Professional Documents

Culture Documents

Atlanta NSP Agreement Financing Through FY 2050

Uploaded by

Allie M GrayCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Atlanta NSP Agreement Financing Through FY 2050

Uploaded by

Allie M GrayCopyright:

Available Formats

Proposed New Atlanta Falcons Stadium Project

Comparison of Tax Revenues to Debt Service and to O-M Accounts

Project Inception to Hotel/Motel Tax Expiration Anticipating 35 Year Bond Financing

3/12/2013

1

Debt

Year

0

1

2

3

4

5

6

7

8

9

10

11

12

13

14

15

16

17

18

19

20

21

22

23

24

25

FY

2014

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

2026

2027

2028

2029

2030

2031

2032

2033

2034

2035

2036

2037

2038

2039

Projected Tax

Revenues *

$19,980,880.00

$20,716,023.00

$21,499,089.00

$22,333,635.00

$22,971,146.00

$23,587,866.00

$24,241,153.00

$24,895,664.13

$25,567,847.06

$26,258,178.93

$26,967,149.76

$27,695,262.81

$28,443,034.90

$29,210,996.85

$29,999,693.76

$30,809,685.49

$31,641,547.00

$32,495,868.77

$33,373,257.23

$34,274,335.17

$35,199,742.22

$36,150,135.26

$37,126,188.91

$38,128,596.01

$39,158,068.11

$40,215,335.95

agraynation.com 3/12/2013

1:12 AM

Total Net Debt

Service

Tax Revenues

Less Debt

Service (Col. 3 -

(Sum of Col. 4-7)

Total Net Debt

Service Assuming

$200 million capped

debt

$16,648,840.00

$16,817,241.00

$16,983,172.00

$18,706,878.00

$18,874,608.00

$19,055,600.00

$19,227,663.00

$19,407,263.00

$19,578,974.00

$19,715,967.00

$19,882,889.00

$20,132,122.00

$20,281,988.00

$20,281,972.00

$20,281,972.00

$20,281,972.00

$20,281,972.00

$20,281,971.00

$20,281,973.00

$20,281,973.00

$20,281,971.00

$20,281,971.00

$20,281,973.00

$20,281,956.00

$20,281,956.00

$9,249,355.56

$9,342,911.67

$9,435,095.56

$10,392,710.00

$10,485,893.33

$10,586,444.44

$10,682,035.00

$10,781,812.78

$10,877,207.78

$10,953,315.00

$11,046,049.44

$11,184,512.22

$11,267,771.11

$11,267,762.22

$11,267,762.22

$11,267,762.22

$11,267,762.22

$11,267,761.67

$11,267,762.78

$11,267,762.78

$11,267,761.67

$11,267,761.67

$11,267,762.78

$11,267,753.33

$11,267,753.33

$11,466,667.44

$12,156,177.33

$12,898,539.44

$12,578,436.00

$13,101,972.67

$13,654,708.56

$14,213,629.13

$14,786,034.28

$15,380,971.16

$16,013,834.76

$16,649,213.36

$17,258,522.68

$17,943,225.74

$18,731,931.54

$19,541,923.27

$20,373,784.78

$21,228,106.55

$22,105,495.56

$23,006,572.39

$23,931,979.44

$24,882,373.59

$25,858,427.25

$26,860,833.24

$27,890,314.77

$28,947,582.61

Col. 5)

1 of 3

Present Value

Discounted at

5.25%

$10,894,695.91

$10,973,693.30

$11,063,033.38

$10,250,338.95

$10,144,395.36

$10,044,996.92

$9,934,596.85

$9,819,172.12

$9,704,760.39

$9,600,067.75

$9,483,105.22

$9,339,816.93

$9,225,993.88

$9,151,095.73

$9,070,594.16

$8,984,999.18

$8,894,785.56

$8,800,399.23

$8,702,257.60

$8,600,754.10

$8,496,256.43

$8,389,108.43

$8,279,632.81

$8,168,135.01

$8,054,891.40

Less: O&M Accounts Available Funds

Per Atlanta

After $200 Million

Agreement at Present

Cap and O&M

Value (5.25%)

Accounts

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

(4,750,593.82)

(4,603,900.90)

(4,461,737.69)

(4,323,964.32)

(4,190,445.23)

(4,061,049.06)

(3,935,648.50)

(3,814,120.16)

(3,696,344.48)

(3,582,205.57)

(3,471,591.15)

(3,364,392.37)

(3,260,503.77)

(3,159,823.13)

(3,062,251.40)

(2,967,692.56)

(6,228,132.33)

(2,787,244.35)

(2,701,177.42)

(2,617,768.14)

(2,536,934.44)

(2,458,596.80)

(2,382,678.13)

(2,309,103.75)

(2,237,801.26)

$6,144,102.08

$6,369,792.39

$6,601,295.68

$5,926,374.63

$5,953,950.12

$5,983,947.86

$5,998,948.35

$6,005,051.96

$6,008,415.91

$6,017,862.18

$6,011,514.07

$5,975,424.56

$5,965,490.11

$5,991,272.60

$6,008,342.77

$6,017,306.62

$2,666,653.22

$6,013,154.88

$6,001,080.18

$5,982,985.96

$5,959,321.99

$5,930,511.63

$5,896,954.68

$5,859,031.26

$5,817,090.14

Atlanta NSP Financing Through FY 2051

Debt service less O&M Accounts

Proposed New Atlanta Falcons Stadium Project

Comparison of Tax Revenues to Debt Service and to O-M Accounts

Project Inception to Hotel/Motel Tax Expiration Anticipating 35 Year Bond Financing

3/12/2013

1

Debt

Year

26

27

28

29

30

31

32

33

34

35

36

37

FY

2040

2041

2042

2043

2044

2045

2046

2047

2048

2049

2050

2051

Total Net Debt

Service

Tax Revenues

Less Debt

Service (Col. 3 Col. 5)

Present Value

Discounted at

5.25%

$30,033,396.68

$31,148,527.73

$32,293,767.32

$33,469,928.38

$34,677,845.23

$35,918,377.52

$37,192,402.48

$38,500,826.69

$39,844,577.79

$41,224,611.30

$42,641,905.15

$16,414,856.30

$884,822,286.13

$7,940,168.80

$7,824,213.68

$7,707,256.02

$7,589,510.26

$7,471,176.03

$7,352,439.69

$7,233,473.40

$7,114,438.11

$6,995,482.52

$6,876,744.86

$6,758,352.46

$2,471,833.53

$317,406,672.95

Projected Tax

Revenues *

(Sum of Col. 4-7)

Total Net Debt

Service Assuming

$200 million capped

debt

$41,301,150.02

$42,416,281.07

$43,561,520.66

$44,737,681.71

$45,945,599.12

$47,186,130.30

$48,460,155.81

$49,768,580.02

$51,112,331.68

$52,492,364.64

$53,909,658.48

$27,682,609.63

$1,291,533,563.46

$20,281,956.00

$20,281,956.00

$20,281,956.00

$20,281,956.00

$20,281,957.00

$20,281,955.00

$20,281,956.00

$20,281,956.00

$20,281,957.00

$20,281,956.00

$20,281,956.00

$20,281,956.00

$732,080,310.00

$11,267,753.33

$11,267,753.33

$11,267,753.33

$11,267,753.33

$11,267,753.89

$11,267,752.78

$11,267,753.33

$11,267,753.33

$11,267,753.89

$11,267,753.33

$11,267,753.33

$11,267,753.33

$406,711,283.33

Less: O&M Accounts Available Funds

Per Atlanta

After $200 Million

Agreement at Present

Cap and O&M

Value (5.25%)

Accounts

$

$

$

$

$

$

$

$

$

$

$

$

(2,168,700.51)

(2,101,733.51)

(2,036,834.37)

(1,973,939.25)

(1,912,986.26)

(1,853,915.42)

(1,796,668.63)

(1,741,189.55)

(1,687,423.60)

(767,941.83)

(1,584,821.13)

(767,941.83)

$5,771,468.29

$5,722,480.17

$5,670,421.65

$5,615,571.01

$5,558,189.77

$5,498,524.27

$5,436,804.77

$5,373,248.56

$5,308,058.92

$6,108,803.03

$5,173,531.33

$1,703,891.69

($107,359,788.64)

$210,046,878.30

Notes

White Based upon: Citi Presentation of June 2012 (cited in August 2012 GWCCA Report), page 6

HM Tax Revenues projected over the tax collection years authorized through 12/31/2050 at average growth rate,

Yellow which was also used by Citi for the first years.(2013 collections up 7.49%)

Tan

Calculations based upon Citi presentation. 5.25% discount to present value of a year-end lump sum, which is above the 4.15% cited

Debt service in original Citi presentation assumed no revenue growth. See original report footnote (2)

2010 BSG study high case scenario used 4% for H/M tax revenue growth and the 2013 increase in

H/M tax revenues over 2012 was 7.49% (Page 9)

Noted that Citi used 35 year bond financing, while other GWCCA reports used 30 years.

Noted that authority to collect the HM tax expires December 31, 2050, with six months in FY 2051.

(*) Base year HM Tax Revenues in 2014 used to show origin in Citi-provided data but are not included in total revenues through year 35

agraynation.com 3/12/2013

1:12 AM

2 of 3

Atlanta NSP Financing Through FY 2051

Debt service less O&M Accounts

Proposed New Atlanta Falcons Stadium Project

Comparison of Tax Revenues to Debt Service and to O-M Accounts

Project Inception to Hotel/Motel Tax Expiration Anticipating 35 Year Bond Financing

3/12/2013

1

Debt

Year

FY

Projected Tax

Revenues *

Total Net Debt

Service

Total Net Debt

Service Assuming

$200 million capped

debt

Tax Revenues

Less Debt

Service (Col. 3 -

(Sum of Col. 4-7)

Col. 5)

Present Value

Discounted at

5.25%

Less: O&M Accounts Available Funds

Per Atlanta

After $200 Million

Agreement at Present

Cap and O&M

Value (5.25%)

Accounts

Green Pro rata adjustment to Citi debt proceeds estimate of $360 million to the $200 million cap. 200/360 = .55556 of Citi estimated debt service used

Blue

O&M account funding per City of Atlanta Summary

Summary of the Accounts Established by March 2013 Atlanta Falcons - Kasim Reed Agreement

The nominal Tax revenues less Debt Service of $884,822 less the nominal O-M/licensing accounts of $273,071,554 produces

$611,750,732 in revenues over and above O-M requirements for 4 accounts in the revised Term Sheet of March 2013

Gross Tax Revenues less total debt service on $200 million in bonds (Column 6 Above) over 35 years

884,822,286.13

Less: Gross Deposits into O-M Accounts net of Falcons license payments

(273,071,554.00)

611,750,732.00

See here

Unexplained Balance of Gross Hotel Motel Taxes unused if debt is capped at $200 million

agraynation.com 3/12/2013

1:12 AM

3 of 3

Atlanta NSP Financing Through FY 2051

Debt service less O&M Accounts

You might also like

- FY 16 Analysis of Introduced Budget 102115Document65 pagesFY 16 Analysis of Introduced Budget 102115The Daily LineNo ratings yet

- Lansdale Bond Refunding ReportDocument13 pagesLansdale Bond Refunding Reportsokil_danNo ratings yet

- Solution To QB QuestionsDocument3 pagesSolution To QB QuestionsSurabhi Suman100% (1)

- Rev Proc 15-53Document28 pagesRev Proc 15-53Kelly Phillips ErbNo ratings yet

- Kevyn Orr's Proposal To Detroit's CreditorsDocument134 pagesKevyn Orr's Proposal To Detroit's CreditorsHuffPostDetroitNo ratings yet

- FINAL EXAM Winter 2014Document8 pagesFINAL EXAM Winter 2014denisemriceNo ratings yet

- Analyse Equip09Document10 pagesAnalyse Equip09Aqeel ChaudhryNo ratings yet

- 2013 14 d156 Budget State Form 091013Document29 pages2013 14 d156 Budget State Form 091013api-233183949No ratings yet

- LTC 013-2014 Reports and Informational Items For Jan 15 2013 CMDocument68 pagesLTC 013-2014 Reports and Informational Items For Jan 15 2013 CMDonPeeblesMIANo ratings yet

- Project Viability Assessment Worked ExampleDocument5 pagesProject Viability Assessment Worked ExampleokucuanthonyNo ratings yet

- BHARAT HEAVY ELECTRICALS LIMITED AUDITED FINANCIAL RESULTS FOR Q4 AND FY 2012Document3 pagesBHARAT HEAVY ELECTRICALS LIMITED AUDITED FINANCIAL RESULTS FOR Q4 AND FY 2012Shubham TrivediNo ratings yet

- Chapter 15. Model For Managing Current AssetsDocument6 pagesChapter 15. Model For Managing Current AssetsKartikasari NiaNo ratings yet

- Accounting For Income Tax HandoutsDocument4 pagesAccounting For Income Tax HandoutsMichael Bongalonta0% (1)

- Best BudgetDocument31 pagesBest BudgetSyed Muhammad Ali SadiqNo ratings yet

- 6 201506Q3Document19 pages6 201506Q3Hannah GohNo ratings yet

- Please Answer The Following Questions in The Space ProvidedDocument5 pagesPlease Answer The Following Questions in The Space ProvidedAustinNo ratings yet

- ACCT 202 Pre-Quiz Number 2 Spring 2018Document6 pagesACCT 202 Pre-Quiz Number 2 Spring 2018Lexzy Chant LopezNo ratings yet

- PUP QUIZ No. 2 ACCO 30193 Strategic Tax Management 2nd Semester AY 2020 2021Document7 pagesPUP QUIZ No. 2 ACCO 30193 Strategic Tax Management 2nd Semester AY 2020 2021Cailin MejiaNo ratings yet

- KMC Budget Statement 2019-20 Highlights Key Projects and Revenue SourcesDocument58 pagesKMC Budget Statement 2019-20 Highlights Key Projects and Revenue SourcesAbhishek SatpathyNo ratings yet

- Is Chicago's Fiscal Crisis Over?Document10 pagesIs Chicago's Fiscal Crisis Over?The Daily LineNo ratings yet

- ComprehensiveexamDocument14 pagesComprehensiveexamLeah BakerNo ratings yet

- Dziczek DABE January 2012Document30 pagesDziczek DABE January 2012Carlos RamosNo ratings yet

- Security DepositsDocument3 pagesSecurity DepositsQueen ValleNo ratings yet

- Park Ridge - Niles School District 64, Cook County, Illinois Financing OptionsDocument9 pagesPark Ridge - Niles School District 64, Cook County, Illinois Financing OptionslobitodelperuNo ratings yet

- 06-0718 ReportDocument15 pages06-0718 ReportRecordTrac - City of OaklandNo ratings yet

- Fianl AccountsDocument10 pagesFianl AccountsVikram NaniNo ratings yet

- Recovery Notice Virendra Hiremath 970542 7ccd2a736ec9341aDocument2 pagesRecovery Notice Virendra Hiremath 970542 7ccd2a736ec9341aVedans FinancesNo ratings yet

- 12.19.14 - Fiscal Estimate For Casino Property Tax Stabilization ActDocument4 pages12.19.14 - Fiscal Estimate For Casino Property Tax Stabilization ActJohn V. SantoreNo ratings yet

- Problems On Cash FlowsDocument14 pagesProblems On Cash FlowsAbin Jose100% (2)

- Special City Council Meeting Agenda Packet 03-19-13Document115 pagesSpecial City Council Meeting Agenda Packet 03-19-13L. A. PatersonNo ratings yet

- Project Planning Appraisal and Control AssignmentDocument31 pagesProject Planning Appraisal and Control AssignmentMpho Peloewtse Tau50% (2)

- Eastland Center - Loan Prop DetailDocument10 pagesEastland Center - Loan Prop DetailClickon DetroitNo ratings yet

- IT Return Extension Expected Till 15 DecemberDocument8 pagesIT Return Extension Expected Till 15 DecemberMuhammad Wisal AhmedNo ratings yet

- CBO Reid Letter HR3590Document28 pagesCBO Reid Letter HR3590clyde2400No ratings yet

- TX Zwe Examiner's Report June 2022Document10 pagesTX Zwe Examiner's Report June 2022Sean ChigagaNo ratings yet

- Estimated Revenues, Profits and Expenditure For Next Three YearsDocument6 pagesEstimated Revenues, Profits and Expenditure For Next Three YearsRajeev Kumar GottumukkalaNo ratings yet

- Chapter 20. CH 20-06 Build A ModelDocument4 pagesChapter 20. CH 20-06 Build A ModelCarol Lee0% (1)

- CTYAUD Reports Fy2018 Visitors PDFDocument33 pagesCTYAUD Reports Fy2018 Visitors PDFcallertimesNo ratings yet

- Council Questions - Fiscal Year 2013 Budget Discussion March 2012Document6 pagesCouncil Questions - Fiscal Year 2013 Budget Discussion March 2012Richard G. FimbresNo ratings yet

- Financial Statement Analysis for Semiconductor CompanyDocument19 pagesFinancial Statement Analysis for Semiconductor CompanyMohammad ShahraeeniNo ratings yet

- Application Level Corporate Laws Practices Nov Dec 2013Document3 pagesApplication Level Corporate Laws Practices Nov Dec 2013Timothy GillespieNo ratings yet

- Sinclair Company Group Case StudyDocument20 pagesSinclair Company Group Case StudyNida Amri50% (4)

- Protecting Bonds To Save Infrastructure and Jobs (February 2013) : ReportDocument13 pagesProtecting Bonds To Save Infrastructure and Jobs (February 2013) : ReportDustin Tyler JoyceNo ratings yet

- f3 Specimen j14 PDFDocument21 pagesf3 Specimen j14 PDFBestNo ratings yet

- F3 Specimen Exam 2014 PDFDocument21 pagesF3 Specimen Exam 2014 PDFgrrrklNo ratings yet

- Summary of Host Community Agreement Between Palmer and Mohegan SunDocument5 pagesSummary of Host Community Agreement Between Palmer and Mohegan SunMassLiveNo ratings yet

- Fundamentals Level – Skills Module exam questionsDocument8 pagesFundamentals Level – Skills Module exam questionsjadechoy621No ratings yet

- Financial Management Fundamentals Level Skills Module NPV CalculationDocument8 pagesFinancial Management Fundamentals Level Skills Module NPV CalculationgulhasanNo ratings yet

- Ekotek - Alfiano Fuadi3Document50 pagesEkotek - Alfiano Fuadi3Alfiano Fuadi0% (1)

- Buc-Ee's Econominc Development Agreement With City of AmarilloDocument20 pagesBuc-Ee's Econominc Development Agreement With City of AmarilloJamie BurchNo ratings yet

- Budget OverviewDocument14 pagesBudget OverviewWestSeattleBlogNo ratings yet

- Downtown Arena Framework Responses To Councillors QuestionsDocument13 pagesDowntown Arena Framework Responses To Councillors QuestionsMonsieurLeLoucheNo ratings yet

- Senate Amendment 2137 To H.R. 3684, The Infrastructure Investment and Jobs Act, As Proposed On August 1, 2021Document19 pagesSenate Amendment 2137 To H.R. 3684, The Infrastructure Investment and Jobs Act, As Proposed On August 1, 2021Cynthia MoranNo ratings yet

- City of Windsor Capital Budget Documents For 2013.Document362 pagesCity of Windsor Capital Budget Documents For 2013.windsorstarNo ratings yet

- Write-Up CITIRA BillDocument3 pagesWrite-Up CITIRA BillMaeJoNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific-Seventh EditionNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- Credit Union Revenues World Summary: Market Values & Financials by CountryFrom EverandCredit Union Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- A Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionFrom EverandA Comparative Analysis of Tax Administration in Asia and the Pacific—Sixth EditionNo ratings yet

- Georgia Bank and Trust Proposal With Unnumbered Pages Added Past Page 21Document25 pagesGeorgia Bank and Trust Proposal With Unnumbered Pages Added Past Page 21Allie M GrayNo ratings yet

- April 20, 2010 Columbia County Board of Commission MinutesDocument7 pagesApril 20, 2010 Columbia County Board of Commission MinutesAllie M GrayNo ratings yet

- Gregg Grant Lincoln County Georgia Overlay GORA Whole ResponseDocument133 pagesGregg Grant Lincoln County Georgia Overlay GORA Whole ResponseAllie M GrayNo ratings yet

- Columbia County Bank Balances December 31, 2010 Per Hutter GORA ResponseDocument3 pagesColumbia County Bank Balances December 31, 2010 Per Hutter GORA ResponseAllie M GrayNo ratings yet

- Columbia County Banking RFP Presentation Sign in Sheet and Finance Director Evaluation Dated March 1, 2010Document10 pagesColumbia County Banking RFP Presentation Sign in Sheet and Finance Director Evaluation Dated March 1, 2010Allie M GrayNo ratings yet

- GB&T FDIC Uniform Bank Performance Reports Binder 2008-2010Document13 pagesGB&T FDIC Uniform Bank Performance Reports Binder 2008-2010Allie M GrayNo ratings yet

- Original Proposal of Georgia Bank and Trust To Columbia County For Banking ServicesDocument20 pagesOriginal Proposal of Georgia Bank and Trust To Columbia County For Banking ServicesAllie M GrayNo ratings yet

- Columbia County Finance Director Deloach Evaluation of Presenting Banks March 1, 2010Document9 pagesColumbia County Finance Director Deloach Evaluation of Presenting Banks March 1, 2010Allie M GrayNo ratings yet

- GB&T Balance Sheet $ Quarterly 2010Document3 pagesGB&T Balance Sheet $ Quarterly 2010Allie M GrayNo ratings yet

- September 30, 2010 Columbia County Water and Sewer Bond Issuance Selected InformationDocument7 pagesSeptember 30, 2010 Columbia County Water and Sewer Bond Issuance Selected InformationAllie M GrayNo ratings yet

- Financial Services Ranking of GB&T As StableDocument1 pageFinancial Services Ranking of GB&T As StableAllie M GrayNo ratings yet

- Columbia County Banking RFPPrebid Meeting Attendees With Email Invitation To February 4, 2010 MeetingDocument5 pagesColumbia County Banking RFPPrebid Meeting Attendees With Email Invitation To February 4, 2010 MeetingAllie M GrayNo ratings yet

- Jefferies Bond AnnouncementDocument1 pageJefferies Bond AnnouncementAllie M GrayNo ratings yet

- 1st Citizens FDIC Uniform Bank Performance Reports Binder 20082010Document23 pages1st Citizens FDIC Uniform Bank Performance Reports Binder 20082010Allie M GrayNo ratings yet

- GB&T-Southeastern Financial Code of EthicsDocument5 pagesGB&T-Southeastern Financial Code of EthicsAllie M GrayNo ratings yet

- Columbia County Cash To Debt 2006 - 2014 With Annual Balance SheetsDocument10 pagesColumbia County Cash To Debt 2006 - 2014 With Annual Balance SheetsAllie M GrayNo ratings yet

- ARC TIA GiveawayDocument1 pageARC TIA GiveawayAllie M GrayNo ratings yet

- Columbia County Request For Proposal Dated January 25, 2010Document25 pagesColumbia County Request For Proposal Dated January 25, 2010Allie M GrayNo ratings yet

- MARI Congressional Presention 2004 Plus 2005 Georgia RankingDocument1 pageMARI Congressional Presention 2004 Plus 2005 Georgia RankingAllie M GrayNo ratings yet

- ARC TIA GiveawayDocument1 pageARC TIA GiveawayAllie M GrayNo ratings yet

- Financial Services Memo of Aptil 13, 2010 To The Columbia County Management and Financial Services CommitteeDocument10 pagesFinancial Services Memo of Aptil 13, 2010 To The Columbia County Management and Financial Services CommitteeAllie M GrayNo ratings yet

- Columbia County GB&T Proposal Reference To 2008 FinancialsDocument2 pagesColumbia County GB&T Proposal Reference To 2008 FinancialsAllie M GrayNo ratings yet

- GB&T Board From 2008 Annual Report Issued in 2009Document1 pageGB&T Board From 2008 Annual Report Issued in 2009Allie M GrayNo ratings yet

- Georgia's Number 1 Mortgage Fraud Ranking 2000-2005Document1 pageGeorgia's Number 1 Mortgage Fraud Ranking 2000-2005Allie M GrayNo ratings yet

- City of Atlanta Designated O-M Accounts - New Stadium ProjectDocument2 pagesCity of Atlanta Designated O-M Accounts - New Stadium ProjectAllie M GrayNo ratings yet

- Tee Budget Detailed Questions Rev. 1Document4 pagesTee Budget Detailed Questions Rev. 1Allie M GrayNo ratings yet

- GWCCA Naming RightsDocument1 pageGWCCA Naming RightsAllie M GrayNo ratings yet

- GWCCA December 2012 Financial ReportDocument14 pagesGWCCA December 2012 Financial ReportAllie M GrayNo ratings yet

- Atlanta NSP Concessions ProjectionsDocument1 pageAtlanta NSP Concessions ProjectionsAllie M GrayNo ratings yet

- Complaint Handling Policy and ProceduresDocument2 pagesComplaint Handling Policy and Proceduresjyoti singhNo ratings yet

- Expert Business Analyst Darryl Cropper Seeks New OpportunityDocument8 pagesExpert Business Analyst Darryl Cropper Seeks New OpportunityRajan GuptaNo ratings yet

- Lister LRM & SRM 1-2-3 Manual and Parts List - Lister - Canal WorldDocument4 pagesLister LRM & SRM 1-2-3 Manual and Parts List - Lister - Canal Worldcountry boyNo ratings yet

- John GokongweiDocument14 pagesJohn GokongweiBela CraigNo ratings yet

- Lorilie Muring ResumeDocument1 pageLorilie Muring ResumeEzekiel Jake Del MundoNo ratings yet

- Dell 1000W UPS Spec SheetDocument1 pageDell 1000W UPS Spec SheetbobNo ratings yet

- Distribution of Laptop (Ha-Meem Textiles Zone)Document3 pagesDistribution of Laptop (Ha-Meem Textiles Zone)Begum Nazmun Nahar Juthi MozumderNo ratings yet

- Comparing Time Series Models to Predict Future COVID-19 CasesDocument31 pagesComparing Time Series Models to Predict Future COVID-19 CasesManoj KumarNo ratings yet

- (Free Scores - Com) - Stumpf Werner Drive Blues en Mi Pour La Guitare 40562 PDFDocument2 pages(Free Scores - Com) - Stumpf Werner Drive Blues en Mi Pour La Guitare 40562 PDFAntonio FresiNo ratings yet

- Wind EnergyDocument6 pagesWind Energyshadan ameenNo ratings yet

- Chapter 6: Structured Query Language (SQL) : Customer Custid Custname OccupationDocument16 pagesChapter 6: Structured Query Language (SQL) : Customer Custid Custname OccupationSarmila MahendranNo ratings yet

- Econometrics Chapter 1 7 2d AgEc 1Document89 pagesEconometrics Chapter 1 7 2d AgEc 1Neway AlemNo ratings yet

- QSK45 60 oil change intervalDocument35 pagesQSK45 60 oil change intervalHingga Setiawan Bin SuhadiNo ratings yet

- StandardsDocument3 pagesStandardshappystamps100% (1)

- Installing and Registering FSUIPCDocument7 pagesInstalling and Registering FSUIPCKAPTAN XNo ratings yet

- 2.8 V6 5V (Aha & Atq)Document200 pages2.8 V6 5V (Aha & Atq)Vladimir Socin ShakhbazyanNo ratings yet

- ContactsDocument10 pagesContactsSana Pewekar0% (1)

- EPS Lab ManualDocument7 pagesEPS Lab ManualJeremy Hensley100% (1)

- Super Flexible, Super Fast, Super Value: Gigabit PTMP Client and PTP With Modular AntennasDocument5 pagesSuper Flexible, Super Fast, Super Value: Gigabit PTMP Client and PTP With Modular AntennasAbdallaNo ratings yet

- Group 4 HR201 Last Case StudyDocument3 pagesGroup 4 HR201 Last Case StudyMatt Tejada100% (2)

- Fundamental of Investment Unit 5Document8 pagesFundamental of Investment Unit 5commers bengali ajNo ratings yet

- Craft's Folder StructureDocument2 pagesCraft's Folder StructureWowNo ratings yet

- Dwnload Full International Monetary Financial Economics 1st Edition Daniels Solutions Manual PDFDocument36 pagesDwnload Full International Monetary Financial Economics 1st Edition Daniels Solutions Manual PDFelegiastepauleturc7u100% (16)

- 7458-PM Putting The Pieces TogetherDocument11 pages7458-PM Putting The Pieces Togethermello06No ratings yet

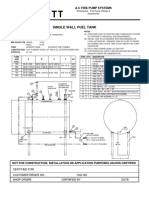

- Single Wall Fuel Tank: FP 2.7 A-C Fire Pump SystemsDocument1 pageSingle Wall Fuel Tank: FP 2.7 A-C Fire Pump Systemsricardo cardosoNo ratings yet

- 01-Azeotropic Distillation (IL Chien)Document35 pages01-Azeotropic Distillation (IL Chien)Shivam Vinoth100% (1)

- Discursive Closure and Discursive Openings in SustainabilityDocument10 pagesDiscursive Closure and Discursive Openings in SustainabilityRenn MNo ratings yet

- Part I-Final Report On Soil InvestigationDocument16 pagesPart I-Final Report On Soil InvestigationmangjuhaiNo ratings yet

- Micromaster 430: 7.5 KW - 250 KWDocument118 pagesMicromaster 430: 7.5 KW - 250 KWAyman ElotaifyNo ratings yet

- Product Manual 36693 (Revision D, 5/2015) : PG Base AssembliesDocument10 pagesProduct Manual 36693 (Revision D, 5/2015) : PG Base AssemblieslmarcheboutNo ratings yet