Professional Documents

Culture Documents

Approaches For Compliance - Guidance On Risk Management Practices For Loans

Uploaded by

Andrew ArmstrongOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Approaches For Compliance - Guidance On Risk Management Practices For Loans

Uploaded by

Andrew ArmstrongCopyright:

Available Formats

nylx.

com

A NYLX WHITE PAPER

Approaches for

Compliance with the

January 31 Interagency

Guidance on Risk

Management Practices

The Fed, OCC, FDIC and the NCUA

jointly released an important policy

guidance letter on January 31, 2012.

The letter provides guidance on calculating Allowance for Loan and Lease

Losses (ALLL) estimation for portfolios of second liens in particular, though

the guidance applies to loans of all types.

The agencies have concerns that the institutions they regulate will require

higher ALLL in the coming years. The reason for the concern is the continued

deterioration of residential values and the potential for payment shock as home

equity lines of credit exit their draw periods and become amortizing loans.

This paper will review the requirements set forth in the guidance letter and

explore methods for complying with those requirements. For convenience,

we will refer to all federally regulated institutions as banks, though we recognize

both credit unions and thrifts are afected by the new guidance.

A NYLX WHITE PAPER

Approaches for Compliance with

the January 31 Interagency Guidance

on Risk Management Practices

Page 1 nylx.com

Loss Estimation Using

Segmentation and Trending

Banks must recognize a charge against income when two key conditions

are met for a loan:

As of the date fnancial statements are issued, it is probable that an

asset had been impaired or a liability had been incurred.

The amount of the loss can be reasonably estimated

Methodology for defning an impairment pool and reasonably

estimating loss.

The impairment pool should be populated with those loans which have an

elevated risk profle. These require a risk-weighted reserve in anticipation

of losses. The risk weighting should factor in recent delinquent payments,

probability of delinquency and default, and the potential loss severity of

each individual loan.

Loans should be considered impaired under a combination of at least 3

circumstances due to the correlation of these factors and default. The frst is

when a loan has been delinquent at any time in the prior 12 months. Many

banks use this condition as an impairment fag, knowing that if a missed

payment is more than a mere oversight, another missed payment is far more

likely within the next 12 or 24 months. This information is typically readily

available in your servicing platform, and payment histories can usually be

extracted for either 12 or 24 months.

The credit profle of the borrowers is the second factor. There are many

ways to arrive at a 680 FICO score. Because of this, banks should

monitor all credit quality indicators." Your bank should derive a waterfall

scenario for credit stress. A primary threshold might be the current FICO or

VantageScore, but the screen should compare this score with prior credit

refreshes or the score at origination. A borrower with a highly drawn HELOC

and high balance-to-limit ratios on revolving consumer trade-lines might still

have a 720 FICO score, but be one paycheck away from a complete credit

collapse. Some banks use increases in balance-to-limit ratios, delinquencies

on non-mortgage accounts, and newly opened accounts as early warning

indicators. As a borrowers leverage increases, so does the likelihood of

default. Therefore, monitoring credit-score migration and updating credit

profles is a best practice.

Finally, when the LTv (for frst mortgagesj or CLTv (for both frst and

second mortgages) exceeds your banks threshold for risk, a loan should

be considered impaired. The precise threshold is highly dependent on local

factors such as the spread between arms length and distressed sales prices

A NYLX WHITE PAPER

Approaches for Compliance with

the January 31 Interagency Guidance

on Risk Management Practices

Trends and Extrapolation for

ALLL adjustments

Banks have begun in recent years

tracking interest rate trends, FICO

migration, and YoY changes to

property values. Their ALLL

calculations now need to incorpo-

rate that data, extrapolating clear

trends. These ALLL adjustments

should be supported by the analysis

that underlies the adjustment, and

management must not cherry-pick

favorable trends while discounting

or ignoring others.

The good news is that trends

and analysis cut both ways.

As economic, credit, or housing

conditions ultimately begin to

improve, ALLLs can be reduced,

and a rigorous analytics output

can help defend those reductions

to examiners.

Page 2 nylx.com

in the portfolio's geography, the 6-month outlook for real estate values,

and your banks tolerance for risk. When a loan at 90% LTV has a junior

lien held by another institution that pushes the CLTV to well over 100%,

the risk of loss on the frst increases substantially. Therefore, it is critical to

perform lien searches on all real-estate-backed loans on at least an annual

basis and cross reference that information with the borrower's credit profle

to understand the additional layers of risk introduced by the silent liens.

Metrics such as a collateral integrity analysis can defne market-level stress,

and when overlaid with CLTv information, puts a fner analysis on risk of loss

than just looking at the current value.

Monitor All Credit

Quality Indicators

The primary guidance is for risk managers to monitor all credit quality

indicators relative to credit portfolios. The traditional metrics for mortgage

portfolios are FlCO scores and Loan-to-value ratios (LTvsj. For decades,

portfolios were commonly graded at the pool level based on the origination

data. ALLL calculations were generated using that information, and

for decades, this approach sumced to bufer banks from recession-

induced default increases.

However, as the subprime contagion spread into fnancial markets around

the world, banks that had seen no losses whatsoever in a decade or more

on mortgage portfolios began to experience charge-ofs in signifcant

amounts. ln reviewing their impaired and charged-of loans, many banks

found that the credit scores and LTVs at origination were materially

degraded at the time of the frst missed payment.

Proactive risk managers began refreshing FICO scores on their borrowers

and Automated valuation Models (AvMsj on the collateral securing their frst

and second mortgage portfolios. As losses on second mortgage defaults

began to consistently approach 100%, the regulating bodies realized that

banks have not been monitoring all of the factors that afect collectability

on these junior-lien portfolios. As a result, the guidance requires banks to

make use of all reasonably available" information, which includes the

payment status of senior liens not held by the institution, CLTV, credit

scores, and occupancy, documentation, and property type, and to

refresh that information as often as necessary considering housing

and economic conditions.

A NYLX WHITE PAPER

Approaches for Compliance with

the January 31 Interagency Guidance

on Risk Management Practices

Page 3 nylx.com

Methodology for refreshing information that is

reasonably available.

If information is out there, you should be using it! But the frequency with

which you refresh that information depends on the data itself. For credit,

most banks refresh information quarterly, in conjunction with preparing their

call reports. Refreshing credit profles rather than just scores allows you to

monitor payment status of senior liens not held by your institution, as is now

required. Increasing liabilities, too, are good indicators of stress. For this,

quarterly analysis is frequent enough to capture change, but not so frequent

as to be cost-prohibitive.

For property valuations, while it is not clear whether housing has truly

bottomed, values have certainly stabilized and though they may continue

to fall somewhat, the rate of decline in all areas of the country has slowed

dramatically. As a result, in todays environment, semiannual valuations and

lien searches can be appropriate.

Oosts and Benefts

of Compliance

One of the sections of the guidance letter actually saves banks money on

risk management if diligently applied. If we presume a portfolio of 10,000

junior liens, for easy math, and a quarterly credit refresh and semiannual

collateral analysis, this means 40,000 credit profles and 20,000 AvMs and

liens searches. While expensive, they are far less expensive than the losses

that might be incurred on a poorly managed junior-lien portfolio.

However, the guidance requires banks to segment their loans based on

risk levels, and monitor accordingly. This segmentation should enhance

the bank's ability to track default rates and loss severity for high-risk

segments. The great news here is that once a baseline risk level has

been established for the portfolio, the bank can move high-risk loans into

separate pools for enhanced analysis, while leaving the lower-risk loans in

pools that have lower frequency and depth of analysis.

Practically speaking, this means you can segment your risk analysis as well.

Data analysts can focus eforts where they make the greatest impact.

A NYLX WHITE PAPER

Approaches for Compliance with

the January 31 Interagency Guidance

on Risk Management Practices

Federal Reserve Recent Study

In a fascinating study, the Federal

Reserve

1

found that 620 was a very

signifcant threshold for default

predictions, particularly with

respect to strategic defaults.

In fact, for borrowers between

620 and 680, strategic default is

as much as twice as likely as for

borrowers with either lower or

higher scores.

The study contains several

interesting conclusions, includ-

ing that borrowers who missed a

payment but cured the delinquency

were less likely to default than those

who never missed a payment prior

to termination. This means that if

a bank can get a borrower current,

they work harder to remain in their

homes. This information, coupled

with an Ability to Pay model, can

lead to loss mitigation decisions

that might be counterintuitive at

frst blush.

Page 4 nylx.com

Methodology for achieving a better cost/beneft approach

for compliance.

Rather than spending your budget performing the same level of analysis

on all loans, you can achieve better results by segmenting your loans and

conducting more in-depth analysis where risk is higher. Here is a simple

example to illustrate the point.

Lets assume your directive is to run quarterly credit and semiannual

collateral. For our easy math, well assume $1 for credit and $5 for AVM

and Lien Search combined. Given a pool of 10,000 loans and no other

costs, the total investment would be $140,000. Money well spent to manage

losses, but let's see if there is a better approach that is more cost efective.

Assuming a full 20% of the portfolio is high risk" once segmented; let's

examine the impact of conducting the same analysis on those loans,

but an annual review of the low risk pool.

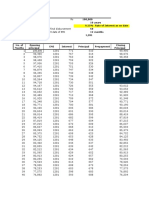

Un-segmented Analysis:

10,000 Total Loans Credit AVMs/Liens Total Cost

@ $1 / run @ $5 / run

10,000 run $40,000 $100,000 $140,000

quarterly for

credit, semiannual

for collateral

Segmented Analysis:

10,000 Total Loans Credit AVMs/Liens Total Cost

@ $1 / run @ $5 / run

8,000 low risk run $8,000 $40,000 $48,000

annually

2000 high risk run $8,000 $20,000 $28,000

quarterly for credit,

semiannual for

collateral

Grand Total $16,000 $60,000 $76,000

The result from using segmented analysis is more than a 45% savings, and

allows you to allocate dollars to deeper analysis on the risky pool while still

maintaining compliance with the guidance letter.

A NYLX WHITE PAPER

Approaches for Compliance with

the January 31 Interagency Guidance

on Risk Management Practices

Page 5 nylx.com

Using a more segmented and focused approach, risk managers can actually

gain more insight into their loan portfolios, calculate more accurate ALLLs,

and reduce their cost of compliance. This is a much better alternative

for cost management than cutting back to semiannual credit and annual

collateral analysis for all loans, regardless of risk profle - an approach that

wont likely sit well with examiners in light of the reasonableness standards

set forth in the guidance.

New Guidance Drives

Increased Complexity

One of the challenges posed by the new guidance is the requirement to

monitor so many more variables in the portfolio. In addition to a simple

two-dimensional FlCO/LTv matrix that sumced for decades, examiners are

asking banks to factor in geographic concentrations, payment status of

senior liens, origination channel, property type, CLTV, and even potential

payment shock of ARMs resetting and HELOCs entering fxed amortizations.

The spreadsheets are becoming numerous and getting cluttered.

In order to digest the level of complexity new regulations have introduced,

many banks have built or bought platforms into which they can load loans

and apply data. Efective platforms allow for easy reporting, efective

segmentation, and visually oriented output.

Assessing the pros and cons of build vs. buy risk

management platforms.

Building a proprietary platform allows a bank to build in just those data

feeds they decide to use, to use the best-of-breed source for each data

feed, and to develop the exact output, user interface, and reports they want.

Key challenges: Adequate transparency measurements, integration of data

from the various sources, and the upfront cost of building and maintaining

such a platform.

Buying a platform eliminates the development time necessary to create

one in house, and streamline the process of bringing in multiple data

sources seamlessly.

Key challenges: Integrating with IT environments, potential security

concerns, data that may or may not be best-of-breed (especially if the

platform is provided by a data vendor), timeliness of getting data into

and out of the system, control of the data and access to it, and lower

levels of customization.

A NYLX WHITE PAPER

Approaches for Compliance with

the January 31 Interagency Guidance

on Risk Management Practices

Complex Models

The model for predicting foreclosure

and delinquency is complex, and

looks like this:

Clearly, from this, we can discern

that any help a bank can get in

reducing multiple complex variables

into a readily digestible format is

valuable.

Page 6 nylx.com

Conclusion

We dont believe Microsoft designed and built Excel expecting it to be the

risk management tool of the fnancial industry, but for the last 20 years,

it has. Whether you choose to build or buy a risk management platform,

the complexities of the data are now beyond the capabilities of Excel,

even with the vaunted Pivot Table.

The regulatory environment has forced banks to look beyond

the spreadsheet.

Compliance with this guidance will require banks to incorporate new data

into their analysis, but segmentation of the portfolio can reduce the cost

impact of compliance. Smart banks are using this deeper knowledge not

only to improve their loss-mitigation decisions, but also to cross-sell their

quality borrowers, enhancing revenue and customer loyalty.

1

The Depth of Negative Equity and Mortgage Default Decisions

http://www.federalreserve.gov/pubs/feds/2010/201035/201035pap.pdf

About NYLX

NYLX is a software-as-a-service application provider to Banks, Credit

Unions and Mortgage Bankers. Our oferings include LoanDecisions

product eligibility and mortgage loan pricing and LoanHD life-of-loan

performance analytics and monitoring. These solutions aggregate

information from a robust set of sources and deliver it through a

user friendly, highly intuitive user interface. Our clients use these

applications to improve mortgage loan origination, secondary marketing

and consumer/mortgage loan portfolio management functions. NYLX

technology is supported by client service expertise, case management

technology, online training webinars, and partnership resources to deliver

complete solutions and help our clients achieve high return on investment.

Our commitment to compliance and security aligns with our customers

need to address their own highly regulated environments.

A NYLX WHITE PAPER

Approaches for Compliance with

the January 31 Interagency Guidance

on Risk Management Practices

Page 7 nylx.com

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- FNL Responsibilities For Lenders WP 2014Document7 pagesFNL Responsibilities For Lenders WP 2014Andrew ArmstrongNo ratings yet

- Pipeline Hedging: The New Imperative For The Independent Mortgage Banker.Document8 pagesPipeline Hedging: The New Imperative For The Independent Mortgage Banker.Andrew ArmstrongNo ratings yet

- Mortgage Lending: Product & Pricing Engines - Strategic Uses For Compliance, Competitiveness & ProfitDocument7 pagesMortgage Lending: Product & Pricing Engines - Strategic Uses For Compliance, Competitiveness & ProfitAndrew ArmstrongNo ratings yet

- Best Practices For Maximizing ProfitabilityDocument7 pagesBest Practices For Maximizing ProfitabilityAndrew ArmstrongNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Payroll AccountinDocument2 pagesPayroll AccountinIvy Veronica SandagonNo ratings yet

- Fin 242 FullDocument5 pagesFin 242 FullIzzaty AffrinaNo ratings yet

- Bret 7 UDocument31 pagesBret 7 UQuint WongNo ratings yet

- Most Comprehensive Economics Current Affairs For Mains 2019 by PrepmateDocument168 pagesMost Comprehensive Economics Current Affairs For Mains 2019 by Prepmatevishal pathaniaNo ratings yet

- Barclays Municipal Research Detroit - Chapter 9 BeginsDocument22 pagesBarclays Municipal Research Detroit - Chapter 9 Beginsabcabc123123xyzxyxNo ratings yet

- Activity No. 2 (Moredo) : Problem 1Document3 pagesActivity No. 2 (Moredo) : Problem 1Eloisa Joy MoredoNo ratings yet

- Aud Spec 101Document19 pagesAud Spec 101Yanyan GuadillaNo ratings yet

- Budgetary Control AssignmentDocument6 pagesBudgetary Control AssignmentBhavvyam BhatnagarNo ratings yet

- Business Risk and Its TypesDocument47 pagesBusiness Risk and Its TypesAtia KhalidNo ratings yet

- 5 Hidden Secrets About Stock Market That You Can't Learn From Books - by Indrazith Shantharaj - May, 2022 - MediumDocument10 pages5 Hidden Secrets About Stock Market That You Can't Learn From Books - by Indrazith Shantharaj - May, 2022 - MediumArun KumarNo ratings yet

- Cuartero - Unit 3 - Accounting Changes and Error CorrectionDocument10 pagesCuartero - Unit 3 - Accounting Changes and Error CorrectionAim RubiaNo ratings yet

- Basic Accounting For Non-Accountants (A Bookkeeping Course)Document49 pagesBasic Accounting For Non-Accountants (A Bookkeeping Course)Diana mae agoncilloNo ratings yet

- AG Office AccountingDocument165 pagesAG Office AccountingabadeshNo ratings yet

- Audit of Cash Module 1Document5 pagesAudit of Cash Module 1calliemozartNo ratings yet

- Loan CalculatorDocument5 pagesLoan CalculatorHema Kumar Hema KumarNo ratings yet

- RC&G Transcript 2018Document28 pagesRC&G Transcript 2018YashNo ratings yet

- Motion To Lift Order of Default With Position PaperDocument3 pagesMotion To Lift Order of Default With Position PaperAtty. Dahn UyNo ratings yet

- Shrimp FarmingDocument12 pagesShrimp FarmingGrowel Agrovet Private Limited.100% (2)

- Sunnix Memo To BoardDocument4 pagesSunnix Memo To BoardDennie IdeaNo ratings yet

- Final Annual NGBIRR FY 2022.23Document208 pagesFinal Annual NGBIRR FY 2022.23Dunson MuhiaNo ratings yet

- Debt Collector DirectDocument1 pageDebt Collector DirectRandy RoxxNo ratings yet

- IT Sector ReviewDocument16 pagesIT Sector ReviewPratik RambhiaNo ratings yet

- Yogesh 19Document3 pagesYogesh 19DeltaNo ratings yet

- Initiative of National Housing PolicyDocument4 pagesInitiative of National Housing PolicyMuhaimin RohizanNo ratings yet

- Cost AccountingDocument8 pagesCost AccountingKim Nicole ReyesNo ratings yet

- Chapter 5 ReconciliationDocument7 pagesChapter 5 ReconciliationDevender SinghNo ratings yet

- Naghmeh Panahi Vs Saeed AbediniDocument24 pagesNaghmeh Panahi Vs Saeed AbediniLeonardo BlairNo ratings yet

- Share Market ScamDocument14 pagesShare Market ScamPramod DasadeNo ratings yet

- Digest RR 14-2001 PDFDocument1 pageDigest RR 14-2001 PDFCliff DaquioagNo ratings yet

- Understanding Vietnam: The Rising Star: Economics & StrategyDocument11 pagesUnderstanding Vietnam: The Rising Star: Economics & StrategyHandy HarisNo ratings yet