Professional Documents

Culture Documents

Business Organizations Outline

Uploaded by

esquire2014flCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Business Organizations Outline

Uploaded by

esquire2014flCopyright:

Available Formats

1 Busn Organizations Outline

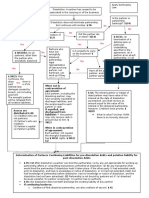

CHAPTER TWO: AGENCY The Creation of an Agency Relationship Three requirements for an agency relationship to exist o Must be a mutual agreement o The agent must be acting on behalf of the principal o The agent must act subject to the principals control As long as the requisite elements are present, it is irrelevant whether the parties understood that they were creating an agency relationship or desired to create such a relationship [2nd restate 1 cmt b or 3rd restate 1.02] Marital status cannot in and of itself prove the agency relationship Agency vs Gratuitous Bailment o 2nd restate 1, 13-14, 16, 30 o 3rd restate 1.01-1.04 Not essential to the existence of authority that there ve a contract btwn principal and agent or that the agent promise to act as such, nor is it essential to the relationship of principal and agent that they or either receive compensation A principal may be liable for the torts of his agent A Gratuitous Bailment is the transfer of possession or use of property without compensation Agency vs Creditor Debtor Relationship o 2nd restate 14K, 14O Court concludes that Cargill, by its control and influence over Warren, became a principal with liability for the transactions entered into by its agent Warren The existence of the agency may be proved by circumstantial evidence which shows a course of dealings btwn the two parties o When an agency relationship is to be proven by circumstantial evidence, the principal must be shown to have consented to the agency since one cannot be the agent of another except by consent of the latter A creditor who assumes control of his debtors busn may become liable as principal for the acts of the debtor in connection with the busn [2nd restate 14O] o Veto power is not enough o Must take over management in person or through an agent and directs what may be done in the normal course of busn (de facto control of agent) Factors must be viewed in light of all the circumstances of the busn arrangements 2nd Restate 14K requires that the supplier has an independent busn before it can be concluded that he is not an agent Agency vs Contract Relationship o 2nd restate 2, 14N, 391 o 3rd restate 8.03 1

2 Three characteristics having particular relevance to the determination of the existence of a principal agent relationship [2nd restate 12-14] o Agents power to alter the legal relations of the principal o The agents duty to act primarily for the benefit of the principal o The principals right to control the agent An Agent renders services but retains control over the manner of doing it An independent contractor, as distinguished from a servant, is a person who contracts with another to do something for him but is not controlled by the other nor subject to the others right to control with respect to his physical conduct in the performance of the undertaking. He may or may not be an agent [2nd restate 2(3)] o The 3rd restatement drops the distinction btwn independent contractors and servants. It provides a general definition of agency [3rd restate 1.10]

Express Actual Authority o 2nd restate 26, 32-34, 37 o 3rd restate 2.01, 3.01 Express Actual Authority a principal has expressly communicated to an agent the power to perform some act on the principals behalf. However the scope of an express grant of authority may well be an issue. The ultimate test is whether a reasonable person in the agents position would interpret the principals communication to encompass a particular act The power to borrow money or to execute and deliver promissory notes must be granted by express terms or flow as a necessary and inevitable consequence from the nature of the agency actually created Implied Actual Authority and Apparent Authority o 2nd restate 26-27, 35, 49 o 3rd restate 2.01-2.03, 3.01, 3.03 Implied Actual Authority an agent has implied actual authority when the principal does not expressly confer authority but the principals words or conduct, reasonably interpreted, causes the agent to believe that he has authority Apparent Authority an agent has apparent authority in dealing with a third person when the principals words or conduct, reasonably interpreted, causes the third person to believe that the agent has authority o apparent authority is created by the conduct of the principal which causes a third person reasonably to believe that the purported agent has the authority to act for the principal and to reasonably and in good faith rely on the authority held out by the principal An agent may have apparent authority to act even though as between himself and the principal, such authority has not been granted. Apparent authority does not arise from the acts of the agent o Three ways to establish apparent authority Principal expressly and directly telling a third person that a second person has authority to act on the principals behalf Prior acts By position 2

3 o If a principal allows an agent to occupy a position which, according to the ordinary habits of people in the locality, trade or profession, carries a particular kind of authority, then anyone dealing with the agent is justified in inferring that the agent has such an authority. The principal may also create the appearance of authority by prior acts. By allowing an agent to carry out prior similar transactions, a principal creates the appearance that the agent is authorized to carry out such acts subsequently Inherent Authority o 2nd restate 3-4, 8A, 9C, 161-161A, 194-195A, 219 Inherent Authority a principal may be liable in contract for the acts of a general agent even if the agent lacks actual and apparent authority. A general agent is said to have inherent authority to bind the principal o A principal is disclosed if the third party is aware that a principal exists and knows the principals identity. A principal is partially disclosed if the third party knows that a principal exists but is unaware of the principals identity. A principal is undisclosed if the third party is unaware that a principal exists and believes that he is doing busn with the agent [2nd restate 4; 3rd restate 1.04(2)] o A general agent is an agent authorized to conduct a series of transactions involving a continuity of service [2nd restate 3(1) A general agent has inherent authority to act ofr a disclosed or partially disclosed principal regarding acts done on the principals account which usually accompany or are incidental to transactions which the agent is authorized to conduct I, although they are forbidden by the principal, the other party reasonably believes that the agent is authorized to do them and has no notice that he is not so authorized [2nd restate 161] o 3rd restatement declines to adopt the concept inherent agency power [2.01 cmt b] Well established that an agent for an undisclosed principal subject the principal to liability for acts done on his account if they are usual or necessary in such transactions [2nd restate 194]. This is true even if the principal has previously forbidden the agent to incur such debts so long as the transaction is in the usual course of busn engaged in by the agent [2nd restate 195; 3rd restate 2.06] o Secret instructions or limitations placed upon the authority of an agent must be known to the party dealing with the agent, or the principal is bound as if the limitations had not been made. o A principal may be held liable for the unauthorized acts of his agent if the principal ratifies the transaction after acquiring knowledge of the material facts concerning the transaction Ratification o 2nd restate 82-83, 91-92, 94-96, 98-100A o 3rd restate 4.01-4.08 Ratification a principal may ratify the conduct of an agent who acted without authority. A principal may do so unless allowing ratification would be unfair to the 3rd party as a consequence of changed circumstances [3rd restate 4.05] 3

4 o Ratification is defined as the affirmance by a person of a prior act which did not bind him but which was done or professedly done on his account [2nd restate 82] Ratification requires acceptance of the results of the act with an intent to ratify and with full knowledge of all the material circumstances o If the original transaction was not purported to be done on account of the principal, the fact that the principal receives its proceeds does not make him a party to it [2nd restate 98 cmt f] Ratification, like actual authority, may be express or implied as long as there is an affirmance of the contract by the principal. The most common basis of implied ratification exists when a principal has knowledge of a transaction, accepts its benefits, and fails to repudiate it [2nd restate 94, 98-99; 3rd restate 4.01] A principals ratification must be complete to be valid. He cannot ratify part of a contract or transaction [2nd restate 96, 3rd restate 4.07] o Once a principal manifests affirmance, the contract is ratified. It is not necessary that the principal communicate the affirmance to the agent, the third party or any other person [2nd restate 95; 3rd restate 4.02(1)] o If a principal ratifies a contract, the effect is to validate the contract from the moment of its original formation. It is as if the ratification travels back in time to create the agents authority [2nd restate 82, 100-100A; 3rd restate 4.02(1)] o Consideration is not required to validate a ratification. Ratification may also operate in the absence of unjust enrichment or estoppels [2nd restate 82 cmt c, 92(e); 3rd restate 4.01 cmt b] o 2nd restate 8B o 3rd restate 2.05 Estoppel a principal who misleads a third party into believing that an agent has authority to effect a particular transaction is liable with respect to that transaction [2nd restate 8B; 3rd restate 2.05] o However the courts often require that the third party justifiably rely on the agents purported authority Must Show o Express or real authority o Implied authority OR o Apparent authority Where a proprietor of a place of busn by his dereliction of duty enables one who is not his agent conspicuously to act as such and ostensibly to transact the proprietors busn with a patron in the establishment, the appearances being of such a character as to lead a person of ordinary prudence and circumspection to believe that the imposter was in truth the proprietors agent, in such circumstances the law will not permit the proprietor defensively to avail himself of the impostors lack of authority and thus escape liability for the consequential loss thereby sustained by the customer [gross negligence]

Estoppel

Liability in Contract Agents Liability to Third Parties 2nd restate 9, 210-210A, 320-322, 329-330, 336-337 4

5 3rd restate 5.01, 6.01-6.03, 6.10 o If an agent with a third party on behalf of a disclosed principal, the agent is not liable on the contract absent a contrary agreement (2nd restate 320; 3rd restate 6.01(2)) Courts typically require clear proof of intent to bind the agent Conversely, when an agent contracts on behalf of a partially disclosed or undisclosed principal, the agent is normally liable on the contract unless the contract states otherwise (2nd restate 321-322; 3rd restate 6.02(2), 6.03(2)) o If the agent lacks the power to bind the principal, the third party may sue the agent for breach of warranty of authority or misrepresentation of authority (2nd restate 329-330; 3rd restate 6.10) Well settled that where one enters into a contract as agent for an undisclosed principal, he may be held individually liable on the contract In order for an agent to avoid personal liability on a contract negotiated in his principals behalf, the agent must disclose not only that he is an agent but also the identity of his principal, regardless of whether the third person might have knowth that the agent was acting in a representative capacity. o the disclosure of an agency is not complete for the purpose of relieving the agent from personal liability unless it embraces the name of the principal, without that, the party dealing with the agent may understand that he intended to pledge his personal liability and responsibility in support of the contract and for its performance. o Furthermore, the use of a trade name is not necessarily a sufficient disclosure of the identity of the principal and the fact of agency so as to protect the agent against personal liability nd 321 2 Restate liability of agent under circumstances where identify of principal is unknown/partially disclosed to other party o Agent is a party to the contract unless the agent gives such complete info concerning his principals identity that he can be readily distinguished. If the other party has no reasonable means of ascertaining the principal, the inference is almost irresistible and prevails in the absence of an agreement to the contrary The Third Partys Liability to the Principal 2nd restate 292, 302-304 3rd restate 6.01-6.03 o When the principal is undisclosed 2nd restate 302, 304 = the third party is bound to a contract if principal undisclosed and agent had authority unless (a) the principals existence is fraudulently concealed, or (b) the third party is induced to enter into the contract by a representation that the agent was acting for himself and the

6 agent or the principal has notice that the third party would not have dealt with the principal 3rd restate 6.03(2) = the third party is simply bound to a contract with an undisclosed principal who agent had actual authority [commenters believe that if agent coming in to trick 3rd party into doing busn with undisclosed principal then the contract could still be rescindable] o An undisclosed principal cannot require that a third party accept the principals performance instead of the agents if this substitution changes the performance contemplated by the contract (2nd restate 309; 3rd restate 6.03 cmt d) [vice versa] Not fraud or deceit either 2nd restate 304 = a person with whom an agent contracts on account of an undisclosed principal can rescind the contract if he was induced to enter into it by a representation that the agent was not acting for a principal and if, as the agent or principal had notice, he would not have dealt with the principal o No evidence that the appellants would not have dealt with the Crosses had their existence been known [need evidence in course of dealings] The Agents Duties to the Principal o 2nd restate 13, 376-396, 398-401, 403-404, 407 o 3rd restate 8.01-8.12 An agent has an obligation to act in the principals best interests rather than his own (2nd restate 13; 3rd restate 8.01) The law places three major duties on the agent: loyalty, care and obedience o Loyalty account to the principal for all profits from the transaction that have not been promised to the agent by contract (2nd restate 388, 3rd restate 8.02), refrain from acting as or on behalf of an adverse party (2nd restate 389, 391, 393; 3rd restate 8.03), refrain from competing with the principal (2nd restate 393; 3rd restate 8.04), refrain from using the principals property or confidential info for personal purposes or for a third party (2nd restate 395, 404; 3rd restate 8.05), disclose relevant info to the principal (2nd restate 381, 3rd restate 8.11), segregate the principals property and keep and render accounts (2nd restate 382, 398; 3rd restate 8.12) and act in accordance with a general duty of good conduct (2nd restate 380; 3rd restate 8.10) o Care flows from the parties implicit assumption that the agent will carry out his duties with reasonable care (2nd restate 379; 3rd restate 8.08) o Obedience flows form the nature of the agency definition, which specifies that the agent must be subject ot the principals control. As a consequence, the agent must act only as authorized by the principal and must obey the principals instructions (2nd restate 383, 385; 3rd restate 8.09). must perform any contractual duties owned to the principal (2nd restate 376-377; 3rd restate 8.07) Violations void a contract restate 407(1) if an agent has received a benefit as a result of violating his duty of loyalty, the principal is entitled to recover from him what he has so received, its value, or its proceeds, and also the amount of damage thereby caused, except that if the violation 6

7 consists of the wrongful disposal of the principals property, the principal cannot recover its value and also what the agent received in the exchange therefore principal is entitled to be indemnified by the agent for any loss which has been caused to his interests by the improper transaction

Principals Duty to the Agent o 2nd restate 432, 435, 437-438, 441, 470 o 3rd restate 8.13-8.15 The principal and agent may specify their mutual obligations by contract, and the principal is, of course, required to comply with such contractual obligations [2nd restate 432; 3rd restate 8.13] In addition, b/c the agent is acting on the principals behalf, the law will often imply certain duties that the principal has to the agent, including duties to: (a) compensate the agent for services [2nd restate 441; 3rd restate 8.13 cmt d] (b) indemnify the agent for expenses [2nd restate 438; 3rd restate 8.14] (c) provide the agent with information concerning the risks of physical hamr or pecuniary loss attendant to his agency [2nd restate 435; 3rd restate8.15] (d) refrain from injuring the agents busn reputation or self respect [2nd restate 437; 3rd restate 8.15 cmt d] and (e) provide a safe working environment for agents who are servants [ 2nd restate 470]. The 3rd restate also includes a duty to deal with the agent fairly and in good faith [8.15] Under all evidence, were the circumstances such that the plaintiff could reasonably assume he was to be paid and that the defendant should have reasonably expected to pay for such services Imputing an Agents Knowledge to the Principal o 2nd restate 268, 272-273, 277, 282 o 3rd restate 5.02-5.04 Notification given to an agent is effective as notification ot the principal when the agent has actual or apparent authority to receive notification, unless the 3rd party knows or has reason to know that the agent is acting adversely to the principal [2nd restate 268(1); 3rd restate 5.02(1)] o A similar rule applies to notification given by an agent [2nd restate 268(2); 3rd restate 5.02(2)] An agents knowledge is imputed to the principal when the agent acquired the knowledge acting within the scope of his actual authority, but not when acting within the scope of his apparent authority (unless a third party relied on the appearance of an agency relationship) [2nd restate 272-3; 3rd restate 5.03 (providing that knowledge that is material to the agents duties to the principal may be imputed)] When an agents knowledge is imputed to the principal, the principal is charged not only with the agents actual knowledge, but also with information that the agent has reason to know [2nd restate 272 cmt b; 3rd restate 5.03] o Nevertheless, the 2nd restate provides that unless a principal has a duty to use care in obtaining info, the principal is not responsible for info that the agent should have acquired but did not acquire in the performance of the agents duties [2nd restate 277; 3rd restate does not contain this exception]

8 2nd restate provides that when an agent is acting adversely to the principal, the agents knowledge is not imputed to the principal unless: (a) the agents failure to reveal or act on the information results in the violation of a duty owed by the principal to a third party (b) the agent negotiates with a third party who reasonably believes tha thte agent is acting within the scope of his authority (c) the principal, before changing his position, knowingly retains a benefit through the act of the agent that he would not otherwise have received [2nd restate 288] o 3rd restate provides more generally that when an agent is acting adversely to the principal, the agents knowledge is not imputed to the principal unless such imputation is necessary to protect het rights of a third party acting in good faith, or when the principal has ratified or knowingly retained a benefit from the agents action [3rd restate 5.04] (note differences)

Termination of Agency Relationship o 2nd restate 105-125, 138-139 o 3rd restate 3.06-3.13 With respect to principal sand agents who are individuals, the death of either the principal or the agent terminates the agency relationship [2nd restate 120(1), 121; 3rd restate 3.07(1),(2)] o With respect to principals and agents that are not individuals, the 3rd restate also provides that the agency relationship is terminated when the principal or agent ceases to exist, commences a process that will lead to cessation of existence, or has its powers of operation suspended [3rd restate 3.07(3), (4)] 2nd restatement provides a laundry list of changed circumstances that may cause an agency relationship to terminate o 105 lapse of time o 106 accomplishment of authorized act o 107 happening of specified events o 108 happening of unspecified events or changes o 109-change in value of busn conditions o 110 loss or destruction of subject matter o 111 loss of qualification of principal or agent o 112 disloyalty of agent o 113 bankruptcy agent o 114 bankruptcy of principal o 115 war o 116 change of law o 124 impossibility 3rd restatement takes a more general approach o Actual authority exists when at the time of taking the action that has legal consequences for the principal, the agent reasonably believes, in accordance with the principals manifestations to the agent, that the principal wishes the agent so to act [3rd restate 2.01] The principal and agent may, of course, simply terminate the agency relationship by mutual agreement [2nd restate 117; 3rd restate 3.09]

9 o The agent, may, however, continue to have apparent authority with respect to third parties who lack notices of the termination [2nd restate 125; 3rd restate 311(2) (providing that apparent authority terminates when it is no longer reasonable for the third party to believe that the agent continues to act with actual authority)] The principal or agent may terminate the agency relationship at will, even when such termination constitutes a breach of contract [2nd restate 118-119; 3rd restate 3.10] o One major exception to revocability at will: the agents authority may not be revoked if it involves a power given as security If a power be coupled with an interest it survives the person giving it and may be executed after his death o The breaching party will be liable under contract law for any damages caused to the other party o 2nd restate 5, 77-80, 137, 142, 283, 406, 428, 458 o 3rd restate 3.15 According to the 2nd restatement, an agent may appoint a subagent, who is subject to the control of the agent as well as the principal, and may delegate tasks to the subagent if the agent has actual, apparent or inherent authority to make such an appointment [2nd restate 5 cmt. (a), 77] The 3rd restatement has a similar provision but does not include the power to appoint a subagent pursuant to inherent authority b/c the third restatement does not recognize the concept of inherent authority [3rd restate 3.15] A principal may also empower an agent to appoint another agent to act directly on the principals behalf. In this circumstance, the newly appointed agent is called a co-agent or simply an agent rather than subagent [2nd restate 5 cmt. (a); 3rd restate 3.15 cmt. (b)] o Subagents may be appointed in series If an agent has express actual authority to appoint a subagent, there is generally no difficulty in finding that a subagency relationship has been created o Implied actual authority in this context depends on what a reasonable person in the agents position would infer from the principals manifestations in light of all of the relevant circumstances [2nd restate 77; 3rd restate 3.15 cmt (c)] If the principal is aware that the agent has employees, there is usually implied consent for the agent to delegate tasks to his employees. When the agent is a corporation or other entity rather than an indiv, the agent has no choice but to act through subagents [2nd restate 80(b)(c)(d); 3rd restate 3.15 cmt (c)] A subagency relationship may also be created through apparent authority. Even if secretly forbidden to appoint subagents, if appointed, the subagent will bind the principal with respect to third parties who were unaware of the sever restrictions [2nd restate 5 cmt. (a), 142; 3rd restate 3.15 cmt (c)] o Of course the agent will be liable to the principal for disobeying the principals instructions According to the 2nd restate, a general agent may have inherent authority to appoint subagents when such appointments are a normal incident of the agents position without regard to whether the principal forbids the exercise of such power [2nd restate 5 cmt. (a)]

Subagency

10 In the event of conflicting instructions, the subagent should obey the principal [2nd restate 428 & cmt (b); 3rd restate 3.15 cmt (d)] The principal and the appointing agent both owe the duties of a principal to the subagent, except that the principal is not subject to duties created by agreements btwn the appointing agnet and the subagent (including compensation agreements) [2nd restate 458; 3rd restate 3.15 cmt (d)] Any knowledge acquired by the subagent will be imputed to the principal if such knowledge would have been imputed if acquired by the appointing agent [2nd restate 283; 3rd restate 3.15 cmt (d)] The appointing agent is responsible to the principal for the subagents actions. o Thus if a subagents misconduct exposes the principal to liability, the principal has a right of indemnity against both the appointing agent and the subagent. o If the subagent acts without authority, only the principal may ratify the subagents conduct (unless the appointing agent has authority to ratify) [2nd restate 406 & cmt (b); 3rd restate 3.15 cmt (d)] A principal may terminate the subagency relationship by communicating his intentions to either the appointing agent or the subagent o 2nd restate 137 cmt (b) a communication to the appointing agent terminates the subagency relationship, but termination does not become operative as to the subagent until the appointing agent has had time to communicate with him o 3rd restate 3.15 cmt (e) a communication to the appointing agent terminating the subagency relationship is not effective relative to the subagent until the subagent receives notice of termination

CHAPTER THREE: THE PARTNERSHIP General choice of law principles suggest that a court will apply the law of the state with the most significant relationship to the partnership and transaction at issue o May vary this by agreement o A choice of law provision will be invalidated only if: (a) there is no substantial relationship btwn the state whose law is chosen and the parties or the transaction at issue, and there is no other reasonable basis for the parties choice; or (b) the state whose law would otherwise have applied has a materially greater interest in the controversy and has a fundamental policy interest that would be contravened by application fo the chosen states law Formation o Uniform Partnership Act 6-7 [UPA] o Revised Uniform Partnership Act 101(6), 202 [RUPA ~ Texas] May be created informally o No written agreement is required to form a partnership o May be created without filing any organizational documents with the state Most Important Partnership Rules o Every partner has the right to perform the partnerships busn and to participate in the management of the partnership. Partners have equal voting power o Partners share equally in the profits and losses of the partnership 10

11 o The partnership is liable for contracts entered into by partners acting with actual or apparent authority. (this cannot be varied by agreement) The partnership is also liable for torts committed by partners acting with authority or in the ordinary course of the partnership busn Partners are personally liable to third parties for the obligations of the partnership o It takes unanimous agreement to admit new partners o Partners owe fiduciary duties to each other o Every partner may dissolve an at will partnership A partnership is an association of two or more persons to carry on as co-owners a busn for profit [UPA 6(1); RUPA 202(a)] Partnerships are established in common law by four factors o An agreement to share profits o An agreement to share losses o A mutual right of control or management of the enterprise o A community of interest in the venture However, the partnership definition in UPA and RUPA are more general o What matters is whether the parties have created the kind of association defined by statute to be a partnership o An agreement to share profits is by far the most important indicator of partnership status [UPA 7(4); RUPA 202(c)(3)) However both UPA and RUPA make exceptions if profits are distributed as (a) payment of a debt (b) wages to an employee or rent to a landlord (c) an annuity to a widow or representative of a deceased partner (d) interest on a loan (e) consideration for the sale of the goodwill of a busn or other property [UPA 7(4); RUPA 202(c)(3)] o Whether a partnership exists is by applying the definition of a partnership to the totality of the circumstances on a case by case basis Partnership by Estoppel o UPA 16 o RUPA 308 Partner by estoppel [UPA 16] when a person, by words spoken or writted or by conduct, represents himself, or consents to another representing him or anyone, as a partner in an existing partnership or with one or more persons not actual partners, he is liable to any such person to whom such representation has been made, who has, on the faith of such representation, given credit to the actual or apparent partnership, and if he has made such representation or consented to its being made in a public manner he is liable to such person, whether the representation has or has not been made or communicated to such person so giving credit by or with the knowledge of the apparent partner making representation or consenting to its being made Aggregate vs Entity Status o UPA 6, 10, 18(g), 24, 26-27, 29, 31-32, 41 11

12 As soon as a partner leaves the partnership dissolves Aggregate theory Partnership not separate from the partners o RUPA 201, 307, 801-802 A partnership is an entity distinct from its partners Entity theory Partnership different from the partners Federal Tax Consequences o A partnership is taxed on a pass through basis o A partnership is required to file a separate tax return reflecting the receipts and expenditures of the busn However no tax is paid with this return The net income or loss from the partnership operations is allocated among the partners and then carried over to each partners indiv return

Management and Control UPA 18(h) [RUPA 401(j)] any difference arising as to ordinary matters connected with the partnership busn may be decided by a majority of the partners [mandatory] o If no differences, partners can make ordinary decisions in the course of busn What is ordinary is not specified and is determined as a question of fact o If it is an extraordinary decision not in the course of busn, then you need the majority of partners consenting UPA 18(e) [RUPA 401(f)] bestows equal rights in the management and conduct of the partnership busn upon all the partners o It is manifestly unjust to permit recovery of an expense which was incurred individually and not for the benefit of the partnership but rather for the benefit of one partner acts in contravention of the partnership agreement require unanimous consent [RUPA 401 cmt 11] o amendments to the partnership agreements requires unanimous consent Financial Rights and Obligations Partnership Accounting o Capital Accounts The capital investment held by each party is simply a reflection the relative claims of the partners to the assets of the partnerships o Draw Term used to decided cash distributions to partners The amount of the draw of each partner is determined by majority vote of the partners (absence another express agreement) and may be more or less than the profit The draw would reduce their capital investment in the firm o Capital Accounts and Value of a Partners Interest Profit or loss of the busn is distributed evenly across the partners capital investment in the firm (unless agreed otherwise) Sharing Profits and Losses 12

13 UPA 18(a), (b), (f) RUPA 401(b), (c), (h) o General rule is that in the absence of an agreement to such effect, a partner contributing only personal services is ordinarily not entitled to any share of partnership capital pursuant to dissolution Personal services may qualify as capital contributions to a partnership where an express or implied agreement to such effect exists o To be distinguished from non cash capital contributions to a partnership, an agreement is usually needed Liabilities to Third Parties UPA 4(3), 9, 13-15, 17 RUPA 104(a), 201, 301, 305-307 o Under the UPA, the partnership is liable for contracts entered into by partners acting with actual or apparent authority [UPA 9] The partnership is liable to third parties in tort for wrongful acts or omissions of partners acting with authority or in the ordinary course of the partnership [UPA 13] The partnership is also liable for certain breaches of trust committed by partners [UPA 14] Although UPA establishes partnership liability, it does not state that the partnership may be sued directly because, the UPA does not recognize the partnership as an entity. Partners are jointly and severally liable for partnership obligations pursuant to UPA 13-14 [UPA 15(a)] When liability is joint and several, a plaintiff may sue the partners together or individually. However, when liability is merely joint, a plaintiff must sue all of the partners in a single action Thus UPA makes it substantially easier to sue partners in tort than in contract o Under RUPA, a partnership is an entity distinct from its partners and that a partnership may sue and be sued [RUPA 201(a), 307(a)] Also, partners are jointly and severally liable for all obligations of the partnership [RUPA 306(a)] RUPA creates a hurdle for partnership creditors that is not present in UPA. Under RUPA, although a creditor may sue the partnership and the partners in a single action, a creditor may not collect his judgment against a partner unless he ahs a separate judgment against the partner and (a) he has attempted unsuccessfully to enforce judgment against the partnership (exhaustion requirement); (b) the partnership is in bankruptcy; (c) the partner has waived the exhaustion requirement by contract; (d) a court waives the exhaustion requirement; or (e) the partners is independently liable to the plaintiff [RUPA 307(c), (d)] o Liability in Contract UPA (9) every partners is an agent of the partnership for the purpose of its busn and the act of every partner, including the execution in the 13

14 partnership name of any instrument, for apparently carrying on in the usual way the busn of the partnership of which he is a member binds the partnership, unless the partners so acting ahs in fact no authority to act for the partnership in the particular matter, and the person with whom he is dealing has knowledge of the fact that he has no such authority The act of a partner binds the firm, absent an express limitation of authority know to the party dealing with such partner o Liability in Tort Liability is imposed on a partner for the tortious acts of his partner only where (1) the act occurred in the ordinary course of the partnerships busn or (2) the tortfeasor partner acts with the authority of his partner or partners Generally, authority to manage a busn includes authority to (1) make contracts which are incidental to such busn, are usually made in it or are reasonable necessary in conducting it; (2) to procure equipment and supplies and to make repairs reasonably necessary for the proper conduct of the busn; (3) to employ, supervise or discharge employees as the course of busn may reasonable require; (4) to sell or otherwise dispose of goods or other things in accordance with the purposes for which the busn is operated; (5) to receive payment of sums due the principal and to pay debts from the principal arising out of the busn enterprise and (6) to direct the ordinary operations of the busn [2nd restate agency 73] Under RUPA a partnership is a separate and distinct entity from the partner members. Thus to recover against the partners individually, one must prove a contract against each partner of the partnership Two ways to establish the indiv liability of a partner o Prove a separate contract o Prove that partnership assets have been exhausted Once partnership assets have been exhausted, a partnership creditor becomes a creditor of the indiv partner with the same rights and upon the same level as the partners other indiv creditors Under joint liability, once all the debtors are named in the suit and judgment is entered against them, the creditor may force any one of the debtors to pay all of the judgment o Each debtor is responsible for the entire sum Indemnity and Contribution UPA 18(a), (b), 40(b), (d) RUPA 401(b), (c), 807(a), (b) o If a partner pays a partnership obligation, he is entitled to be indemnified by the partnership [UPA 18(b); RUPA 401(c)] o If the partnership is unable to pay, the other partners must contribute and pay according to their loss shares [UPA 18(a); RUPA 401(b)] o The partners may also be required to contribute to satisfy creditors, including partner creditors, on dissolution [UPA 40(b)(I), (b)(II), (d); RUPA 807(a)(b)] 14

15 o Thus as btwn partners and the outside world, every partner is liable for partnership obligations Any third party may collect the entirety of a partnership obligation from any partner under UPA and from any partner under RUPA if a judgment against the partnership goes unsatisfied Ownership Interests and Transferability Partnership Property UPA 8, 25 RUPA 201(a), 203-204, 501 o UPA 8(1) provides that all property originally brought into the partnership stock or subsequently acquired by purchase or otherwise, on account of the partnership, is partnership property UPA 8(2) presumption that property bought with partnership funds is partnership property o Although the UPA takes the aggregate theory of partnership, UPA 25 replicates a situation where the partnership, rather than the partners, owns partnership property o RUPA with its separate entity theory views that the partnership, rather than the indiv partners, owns partnership property [201(a), 203] o RUPA provides consistently that a partner is not a co-owner of partnership property and has no interest in partnership property which can be transferred, either voluntarily or involuntarily [501] o RUPA provides that property is deemed to be partnership property when acquired: (a) in the partnerships name or (b) in the name of one or more partners if the document transferring titlte to the property references the acquiring partners status as a partner or the existence of a partnership Presumption that property bought with partnership funds is property of the partnership otherwise property is presumed to be a partners indiv property [RUPA 204(c),(d)] Admitting New Partners vs. Assigning Partnership Interests UPA 18(g), 24, 26-28 RUPA 401(i), 502-504 o Consent needed by all the partners in order to admit new members into the partnership An assignee of an interest in the partnership is not entitled to interfere in the management or administration of the partnership busn but is merely entitled to receive the profits to which the assigning partner would otherwise be entitled The Rights of a Partners Creditors UPA 28, 31(5), 32(2), 40(h) RUPA 504, 601(6), 701, 801 o A partners judgment creditor may obtain a charging order against the partners interest in the partnership [UPA 28(1); RUPA 504(a)] This order permits the creditor to receive any partnership distributions to which the partner would otherwise be entitled. However, the partner 15

16 retains full rights to participate in the management of the partnership and the creditor receives no such rights The creditor may obtain foreclosure of the partners interest in the partnership, which the creditor or a third party may purchase [UPA 28(2); RUPA 504(b)] The foreclosure purchaser may cause a judicial dissolution of the partnership if the partnerships term has expired or if the partnership was at will at the time the charging order was obtained [UPA 32(2); RUPA 801(6)] On dissolution, the foreclosure purchaser receives the debtorpartners share o Under UPA, a judgement creditor may also cause a dissolution fo the partnership by putting the debtor-partner into bankruptcy [UPA 31(5)]. By contrast, under RUPA, a debtor-partners bankruptcy merely dissociates the partner from the partnership [RUPA 601(6)(i)]. The other partners may choose to dissolve the partnership as a consequence [RUPA 801(1), (2)(i)] If the other partners choose to continue the partnership, the dissociated partners has the right to be bought out by the partnership [701(a), (b)] o What if the partnership and the debtor-partner both end up in bankruptcy? UPA 40(h) partnership creditors have priority with respect to partnership assets, and the partners separate creditors have priority with respect ot the partners indiv assets Bankruptcy code allows partnership creditors who go unsatisfied with partnership assets, to take on par with the partners separate creditors with respect to the partners indiv assets o Hellman v. Anderson (Ca ct app 1991) Court holds that a judgment debtors interest in a partnership may be foreclosed upon and sold, even though other partners do not consent to the sale, provided the foreclosure does not unduly interfere with the partnership busn A partners right in specific partnership property is different from his interest in the partnership The property rights of a partner are (1) his rights in specific partnership property, (2) his interest in the partnership and (3) his right to participate in the management Judicial authority to order foreclosure and sale of the charged interest b/c the interest charged may be redeemed at any time before foreclosure, or in case of a sale being directed by the court may be purchased by nondebtor partners without causing a dissolution of the partnership In some cases, foreclosure might cause a partner with essential managerial skills to abandon the partnership. In other cases, foreclosure would appear to have no appreciable effect on the conduct of partnership busn

16

17 Effect of foreclosure on a partnership should be evaluated on a case by case basis by the trial court in connection with its equitable power to order a foreclosure

Fiduciary Duties Codification of Fiduciary Duty and Contractual Waiver UPA 21-22 RUPA 103, 404 o UPA 21 every partner must account ot the partnership for any benefit, and hold as trustee for it any profits derived by him without the consent of the other partners, from any transaction connected with the formation, conduct or liquidation of the partnership or from any use by him of its property If UPA 21 is violated, any aggrieved partner has the right to an accounting [UPA 22(c)] o RUPA 404(a) the only fiduciary duties a partner owes to the partnership and the other partners are the duty of loyalty and the duty of care set forth in (b) and (c) (b) (1)to account to the partnership and hold as trustee for it any property, profit or benefit derived by the partner in the conduct and winding up of the partnership busn or derived from a use by the partner of partnership property, including the appropriation of a partnership opportunity; (2) to refrain from dealing with the partnership in the conduct or winding up of the partnership busn as or on behalf of a party having an interest adverse to the partnership; and (3) to refrain from competing with the partnership in the conduct of the partnership busn before the dissolution of the partnership (d) - imposes on partners an obligation of good faith and fair dealing when discharging any duties owed to the partnership and the other partners or when exercising any rights (e) - a partner does not violate any duty or obligation merely b/c the partners conduct furthers the partners own interest Unlike a true fiduciary, every partner has legitimate, selfish interests (f) permits a partner to lend money to and transact other busn with the partnership and as to each loan or transaction the rights and obligations of the partner are the same as those of a person who is not a partner, subject to other applicalbe law o Whereas UPA 21(a) applies to the formation, conduct or liquidation of the partnership, RUPA 404(b)(1) and (2) applies only to the conduct and winding up of the partnership busn o Most of RUPAs rules may be altered by agreement. Among the few exceptions are the rules governing a partners duties. Partners may not eliminate the duty of loyalty by contract [103(b)(3)] However, they may identify specific types or categories of activities that do not violate the duty of loyalty, if not manifestly unreasonable [103(b)(3)(i)]

17

18 Similarly, partners may not unreasonably reduce the duty of care [103(b)(4)] Partners also may not eliminate the obligation of good faith and fair dealing but they may prescribe the standards by which such obligation is measured if the standards are not manifestly unreasonable [103(b)(5)]

Duty of Disclosure o UPA 19-20 o RUPA 103(b), 403 Under UPA, a partnership is required to keep books and to make them available to partners for inspection and copying [19] o Beyond this, UPA contains a narrow version of a partners duty of disclosure: partners shall render on demand true and full information of all things affecting the partnership to any partner [20] RUPA also requires that a partnership give every partner access to the partnerships books and records [403(b)] o However, RUPA contains an affirmative obligation to make certain disclosures It requires that each partner and the partnership furnish without demand any info concerning the partnerships busn and affairs reasonably required for the proper exercise of the partners rights and duites under the partnership agreement or RUPA [403(c)(1)] Requires each partner and the partnership to furnish on demand any other info concerning the partnerships busn and affairs, except to the extent the demand or the info demanded is unreasonable or otherwise improper under the circumstances [403(c)(2)] RUPA 404(a) limits a partners fiduciary duties to the duties of loyalty and care described in 404(b) and 404(c) o The duty of disclosure is contained in 403. o Moreover, RUPA places few restriction on the ability to waive disclosure obligations 103 contains a list of the rules that may not be varied by agreement, provides that the partners may not unreasonably restrict the right of access to books and records under 403(b) [103(b)(2)] Does not address the duty to make disclosures pursuant to RUPA 403(c). therefore the 403(c) duties may be varied or eliminated by agreement [403 cmt (c)] Duty of Care RUPA 404(c) o Provides that a partner must be guilty of more than negligent mismanagement before he is liable o A partners duty of care to the partnership and the other partners in the conduct and winding up of the partnership busn is limited to refraining from engaging in grossly negligent or reckless conduct, intentional misconduct or a knowing violation of law. The partners may not unreasonably reduce the duty of car by contract [103(b)(4)] 18

19 Under UPA it is not clear that a partner has standing to bring suit for mismanagement or other torts. o Other than the right to seek an accounting pursuant to UPA 22 the only available statutory remedy appeasrs to be dissolution [31] o UPA 13 governs liability based on any wrongful act or omission by any partner acting in the ordinary course of the busn of the partnership applies only to injuires to any person, not being a partner in the partnership Language appears to preclude one partner form suing the partnership or the other partners for mismanagement or other torts RUPA 305(a)s intent is to allow partners to sue the partnership based on wrongful acts or omission committed in the ordinary course of the partnerships busn RUPA 405(b) permits a partner to maintain certain actions against the partnership or the other partners including actions for breach of fiduciary duty o UPA 21-22 o RUPA 405 UPA 22 a partner may assert a breach of fiduciary duty claim against a co partner as part of an accounting action o An accounting action involves an all encompassing review of the partnerships affairs and the partners obligation to each other. At common law an accounting action had to be preceded by dissolution o UPA 22 makes clear that dissolution is no longer required to obtain an accounting o The difficult question under UPA is whether an accounting action is the exclusive means by which a partner can seek recourse for breach of fiduciary duty or for violation of other legal duties Usual and normal remedy for a breach of fiduciary duty or other legal conflict among partners is an accounting o A party seeking an accounting must introduce sufficient evidence to enable the court to make a definitive accounting that states the true condition of the affairs btwn the partners

Remedies

Dissolution o UPA 29-33, 37-38, 40 Events Causing Dissolution UPA 29 the dissolution of a partnership is the change in the relation of the partners caused by any partner ceasing to be associated in the carrying on as distinguished from the winding up of the busn Rule reflects UPAs aggregate theory of partnership The separation of any partner from the partnership causes dissolution as a different aggregate of the partners would remain The partnership still remains to wind up its affairs, pay off creditors, and distribute what is left to the partners [UPA 30,37] 19

20 UPA 31(1)(b) default rule that a partnership is terminable at will by any partner The partners may agree, formally or informally, that the partnership will continue for a definite term or particular undertaking o In any event, the partnership terminates when the term expires or the undertaking is completed [31(1)(a)] The partnership can be dissolved prior to the expiration of the term or the completion of the undertaking by the unanimous consent of all partners who have neither assigned their interests nor had them subjected to a charging order [31(1)(c)] The partnership can also be dissolved by the bona fide expulsion of any partner pursuant to the partnership agreement [31(1)(d)] The partnership can also be dissolved by (a) any event that makes it unlawful to carry on the partnership; (b) death of a partner; or (c) the bankruptcy of any partner or the partnership [31(3), (4), (5)] The partnership may also be dissolved by judicial decree [31(6), 32] o Under UPA 31(1)(d) and 38(1), the expulsion of a partner pursuant to a partnership agreement must be bona fide Consequences of Dissolution o Unless the exceptions discussed below apply, a partnerships dissolution commences the winding up of the partnerships affairs and leads to the partnerships ultimate termination [UPA 30] The partnership will need to complete transactions that have begun and sell its assets. Once the partnership assets are sold, the proceeds are distributed in the following order Nonpartner creditors are paid Partner creditors are paid Partners receive a return of their capital contributions Partners receive any remaining profits according to their relative profit shares [40(d)] If the partnership assets are insufficient to satisfy the partnerships liabilities, the partners must contribute according to their loss shares [40(d)] o After dissolution, a partner may bind the partnership when acting to wind up the busn or to complete unfinished transactions [33] o In addition a partner retains apparent authority to bind the partnership in transactions with third parties A partner may bind the partnership in a transaction with a third party if the partners acts would have bound the partnership before dissolution, unless the third party receive knowledge or notice of the dissolution or the partnership publishes a notice of dissolution in a newspaper of general circulation in every place where the partnership regularly does busn o Among the partners, a partners authority to act for the partnership, other than in connection with winding up the busn and completing unfinished transactions, terminates: (a) upon dissolution when dissolution occurs other than by act, bankruptcy or death of a partner; (b) upon knowledge of dissolution when dissolution 20

21 is caused by the act of a partner; (c) upon knowledge or notice of dissolution when dissolution is caused by the death or bankruptcy of a partner [UPA 33-34] If a partner acts without authority under UPA 34, he may not call on his copartners to contribute to any liability that his actions have created o UPA aggregate theory of partnership requires that dissolution occurs whenever a partner leaves the partnership [29] However, dissolution does not always lead to liquidation of the partnership busn Upon a dissolution that is not wrongful, the busn must be liquidated unless otherwise agreed [38(1)]. Agreement must be unanimous and must include the consent of any departing partners. Partners may also agree in advance that a partners expulsion will not lead to liquidation. o The prevailing view under UPA is that dissolution cannot be prevented by agreement Instead, an agreement purporting to avoid dissolution will be construed as an agreement providing for the creation of a new partnership with the ability to continue the busn How to allocate liabilities btwn the old and new partnerships??? o After dissolution, the partners in the old partnership remain responsible for predissolution liabilities [36(1)] o The successor partnership succeds to the liabilities of its predecessor [41(1)] o A new partners liability for partnership obligatiosn incurred before his admission may be satisfied only out of partnership property [17] Wrongful Dissolution o The penalty for wrongfully dissolving a partnership can be severe Includes (1) expulsion from the partnership busn; (2) damages for breach of contract pursuant to UPA 38(2)(a)(II) and (3) a distributive share that does not reflect the goodwill of the busn

RUPA 201(a), 601-602, 701, 801-803, 807 Partnership Dissociation o Due to RUPAs entity view of partnership, RUPA is able to distinguish btwn partner dissociation and partnership dissolution o RUPA 601 provides the circumstances under which a partner becomes dissociated from a partnership Partnership has notice of the partners express will to withdraw An event agreed to in the partnership agreement as causing the partners dissociation occurs The partner is expelled pursuant to the partnership agreement The partner is expelled for misconduct by court order The partner becomes a debtor in bankruptcy The partner dies o RUPA 602(a) continues the rule that a partner may dissociate form a parnership at any time, whether such dissociation is rightful or wrongful.

21

22 In a partnership for a definite term or particular undertaking, a partners dissociation is wrongful when, prior to the expriation of the term or completion of the undertaking The partner withdraws by express will The partner is expelled by court order for misconduct The partner becomes a debtor in bankruptcy A partner is not a natural person is expelled or otherwise dissociated b/c it willfully dissolve or terminates [602(b)] o Pursuant to RUPA 601(5), a court may expel a partner for misconduct on the following grounds The partner has engaged in wrongful conduct that adversely and materially affects the partnership The partner commits a willful and persistent breach of the partnership agreement or a duty owed to the partners or partnership under RUPA 404 The partner engages in conduct relating to the partnership busn that makes it not reasonably practicable to carry on the busn in partnership with him o A partner who wrongfully dissociates form the partnership is liable to the partnership and the other partners for any damages caused by his wrongful conduct [602(c)] o A partners dissociation from a partnership pdoes not discharge his liability for partnership obligations incurred prior to his dissociation [703(a)] A partner who dissociates form a continuing partnership is generally not liable for partnership obligations incurred after his dissociation. However if the partnership transacts busn with a third party who lacks notice of the partners dissociation and reasonably believes that the dissociated partner is still a partner, the dissociated partner is laible o This potential liability continues for two years after the partners dissociation [703(b)] To protect himself against such liability, a dissociating partner may file a statement of dissociation o Non partners are deemed to have notice of such a statement 90 days after it is filed [704] o A new partner is not personally liable for partnership obligations incurred before his admission as a partner [306(b)] Partnership Dissolution o RUPA 801(1) continues the rule that a partner may dissolve an at will partnership at any time Tex Rev Civ State art 6132b, 7.01(a), 8.01(a) providing that partners have the right to a majority of the profits may decide to continue an at will partnership subject to a duty to buy out the withdrawing partner at fair value o A partnership for a definite term or particular undertaking is dissolved At the expiration for a definite term or on completion of the undertaking By unanimous agreement of the partners

22

23 Within 90 days of dissociation, by express will of at least half of the remaining partners when a partner has wrongfully dissociated himself from the partnership ursuant to RUPA 602(b) or become dissociated pursuant to RUPA 601(6-10) [RUPA 801(2)] o A partnership is also dissolved when An event specified in the partnership agreement as dissolving the partnership occurs An event that makes it unlawful to carry on the partnership busn occurs A court decrees dissolution because The econ purpose of the partnership is likely to be unreasonably frustrated A partner has engaged in conduct so that it is not reasonably practicable to carry on the partnership busn It is not reasonably practicable to carry on the partnership busn in conformity with the partnership agreement A transferee of a partners interest seeks dissolution [801(3-6) o Under RUPA partner creditors stand on the same footing as outside creditors [807(a)] o all profits and losses resulting from selling the partnerships assets are charged to the partners accounts in accordance with their profit and loss shares if positive than cash is received; if negative cash must be paid [807(b)] o a partnership is bound by a partners act after dissolution if the act is appropriate for winding up the busn the act would have bound the partnership before dissolution and the third party does not have notice of dissolution [804] o a partner who incurs partnership liability is liable to his co-partners for acts taken after he acquired knowledge of the partnerships dissolution [806] o a partner may file a statement of dissolution on behalf of the partnership [805(c)] third parties are deemed to have notice of such a statement 90 days after it is filed o even when RUPA provides that partner dissociation leads to dissolution, the partners may vary this outcome by agreement to the extent permitted by RUPA 103 unless dissolution occurs pursuant to RUPA 801(4), (5) or (6) the partners may agree that partner dissociation does not dissolve the partnership [103(b)(8)] in this circumstance, the partnership simply continues in existence despite the change in membership o the agreement must be unanimous and must include any partners dissociating from the partnership. In this event, the partnership is treated as if dissolution never occurred [802(b)] Buying Out Dissociated Partners o If a partnerships dissociation does nto result in dissolution of the partnership, the partnership continues in existence and a buyout of the dissociated partners interest occurs [701] 23

24 The buyout price is the amount the dissociated partner would have received upon dissolution, assuming that the partnership assets were sold at the greater of liquidation or going concern value [701(b)] Provision does not permit minority or marketability discounts in arriving at the buy out price If a partner wrongfully dissociates from the partnership, the buyout price is reduced by any damages caused by his wrongful conduct [701(c)] o No other penalty for wrongful dissociation o Contrary to UPA, there is no loss of goodwill value as a consequence of wrongful dissociation A prartner who wrongfully dissociates from a partnership for a term or undertaking does not receive his buyout share until the term expires or the undertaking is completed, unless a court finds that earlier payment will not cause undue hardship to the partnership [701(h)]

CHAPTER FOUR: THE CORPORATION Introduction Comparing the Partnership and the Corporation o A corporation can only be created by filing a certificate of incorporation with the state in accordance with statutory criteria. [partnership can be created informally] o A corporation is a distinct entity [UPA not distinct; RUPA distinct] o A corporation has a perpetual existence until and unless it is dissolved [partnership are easy to dissolve] Corporation dissolution requires approval by the corporations board of directors and shareholders o A corporation is governed by a board of directors chosen by the shareholders [partners govern the partnership] Shareholders otherwise vote only on fundamental transactions (mergers/dissolutions) o Shareholders of a corporation have limited liability [partnership partners personally liable] limited to the value of their investment o Corporation shares are freely transferable [not happening in partnership] o A corporation is taxed as a separate legal person [partnership taxed on a pass through basis] Choosing a State of Incorporation o The internal affairs of a corporation are normally governed by the jurisdiction of incorporation FORMATION Incorporation and its Aftermath Delaware General Corp Law 102-103, 107-109, 141, 151, 165, 211 Model Busn Code Annotated 2.01-2.07, 6.01-6.02, 6.20, 7.03, 8.06

24

25 o The first step in forming a corporation involves filing a certificate of incorporation with a state official, usually the Secretary of State Under the MBCA this document is called the articles of incorporation The corporation existence commences upon the filing of the certificate [DGCL 106; MBCA 2.03] There is a statutory list of items that the certificate must include [DGCL 102(a); MBCA 2.02(a)] Number of shares that the corp is authorized to issue and share classes o Cannot issue stock that is not authorized o May include statement that the board may fix the terms at the time of issuance [DGCL 102(a)(4), 151(a); MBCA 2.02(a)(2), 6.01(a), 6.02] May include any provision concerning the management of the corps busn or the conduct of the corps affairs that is not otherwise contrary to law [DGCL 102(b)(1); MBCA 2.02(b)(2)] After the certificate of incorporation is filed, the incorporators, or the initial directors if they are named in the certificate, call an organizational meeting [DGCL 108; MBCA 2.05] o If the incorporators call the meeting, they elect the initial board of directors o At the organizational meeting, the initial directors typically approve the following: (1) the certificate of incorporation; (2) the corporations minute book; (3) the form of stock certificate that will represent ownership of the corps shares; (4) the corporate seal The initial directors usually adopt bylaws at the corps organizational meeting o The bylaws may contain any provision not inconsistent with the certificate of incorporation or the law generally [DGCL 109(b); MBCA 2.06] the first annual meeting of shareholders is often held directly after the organizational meeting o the primary purpose of this meeting is to elect directors to replace the initial directors o the directors elected at this meeting hold office for one year or longer if the corp has a staggered board [DGCL 141(d), 211(c); MBCA 8.03, 8.06]

Financing the Corporation The only statutory requirement for the issuance of shares is that their authorized number and terms appear in the certificate of incorporation Corp may borrow money from a bank or directly from investors o May be secured by corps assets [bond] or stock [debenture] Preemptive Rights o DGCL 102(b)(3) o MBCA 6.30 Preemptive rights give existing shareholders the ability to subscribe proportionately to any new issuance of shares

25

26 o Preemptive rights enable shareholder to preserve their proportional stake in the corps assets, earnings and voting power o In most states preemptive rights do not exist unless they are granted by the certificate of incorporation [DGCL 102(b)(3); MBCA 6.30(a)] In closely held corps, protection against dilution is often important and preemptive rights may serve a real purpose o In order to preserve a shareholders relative position through the exercise of preemptive rights, the shareholder must make a further cash contribution to the corp

Promoters Contracts A promoter is someone who helps to found and organize a corp o A promoter will often make contracts for the corps benefit with the intention of causing the corp to adopt the contracts once it is formed o Question whether the corp comes to be liable on the contracts and if so, whether the promoter remains liable A corp which is incapable of authorizing an agreement made on its behalf prior to its existence may nevertheless adopt the agreement after its incorp Adoption may be manifested by the corps receipt of the contracts benefits with knowledge of its terms o A corp is therefore liable for the breach of an agreement executed on its behalf by its promoters where the corp expressly adopts the agreement or benefits from it with knowledge of its terms o It is axiomatic that the promoters of a corp are at least initially liable on any contracts they execute in furtherance of the corp entity prior to its formation The promoters are released from liability only where (1) the contact provides that performance is to be the obligation of the corp, (2) the corp is ultimately formed, and (3) the corp then formally adopts the contract A newly formed corp does not have the capacity to ratify pre-incorporation contracts made on its behalf b/c ratification requires the principal to exist at the time the contract was made [2nd restate 84(1), 86(1); 3rd restate 4.04] o However the corp may adopt pre-incorporation contracts according to rules that are similar to the rules governing ratification Ratification retroactively validates a contract from the time the contract was made Adoption makes a corp a party to a contract only form the movement of adoption Defective Incorporation o DGCL 105-106, 329 o MBCA 2.03-2.04 Considered in light that the plaintiffs knew they were dealing with a corp entity and not the indiv himself the de facto status of the corp suffices to absolve the person from indiv liability De facto status allows the shareholder to retain their limited liability in suits by third parties 26

27 o Three elements of de facto corp A statute that permits incorporation A bona fide attempt to incorp Some actual use or exercise of corporate privileges Corporations by Estoppel o A corp may not avoid a contract based on defective incorporation nor may it deny its corp status at a later time o A third party may not avoid a contract with a corp based on defective incorporation o Allows shareholders of a defective corp to retain their limited liability when a third party understands his contract to be with the purported corp o Robertson v. Levy (DC ct app 1964) Whether the president of an association which filed its articles of incorp, which were first rejected but later accepted, can be held personally liable on an obligation entered into by the association before the certificate of incorp has been issued or whether the creditor is stopped from denying the existence of the corp b/c after the certificate of incorp was issued, he accepted the first installment payment on the note Indiv is subjected to personal liability b/c before the date of contract, he assumed to act as a corp without any authority to do so An indiv who incurs statutory liability on an obligation b/c he has acted w/out authority is not relieved of that liability where at a later time, the corp does come into existence by complying with the contract o Subsequent partial payment by the corp does not remove this liability

The Ultra Vires Doctrine o DGCL 102, 122, 124 o MBCA 2.02, 3.02, 3.04 Under modern law, statutes permit a corp to state that it is created to perform any lawful act [DGCL 102(a)(3)] or make a declaration of purposes option [MBCA 2.02(b)(2)(i), 3.01(a)] o The ultra vires doctrine tends to be an issue only when conduct does not benefit the corp in any manner Court may set aside and enjoin the performance of the ultra vires contract if it deems such a course equitable MANAGEMENT AND OPERATION Allocation of Power o DGCL 109, 141-142, 211, 220, 223, 228, 242 o MBCA 7.02-7.04, 8.01, 8.06, 8.08-8.10, 8.40, 10.03, 10.20, 16.05 According to the traditional model of corporate governance, the board of directors appoints the officers and supervises the management of the corporations busn o The officers run the corps day to day affairs. 27

28 o The shareholders elect the board and vote on extraordinary matters Otherwise shareholders have little role in running the corps busn Directors are true fiduciaries in that they have a duty to act solely in the best interests of the corp. Although they manage corporate property on behalf of shareholders, directors are not agents of the shareholders Directors have greater informational rights than shareholders o Right to inspect the corps books and records as long as they do not have a purpose detrimental to the corp [DGCL 220(d); MBCA 16.05(a)]

Removal of Directors Unless the certificate or bylaws provide to the contrary, any director, or the entire board may be removed by the shareholders with or without cause [DGCL 141(k); MBCA 8.08(a) Three important restrictions on the shareholders ability to remove directors without cause o First, if a corp has a classified or staggered board, directors may be removed only for cause A classified board is usually divided into three groups with one group of directors standing for election each year. Each director is elected to a three year term [DGCL 141(d); MBCA 8.06] o In a corp that permits cumulative voting, if less than the entire board is to be removed, no single director may be removed if the votes cast against the removal would be sufficient to elect him o Whenever a particular class or series of stock has the right to elect one or more directors, only the shareholders eligible to vote for such directors are permitted to vote on the removal of such directors A director threatened with removal for cause is entitled to notice of the charges against him, an opportunity to be heard and a hearing o In the absence of a statute authorizing judicial removal of directors [MBCA 8.09] there is a split of authority on whether a court has the power to remove a director for cause It is generally settled that the board itself lacks the power to remove a director Interference with the Shareholder Franchise o DGCL 102, 109, 141, 212, 228, 242 o MBCA 2.02, 7.21, 8.02, 10.03, 10.20 Stroud v. Grace (De SC 1992) o Allegation that board of directors breached its fiduciary duties by recommending certain charter amendments to its shareholders o Board of directors did not act out of threat of lost control No improper corp purpose is crucial to analysis Must show abuse o Delaware corps have broad authority to adopt charter provisions

28

29 DGCL 102(b)(1) authorizes the inclusion in the certificate of incorp of any provision creating, defining, limiting and regulating the powers of the directors as long as they are not contrary to the laws of this state DGCL 141(b) permits the certificate of incrop or the bylaws to prescribe other qualifications for directors DGCL 242(b) no such charter amendment can be effected without stockholder approval Delaware law permits weighted voting [DGCL 212(a)]

Formalities Required for Board Action o DGCL 141, 229 o MBCA 8.20-8.25, 14.30 The general rule is that a board of directors may exercise its power only as a body at a meeting duly assembled o Directors may act by unanimous written consent in lieu of having a meeting [DGCL 141(f); MBCA 8.21] o Directors may participate in a board meeting by any method that allows all of the participants to hear each other [DGCL 141(i); MBCA 8.20(b)] o The board may delegate most matters to committees comprised of one or more directors [DGCL 141(c); MBCA 8.25] Delaware does not have statutory provisions dealing with the required notice for board meetings. The question is usually addressed in the bylaws o The MBCA states that unless the articles or bylaws provide otherwise, regular meetings of the board may be held without notice of the date, time, place or purpose of the meeting Special meetings require at least two days notice of the date, time, and place but do not require notice of the purpose of the meeting [MBCA 8.22] o A director may waive any notice requirement in writing. He may also waive notice by attending the meeting without objection [DGCL 229; MBCA 8.23] A quorum of directors is a majority of the total number of authorized directors o The certificate or bylaws may specify that any percentage greater or lesser than a majority constitutes a quorum but they may not specify a percentage less than one third of the total number of authorized directors [DGCL 141(b); MBCA 8.24(a)(b)] If a quorum exists, it takes a majority vote of the directors present to approve a matter. The certificate or bylaws may specify that a supermajority board vote is required [DGCL 141(b); MBCA 8.24(c)] In closely held corps, unanimous assent or acquiescence by directors is normally viewed as the equivalent of formal board action o Moreover, the dissenting directors are entitled to be informed of the action before it is taken When all of the shareholders of a closely held corp approve a transaction, courts often ignore the fact that the board, rather than the shareholders, was the body required to make the decision

29

30 The Authority of Officers o DGCL 142 o MBCA 8.40-8.44 A corp has such offices as are stated in its bylaws or in a board resolution that is not inconsistent with its bylaws Officers are chosen in a manner prescribed by the bylaws or the board of directors [DGCL 142; MBCA 8.40] o Usually the board of directors appoint officers The extent to which officers have authority to bind the corp is governed by the law of agency A president may have implied authority based upon the boards acquiescence to a course of conduct o The board can always ratify actions In jurisdictions that follow LEE, the president is normally thoguth to have at least apparent authority to bind the corp to ordinary but not extraordinary transactions Shareholder Action Formalities Required for Shareholder Action o DGCL 211, 213, 216, 219, 228-229 o MBCA 7.01-7.02, 7.04-7.07, 7.20, 7.25, 7.27-7.28 o The corp is required to hold an annual meeting of shareholders at which directors are elected [DGCL 211(b); MBCA 7.01(a)] In Delaware, unless otherwise provided in the certificate or bylaws, only the board of directors may call a special meeting of shareholders [DGCL 211(d)] Under the MBCA, owners of at least 10% of the shares entitled to vote may call a special meeting. The articles may alter this percentage bu may not raise it above 25% [MBCA 7.02] The shareholders must be sent notice of an annual or special meeting that specifies the date, time, and place of the meeting. The notice of meeting must be mailed at least ten days and not more than sixty days before the meeting [DGCL 222(b); MBCA 7.05] o Shareholders may waive defects in the notice in writing or by attending the meeting without objection [DGCL 229; MBCA 7.06] o In Delaware, to determine which shareholders are allowed to vote at a meeting, the board establishes a record date At least ten and not more than sixty days before the meeting Under the MBCA, unless otherwise provided in the bylaws, the board may set a record date that is not more than seventy days before the meeting [MBCA 7.07] If no date established then the record date is the day prior to the meeting [DGCL 213(a)]

30