Professional Documents

Culture Documents

FINS3616 - Final

Uploaded by

dwm1855Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FINS3616 - Final

Uploaded by

dwm1855Copyright:

Available Formats

- - - - - - - - - -

Final Exam Format 2.5hrs + 10min reading time 45% 40 MCQ (25 marks equal) <- Is this Testbank??? 4 SAQ (20 marks equal = 5 marks each. Submarks included. i.e. question 1A, 1B, 1C etc.) SAQ are similar to tutorial questions. Materials from weeks 6, 8-12 lectures/7-13 tutorials. (Chapters 11-20) Anything covered in midsession will not be directly tested. May be indirectly tested. UNSW-approved calculators only. NO FORMULA SHEET. Not much formula apart from WACC/APV/CAPM. Do not need to memorise US tax law or anything to do with the US, just understand the reasoning of the more important ones and understand their implications to MNCs.

WEEK 6 CHAPTER 11 MANAGING OPERATING EXPOSURE TO CURRENCY RISK - Managing Operating Exposures in Financial Markets Importer Exporter Buy Sell Long-dated forward contracts Invest Finance Long-dated foreign bonds Acquire financial assets Acquire financial liabilities In foreign currency Repeatedly buy Repeatedly sell The foreign currency forward Advantages Actively traded/liquid Zero-NPV transactions Disadvantages Imperfect Hedge Managing Operating Exposures in Financial Markets Plant Location Product Sourcing Market Selection Advantages Long-lasting change to currency risk exposure. Internationalizes the MNC, allowing quicker responses to opportunities. Disadvantages Seldom Zero-NPV projects. Price elasticity of demand. (Q/Q)/(P/P) Unit price elasticity = 1 unit of price = 1 unit of quantity. Elastic = sensitive (Larger than 1). Inelastic = Insensitive (Less than 1) CHAPTER 12: MANAGING TRANSLATION EXPOSURE AND ACCOUNTING FOR FINANCIAL TRANSACTIONS - Goals of Financial Accounting Reliability Relevance Translation Exposure: Impact of exchange rate changes on consolidated financial statements. Current/Non-Current Method: As name says. Income at average. Depreciation at historical. Monetary/Non-Monetary (Temporal) Method: As method says. Income at average. Depreciation and COGS at historical. Current Method: All at current, except common equity at historical. Income at average. Imbalance is recorded into cumulative translation adjustment account (CTA). Why hedge?

Satisfying loan covenants Meeting profit forecasts Retaining credit rating Policy recommendations Hedge economic exposures. Translation only if there are economic reasons. Use local sources of capital Insulate managerial compensation from FX risk. Quote market prices if translation exposure is necessary.

WEEK 8 CHAPTER 13: FOREIGN MARKET ENTRY AND COUNTRY RISK MANAGEMENT - Modes of Entry Export/Import Contract-Based Investment-Based Potential for higher sales/lower costs and avoids import/export tariffs/quotas. Higher resource commitment, exit costs and must overcome investment/cultural barriers. Foreign Direct Investment: Slow entry but maintain control over intellectual property. Merger/Acquisitions: Rapid entry, but high price/premium is common. Joint Ventures: Avoid restrictions and less exposure, but potential loss of IP. Strategic Alliance Sources of Country Risk Political Risk: Risk host government will change things unexpectedly. Financial Risk: Risk to financial and economic life in country. Macro Risk: Risk to all firms in the country. Micro Risk: Risk to specific industry, firm or project. Business Factors Taxes Local Content Protectionism Tradition Intellectual property rights. Political Factors (Usually Macro Risk) Civil war Corruption Military or religion in politics Racial or ethnic tensions Terrorism Examples of Country Risk Expropriation Disruptions in operations Protectionism Blocked Funds Loss of intellectual property rights. Political Risk Insurance MNCs are self-insured against political risk if they are operating in many countries. It is costly, but it may be worth it for the risk it avoids. Must have Characteristics of Insurable Risk Loss is identifiable

Large number of people are exposed to the risk Expected loss from risk is estimable. Loss is outside own influence. Ways to limit exposures to loss Find the right partner Limit your exposure CHAPTER 14: CROSS-BORDER CAPITAL BUDGETING

Domestic NPV Calculations Recipe 1 Estimate future cash flows Identify discount rate Find NPV Convert to domestic currency Recipe 2 Estimate future cash flows Convert to domestic currency Identify discount rate Find NPV Should be the same if international parity conditions hold. When parity does not hold Discounted in foreign currency is > 0: Value for foreign investor. Should try to lock in the time 0 value of the project. Can sell the project to a local investor, or find a joint venture partner. Discounted in domestic currency is > 0: Value for parent/local investor. Should look for better projects in foreign currency. > 0 for both is value for both parties. Accept. < 0 for both is not value for both parties. Outright reject. Decision to Hedge Foreign discount is greater than domestic discount, then the project should be hedged. Domestic discount is greater than foreign discount, then the choice to hedge depends on firm policy. It lowers risk, but also lowers NPV. Side Effects Subsidized funding Blocked funds Tax holidays Expropriation risk Negative NPV tie-in projects. Projects that are taken by companies in developing countries to gain access to positive-NPV projects in that country.

WEEK 9 CHAPTER 15 MULTINATIONAL CAPITAL STRUCTURE AND COST OF CAPITAL - MM Conclusions If financial markets are perfect, then corporate financial policy is irrelevant. No taxes or bankruptcy costs (No optimal) Corporate taxes but no bankruptcy costs (100% debt optimal) Corporate taxes and bankruptcy costs (Part debt/equity optimal) Factors for financial market segmentation

Different legal and political systems Prohibitive transaction costs Regulatory transaction costs Differential taxes Informational barriers Differential investor expectations Home bias

Project Valuation WACC is found by weighting the required return on debt and equity. Tax also needs to be accounted for on debt. This is used as the discount rate for the normal NPV calculation. APV uses the value of an unlevered, all-equity project, before deducting side-effects and the initial investment. Country Risk and Equity Returns Increase in country risk = Prices go down. (Vice-versa) Higher country risk = More volatile returns/Lower beta. (Vice-versa) Financial market liberalizations benefit firms in the country. Increase correlation and decrease capital costs. Financial Pecking Order Internal External Debt Equity Targeted Registered Offerings: Issued registered bearer securities to international investors. The owner must be a financial institution. Global Equity Issues: Equity issues offered internationally. Signals that managers believe equity is overvalued and thus, causes share prices to drop. Project Financing: Such as Build-Own-Operate/Build-Own-Transfer contracts. Debt is contractually linked to the project. Leverage increases with asset tangibility and firm size. Leverage decreases with growth opportunities and profitability. WEEK 16: TAXES & MULTINATIONAL CORPORATE STRATEGY

- - -

- - -

Tax Neutrality Domestic: Ensure the domestic government taxes income from anywhere similarly. Foreign: Ensure taxes on foreign operations of domestic firms are the same as local competitors in that country. Goal is to ensure that there are no undue tax burdens compared to other operations. Explicit Taxes Taxes that are explicitly set by the government such as PAYG tax, GST, Tariffs, CGT, FBT etc. Implicit Taxes Caused by PPP where equivalent assets sell for the same after-tax expected return. Hence, countries with low taxes have low pre-tax required returns. Systems of Taxation Worldwide tax system: Taxes income as repatriated back to parent. Foreign corporation income is taxed as repatriated. They are legal entities in the host country and thus, disclosure and liability is only limited to that country.

- -

Foreign branch income is taxed as it is earned. It is still legally part of the parent and as such, can be beneficial for start-ups that are expected to make a loss. Can be disadvantageous in low-tax countries and also exposes the parent to legal liabilities. Territorial tax system: Taxes income domestically only. i.e. Where the income is earned is where the income is taxed. - Foreign Tax Credits (FTCs) Domestic US tax can be offset with tax paid overseas. - Transfer Pricing and Tax Planning MNCs have incentive to shift income to low-tax countries. Most tax-codes require arms length transfer pricing. Advantageous for high gross operating margin firms operating in more than one country. WEEK 10 CHAPTER 17 REAL OPTIONS & CROSS-BORDER INVESTMENT - Types of Options Simple: Call and Put Options. European vs American options. Compound: An option on an option. Rainbow: An option with more than one source of uncertainty. - Financial vs Real Options Observable vs Unobservable prices High transaction costs vs Low transaction costs. Arbitrage issues. Multiple sources of uncertainty vs single source. Endogenous vs Exogenous uncertainty. Investment reveals more information later on. - Option Value = Intrinsic Value + Time Value Time Value increases as exogenous price uncertainty increases (outside firm influence) - Real Options (An option on a real asset) [Compound Rainbow Options] Compare NPV if we invest now, vs Weighted NPV of investing 1 year later. Option to invest or abandon - Use of inflated hurdle rates in uncertain investment environments Option to expand or contract - Failure to abandon unprofitable investments Negative in front of NPV calculation as it is a disinvestment. Choose project with lowest NPV. NOT the highest NPV. Option to speed up or defer - Negative-NPV investments in new/emerging markets - Hysteresis: International investments normally have different thresholds. Entry only when expected return is well above required return (safer) Exit does not occur even if unprofitable (higher exit costs) CHAPTER 19 INTERNATIONAL CAPITAL MARKETS - Public Debt Domestic Bonds: Issued in the domestic market in domestic currency. Foreign Bonds: Issued in domestic market by foreign borrower. Eurobonds: Issued outside the country of the denomination. Global Bonds: Trade in Eurobond and other internal bond markets. - Bond Market Conventions Eurobonds (Bearer) Fixed: Annual coupon, 30/360. Floating: Quarterly/Semi-Annually, Actual/360. Eurocurrencies (Registered) LIBOR: Quarterly/Semi-Annually, Actual/360.

- Overcoming Capital Flow Barriers Domestic Based MNCs Familiar and accessible to domestic investors, but high country risk. Individual Foreign Securities Direct purchases but have high info/trans costs. Foreign shares/Depository Receipts. Mutual Funds of Foreign Assets Open-ended and Closed-ended funds. Exchange Traded Funds (EFTs) Hedge Funds and Private Equity Private investment partnerships. Private equity are hedge funds in private firms (Venture capital). Other Stock index futures, options and swaps. WEEK 11 CHAPTER 20 INTERNATIONAL PORTFOLIO DIVERSIFICATION - Assumptions Nominal returns are normally distributed. Investors want more return for less risk. - Key Results of Portfolio Theory As the number of assets approaches infinity, portfolio variance depends only on covariance. The risk of an asset in a large portfolio depends on its covariance/correlation with other assets in the portfolio. High (low) correlation = Low (High) diversification - Mean-Variance Efficiency (Fear and Greed) Maximise our mean/expected return and minimize variance/risk. Risker assets tend to have higher returns. Smaller and less diversified countries typically have more volatile returns in the local currency. - Globally diversified portfolio has: Higher expected return: Emerging markets are likely to experience above average returns. Lower portfolio risk: More diversified as more low correlation stocks are chosen. - Countries will have highly correlated stock markets if: They are geographically close. They have substantial trade agreements and/or trade. They are members of the Eurozone. - Return on a Foreign Asset (1+rd) = (1+rf)(1+sd/f); where r = rate of return and s = change in spot rate. - Expected return on Foreign Assets E[rd] = E[rf] + E[sd/f] + E[rfsd/f] - Changing Nature of Portfolio Analysis Expected Returns are low when economic conditions are strong; and vice-versa. Volatility varies over time and is modelled with models such as GARCH. Correlations are higher during downturns than what models predict. - Home-Bias Even with all the potential benefits of international portfolio diversification, most investors skew their portfolios to domestic securities. Portfolio Theory argues either way: For: Domestic stock hedges domestic inflation risk. For: Domestic liabilities best held with domestic assets.

Against: Labour income is highly correlated, so there should be less domestic stock. Not a perfect world. Violations of perfect world assumptions Market frictions Government controls, taxes and transaction costs. Investor irrationality Unequal access to market prices Unequal access to information Hard to get and interpret overseas information. Difficult to monitor distant managers. Investor Irrationality Heuristics: Rules-of-thumb/shortcuts which simplify decision-making can be biased. Frame Dependence: Overconfidence and Regret Avoidance are human nature. Empirical Evidence People simply prefer investments that are close and culturally similar. CHAPTER 21 INTERNATIONAL ASSET PRICING

- -

- -

- -

- WEEK 12 CHAPTER 18: CORPORATE GOVERNANCE AND THE INTERNATIONALS MARKET FOR CORPORATE CONTROL - Corporate Governance The way stakeholders exert control over the corporation. Internal: Board of Directors External: Market for Corporate Control - Synergy Synergy is when the whole is greater than the sum of all parts

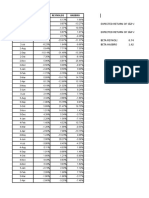

CML and SML CAPM Assumptions Perfect Markets Homogenous Expectations Everyone can borrow and lend at the risk-free rate. IAPM Additional assumptions: PPP Holds and Investors have the same basket in all countries. Same as CAPM except market portfolio is globally diversified and the risk free asset is replaced with the hedge portfolio a portfolio of risk-free domestic and foreign assets. Arbitrage Pricing Theory (APT) Beta and F capture systematic risk. Random error term captures unsystematic risk. Roll & Ross APT 4 APT Factors: Industrial production, risk premia (corporate govt bond yield), term premia (long-term T-bond minus T-bill yield), inflation. Market return insignificant and not independent. Fama & French APT 3 APT Factors: Firm size (difference in mean return between smallest 10% and largest 10% of firms), and relative financial distress (difference in return between value and growth stocks). Small firms and value stocks outperform by 7%-12%. Applies internationally too. Good investment depends on personal risk aversion Momentum Portfolios of past winners outperform losers by 1%/month. Lasts one year, and then it is reversed. Possibly because of market correction. Hence inefficient markets. Currency risk is not priced in the US.

- -

Synergy = VAT (VA + VT) Corporate Governance Systems Market-Based Government does not usually intervene. Hostile takeovers are common. Bank-Based Hostile takeovers are rare due to large groups. Even with limited bank ownership in Japan. Family or State Hostile takeovers also rare due to controlling families/state. Privatization Selling of state-owned enterprises to the public. Usually conducted as: Voucher Program Management Buyout (MBO) Mass Privatisation Program (MPP) Need to have good legal and corporate governance systems to be able to successfully privatise. Hostile Acquisitions in Market Based Systems Target firms are winners in that shareholders get large gains when takeover is announced. More gains if there are multiple bidders. Acquiring firms may or may not win in the US, since it is an efficient market. They will most likely win in non-US markets. Contributing Factors Method of Payment: Cash offers do not send negative signals but stock offers do, as it signals that management believes stock is overpriced. Free Cash Flow: Too much free cash flow is wasteful if they do not distribute it or re-invest in positive NPV projects. Tax Environment: International acquisitions may be looked upon favourably because it will allow the MNC to lower tax expensies. Real Exchange Rates: A strong domestic currency deters overseas investors and makes it easier for domestic investors to acquire. Takeovers in Japan Rare because of keiretsu cross-shareholdings and restrictive regulations on cross-border M&A. Keiretsu: Extensive cross-shareholdings, personnel swaps, strategic coordination, transactions. Takeovers in Germany Rare because of the structure of supervisory boards and restrictive laws. Tunnelling Expropriation of corporate assets from minority shareholders (excessive compensation etc.)

You might also like

- Investments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsFrom EverandInvestments Profitability, Time Value & Risk Analysis: Guidelines for Individuals and CorporationsNo ratings yet

- The Investor's Guide to Investing in Direct Participation Oil and Gas ProgramsFrom EverandThe Investor's Guide to Investing in Direct Participation Oil and Gas ProgramsRating: 5 out of 5 stars5/5 (1)

- Petroleum EconomicsDocument51 pagesPetroleum EconomicsJoeMacho86% (7)

- Capital markets facilitate long-term funds over 1 yearDocument3 pagesCapital markets facilitate long-term funds over 1 yearThuỳ Linh100% (8)

- Applied Corporate Finance. What is a Company worth?From EverandApplied Corporate Finance. What is a Company worth?Rating: 3 out of 5 stars3/5 (2)

- IfmDocument209 pagesIfmSalim Akhtar KhanNo ratings yet

- 60secs Binary Options StrategyDocument6 pages60secs Binary Options Strategybookdotcom72210% (1)

- S&P 500, Reynolds, Hasbro stock returns & analysisDocument3 pagesS&P 500, Reynolds, Hasbro stock returns & analysisSiona Maria NathanielNo ratings yet

- Financial ModelingDocument6 pagesFinancial Modelingyousafkhalid48675% (4)

- On January 1 2012 Mamood LTD Paid 322 744 44 For 12Document1 pageOn January 1 2012 Mamood LTD Paid 322 744 44 For 12Hassan JanNo ratings yet

- International Financial Management - An OverviewDocument30 pagesInternational Financial Management - An Overviewutp100% (1)

- International Capital BudgetingDocument27 pagesInternational Capital Budgetingshuaib20No ratings yet

- CH 01 Investment Setting SolutionsDocument7 pagesCH 01 Investment Setting Solutionsdwm1855No ratings yet

- Chapter 13 - Direct Foreign InvestmentDocument27 pagesChapter 13 - Direct Foreign InvestmentAdyaning PratitaNo ratings yet

- International Financial Management PgapteDocument54 pagesInternational Financial Management PgapteShiva PNo ratings yet

- International Financial Management PgapteDocument20 pagesInternational Financial Management Pgapterameshmba100% (1)

- Capital Budgeting DecisionDocument94 pagesCapital Budgeting DecisionRahul GuptaNo ratings yet

- Finance Cours8 2003Document36 pagesFinance Cours8 2003Angates1No ratings yet

- AcFn 611 CH 04Document37 pagesAcFn 611 CH 04embiale ayaluNo ratings yet

- 8 International Aspect of FM - Jan 2012Document10 pages8 International Aspect of FM - Jan 2012Moud KhalfaniNo ratings yet

- International Financial Management International Financial ManagementDocument45 pagesInternational Financial Management International Financial ManagementSebastian M.VNo ratings yet

- Multinational FinanceDocument45 pagesMultinational Financechun88No ratings yet

- International Cost of Capital (ICOC)Document19 pagesInternational Cost of Capital (ICOC)rameshkondetiNo ratings yet

- International Financial Management: Q1. Discuss The Complexities Involved in International Capital Budgeting AnswerDocument148 pagesInternational Financial Management: Q1. Discuss The Complexities Involved in International Capital Budgeting AnswerVinay GattaniNo ratings yet

- 4079 Chapter 11 NDocument15 pages4079 Chapter 11 NAngates1No ratings yet

- Presentation On: International Portfolio InvestmentDocument42 pagesPresentation On: International Portfolio InvestmentIftakher HossainNo ratings yet

- International Financial ManagementDocument43 pagesInternational Financial Managementirshan amirNo ratings yet

- Risk ManagementDocument27 pagesRisk ManagementCarine TeeNo ratings yet

- Cost and Availability of Capital 3QJ8RLNo7zDocument33 pagesCost and Availability of Capital 3QJ8RLNo7zNikitha NithyanandhamNo ratings yet

- Foreign Investment AnalysisDocument86 pagesForeign Investment Analysiss.manoprabha3604No ratings yet

- Foreign Exchange Risk Management - International Financial Environment, International Business - EduRev NotesDocument8 pagesForeign Exchange Risk Management - International Financial Environment, International Business - EduRev Notesswatisin93No ratings yet

- Capital Budgeting For Multinational FirmsDocument21 pagesCapital Budgeting For Multinational Firmskarim swillahNo ratings yet

- Multinational Capital BudgetingDocument26 pagesMultinational Capital BudgetingKirti AgrawalNo ratings yet

- Capital Budgeting Cash FlowDocument53 pagesCapital Budgeting Cash FlowAbraham FukjiantoNo ratings yet

- CostDocument30 pagesCostjagadeesh88apNo ratings yet

- FN 605: International Business FinanceDocument32 pagesFN 605: International Business FinancelekokoNo ratings yet

- Cost of CapitalDocument40 pagesCost of CapitalRohit BhardawajNo ratings yet

- Global Cost and Availability of Capital for FirmsDocument5 pagesGlobal Cost and Availability of Capital for FirmsAlis UyênNo ratings yet

- Lecture 1: Introduction to International Financial ManagementDocument17 pagesLecture 1: Introduction to International Financial ManagementMahbubul Islam KoushickNo ratings yet

- R04 Capital Market Expectations, Part 2 - Forecasting Asset Class Returns HY NotesDocument7 pagesR04 Capital Market Expectations, Part 2 - Forecasting Asset Class Returns HY NotesArcadioNo ratings yet

- Capital Budgeting For International ProjectsDocument26 pagesCapital Budgeting For International ProjectsVanitWasanNo ratings yet

- Corporate Financing Lecture NotesDocument9 pagesCorporate Financing Lecture NotesVictoria MPNo ratings yet

- Acf305: International Financial and Risk ManagementDocument26 pagesAcf305: International Financial and Risk ManagementSimon GathuNo ratings yet

- F9FM-Session17 d08xsxDocument16 pagesF9FM-Session17 d08xsxErclanNo ratings yet

- Multinational Financial Management: An Overview: South-Western/Thomson Learning © 2003Document30 pagesMultinational Financial Management: An Overview: South-Western/Thomson Learning © 2003Nafisa Afsana TaskiaNo ratings yet

- Eun 9e International Financial Management PPT CH15Document25 pagesEun 9e International Financial Management PPT CH15Dhanush Kumar KumarNo ratings yet

- Capital Budgeting TheoryDocument9 pagesCapital Budgeting TheoryTarapara KenilNo ratings yet

- Chapter 18 Derivatives and Risk Management No CoverDocument85 pagesChapter 18 Derivatives and Risk Management No CoverVenn Bacus RabadonNo ratings yet

- Multinational Financial Management: An Overview: South-Western/Thomson Learning © 2006Document25 pagesMultinational Financial Management: An Overview: South-Western/Thomson Learning © 2006Annie ShahNo ratings yet

- Sess 19-20 - Fx. ExposureDocument19 pagesSess 19-20 - Fx. ExposureAjay KumarNo ratings yet

- Country Risk AnalysisDocument33 pagesCountry Risk AnalysisnishgudsNo ratings yet

- Financial Management in Global ContextDocument26 pagesFinancial Management in Global Contextbharti_peshwaniNo ratings yet

- Acceptance Criteria for Foreign InvestmentsDocument20 pagesAcceptance Criteria for Foreign InvestmentsHarsh Vardhan GuptaNo ratings yet

- Foreign Exchange Risk Management - International Financial Environment, International Business B Com Notes - EduRevDocument14 pagesForeign Exchange Risk Management - International Financial Environment, International Business B Com Notes - EduRevBasavarajNo ratings yet

- International Capilat BudgetingDocument43 pagesInternational Capilat BudgetingHimanshu GuptaNo ratings yet

- Pm652 Lm7 NotesDocument6 pagesPm652 Lm7 NotesNatasha ReavesNo ratings yet

- Fidelia Agatha - 2106715765 - Summary&Problem MK - Pertemuan Ke 7Document20 pagesFidelia Agatha - 2106715765 - Summary&Problem MK - Pertemuan Ke 7Fidelia AgathaNo ratings yet

- 2 - NPV Capital BudgetingDocument56 pages2 - NPV Capital BudgetingRafi RahmanNo ratings yet

- For Foreign Investment Decision or Multi-National Capital BudDocument6 pagesFor Foreign Investment Decision or Multi-National Capital Budapi-3727090No ratings yet

- Week 9 Lecture 9 (2017) - FTM Construction of Financial Technical ModelsDocument43 pagesWeek 9 Lecture 9 (2017) - FTM Construction of Financial Technical ModelsElijah MuntembaNo ratings yet

- Finance Chapter 21Document12 pagesFinance Chapter 21courtdubs100% (2)

- Ifrm SlidesDocument70 pagesIfrm Slidessustainablerewards8No ratings yet

- International Finance Lecture NotesDocument30 pagesInternational Finance Lecture NotesIRENE WARIARANo ratings yet

- Cheat Sheet - ReadingsDocument2 pagesCheat Sheet - ReadingsNicola GrecoNo ratings yet

- The Future of Hedge Fund Investing: A Regulatory and Structural Solution for a Fallen IndustryFrom EverandThe Future of Hedge Fund Investing: A Regulatory and Structural Solution for a Fallen IndustryNo ratings yet

- Whirlpool Refrigerator Updated 2012 User ManualDocument36 pagesWhirlpool Refrigerator Updated 2012 User Manualdwm1855No ratings yet

- The Big Noise of Senator Elizabeth WarrenDocument3 pagesThe Big Noise of Senator Elizabeth Warrendwm1855No ratings yet

- Whirlpool Refrigerator Updated 2012 User ManualDocument36 pagesWhirlpool Refrigerator Updated 2012 User Manualdwm1855No ratings yet

- How waiters read your table cues for better serviceDocument23 pagesHow waiters read your table cues for better servicedwm1855No ratings yet

- Will Supreme Court Health Care Case Boost The GOP, or DemocratsDocument2 pagesWill Supreme Court Health Care Case Boost The GOP, or Democratsdwm1855No ratings yet

- FINS3616 - Mid SemesterDocument7 pagesFINS3616 - Mid Semesterdwm1855No ratings yet

- Classroom and Management Decisions Using Student Data - Developing An Information SystemDocument3 pagesClassroom and Management Decisions Using Student Data - Developing An Information Systemdwm1855No ratings yet

- Keurig B40 Elite ManualDocument30 pagesKeurig B40 Elite Manualdwm185550% (2)

- CH 01 The Investment SettingDocument56 pagesCH 01 The Investment Settingdwm1855100% (1)

- 5 Ways Social Media Could Be Hurting Your Job SearchDocument5 pages5 Ways Social Media Could Be Hurting Your Job Searchdwm1855No ratings yet

- CH 13 Study Review QuestionsDocument24 pagesCH 13 Study Review Questionsdwm1855No ratings yet

- Obama, Romney Look For Foreign Policy Edge in Final Debate - Fox NewsDocument2 pagesObama, Romney Look For Foreign Policy Edge in Final Debate - Fox Newsdwm1855No ratings yet

- Lecture 1 The Global Financial EnvironmetDocument8 pagesLecture 1 The Global Financial Environmetdwm1855No ratings yet

- Calculate Gains and Losses in Stock TradingDocument11 pagesCalculate Gains and Losses in Stock Tradingdwm1855100% (1)

- CH 1 HWKDocument2 pagesCH 1 HWKdwm1855No ratings yet

- Calculate Gains and Losses in Stock TradingDocument11 pagesCalculate Gains and Losses in Stock Tradingdwm1855100% (1)

- Mitt Romney Outlines Governing Plan - POLITICO - Com Print ViewDocument4 pagesMitt Romney Outlines Governing Plan - POLITICO - Com Print Viewdwm1855No ratings yet

- CH 13 Study Review QuestionsDocument24 pagesCH 13 Study Review Questionsdwm1855No ratings yet

- CH 001: The Investment SettingDocument16 pagesCH 001: The Investment Settingdwm1855No ratings yet

- Chapter 2: The Court SystemsDocument2 pagesChapter 2: The Court Systemsdwm1855No ratings yet

- Worlds Collide Over A Washington Weekend - WSJDocument3 pagesWorlds Collide Over A Washington Weekend - WSJdwm1855No ratings yet

- Article1379417503 - Omisore Et AlDocument10 pagesArticle1379417503 - Omisore Et AlThanaa LakshimiNo ratings yet

- CARO, 2016: J.K.Shah Classes I.P.C.C. - AUDITDocument4 pagesCARO, 2016: J.K.Shah Classes I.P.C.C. - AUDITRaviNo ratings yet

- TRSMGT Module III CH 2Document19 pagesTRSMGT Module III CH 2santucan1No ratings yet

- ACCT5942 Week4 PresentationDocument13 pagesACCT5942 Week4 PresentationDuongPhamNo ratings yet

- Annual Report 2010-11 HighlightsDocument84 pagesAnnual Report 2010-11 HighlightsMaitri ThakarNo ratings yet

- Privatization of HBLDocument10 pagesPrivatization of HBLUmair HassanNo ratings yet

- Presentation - Transfer Pricing - Sanjay KapadiaDocument25 pagesPresentation - Transfer Pricing - Sanjay KapadiaAjayKumar VermaNo ratings yet

- IFRS 9 Financial Instruments OverviewDocument33 pagesIFRS 9 Financial Instruments OverviewMirzakarimboy AkhmadjonovNo ratings yet

- Executive Mba Programme Ii Year Assignment Question Papers 2010-2011 201: Business Policy and Strategic ManagementDocument21 pagesExecutive Mba Programme Ii Year Assignment Question Papers 2010-2011 201: Business Policy and Strategic ManagementLarin V JosephNo ratings yet

- 3rd Sem MBA - International FinanceDocument1 page3rd Sem MBA - International FinanceSrestha ChatterjeeNo ratings yet

- Intangible Assets: Measurement, Drivers, UsefulnessDocument33 pagesIntangible Assets: Measurement, Drivers, UsefulnessLaarnie PantinoNo ratings yet

- Risk and InvestmanagementDocument5 pagesRisk and InvestmanagementDeepak ParidaNo ratings yet

- Accounting For Managers - FinalDocument21 pagesAccounting For Managers - FinalAnuj SharmaNo ratings yet

- United States Court of Appeals, Third CircuitDocument7 pagesUnited States Court of Appeals, Third CircuitScribd Government DocsNo ratings yet

- Full Alliance Group Inc (FAGI)Document48 pagesFull Alliance Group Inc (FAGI)triguy_2010No ratings yet

- Risk and Return in Practice - ProblemsDocument6 pagesRisk and Return in Practice - ProblemsKinNo ratings yet

- Marriott CorporationDocument15 pagesMarriott Corporationapi-371968790% (10)

- Assorted NotesDocument8 pagesAssorted NotesArmel AbarracosoNo ratings yet

- Credit Union Performance - L Dean Odle 2Document2 pagesCredit Union Performance - L Dean Odle 2api-413534603No ratings yet

- STKMKT 16Document13 pagesSTKMKT 16jig3309No ratings yet

- Legal Forms of BusinessDocument11 pagesLegal Forms of Businessaitzaz98No ratings yet

- Synopsis Nse and Bse Mb197748Document11 pagesSynopsis Nse and Bse Mb197748Srivalli GuptaNo ratings yet

- 12 Accountancy CBSE Exam Papers 2015 Comptt Delhi Marking SchemeDocument42 pages12 Accountancy CBSE Exam Papers 2015 Comptt Delhi Marking Schemeramesh devtallaNo ratings yet

- Dof Local Finance Circular 1-93 An Assessment of Impact of Proposed AmendmentsDocument30 pagesDof Local Finance Circular 1-93 An Assessment of Impact of Proposed AmendmentsepraNo ratings yet

- Contract II - K-2004 PDFDocument81 pagesContract II - K-2004 PDFRavindra SimpiNo ratings yet