Professional Documents

Culture Documents

Audit Sampling

Uploaded by

sanjay_kafleCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Audit Sampling

Uploaded by

sanjay_kafleCopyright:

Available Formats

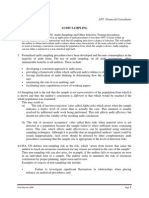

AUDIT SAMPLING

Client: ABC Sugar Mills Limited Audit For The Year Ended: September 30, 2008 Subject: Audit Sampling Audit Sampling (Sampling) involves the application of audit procedures to less than 100% of items within a class of transaction and account balance such that all sampling units have a chance of selection. Risk Considerations In Obtaining Audit Evidence In obtaining audit evidence, we will use professional judgment to access the risk of material misstatement (which includes inherent and control risk) and design further audit procedures to ensure this risk is reduced to an acceptably low level. Selecting Evidence Items For Testing To Gather Audit

When designing audit procedures, we will determine appropriate means of selecting items for testing. The means available to us are: (a) Selecting all items (b) Selecting specific items; and (c) Audit sampling Selecting All Items We may decide that it will be most appropriate to examine the entire population of items that make up a class of transactions or account balance (or a

stratum within that population). 100% examination is unlikely in the case of test of controls; however, it is more common for test of details. Selecting Specific Items We may decide to select specific items from a population based on such factors as our understanding of the entity, the assessed risk of material misstatement, and the characteristics of the population being tested. The judgmental selection of specific items is subject to nonsampling risk. Specific items selected may include: All items over a certain amount. We may decide to examine items whose value exceeds a certain amount so as to verify a large proportion of the total amount of class of transactions or account balance. Items to test control activities. We may use judgment to select and examine specific items to determine whether or not a particular control activity is being performed.

Sample Selection Method Haphazard selection, in which we select the sample without following a structured technique. Although no structured technique is used, we will not avoid any conscious bias or predictability ( For example avoiding difficult to locate items, or always choosing or avoiding the fast or last entries on a page) and thus attempt to ensure that all items in the population have a chance of selection. Haphazard selection is not appropriate when using statistical sampling.

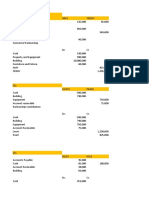

Following are the heads allocated for us: Account Heads ABC & Co. Chartered Accounta nts YES YES YES YES YES Sampling %

BALANCE SHEET Stores, Spares & Loose Tools Stock-In-Trade Trade Debts Tax Refund From Government Cash & Bank Balances

Random Random Random Random 100%

Issued, Subscribed & Paid up Capital Deferred Liabilities Deferred Tax Advance From Customer Related Parties Accrued Liabilities Contingencies & Commitments PROFIT & LOSS ACCOUNT Sales and Services Cost Of Sales and Services Distribution/Sell ing Expenses Taxation

YES YES YES YES YES YES YES

100% Random 100% 100% Random Random 100%

YES YES YES YES

Random Random Random 100%

You might also like

- The Concise Calibration & Test Equipment Management Guide: The Concise Collection, #1From EverandThe Concise Calibration & Test Equipment Management Guide: The Concise Collection, #1Rating: 4.5 out of 5 stars4.5/5 (2)

- 17 - Chapter 11Document34 pages17 - Chapter 11Carey HillNo ratings yet

- Basic Audit Sampling ConceptsDocument36 pagesBasic Audit Sampling ConceptsAldrin DagamiNo ratings yet

- 3 Auditing Techniques and Internal AuditDocument30 pages3 Auditing Techniques and Internal Audit3257 Vibhuti WadekarNo ratings yet

- Audit SamplingDocument85 pagesAudit SamplingCarla Jean Cuyos100% (1)

- RED - Audit SamplingDocument10 pagesRED - Audit SamplingClyde RamosNo ratings yet

- Audit Sampling.2024Document48 pagesAudit Sampling.2024najiath mzeeNo ratings yet

- Chapter 11Document38 pagesChapter 11faye anneNo ratings yet

- Chapter 11 - Audit Sampling Concepts - NotesDocument9 pagesChapter 11 - Audit Sampling Concepts - NotesSavy DhillonNo ratings yet

- Audassprin 15Document110 pagesAudassprin 15Frances AgustinNo ratings yet

- Chapt 11Document30 pagesChapt 11AndriatsirihasinaNo ratings yet

- Audit SamplingDocument9 pagesAudit Samplingemc2_mcv100% (3)

- Audit SamplingDocument10 pagesAudit SamplingJayson Manalo GañaNo ratings yet

- Nonprobabilistic Sample Selection MethodsDocument10 pagesNonprobabilistic Sample Selection MethodsDiah Dwi FitrianiNo ratings yet

- Week 10 Audit Sampling - ACTG411 Assurance Principles, Professional Ethics & Good GovDocument6 pagesWeek 10 Audit Sampling - ACTG411 Assurance Principles, Professional Ethics & Good GovMarilou Arcillas PanisalesNo ratings yet

- Lesson 14 Audit SamplingDocument9 pagesLesson 14 Audit SamplingMark TaysonNo ratings yet

- AT Quizzer (CPAR) - Audit SamplingDocument2 pagesAT Quizzer (CPAR) - Audit SamplingPrincessNo ratings yet

- At.114 Audit SamplingDocument8 pagesAt.114 Audit SamplingmiolataNo ratings yet

- Audit Sampling ModuleDocument7 pagesAudit Sampling ModuleFery AnnNo ratings yet

- Audit SamplingDocument5 pagesAudit SamplingpateljhNo ratings yet

- Topic 1Document35 pagesTopic 1fbicia218No ratings yet

- Chapter Eleven Basic Audit and Sampling Concepts: Auditing and Assurance PrinciplesDocument25 pagesChapter Eleven Basic Audit and Sampling Concepts: Auditing and Assurance Principlesfaye anneNo ratings yet

- Audit Process Sample SelectionDocument5 pagesAudit Process Sample SelectionAditya Kumar SNo ratings yet

- Audit Sampling: APT Financial ConsultantsDocument14 pagesAudit Sampling: APT Financial ConsultantsMurali KrishnanNo ratings yet

- Chapter 9 Audit SamplingDocument17 pagesChapter 9 Audit SamplingMAG MAGNo ratings yet

- Chapter 9 Audit SamplingDocument17 pagesChapter 9 Audit SamplingCzarmae DumalaonNo ratings yet

- Audit SamplingDocument8 pagesAudit SamplingXyza AbcdNo ratings yet

- Audit Evidence & Audit SamplingDocument44 pagesAudit Evidence & Audit SamplingAsma Ul Husna MumuNo ratings yet

- Lecture 1124Document24 pagesLecture 1124jasonnumahnalkelNo ratings yet

- Sampling Techniques in AuditDocument3 pagesSampling Techniques in AuditxxxfarahxxxNo ratings yet

- AUDITDocument55 pagesAUDITYovankaNo ratings yet

- Auditing Theory: Audit SamplingDocument11 pagesAuditing Theory: Audit SamplingFayehAmantilloBingcangNo ratings yet

- Focus Notes Psa 530Document1 pageFocus Notes Psa 530Joyce Kay AzucenaNo ratings yet

- Audit Sampling and Testing-1Document31 pagesAudit Sampling and Testing-1Kananelo MOSENANo ratings yet

- SAMPLING Group II NJSKNKSNDocument164 pagesSAMPLING Group II NJSKNKSNPraise Buenaflor100% (1)

- Various Means of Gathering Audit EvidenceDocument14 pagesVarious Means of Gathering Audit EvidenceCRAZY SportsNo ratings yet

- Psa 530: Audit Sampling and Other Selective TestingDocument49 pagesPsa 530: Audit Sampling and Other Selective TestingJeric IsraelNo ratings yet

- Internal Audit and Control MF0013 Spring Drive Assignment-2012Document26 pagesInternal Audit and Control MF0013 Spring Drive Assignment-2012Sneha JenaNo ratings yet

- Chapter-3 Auditing Techniques 3.1 Test Checking 1.meaningDocument13 pagesChapter-3 Auditing Techniques 3.1 Test Checking 1.meaningRajshahi BoardNo ratings yet

- Chapter Seven: Audit EvidenceDocument24 pagesChapter Seven: Audit EvidenceAbdulahi farah AbdiNo ratings yet

- Chapter 17 Basic Audit Sampling ConceptsDocument32 pagesChapter 17 Basic Audit Sampling ConceptsClar Aaron Bautista100% (1)

- CIA Material SamplingDocument6 pagesCIA Material SamplingumasankarNo ratings yet

- Chapter 15 AuditingDocument41 pagesChapter 15 AuditingMisshtaCNo ratings yet

- Test CheckDocument13 pagesTest CheckLavanya BhoirNo ratings yet

- C11 Audit SamplingDocument40 pagesC11 Audit Samplingchongjiale5597No ratings yet

- Audit Sampling, Techniques & Procedures: - Abhijitsanzgiri Chartered AccountantDocument24 pagesAudit Sampling, Techniques & Procedures: - Abhijitsanzgiri Chartered AccountantajayuselessNo ratings yet

- Attribute SamplingDocument18 pagesAttribute SamplingIcolyn Coulbourne100% (2)

- Audit Sampling Notes and Answers To Quiz. Accounting Help.Document17 pagesAudit Sampling Notes and Answers To Quiz. Accounting Help.Cykee Hanna Quizo LumongsodNo ratings yet

- Chap.S 8 & 9-Audit Sampling: An Application To Tests of Controls & Substantive TestingsDocument25 pagesChap.S 8 & 9-Audit Sampling: An Application To Tests of Controls & Substantive TestingsFarhad AhmedNo ratings yet

- Aduit Policy, Pro, Gudie-AunsiyaDocument5 pagesAduit Policy, Pro, Gudie-AunsiyaSampath KumarNo ratings yet

- 12 Determining The Extent of TestingDocument8 pages12 Determining The Extent of TestingIrish SanchezNo ratings yet

- Chapter 1 & 2Document12 pagesChapter 1 & 2Tesfahun tegegnNo ratings yet

- Topic 10 - Audit SamplingDocument34 pagesTopic 10 - Audit Samplinglheriejane manzanilloNo ratings yet

- OM Quality Management 8Document13 pagesOM Quality Management 8Rehan AhmadNo ratings yet

- ACCA F8 Audit - EvidenceDocument16 pagesACCA F8 Audit - EvidenceSalim Ahsan Raad0% (1)

- Statistical and Non Statistical SamplingDocument5 pagesStatistical and Non Statistical Samplingsymnadvi8047No ratings yet

- Unit 1Document11 pagesUnit 1fekadegebretsadik478729No ratings yet

- Basic Audit Sampling Concepts: Jasmine V. Malabanan Kimberly Kaye O. FranciscoDocument35 pagesBasic Audit Sampling Concepts: Jasmine V. Malabanan Kimberly Kaye O. FranciscoKimberly Kaye Olarte FranciscoNo ratings yet

- ICAN B2 AA Mock 1 Answers 2014Document14 pagesICAN B2 AA Mock 1 Answers 2014HoJoJoNo ratings yet

- Audit Sampling: Gay & Simnett, Auditing and Assurance Services in Australia, 6eDocument44 pagesAudit Sampling: Gay & Simnett, Auditing and Assurance Services in Australia, 6eHasan Mahmud Maruf 1621513630No ratings yet

- ESCAP HLiu Financing Renewable Energy 270313Document7 pagesESCAP HLiu Financing Renewable Energy 270313sanjay_kafleNo ratings yet

- VAT StudyInSAFACountriesDocument174 pagesVAT StudyInSAFACountriessanjay_kafle100% (1)

- AA Tech Update 12 11 Public VersionDocument2 pagesAA Tech Update 12 11 Public Versionsanjay_kafleNo ratings yet

- ACC 650 Audit Assignment V15Document29 pagesACC 650 Audit Assignment V15sanjay_kafleNo ratings yet

- Adit Prospectus 2011webDocument14 pagesAdit Prospectus 2011websanjay_kafleNo ratings yet

- Land Bank of The PhilippinesDocument30 pagesLand Bank of The PhilippinesAdam WoodNo ratings yet

- Kukreja Institute of Hotel Management and Catering Technology Internal Examination Paper 2012 M.M. - 100 Front Office, B.H.M. 1 SEM TIME-3 HrsDocument1 pageKukreja Institute of Hotel Management and Catering Technology Internal Examination Paper 2012 M.M. - 100 Front Office, B.H.M. 1 SEM TIME-3 HrsSumit PratapNo ratings yet

- Balance Sheet of Indian Oil Corporation PDFDocument5 pagesBalance Sheet of Indian Oil Corporation PDFManpreet Kaur SekhonNo ratings yet

- New Microsoft Word DocumentDocument28 pagesNew Microsoft Word Documentjaz143No ratings yet

- Silo - Tips - Trading With An Edge Multiple Systems Multiple Time FramesDocument44 pagesSilo - Tips - Trading With An Edge Multiple Systems Multiple Time Framesshailesh233No ratings yet

- Cir V Smart CommunicationDocument2 pagesCir V Smart CommunicationAnonymous Ig5kBjDmwQNo ratings yet

- W07 Case Study Loan AssignmentDocument66 pagesW07 Case Study Loan AssignmentArmando Aroni BacaNo ratings yet

- Act of 3135, As Amended by RDocument20 pagesAct of 3135, As Amended by RRalph ValdezNo ratings yet

- f6vnm 2015dec Q PDFDocument16 pagesf6vnm 2015dec Q PDFSinhNo ratings yet

- Cash Flow - S-CurveDocument12 pagesCash Flow - S-CurveAlexandruDanielNo ratings yet

- Final Prentation of ProjectDocument17 pagesFinal Prentation of ProjectnilphadtareNo ratings yet

- Solution Manual For Contemporary Project Management 4th EditionDocument36 pagesSolution Manual For Contemporary Project Management 4th Editionmeawcocklofttp47100% (49)

- Answers For Tutorial Chapter 4Document8 pagesAnswers For Tutorial Chapter 4AdilahNo ratings yet

- Tex Lee Mason Trust 26 Feb 2015Document11 pagesTex Lee Mason Trust 26 Feb 2015joe100% (9)

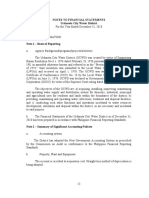

- Notes To Financial Statements Urdaneta City Water DistrictDocument8 pagesNotes To Financial Statements Urdaneta City Water DistrictEG ReyesNo ratings yet

- Prop OutlineDocument22 pagesProp OutlinekmsilvermanNo ratings yet

- Abhishek ReportDocument67 pagesAbhishek ReportAbhishek KarNo ratings yet

- BPI Family Savings Bank Vs SMMCIDocument1 pageBPI Family Savings Bank Vs SMMCIManila LoststudentNo ratings yet

- Auditing Gray 2015 CH 13 Final Work Spesific Problems Related To Inventories Contruction Contract Trade Payables Financial LiabilitiesDocument29 pagesAuditing Gray 2015 CH 13 Final Work Spesific Problems Related To Inventories Contruction Contract Trade Payables Financial LiabilitiesSani AuroraNo ratings yet

- Sky City Accounting and Financialy AnalysisDocument6 pagesSky City Accounting and Financialy AnalysisElenaWang1111No ratings yet

- Indian Retail Lending Loans SectorDocument29 pagesIndian Retail Lending Loans SectorBangaru BharathNo ratings yet

- Phrasal Verbs Related To MoneyDocument3 pagesPhrasal Verbs Related To MoneyFrancisco Antonio Farias TorresNo ratings yet

- Henry vs. Structured Investments Co.Document9 pagesHenry vs. Structured Investments Co.pbsneedtoknowNo ratings yet

- Hedge Funds: Origins and Evolution: John H. MakinDocument17 pagesHedge Funds: Origins and Evolution: John H. MakinHiren ShahNo ratings yet

- Yaba, Brixzel's AssignmentDocument4 pagesYaba, Brixzel's AssignmentYaba Brixzel F.No ratings yet

- Private Lender SEC ComplianceDocument59 pagesPrivate Lender SEC ComplianceyourlearNo ratings yet

- Acs102 Fundamentals of Actuarial Science IDocument6 pagesAcs102 Fundamentals of Actuarial Science IKimondo King100% (1)

- Fund Flow StatementDocument17 pagesFund Flow StatementPrithikaNo ratings yet

- Profit Maximization Vs Value MaximizationDocument2 pagesProfit Maximization Vs Value MaximizationNicklas Garștea100% (4)

- Questões Inglês para CesgranrioDocument36 pagesQuestões Inglês para Cesgranriosamuel souzaNo ratings yet