Professional Documents

Culture Documents

Cost of Production

Uploaded by

sajid93Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cost of Production

Uploaded by

sajid93Copyright:

Available Formats

COST OF PRODUCTION

MICROECONOMICS

SUBMITTED TO: Miss FOUZIA AWAN SUBMITTED BY: BILAL AHMAD 12002001006, SAJID NADEEM 12002001004, MEHMAN ALI 12002001005 BS.AM

1/14/2013

COST OF PRODUCTION 2013

Table of Contents

Cost of Production ........................................................................................................................................ 2 Total Cost .................................................................................................................................................. 2 Total Revenue ........................................................................................................................................... 2 Profit ......................................................................................................................................................... 2 Opportunity Cost ....................................................................................................................................... 2 Explicit Costs ................................................................................................................................................ 3 Implicit Costs ................................................................................................................................................ 3 Economic Profit vs. Accounting Profit ......................................................................................................... 4 Economic Profit ............................................................................................................................................ 5 The Production Function............................................................................................................................... 5 Law of Diminishing marginal product .......................................................................................................... 6 Comparison of Total Cost Curve and Production Function .......................................................................... 7 Various Measures of Cost ............................................................................................................................. 7 Fixed Cost ................................................................................................................................................. 8 Variable Cost ............................................................................................................................................ 8 Total Cost .................................................................................................................................................. 8 Average Total Cost ................................................................................................................................... 8 Average Fixed Cost................................................................................................................................... 8 Average Variable Cost .............................................................................................................................. 8 Marginal Cost............................................................................................................................................ 8 Shapes of Cost Curves .................................................................................................................................. 9 Relationship between ATC and MC ........................................................................................................... 10 Relationship between ATC, AFC, and AVC. ............................................................................................. 10

1|Page

COST OF PRODUCTION 2013

Cost of Production

In economics, the cost-of-production is the price of a good which is determined by the sum of the cost of the resources that went into making it. The cost can compose any of the factors of production (including labor, entrepreneur, capital, or land) and taxation.

Total Cost

Cost is the market value of inputs that a company uses in production of certain good.

Total Revenue

The amount a firm receives for the sale of its output.

Profit

Total revenue Total cost

Opportunity Cost

The value of most appealing alternative that is not chosen is called opportunity cost. It is the cost of something is what you give up to get it i.e. the cost of an item refers to all those things that must be forgone to acquire that item. Example Opportunity cost is the value of something you give up to obtain another thing. It can also be thought of as "the next best thing". Opportunity cost is not monetary but can be applied when money is involved. An example of opportunity cost would be if you have two choices: to work all day and make some money or to take the day off and go to a movie that you have been waiting to see for a long time. If you choose the movie, the opportunity cost is the money that you could've made working all day. If you choose the work, the opportunity cost is the joy you would receive from seeing the movie.i

2|Page

COST OF PRODUCTION 2013

Opportunity cost = Explicit cost + Implicit cost The opportunity cost of a decision is based on what must be given up (the next best alternative) as a result of the decision. What must be given up can be either explicit cost or implicit cost. It is ii this combination of implicit and explicit costs that when combined; make up the total opportunity cost.iii

Explicit Costs

Input cost that requires an outlay of money by the firm is called explicit cost. Explicit costs are payments to non-owners of a firm for their resources. Explicit costs represent obvious cash outflows from businesses that reduce its bottom-line profitability. Some of the resources the firm needs must be purchased or hired from outside the firm and thus must be obtained on payment. Such resources include electricity, fuel, raw materials, labor, insurance, etc.; these are items for which payments are made.

Real Life Explicit Cost Example

Suppose you and five friends - six entrepreneurs - get together and open up a computer software firm that produces specialized computer software. Some of the payments that must be made for the production of the software are termed explicit costs. For example, these explicit costs might include computer hardware, utilities, supplies, property and other taxes, maintenance costs, payments to wholesalers for the materials needed to produce the software, and the salaries of office support staff.

Implicit Costs

An implicit cost is a cost that is represented by lost opportunity in the use of a company's own resources, excluding cash. Since these resources are not obtained by direct monetary payments (as were the resources for which explicit costs were paid), these costs are termed implicit costs. For example, the time and effort that an owner puts into the maintenance of the company rather than working on expansion is an implicit cost.

Real Life Implicit Cost Example

In the example above, if the entrepreneurs that started the computer software firm own the small building outright within which they operate, use their own funds (in equal amounts =$50,000 each) to finance the startup of the computer firm, and each put in 60 hours a week into the software business, then the implicit cost of such resources would include the lease payment or rent they would otherwise receive for the use of the building, the interest or dividends their

3|Page

COST OF PRODUCTION 2013

money could earn if invested elsewhere, and the salaries they could earn if they were employed in another business.

Economic Profit vs. Accounting Profit Understanding Accounting Profit

An accounting profit is the excess of business income over the business expenses. The business earns money after selling their goods or services. If the money they earn is more than the money they spend for making/providing the goods/services, it is said that the business has made an accounting profit. So once all these costs are reduced from the total income earned by a business enterprise, if the remaining amount is positive, it is an accounting profit. If the remaining amount is negative, it is known as an accounting loss, which means that the business has spent beyond its earning capacity in the accounting period. Thus we can say that an accounting profit is the excess of accounting income over accounting expenses. Accounting Profit = Total Income - Total Expensesiv

4|Page

COST OF PRODUCTION 2013

Economic Profit

Total revenue minus total cost including implicit and explicit costs is called economic profit. It is the difference between the revenue received from the sale of an output and the opportunity cost of the inputs used. Economic Profit = Total Income - Total Expenses - Opportunity Lost Cost Economic profit is always less than the accounting profit.

The Production Function

It is the relationship between quantity of input used to make good and the quantity of output. The production function describes the maximum output that can be produced from any combination of inputs available in a given time period.

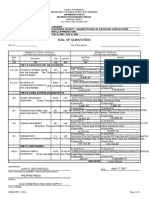

Table shows an example of the quantity of cookies Helens factory produces per hour depends on the number of workers. No. workers/ quantity 0 1 2 3 4 5 6 of Output Marginal quantity of product cookies produced/hour 0 $50 50 40 90 30 120 20 140 150 5 155 30 60 90 10 30 30 40 50 70 80 30 30 60 30 20 50 30 10 40 Fixed cost/ Variable cost/ Total cost of cost of factory cost of inputs= workers F.C+V.C $30 $0 $30

5|Page

COST OF PRODUCTION 2013

Production function and T.C curve is shown in graphs.

Law of Diminishing marginal product

The property where the marginal product of an input declines as the quantity of the input increases is called law of diminishing marginal product. The law of diminishing returns states that as one type of production input is added, with all other types of input remaining the same, at some point production will increase at a diminishing rate. There may be levels of input where increasing inputs causes production to go up at an increasing rate. However, according to the law of diminishing returns, at some point production will go up at a decreasing rate.

6|Page

COST OF PRODUCTION 2013

Comparison of Total Cost Curve and Production Function

The total cost curve gets steeper as the amount produces rises, whereas the production function gets flatter as the production increases. This is due to the law of diminishing marginal product as the production increases the production area become more crowded due to increase in workers. Thus each additional worker adds less to the production. Therefore production function is relatively flat. When the production area is crowded then producing an additional unit requires a lot of additional workers and thus very costly. Therefore when the quantity produce is large, the total cost curve is relatively steep.

Various Measures of Cost

There are various types of costs which is described below with the help of table.

Marginal cost Average Average Average Fixed Variable Total Change in Quantity fixed variable total cost= cost cost cost=F.C+V.C total cost=FC/Q cost=VC/Q AFC+AVC cost/change in quantity 0 1 2 3 4 5 6 7 8 9 10 $3 3 3 3 3 3 3 3 3 3 3 $0.0 0.3 0.8 1.5 2.4 3.5 4.8 6.3 8.0 9.9 12 $3 3.3 3.8 4.5 5.4 6.5 7.8 9.3 11.0 12.9 15.0 --$3.0 1.5 1.0 0.75 0.6 0.5 0.43 0.38 0.33 0.30 --$0.30 0.40 0.50 0.6 0.7 0.8 0.9 1.0 1.10 1.20 --$3.3 1.9 1.5 1.35 1.30 1.30 1.33 1.38 1.43 1.50

$0.3 0.5 0.7 0.9 1.1 1.3 1.5 1.7 1.9 2.1

7|Page

COST OF PRODUCTION 2013

Fixed Cost

Costs that do not vary with the quantity of output produced. In economics, fixed costs are business expenses that are not dependent on the level of goods or services produced by the business. They tend to be time-related, such as salaries or rents being paid per month.v

Variable Cost

Costs that do vary with the quantity of output produced. Variable costs are expenses that change in proportion to the activity of a business. Variable cost is the sum of marginal costs over all units produced. It can also be considered normal costs. For example, a firm pays for raw materials. When activity is decreased, less raw material is used, and so the spending for raw materials falls. When activity is increased, more raw materials is used and spending therefore rises. Note that the changes in expenses happen with little or no need for managerial intervention. These costs are variable costs.vi

Total Cost

F.C+V.C

Average Total Cost

Total cost divided by the quantity of output. In economics, average cost or unit cost is equal to total cost divided by the number of goods produced (the output quantity, Q). It is also equal to the sum of average variable costs (total variable costs divided by Q) plus average fixed costs (total fixed costs divided by Q).vii

Average Fixed Cost

Fixed cost divided by the quantity of output.

Average Variable Cost

Variable cost divided by the quantity of output.

Marginal Cost

The increase in total cost that arises from an extra unit of production. The increase or decrease in the total cost of a production run for making one additional unit of an item. It is computed in situations where the breakeven point has been reached: the fixed costs have already been absorbed by the already produced items and only the direct (variable) costs have to be accounted for. Marginal costs are variable costs consisting of labor and material costs, plus an estimated portion of fixed costs (such as administration overheads and selling expenses). In companies where average costs are fairly constant, marginal cost is usually equal to average cost. However, in industries that require heavy capital investment (automobile plants, airlines, mines) and have high average costs, it is comparatively very low. The concept of marginal cost is critically important in resource allocation because, for optimum results, management must concentrate its resources where the excess of marginal revenue over the marginal cost is maximum. Also called choice cost, differential cost, or incremental cost.viii

8|Page

COST OF PRODUCTION 2013

Shapes of Cost Curves Cost Curves

The short-run marginal cost (MC) curve will at first decline and then will go up at some point, and will intersect the average total cost and average variable cost curves at their minimum points.

The average variable cost (AVC)

The average variable cost (AVC) curve will go down (but will not be as steep as the marginal cost), and then go up. This will not go up as fast as the marginal cost curve.

The average fixed cost (AFC)

The average fixed cost (AFC) curve will decline as additional units are produced, and continue to decline.

The average total cost (ATC)

The average total cost (ATC) curve initially will decline as fixed costs are spread over a larger number of units, but will go up as marginal costs increase due to the law of diminishing returns. The graph below illustrates the shapes of these curves.ix

9|Page

COST OF PRODUCTION 2013

Relationship between ATC and MC

When MC is below ATC, ATC must be declining. When MC is above ATC, ATC must be rising. Therefore, MC crosses ATC at the minimum of ATC.

Relationship between ATC, AFC, and AVC.

AFC plus AVC equals ATC.

http://apecon3.wikispaces.com/Opportunity+Cost http://www.buzzle.com/articles/economic-profit-vs-accounting-profit.htm iii http://econ651spring2008.wikispaces.com/Opportunity+costs+including+implicit+costs+and+explicit+costs iv http://www.buzzle.com/articles/economic-profit-vs-accounting-profit.html v http://en.wikipedia.org/wiki/Fixed_cost vi http://en.wikipedia.org/wiki/Variable_cost vii http://en.wikipedia.org/wiki/Average_total_cost viii http://www.businessdictionary.com/definition/marginal-cost.html ix http://www.investopedia.com/exam-guide/cfa-level-1/microeconomics/marginal-average-total-costcurve.asp#axzz2HwxMSh8p

ii

10 | P a g e

You might also like

- Cost of ProductionDocument47 pagesCost of ProductionHABIB UR REHMAN100% (2)

- Public Expenditure PFM handbook-WB-2008 PDFDocument354 pagesPublic Expenditure PFM handbook-WB-2008 PDFThơm TrùnNo ratings yet

- Introduction To MicroeconomicsDocument107 pagesIntroduction To Microeconomicsmoza100% (1)

- Ricardian Theory of International TradeDocument4 pagesRicardian Theory of International TradeFaizan FayazNo ratings yet

- Chap001 - Introduction To Operations ManagementDocument32 pagesChap001 - Introduction To Operations ManagementUmar Saeed100% (1)

- Bull Whip EffectDocument5 pagesBull Whip EffectNandhini RamanathanNo ratings yet

- Understanding the Concept of National Income AccountingDocument37 pagesUnderstanding the Concept of National Income Accountingshivanshu123No ratings yet

- Demand, Elasticity of Demand and Demand ForecastingDocument16 pagesDemand, Elasticity of Demand and Demand Forecastingankit thapliyal100% (1)

- Production & Cost Concepts - Managerial EconomicsDocument80 pagesProduction & Cost Concepts - Managerial Economicsdiivya198786% (14)

- Cost Classification and Cost BehaviorDocument84 pagesCost Classification and Cost BehaviorBrijesh YaduvanshiNo ratings yet

- Gathering Information and Scanning The Environment: Marketing ManagementDocument31 pagesGathering Information and Scanning The Environment: Marketing ManagementAnuradha TomarNo ratings yet

- Elasticity of DemandDocument22 pagesElasticity of DemandHeta ShastriNo ratings yet

- Dfi 306 Public FinanceDocument134 pagesDfi 306 Public FinanceElizabeth MulukiNo ratings yet

- 2.1. Perfect CompetitionDocument73 pages2.1. Perfect Competitionapi-3696178100% (5)

- Economic and Cultural Factors in International MarketingDocument4 pagesEconomic and Cultural Factors in International MarketingViraja GuruNo ratings yet

- BullWhip EffectDocument17 pagesBullWhip EffectSaurabh Krishna SinghNo ratings yet

- Basic Cost Management ConceptsDocument15 pagesBasic Cost Management ConceptsKatCaldwell100% (1)

- Macroeconomic Goals and Policy Instruments ExplainedDocument25 pagesMacroeconomic Goals and Policy Instruments ExplainedJutt TheMagician100% (1)

- 1 Introduction To Production and Operations ManagementDocument43 pages1 Introduction To Production and Operations ManagementJyotiGhanchiNo ratings yet

- Reporte Anual 2019 - IkeaDocument54 pagesReporte Anual 2019 - IkeaLeodan ZapataNo ratings yet

- Crafting The Brand Positioning: Devera, Dianne Lu, Vida Mantos, Charles Valeroso, EuniceDocument19 pagesCrafting The Brand Positioning: Devera, Dianne Lu, Vida Mantos, Charles Valeroso, EuniceEunice ValerosoNo ratings yet

- Setting expectations for costs and pricingDocument27 pagesSetting expectations for costs and pricingcarlito alvarezNo ratings yet

- Chapter 004 Managerial Accounting-Hilton-2nd Edition SolutionsDocument54 pagesChapter 004 Managerial Accounting-Hilton-2nd Edition SolutionsMuhammed GhazanfarNo ratings yet

- Price Elasticity of DemandDocument5 pagesPrice Elasticity of Demandalien888No ratings yet

- Operation ManagementDocument41 pagesOperation ManagementRheyNo ratings yet

- Business Excellence at Philips: Achieving Impressive Results Through Quality ImprovementDocument10 pagesBusiness Excellence at Philips: Achieving Impressive Results Through Quality ImprovementrubabNo ratings yet

- Economic AnalysisDocument12 pagesEconomic Analysisshrikant hegadi100% (1)

- Define DemandDocument9 pagesDefine Demandtheabrar83No ratings yet

- Chapter-2 Business EnvironmentDocument29 pagesChapter-2 Business EnvironmentMohammad Kaif KabboNo ratings yet

- Operations Management Revision NotesDocument16 pagesOperations Management Revision Notescthiruvazhmarban0% (1)

- Consumer Choice TheoryDocument59 pagesConsumer Choice TheoryVatandeep SinghNo ratings yet

- The Global Marketing EnvironmentDocument24 pagesThe Global Marketing EnvironmentDi3kyNo ratings yet

- Cost & Cost CurvesDocument46 pagesCost & Cost CurvesManoj Kumar SunuwarNo ratings yet

- R16 The Firm and Market Structures PDFDocument37 pagesR16 The Firm and Market Structures PDFROSHNINo ratings yet

- Market Failures and The Role of GovermentDocument19 pagesMarket Failures and The Role of GovermentMary KuchinskayaNo ratings yet

- Microeconomics Lecture - Profit Maximization and Competitive SupplyDocument48 pagesMicroeconomics Lecture - Profit Maximization and Competitive Supplybigjanet100% (1)

- Chapter 4—Supply and Demand LawsDocument31 pagesChapter 4—Supply and Demand LawsAira CayananNo ratings yet

- The Four Types of Market StructuresDocument5 pagesThe Four Types of Market StructuresAlly Beralde50% (2)

- Profit Maximization and Competitive MarketDocument18 pagesProfit Maximization and Competitive MarketRini Anggreini KotoNo ratings yet

- Operating Budget Garrison Chap009Document81 pagesOperating Budget Garrison Chap009Malak Kinaan100% (2)

- Theory of Production and CostDocument12 pagesTheory of Production and CostCharizze Dela CruzNo ratings yet

- Role of Government in The Economy MBS First YearDocument27 pagesRole of Government in The Economy MBS First YearStore Sansar100% (1)

- Layout StrategyDocument78 pagesLayout StrategyUsman ShahidNo ratings yet

- External Suprastructures Impact BusinessDocument6 pagesExternal Suprastructures Impact BusinessKarl Jason Dolar CominNo ratings yet

- Production TheoryDocument72 pagesProduction TheoryAnirudh Dutta100% (1)

- MGT/510 Midterm and Final Exam QuizDocument170 pagesMGT/510 Midterm and Final Exam Quizgood0% (1)

- Target CostingDocument17 pagesTarget CostingMoshmi MazumdarNo ratings yet

- Operations ManagementDocument33 pagesOperations ManagementNiña GunoNo ratings yet

- CH 8 Production and Cost FunctionsDocument63 pagesCH 8 Production and Cost FunctionsJudz Sawadjaan100% (1)

- UtilityDocument51 pagesUtilityVikram Jhalani100% (1)

- The Economic Role of GovernmentDocument20 pagesThe Economic Role of GovernmentIkhwan Catur RahmawanNo ratings yet

- Introduction To International Marketing ResearchDocument7 pagesIntroduction To International Marketing ResearchPrem Zip Zap ZoomNo ratings yet

- Market Structure-Perfect CompetitionDocument72 pagesMarket Structure-Perfect CompetitionUtsav AaryaNo ratings yet

- Macroeconomics Anforme TextbookDocument64 pagesMacroeconomics Anforme TextbookScott Jefferson100% (1)

- Managerial Economics - Explicit and Implicit CostsDocument7 pagesManagerial Economics - Explicit and Implicit CostsSreejib DebNo ratings yet

- Marginal Analysis NotesDocument26 pagesMarginal Analysis NotesVikram MandalNo ratings yet

- Concept of CostDocument9 pagesConcept of CostNoorKamaL AankNo ratings yet

- Lecture 6Document79 pagesLecture 6Nikoli MajorNo ratings yet

- Understanding Cost Concepts for Managerial DecisionsDocument75 pagesUnderstanding Cost Concepts for Managerial DecisionsVivek AnbuNo ratings yet

- Assignment Topic: Submitted To: Submitted By:: Costs of Production Ma'am Noor FatimaDocument27 pagesAssignment Topic: Submitted To: Submitted By:: Costs of Production Ma'am Noor Fatimaazizur rehmanNo ratings yet

- Backgrounder - The Boeing 777X Delivers Proven Performance, Profitability and ReliabilityDocument2 pagesBackgrounder - The Boeing 777X Delivers Proven Performance, Profitability and Reliabilitysajid93No ratings yet

- Islamic and Western World Contributions in Field of PsychologyDocument24 pagesIslamic and Western World Contributions in Field of Psychologysajid93No ratings yet

- College AlgebraDocument506 pagesCollege Algebrasajid93No ratings yet

- Developing A Global Atmospheric Turbulence Decision Support System For AviationDocument6 pagesDeveloping A Global Atmospheric Turbulence Decision Support System For Aviationsajid93No ratings yet

- Macro-Economics Assignment 5Document6 pagesMacro-Economics Assignment 5sajid93No ratings yet

- Fashion Is Not For Boys, Its Girl's HeadacheDocument69 pagesFashion Is Not For Boys, Its Girl's Headachesajid93No ratings yet

- Linear Equations and Inequalities ch02 Section2Document14 pagesLinear Equations and Inequalities ch02 Section2sajid93No ratings yet

- Inflation and Unemployment: What Is The Connection?Document24 pagesInflation and Unemployment: What Is The Connection?sajid93No ratings yet

- Dynamics of PersonalityDocument2 pagesDynamics of Personalitysajid93No ratings yet

- OneNote 2010Document37 pagesOneNote 2010sajid93No ratings yet

- ETHICS IN AVIATION EDUCATION - The Journal of Aviation/Aerospace Education & ResearchDocument5 pagesETHICS IN AVIATION EDUCATION - The Journal of Aviation/Aerospace Education & Researchsajid93No ratings yet

- Misleading Communication vs. Effective Aviation ManagementDocument4 pagesMisleading Communication vs. Effective Aviation Managementsajid93No ratings yet

- The World Airline Awards 2010Document2 pagesThe World Airline Awards 2010Moosa NazimNo ratings yet

- Mathematics For AviationDocument285 pagesMathematics For Aviationsajid93No ratings yet

- Airport Mapping DatabaseDocument3 pagesAirport Mapping Databasesajid93No ratings yet

- ADREP Reporting ICAO-AIG.2013Document16 pagesADREP Reporting ICAO-AIG.2013sajid93No ratings yet

- Fifo, Lifo and Weighted Average CostDocument13 pagesFifo, Lifo and Weighted Average Costsajid9367% (3)

- The Automatic Fiscal Stabilizers: Quietly Doing Their ThingDocument72 pagesThe Automatic Fiscal Stabilizers: Quietly Doing Their Thingsajid93No ratings yet

- Convective CloudsDocument7 pagesConvective Cloudssajid93No ratings yet

- Aviation ModellingDocument161 pagesAviation ModellingDavid Gayton100% (5)

- Economic and Emissions Impacts of Renewable Fuel Goals For Aviation in The USDocument13 pagesEconomic and Emissions Impacts of Renewable Fuel Goals For Aviation in The USsajid93No ratings yet

- ASRS Program Briefing 2012Document56 pagesASRS Program Briefing 2012sajid93No ratings yet

- Icao - Africa and Indian Ocean (Afi) Regional Sigmet GuideDocument60 pagesIcao - Africa and Indian Ocean (Afi) Regional Sigmet Guidesajid93No ratings yet

- CDM - Assignment DataDocument18 pagesCDM - Assignment Datasajid93No ratings yet

- Safety Risk Management Assurance and PromotionDocument9 pagesSafety Risk Management Assurance and Promotionsajid93No ratings yet

- Punjabi LanguageDocument13 pagesPunjabi Languagesajid93100% (1)

- Assignment 5Document10 pagesAssignment 5sajid93No ratings yet

- OIL Pressure GuageDocument6 pagesOIL Pressure Guagesajid93No ratings yet

- The Complete Book of Origami PDFDocument161 pagesThe Complete Book of Origami PDFmichael01382% (17)

- Pak Us RelationDocument26 pagesPak Us Relationsajid93100% (2)

- By: John Paul Diaz Adonis Abapo Alvin Mantilla James PleñosDocument9 pagesBy: John Paul Diaz Adonis Abapo Alvin Mantilla James PleñosRhea Antonette DiazNo ratings yet

- Analysis of Mutual Funds as an Investment in IndiaDocument19 pagesAnalysis of Mutual Funds as an Investment in IndiaVivek GuptaNo ratings yet

- Clinker DROP TEST 01092021Document36 pagesClinker DROP TEST 01092021Valipireddy NagarjunNo ratings yet

- Peraturan Presiden Nomor 16 Tahun 2018 - 1001 - 1Document174 pagesPeraturan Presiden Nomor 16 Tahun 2018 - 1001 - 1Bambang ParikesitNo ratings yet

- Private Equity Real Estate FirmsDocument13 pagesPrivate Equity Real Estate FirmsgokoliNo ratings yet

- Prager History of IP 1545-1787 JPOS 1944Document36 pagesPrager History of IP 1545-1787 JPOS 1944Vent RodNo ratings yet

- RubricsDocument2 pagesRubricsScarlette Beauty EnriquezNo ratings yet

- Train Law Excise Tax 1Document29 pagesTrain Law Excise Tax 1Assuy AsufraNo ratings yet

- FLYFokker Fokker 70 Leaflet - 1Document4 pagesFLYFokker Fokker 70 Leaflet - 1FredyBrizuelaNo ratings yet

- pt-2 Time TableDocument1 pagept-2 Time Table6631 SHUBHAM KUMARNo ratings yet

- Regional Acceptance Ach Draft Form-OneDocument2 pagesRegional Acceptance Ach Draft Form-Onejohnlove720% (1)

- Analysis of Marketing Mix of Honda Cars in IndiaDocument25 pagesAnalysis of Marketing Mix of Honda Cars in Indiaamitkumar_npg7857100% (5)

- Conforming Vs Nonconforming Material Control SystemDocument5 pagesConforming Vs Nonconforming Material Control SystemManu ElaNo ratings yet

- 17FG0045 BoqDocument2 pages17FG0045 BoqrrpenolioNo ratings yet

- OCI DiscussionDocument6 pagesOCI DiscussionMichelle VinoyaNo ratings yet

- Formulación Matemática Del Sistema RicardianoDocument22 pagesFormulación Matemática Del Sistema RicardianoPili BarrosNo ratings yet

- Emissions TradingDocument22 pagesEmissions Tradingasofos100% (1)

- BELENDocument22 pagesBELENLuzbe BelenNo ratings yet

- Pewag Winner Chain System in G10: 2009 / 2010 Lifting and LashingDocument88 pagesPewag Winner Chain System in G10: 2009 / 2010 Lifting and Lashingado31No ratings yet

- Lista codurilor BIC din RomaniaDocument1 pageLista codurilor BIC din RomaniaIlieșDoraNo ratings yet

- Adv Statement LegalDocument2 pagesAdv Statement LegalAMR ERFANNo ratings yet

- Invoice: Deepnayan Scale CompanyDocument1 pageInvoice: Deepnayan Scale CompanyDssp StmpNo ratings yet

- 2022 Obc GuidelinesDocument3 pages2022 Obc Guidelinesbelle pragadosNo ratings yet

- Method Statement-Site CleaningDocument6 pagesMethod Statement-Site Cleaningprisma integrated100% (1)

- Report PDFDocument2 pagesReport PDFGauriGanNo ratings yet

- The New Progressive Agenda: Peter MandelsonDocument8 pagesThe New Progressive Agenda: Peter MandelsonLoriGirlNo ratings yet

- Airline Leader - Issue 15Document91 pagesAirline Leader - Issue 15capanaoNo ratings yet

- Economics Higher Level Paper 3: Instructions To CandidatesDocument20 pagesEconomics Higher Level Paper 3: Instructions To CandidatesAndres LopezNo ratings yet

- Elasticity of SupplyDocument11 pagesElasticity of Supply201222070% (1)

- Ali BabaDocument1 pageAli BabaRahhal AjbilouNo ratings yet