Professional Documents

Culture Documents

All Types of Cost Incurred For That Product. Detailed Description of Each Type of Cost. Cost Sheet For Per Unit As Well As For 100 Units

Uploaded by

akashniranjaneOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

All Types of Cost Incurred For That Product. Detailed Description of Each Type of Cost. Cost Sheet For Per Unit As Well As For 100 Units

Uploaded by

akashniranjaneCopyright:

Available Formats

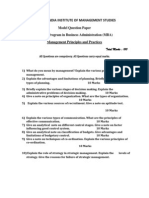

Cost & Management Accounting Date: 09th March. 2013. The students of MMS Year 2nd Sem.

are given the following two assignments. Both the assignments are required to be submitted on or before 20th March 2013. Late submission will not be accepted. No. of Assignment 1 Question for the Assignment Prepare Cost Sheet for any food product, which should content: All types of cost incurred for that product. Detailed description of each type of cost. Cost Sheet for per unit as well as for 100 units.

Students have been given the question bank. The number of question indicates the roll no. of the student. Each student is required to take a question as per his/her roll no. and detailed answer is required to be written on regular assignment paper. Question Bank 1. What are the advantages of cost accounting? 2. Explain in detail the Types of cost on the basis of Nature of expense. 3. Explain in detail the Types of cost on the basis of Relation to cost centre. 4. Explain in detail the Types of cost on the basis of Function. 5. Explain in detail the Types of cost on the basis of Behaviour. 6. Explain in detail the Types of cost on the basis of Management decision. 7. Explain in detail the Types of cost on the basis of Time period. 8. Explain in detail the Types of cost on the basis of Production process. 9. What is Job costing? Explain with at least 2 appropriate examples. 10. What is Process costing? Explain with at least 2 appropriate examples. 11. What is Service costing? Explain with at least 2 appropriate examples. 12. Distinguish between Cost Accounting & Management Accounting 13. Distinguish between Management Accounting & Financial Accounting 14. Distinguish between Financial Accounting & Cost Accounting 15. Distinguish between Break Even Point (BEP) & Margin of Safety (MOS) 16. Distinguish between Fixed cost & Variable cost 17. Distinguish between Fixed cost & Semi- Variable cost 18. Distinguish between Variable Cost & Semi- Variable cost 19. What is Break Even Point? Explain with graph. 20. What is Contribution? How the decision of pricing can be taken with the help of contribution? 21. How the marginal costing is helpful in decision making? Explain. 22. What do you mean by budgetary control? 23. Explain the advantages of budgetary control. 24. Explain in detail the concept of Flexible budget. 25. Explain in detail the concept of Functional budget. 26. Explain in detail the concept of Master budget.

27. Explain in detail the concept of Cash budget. 28. Explain in detail the concept of Zero based budget. 29. Explain in detail the concept of Responsibility Centre. 30. What are the types of responsibility centers? 31. What do you mean by Cost centre? Explain in detail responsibilities & performance measurement tools for the manager of Cost centre. 32. What do you mean by Profit centre? Explain in detail responsibilities & performance measurement tools for the manager of Profit centre. 33. What do you mean by Revenue centre? Explain in detail responsibilities & performance measurement tools for the manager of Revenue centre. 34. What do you mean by Investment centre? Explain in detail responsibilities & performance measurement tools for the manager of Investment centre. 35. What is Responsibility accounting? Explain. 36. Which are the performance measurement tools for responsibility accounting? 37. Explain in detail the concept of transfer price. 38. Explain the methods to set the transfer price. 39. How the price can be determined with the help of marginal costing? 40. Graphically explain the concept Fixed Cost. 41. Graphically explain the concept Semi-variable Cost. 42. Graphically explain the concept Variable Cost. 43. What are the types of budget? 44. How the budgetary control helps the organization? Explain. 45. List out all the formulae of marginal costing. 46. Prepare the format of cost sheet. 47. Prepare the format of marginal cost sheet. 48. Benefits of cost techniques in organization. 49. Write the format of cost sheet in detail. 50. Transfer price is not an accounting tool. Explain.

You might also like

- CMA - Theory Question BankDocument4 pagesCMA - Theory Question Bankpatel ashishNo ratings yet

- Question Bank M&CCDocument2 pagesQuestion Bank M&CCKishore AntonyNo ratings yet

- Question Bank Unit 3, 4 and 5Document4 pagesQuestion Bank Unit 3, 4 and 5Betty N LeoNo ratings yet

- CA Inter Cost & Management Accounting Theory Book by CA Purushottam AggarwalDocument125 pagesCA Inter Cost & Management Accounting Theory Book by CA Purushottam Aggarwalabhinesh243No ratings yet

- Management AccountingDocument13 pagesManagement AccountingYashwant ShrimaliNo ratings yet

- Horngrens Cost Accounting A Managerial Emphasis Canadian 8Th Edition Datar Test Bank Full Chapter PDFDocument68 pagesHorngrens Cost Accounting A Managerial Emphasis Canadian 8Th Edition Datar Test Bank Full Chapter PDFaddorsedmeazel1exjvs100% (7)

- Engineering Economics Old QuestionDocument3 pagesEngineering Economics Old QuestionSushil AchhamiNo ratings yet

- Management Accounting NotesDocument9 pagesManagement Accounting NotesGazal GuptaNo ratings yet

- EME Quiz and QuestionsDocument15 pagesEME Quiz and QuestionsAmeer FaisalNo ratings yet

- Management AccountingDocument112 pagesManagement AccountingSugandha Sethia100% (1)

- Management Accounting Notes: Nature of Management Accounting Characteristics of Management AccountingDocument7 pagesManagement Accounting Notes: Nature of Management Accounting Characteristics of Management AccountingRobin FernandoNo ratings yet

- Swarnarik Chatterjee 23405018005 CA2 Management AccountingDocument9 pagesSwarnarik Chatterjee 23405018005 CA2 Management AccountingRik DragneelNo ratings yet

- MBA Assignment Topics Dec 2013Document13 pagesMBA Assignment Topics Dec 2013Sarika ThoratNo ratings yet

- Management Accounts Important QuestionsDocument1 pageManagement Accounts Important QuestionsSubhasish Mitra0% (2)

- Assignment COST ACCDocument11 pagesAssignment COST ACCprotaiskigali100% (1)

- Group & Individual AssignmentDocument4 pagesGroup & Individual AssignmentKinetibebNo ratings yet

- Management Accounting Costing and BudgetingDocument31 pagesManagement Accounting Costing and BudgetingnileshdilushanNo ratings yet

- Question Bank - Engineering EconomicsDocument18 pagesQuestion Bank - Engineering EconomicsRAMESH BABU S MECNo ratings yet

- AFM Important QuestionsDocument2 pagesAFM Important Questionsuma selvarajNo ratings yet

- Trường Đại Học Thương Mại: (Phần dành cho sinh viên/ học viên)Document11 pagesTrường Đại Học Thương Mại: (Phần dành cho sinh viên/ học viên)Nguyễn HoàngNo ratings yet

- Preface: Meaning of Financial StatementsDocument3 pagesPreface: Meaning of Financial StatementsVipin PalNo ratings yet

- Business Economics Students Copy QBDocument11 pagesBusiness Economics Students Copy QBNarayan RamanathanNo ratings yet

- Model Question Paper MBADocument7 pagesModel Question Paper MBAraopandit2001No ratings yet

- Top 61 Accounting Interview QuestionsDocument2 pagesTop 61 Accounting Interview Questionsparminder211985No ratings yet

- Ignou Important Questions MMPC 004Document2 pagesIgnou Important Questions MMPC 004catch meNo ratings yet

- I Sem MbaDocument5 pagesI Sem MbaPravin_it14No ratings yet

- Financial Management-QuestionsDocument2 pagesFinancial Management-Questionsrealmb114497No ratings yet

- T32017 AssignmentDocument12 pagesT32017 Assignmentgrizzly2010No ratings yet

- Important Question Cost AccountingDocument2 pagesImportant Question Cost Accountingmehakmalhotra10315No ratings yet

- Assessment: Task - B: Short Answers Section 1Document12 pagesAssessment: Task - B: Short Answers Section 1Ramsha RafiNo ratings yet

- Final Sem Theory AnswerDocument11 pagesFinal Sem Theory AnswerSrabon BaruaNo ratings yet

- Session 10, Week 11, CVP Analysis-4Document4 pagesSession 10, Week 11, CVP Analysis-4Victoria DrizosNo ratings yet

- Operating CostingDocument39 pagesOperating CostingMishkaCDedhia100% (1)

- Imp Ques - Managerial EconomicsDocument6 pagesImp Ques - Managerial EconomicsPavan Kumar NNo ratings yet

- MEFA Important QuestionsDocument14 pagesMEFA Important Questionstulasinad123No ratings yet

- Tutorial Sheet For Engineering and Managerial EconomicsDocument3 pagesTutorial Sheet For Engineering and Managerial Economicssaxena_sumit1985No ratings yet

- 0.accounting Questions On Interview 1 1Document19 pages0.accounting Questions On Interview 1 1abdul majid khawajaNo ratings yet

- Quantitative Analysis of Business Decisions: MarketingDocument11 pagesQuantitative Analysis of Business Decisions: MarketingMorvinNo ratings yet

- English Assignment Cost Accounting: Accounting of Polytechnic Negeri Sriwijaya 2014Document17 pagesEnglish Assignment Cost Accounting: Accounting of Polytechnic Negeri Sriwijaya 2014diki sudarmanNo ratings yet

- IMT 58 Management Accounting M3Document2 pagesIMT 58 Management Accounting M3solvedcareNo ratings yet

- Service Sector Management QuestionsDocument2 pagesService Sector Management QuestionsRohit SharmaNo ratings yet

- MBA Assignment Topics 2013Document17 pagesMBA Assignment Topics 2013Giri KanyakumariNo ratings yet

- Top 100 Accounting Interview QuestionsDocument12 pagesTop 100 Accounting Interview QuestionsAtif AkramNo ratings yet

- QCF Syllabus: Introduction To AccountingDocument3 pagesQCF Syllabus: Introduction To AccountingHamis MohamedNo ratings yet

- IntroDocument37 pagesIntrowfd52muni100% (1)

- Sanket Dhole Week 4 (Task - Monday and Tuesday)Document8 pagesSanket Dhole Week 4 (Task - Monday and Tuesday)Sanket DholeNo ratings yet

- Mid Term Paper EconomicsDocument5 pagesMid Term Paper EconomicsSaad MaqboolNo ratings yet

- Top 61 Accounting Interview QuestionsDocument3 pagesTop 61 Accounting Interview QuestionsSachin KumarNo ratings yet

- Cost Accounting Question Bank FinalDocument13 pagesCost Accounting Question Bank FinalSandeepSinghNo ratings yet

- KMBN102 Question BankDocument2 pagesKMBN102 Question Banksaurabh prasadNo ratings yet

- Ecs2603 Turial 101Document141 pagesEcs2603 Turial 101Sylvester RakgateNo ratings yet

- Macb A1 Ocf Oct 2013 Ute TDDocument8 pagesMacb A1 Ocf Oct 2013 Ute TDAli BabaNo ratings yet

- Management Accounting NotesDocument9 pagesManagement Accounting NoteskamdicaNo ratings yet

- ME QuestionsDocument2 pagesME QuestionskajuNo ratings yet

- Trinity Mba MBA-I Semester (I Year)Document8 pagesTrinity Mba MBA-I Semester (I Year)Wameq SiddiquiNo ratings yet

- Galutera Man EconDocument6 pagesGalutera Man Econbeavivo1No ratings yet

- Management Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageFrom EverandManagement Accounting: Decision-Making by Numbers: Business Strategy & Competitive AdvantageRating: 5 out of 5 stars5/5 (1)

- ECON 101 Notes + Study Guide - Standard: Introduction to MicroeconomicsFrom EverandECON 101 Notes + Study Guide - Standard: Introduction to MicroeconomicsNo ratings yet

- Financial Performance Measures and Value Creation: the State of the ArtFrom EverandFinancial Performance Measures and Value Creation: the State of the ArtNo ratings yet

- Best Mirrorless CamerasDocument1 pageBest Mirrorless CamerasakashniranjaneNo ratings yet

- Library SoftwareDocument5 pagesLibrary SoftwareakashniranjaneNo ratings yet

- Google AdsDocument1 pageGoogle AdsakashniranjaneNo ratings yet

- 28-7-15 MBA Calling DataDocument6 pages28-7-15 MBA Calling Dataakashniranjane0% (1)

- Best DSLR CamerasDocument1 pageBest DSLR CamerasakashniranjaneNo ratings yet

- Report Guidelines 20-5-15Document17 pagesReport Guidelines 20-5-15akashniranjaneNo ratings yet

- Sagar Suresh Gupta: Career ObjectiveDocument3 pagesSagar Suresh Gupta: Career ObjectiveakashniranjaneNo ratings yet

- A Session On: Digital Marketing With Google AdsDocument18 pagesA Session On: Digital Marketing With Google AdsakashniranjaneNo ratings yet

- (XYZ Provides Information On The Same) : XYZ! What About PlacementsDocument1 page(XYZ Provides Information On The Same) : XYZ! What About PlacementsakashniranjaneNo ratings yet

- Job Description PPC Executive: Roles & ResponsibilitiesDocument2 pagesJob Description PPC Executive: Roles & ResponsibilitiesakashniranjaneNo ratings yet

- Training Strategy For ASHA Facilitators and ANMDocument3 pagesTraining Strategy For ASHA Facilitators and ANMakashniranjaneNo ratings yet

- 2013 ITT Evaluation MatrixDocument12 pages2013 ITT Evaluation MatrixakashniranjaneNo ratings yet

- MBA Internal Exam Duty Chart MorningDocument2 pagesMBA Internal Exam Duty Chart MorningakashniranjaneNo ratings yet

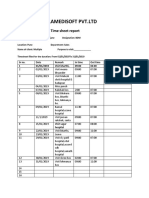

- Birlamedisoft PVT - LTD: Time Sheet ReportDocument1 pageBirlamedisoft PVT - LTD: Time Sheet ReportakashniranjaneNo ratings yet

- 6 Maintenance Methodology & SLADocument14 pages6 Maintenance Methodology & SLAakashniranjaneNo ratings yet

- Cancer Screening QuestionnaireDocument3 pagesCancer Screening QuestionnaireakashniranjaneNo ratings yet

- Birlamedisoft PVT - LTD: Time Sheet ReportDocument2 pagesBirlamedisoft PVT - LTD: Time Sheet ReportakashniranjaneNo ratings yet

- Proposed Project Implementation Plan - HospitalDocument1 pageProposed Project Implementation Plan - HospitalakashniranjaneNo ratings yet

- Training Strategy For ASHA Facilitators and ANMDocument27 pagesTraining Strategy For ASHA Facilitators and ANMakashniranjaneNo ratings yet

- Section 1.1 Adopt - Assess - Implementation of Systems - 1Document8 pagesSection 1.1 Adopt - Assess - Implementation of Systems - 1akashniranjaneNo ratings yet

- PACS QuestionnaireDocument4 pagesPACS QuestionnaireakashniranjaneNo ratings yet

- Training Strategy For ASHA Facilitators and ANMDocument3 pagesTraining Strategy For ASHA Facilitators and ANMakashniranjaneNo ratings yet

- Placement BrochureDocument48 pagesPlacement BrochureakashniranjaneNo ratings yet

- Estimate Acceptance Form: Contract)Document3 pagesEstimate Acceptance Form: Contract)akashniranjaneNo ratings yet

- Reasoning - : Topic Expected Number of SDocument3 pagesReasoning - : Topic Expected Number of SakashniranjaneNo ratings yet

- Plant Tour Application Form: Sagar Suresh GuptaDocument2 pagesPlant Tour Application Form: Sagar Suresh GuptaakashniranjaneNo ratings yet

- System Development Life CycleDocument22 pagesSystem Development Life CycleakashniranjaneNo ratings yet

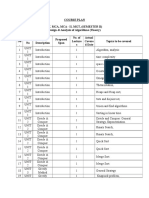

- Teaching PlanDocument3 pagesTeaching PlanakashniranjaneNo ratings yet

- Rules of Finance & Budgeting Gilgit-Baltistan Under Self-Gov. Ordinance '09Document66 pagesRules of Finance & Budgeting Gilgit-Baltistan Under Self-Gov. Ordinance '09Razi Kazmee100% (2)

- Chapter 9Document13 pagesChapter 9ppantin0430No ratings yet

- 300 Accounting ManualDocument53 pages300 Accounting ManualHassan Gardezi100% (2)

- Final Result For This Unit: AIC-UP-BSBFIM501-V4.0 Page 1 of 17Document17 pagesFinal Result For This Unit: AIC-UP-BSBFIM501-V4.0 Page 1 of 17Samir BhandariNo ratings yet

- Lec-14A - Chapter 34 - The Influence of Monetary and Fiscal Policy On Aggregate DemandDocument50 pagesLec-14A - Chapter 34 - The Influence of Monetary and Fiscal Policy On Aggregate DemandMsKhan0078No ratings yet

- Funds Management For Public Sector PDFDocument37 pagesFunds Management For Public Sector PDFDan Argynov100% (5)

- CAG Report On Local Governments in Kerala 2010-11Document79 pagesCAG Report On Local Governments in Kerala 2010-11K RajasekharanNo ratings yet

- Mid-Course Intermship ReportDocument30 pagesMid-Course Intermship ReportTrương Mỹ LinhNo ratings yet

- DBM Presentation - 23rd Annual Convention-Janet B. Abuel PDFDocument19 pagesDBM Presentation - 23rd Annual Convention-Janet B. Abuel PDFJacqueline P AlfaroNo ratings yet

- Educ 104 School Plant AdministrationDocument22 pagesEduc 104 School Plant AdministrationGlenda FernandoNo ratings yet

- Fiscal PolicyDocument13 pagesFiscal PolicyAakash SaxenaNo ratings yet

- Constitutional and Legal Basis For Philippine Fiscal AdministrationDocument18 pagesConstitutional and Legal Basis For Philippine Fiscal AdministrationDoris Joy Villegas50% (2)

- Final Exam Afar 3 2022Document10 pagesFinal Exam Afar 3 2022Cassie HowardNo ratings yet

- Bba-205 FMDocument345 pagesBba-205 FMIndu GuptaNo ratings yet

- MATH 108X - Budgeting Case Study Excel File: Text Box For Part #5Document4 pagesMATH 108X - Budgeting Case Study Excel File: Text Box For Part #5Emmanuel Nsa0% (1)

- Risk and Rates of ReturnDocument38 pagesRisk and Rates of ReturnTheo SimonNo ratings yet

- Oracle Accounting - Accounting BasicsDocument28 pagesOracle Accounting - Accounting Basicskarthikppillai100% (3)

- Educ 328 M8Document4 pagesEduc 328 M8Cristel PesanonNo ratings yet

- The Master Budget: Sales Forecast Production Schedule Cost of Goods Sold and Ending Inventory BudgetsDocument79 pagesThe Master Budget: Sales Forecast Production Schedule Cost of Goods Sold and Ending Inventory BudgetsAhmad NawazNo ratings yet

- Republic Act No 9679 PAG IBIGDocument17 pagesRepublic Act No 9679 PAG IBIGJnot VictoriknoxNo ratings yet

- Financial Planning: Budgeting, ForecastingDocument10 pagesFinancial Planning: Budgeting, ForecastingMylene SalvadorNo ratings yet

- Questionnaire Project CostingDocument9 pagesQuestionnaire Project CostingMarwa GhozNo ratings yet

- CH 07 TifDocument39 pagesCH 07 TifFerdinand FernandoNo ratings yet

- Ccasape Letter 2Document3 pagesCcasape Letter 2Jackie ValleyNo ratings yet

- Budget ManualsDocument3 pagesBudget ManualsJun Emmanuel Gapol MacalisangNo ratings yet

- Budgetary ControlDocument16 pagesBudgetary ControlKushal ParekhNo ratings yet

- PMP Formulas Cheat SheetDocument3 pagesPMP Formulas Cheat SheetSudhir AcharyaNo ratings yet

- BallDocument3 pagesBallYsabelle Yu YagoNo ratings yet

- Annual Report KRBL Limited 2015 16 PDFDocument164 pagesAnnual Report KRBL Limited 2015 16 PDFhamsNo ratings yet

- SAP Trg. Log Sheet - All ModulesDocument51 pagesSAP Trg. Log Sheet - All Modulespawandubey9No ratings yet