Professional Documents

Culture Documents

Banco de Oro

Uploaded by

Renand-jay de LaraOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banco de Oro

Uploaded by

Renand-jay de LaraCopyright:

Available Formats

Renand Jay B. De Lara Mr.

Rommel Laurenciano OFFICIAL NAME: Banco De Oro DATE OF ESTABLISHED: January 2, 1968 OWNER: Tycoon Henry Sy

IV St. Peter

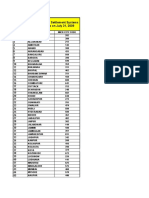

ESTIMATED ASSETS: The acquired assets that are available for sale include properties from Metro Manila,

Luzon, Visayas, and Mindanao. I estimate that there are more than 800 acquired properties in this list of acquired assets from BDO. Aside from acquired assets for sale, the list also contains acquired assets that are available for lease. Other acquired assets for sale include club shares, chattel, as well as repossessed cars. For BDO repossessed cars, I estimate for than a hundred units are for sale. This is quite a huge number of foreclosed cars. Just refer to the list for more details.

SERVICES: Banco de Oro is a full-service universal bank. It provides products and services to the retail and

corporate markets including lending (corporate, middle market, SME, and consumer), deposittaking, foreign exchange, brokering, trust and investments, credit cards, corporate cash management and remittances. Through its subsidiaries, the Bank offers Leasing and Financing, Investment Banking, Private Banking, Bancassurance, Insurance Brokerage and Stock Brokerage services. Banco de Oro is a member of the SM Group, one of the countrys largest conglomerates with businesses spanning between retail, mall operations, property development (residential, commercial, resorts/hotel), and financial services. Although part of a family conglomerate, BDOs day-today operations are handled by a team of managers and bank officers.

BRIEF HISTORY: Beginnings

Banco de Oro had its humble beginnings on January 2, 1968, when it started off as a thrift bank called Acme Savings Bank. With two branches in Metro Manila, Acme was one of the smallest banks in the Philippines at the time. In November 1976, Acme was acquired by the Sy Group, the group of companies currently owned by retail magnate Henry Sy, and renamed Banco de Oro Savings and Mortgage Bank. In December 1994, BDO became a commercial bank. To reflect the bank's new status, BDO was renamed Banco de Oro Commercial Bank, and in September 1996, BDO became a universal bank, which led to the bank's name being changed to the current Banco de Oro Universal Bank. It is one of the many banks owned by a Chinese-Filipino in the Philippines (others include Metrobank and Chinabank). BDO eventually became involved in insurance services in 1997 (it is a bancassurance firm) by establishing a subsidiary called BDO Insurance Brokers. In 1999, BDO expanded its insurance services through partnerships with Assicurazoni Generali s.p.a., one of the world's largest insurance firms, and Jerneh Asia Berhad, a member of Malaysia's Kuok Group. Later, BDO partnered up with its insurance affiliates, which are Generali Pilipinas Life Assurance Company and Generali Pilipinas Insurance Company, in March 2000.

You might also like

- BDO Unibank General InformationDocument2 pagesBDO Unibank General InformationLolNo ratings yet

- BDO Unibank General InformationDocument2 pagesBDO Unibank General InformationLolNo ratings yet

- BDO Unibank General InformationDocument2 pagesBDO Unibank General InformationMayolito WajeNo ratings yet

- Top 5 Commercial Banks in The PhilippinesDocument10 pagesTop 5 Commercial Banks in The PhilippinesJay Ann Belen AlbayNo ratings yet

- BDO UnfinishedDocument3 pagesBDO UnfinishedPaolo Nico P HermoNo ratings yet

- Final OutputDocument6 pagesFinal OutputSiena KaleiNo ratings yet

- Research Group 5 Balboa Campos Villanueva R.Document4 pagesResearch Group 5 Balboa Campos Villanueva R.Rose Gwenn VillanuevaNo ratings yet

- Banking and FinancialDocument8 pagesBanking and FinancialBaby PinkNo ratings yet

- HistoryDocument3 pagesHistoryPia Angela ElemosNo ratings yet

- Stratma PaperDocument20 pagesStratma PaperManny LopezNo ratings yet

- BDO-Strategic PlanDocument37 pagesBDO-Strategic PlanJENNIFER MORANTENo ratings yet

- Preliminary ProjectDocument9 pagesPreliminary ProjectLuna, Annalie RamirezNo ratings yet

- Banco de Oro: Corporate ProfileDocument6 pagesBanco de Oro: Corporate ProfileNilo Palsic CampoNo ratings yet

- FM 422Document8 pagesFM 422Harmaein KuaNo ratings yet

- History: BeginningsDocument3 pagesHistory: Beginningsrobloxian MobiNo ratings yet

- BDO UnibankDocument2 pagesBDO Unibanklitac baresNo ratings yet

- BDO UnibankDocument7 pagesBDO UnibankJana Kryzl DibdibNo ratings yet

- Research Paper: St. Nicholas Senior High SchoolDocument11 pagesResearch Paper: St. Nicholas Senior High SchoolDominic Dalton CalingNo ratings yet

- Hussein Ali (JUREYJ ALI)Document9 pagesHussein Ali (JUREYJ ALI)ciisecalibare fiidowNo ratings yet

- 2023 Baf 414 Investment Banking NotesDocument58 pages2023 Baf 414 Investment Banking NotesEneji ClementNo ratings yet

- Ramirez, Christine Marie T. - FM 415 - Act#1Document4 pagesRamirez, Christine Marie T. - FM 415 - Act#1Christine Marie RamirezNo ratings yet

- Strategic Management BDODocument33 pagesStrategic Management BDOKapoy-eeh Lazan82% (11)

- (L05) Bank and CorporationsDocument2 pages(L05) Bank and CorporationsPsycho Kpop OtakuNo ratings yet

- Buss. Finance FinalDocument7 pagesBuss. Finance FinalAlvin Vin VinNo ratings yet

- Assessment 1 in Financial Management: Central Bicol State University of AgricultureDocument8 pagesAssessment 1 in Financial Management: Central Bicol State University of AgricultureDan Louie San AgustinNo ratings yet

- TOP5 Commercial BanksDocument15 pagesTOP5 Commercial BanksJay Ann Belen AlbayNo ratings yet

- Strama 2015Document72 pagesStrama 2015Millicent Matienzo100% (5)

- Monetary PolicyDocument4 pagesMonetary PolicyBunnyNo ratings yet

- Merchant Banking in India: IndexDocument51 pagesMerchant Banking in India: IndexMuumini De Souza NezzaNo ratings yet

- Sector Sub - Sector CompanyDocument4 pagesSector Sub - Sector CompanyTrinidad, Ma. AngelicaNo ratings yet

- History of Philippine BankingDocument11 pagesHistory of Philippine BankingMark Ceddrick MioleNo ratings yet

- Ayala Homework 1Document6 pagesAyala Homework 1French D. AyalaNo ratings yet

- Intership Report On CitibankDocument26 pagesIntership Report On Citibankmoonmanj100% (2)

- Union Bank of IndiaDocument10 pagesUnion Bank of Indiashabaan786No ratings yet

- BankingDocument101 pagesBankingvipul5290No ratings yet

- AssignmentDocument4 pagesAssignmentHaziel LadananNo ratings yet

- Into To Financial Markets.9q7zOKK1Document23 pagesInto To Financial Markets.9q7zOKK1JabbaNo ratings yet

- Public Financial System and Public Enterprises ExperiencesDocument5 pagesPublic Financial System and Public Enterprises ExperiencesMeane BalbontinNo ratings yet

- Citi Bank FinalDocument64 pagesCiti Bank Finalmldc2011No ratings yet

- Merchant Banking in IndiaDocument51 pagesMerchant Banking in IndiaAadhish PathareNo ratings yet

- Merchant Banking Cha-1 by Saidul AlamDocument3 pagesMerchant Banking Cha-1 by Saidul AlamSaidul AlamNo ratings yet

- Union Bank of IndiaDocument10 pagesUnion Bank of IndiaRakesh Prabhakar ShrivastavaNo ratings yet

- History of Banking by Gunjan PrajapatiDocument94 pagesHistory of Banking by Gunjan PrajapatiGunjan PrajapatiNo ratings yet

- Merchant Banking PDFDocument14 pagesMerchant Banking PDFsatishiitr0% (1)

- Banking Law Assignment: Submitted By, Muhammed Suhail P, Semester XDocument17 pagesBanking Law Assignment: Submitted By, Muhammed Suhail P, Semester XKashyap SKNo ratings yet

- Fin 4Document4 pagesFin 4kablon farm foods CorporationNo ratings yet

- About CimbDocument7 pagesAbout CimbShahmin HalimiNo ratings yet

- A Case StudyDocument11 pagesA Case StudyAvila SimonNo ratings yet

- Main Contents - 2007Document57 pagesMain Contents - 2007Arjun KhuntNo ratings yet

- Investment Banking ProjectDocument51 pagesInvestment Banking ProjectSajid Anotherson100% (1)

- Merchant Banking in IndiaDocument66 pagesMerchant Banking in IndiaNitishMarathe80% (40)

- Microfinance for Bankers and Investors: Understanding the Opportunities and Challenges of the Market at the Bottom of the PyramidFrom EverandMicrofinance for Bankers and Investors: Understanding the Opportunities and Challenges of the Market at the Bottom of the PyramidNo ratings yet

- Better Bankers, Better Banks: Promoting Good Business through Contractual CommitmentFrom EverandBetter Bankers, Better Banks: Promoting Good Business through Contractual CommitmentNo ratings yet

- Summary of The Big Short: by Michael Lewis | Includes AnalysisFrom EverandSummary of The Big Short: by Michael Lewis | Includes AnalysisNo ratings yet

- The Fix: How Bankers Lied, Cheated and Colluded to Rig the World's Most Important NumberFrom EverandThe Fix: How Bankers Lied, Cheated and Colluded to Rig the World's Most Important NumberRating: 3 out of 5 stars3/5 (1)

- Grievance ReportDocument2 pagesGrievance ReportVasantginigera TondihalNo ratings yet

- ETF Quarterly 4Q09Document4 pagesETF Quarterly 4Q09Vladimir KreindelNo ratings yet

- Codes Banking MICR Codes RBI 15102010 67440Document1,455 pagesCodes Banking MICR Codes RBI 15102010 67440abhayarchivNo ratings yet

- Anual Report AmfundDocument48 pagesAnual Report AmfundAaron FooNo ratings yet

- A Summer Internship Presentation ON "Banking Operations" inDocument16 pagesA Summer Internship Presentation ON "Banking Operations" insweetashusNo ratings yet

- Tutorial Test 5: 1. Three Types of ActivitiesDocument4 pagesTutorial Test 5: 1. Three Types of ActivitiesVan Nguyen Thi HoangNo ratings yet

- NBS Bank Statement Dec 2022Document2 pagesNBS Bank Statement Dec 2022Eric CartmanNo ratings yet

- Horngrens Accounting Volume 1 Canadian 10Th Edition Nobles Solutions Manual Full Chapter PDFDocument67 pagesHorngrens Accounting Volume 1 Canadian 10Th Edition Nobles Solutions Manual Full Chapter PDFgiaocleopatra192y100% (9)

- Sbi and HDFC BankDocument51 pagesSbi and HDFC BankSumit ChakravortyNo ratings yet

- s5 PDFDocument5 pagess5 PDFKeshav KumarNo ratings yet

- 2023 06 08 10 07 01mar 23 - 524004Document16 pages2023 06 08 10 07 01mar 23 - 524004k. prudhvi rajNo ratings yet

- NETS Prepaid Card Vs NETS FlashPay Comparison - v3.4Document1 pageNETS Prepaid Card Vs NETS FlashPay Comparison - v3.4TestNo ratings yet

- Much Test Very 2021Document8 pagesMuch Test Very 2021N-am Nici O TreabaNo ratings yet

- ITTF Advanced Coaching Manual Order FormDocument1 pageITTF Advanced Coaching Manual Order FormRyanNo ratings yet

- Account Opening FormDocument19 pagesAccount Opening Formrgsr2008No ratings yet

- Statement 2023 OctDocument2 pagesStatement 2023 Octbabyshark9030No ratings yet

- MBA Project Report On Kotak Life InsuranceDocument61 pagesMBA Project Report On Kotak Life InsuranceCyberfunNo ratings yet

- BANKSDocument28 pagesBANKSJb :3No ratings yet

- Essentials of Managerial Finance 14th Edition Besley Solutions ManualDocument31 pagesEssentials of Managerial Finance 14th Edition Besley Solutions Manualmichaelstokes21121999xsb100% (31)

- Sales & Receivables JournalDocument2 pagesSales & Receivables JournaldianNo ratings yet

- Oblicon Set 2Document1 pageOblicon Set 2Limar Anasco EscasoNo ratings yet

- Deed of Usufructuary MortgageDocument1 pageDeed of Usufructuary MortgageNeelam Shujahuddin100% (1)

- Apy ChartDocument1 pageApy ChartJai mishraNo ratings yet

- 9 MCQ On Third Party Products With Ans.Document4 pages9 MCQ On Third Party Products With Ans.Nitin MalikNo ratings yet

- Corporate-Accounting-bk GoelDocument3 pagesCorporate-Accounting-bk Goeltanisha kochharNo ratings yet

- ALL Course Exit ExamDocument343 pagesALL Course Exit Examnaolmeseret22No ratings yet

- Assignment No.1 Time and Money RelationshipDocument2 pagesAssignment No.1 Time and Money RelationshipMark Jerahmeel Juguilon0% (1)

- PDFDocument7 pagesPDFsyedarshad ahmedNo ratings yet

- Chapter 12 Exercise E12-7 SOLUTION Fall 2018Document2 pagesChapter 12 Exercise E12-7 SOLUTION Fall 2018Areeba QureshiNo ratings yet

- Traditional Life Mock Exam ADocument15 pagesTraditional Life Mock Exam ABryan MorteraNo ratings yet