Professional Documents

Culture Documents

Aztec Ratio Solutions

Uploaded by

lfrei003Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Aztec Ratio Solutions

Uploaded by

lfrei003Copyright:

Available Formats

Background

Timberland is a growing company in the retail shoe business. The industry averages used for comparison

include: the Brown Group, Genesco, Nike, Reebok, and Stride Rite.

for comparison

Balance Sheet

Aztec Corp.

Balance Sheet ($ MILLIONS)

Dec-97

Dec-98

Dec-99

22

19

27

Net Receivables

421

541

932

Inventories

Other Current Assets

564

96

705

120

1120

132

1103

1385

2211

Gross Plant, Property & Equipment

462

575

818

Accumulated Depreciation

201

252

335

Net Plant, Property & Equipment

261

323

483

Goodwill

196

189

182

36

46

58

1596

1943

2934

Notes Payable

260

95

180

Accounts Payable

110

141

275

ASSETS

Cash & Equivalents

Total Current Assets

Other Assets

TOTAL ASSETS

LIABILITIES

Page 3

Balance Sheet

Accrued Expenses

158

198

222

Total Current Liabilities

528

434

677

Long Term Debt

332

410

943

Other Liabilities

36

45

60

896

889

1680

300

400

529

525

529

725

700

1054

1254

1596

1943

2934

70%

70%

Dec-97

Dec-98

Dec-99

1.4%

1.0%

0.9%

Net Receivables

26.4%

27.8%

31.8%

Inventories

35.3%

36.3%

38.2%

6.0%

6.2%

4.5%

Total Current Assets

69.1%

71.3%

75.4%

Gross Plant, Property & Equipment

Accumulated Depreciation

Net Plant, Property & Equipment

Goodwill

28.9%

12.6%

16.4%

12.3%

29.6%

13.0%

16.6%

9.7%

27.9%

11.4%

16.5%

6.2%

Other Assets

2.3%

2.4%

2.0%

TOTAL ASSETS

87.7%

90.3%

93.8%

16.3%

4.9%

6.1%

Accounts Payable

6.9%

7.3%

9.4%

Accrued Expenses

9.9%

10.2%

7.6%

33.1%

20.8%

22.3%

21.1%

23.1%

32.1%

2.3%

2.3%

2.0%

56.1%

45.8%

57.3%

TOTAL LIABILITIES

EQUITY

Common Stock

Retained Earnings

TOTAL EQUITY

TOTAL LIABILITIES & EQUITY

Retention Ratio

Aztec Corp.

Common Size Balance Sheet

ASSETS

Cash & Equivalents

Other Current Assets

LIABILITIES

Notes Payable

Total Current Liabilities

Long Term Debt

Other Liabilities

TOTAL LIABILITIES

EQUITY

Page 4

Balance Sheet

Common Stock

18.8%

27.2%

18.0%

Retained Earnings

25.1%

27.0%

24.7%

43.9%

54.2%

42.7%

100.0%

100.0%

100.0%

TOTAL EQUITY

TOTAL LIABILITIES & EQUITY

Page 5

Balance Sheet

Page 6

Balance Sheet

Page 7

Balance Sheet

Page 8

Balance Sheet

Page 9

Balance Sheet

Page 10

Balance Sheet

Page 11

Balance Sheet

Page 12

Balance Sheet

Page 13

Balance Sheet

Page 14

Balance Sheet

Page 15

Balance Sheet

Page 16

Balance Sheet

Page 17

Balance Sheet

Page 18

Balance Sheet

Page 19

Balance Sheet

Page 20

Income Statement

Aztec Corp.

Annual Income Statement

($ MILLIONS)

1

2

3

4

5

Dec-97

Dec-98

Dec-99

6 Sales

2477

2914

4,189

1560

1749

2,501

917

1165

1688

645

762

1,033

Cost of Goods Sold

8 Gross Profit

9

10

Selling, General, & Admin.

11

Amortization

12

Depreciation

45

51

83

220

345

565

30

48

87

190

297

478

76

119

191

114

178

287

13 Operating Profit

14

Interest Expense

15 Taxable Income

16

Total Income Taxes

17 Net Income

18

19

Aztec Corp.

Common Size Income Statement

20

21

22

23

24

Dec-97

Dec-98

Dec-99

25 Sales

100.0%

100.0%

100.0%

63.0%

60.0%

59.7%

37.0%

40.0%

40.3%

26.0%

26.1%

24.7%

0.3%

1.8%

0.2%

1.8%

0.2%

2.0%

32 Operating Profit

8.9%

11.8%

13.5%

33

1.2%

1.6%

2.1%

34 Taxable Income

7.7%

10.2%

11.4%

35

3.1%

4.1%

4.6%

4.6%

6.1%

6.9%

26

Cost of Goods Sold

27 Gross Profit

28

29

Selling, General, & Admin.

30

31

Amortization

Depreciation

Interest Expense

Total Income Taxes

36 Net Income

Page 21

Cash Flow Statement

Aztec Corp.

Cash Flow Statement

($ MILLIONS)

Dec-98

Dec-99

178

51

7

(120)

(141)

(24)

(10)

31

40

9

21

287

83

7

(391)

(415)

(12)

(12)

134

24

15

(280)

Gross Plant, Property & Equipment

Total Investinging Cash Flows

(113)

(113)

(243)

(243)

Financing Cash Flows

Notes Payable

Long Term Debt

(165)

78

85

533

229

(53)

89

(87)

531

(3)

22

19

8

19

27

Cash Flows From Operations

Net Income

Depreciation

Amortization

Net Receivables

Inventories

Other Current Assets

Other Assets

Accounts Payable

Accrued Expenses

Other Liabilities

Total Operating Cash Flows

Investing Cash Flows

Common Stock

Dividends

Total Financing Cash Flows

Net Cash Flow

Beginning Cash Balance

Ending Cash Balance

Page 22

Ratios

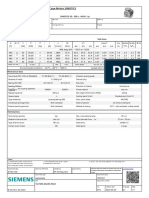

Aztec Corp.

Selected Ratios

Du pont ROE decomposition

Dec-97

Dec-98

Dec-99

Return on equity (%)

Profit margin (%)

Asset turnover (x)

Asset to equity (x)

16.29%

4.60%

1.55

2.28

16.89%

6.11%

1.50

1.84

22.89%

6.85%

1.43

2.34

Industry

35.41%

3.00%

3.70

3.19

Return on equity (%)

Return on assets (%)

16.29%

7.14%

16.89%

9.16%

22.89%

9.78%

35.41%

11.10%

Profit margin (%)

Operating profit margin

Gross margin (%)

4.60%

8.88%

37.02%

6.11%

11.84%

39.98%

6.85%

13.49%

40.30%

3.00%

9.00%

15.20%

1.55

9.49

5.88

2.77

3.24

1.50

9.02

5.39

2.48

2.38

1.43

8.67

4.49

2.23

2.35

3.70

6.50

6.24

2.57

4.10

62.0

132.0

25.7

168.3

67.8

147.1

29.4

185.5

81.2

163.5

40.1

204.5

58.5

142.0

35.0

165.5

2.28

56.1%

128.0%

7.33

2.09

1.02

1.84

45.8%

84.3%

7.19

3.19

1.57

0.09

0.7%

2.34

57.3%

134.0%

6.49

3.27

1.61

-0.37

-6.7%

3.19

69.00%

220.0%

7.1

3.50

2.40

1.70

0.40

Profitability Ratios :

Turnover-control ratios :

Asset turnover (x)

Fixed-asset turnover (x)

Accounts receivable turnover (x)

Inventory turnover (x)

Days' sales in cash (days)

Collection period (days)

Inventory period (days)

Payable period (days)

Cash conversion cycle (days)

Leverage and liquidity ratios :

Asset to equity (x)

Total liabilities to asset (%)

Total liabilities to equity (%)

Times interest earned (x)

Current ratio (x)

Acid test (x)

Cash Flow Liquidity (x)

Operating Cash Flow / Sales

42.7%

234%

Page 23

#DIV/0!

319%

You might also like

- ABC Family Channel: Capital BudgetingDocument1 pageABC Family Channel: Capital Budgetinglfrei003No ratings yet

- Example Real Estate ProjectDocument28 pagesExample Real Estate Projectlfrei003100% (1)

- Accounting Study GuideDocument45 pagesAccounting Study Guidelfrei003No ratings yet

- Rations and Technology ToolsDocument9 pagesRations and Technology Toolslfrei003No ratings yet

- Coca-Cola Company: Liabilities & Stockholder's EquityDocument8 pagesCoca-Cola Company: Liabilities & Stockholder's Equitylfrei003No ratings yet

- Chapter 1 NotesDocument4 pagesChapter 1 Noteslfrei003No ratings yet

- Final ReviewDocument1 pageFinal Reviewlfrei003No ratings yet

- Chapter 1 NotesDocument4 pagesChapter 1 Noteslfrei003No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Usa Easa 145Document31 pagesUsa Easa 145Surya VenkatNo ratings yet

- Arizona Supreme CT Order Dismisses Special ActionDocument3 pagesArizona Supreme CT Order Dismisses Special Actionpaul weichNo ratings yet

- 3) Stages of Group Development - To StudsDocument15 pages3) Stages of Group Development - To StudsDhannesh SweetAngelNo ratings yet

- I. ICT (Information & Communication Technology: LESSON 1: Introduction To ICTDocument2 pagesI. ICT (Information & Communication Technology: LESSON 1: Introduction To ICTEissa May VillanuevaNo ratings yet

- Introduction To Elective DesignDocument30 pagesIntroduction To Elective Designabdullah 3mar abou reashaNo ratings yet

- Area Access Manager (Browser-Based Client) User GuideDocument22 pagesArea Access Manager (Browser-Based Client) User GuideKatherineNo ratings yet

- 04 Dasmarinas Vs Reyes GR No 108229Document2 pages04 Dasmarinas Vs Reyes GR No 108229Victoria Melissa Cortejos PulidoNo ratings yet

- Venturi Meter and Orifice Meter Flow Rate CalculationsDocument2 pagesVenturi Meter and Orifice Meter Flow Rate CalculationsVoora GowthamNo ratings yet

- Indian Institute of Management KozhikodeDocument5 pagesIndian Institute of Management KozhikodepranaliNo ratings yet

- 7th Kannada Science 01Document160 pages7th Kannada Science 01Edit O Pics StatusNo ratings yet

- Information Pack For Indonesian Candidate 23.06.2023Document6 pagesInformation Pack For Indonesian Candidate 23.06.2023Serevinna DewitaNo ratings yet

- Bob Duffy's 27 Years in Database Sector and Expertise in SQL Server, SSAS, and Data Platform ConsultingDocument26 pagesBob Duffy's 27 Years in Database Sector and Expertise in SQL Server, SSAS, and Data Platform ConsultingbrusselarNo ratings yet

- Banas Dairy ETP Training ReportDocument38 pagesBanas Dairy ETP Training ReportEagle eye0% (2)

- Business Case - Uganda Maize Export To South SudanDocument44 pagesBusiness Case - Uganda Maize Export To South SudanInfiniteKnowledge33% (3)

- Understanding CTS Log MessagesDocument63 pagesUnderstanding CTS Log MessagesStudentNo ratings yet

- 3 Intro To Ozone LaundryDocument5 pages3 Intro To Ozone LaundrynavnaNo ratings yet

- CORE Education Bags Rs. 120 Cr. Order From Gujarat Govt.Document2 pagesCORE Education Bags Rs. 120 Cr. Order From Gujarat Govt.Sanjeev MansotraNo ratings yet

- Tata Group's Global Expansion and Business StrategiesDocument23 pagesTata Group's Global Expansion and Business Strategiesvgl tamizhNo ratings yet

- AnkitDocument24 pagesAnkitAnkit MalhotraNo ratings yet

- 1LE1503-2AA43-4AA4 Datasheet enDocument1 page1LE1503-2AA43-4AA4 Datasheet enAndrei LupuNo ratings yet

- Oop Assignment # 2 Submitted By: Hashir Khan Roll #: 22f-7465 Date: 3-3-2023Document14 pagesOop Assignment # 2 Submitted By: Hashir Khan Roll #: 22f-7465 Date: 3-3-2023Hashir KhanNo ratings yet

- Tata Chemicals Yearly Reports 2019 20Document340 pagesTata Chemicals Yearly Reports 2019 20AkchikaNo ratings yet

- Lister LRM & SRM 1-2-3 Manual and Parts List - Lister - Canal WorldDocument4 pagesLister LRM & SRM 1-2-3 Manual and Parts List - Lister - Canal Worldcountry boyNo ratings yet

- Aptio ™ Text Setup Environment (TSE) User ManualDocument42 pagesAptio ™ Text Setup Environment (TSE) User Manualdhirender karkiNo ratings yet

- 3838 Chandra Dev Gurung BSBADM502 Assessment 2 ProjectDocument13 pages3838 Chandra Dev Gurung BSBADM502 Assessment 2 Projectxadow sahNo ratings yet

- KDL 23S2000Document82 pagesKDL 23S2000Carlos SeguraNo ratings yet

- Developing a Positive HR ClimateDocument15 pagesDeveloping a Positive HR ClimateDrPurnima SharmaNo ratings yet

- Conplast SP430 0407Document4 pagesConplast SP430 0407Harz IndNo ratings yet

- An4856 Stevalisa172v2 2 KW Fully Digital Ac DC Power Supply Dsmps Evaluation Board StmicroelectronicsDocument74 pagesAn4856 Stevalisa172v2 2 KW Fully Digital Ac DC Power Supply Dsmps Evaluation Board StmicroelectronicsStefano SalaNo ratings yet

- 5.PassLeader 210-260 Exam Dumps (121-150)Document9 pages5.PassLeader 210-260 Exam Dumps (121-150)Shaleh SenNo ratings yet