Professional Documents

Culture Documents

FI Market

Uploaded by

puneetk20Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FI Market

Uploaded by

puneetk20Copyright:

Available Formats

Fixed Income Market

A Glossary of Terms

No. Terms 1 Financial System Description A system that acts as a mediator to facilitate transfer of money/funds efficiently and timely from ones who have it in surplus to the ones who are in need of it. This transfer happens through agreements called Debt Instruments. When money/fund flows from the entity that has it in surplus to the entity that is in dearth of it, there is a legally binding agreement that is prepared which gives birth to a Financial Product. These are the products through which Corporates/Government raise funds. The process of financial product creation is pretty much like the process of lending and borrowing. In the process, there are usually two parties involved- a lender and a borrower. There is an obligation or a promise to pay back A rate of interest is fixed at which the funds are borrowed/lend. A tenure of repayment for the sum borrowed is fixed.

Financial Product

Financial Product Creation

Collateral/ Guarantor To avoid a situation wherein a borrower fails/defaults in the payment of the borrowed sum, the concept of Collateral/ Guarantor was brought in. Debt Market The debt market is the market where Fixed Income Securities of various types and features are issued and traded. Debt Markets are therefore, markets for fixed income securities issued by Central and State Governments, Municipal Corporations, Government Bodies and commercial entities like Financial Institutions, Banks, Public Sector Units, Public Ltd Units and also structured finance companies. Efficient mobilization and allocation of resources in the economy Financing the development activities of the Government Transmitting signals for implementation of the monetary policy Facilitating liquidity management in tune with over all short term and long term objectives.

Role of debt Market

Money Market

The Money market is a general term for the markets in which banks and financial institutions lend to and borrow from each other, trade in financial instruments such as Certificates of deposits, Commercial papers and enter into agreements like Repos.

No. 8

Terms Fixed Income Securities

Description Fixed Income Securities are often referred to as bonds, fixed income assets which are issued by Corporations, Governments and Federal agencies. These investments provide a steady stream of interest income and the repayment of their principal at the end of a certain period of time. However, their value may fluctuate during the lifetime of the loan resulting in an investment gain / loss. Interest rates and inflation have a very strong influence on fixed income instruments.

Fixed Income Fixed Income Securities offer predictable stream of payments by way of Securities - Features interest and repayment of principal at maturity of the instrument. The debt securities are issued by the eligible entities against the money borrowed by them from the investors in these instruments. Most debt securities carry a fixed charge on the assets of the entity and generally enjoy a reasonable degree of safety and by way of security of the fixed and/or movable assets of the company. Fixed Income Securities Why invest? The investors benefit by investing in fixed income securities as they preserve and increase their invested capital and also ensure the receipt of regular interest income. The investors can even neutralize the default risk on their investments by investing in Government Securities, which are normally referred to as risk free investments due to the sovereign guarantee on these schemes. The prices of debt securities display a lower average volatility as compared to the prices of other financial securities and ensure the greater safety of accompanying investments. Debt securities enable wide based and efficient portfolio diversification and thus assist in portfolio risk mitigation.

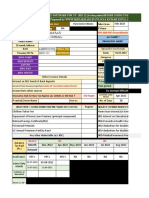

Issuer Central Government State Government Public Sector Bonds Instruments Zero Coupon Bonds, Coupon Bearing Bonds, Treasury Bills Coupon Bearing Bonds

10

11

Different instruments Market Segment Government securities in Debt Market

Government Agencies Government Guaranteed Bonds, / Statutory Bodies, Debentures, PSU Bonds, PSUs Commercial Paper Corporate, Banks Bonds, Debentures, Commercial Paper, Floating Rate Bonds, Zero Coupon Bonds, Inter Corporate Deposits, Certificates of Deposits Certificates of Deposits, Bonds

Private Sector Bonds

Financial Institutions

12

Different instruments Call Money in Money Market Repo Government Securities State Development Loans Treasury Bills Certificates of Deposit Fixed Deposit Non-Convertible Debentures Commercial Papers

No. 13

Terms Call Money

Description Call Money is basically overnight lending and borrowing at a pre- determined rate at a simple interest for a tenor ranging between 1-7 days. The participants in the same are mainly Banks, All India Financial Institutions, PSUs, Mutual Funds. The repo rate is simply the annualised interest rate at which banks borrow money from the Reserve Bank of India (RBI) over a short term. This is gener ally seen as a way of tiding over a short-term liquidity crunch that is experi enced by banks. A reverse repo is when the RBI borrows money from the bank. The interest rate at which RBI borrows the money becomes the reverse repo rate. While the repo is generally used to infuse liquidity into the system, the reverse repo is used to reduce the supply of money in the market. G Secs are zero credit risk bonds issued by GOI. It is often referred to as sovereign debt.

14

Repo Rate

15

Reverse Repo Rate

16

Government Securities (G Secs) Types of Government Securities (G Secs) State Development Loan

17

Fixed coupon bearing instruments Floating or Variable rate bonds with Annual reset Zero coupon bonds These are zero credit risk bonds issued by State Government. They have characteristics similar to Fixed Coupon Central Government Security. They are quite illiquid in nature due to low demand. These are short term debt instruments issued by the GOI for a tenor ranging between 91- 364 days. These are zero credit risk instruments which are traded in the secondary market wherein no interim interest payments are made and par value is paid at maturity of the instrument. This is a highly liquid instrument. These are fixed interest rate and fixed tenor instruments issued by Banks and Financial Institutions. These instruments are normally rated by Rating Agencies so they carry minimal interest rate risk. Fixed Deposits are fixed interest rate and fixed tenor financial instrument issued by banks and financial instruments. These are unrated financial instru ment which do not carry any interest rate risk. These are bonds issued by banks, financial instruments and corporates with fixed interest rate and fixed tenor. They are rated by rating agencies as they carry significant interest rate and credit risk. NCDs can be traded in secondary market. CPs are short term papers issued by corporates to meet their working capital requirements with a tenor ranging between 3 month to 1 year maturity. These are negotiable instruments traded in the secondary market which are also rated by rating agencies.

18

19

Treasury Bills

20

Certificate of Deposit

21

Fixed Deposits

22

Non Convertible Debentures (NCDs)

23

Commercial Paper (CPs)

No. Terms 24 Bonds

Description A bond is an organization's promise to repay a sum of money at a certain interest rate and over a certain period of time. A bond is simply a loan in the form of a security with different terminology: The issuer is equivalent to the borrower, the bond holder to the lender, and the coupon to the interest. Bonds enable the issuer to finance long-term investments with external funds. Debt funds by nature, bond funds like all mutual funds, are investment vehicles. They are meant especially for investors with relatively less appetite for risk and having an intention to earn returns higher than what are possible to earn from other avenues like Fixed Deposits that are considered as safe. So, safety and return both are of equal concern for those investing in Bond Funds. Most bond funds pay income regularly and their NAVs tend to fluctuate less than an equity fund.

25

Bond Fund

26

Bond Funds: In order to successfully achieve the goals of the fund, they invest in a multiplicity Investment Avenues of debt instruments such as Corporate Papers, papers issued by GOI etc, with different maturities and qualities. In order to balance the liquidity needs of investors who might want to redeem their funds any time, they also have exposure to money market instruments and call papers. Generally, mutual funds invest in bonds issued by different issuers such as government, corporate houses etc. Classification of Bonds Government Bond Government Bonds, Corporate Bonds, Municipal Bonds The Government Treasury and its agencies issue these bonds. Treasury bonds are considered the highest quality of all bonds because the credit of the government backs them and so the payment upon maturity is more or less guaranteed. In exchange for this very high margin of credit safety, they have the lowest yields. These are issued by various companies to finance their operations, expansion activities etc. Credit rating agencies such as CRISIL, CARE, ICRA rate these instruments in India on the basis of their degree of safety, which is defined as their ability to pay the amount on maturity. The risk-return trade off is witnessed here as well, for companies with good rating offer less yield. These bonds are issued by governments and municipalities. Considered as reasonably safe, these bonds provide varying returns depending upon their maturities. The value of the bond is nothing but the present value of the future cash flows. For Zero Coupon bonds, the weighted average maturity is same as Duration of the Bond Weighted average maturity of a coupon bearing bond is less than its tenure. Higher the weighted average maturity of the bond , higher will the volatility in the price of the bond. Average maturity indicates the number of years in which the principal will be repaid. The uncertainity related to the unfavorable outcome of an event. Interest Rate Risk, Credit Risk, Delay Risk, Operational Risk, Systematic Risk, Counter Party Risk etc

27 28

29

Corporate Bonds

30

Municipal Bonds

31

Features of Bonds

32 33

Risk Types of Risk

No. Terms 34 Credit Risk

Description Just like shares where the performance of the company has some bearing on the stock prices, credibility of the issuer is of importance in debt instruments. The risk of the issuer not being able to make payments on his liabilities (debt instrument) is termed as default risk or credit risk. This is of special concern to the investor if the fund is investing into junk bonds or lower quality bonds. Bond funds offer professional management and a range of quality ratings to help lower this risk and so investors stand to benefit by the expertise of fund to pick good papers only. Unlike stock market where an upward movement of market leads to upward movement in stock prices, it is a fall in the market yield that pushes up the prices of debt securities. This happens because there exists an inverse relationship between the yield and the price of a bond. So, if there is an upward movement of interest rates after one has invested in a bond fund, the prices of bonds will go down leading to a corresponding fall in the NAVs of the bond funds. Securitization refers to creating marketable securities out of future revenue streams, or simply, raising money by selling cash flows. When mortgages are pooled together and undivided interest in the pool is sold, pass-through securities are created. The term 'undivided' in this context means that each holder of the security has a proportionate interest in each cash flow generated in the pool. The pass-through securities promise that the cash flow from the underlying mortgages would be passed through to the holders of the securities in the form of monthly payments of interest and principal From the perspective of the company that securitizes its cash flows, the major benefits are in terms of getting immediate cash and passing the risk to the investors. For finance companies, securitization would take the loan assets off the balance sheet, thereby relieving pressures of capital adequacy. Flexibility- A pool of receivables could be split into different `strips' and sold to different types of investors. For example, a money market mutual fund might be interested in a short-term paper (pass through certificate), whereas a pension fund might want to invest in a long-term paper. The SPV can have something to offer to both. Typically, yields in asset-backed securities (car loans, lease rentals etc) are higher than that of other securities of the same rating (Crisil Position Paper on Securitization). The papers are also considered to be relatively safer. There has been few instances of default or downgrade of rating despite the fact that some of the originators have been downgraded".

35

Interest Rate Risk

36

Securitization

37

Pass Through Certificate (PTC)

38

Benefits of PTCs

No. Terms 39 Difference between PTCs and Bonds

Description

Points of Differentiation Type Structure Interest bearing debt instrument. A debt security issued by a company (called the Issuer), which offers to pay interest in lieu of the money borrowed for a certain period. In essence it represents a loan taken by the issuer who pays an agreed rate of interest during the lifetime of the instrument and repays the principal normally, unless otherwise agreed, on maturity. These are long-term debt instruments issued by private sector companies. These are issued in denomination as low as Rs. 1000 and have maturity ranging between one and ten years. Not direct debt instruments; instead derive their value from other debt instruments. When mortgages are pooled together and undivided interest in the pool is sold, pass-through securities are created. The pass-through securities promise that the cash flow from the underlying mortgages would be passed through to the holders of the securities in the form of monthly payments of interest and principal. Bonds PTCs

Yield Duration

Comparatively Higher A pool of receivables could be split into different `strips' and sold to different types of investors. For example, a money market mutual fund might be interested in a short-term paper (pass through certificate), whereas a pension fund might want to invest in a long-term paper. The SPV can have something to offer to both.

Disclaimer: The Glossary is intended solely for information purpose & does not constitute any opinion or guidelines or recommendation on any course of action to be followed by the reader. Readers are advised to seek independent professional advice and arrive at an informed investment decision before making any investments. The information contained herein has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. None of The Sponsor, The Investment Manager, The Trustee, their respective directors, employees, affiliates or representatives assume any responsibility for, or warrant the accuracy, completeness, adequacy and reliability of such information. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and opinions given fair and reasonable. This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Recipients of this information should rely on information/data arising out of their own investigations. Readers are advised to seek independent professional advice and arrive at an informed investment decision before making any investments. None of The Sponsor, The Investment Manager, The Trustee, their respective directors, employees, affiliates or representatives shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material.

Source: BSE Publications, Investopedia.com, investorglossary.com, finance-glossary.com

You might also like

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- UntitledDocument1 pageUntitledpuneetk20No ratings yet

- Google Certified Associate Cloud EngineerDocument339 pagesGoogle Certified Associate Cloud Engineerpuneetk20No ratings yet

- Data See DDB ContextDocument2 pagesData See DDB Contextpuneetk20No ratings yet

- Tax AssignmentDocument13 pagesTax Assignmentpuneetk20No ratings yet

- Organ LDR & Decision MKNG (Genex Fuels Case Study)Document7 pagesOrgan LDR & Decision MKNG (Genex Fuels Case Study)puneetk20No ratings yet

- 6028 Tax AssignmentDocument8 pages6028 Tax Assignmentpuneetk20No ratings yet

- Audit, Assurance and Compliance Name of The Student Name of The UniversityDocument11 pagesAudit, Assurance and Compliance Name of The Student Name of The Universitypuneetk20No ratings yet

- Question Paper Code 71072Document2 pagesQuestion Paper Code 71072puneetk20No ratings yet

- Mir Sana - 5242 Hi5017 ReflectionDocument5 pagesMir Sana - 5242 Hi5017 Reflectionpuneetk20No ratings yet

- Finance AssignmentDocument17 pagesFinance Assignmentpuneetk20No ratings yet

- 13 Jun 2013, Max Mark: 50, Sessional Type:External: S.no. Roll No. Student Name Status MM:50Document4 pages13 Jun 2013, Max Mark: 50, Sessional Type:External: S.no. Roll No. Student Name Status MM:50puneetk20No ratings yet

- Introduction To Cost Accounting: By: Puneet Kumar Asst. Prof. Niet, NbsDocument31 pagesIntroduction To Cost Accounting: By: Puneet Kumar Asst. Prof. Niet, Nbspuneetk20No ratings yet

- WILL and Types of WillsDocument8 pagesWILL and Types of Willspuneetk20No ratings yet

- Mutual FundDocument13 pagesMutual Fundpuneetk20No ratings yet

- Reliance Mutual Fund Presents: Systematic Investment Plan Systematic Investment PlanDocument24 pagesReliance Mutual Fund Presents: Systematic Investment Plan Systematic Investment Planpuneetk20No ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Greenleaf RhodeIslandDOCSDocument95 pagesGreenleaf RhodeIslandDOCSTimothy TuckNo ratings yet

- BADM 2001 - Fall 2019 - Assignment 3Document2 pagesBADM 2001 - Fall 2019 - Assignment 3Vanessa M. EzzatNo ratings yet

- Fiqh of Zakat: Mufti Faraz Adam Amanah AdvisorsDocument49 pagesFiqh of Zakat: Mufti Faraz Adam Amanah AdvisorsRendiNurcahyoNo ratings yet

- Afm June 2005 QT AnsDocument25 pagesAfm June 2005 QT AnsBijay AgrawalNo ratings yet

- LatihanDocument12 pagesLatihanSurameto HariyadiNo ratings yet

- Our Educational Institutions Controlled by IlluminatiDocument4 pagesOur Educational Institutions Controlled by IlluminatiArnulfo Yu LanibaNo ratings yet

- Restoring The Value of The CediDocument50 pagesRestoring The Value of The CediMahamudu Bawumia100% (6)

- Financial Ratios - ReadingsDocument5 pagesFinancial Ratios - Readingsdeborah remigioNo ratings yet

- Spouses Eduardo and Lydia Silos Vs Philippine National Bank (PNB)Document6 pagesSpouses Eduardo and Lydia Silos Vs Philippine National Bank (PNB)gregbaccayNo ratings yet

- Chapter 1-Liabilities PDFDocument5 pagesChapter 1-Liabilities PDFMarx Yuri JaymeNo ratings yet

- Isabel - Credit Report - ZumperDocument9 pagesIsabel - Credit Report - ZumperMariangelNo ratings yet

- Cash Management Techniques of Selected ADocument50 pagesCash Management Techniques of Selected AivyNo ratings yet

- Amfi IapDocument30 pagesAmfi IapAshish AgarwalNo ratings yet

- Chapter 6 Agricultural Lending RevisedDocument25 pagesChapter 6 Agricultural Lending RevisedMikeNo ratings yet

- A Corporate BondDocument2 pagesA Corporate BondMuhammad KhurramNo ratings yet

- PledgeDocument6 pagesPledgeuser-619880No ratings yet

- Business-Ethics-And-Social-Responsibility-Prelim-Exam-2023 (Kenp)Document9 pagesBusiness-Ethics-And-Social-Responsibility-Prelim-Exam-2023 (Kenp)KaenzyNo ratings yet

- Financial Institution and Market Chapter 6Document23 pagesFinancial Institution and Market Chapter 6Jonathan 24No ratings yet

- Grid Connected Rooftop Solar PV Program: Sbi-World BankDocument43 pagesGrid Connected Rooftop Solar PV Program: Sbi-World BankVikas TejyanNo ratings yet

- Teqnion Bokslutskommunike 2022Document33 pagesTeqnion Bokslutskommunike 2022brandon rodriguezNo ratings yet

- Project ReportDocument94 pagesProject ReportViral MakNo ratings yet

- Credit Transactions Midterm Exam: QuestionsDocument3 pagesCredit Transactions Midterm Exam: QuestionsjayNo ratings yet

- Credit-Estores Vs Supangan DigestDocument3 pagesCredit-Estores Vs Supangan DigestKT100% (1)

- Quiz - V-CD-1 - Fin. Mrkts & Inst.: Last Name, First NameDocument2 pagesQuiz - V-CD-1 - Fin. Mrkts & Inst.: Last Name, First NameHONEY JEAN GASANNo ratings yet

- RFBT 2Document27 pagesRFBT 2Paul FrancesNo ratings yet

- Credit Cards Boon or BaneDocument12 pagesCredit Cards Boon or BaneJohn NashNo ratings yet

- Ratio Analysis TheoryDocument22 pagesRatio Analysis TheoryTarun Sukhija100% (1)

- TS IT FY 2022-23 Income Tax Software 16.11.2022.Document37 pagesTS IT FY 2022-23 Income Tax Software 16.11.2022.TestNo ratings yet

- Qii2007 AbcpDocument64 pagesQii2007 Abcpkarasa1No ratings yet

- Chapter: Leverage: DOL Sales-VC Ebit DFL Ebit Ebit-I DCL Dol X DFLDocument7 pagesChapter: Leverage: DOL Sales-VC Ebit DFL Ebit Ebit-I DCL Dol X DFLJagadeesh RocckzNo ratings yet