Professional Documents

Culture Documents

Riverhead School District 2013-2014 Budget Presentation No. 1

Uploaded by

RiverheadLOCALOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Riverhead School District 2013-2014 Budget Presentation No. 1

Uploaded by

RiverheadLOCALCopyright:

Available Formats

All figures are subject to adjustment.

Riverhead CSD 2013-2014 Proposed Budget Presentation #1

Presented by Nancy Carney, Superintendent Riverhead Central School District Board of Education Meeting February 5, 2013

All figures are subject to adjustment.

All figures are subject to adjustment.

Agenda

Board of Education Budget Goals Tax Levy Cap Facts, Myths and Calculations State Aid in the Governors Budget Overview of Changes to the RCSD Program General Support Benefits Debt Service

All figures are subject to adjustment.

All figures are subject to adjustment.

BOE Budget Goals

To design and adopt a budget that stays within the Tax Cap limitations To design and adopt a budget that preserves programs for RCSD students to the greatest extent possible To design and adopt a budget that recognizes the current fiscal reality for Riverhead residents To highlight to state leaders in Albany that ever increasing mandates are financially unsustainable for the RCSD

All figures are subject to adjustment.

All figures are subject to adjustment.

Tax Cap What Does the Law Say?

Revenues raised by the district through property tax the levy can increase no more than approximately 2%, plus exempt items, year over year:

The exact figure is subject to a calculation of exemptions and revenue sources.

Exempt from the tax calculation:

Capital costs Some pension costs

All figures are subject to adjustment.

All figures are subject to adjustment.

Tax Cap What Does the Law Not Say?

Myth: The levy will rise no more than 2%.

Fact: Exempt items are added to the capped items, meaning the levy can rise above 2%.

Myth: The law exempts health insurance costs and mandates.

Fact: Health insurance and most state mandated expenses are not exempt under the law.

All figures are subject to adjustment.

All figures are subject to adjustment.

Impact on RCSD Program

If the budget is Rolled Over:

Estimated Budget To Budget Increase = $6,600,905 Estimated Tax Levy increase = 7.48%

The Roll Over Budget contains all contractual increases and necessary adjustments to preserve existing programs but does not include any cuts. Thus, to comply with the tax levy cap law, the 2013-2014 budget will have to be reduced by about $2 million.

All figures are subject to adjustment.

State Aid in the Governors Budget

All figures are subject to adjustment.

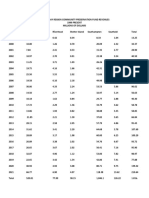

2012-2013 2013-2014 Actual Governor Foundation Aid $13,136,749 $13,136,749 Transportation $2,144,818 $2,942,568 BOCES & Excess Costs $1,554,888 $2,041,425 High Tax Aid $2,256,813 $1,225,869 Building Aid $800,036 $1,134,633 Instructional Materials $458,293 $488,744 Charter School $0 $218,633 Gap Elimination -$3,391,888 -$3,110,049 TOTAL $16,959,709 $18,078,572 +6.60%

All figures are subject to adjustment.

All figures are subject to adjustment.

Overview of Changes to the RCSD Program

At least 20 teachers will retire at the end of the 2012-2013 school year The resulting savings will allow for the preservation of all programs now in place Slight reductions to other areas with reduced needs because of changes in enrollment or completed programs.

All figures are subject to adjustment.

All figures are subject to adjustment.

General Support

Board Of Education Unpaid volunteers Central Administration Superintendents Office, Business Office, Personnel Office Auditing Three unfunded, mandated audits Data Processing State mandated testing District Insurance Real property and vehicle BOCES Administration - Mandated

All figures are subject to adjustment.

All figures are subject to adjustment.

General Support

2011-2012 2012-2013 2012-2013 2013-2014 Actual Adopted Revised Proposed Percentage Expenditure Budget Budget Budget Change

BOE, Clerk, Associations Superintendent's Office and Related Functions Business Administration & Auditing, Treasurer, Legal Personnel & Records, Mailing, Printing Insurance & Assessments BOCES Administration Total

All figures are subject to adjustment.

$110,850 $307,541

$134,386 $327,569

$134,698 $336,084

$135,315 $328,981

0.69% 0.43%

$949,398 $1,233,191 $1,269,948 $1,286,965 $874,072 $573,872 $865,451 $674,108 $876,522 $670,643 $860,634 $685,030

4.36% -0.56% 1.62% 4.00% 2.23%

$517,945 $550,127 $550,127 $572,132 $3,333,678 $3,784,832 $3,838,022 $3,869,058

All figures are subject to adjustment.

Benefits

Employees Retirement RCSD Paid Contribution System (ERS) and Rates of Gross Salary Teachers Retirement 2011- 2012- 2013System (TRS) are state 2012 2013 2014 mandated programs ERS 15.90% 18.90% 21.10%

(estimated)

RCSD also must TRS 11.11% 11.84% 16.25% provide health (estimated) insurance, unemployment benefits, and disability and workers compensation coverage

All figures are subject to adjustment.

All figures are subject to adjustment.

TRS Contribution Rates

25.00%

23.49% 21.40% 21.40% 18.80% 14.79% 8.41% 6.87% 5.63% 0.43%

1994-95 1996-97 1998-99 2000-01 2002-03

Mandatory Employer Contribution Rate

20.00% 15.00% 10.00% 5.00% 0.00% 1978-79

16.25% (estimated) 11.84%

2.52%

2004-05 2006-07 2008-09

6.19%

2012-13 2010-11

1980-81

1982-83

1984-85

1986-87

1988-89

1990-91

1992-93

Years

All figures are subject to adjustment.

All figures are subject to adjustment.

Benefits

2012-2013 Revised Budget 2013-2014 Proposed Budget Percentage Change 22.30% -2.09%

2011-2012 2012-2013 Actual Adopted Expenditure Budget ERS & TRS

$6,938,261 $8,990,296 $8,990,296 $10,995,553

Social Security $4,021,523 $4,781,552 $4,781,552 $4,681,831 Workers' Comp., Unemployment, Disability $1,329,258 $1,793,141 $1,793,141 $1,645,841 Health & Waivers, Misc. $10,692,172 $12,412,019 $12,310,306 $13,075,974 Total $22,981,214 $27,977,008 $27,875,295 $30,399,199

-8.21% 5.35% 8.66%

All figures are subject to adjustment.

About $1.16 million of pension costs are excluded from the Tax Cap calculation under the law.

All figures are subject to adjustment.

Debt Service

The district has certain existing debt obligations, including capital work approved by the voters in 1999 and bus purchases that are made annually. The district is beginning to repay a portion of the bonds authorized in October 2011. The district is also beginning to repay money borrowed under the Energy Performance Contract.

All figures are subject to adjustment.

All figures are subject to adjustment.

Debt Service

2012-2013 Adopted Budget 2012-2013 2013-2014 Revised Proposed Budget Budget Percentage Change

2011-2012 Actual Expenditure All Construction Bonds All Bus Purchases Energy Performance Contract All Library Bonds Total

$1,809,475 $1,351,150 $1,351,150 $322,463 $434,308 $434,308

$1,905,462 $569,047

41.03% 31.02%

$0

$0

$0

$583,088 $217,875 $3,275,472

--49.99% 47.47%

$437,263 $435,625 $435,625 $2,569,201 $2,221,083 $2,221,083

All figures are subject to adjustment.

All figures are subject to adjustment.

Future Presentations

Feb. 26 Regular Day School Budget, Transportation, Facilities March 12 Special Education, PPS, Guidance and Other Instructional Items March 19 Revenues and Projected Tax Levy April 9 Total Tentative Budget April 23 BOE Adoption of Proposed Budget May 21 Budget Vote (6 am 9 pm at local polling locations)

All figures are subject to adjustment.

All figures are subject to adjustment.

Questions?

Call or write to:

Nancy Carney Superintendent (631) 369-6716 nancy.carney@riverhead.net

All figures are subject to adjustment.

You might also like

- Draft Scope Riverhead Logistics CenterDocument20 pagesDraft Scope Riverhead Logistics CenterRiverheadLOCALNo ratings yet

- Riverhead Budget Presentation March 22, 2022Document14 pagesRiverhead Budget Presentation March 22, 2022RiverheadLOCALNo ratings yet

- RXR/GGV Qualified & Eligible Documents (Final 09.26.22)Document23 pagesRXR/GGV Qualified & Eligible Documents (Final 09.26.22)RiverheadLOCALNo ratings yet

- Riverhead Town Board Comprehensive Plan Status Discussion Feb. 17, 2022Document30 pagesRiverhead Town Board Comprehensive Plan Status Discussion Feb. 17, 2022RiverheadLOCALNo ratings yet

- AKRF Public Outreach Report AttachmentsDocument126 pagesAKRF Public Outreach Report AttachmentsRiverheadLOCALNo ratings yet

- Riverhead Town Proposed Battery Energy Storage CodeDocument10 pagesRiverhead Town Proposed Battery Energy Storage CodeRiverheadLOCALNo ratings yet

- N.Y. Downtown Revitalization Initiative Round Five GuidebookDocument38 pagesN.Y. Downtown Revitalization Initiative Round Five GuidebookRiverheadLOCALNo ratings yet

- Robert E. KernDocument3 pagesRobert E. KernRiverheadLOCALNo ratings yet

- 2022 - 03 - 16 - EPCAL Resolution & Letter AgreementDocument9 pages2022 - 03 - 16 - EPCAL Resolution & Letter AgreementRiverheadLOCALNo ratings yet

- Kenneth RothwellDocument5 pagesKenneth RothwellRiverheadLOCALNo ratings yet

- Juan Micieli-MartinezDocument3 pagesJuan Micieli-MartinezRiverheadLOCALNo ratings yet

- Catherine KentDocument7 pagesCatherine KentRiverheadLOCALNo ratings yet

- Peconic Bay Region Community Preservation Fund Revenues 1999-2021Document1 pagePeconic Bay Region Community Preservation Fund Revenues 1999-2021RiverheadLOCALNo ratings yet

- Yvette AguiarDocument10 pagesYvette AguiarRiverheadLOCALNo ratings yet

- Aguiar-Kent Campaign Finance Report 32-Day Pre GeneralDocument2 pagesAguiar-Kent Campaign Finance Report 32-Day Pre GeneralRiverheadLOCALNo ratings yet

- Riverhead Town Police Monthly Report July 2021Document6 pagesRiverhead Town Police Monthly Report July 2021RiverheadLOCALNo ratings yet

- Riverhead Town Police Report, August 2021Document6 pagesRiverhead Town Police Report, August 2021RiverheadLOCALNo ratings yet

- Evelyn Hobson-Womack Campaign Finance DisclosureDocument3 pagesEvelyn Hobson-Womack Campaign Finance DisclosureRiverheadLOCALNo ratings yet

- Old Steeple Church Time CapsuleDocument4 pagesOld Steeple Church Time CapsuleRiverheadLOCALNo ratings yet

- League of Women Voters of NYS 2021 Voters Guide: Ballot PropositionsDocument2 pagesLeague of Women Voters of NYS 2021 Voters Guide: Ballot PropositionsRiverheadLOCAL67% (3)

- Riverhead Town State of Emergency Order Issued May 12, 2021Document3 pagesRiverhead Town State of Emergency Order Issued May 12, 2021RiverheadLOCAL100% (1)

- 2021 General Election - Suffolk County Sample Ballot BookletDocument154 pages2021 General Election - Suffolk County Sample Ballot BookletRiverheadLOCALNo ratings yet

- Town of Southampton Police Reform PlanDocument308 pagesTown of Southampton Police Reform PlanRiverheadLOCALNo ratings yet

- Riverhead Town Marijuana SurveyDocument44 pagesRiverhead Town Marijuana SurveyRiverheadLOCALNo ratings yet

- Town of Riverhead Draft Solid Waste Management PlanDocument73 pagesTown of Riverhead Draft Solid Waste Management PlanRiverheadLOCALNo ratings yet

- Riverhead Police Reform Plan - FinalDocument96 pagesRiverhead Police Reform Plan - FinalRiverheadLOCALNo ratings yet

- "The Case of The DIsappering Landfill, or To Mine or Not To Mine" by Carl E. Fritz JR., PEDocument10 pages"The Case of The DIsappering Landfill, or To Mine or Not To Mine" by Carl E. Fritz JR., PERiverheadLOCALNo ratings yet

- Turtles of New York StateDocument2 pagesTurtles of New York StateRiverheadLOCALNo ratings yet

- 2021-2022 Proposed Budget SummaryDocument2 pages2021-2022 Proposed Budget SummaryRiverheadLOCALNo ratings yet

- Town of Riverhead Railroad Street TOD RedevelopmentDocument54 pagesTown of Riverhead Railroad Street TOD RedevelopmentRiverheadLOCALNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Nigeria Police Academy Past Questions Free Download - POLAC 2019Document16 pagesNigeria Police Academy Past Questions Free Download - POLAC 2019Charles Obaleagbon73% (22)

- Astm A391-A391m-07Document3 pagesAstm A391-A391m-07NadhiraNo ratings yet

- CHAP03Document28 pagesCHAP03Dheeraj ShuklaNo ratings yet

- Rules in Distribution of CLOA PDFDocument11 pagesRules in Distribution of CLOA PDFLuigi ReyesNo ratings yet

- NESCLDocument56 pagesNESCLSamNo ratings yet

- Answer Key To Newtons Laws of MotionDocument2 pagesAnswer Key To Newtons Laws of MotionMARICEL CANTARANo ratings yet

- The A To Z of The Vikings - Katherine Holman PDFDocument407 pagesThe A To Z of The Vikings - Katherine Holman PDFAnonymous zdK2Mr80% (5)

- Ss Case Study - Blue Marine Holdings BHDDocument9 pagesSs Case Study - Blue Marine Holdings BHDAnonymous lHeelqNo ratings yet

- Offer LetterDocument10 pagesOffer LetterAtul SharmaNo ratings yet

- Ifrs25122 PDFDocument548 pagesIfrs25122 PDFAmit Kemani100% (1)

- People v. Taperla Case DigestDocument2 pagesPeople v. Taperla Case DigestStef BernardoNo ratings yet

- SDRL Certificate of Conformity: SubseaDocument6 pagesSDRL Certificate of Conformity: SubseaJones Pereira NetoNo ratings yet

- America The Story of Us Episode 3 Westward WorksheetDocument1 pageAmerica The Story of Us Episode 3 Westward WorksheetHugh Fox III100% (1)

- Gerund or Infinitive Worksheet Like Love Dislike Enjoy Hate Would Like Would Rather Want Interested in Good at Bad at PDFDocument2 pagesGerund or Infinitive Worksheet Like Love Dislike Enjoy Hate Would Like Would Rather Want Interested in Good at Bad at PDFKeyEliiz OrdoñezNo ratings yet

- Block 3 - Group 1Document6 pagesBlock 3 - Group 1GavinIrhandyNo ratings yet

- Mendoza v. People, 886 SCRA 594Document22 pagesMendoza v. People, 886 SCRA 594EmNo ratings yet

- Drug MulesDocument1 pageDrug MulesApril Ann Diwa AbadillaNo ratings yet

- SESSIONAL - PAPER - No 14 2012 PDFDocument134 pagesSESSIONAL - PAPER - No 14 2012 PDFjohnNo ratings yet

- Rent RollDocument2 pagesRent Rolljlarios123No ratings yet

- Offences Against ChildDocument29 pagesOffences Against Child20225 SALONEE SHARMANo ratings yet

- Joint Affidavit of Birth Registration (Of Age)Document2 pagesJoint Affidavit of Birth Registration (Of Age)russell apura galvezNo ratings yet

- Travaux PreparatoriesDocument1 pageTravaux PreparatoriesJavi HernanNo ratings yet

- Business Ethics - Jai Prakash SinghDocument3 pagesBusiness Ethics - Jai Prakash SinghmitulNo ratings yet

- 2014 15 PDFDocument117 pages2014 15 PDFAvichal BhaniramkaNo ratings yet

- United States v. Ottens, 1st Cir. (1996)Document32 pagesUnited States v. Ottens, 1st Cir. (1996)Scribd Government DocsNo ratings yet

- Fall 2016 EditionDocument67 pagesFall 2016 EditionSC International ReviewNo ratings yet

- Global Systems Support: Cobas C 501Document2 pagesGlobal Systems Support: Cobas C 501Nguyễn PhúNo ratings yet

- India Delhi NCR Office Marketbeat Q1 2023 Ver2Document2 pagesIndia Delhi NCR Office Marketbeat Q1 2023 Ver2jaiat22No ratings yet

- SocialmediaplanDocument16 pagesSocialmediaplanapi-273580138No ratings yet

- Chironji Guthli E-Tender Condition 2015 & 2016 - 20161025 - 044915Document36 pagesChironji Guthli E-Tender Condition 2015 & 2016 - 20161025 - 044915Lucky ChopraNo ratings yet