Professional Documents

Culture Documents

Budgeting Separate Solutions From GL

Uploaded by

CP Mario Pérez LópezOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Budgeting Separate Solutions From GL

Uploaded by

CP Mario Pérez LópezCopyright:

Available Formats

Research

Publication Date: 21 April 2010 ID Number: G00175804

Evaluate Budgeting Solutions Separately From GL and Other Finance Systems

Nigel Rayner

Many finance evaluations make the mistake of including budgeting, planning and forecasting (BP&F) functionality as part of their evaluation of core financial management applications. IT professionals and finance users must understand why this is the wrong approach, and how to correctly conduct these evaluations. Key Findings

General ledger (GL) applications can manage budgetary control procedures, but their data structure means they cannot support sophisticated BP&F functionality (like topdown spreading, scenario creation and forecasting). Also, they cannot support driverbased planning. Corporate performance management (CPM) applications have matured; they offer powerful BP&F functionality. BP&F applications are "loosely coupled" to underlying ERP applications, rather than "tightly integrated."

Recommendations

Evaluations of core financial management applications and BP&F systems that are conducted concurrently need to be managed as two separate, but linked, work streams. Do not give excessive weight to BP&F integration with underlying core financial management applications in evaluations. A need to replace BP&F systems may be an indicator that a broader CPM solution is required. Finance teams, therefore, need to consider their broader CPM strategy, rather than thinking of BP&F as an "extension" of the GL.

2010 Gartner, Inc. and/or its Affiliates. All Rights Reserved. Reproduction and distribution of this publication in any form without prior written permission is forbidden. The information contained herein has been obtained from sources believed to be reliable. Gartner disclaims all warranties as to the accuracy, completeness or adequacy of such information. Although Gartner's research may discuss legal issues related to the information technology business, Gartner does not provide legal advice or services and its research should not be construed or used as such. Gartner shall have no liability for errors, omissions or inadequacies in the information contained herein or for interpretations thereof. The opinions expressed herein are subject to change without notice.

WHAT YOU NEED TO KNOW

Budgeting is a key finance process, and many finance teams are planning to replace outdated or Excel-based systems. However, for several reasons, BP&F systems do not form part of an integrated suite of core financial management applications. These applications hold data differently from the core financial management applications (which have data structures optimized for high-volume transaction processing), and provide forecasting and simulation capabilities that cannot be delivered by a GL application. Yet, many finance teams do not understand this and assume that only an administrative ERP suite vendor can provide these capabilities. This limits their evaluation options, plays into the hands of the larger vendors and may result in suboptimal product selections. CFOs and finance teams evaluating finance systems need to understand the difference between core financial management applications and CPM applications, and structure their evaluation activities accordingly. IT professionals supporting business applications should work with business users to ensure that they do not restrict evaluations only to vendors that appear to offer a combination of core financial management applications and BP&F functionality. BP&F is, and will remain, separate from core financial management applications, and should be evaluated as such.

ANALYSIS

Context

Finance teams evaluating finance systems typically look for a combination of core financial management application functionality along with "budgeting." Many CFOs and finance users are unfamiliar with developments in CPM in the past five to 10 years; therefore, they (wrongly) assume that BP&F will be part of the core financial applications. This means their evaluations are wrongly slanted toward vendors that appear to offer a complete solution.

Analysis

Most of Gartner's discussions with clients evaluating core financial management applications focus on the applications needed to support their finance processes. Users list the application modules they require, which typically include the core financial management applications, GL, accounts payable (AP), accounts receivable (AR), fixed assets (FA) and possibly other functionality, such as project accounting and treasury management. Invariably, the word "budgeting" gets added to the list. This is an immediate warning signal that indicates the finance team has a limited knowledge of the technology required to support effective BP&F. This is not surprising, because most finance users do not have much experience with the latest generation of CPM applications, as too many finance users still believe that Excel spreadsheets are an appropriate BP&F solution (see "Embrace or Replace Your Spreadsheets for Performance Management"). However, by creating an evaluation project that combines core financial management applications with BP&F, organizations face two potential issues: The choice of vendors will be restricted to only those that appear to offer a complete solution, ignoring some potentially strong CPM vendors which may lead to suboptimal choices and potentially weaken an organizations negotiating position. The BP&F project will underdeliver on potential benefits, because it will be focused on the current spreadsheet-oriented processes and will fail to take into account the needs of budget managers and business users (see "The Skills Gap Still Limits Success With Corporate Performance Management").

Publication Date: 21 April 2010/ID Number: G00175804 2010 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Page 2 of 6

BP&F Functionality: More Than "Budgeting"

The major challenge for most finance users is that their perception of BP&F is either based on manual, spreadsheet-based processes or outdated, first-generation BP&F applications. Very few users have experience with current-generation CPM applications and BP&F best practices. Their tendency is to focus on simple budgeting functionality, such as budget entry via spreadsheet-like templates, workflow to control the budget submission process, and budget models that are built using GL codes and financial classifications. These are requirements that all the current CPM suite vendors (see "Magic Quadrant for Corporate Performance Management Suites") can satisfy with their BP&F applications, but the capabilities of the current BP&F solutions are far more sophisticated. These include: A financial modeling engine that has an integrated profit-and-loss, balance sheet and cash flow forecasting capability. Support for short-term financial budgeting, usually with a one-year time horizon and longer-term planning, commonly with a three- to five-year time horizon for more-strategic financial and corporate planning. Support for other aspects of strategic planning, such as initiative management, and should provide links to strategy maps in scorecard applications. Detailed budgeting capabilities, such as salary or head count planning, revenue planning, capital planning, or expense planning. Sophisticated forecasting and modeling capabilities, which involve extrapolating new versions of plans and budgets based on the analysis of historical data and trends. These also include top-down spreading of budgetary targets across multiple dimensions (such as products, budget centers and projects). Support for driver-based planning. This enables users to model financial outcomes by varying the business driver assumptions, shifting the focus from planning by the numbers to planning for business activities. This approach provides a coherent and structured way of linking financial budgets with operational plans. Ability to export budget data to ERP applications, and the ability to import actual data and business driver data from ERP and other systems. By leveraging these capabilities, organizations can deliver significant improvements to current budgeting and planning processes, while building a financial planning system that is more closely linked with business operations. Also, this creates an opportunity to leverage other aspects of CPM to increase the overall strategic value of the finance function.

Why the GL Cannot Support Effective BP&F

Finance teams need to understand that delivering BP&F capabilities is not possible in core financial management applications. Many finance users assume BP&F is an "extension" of the functionality in a GL, primarily because some vendors delivered rudimentary budgeting capabilities as part of their GL in the 1990s. However, even the most sophisticated GL will be incapable of delivering this functionality for several reasons: Data structures. The underlying data structures of GL systems are optimized for highvolume transaction processing. They must be able to deal with large volumes of journal postings and interfaces from subsidiary systems, and the current generation of ERP systems all use highly normalized data structures held in relational tables to do this. BP&F systems, on the other hand, do very little (if any) transaction processing. They

Publication Date: 21 April 2010/ID Number: G00175804 2010 Gartner, Inc. and/or its Affiliates. All Rights Reserved. Page 3 of 6

need to be able to aggregate and manipulate large volumes of data on complex models to produce forecasts and scenarios. This requires a data structure very different from a GL, and all BP&F applications have a different database design structure, while many utilize online analytical processing (OLAP) databases to support the complex modeling and aggregation functionality that is required. GL code orientation. The core of any finance application is the GL chart of accounts and code block. This is used by finance personnel to organize all financial transactions for corporate and management reporting. Any budgeting system built in a GL will use the same elements to drive BP&F processes. While this may make sense to finance users, it makes no sense to business managers. To them, GL codes are a necessary evil in BP&F processes. Unlike finance users, business users do not live and breathe GL codes. Planning is performed by using business drivers, such as sales volumes, prices and average deal size. BP&F applications in CPM suites allow users to create planning models based on business drivers, and to map the results to GL codes. The current architecture of GL systems cannot support this capability, which is vital for linking financial budgets more closely to business operations. Processing loads. The primary goal of a GL is to support a rapid close of the books at period end. This means the typical monthly transaction processing loads for GL systems peak significantly in the few days around the period close. This is the same time that most budget center managers will want to run reports against their budgets, update forecasts and complete other complex tasks. Attempting to perform these activities in the GL at the same time as the transaction processing peak will place pressure on hardware resources, slow down the monthly close and create the provision of unused capacity for the rest of the month. For these reasons, it is better to keep the BP&F data in a separate database from the GL data. This enables the BP&F system to manage the peak loads of budget users, which, in some organizations, can be thousands of users, without impacting GL processing. Actual data can be extracted from the GL and passed to the BP&F system, while approved budgets can be passed back to the GL for budgetary control purposes. There is, however, an important aspect of BP&F for which the GL is ideally suited budgetary control. This involves tracking approved budgets in the GL against AP invoices and purchase orders for commitment and encumbrance accounting, along with enforcing commitment limits against approved budget levels. Many public-sector organizations reallocate approved budgets between departments or services by using GL journals to create an audit trail of how the funds were moved. These activities are best-performed in the GL once the approved budgets have been passed back from the BP&F application.

Adopting the Right Evaluation Approach

The differences between BP&F systems and core financial management applications mean that the vendors of BP&F systems differ from the vendors of core financial management applications. There is some overlap, because some vendors offer both core financial management applications (as part of their ERP offerings) and BP&F applications (as part of their CPM suites). However, it is important that evaluations are not restricted to vendors that only offer both solutions, because this will exclude some ERP vendors (which do not have BP&F solutions) and some BP&F vendors (which do not have ERP applications). Finance teams and IT professionals evaluating finance systems should, therefore, adopt the following evaluation approach: Conduct core financial management application and BP&F evaluations as separate, but linked, work streams within the same project.

Publication Date: 21 April 2010/ID Number: G00175804 2010 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Page 4 of 6

Understand that it is not necessary to select a GL before making the choice of a BP&F solution. BP&F applications can be linked to any GL, and the integration tasks are not complex (and can typically be maintained by finance users with the appropriate training). Do not exclude any CPM vendor from consideration because it does not offer core financial management applications, and do not exclude any ERP vendor because it does not offer BP&F. Evaluate the integration provided by an ERP vendor with its BP&F system against the integration capabilities of specialist BP&F vendors. In some cases, they may offer prepackaged connectors for specific ERP systems. If there is little difference (in evaluation terms) between shortlisted BP&F solutions, then give preference to the solution from your preferred ERP vendor (if there is one). However, do not delay the BP&F decision until the core financial applications decision has been made, unless doing so does not compromise your project time scales. Potential vendors of both core financial management applications and BP&F solutions can be found in "MarketScope for Core Financial Management Applications, 2008" and "Magic Quadrant for Corporate Performance Management Suites." One final consideration for IT professionals: Any requirement from finance users for a BP&F solution is usually an indication of a wider need for a broader CPM solution (see "Corporate Performance Management Must Move Beyond Finance"). This means IT must be prepared to engage finance in a discussion of how the BP&F solution will fit into the wider CPM landscape, and also how it may relate to business intelligence initiatives.

The Illusion of Integration

Vendors that offer both core financial management applications and BP&F will sell the benefits of their integrated solutions. While it is true that these vendors will generally offer out-of-the-box integration with their GL and/or underlying data repositories, users should not give excessive weight to this integration in their evaluations. All CPM suites have been designed to work with any back-end GL and finance system, and the integration requirements are relatively straightforward. Master data from the GL (like chart of accounts values and code block elements) needs to be transferred to the BP&F applications, and to aggregate actual data on a periodic basis. All CPM vendors offer integration tools to manage this integration (in some cases, as predefined connectors) and have experience working with most of the common ERP systems. In most cases, the integration tools can be managed by appropriately trained finance users and do not require a high degree of specialized IT skills. Vendors like SAP and Oracle have actually dropped their inhouse-developed BP&F applications in favor of acquired products (from OutlookSoft and Hyperion, respectively). Although they offer integration with their ERP systems, these applications are designed to work as stand-alone solutions, and are still sold on that basis.

Key Facts

A GL and other core financial management applications can support basic budgetary control procedures, but their data structure means they cannot support sophisticated BP&F functionality (such as top-down spreading, scenario creation and forecasting). Also, they cannot support driver-based planning. CPM applications have matured and now offer powerful BP&F functionality. However, these applications are not tightly coupled to the underlying core financial management applications. Several ERP vendors have abandoned their original tightly coupled BP&F solutions and, instead, purchased or built loosely coupled solutions that not only work

Publication Date: 21 April 2010/ID Number: G00175804 2010 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Page 5 of 6

with their core financial management applications but also can be sold as stand-alone solutions. A need to replace BP&F systems may be an indicator that a broader CPM solution is required. Finance teams, therefore, need to consider their broader CPM strategy, rather than thinking of BP&F as an "extension" of the GL. Evaluations of core financial management applications and BP&F systems that are conducted concurrently need to be managed as two separate, but linked, work streams.

RECOMMENDED READING

"MarketScope for Core Financial Management Applications 2008" "Magic Quadrant for Corporate Performance Management Suites" "The Skills Gap Still Limits Success with Corporate Performance Management" "Corporate Performance Management Must Move Beyond Finance"

REGIONAL HEADQUARTERS

Corporate Headquarters 56 Top Gallant Road Stamford, CT 06902-7700 U.S.A. +1 203 964 0096 European Headquarters Tamesis The Glanty Egham Surrey, TW20 9AW UNITED KINGDOM +44 1784 431611 Asia/Pacific Headquarters Gartner Australasia Pty. Ltd. Level 9, 141 Walker Street North Sydney New South Wales 2060 AUSTRALIA +61 2 9459 4600 Japan Headquarters Gartner Japan Ltd. Aobadai Hills, 6F 7-7, Aobadai, 4-chome Meguro-ku, Tokyo 153-0042 JAPAN +81 3 3481 3670 Latin America Headquarters Gartner do Brazil Av. das Naes Unidas, 12551 9 andarWorld Trade Center 04578-903So Paulo SP BRAZIL +55 11 3443 1509

Publication Date: 21 April 2010/ID Number: G00175804 2010 Gartner, Inc. and/or its Affiliates. All Rights Reserved.

Page 6 of 6

You might also like

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Political Economy of Education Financial Literacy and The Racial Wealth GapDocument18 pagesThe Political Economy of Education Financial Literacy and The Racial Wealth GapCP Mario Pérez LópezNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- CFPB - 2012 Credit Bureaus Reporting SystemDocument48 pagesCFPB - 2012 Credit Bureaus Reporting SystemCP Mario Pérez López100% (1)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (894)

- Mi Perfil Profesional - Inglés / My Professional Profile - EnglishDocument8 pagesMi Perfil Profesional - Inglés / My Professional Profile - EnglishCP Mario Pérez LópezNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- TFAF Spring Campaign Report & ScrapbookDocument224 pagesTFAF Spring Campaign Report & ScrapbookCP Mario Pérez LópezNo ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Saving and InvestingDocument17 pagesSaving and InvestingCP Mario Pérez LópezNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Financial Literacy and DebtDocument46 pagesFinancial Literacy and DebtCP Mario Pérez LópezNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- 21st Century Glass SteagallDocument30 pages21st Century Glass SteagallCP Mario Pérez LópezNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Dissecting The Financial Collapse of 2007 - 2008Document20 pagesDissecting The Financial Collapse of 2007 - 2008CP Mario Pérez LópezNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Wealth Management For WomenDocument0 pagesWealth Management For WomenCP Mario Pérez LópezNo ratings yet

- 10 Hidden Costs of Manual Reporting in ExcelDocument9 pages10 Hidden Costs of Manual Reporting in ExcelCP Mario Pérez LópezNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Consumer Financial Protection Bureau - April 2013Document36 pagesConsumer Financial Protection Bureau - April 2013CP Mario Pérez LópezNo ratings yet

- US Security and Exchange Commission - Study Regarding Financial Literacy Among InvestorsDocument212 pagesUS Security and Exchange Commission - Study Regarding Financial Literacy Among InvestorsCP Mario Pérez LópezNo ratings yet

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Financial Education in New England - January 2013Document24 pagesFinancial Education in New England - January 2013CP Mario Pérez LópezNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Planning, Budgeting and ForecastingDocument16 pagesPlanning, Budgeting and ForecastingCP Mario Pérez LópezNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- 6 Steps For Linking Corporate Strategy To The BugetDocument22 pages6 Steps For Linking Corporate Strategy To The BugetCP Mario Pérez LópezNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- 7 Keys To Success in CPA Firm ManagementDocument12 pages7 Keys To Success in CPA Firm ManagementCP Mario Pérez LópezNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Federal Reserve Board: Equal Credit Opportunity - Regulation BDocument7 pagesFederal Reserve Board: Equal Credit Opportunity - Regulation BCP Mario Pérez LópezNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- Financial Literacy Survey - 2011Document10 pagesFinancial Literacy Survey - 2011CP Mario Pérez LópezNo ratings yet

- The Ontario Curriculum Grades 9 - 12 - Financial Literacy, Scope and Sequence of ExpectationsDocument207 pagesThe Ontario Curriculum Grades 9 - 12 - Financial Literacy, Scope and Sequence of ExpectationsCP Mario Pérez López100% (1)

- Federal Reserve Board: Fair Credit Reporting - Regulation VDocument20 pagesFederal Reserve Board: Fair Credit Reporting - Regulation VCP Mario Pérez LópezNo ratings yet

- Fiscal Cliff Whitepaper UPDATEDDocument6 pagesFiscal Cliff Whitepaper UPDATEDCP Mario Pérez LópezNo ratings yet

- Dodd-Frank Wall Street Reform and Consumer Protection Act H. R. 4173Document39 pagesDodd-Frank Wall Street Reform and Consumer Protection Act H. R. 4173CP Mario Pérez LópezNo ratings yet

- Council For Economic Education 2009 SurveyDocument24 pagesCouncil For Economic Education 2009 SurveyCP Mario Pérez LópezNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Council For Economic Education 2009 SurveyDocument24 pagesCouncil For Economic Education 2009 SurveyCP Mario Pérez LópezNo ratings yet

- 6th Central Pay Commission Salary CalculatorDocument15 pages6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- Financial Math TestDocument172 pagesFinancial Math TestCP Mario Pérez López100% (2)

- How Undergraduate Students Use Credit Cards: Sallie Mae's National Study of Usage Rates and Trends 2009Document19 pagesHow Undergraduate Students Use Credit Cards: Sallie Mae's National Study of Usage Rates and Trends 2009CP Mario Pérez LópezNo ratings yet

- SII PIF Rating AgenciesDocument31 pagesSII PIF Rating AgenciesCP Mario Pérez LópezNo ratings yet

- Financial Literacy and DebtDocument46 pagesFinancial Literacy and DebtCP Mario Pérez LópezNo ratings yet

- By Himanshu Panwar Asst. Prof. Civil Engineering Department AkgecDocument34 pagesBy Himanshu Panwar Asst. Prof. Civil Engineering Department AkgecAlok0% (1)

- 1100cc Engine Parts CatalogueDocument39 pages1100cc Engine Parts CatalogueSimon placenciaNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- BK - Scrum and CMMIDocument132 pagesBK - Scrum and CMMIcoolgoroNo ratings yet

- Oracle Service Procurement Advisory & ConsultingDocument22 pagesOracle Service Procurement Advisory & ConsultingPrakashNo ratings yet

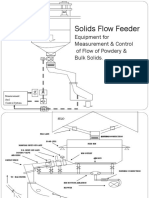

- Solids Flow Feeder Equipment for Precise Measurement & ControlDocument7 pagesSolids Flow Feeder Equipment for Precise Measurement & ControlAbhishek DuttaNo ratings yet

- Scoring Rubric For Oral Presentations Total Points ScoreDocument2 pagesScoring Rubric For Oral Presentations Total Points ScoreLezia pagdonsolanNo ratings yet

- Post TensioningDocument13 pagesPost TensioningAbdullah AhamedNo ratings yet

- Shallow Foundation Assignment 1 (Finals)Document2 pagesShallow Foundation Assignment 1 (Finals)Lensearfwyn NamocatcatNo ratings yet

- TARPfinal PDFDocument28 pagesTARPfinal PDFRakesh ReddyNo ratings yet

- My Ideal Week PDFDocument1 pageMy Ideal Week PDFAnonymous QE45TVC9e3No ratings yet

- Secure Email Transaction SystemDocument32 pagesSecure Email Transaction SystemGautam Sharma100% (1)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- 7 Strategies For Developing Your Own Curriculum As A New TeacherDocument5 pages7 Strategies For Developing Your Own Curriculum As A New TeacherKhusnul KhotimahNo ratings yet

- BS Basics Boundary Scan PDFDocument2 pagesBS Basics Boundary Scan PDFShankar ArunmozhiNo ratings yet

- Project Management Book PDFDocument55 pagesProject Management Book PDFSerigne Mbaye Diop94% (16)

- Electronics QuestionnaireDocument4 pagesElectronics QuestionnaireRenie FedericoNo ratings yet

- 0100CT1901 Sec-23 102520202Document120 pages0100CT1901 Sec-23 102520202Chandra SekaranNo ratings yet

- ASTM 210cDocument1 pageASTM 210cDodi SuhendraNo ratings yet

- Envea Dusty Manual enDocument26 pagesEnvea Dusty Manual enmikiNo ratings yet

- Acha Teff ThresherDocument62 pagesAcha Teff ThresherTANKO BAKO100% (2)

- Project Report PDFDocument4 pagesProject Report PDFPradeep VermaNo ratings yet

- Padlock Sharper Image FingerprintDocument1 pagePadlock Sharper Image FingerprintHenryW.CampbellJr.No ratings yet

- 300G IM SettingsSheets 20160122Document27 pages300G IM SettingsSheets 20160122zeljkoradaNo ratings yet

- 194 Sample ChapterDocument27 pages194 Sample ChapterVikas TiwariNo ratings yet

- Hitachi SetFree MiniVRF 0120LRDocument52 pagesHitachi SetFree MiniVRF 0120LRAhmed AzadNo ratings yet

- Cisco CCIE CCNP RS Study Flashcards Ver 49Document102 pagesCisco CCIE CCNP RS Study Flashcards Ver 49niboozNo ratings yet

- 220 KV GSS, HeerapuraDocument56 pages220 KV GSS, Heerapurapikeshjain33% (3)

- June 2014 Draft for Public ReviewDocument59 pagesJune 2014 Draft for Public ReviewRomel Vargas Sánchez0% (1)

- Ticketreissue PDFDocument61 pagesTicketreissue PDFnicoNicoletaNo ratings yet

- Average Waiting Time at Dental ClinicDocument12 pagesAverage Waiting Time at Dental ClinicJonas Ciabis100% (1)

- Product Oriented Performance Based OrientedDocument43 pagesProduct Oriented Performance Based OrientedAlmira A. Mira-ato100% (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyFrom EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyRating: 5 out of 5 stars5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomFrom EverandProfit First for Therapists: A Simple Framework for Financial FreedomNo ratings yet

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)