Professional Documents

Culture Documents

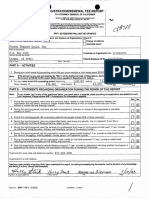

IRS 3500a Form For California Tax-Exemption

Uploaded by

jhbjhbkjhOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

IRS 3500a Form For California Tax-Exemption

Uploaded by

jhbjhbkjhCopyright:

Available Formats

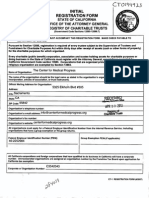

Submission of Exemption Request

Enclose a copy of the Federal Determination Letter.

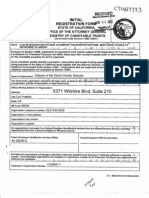

California Corporation number/ California Secretary of State file number Name of organization as shown in the creating document Address (suite, room, or PMB no.) City

CALIFORNIA FORM

Exemption Based on Internal Revenue Code (IRC) Section 501(c)(3) Federal Determination Letter

3500A

FEIN

Daytime telephone number ( State ) ZIP Code Daytime telephone number ( )

Name of representative to contact regarding additional requirements or information Representatives mailing address (suite, room, or PMB no.) City State

ZIP Code

Part I Purpose and Activity 1 Check the organizations primary purpose and activity as allowed in the federal determination letter:

m Charitable m Literary m Health care center

2 3 4 5

m Educational m Hospital m Scientific

m Religious m Medical center

m Testing for public safety

m Church

m School m Credit counseling organization m Qualified sports organization m Prevent cruelty to children or animals

Part II Entity Information

m Corporation m Association m Trust m Foreign corporation (State of incorporation) _______________ Does the IRS consider the organization a private foundation? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 m Yes m No

Entity type (check applicable box): When did the organization establish, incorporate, organize, or conduct business in California? . . . . . . . . . . . . . . . . . . . . . . . 4 Provide gross receipts for the current year and the three immediately preceding taxable years in existence . Gross receipts are defined as the total amounts the organization received from all sources during its annual account period without subtracting any costs or expenses . If the organization has been in existence for less than one year, provide the projected amount of gross receipts for the entire year . Current Year or Projected Gross Receipts From: To: Gross Receipts for the three immediately preceding taxable years: From: To: From: To: From: To: ____ / ____ / ____ mm dd yyyy

Has the IRS ever suspended, revoked, or audited the organization? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

m Yes

m No

If Yes, explain _______________________________________________________________________________________________________ Part III Group Exemption. See instructions . 7 Is the organization applying for a group exemption? . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7 If Yes, attach the federal group determination letter and a list of all California subordinates . Include each subordinates name, corporation number, FEIN, and address . Mail form FTB 3500A and a copy of the federal determination letter to: EXEMPT ORGANIZATIONS UNIT, MS F120, FRANCHISE TAX BOARD, PO BOX 1286, RANCHO CORDOVA CA 95741-1286 .

Under penalties of perjury, I declare I have examined this submission for exemption based on the IRC Section 501(c)(3) federal determination letter, and to the best of my knowledge and belief, it is true, correct, and complete. _________________________ DATE ________________________________________________________ SIGNATURE OF OFFICER OR REPRESENTATIVE ______________________________ TITLE

m Yes

m No

8091123

FTB 3500A

C1

2012

You might also like

- Get Approved: Grant Writing Secrets Most Grant Givers Do Not Want You To Know – Even In a Bad EconomyFrom EverandGet Approved: Grant Writing Secrets Most Grant Givers Do Not Want You To Know – Even In a Bad EconomyRating: 5 out of 5 stars5/5 (3)

- Checklist NonprofitDocument5 pagesChecklist Nonprofitkatenunley100% (1)

- How to Form a Nonprofit Corporation (National Edition): A Step-by-Step Guide to Forming a 501(c)(3) Nonprofit in Any StateFrom EverandHow to Form a Nonprofit Corporation (National Edition): A Step-by-Step Guide to Forming a 501(c)(3) Nonprofit in Any StateRating: 3.5 out of 5 stars3.5/5 (9)

- Ohio Attorney General's Nonprofit HandbookDocument30 pagesOhio Attorney General's Nonprofit HandbookMike DeWine100% (2)

- Ministry NonprofitDocument6 pagesMinistry Nonprofitbyron100% (2)

- Nonprofit Handbook OhioDocument32 pagesNonprofit Handbook OhioSFLDNo ratings yet

- 501 CDocument20 pages501 CEn Mahaksapatalika0% (1)

- Center For Medical Progress California RegistrationDocument10 pagesCenter For Medical Progress California RegistrationelicliftonNo ratings yet

- IRS Publication 4220 - Applying For 501 (C) (3) Tax-Exempt StatusDocument16 pagesIRS Publication 4220 - Applying For 501 (C) (3) Tax-Exempt StatusgeneisaacNo ratings yet

- PDF Income Tax TestbankanssssDocument17 pagesPDF Income Tax TestbankanssssMark Emil Barit100% (1)

- FDD 1023Document23 pagesFDD 1023eliclifton100% (1)

- DCF and Trading Multiple Valuation of Acquisition OpportunitiesDocument4 pagesDCF and Trading Multiple Valuation of Acquisition Opportunitiesfranky1000No ratings yet

- 8107 1 Introduction+to+Taxation 1Document36 pages8107 1 Introduction+to+Taxation 1Isabel ArcangelNo ratings yet

- Chap. 13A 15BDocument72 pagesChap. 13A 15B2vpsrsmg7jNo ratings yet

- Salary SlipDocument2 pagesSalary Slipchethankapoor9999No ratings yet

- Pre Interview FormDocument5 pagesPre Interview Formankitimt100% (2)

- View Certi If CateDocument1 pageView Certi If CateMahfuzur Rahman0% (3)

- Business Tax Reviewer IDocument5 pagesBusiness Tax Reviewer IMariefel Irish Jimenez KhuNo ratings yet

- 1smied Vs CirDocument2 pages1smied Vs CirBam BathanNo ratings yet

- Request Certificate Account Status Terminate EntityDocument1 pageRequest Certificate Account Status Terminate EntityTiffany DacinoNo ratings yet

- Supporting Organization FormDocument2 pagesSupporting Organization FormpatalataNo ratings yet

- Disclosure Form DC Ced ProjectDocument8 pagesDisclosure Form DC Ced ProjectAshebir AjemaNo ratings yet

- NGO Prequal Vol 2Document10 pagesNGO Prequal Vol 2EMery ChristmasNo ratings yet

- Benevolent Funds Program 2011-09-21 ToolkitDocument22 pagesBenevolent Funds Program 2011-09-21 ToolkitNational Association of REALTORS®100% (1)

- ICMJE Form For Disclosure of Potential Conflicts of InterestDocument24 pagesICMJE Form For Disclosure of Potential Conflicts of InterestPaola RodríguezNo ratings yet

- Declaration of Source of Funds Tax AffidavitDocument4 pagesDeclaration of Source of Funds Tax Affidavitchung elaineNo ratings yet

- LOI - General - Operating - The Harrry and Jeanette Weinberg FoundationDocument1 pageLOI - General - Operating - The Harrry and Jeanette Weinberg Foundationlyocco1No ratings yet

- CVL1201 - Director QuestionnaiDocument9 pagesCVL1201 - Director Questionnairind207cNo ratings yet

- SCC RRF 2004Document3 pagesSCC RRF 2004L. A. PatersonNo ratings yet

- CWCS Founding DocumentsDocument98 pagesCWCS Founding DocumentsWilliamsburg GreenpointNo ratings yet

- Clinton Foundation Revised Filing 2013Document108 pagesClinton Foundation Revised Filing 2013Daily Caller News FoundationNo ratings yet

- CA Charity Annual Report FormDocument1 pageCA Charity Annual Report FormagbufzbfNo ratings yet

- Public Charity Status and Public Support: Open To Public InspectionDocument4 pagesPublic Charity Status and Public Support: Open To Public InspectionFrancis Wolfgang UrbanNo ratings yet

- Onondaga County Legislator Timothy Burtis Financial Disclosure 2015Document3 pagesOnondaga County Legislator Timothy Burtis Financial Disclosure 2015Michelle BreidenbachNo ratings yet

- IRS For 501c4 Form14449Document9 pagesIRS For 501c4 Form14449Lucy BernholzNo ratings yet

- Business Background Investigation Consent Form: Confidential InformationDocument7 pagesBusiness Background Investigation Consent Form: Confidential InformationfafdsafNo ratings yet

- PSU Right To Know Report 2011Document71 pagesPSU Right To Know Report 2011OpDeathEatersUSNo ratings yet

- ICMJE Form For Disclosure of Potential Conflicts of InterestDocument15 pagesICMJE Form For Disclosure of Potential Conflicts of InterestArifuddinZrNo ratings yet

- Step 1 Packet NEW PDFDocument6 pagesStep 1 Packet NEW PDFPrabhjot KaurNo ratings yet

- Project 20report 20 28final 29 20 - 20hope 20alliance 20liberiaDocument34 pagesProject 20report 20 28final 29 20 - 20hope 20alliance 20liberiaapi-721237127No ratings yet

- Registration Statement For A Charitable OrganizationDocument4 pagesRegistration Statement For A Charitable Organizationtureen-dancing.0aNo ratings yet

- FTG RRF 2003Document2 pagesFTG RRF 2003L. A. PatersonNo ratings yet

- Fomtnp RRF 2015Document2 pagesFomtnp RRF 2015L. A. PatersonNo ratings yet

- Individual Characteristics Form (ICF) Work Opportunity Tax CreditDocument4 pagesIndividual Characteristics Form (ICF) Work Opportunity Tax CreditThembie DubeNo ratings yet

- 2010 One Caribbean Exempt App RedactedDocument43 pages2010 One Caribbean Exempt App RedactedJimmy VielkindNo ratings yet

- Fatca Non Individual Form Annexure IIDocument6 pagesFatca Non Individual Form Annexure IIabhijit_bhandurge5011No ratings yet

- 1 s2.0 S0168827821000866 mmc1Document6 pages1 s2.0 S0168827821000866 mmc1Thanet aramsangtheanchaiNo ratings yet

- Kristen Cox Disclosure Statement 2018Document8 pagesKristen Cox Disclosure Statement 2018The Salt Lake TribuneNo ratings yet

- 501 (C) (4) Instructions For Set-UpDocument4 pages501 (C) (4) Instructions For Set-UpPratus WilliamsNo ratings yet

- Form 1023.non ProfitDocument28 pagesForm 1023.non ProfitLawrence BolindNo ratings yet

- Pac Rep RRF 2003Document2 pagesPac Rep RRF 2003L. A. PatersonNo ratings yet

- Stevenson Athletic Booster Club By-Laws - Adopted 14jan19Document13 pagesStevenson Athletic Booster Club By-Laws - Adopted 14jan19api-324380033No ratings yet

- Loan Application: Company InformationDocument8 pagesLoan Application: Company InformationChristian AwukutseyNo ratings yet

- LIC Form 300Document7 pagesLIC Form 300PJEYAKANNANNo ratings yet

- What Are The Advantages and Disadvantages For Nonprofit, Tax-Exempt Status?Document6 pagesWhat Are The Advantages and Disadvantages For Nonprofit, Tax-Exempt Status?nicahNo ratings yet

- FEC Orange County Affiliates Capacity Competency Service Survey FillableDocument4 pagesFEC Orange County Affiliates Capacity Competency Service Survey FillableRod LoveNo ratings yet

- CAIR-F 2013 IRS Reinstatement (Ex. 10 To Ex. A - OCR)Document4 pagesCAIR-F 2013 IRS Reinstatement (Ex. 10 To Ex. A - OCR)Tim CavanaughNo ratings yet

- FTG RRF 2005Document2 pagesFTG RRF 2005L. A. PatersonNo ratings yet

- 2009 Police ApplicationDocument46 pages2009 Police Applicationimmortal595No ratings yet

- FTG RRF 2002Document2 pagesFTG RRF 2002L. A. PatersonNo ratings yet

- SCC RRF 2010Document2 pagesSCC RRF 2010L. A. PatersonNo ratings yet

- VIP Online Quick Start GuideDocument9 pagesVIP Online Quick Start GuideNCVONo ratings yet

- Ap 207Document2 pagesAp 207Garrett DukeNo ratings yet

- 8850 Wotc Tax FormDocument2 pages8850 Wotc Tax Formapi-127186411No ratings yet

- 2009 JM 990ezDocument5 pages2009 JM 990ezJakara MovementNo ratings yet

- Lobbying Compliance, Registration and FilingDocument10 pagesLobbying Compliance, Registration and FilingMichele Di FrancoNo ratings yet

- Nejme Form For Disclosure of Potential Conflicts of InterestDocument5 pagesNejme Form For Disclosure of Potential Conflicts of InterestYasser JayawinataNo ratings yet

- 142201-1969-Fernandez Hermanos Inc. v. Commissioner Of20180926-5466-Q8fg1i PDFDocument16 pages142201-1969-Fernandez Hermanos Inc. v. Commissioner Of20180926-5466-Q8fg1i PDFthirdy demaisipNo ratings yet

- Charge DetailsDocument3 pagesCharge DetailsMaths FaccultyNo ratings yet

- Chapter 8Document7 pagesChapter 8yebegashetNo ratings yet

- TDS on Commission to Foreign AgentsDocument6 pagesTDS on Commission to Foreign AgentsSambridh GhimireNo ratings yet

- Sap Bydesign 1702 Product Info Product DataDocument116 pagesSap Bydesign 1702 Product Info Product DataMohammed DobaiNo ratings yet

- Name-Dipesh Bhattacharyya Roll No-03 Course-BBA LLB Subject-Accountancy Topic-Goods and Service Tax (GST) Adamas University DatedDocument12 pagesName-Dipesh Bhattacharyya Roll No-03 Course-BBA LLB Subject-Accountancy Topic-Goods and Service Tax (GST) Adamas University DatedDIPESH BHATTACHARYYANo ratings yet

- Income From House Property Practical 1Document1 pageIncome From House Property Practical 1Jitendra SharmaNo ratings yet

- SAARA Striped, Woven, Embellished Tant Cotton Blend, Poly Silk SareeDocument6 pagesSAARA Striped, Woven, Embellished Tant Cotton Blend, Poly Silk SareeHariprasathNo ratings yet

- Two Collection Recceipt 66067547Document1 pageTwo Collection Recceipt 66067547Kumar BinoyNo ratings yet

- Form No. 3CB (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961, in The Case of of A Person Referred To in Clause (B) of Sub - Rule (1) of The Rule 6GDocument13 pagesForm No. 3CB (See Rule 6G (1) (B) ) Audit Report Under Section 44AB of The Income-Tax Act, 1961, in The Case of of A Person Referred To in Clause (B) of Sub - Rule (1) of The Rule 6GKhehracybercafe SahnewalNo ratings yet

- Acc 111 #18Document1 pageAcc 111 #18Trina AquinoNo ratings yet

- ZVI - ITR 2022 DraftDocument4 pagesZVI - ITR 2022 DraftMike SyNo ratings yet

- Fiscal Tax InvoiceDocument1 pageFiscal Tax InvoiceNicholas MahwenyiyoNo ratings yet

- BIR FormsDocument24 pagesBIR FormsKezziah Niña AbellanosaNo ratings yet

- SAM Co - Union Budget 2023Document39 pagesSAM Co - Union Budget 2023shwetaNo ratings yet

- EL HPL EncashmentDocument8 pagesEL HPL EncashmentSethu MadhavNo ratings yet

- Income Decleration PDFDocument2 pagesIncome Decleration PDFvijay dabhiNo ratings yet

- Acc 201 Taxation PDFDocument166 pagesAcc 201 Taxation PDFadekunle tosinNo ratings yet

- 23-Fwd: 1950's Paparazzi - Performer Contract & W-9Document2 pages23-Fwd: 1950's Paparazzi - Performer Contract & W-9Julio BarriereNo ratings yet

- Richland School District Two 2022-2023 Budget FIRST READINGDocument2 pagesRichland School District Two 2022-2023 Budget FIRST READINGWLTXNo ratings yet

- LEGT2751 Lecture 1Document14 pagesLEGT2751 Lecture 1reflecti0nNo ratings yet

- Problems in Tax Collection at ERCA Merkato BranchDocument59 pagesProblems in Tax Collection at ERCA Merkato BranchTewfic SeidNo ratings yet