Professional Documents

Culture Documents

ACH in R12

Uploaded by

Surya MaddiboinaCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

ACH in R12

Uploaded by

Surya MaddiboinaCopyright:

Available Formats

Login as Payment Setup Administrator Step 1: Go To Payment Setup >> Shared Setup >> Formats >> XML Publisher

Format Templates Click Create Template button.

Name: NI ACH Supplier Payment Template Application: Payments Type: eText - Outbound Default Output Type: eText File: upload from perforce <PATH>

Code: NI_WF_ACH_SUPP_PMT_TMP Data Definition: Oracle Payments Funds Disbursement Payment Instruction Extract 1.0 Start Date: Sysdate Subtemplate: No Language: English

Step 2: Go To Payment Setup >> Shared Setup >> Formats >> Formats Click Create

Code: NI__ACH_SUPP_PMT_FORMAT Name: NI ACH Supplier Payment Format

Data Extract: Oracle Payments Funds Disbursement Payment Instruction Extract 1.0 XML Published Tempalte: NI ACH Supplier Payment Template (created in step 1)

Step 3: Go To Payment Setup >> Shared Setup >> Payment Process Profiles Code: NI_ACH_SUPP_PPP Name: NI ACH Supplier Payment Profile Payment Instruction Format: NI WF ACH Supplier Processing Type: Electronic Electronic Processing Channel: Oracle Payments Payment Completion Point: When Payment

Payment Format (created in step 2) Instruction is Formatted Under Payment Instruction Creation Rules: Check First Party Organization

Click Save and Add Details button and On Payment Instruction Format tab Outbound Payment File Prefix: ACH Outbound Payment File Extension: txt

Click Apply Create Remittance Advice for Reporting Step 1: Go To Payment Setup >> Shared Setup >> Formats >> XML Publisher Format Templates Click Create Template button. Name: NI Separate Remittance Advice Application: Payments Type: RTF File: NI_IBYR_SRA.rtf Default File Territory: United States Code: NI_IBY_SRA Data Definition: Oracle Payments Funds Disbursement Payment Instruction Extract 1.0 Start Date: Sysdate Subtemplate: No Language: English

Step 2: Go To Payment Setup >> Shared Setup >> Formats >> Formats Click Create

Code: NI_PAY_REMIT_ADV Name: NI Separate Remittance Advice

Data Extract: Oracle Payments Funds Disbursement Payment Instruction Extract 1.0 XML Published Tempalte: NI Separate Remittance Advice (created in step 1)

Step 3: Go To Payment Setup >> Shared Setup >> Payment Process Profiles Search for NI WF ACH Supplier Payment Profile created in step 3 Go to Reporting tab Under Separate Remittance Advice add your Remittance Format

Format: NI Separate Remittance Advice (created in step 2) Condition: All Payments

Checkbox: Automatically Submit at Payment Completion Point Delivery Method: Printed

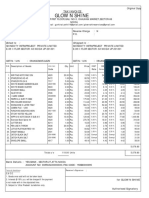

Go Payables Manager Setup >> Payments >> Bank Accounts Search for Cash Disbursement - Wells Fargo-5935 as Bank Account Name Click the account and hit Manager Payments Documents Click Create Name: NI ACH Payment Format: NI ACH Supplier Payment Format (created in step 2) Status: Active And click Apply Paper Stock Type: Blank Stock Payment Document Category: EFT PAY First Available Document Number: 800000

Using AutoLockbox

AutoLockbox (or Lockbox) is a service that commercial banks offer corporate customers to enable them to outsource their accounts receivable payment processing. A lockbox operation can process millions of transactions a month. AutoLockbox eliminates manual data entry by automatically processing receipts that are sent directly to your bank. You specify how you want this information transmitted and Receivables ensures that the data is valid before creating QuickCash receipt batches. You can automatically identify the customer who remitted the receipt and optionally use AutoCash rules to determine how to apply the receipts to your customer's outstanding debit items. You can also use AutoLockbox for historical data conversion. For example, you can use AutoLockbox to transfer receipts from your previous accounting system into

Receivables. AutoLockbox ensures that the receipts are accurate and valid before transferring them into Receivables. AutoLockbox is a three step process: 1. Submit Import: During this step, Lockbox reads and formats the data from your bank file into AutoLockbox tables using an SQL *Loader script. 2. Submit Validation: The validation program checks data in the AutoLockbox tables for compatibility with Receivables. Once validated, the data is transferred into QuickCash tables. At this point, you can optionally query your receipts in the QuickCash window and change how they will be applied before submitting the final step, Post QuickCash. 3. Submit Post QuickCash: This step applies the receipts and updates your customer's balances. See: Post QuickCash. These steps can be submitted individually or at the same time from the submit Lockbox Processing window. After you run Post QuickCash, Receivables treats the receipts like any other receipts; you can reverse and reapply them and apply any unapplied, unidentified, or on-account amounts.

AutoLockbox Validation

Receivables validates the data you receive from the bank to ensure that the entire file was received, there are no duplicate receipts within a batch, and that customers and invoices are valid. AutoLockbox also validates all of your data for compatibility with Receivables. AutoLockbox validates your data by ensuring that the columns in AR_PAYMENTS_INTERFACE reference the appropriate values and columns in Receivables.

o

Transmission Level Validation: AutoLockbox validates your lockbox transmission to ensure that transmission information corresponds to your transmission format. The following attributes are validated:

Transmission format contains receipt records Lockbox number is part of the transmission format or you specify it when you submit AutoLockbox from the Submit Lockbox window

GL date is in an open accounting period Total transmission record count and amount that you supply must match the actual receipt count and amount that is determined by AutoLockbox Origination number is valid if it is provided

Lockbox Level Validation: AutoLockbox validates your lockbox records to ensure that lockbox information corresponds to your transmission format. The following attributes are validated:

Lockbox number is specified in either the Lockbox Header or the Lockbox Trailer, and is valid Lockbox batch count is correct if it is provided Lockbox amount is correct if it is provided Lockbox record count is correct if it is provided Origination number is valid if it is provided No duplicate lockbox numbers

Batch Level Validation: AutoLockbox validates your batch records to ensure that batch information corresponds to your transmission format. The following attributes are validated:

Batch name exists on batch records Batch name is unique within the transmission Batch amount is correct Batch record count is correct Lockbox number exists on batch records if this number is part of the transmission format

Receipt Level Validation: AutoLockbox validates your receipt records to ensure that receipt information corresponds to your transmission format. The following attributes are validated:

Remittance amount is specified Check number is specified Item number is specified and is unique within a batch, a lockbox, or the transmission, depending on the transmission format Lockbox number is specified (if this number is not part of the Lockbox Header or the Lockbox Trailer of the transmission format) and batches are not imported Batch name is specified (if either Batch Headers or Batch Trailers are part of the transmission format) Account number is specified (if Transit Routing Number is part of the transmission format) Invoice1-8 are either valid or are left blank

Attention: If you are using matching numbers and a receipt record indicates that multiple transactions will be paid by this receipt, Lockbox assumes that all of the transactions are the same type (e.g. invoices, sales orders, purchase orders, etc.). For example, if the first 2 transactions are invoices, Lockbox will successfully match them with this receipt. However, if the next transaction is not an invoice, Lockbox will either import the remaining receipt amount as unidentified or reject the entire receipt (depending your Lockbox definition).

Installment1-8 are either valid installment numbers or are left blank Invoice, debit memo, credit memo, deposit, on-account credit, or chargeback number derived from the matching number does not belong to a guarantee or receipt

Transaction number is entered where an application amount is specified Sum of all of the Amount Applied columns for a receipt does not exceed the remittance amount Customer number is valid (refer to Customer Validation below) Customer number and MICR number both reference the same customer (if both are provided) Receipt date is specified Payment method is valid Currency is valid (refer to Currency Validation below)

Overflow Level Validation: AutoLockbox validates your overflow records to ensure that overflow information corresponds to your transmission format. The following attributes are validated:

Batch name is specified (if either Batch Headers or Batch Trailers are part of the transmission format) Lockbox number is specified (if either the Batch Header or the Batch Trailer are not specified and the transmission format includes lockbox number) Item number is specified and matches a receipt record Overflow indicator is specified (unless it is the last overflow record) Overflow sequence is specified Invoice1-8 are valid invoice numbers (these numbers are optional, and can be left blank)

Attention: If you are using matching numbers and a receipt record indicates that multiple transactions will be paid by this receipt, Lockbox assumes that all of the transactions are the same type (e.g. invoices, sales orders, purchase orders, etc.). For

example, if the first 2 transactions are invoices, Lockbox will successfully match them with this receipt. However, if the next transaction is not an invoice, Lockbox will either import the remaining receipt amount as unidentified or reject the entire receipt (depending your Lockbox definition).

Installment1-8 are either valid installment numbers or are left blank Transaction number derived is entered where an application amount is specified

Customer Validation: AutoLockbox can either validate your customer data based on the following attributes, or mark the receipt as 'Unidentified' if no match is found:

Customer number is valid MICR number is valid Bill-To customer is from an AutoAssociated invoice (if AutoAssociate is enabled)

Currency Validation: Receivables lets you process receipts in multiple currencies. If you pass the currency code, exchange rate type, and receipt date, AutoLockbox will try to determine the exchange rate. If it is unable to determine the exchange rate, the receipt will fail validation. Receivables also supports cross currency deposits. This implies that receipts in your lockbox can be either in the same currency as that of the bank account, or in any other currency, provided the bank account is in your functional currency and its Multiple Currency Receipts field is set to Yes (Bank Accounts window, Receivables Options alternative region).

Running AutoLockbox

Run AutoLockbox to submit your lockbox transmission processes and transfer payment information from your bank files into Receivables. Submit AutoLockbox from the Submit Lockbox Processing window. Use AutoLockbox to import your invoice-related receipts. You must process noninvoice related receipts (such as investment income) through the Receipts window using a receipt type of 'Miscellaneous'. You can import, validate, and run AutoLockbox all in one step, or perform the steps separately using the same window. For example, you can import data into Receivables and review it before validating it within Receivables. Upon examination and approval, you can submit the validation step and Receivables will automatically validate your data and create QuickCash receipt batches. Caution: When you receive your bank file, be sure to name the file and move it to the appropriate directory. You will need to specify the location of your bank file when you submit AutoLockbox. If you receive daily files from your bank, be careful not to overwrite the files from the previous day. Receivables uses SQL*Loader to load information from your bank files into AutoLockbox tables. For SQL*Loader to load your bank file properly, each logical record that your bank sends to you must end with a carriage return; otherwise, SQL*Loader displays an error message when you initiate AutoLockbox. Attention: If you are using the automatic receipts feature, AutoLockbox ignores all transactions in this transmission that are selected for automatic receipt (i.e. transactions assigned to a payment method whose associated receipt class has Creation Method set to 'Automatic'). QuickCash lets you enter and apply receipts quickly by only requiring you to provide minimal information. QuickCash also provides an extra level of control for entering high volume receipts because it does not immediately affect your customer's account. When you enter receipts and applications in a QuickCash batch, Receivables stores them in an interim table. After reviewing a QuickCash batch for accuracy, you run Post QuickCash to update your customer's account balances. QuickCash lets you apply your receipts to one or many transactions, use AutoCash rules, place receipts on-account, or enter them as unidentified or unapplied. After you run Post QuickCash, Receivables treats the receipts like any other receipts; you can

reverse and reapply them and apply any unapplied, unidentified, or on-account amounts. You must batch QuickCash receipts. For receipt batches you enter in the QuickCash window, Receivables does not update the status, applied, on account, unapplied, and unidentified fields until you save the batch. If you do not identify the customer for a receipt, Receivables automatically assigns the receipt a status of Unidentified. Additional Information: You cannot add miscellaneous receipts to a QuickCash batch.

Post QuickCash

When you enter receipts in the QuickCash window or import them using AutoLockbox, Receivables stores them in interim tables. You can then use the QuickCash window to review each receipt and use the Applications window to ensure that the application information is correct. After you approve the receipts and their applications, run Post QuickCash to update your customer's account balances. You can choose which QuickCash or Lockbox batches to review. For example, you may want to review only the receipts entered by your data entry clerks or the data files sent by your bank. The following diagram summarizes how Post QuickCash transfers receipts and applications from interim tables into Receivables.

You might also like

- r12 Ach StepsDocument4 pagesr12 Ach StepsPradeep Kumar ShuklaNo ratings yet

- Payment Process ProfileDocument10 pagesPayment Process ProfileRajesh100% (1)

- R12 Bank Account Transfer Ver 1 0 PDFDocument644 pagesR12 Bank Account Transfer Ver 1 0 PDFram knlNo ratings yet

- Oracle R12 AP Check Printing Setups and Process DocumentDocument48 pagesOracle R12 AP Check Printing Setups and Process DocumentCA Vara Reddy50% (2)

- Import External Bank Accounts r12 Oracle AppsDocument12 pagesImport External Bank Accounts r12 Oracle AppsashibekNo ratings yet

- R12 Payment Process RequestDocument9 pagesR12 Payment Process RequestAmit ChauhanNo ratings yet

- Creating AP Checks in Oracle R12Document5 pagesCreating AP Checks in Oracle R12pibu128No ratings yet

- Oracle Apps Credit Card in AP & IExpenseDocument2 pagesOracle Apps Credit Card in AP & IExpensesivaramsvNo ratings yet

- How To Set Up Bank Accounts For Use by Multiple Operating UnitsDocument9 pagesHow To Set Up Bank Accounts For Use by Multiple Operating UnitsMadhurima ChatterjeeNo ratings yet

- Steps To Create Payment Document in R12 PayablesDocument2 pagesSteps To Create Payment Document in R12 Payablessrees_15No ratings yet

- Payment ACH Best GuideDocument66 pagesPayment ACH Best Guidepandian0020% (1)

- Step 1:: Payment Process ProfilesDocument4 pagesStep 1:: Payment Process ProfilesckanadiaNo ratings yet

- Oracle Credit CheckingDocument33 pagesOracle Credit CheckingVinita Bhatia100% (1)

- Procure To Pay P2P Accounting EntriesDocument10 pagesProcure To Pay P2P Accounting EntriesAkash100% (1)

- Transfer of Funds-User Guide-SEWDocument23 pagesTransfer of Funds-User Guide-SEWkommineni11No ratings yet

- BAI2 CodesDocument14 pagesBAI2 CodesLearn.online100% (1)

- Oracle R12 AP Check Printing Setups and Process DocumentDocument48 pagesOracle R12 AP Check Printing Setups and Process DocumentKausik Ghosh100% (1)

- Setup Credit Card Payments in Oracle ReceivablesDocument21 pagesSetup Credit Card Payments in Oracle ReceivablesMag Marina50% (2)

- ChequeDocument3 pagesChequeRischa SoebrotoNo ratings yet

- Bank Transaction Codes in R12Document4 pagesBank Transaction Codes in R12Nageshwar RaoNo ratings yet

- ACH Quick Guide 0914Document5 pagesACH Quick Guide 0914aplawNo ratings yet

- Application: Account Receivables Title: Customer Refund: OracleDocument23 pagesApplication: Account Receivables Title: Customer Refund: OraclesureshNo ratings yet

- CheckPrintingXMLP R12Document16 pagesCheckPrintingXMLP R12Eder EsquivelNo ratings yet

- How to associate bank account to multiple sitesDocument5 pagesHow to associate bank account to multiple sitesMadhurima ChatterjeeNo ratings yet

- R12 Payment Process Request - Functional and Technical Information (ID 821133.1)Document8 pagesR12 Payment Process Request - Functional and Technical Information (ID 821133.1)orafinphrNo ratings yet

- Setting Up Payroll For Oracle Cash Management IntegrationDocument6 pagesSetting Up Payroll For Oracle Cash Management Integrationmohammedsalah89No ratings yet

- Checks: Naydud K. Cutipa Roiro Mg. Emerson Angel Espiritu Saenz Interpersonal Communication Accounting Day Iv-ADocument11 pagesChecks: Naydud K. Cutipa Roiro Mg. Emerson Angel Espiritu Saenz Interpersonal Communication Accounting Day Iv-AWilliam Paucar GarciaNo ratings yet

- AR - Direct DebitDocument37 pagesAR - Direct DebitObilesu Rekatla100% (2)

- Signature On CheckDocument4 pagesSignature On Checkkencheng2No ratings yet

- Bank Statement To Cash Reconciliation: EMO CriptDocument24 pagesBank Statement To Cash Reconciliation: EMO CriptsmohammedsaadNo ratings yet

- Credit Card RefundsDocument8 pagesCredit Card RefundsthulaseeNo ratings yet

- Check Printing User Guide - OracleDocument452 pagesCheck Printing User Guide - Oracleayub_bmeNo ratings yet

- Create Bank Statement TransactionsDocument9 pagesCreate Bank Statement TransactionsmanpreetgilNo ratings yet

- Oracle Applications - Oracle R12 Credit Card Payments Setups and ProcessDocument34 pagesOracle Applications - Oracle R12 Credit Card Payments Setups and ProcessAsif Sayyed100% (1)

- Credit Card Payments Setups and Process in Oracle R12Document55 pagesCredit Card Payments Setups and Process in Oracle R12Seenu DonNo ratings yet

- How To Process A Loan Along Its LifecycleDocument85 pagesHow To Process A Loan Along Its LifecycleMadhu Devarasetti50% (2)

- Micr Code Meaning of ChequeDocument3 pagesMicr Code Meaning of Chequeमन्नू लाइसेंसीNo ratings yet

- P CardDocument17 pagesP Cardawer99100% (1)

- Bank AccountDocument3 pagesBank AccountElijah ChenNo ratings yet

- Epayments ACH Processing ApplicationDocument5 pagesEpayments ACH Processing ApplicationepaymentsproNo ratings yet

- MTAP Bank Cheque Verification Using Image ProcessingDocument35 pagesMTAP Bank Cheque Verification Using Image Processingjasti chakradharNo ratings yet

- Overview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementDocument2 pagesOverview of Regular Savings Key Policies and Fees: Bank of America Clarity StatementJacob DaleNo ratings yet

- Tax Setup Steps R12.1.2Document37 pagesTax Setup Steps R12.1.2Rashid Jamal97% (32)

- Credit Card PaymentsDocument14 pagesCredit Card PaymentscanjiatpNo ratings yet

- Step-By - Step Process For Check Printing in Oracle R12Document13 pagesStep-By - Step Process For Check Printing in Oracle R12subbaraocrm67% (3)

- Receiving Receipts FAQ'sDocument13 pagesReceiving Receipts FAQ'spratyusha_3No ratings yet

- Oracle Cash Management-Bank Statement LoadDocument21 pagesOracle Cash Management-Bank Statement LoadAmith Kumar IndurthiNo ratings yet

- Transferwise Set-Up ProcessDocument4 pagesTransferwise Set-Up ProcessAgarwal ShubhamNo ratings yet

- Does My Business Need A Federal Tax ID Number?Document3 pagesDoes My Business Need A Federal Tax ID Number?Yan AcostaNo ratings yet

- Add On Credit CardDocument1 pageAdd On Credit CardrizanaqviNo ratings yet

- R12 - Bank Account Transfer Ver 1.0Document644 pagesR12 - Bank Account Transfer Ver 1.0phanisure100% (5)

- How To Set Up Intercompany Balancing Rules For Bank Account TransfersDocument9 pagesHow To Set Up Intercompany Balancing Rules For Bank Account TransfersflavioNo ratings yet

- Methods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeFrom EverandMethods to Overcome the Financial and Money Transfer Blockade against Palestine and any Country Suffering from Financial BlockadeNo ratings yet

- Build a $1,000 Emergency Fund in 10 Steps: Financial Freedom, #82From EverandBuild a $1,000 Emergency Fund in 10 Steps: Financial Freedom, #82No ratings yet

- Oracle Lockbox - Cash Application: Author: Karun Jain Date: 25-Dec-2008 ProjectDocument16 pagesOracle Lockbox - Cash Application: Author: Karun Jain Date: 25-Dec-2008 ProjectPradeep MenochaNo ratings yet

- Auto Lockbox Setup in Oracle ReceivablesDocument75 pagesAuto Lockbox Setup in Oracle ReceivablesNagu SwamyNo ratings yet

- Te.040 GLDocument23 pagesTe.040 GLSurya MaddiboinaNo ratings yet

- VertexDocument25 pagesVertexSurya Maddiboina100% (1)

- GL - SetupDocument21 pagesGL - SetupSurya MaddiboinaNo ratings yet

- BR100 ProjectsDocument47 pagesBR100 ProjectsSurya MaddiboinaNo ratings yet

- Brazil LocalizationDocument75 pagesBrazil LocalizationSurya MaddiboinaNo ratings yet

- Te.40 ApDocument45 pagesTe.40 ApSurya MaddiboinaNo ratings yet

- AP AR NettingDocument9 pagesAP AR NettingSurya MaddiboinaNo ratings yet

- AP End User TrainingDocument156 pagesAP End User TrainingSurya MaddiboinaNo ratings yet

- AP/AR Netting Setup & ProcessDocument16 pagesAP/AR Netting Setup & ProcessSurya MaddiboinaNo ratings yet

- Oracle AIM Crisp HandoutDocument7 pagesOracle AIM Crisp HandoutYogita SarangNo ratings yet

- AIM OverviewDocument22 pagesAIM OverviewSaqib RahatNo ratings yet

- Business Flow Diagram AR-FinalDocument7 pagesBusiness Flow Diagram AR-FinalSurya MaddiboinaNo ratings yet

- Agile Processes and Methodologies: A Conceptual StudyDocument7 pagesAgile Processes and Methodologies: A Conceptual StudySam ThorNo ratings yet

- R12 Enhancements for Legal Entities, TCA, and Bank AccountsDocument3 pagesR12 Enhancements for Legal Entities, TCA, and Bank AccountsSurya MaddiboinaNo ratings yet

- R12 Enhancements for Legal Entities, TCA, and Bank AccountsDocument3 pagesR12 Enhancements for Legal Entities, TCA, and Bank AccountsSurya MaddiboinaNo ratings yet

- HI REACH broadband invoiceDocument1 pageHI REACH broadband invoicenarsampet stcNo ratings yet

- Ticket SampleDocument1 pageTicket SampleSamara ConsultantNo ratings yet

- DepEd Nueva Vizcaya SRI payrollDocument4 pagesDepEd Nueva Vizcaya SRI payrollChester BoliquenNo ratings yet

- Case Study On Letter of CreditDocument9 pagesCase Study On Letter of CreditPrahant KumarNo ratings yet

- Accounting Information SystemDocument70 pagesAccounting Information SystemkonyatanNo ratings yet

- Ola ride receipt for ₹444 tripDocument3 pagesOla ride receipt for ₹444 tripseeralan_1986No ratings yet

- Test Bank For Delivering Health Care in America 6th Ed Test BankDocument8 pagesTest Bank For Delivering Health Care in America 6th Ed Test Banktestbankloo0% (1)

- Sol. Man. - Chapter 9 Income TaxesDocument15 pagesSol. Man. - Chapter 9 Income TaxesMiguel Amihan100% (1)

- Unit-3 Im (Detailed Notes)Document14 pagesUnit-3 Im (Detailed Notes)Kuldeep singhNo ratings yet

- E StatmentDocument2 pagesE StatmentShekhar BathawNo ratings yet

- Developing A Multimodal Transport Hub and Bus Service Improvements For BattaramullaDocument6 pagesDeveloping A Multimodal Transport Hub and Bus Service Improvements For Battaramullasandaru malindaNo ratings yet

- Stationary Invoice-5080 PaidDocument2 pagesStationary Invoice-5080 PaidAnkur Agarwal100% (1)

- 2307 All Support StaffDocument4 pages2307 All Support StaffReyna Maree GarciaNo ratings yet

- USPS Change of AddressDocument20 pagesUSPS Change of AddressmegcorNo ratings yet

- Lightening The Load - Marco Polo Leads The WayDocument28 pagesLightening The Load - Marco Polo Leads The WaydmaproiectNo ratings yet

- Screenshot 2023-11-09 at 9.42.54 AMDocument8 pagesScreenshot 2023-11-09 at 9.42.54 AMmegahygieneNo ratings yet

- Tax Invoice: Rebel Enterprise 1325/18-19 4-Jan-2019Document2 pagesTax Invoice: Rebel Enterprise 1325/18-19 4-Jan-2019HARDIK PATELNo ratings yet

- Domestic Express Post parcel charges by zone and weightDocument2 pagesDomestic Express Post parcel charges by zone and weightJames CurryNo ratings yet

- My Transactions ReportDocument3 pagesMy Transactions ReportWilson Ng0% (2)

- CA CPT Fundamentals of Accounting PPT Bills of Exchange and Promissory Notes Part 1Document21 pagesCA CPT Fundamentals of Accounting PPT Bills of Exchange and Promissory Notes Part 1Palani Muthusamy100% (1)

- VAT Compliance RequirementsDocument4 pagesVAT Compliance RequirementsRyan AllanicNo ratings yet

- Cash Book Solutions for Class 11 Accountancy Chapter 11Document51 pagesCash Book Solutions for Class 11 Accountancy Chapter 11jigyasuNo ratings yet

- GRCCCM NOTESAir CargoDocument19 pagesGRCCCM NOTESAir CargochandanNo ratings yet

- Terumo - Tllu6099284 - EdDocument2 pagesTerumo - Tllu6099284 - EdmnmusorNo ratings yet

- GST entries for RCM, advancesDocument5 pagesGST entries for RCM, advancesHEERA BABU MERTIANo ratings yet

- The Concept and Development of MoneyDocument19 pagesThe Concept and Development of MoneyMARK EVANSNo ratings yet

- Daily Use AugDocument8 pagesDaily Use AugShashank Nainwal50% (2)

- Supply Chain Output KPIsDocument4 pagesSupply Chain Output KPIstranhungdao12a3100% (1)

- Blackbook Project On Modernization in Banking System in India - 163418955 PDFDocument81 pagesBlackbook Project On Modernization in Banking System in India - 163418955 PDFAkash Patil62% (50)

- Philippine Airlines vs. Commissioner of Internal RevenueDocument3 pagesPhilippine Airlines vs. Commissioner of Internal RevenueGenebva Mica NodaloNo ratings yet