Professional Documents

Culture Documents

PNB Vs Banatao

Uploaded by

Benedicto Eulogio C. ManzonOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

PNB Vs Banatao

Uploaded by

Benedicto Eulogio C. ManzonCopyright:

Available Formats

PNB vs Banatao

Sec. trans no. 1

FACTS: Banatao, et al. (plaintiffs-respondents) initiated an action against Marciano Carag (one of the defendantsrespondents) before the RTC for the recovery of real property that the plaintiffs-respondents claimed as the owners of the adjoining . The defendants-respondents, were the occupants of the disputed property. The defendants-respondents were able to secure homestead patents evidenced by Original Certificates of Title (OCTs) issued in their names, and all bear the proviso that, in accordance with the Public Land Act, the patented homestead shall neither be alienated nor encumbered for five (5) years from the date of the issuance of the patent. The defendants-respondents separately applied for loans with the PNB secured by real estate mortgages which the bank approved the mortgages, relying solely on the OCTs which, at the time, did not contain any notice of lis pendens or annotation of liens and encumbrances. The bank extrajudicially foreclosed was declared the highest bidder of the property. The spouses Soriano failed to redeem the foreclosed property, resulting in the consolidation of title in the banks name. The plaintiffs-respondents and the defendants-respondents entered into a compromise agreement whereby ownership of virtually the northern half of the disputed property was ceded to the plaintiffs-respondents, while the remaining southern half was given to the defendants-respondents. In the same compromise agreement, the defendantsrespondents acknowledged their indebtedness to petitioner PNB and bound themselves to pay their respective obligations to the bank, including the interests accruing thereon. Petitioner PNB, however, was not a party to the compromise agreement. The trial court rendered its decision, approving and adopting in toto the compromise agreement, and ordering the participating parties to strictly comply with its terms. The bank moved for reconsideration of the trial courts decision and for the setting aside of the compromise agreement. The trial court denied the motion thus, compelled the bank to elevate the case to the CA. The appellate court dismissed the appeal in, ruling that the bank is not an indispensable party to the compromise agreement that only settles the actions for: (1) recovery of property; and (2) cancellation of OCTs. On the third cause of action for annulment of mortgage, the court held the bank is only a necessary party and the issue could be dealt with in a separate and distinct action. The appellate court in the same decision proceeded to strike down the mortgages as void because the mortgagors (defendants-respondents), not being the absolute owners of the disputed parcels of land as agreed upon in the compromise agreement, did not have the right to constitute a mortgage on these properties. ISSUE: WHETHER THE COMPROMISE AGREEMENT ENTERED INTO LEGALLY BINDS PETITIONER PNB WHICH IS NOT A PARTY THERETO AND CONSTITUTES SUFFICIENT LEGAL BASIS TO NULLIFY PNB'S MORTGAGE LIEN ON THE REALTY IN QUESTION. RULING: We resolve to dismiss the petition for the reasons discussed below.

It is basic in law that a compromise agreement, as a contract, is binding only upon the parties to the compromise, and not upon non-parties. This is the doctrine of relativity of contracts. A court judgment made solely on the basis of a compromise agreement binds only the parties to the compromise, and cannot bind a party litigant who did not take part in the compromise agreement. We conclude from our own examination of these OCTs that the mortgages cannot but be void ab initio. On the faces of all the OCTssecured through homestead patentsare inscribed which contains a proscription against the alienation or encumbrance of homestead patents within five years from issue. PNB cannot claim that it is a mortgagee in good faith. One who contracts with a homestead patentee is charged with knowledge of the law's proscriptive provision that must necessarily be read into the terms of any agreement involving the homestead. Under the circumstances, the PNB simply failed to observe the diligence required in the handling of its transactions and thus made the fatal error of approving the loans secured by mortgages of properties that cannot, in the first place, be mortgaged. Both the defendants-respondents and the bank are to be faulted for the invalidity of the mortgages. Our conclusion on the nullity of mortgage issue renders it unnecessary to decide the question of whether the compromise agreement between the plaintiffs-respondents and the defendants-respondents should be set aside for its effect on the bank. With the mortgages invalidated, the PNB no longer has any interest that the compromise agreement can affect. The parties liabilities to PNB on the loans they obtained are not issues before us for disposition, and are for the parties to act upon as matters outside the coverage of this case.

You might also like

- In The Matter of Credit Transactions Case DigestsDocument51 pagesIn The Matter of Credit Transactions Case DigestsGerard TinampayNo ratings yet

- Digest PNB Vs BanataoDocument2 pagesDigest PNB Vs BanataoRegine Joy MagaboNo ratings yet

- 53) Asian Cathay Finance and Leasing Corporation vs. Gravador, 623 SCRA 517 (2010)Document1 page53) Asian Cathay Finance and Leasing Corporation vs. Gravador, 623 SCRA 517 (2010)Zyrene CabaldoNo ratings yet

- 02 Act. No. 2137 Warehouse Receipts LawDocument11 pages02 Act. No. 2137 Warehouse Receipts LawPamela PlatonNo ratings yet

- Domicile of A CorporationDocument3 pagesDomicile of A CorporationmaggiNo ratings yet

- Phil. Banking Corp. Vs CIRDocument2 pagesPhil. Banking Corp. Vs CIRKatherine EvangelistaNo ratings yet

- CIR V Castaneda DigestDocument1 pageCIR V Castaneda DigestKTNo ratings yet

- Molina vs. de RivaDocument3 pagesMolina vs. de RivaAnonymous 33LIOv6LNo ratings yet

- Benguet Corp. v. CIR PDFDocument2 pagesBenguet Corp. v. CIR PDFKarla Lois de GuzmanNo ratings yet

- Introduction To Transfer TaxesDocument3 pagesIntroduction To Transfer TaxesKiana FernandezNo ratings yet

- Ethics and The SocietyDocument9 pagesEthics and The SocietyمحمودعليNo ratings yet

- Keihin-Everett vs. Tokio Marine Malayan InsuranceDocument4 pagesKeihin-Everett vs. Tokio Marine Malayan InsuranceJohn Mark RevillaNo ratings yet

- Nego CasesDocument13 pagesNego CasesEnrique Legaspi IVNo ratings yet

- Tayag vs. Benguet ConsolidatedDocument17 pagesTayag vs. Benguet ConsolidatedisaaabelrfNo ratings yet

- 247-Penid v. Virata G.R. No. L-44004 March 25, 1983Document4 pages247-Penid v. Virata G.R. No. L-44004 March 25, 1983Jopan SJNo ratings yet

- Aguinaldo Vs SantosDocument1 pageAguinaldo Vs Santosxsar_xNo ratings yet

- UP Law F2021: Yau Chu v. CADocument1 pageUP Law F2021: Yau Chu v. CAJuno GeronimoNo ratings yet

- LTDDocument50 pagesLTDMheryza De Castro PabustanNo ratings yet

- Limson V CADocument3 pagesLimson V CAJeliza ManaligodNo ratings yet

- Nego Case Patrimonio Vs GutierrezDocument2 pagesNego Case Patrimonio Vs GutierrezIsay JimenezNo ratings yet

- Wills and Succession FINAL NOTEDocument504 pagesWills and Succession FINAL NOTEJaniceNo ratings yet

- Philippine National Bank v. AmoresDocument6 pagesPhilippine National Bank v. AmoresRoemma Kara Galang PaloNo ratings yet

- Credit Transactions Course Outline: Mr. Mark Xavier D. OyalesDocument3 pagesCredit Transactions Course Outline: Mr. Mark Xavier D. OyalesSand FajutagNo ratings yet

- R.A. 8791 GENERAL BANKING LAW of 2000 - Law, Politics, and Philosophy (Recovered)Document23 pagesR.A. 8791 GENERAL BANKING LAW of 2000 - Law, Politics, and Philosophy (Recovered)Michael VillalonNo ratings yet

- Chapter 2 (Oblicon Digest)Document22 pagesChapter 2 (Oblicon Digest)Michaela RetardoNo ratings yet

- PDIC vs. GidwaniDocument2 pagesPDIC vs. GidwaniheyoooNo ratings yet

- I. SHORT TITLE: Philippine National Bank Vs Rocha Ii. Full TitleDocument3 pagesI. SHORT TITLE: Philippine National Bank Vs Rocha Ii. Full TitleeizNo ratings yet

- Case: Action To Recover From The Defendant, Collector of Internal Revenue, Certain Sums of Money PaidDocument6 pagesCase: Action To Recover From The Defendant, Collector of Internal Revenue, Certain Sums of Money PaidJulian DubaNo ratings yet

- 07 Bank of Commerce Vs Serrano (Flordeliza)Document2 pages07 Bank of Commerce Vs Serrano (Flordeliza)Rad IsnaniNo ratings yet

- Admin Case PoolDocument131 pagesAdmin Case PoolBenedict Jonathan BermudezNo ratings yet

- 62-6 Mesina vs. IACDocument11 pages62-6 Mesina vs. IACRudejane TanNo ratings yet

- Philippine Phosphate Fertilizer Corporation Vs KamaligDocument9 pagesPhilippine Phosphate Fertilizer Corporation Vs KamaligAJ LeoNo ratings yet

- Cred Transaction Case Doctrines (De-Leon Manzano)Document6 pagesCred Transaction Case Doctrines (De-Leon Manzano)Angela FeriaNo ratings yet

- Succession Review - Case List 1Document102 pagesSuccession Review - Case List 1Jo-Al GealonNo ratings yet

- Civpro Support Group Finals Case DigestsDocument290 pagesCivpro Support Group Finals Case Digestsheber suarezNo ratings yet

- Credit CasesDocument49 pagesCredit CasesBechay PallasigueNo ratings yet

- Sec 1 - 23 Self Made ReviewerDocument21 pagesSec 1 - 23 Self Made ReviewerJyasmine Aura V. AgustinNo ratings yet

- Civpro Fin Cases WK1Document39 pagesCivpro Fin Cases WK1Jan Kenrick SagumNo ratings yet

- People Vs GoDocument33 pagesPeople Vs GoMelissa AdajarNo ratings yet

- Case 5 PDFDocument2 pagesCase 5 PDFWilliam DC RiveraNo ratings yet

- Go Vs MetropolitanDocument4 pagesGo Vs MetropolitanKayee KatNo ratings yet

- 2I2J-Nego CaseDigest TemplateDocument1 page2I2J-Nego CaseDigest TemplatekarlNo ratings yet

- Metropolitan Bank & Trust Company vs. CADocument2 pagesMetropolitan Bank & Trust Company vs. CALenie SanchezNo ratings yet

- Oposa V. Factoran Davide, Jr. - July 30, 1993 - G.R. No. 101083 Summary/Doctrine: Specified Cause of ActionDocument4 pagesOposa V. Factoran Davide, Jr. - July 30, 1993 - G.R. No. 101083 Summary/Doctrine: Specified Cause of ActionBananaNo ratings yet

- Lee Yeung Case DigestDocument3 pagesLee Yeung Case DigestKuthe Ig TootsNo ratings yet

- Teodoro v. Metropolitan Bank and CoDocument18 pagesTeodoro v. Metropolitan Bank and CoJamaika Ina CruzNo ratings yet

- Issues On Remedies Under TCCDocument18 pagesIssues On Remedies Under TCCLheila MendozaNo ratings yet

- Punsalan Vs ManilaDocument4 pagesPunsalan Vs ManilaPaolo Antonio EscalonaNo ratings yet

- Political Law DigestDocument95 pagesPolitical Law DigestAnonymous IobsjUatNo ratings yet

- Domingo vs. Garlitos (8 SCRA 443, G.R. No. L-18994, June 29, 1963)Document2 pagesDomingo vs. Garlitos (8 SCRA 443, G.R. No. L-18994, June 29, 1963)Kent UgaldeNo ratings yet

- BusOrg II Group 4 Other Corporations PDFDocument55 pagesBusOrg II Group 4 Other Corporations PDFIanLightPajaro100% (1)

- Letters of Credit Cases-DigestDocument3 pagesLetters of Credit Cases-Digestrlg2vmmcNo ratings yet

- LegRes Lounge - MARTINEZ v. ONGSIAKODocument2 pagesLegRes Lounge - MARTINEZ v. ONGSIAKOChaze CerdenaNo ratings yet

- Property Wednesday FinalDocument9 pagesProperty Wednesday FinalNeon True BeldiaNo ratings yet

- Baluyot Vs HolganzaDocument3 pagesBaluyot Vs HolganzaJohn Allen De TorresNo ratings yet

- Borromeo Vs DescallarDocument6 pagesBorromeo Vs DescallarKhayzee AsesorNo ratings yet

- Apostolic Prefect v. Treasurer of Baguio CORRECT VERSIONDocument1 pageApostolic Prefect v. Treasurer of Baguio CORRECT VERSIONJevi RuiizNo ratings yet

- Lee V Court of Appeals G.R. NO. 117913. February 1, 2002Document12 pagesLee V Court of Appeals G.R. NO. 117913. February 1, 2002Zarah JeanineNo ratings yet

- PNB Vs CA Case DigestDocument2 pagesPNB Vs CA Case Digesttine delos santosNo ratings yet

- PNB-V-BANATAO DigestDocument5 pagesPNB-V-BANATAO DigestLau NunezNo ratings yet

- DBP Vs NLRCDocument2 pagesDBP Vs NLRCBenedicto Eulogio C. Manzon100% (1)

- DBP Vs NLRCDocument2 pagesDBP Vs NLRCBenedicto Eulogio C. Manzon100% (1)

- Test 1 Fundamentals of NursingDocument16 pagesTest 1 Fundamentals of NursingBenedicto Eulogio C. ManzonNo ratings yet

- DBP Vs NLRCDocument2 pagesDBP Vs NLRCBenedicto Eulogio C. Manzon100% (1)

- DBP Vs NLRCDocument2 pagesDBP Vs NLRCBenedicto Eulogio C. Manzon100% (1)

- Business Name FormIndividualDocument3 pagesBusiness Name FormIndividualpauljaynesNo ratings yet

- Trial Preparation ChecklistDocument4 pagesTrial Preparation ChecklistSami Hartsfield100% (6)

- FCI Registration Slip ANUPDocument2 pagesFCI Registration Slip ANUPDebajyoti SahooNo ratings yet

- BELGICA Vs OCHOA Simplified DigestDocument3 pagesBELGICA Vs OCHOA Simplified Digestonryouyuki100% (1)

- Is Time An Essence of ContractDocument9 pagesIs Time An Essence of ContractVishakh NagNo ratings yet

- Tan v. AndradeDocument1 pageTan v. AndradeIkangApostolNo ratings yet

- How To Register A Company in Pakistan (Copied)Document4 pagesHow To Register A Company in Pakistan (Copied)Tinna Devi ArmasamyNo ratings yet

- US Vs Javier, G.R. No. L-12990Document2 pagesUS Vs Javier, G.R. No. L-12990JNo ratings yet

- Republic vs. Bermudez-LorinoDocument4 pagesRepublic vs. Bermudez-LorinoCharmaine MejiaNo ratings yet

- RemLaw Compilation1Document117 pagesRemLaw Compilation1Antonio BartolomeNo ratings yet

- Freedom of Press and Print NewsDocument8 pagesFreedom of Press and Print Newstayyaba redaNo ratings yet

- Writing Editorials 2017 (JLVillalobos)Document17 pagesWriting Editorials 2017 (JLVillalobos)Naquines Bachicha QueenlyNo ratings yet

- Orlando Antonio Bonilla-Molina, A094 246 276 (BIA Sept. 2, 2015)Document6 pagesOrlando Antonio Bonilla-Molina, A094 246 276 (BIA Sept. 2, 2015)Immigrant & Refugee Appellate Center, LLCNo ratings yet

- Full Text Arnado Vs Comelec Aug 18 2015Document61 pagesFull Text Arnado Vs Comelec Aug 18 2015Brent DagbayNo ratings yet

- RML V Netflix DecisionDocument9 pagesRML V Netflix DecisionTHROnlineNo ratings yet

- Title 11 - Double InsuranceDocument2 pagesTitle 11 - Double InsuranceRodel Cadorniga Jr.No ratings yet

- G.R. No. 105371 Phil Judges Association Vs Prado (Equal Protection Clause)Document5 pagesG.R. No. 105371 Phil Judges Association Vs Prado (Equal Protection Clause)MarkNo ratings yet

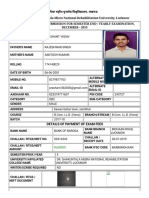

- Details of Payment of Exam FeesDocument2 pagesDetails of Payment of Exam FeesSaurabh YadavNo ratings yet

- Ethics in Research ArchanaDocument50 pagesEthics in Research ArchanaArchana MoreyNo ratings yet

- Plaintiff-Appellee Vs Vs Defendant-Appellant Solicitor General Eugenio G GemarinoDocument2 pagesPlaintiff-Appellee Vs Vs Defendant-Appellant Solicitor General Eugenio G GemarinoAnnieNo ratings yet

- Insular Drug Co v. National BankDocument2 pagesInsular Drug Co v. National BankPio MathayNo ratings yet

- Newport v. Fact Concerts, Inc., 453 U.S. 247 (1981)Document27 pagesNewport v. Fact Concerts, Inc., 453 U.S. 247 (1981)Scribd Government DocsNo ratings yet

- Impact of Influencers in Consumer Decision Process: The Fashion IndustryDocument1 pageImpact of Influencers in Consumer Decision Process: The Fashion IndustryTeodora Maria Andreea DeseagăNo ratings yet

- Petition For AdoptionDocument6 pagesPetition For AdoptionKuya KimNo ratings yet

- Ordinary ContractDocument11 pagesOrdinary ContracttmaderazoNo ratings yet

- Industrial Development Regulation ActDocument49 pagesIndustrial Development Regulation Actps_gurumurthyNo ratings yet

- Permit To Join ActivitiesDocument2 pagesPermit To Join ActivitiesCHARLYNE MAE GABRIELNo ratings yet

- Unit 2 - Session 1: LEARNING OBJECTIVE: Talk About My FamilyDocument11 pagesUnit 2 - Session 1: LEARNING OBJECTIVE: Talk About My Familyyesica suarezNo ratings yet

- G.R. No. 212398 Ejercito Vs ComelecDocument24 pagesG.R. No. 212398 Ejercito Vs ComelecKenshin HealerNo ratings yet

- Change of Meter-GhafniDocument4 pagesChange of Meter-GhafniJahanzaib SheikhNo ratings yet