 pagesCopia de FCXWalter Valencia BarrigaNo ratings yet

- Quiz CorporateDocument4 pagesQuiz CorporateYoussef Youssef Ahmed Abdelmeguid Abdel LatifNo ratings yet

- Bed Bug Addendum: 1321 Dolce MidtownDocument33 pagesBed Bug Addendum: 1321 Dolce MidtowncemekaobiNo ratings yet

- Learning Unit 4Document45 pagesLearning Unit 4Neeke RedmanNo ratings yet

- PDIC Deposit Insurance CoverageDocument40 pagesPDIC Deposit Insurance CoverageAleah Jehan AbuatNo ratings yet

- Legal Forms Assign 2Document41 pagesLegal Forms Assign 2Alyssa joy TorioNo ratings yet

- Overview of Power Trading & Exchange PerspectiveDocument50 pagesOverview of Power Trading & Exchange PerspectiveamitNo ratings yet

- Doing Business in The Democratic Republic of CongoDocument13 pagesDoing Business in The Democratic Republic of CongoWaynersonNo ratings yet

- Fintech InvestorsDocument52 pagesFintech InvestorsIngmar Janssen0% (1)

- Demat and Remat: Key DifferencesDocument38 pagesDemat and Remat: Key DifferencesBhuvi100% (1)

- Inventory and MRP problemsDocument4 pagesInventory and MRP problemsKhiren MenonNo ratings yet

- Petition to Declare Debtor InsolventDocument2 pagesPetition to Declare Debtor InsolventSathya Mandya100% (1)

- C9714 Assessment NoticeDocument1 pageC9714 Assessment NoticeCharles MakozaNo ratings yet

- Prepare Trial BalanceDocument7 pagesPrepare Trial BalanceLiliney Del VillarNo ratings yet

- Finals Chapter 17 - Legal AspectDocument8 pagesFinals Chapter 17 - Legal AspectAlexis EusebioNo ratings yet

- FIN-03. Receiving ProcedureDocument5 pagesFIN-03. Receiving ProcedureVu Dinh ThietNo ratings yet

- Raghbendra Jha - Modern Public Economics (2009, Routledge)Document648 pagesRaghbendra Jha - Modern Public Economics (2009, Routledge)Just Breathe100% (1)

- University of Cambridge International Examinations International General Certificate of Secondary EducationDocument4 pagesUniversity of Cambridge International Examinations International General Certificate of Secondary Educationmojuba gbabNo ratings yet

- Driving Towards Success A Comprehensive Swot Analysis of Tesla Company SlidesDocument8 pagesDriving Towards Success A Comprehensive Swot Analysis of Tesla Company SlidesPro ProfessionalNo ratings yet

- Unit 1: Classification of Cost ContentDocument14 pagesUnit 1: Classification of Cost ContentSimon MollaNo ratings yet

- QKJNDocument1 pageQKJNDineshNo ratings yet

- Chapter 6 Math of FinanceDocument10 pagesChapter 6 Math of FinanceEmmanuel Santos IINo ratings yet

- Company and Marketing StrategyDocument10 pagesCompany and Marketing StrategyHannah Martin100% (1)

- Ch. 5 - The Open EconomyDocument35 pagesCh. 5 - The Open EconomyaritjahjaNo ratings yet

- Iho1 Robot Spare: QuotationDocument3 pagesIho1 Robot Spare: QuotationChandru ChristurajNo ratings yet

- Buyer Persona - HubSpotDocument18 pagesBuyer Persona - HubSpotTushar ShodwaniNo ratings yet

- CFA Level 1 Economics - Our Cheat Sheet - 300hoursDocument22 pagesCFA Level 1 Economics - Our Cheat Sheet - 300hoursMichNo ratings yet

- Simple Loan Calculator: Loan Values Loan SummaryDocument11 pagesSimple Loan Calculator: Loan Values Loan SummarymerrwonNo ratings yet

- Deed of Sale Cum AssignmentDocument16 pagesDeed of Sale Cum AssignmentSouravNo ratings yet

- Eco 531 - Chapter 4Document46 pagesEco 531 - Chapter 4Nurul Aina IzzatiNo ratings yet