Professional Documents

Culture Documents

Another New All Time Closing High For Dow Transports.

Uploaded by

Richard SuttmeierOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Another New All Time Closing High For Dow Transports.

Uploaded by

Richard SuttmeierCopyright:

Available Formats

Richard Suttmeier is the Chief Market Strategist at www.ValuEngine.com. ValuEngine is a fundamentally-based quant research firm in Newtown, PA.

ValuEngine covers over 7,000 stocks every day. A variety of newsletters and portfolios containing Suttmeier's detailed research, stock picks, and commentary can be found http://www.valuengine.com/nl/mainnl To unsubscribe from this free email newsletter list, please click

http://www.valuengine.com/pub/Unsubscribe? March 5, 2013 Another new all time closing high for Dow Transports.

10-Year Note (1.875) Weekly, annual, and semiannual value levels are 1.932, 1.981, 2.476 and 3.063 with daily, monthly and semiannual risky levels at 1.781, 1.796 and 1.413. Comex Gold ($1572.8) The December 2011 low is $1523.9 with my annual pivot at $1599.9, and weekly, semiannual, monthly, quarterly and annual risky levels at $1604.8, $1719.2, $1737.6, $1802.9 and $1852.1. Nymex Crude Oil ($90.07) The 200-week SMA is $86.64 with a daily value level at $89.32, the 200-day at $90.37, and weekly, quarterly, monthly and annual risky levels at $95.72, $95.84, $98.23, $115.23 and $115.42. The Euro (1.3017) Daily and semiannual value levels are 1.2885 and 1.2797 with monthly, annual, quarterly, weekly and annual risky levels at 1.3249, 1.3257, 1.3334, 1.3430 and 1.4295.

The Dow Transports set another new closing high at 6044.67 on Monday with the Dow Industrials still below its all time closing high of 14,164.53 set on Oct 9, 2007. Monthly pivots are 13,949 Dow Industrials, 1528.6 S&P 500, 3197 NASDAQ, and 901.68 Russell 2000. Above are my semiannual risky levels at 14,323 Dow Industrials, 1566.9 S&P 500 and 965.51 Russell 2000. Weekly risky levels are 14,387 Dow Industrials, 1547.7 S&P 500, 3226 NASDAQ, 6192 Dow Transports and 936.95 Russell 2000. My monthly value level is 5522 Dow Transports. Quarterly and annual value levels are 13,668 Industrials, 1431.1 S&P 500, 3071 NASDAQ, 5469 Transports and 860.25 Russell 2000.

Daily Dow: (14,128) Monthly, quarterly and annual value levels are 13,949, 13,920, 13,668, 12,696 and 12,509 with a daily pivot at 14,082, and semiannual and weekly risky levels at 14,323 and 14,387. S&P 500 (1525.2) Daily, quarterly and annual value levels are 1510.7, 1431.1 and 1348.3 with monthly, weekly and semiannual risky levels at 1528.6, 1547.7 and 1566.9. The October 2007 high is 1576.09. NASDAQ (3182) Daily, quarterly and annual value levels are 3146, 3071, 2806 and 2790 with monthly, weekly and semiannual risky levels at 3197, 3226 and 3583. NASDAQ 100 (NDX) (2760) Daily and annual value levels are 2729, 2463 and 2385 with weekly, quarterly and monthly risky levels at 2779, 2798 and 2809. Dow Transports (6045) Daily, monthly, annual and quarterly value levels are 5970, 5522, 5469 and 5094 with annual and semiannual pivots at 5925 and 5955, and weekly risky level at 6192. Russell 2000 (916.68) Daily, monthly, annual, quarterly and annual value levels are 905.74, 901.68, 860.25, 821.01 and 809.54 with weekly and semiannual risky levels at 936.95 and 965.51. The SOX (424.01) Monthly, quarterly and annual value levels are 404.22, 371.62 and 338.03 with a daily pivot at 421.38, and quarterly, weekly and semiannual risky levels at 440.36, 441.87 and 520.17.. VE Morning Briefing If you want expanded analysis of the US Capital Markets go to this link and sign up: http://www.valuengine.com/nl/mainnl?nl=D

You might also like

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- The Power of The Pivots Continue For The Major Equity Averages.Document2 pagesThe Power of The Pivots Continue For The Major Equity Averages.Richard SuttmeierNo ratings yet

- Daily Charts Are Negative For The Five Major Equity Averages.Document2 pagesDaily Charts Are Negative For The Five Major Equity Averages.Richard SuttmeierNo ratings yet

- Dow Industrials, S&P 500 and Dow Transports Set All-Time Highs.Document2 pagesDow Industrials, S&P 500 and Dow Transports Set All-Time Highs.Richard SuttmeierNo ratings yet

- Daily Charts Are Negative For The Five Major Equity Averages.Document2 pagesDaily Charts Are Negative For The Five Major Equity Averages.Richard SuttmeierNo ratings yet

- Dow Industrials & S&P 500 Ended Last Week With Daily Key Reversals.Document2 pagesDow Industrials & S&P 500 Ended Last Week With Daily Key Reversals.Richard SuttmeierNo ratings yet

- Fed Minutes Move Stocks Back Towards Higher Pivots.Document2 pagesFed Minutes Move Stocks Back Towards Higher Pivots.Richard SuttmeierNo ratings yet

- Pivots Still Rule As Choppy Trading Continue, To The Upside So Far This Week!Document2 pagesPivots Still Rule As Choppy Trading Continue, To The Upside So Far This Week!Richard SuttmeierNo ratings yet

- The Dow 30 Missed Setting An All-Time Intraday High by 6 Cents On Wed.Document2 pagesThe Dow 30 Missed Setting An All-Time Intraday High by 6 Cents On Wed.Richard SuttmeierNo ratings yet

- We Now Have Negative Weekly Charts For The Nasdaq and Russell 2000.Document2 pagesWe Now Have Negative Weekly Charts For The Nasdaq and Russell 2000.Richard SuttmeierNo ratings yet

- The Dow Retested My Semiannual Pivot at 16245 On Monday.Document2 pagesThe Dow Retested My Semiannual Pivot at 16245 On Monday.Richard SuttmeierNo ratings yet

- New All-Time Intraday Highs Were Set For The S&P 500 and Dow Transports!Document2 pagesNew All-Time Intraday Highs Were Set For The S&P 500 and Dow Transports!Richard SuttmeierNo ratings yet

- The Dow Retested My Semiannual Pivot at 16245 On Monday.Document2 pagesThe Dow Retested My Semiannual Pivot at 16245 On Monday.Richard SuttmeierNo ratings yet

- The Major Equity Average Straddle New Monthly and Quarter Levels.Document2 pagesThe Major Equity Average Straddle New Monthly and Quarter Levels.Richard SuttmeierNo ratings yet

- The S&P 500 Eked Out A New All-Time Intraday High at 1883.97 On Friday.Document2 pagesThe S&P 500 Eked Out A New All-Time Intraday High at 1883.97 On Friday.Richard SuttmeierNo ratings yet

- Dow, Nasdaq, Russell 2000 Are Below Pivots at 16,245 / 4272 and 1180.35!Document2 pagesDow, Nasdaq, Russell 2000 Are Below Pivots at 16,245 / 4272 and 1180.35!Richard SuttmeierNo ratings yet

- The Dow Retested My Semiannual Pivot at 16245 On Monday.Document2 pagesThe Dow Retested My Semiannual Pivot at 16245 On Monday.Richard SuttmeierNo ratings yet

- The Line in The Sand Is 16245 On The Dow Industrial Average.Document2 pagesThe Line in The Sand Is 16245 On The Dow Industrial Average.Richard SuttmeierNo ratings yet

- New Highs Are in Sight As We Wait For The Fed.Document2 pagesNew Highs Are in Sight As We Wait For The Fed.Richard SuttmeierNo ratings yet

- Monday Was A Day Without New Highs.Document2 pagesMonday Was A Day Without New Highs.Richard SuttmeierNo ratings yet

- The Line in The Sand Is 16245 On The Dow Industrial Average.Document2 pagesThe Line in The Sand Is 16245 On The Dow Industrial Average.Richard SuttmeierNo ratings yet

- Dow Industrials Ended Last Week Below Its Five-Week MMA at 16158.Document2 pagesDow Industrials Ended Last Week Below Its Five-Week MMA at 16158.Richard SuttmeierNo ratings yet

- Look For New Value Levels, Risky Levels and Pivots On Jan. 2, 2014.Document2 pagesLook For New Value Levels, Risky Levels and Pivots On Jan. 2, 2014.Richard SuttmeierNo ratings yet

- Dow Industrials Ended Last Week Below Its Five-Week MMA at 16158.Document2 pagesDow Industrials Ended Last Week Below Its Five-Week MMA at 16158.Richard SuttmeierNo ratings yet

- Look For New Value Levels, Risky Levels and Pivots On Jan. 2, 2014.Document2 pagesLook For New Value Levels, Risky Levels and Pivots On Jan. 2, 2014.Richard SuttmeierNo ratings yet

- New Highs Except For Dow Industrials and Dow Transports.Document2 pagesNew Highs Except For Dow Industrials and Dow Transports.Richard SuttmeierNo ratings yet

- The Major Averages Continue To Straddle Key Pivots.Document2 pagesThe Major Averages Continue To Straddle Key Pivots.Richard SuttmeierNo ratings yet

- New Highs Except For Dow Industrials and Dow Transports.Document2 pagesNew Highs Except For Dow Industrials and Dow Transports.Richard SuttmeierNo ratings yet

- The S&P 500 and Dow Transports Set New All-Time Highs On Friday.Document2 pagesThe S&P 500 and Dow Transports Set New All-Time Highs On Friday.Richard SuttmeierNo ratings yet

- New Highs Except For Dow Industrials and Dow Transports.Document2 pagesNew Highs Except For Dow Industrials and Dow Transports.Richard SuttmeierNo ratings yet

- Dow Industrials & Dow Transports Are The YTD Laggards.Document2 pagesDow Industrials & Dow Transports Are The YTD Laggards.Richard SuttmeierNo ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Tally TestDocument2 pagesTally TestHK DuggalNo ratings yet

- Accounting ProjectDocument33 pagesAccounting Projectapi-353552300100% (1)

- Competition ActDocument25 pagesCompetition ActAnjali Mishra100% (1)

- CSR 2Document7 pagesCSR 2Shravan RamsurrunNo ratings yet

- Complete History of The Soviet Union, Arranged To The Melody of TetrisDocument2 pagesComplete History of The Soviet Union, Arranged To The Melody of TetrisMikael HolmströmNo ratings yet

- L7 Cost Management PDFDocument85 pagesL7 Cost Management PDFhalia bonjoNo ratings yet

- To Sell or Scale Up: Canada's Patent Strategy in A Knowledge EconomyDocument22 pagesTo Sell or Scale Up: Canada's Patent Strategy in A Knowledge EconomyInstitute for Research on Public Policy (IRPP)No ratings yet

- M4e PDFDocument699 pagesM4e PDFRahul Singh100% (3)

- Looting Ukraine - How East and West Teamed Up To Steal A CountryDocument24 pagesLooting Ukraine - How East and West Teamed Up To Steal A Countryvidovdan9852No ratings yet

- The Debasement of The Bezant in The Eleventh Century / Ph. GriersonDocument16 pagesThe Debasement of The Bezant in The Eleventh Century / Ph. GriersonDigital Library Numis (DLN)No ratings yet

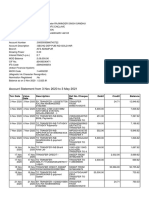

- Account Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDocument8 pagesAccount Statement From 3 Nov 2020 To 3 May 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceRajwinder SandhuNo ratings yet

- Exemption Certificate PDFDocument33 pagesExemption Certificate PDFChaudhary Hassan ArainNo ratings yet

- Evaluation Sheet For Extension ServicesDocument1 pageEvaluation Sheet For Extension Servicesailine donaireNo ratings yet

- Performa Teknis Overall - Jul 2023Document95 pagesPerforma Teknis Overall - Jul 2023adiNo ratings yet

- Midc MumbaiDocument26 pagesMidc MumbaiparagNo ratings yet

- 00Document19 pages00AmeenNo ratings yet

- Grammar Vocabulary 1star Unit7 PDFDocument1 pageGrammar Vocabulary 1star Unit7 PDFLorenaAbreuNo ratings yet

- Quiz #2 - Week 03/08/2009 To 03/14/2009: 1. Indifference Curves Are Convex, or Bowed Toward The Origin, BecauseDocument6 pagesQuiz #2 - Week 03/08/2009 To 03/14/2009: 1. Indifference Curves Are Convex, or Bowed Toward The Origin, BecauseMoeen KhanNo ratings yet

- Capsim Success MeasuresDocument10 pagesCapsim Success MeasuresalyrNo ratings yet

- Chapter - Money Creation & Framwork of Monetary Policy1Document6 pagesChapter - Money Creation & Framwork of Monetary Policy1Nahidul Islam IUNo ratings yet

- How NGOs Can Develop Budgets in Their ProposalsDocument10 pagesHow NGOs Can Develop Budgets in Their ProposalsMurali PrasadNo ratings yet

- Everything To Know About Customer Lifetime Value - Ebook PDFDocument28 pagesEverything To Know About Customer Lifetime Value - Ebook PDFNishi GoyalNo ratings yet

- Money, Banking, and Monetary Policy: ObjectivesDocument9 pagesMoney, Banking, and Monetary Policy: ObjectivesKamalpreetNo ratings yet

- Class Test 3 Answer SchemeDocument5 pagesClass Test 3 Answer SchemeSujata NawleNo ratings yet

- Arch Support - DesigningDocument7 pagesArch Support - DesigningjasonjcNo ratings yet

- Shantilal Shah Engineering College, Bhavnagar: Submission of Proposal For Project/ModelDocument7 pagesShantilal Shah Engineering College, Bhavnagar: Submission of Proposal For Project/Modelparth patelNo ratings yet

- Proforma Invoice No - SI20171103 of PONo. 02KINGDAINDEX-2017Document1 pageProforma Invoice No - SI20171103 of PONo. 02KINGDAINDEX-2017lê thu phươngNo ratings yet

- FHA Financing AddendumDocument2 pagesFHA Financing AddendumRon SimentonNo ratings yet

- RSAW Review of The Year 2021Document14 pagesRSAW Review of The Year 2021Prasamsa PNo ratings yet

- BHP Billiton CaseDocument30 pagesBHP Billiton CaseMonjurul Hassan100% (2)