Professional Documents

Culture Documents

Long-Lived Assets

Uploaded by

bluemajaOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Long-Lived Assets

Uploaded by

bluemajaCopyright:

Available Formats

1.

Failure to capitalize a fixed asset at the correct amount affects __________ until the company disposes of the asset. a. the balance sheet only b. the income statement only c. the cash flow statement only d. both the income statement and the balance sheet 2. In rare cases, the auditor may believe it is necessary that a complete physical inventory of fixed assets be taken to make sure they actually exist. If an inventory is taken, the auditor normally: a. takes the inventory. b. requires client to take the inventory and provide documentation to the auditor. c. observes the count. d. requires that it be done by an outside, independent third party. 3. A major consideration in verifying the ending balance in fixed assets is the possibility of existing legal encumbrances. Tests to identify possible legal encumbrances would satisfy the audit objective of: a. existence. b. presentation and disclosure. c. detail tie-in. d. classification. 4. When auditing depreciation expense, the two major concerns related to the accuracy audit objective are: a. consistent application of depreciation method and useful lives. b. consistent application of depreciation method and classification of assets. c. correctness of calculations and consistent application of depreciation method. d. cost of the fixed asset and useful lives. 5. The auditor ___________ to test the accuracy or classification of fixed assets recorded in prior periods. a. normally needs b. never needs c. normally does not need d. is required 6. The auditor normally does not need to test the accuracy or classification of fixed assets recorded in prior periods because: a. they are rarely material to the audit. b. they rarely contain misstatements. c. they are verified in previous audits. d. they dont affect the balance sheet. 7. To auditors may conclude that depreciation charges are insufficient by noting: a. Insured values greatly in excess of book values b. Large amounts of fully depreciated assets c. Continuous trade-ins of relatively new assets d. Excessive recurring losses on assets retired 8. The failure to capitalize a permanent asset, or the recording of an asset acquisition at the improper amount, affects the balance sheet a. For the current period b. For the depreciable life of the asset c. Until the firm disposes of the asset d. Forever 9. The failure to capitalize a permanent asset, or the recording of an asset acquisition at the improper amount, affects the income statement a. For the current period b. For the depreciable life of the asset c. Until the firm disposes of the asset d. Forever 10. The erroneous inclusion of transactions that should properly be recorded as assets into accounts such as repairs expense, lease expense, or supplies is a common client error. The auditor should evaluate the likelihood of these types of misclassifications in conjunction with a. Obtaining an understanding of the internal control structure b. The test of controls

11.

12.

13.

14.

15.

16.

17.

18.

c. The test of transactions d. The test of details of balances If the auditor believes there is a high likelihood of significant missing permanent assets that are still recorded on the accounting records, an appropriate procedure is to select a sample from the assets master file and examine a. The documents verifying their acquisition b. The assets c. All the related journal entries d. The accumulated depreciation calculations Property, plant and equipment are assets that: a. Have expected lives of more than one year b. Are used in the business c. Are not acquired for resale d. Meet all of the requirements stated above Which of the following is not a category of tests commonly associated with the audit of manufacturing equipment? a. Verification of depreciation expense b. Analytical procedures c. Verification of current-period disposals d. Verification of the beginning balance in accumulated depreciation A term used to describe managements recognition that a significa nt portion of fixed assets is no longer as productive as had originally been expected a. Asset recognition b. Asset impairment c. Discontinued operations d. Wasted productivity Expense accounts analysis is closely related to tests of controls and substantive tests of transactions. The major difference is: a. The difference in the types of underlying documentation which is examined b. The degree of concentration on an individual account c. The use or nonuse of cutoff tests d. That one emphasizes transactions and the other emphasizes amounts To achieve effective internal accounting control over fixed asset additions, a company should establish procedures that require: a. Authorization and approval of major fixed asset additions b. Capitalization of the cost of fixed asset additions in excess of a specific dollar amount c. Classification, as investments, of those fixed asset additions that are not used in the business d. Performance of recurring fixed asset maintenance work solely by maintenance department employees Which of the following is a customary audit procedure for the verification of the legal ownership of real property? a. Examination of correspondence with the corporate counsel concerning acquisition matters b. Examination of ownership documents registered and on file at the public hall of records c. Examination of corporate minutes and resolutions concerning the approval to acquire property, plant and equipment d. Examination of deeds and title guarantee policies on hand An auditor would be least likely to use confirmations in connection with the examination of: a. Inventories b. Long-term debt c. Property, plant and equipment d. Stockholders equity

-------SPECIAL TOPICS Intangible assets 1. Statement 1: Legal costs for obtaining and defending a patent are capital expenditures if the defense is successful.

2.

3.

Statement 2: If the defense of the patent is not successful, the patent still has a value and should be capitalized. a. Only statement 1 is false b. Only statement 2 is false c. Both are false d. Both are true TRUE OR FALSE. The cost of patents should amortized over their legal life or their estimated useful life, whichever is longer. Answer: FALSE, shorter In auditing patents, an intangible asset, an auditor most likely would review or recomputed amortization and determine whether the amortization period is reasonable. This procedure would support which of the managements assertions? a. Valuation b. Existence c. Completeness d. Rights

Natural Resources 4. The following are unique problems presented by natural resources, except: a. It is often difficult to identify the costs associated with discovery of the natural resource b. Reclamation costs may be difficult to estimate c. It is often difficult to estimate the amount of commercially available resources to be used in determining a depletion rate d. None of the above 5. The expense associated with the extraction of natural resources is called a. Depreciation b. Reclamation c. Depletion d. Extrapolation 6. Depletion expense should be based on the items extracted during the year using the a. Straight line method b. Units of production method c. Sum-of-the-years-digits method d. Declining balance method 7. In which of the following situations will an auditor least likely rely on a specialist? a. The estimation of oil and gas reserves b. The interpretation of contracts, laws, and regulations c. The calculation of interest expense d. The valuation of land and buildings, plant and machinery, and intangible assets 8. Costs associated with restoring land used in mining to an agreed-upon natural state that reflects safeguards to protect the environment a. Restoration expenses b. Environmental costs c. Reclamation expenses d. Mining costs 9. Statement 1: All reclamation expenses associated with restoring the property to its original state should be estimated and accrued. Statement 2: Reclamation expenses should be amortized against the use of the natural resources as part of the depletion expense. a. Both statements are false b. Only Statement 1 is true c. None of the statements are false d. Only Statement 1 is false Leases Motivation to Lease 10. Which of the following is a reason for companies to engage in leasing transactions?

To finance the use of the asset instead of making an outright purchase To maintain a flexible operating profile To acquire the use of an asset for an extended period of time, but keep the asset and related liability off the balance sheet d. All of the above 11. The audit approach for leases starts with ______________ to assure proper recording of leases. a. Establishing audit objectives b. An analysis of controls the company uses c. Reviewing clients disclosures d. Testing the clients schedule 12. Leases must be capitalized if at least one of the four conditions is satisfied. Which of the following is not one of the four conditions? a. the present value of the minimum lease payments is at least equal to 90% of the assets fair market value b. the lessee can acquire title to the asset at the end of the lease for a bargain purchase price c. the lease term covers at least 90% of the useful life of the asset d. the lease transfers ownership to the lessee by the end of the lease term 13. Which of the following is true of capitalized leases as compared to operating leases? a. Only rent expense is reflected in the income statement b. The leased asset does not appear on the balance sheet c. Liabilities include lease obligation d. Future minimum lease obligations are not required to be disclosed

a. b. c.

You might also like

- SIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)From EverandSIE Exam Practice Question Workbook: Seven Full-Length Practice Exams (2023 Edition)Rating: 5 out of 5 stars5/5 (1)

- Revenge of The Debtors - Who Can Legally Enforce A Mortgage After A "Landmark" CaseDocument6 pagesRevenge of The Debtors - Who Can Legally Enforce A Mortgage After A "Landmark" CaseForeclosure Fraud100% (6)

- The Entrepreneur’S Dictionary of Business and Financial TermsFrom EverandThe Entrepreneur’S Dictionary of Business and Financial TermsNo ratings yet

- The 3 PigsDocument24 pagesThe 3 Pigsmatiaslmart4571No ratings yet

- Territorial Waters, Exclusive Economic Zones (EEZ) & Continental ShelfDocument5 pagesTerritorial Waters, Exclusive Economic Zones (EEZ) & Continental ShelfGavriil Prigkipakis100% (2)

- TEST BANK-Auditing-ECDocument16 pagesTEST BANK-Auditing-ECAnonymous qi4PZkNo ratings yet

- Chapter 19 Auditing Theory: Multiple-Choice QuestionsDocument14 pagesChapter 19 Auditing Theory: Multiple-Choice QuestionsMaria Ferlin Andrin MoralesNo ratings yet

- Ch12 - Substantive Audit Testing Expenditure CycleDocument20 pagesCh12 - Substantive Audit Testing Expenditure CycleJennifer Valdez80% (5)

- TEST BANK Auditing Tak KerjainDocument15 pagesTEST BANK Auditing Tak Kerjaindian agitaNo ratings yet

- Chapter 11 - Substantive Test of Inventories and Cost of Sales Chapter 11: Review Questions-TheoreticalDocument6 pagesChapter 11 - Substantive Test of Inventories and Cost of Sales Chapter 11: Review Questions-TheoreticalAlexanNo ratings yet

- AudProb Test BankDocument18 pagesAudProb Test BankKarina Barretto AgnesNo ratings yet

- Law of Contract: ZimbabweDocument8 pagesLaw of Contract: Zimbabwetatenda75% (4)

- Unit V Audit PlanningDocument23 pagesUnit V Audit PlanningJhuliane RalphNo ratings yet

- Auditing Theory - 074: Process Part 2 CMP Test of Control and Substantive Test in The ConversionDocument6 pagesAuditing Theory - 074: Process Part 2 CMP Test of Control and Substantive Test in The ConversionMaria PauNo ratings yet

- Auditing Theory Test BanksDocument2 pagesAuditing Theory Test BanksJea Balagtas100% (1)

- Bsa 2101 Cfas Finals PDFDocument11 pagesBsa 2101 Cfas Finals PDF수지No ratings yet

- AUD-1stPB 10.22Document14 pagesAUD-1stPB 10.22Harold Dan AcebedoNo ratings yet

- Project Family Law IIDocument5 pagesProject Family Law IIKanishka Sihare100% (1)

- AC1011.7.1 Midterm Examinations Questions and AnswersDocument20 pagesAC1011.7.1 Midterm Examinations Questions and AnswersrheaNo ratings yet

- AUDIT MCQs-Arens, Elder, Beasley - FinalDocument13 pagesAUDIT MCQs-Arens, Elder, Beasley - FinalLeigh PilapilNo ratings yet

- Amalgamation of Banking CompaniesDocument20 pagesAmalgamation of Banking Companiessapna pandeyNo ratings yet

- May 09 Final Pre-Board (At)Document13 pagesMay 09 Final Pre-Board (At)Ashley Levy San PedroNo ratings yet

- Substantive Audit Testing - ExpenditureDocument28 pagesSubstantive Audit Testing - ExpenditureAid BolanioNo ratings yet

- Audit of PpeDocument6 pagesAudit of PpeJonailyn YR Peralta0% (1)

- Chapter 13 Property Plant and Equipment Depreciation and deDocument21 pagesChapter 13 Property Plant and Equipment Depreciation and deEarl Lalaine EscolNo ratings yet

- Prelim Exam - Auditing and Assurance: Specialized Industries Class: Bachelor of Science in Accountancy - 3rd YearDocument10 pagesPrelim Exam - Auditing and Assurance: Specialized Industries Class: Bachelor of Science in Accountancy - 3rd YearJeremae Ann Ceriaco100% (1)

- PledgeDocument26 pagesPledgebluemaja50% (2)

- Problem 26 2Document2 pagesProblem 26 2CodeSeekerNo ratings yet

- BreathDocument2 pagesBreathbluemajaNo ratings yet

- Audit of PpeDocument2 pagesAudit of PpeWawex DavisNo ratings yet

- Auditing QuestionsDocument22 pagesAuditing QuestionsRhett Sage100% (1)

- Kalalo Vs LuzDocument2 pagesKalalo Vs LuzSJ San JuanNo ratings yet

- Substantive Audit of PpeDocument3 pagesSubstantive Audit of PpeSteve SuppieNo ratings yet

- Audit of Fixed AssetsDocument2 pagesAudit of Fixed AssetsstillwinmsNo ratings yet

- Chapter 15Document25 pagesChapter 15cruzchristophertangaNo ratings yet

- Cpa Review School of The Philippines ManilaDocument4 pagesCpa Review School of The Philippines ManilaAljur SalamedaNo ratings yet

- HMWK 12Document8 pagesHMWK 12macmac29No ratings yet

- PpeDocument5 pagesPpeRachel LeachonNo ratings yet

- Aut 590Document6 pagesAut 590Aiko E. LaraNo ratings yet

- Colegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Preliminary Examination Auditing TheoryDocument18 pagesColegio de Dagupan Arellano Street, Dagupan City School of Business and Accountancy Preliminary Examination Auditing TheoryFeelingerang MAYoraNo ratings yet

- QUIZ-Audit Evidence and Audit ProgramsDocument12 pagesQUIZ-Audit Evidence and Audit ProgramsKathleenNo ratings yet

- Ppe Depreciation and DepletionDocument21 pagesPpe Depreciation and DepletionEarl Lalaine EscolNo ratings yet

- Reviewer For Auditing TheoryDocument10 pagesReviewer For Auditing TheoryMharNellBantasanNo ratings yet

- Audit Review Activity 6Document8 pagesAudit Review Activity 6Gwyneth Mae GallardoNo ratings yet

- Midterm Questions PDFDocument9 pagesMidterm Questions PDFJhanvi SinghNo ratings yet

- Audit Evidence Quiz 1: Multiple ChoiceDocument7 pagesAudit Evidence Quiz 1: Multiple ChoiceweqweqwNo ratings yet

- Prof. Falsado Online SeatworkDocument9 pagesProf. Falsado Online SeatworkMarian Grace DelapuzNo ratings yet

- Aud Qlfy Exam RWDocument7 pagesAud Qlfy Exam RWYeji BabeNo ratings yet

- Disbursements Transactions PDFDocument6 pagesDisbursements Transactions PDFMarlyn Joy YaconNo ratings yet

- Aut 1087Document8 pagesAut 1087Aiko E. LaraNo ratings yet

- Auditing Handout Practice Question With Key 1Document5 pagesAuditing Handout Practice Question With Key 1Rinajean Masisado RaymundoNo ratings yet

- CFASDocument15 pagesCFASMary Rose NonesNo ratings yet

- IA 1 ExaminationDocument12 pagesIA 1 ExaminationNathan John Rosales (NightHound)No ratings yet

- C10, C11 QuestionsDocument6 pagesC10, C11 QuestionsFery AnnNo ratings yet

- N C O B A A: Ational Ollege F Usiness ND RTSDocument9 pagesN C O B A A: Ational Ollege F Usiness ND RTSNico evansNo ratings yet

- Audit of PPE StudentsDocument13 pagesAudit of PPE StudentsJames R JunioNo ratings yet

- Audit Risk and MaterialityDocument5 pagesAudit Risk and Materialitycharmsonin12No ratings yet

- 05GeneralInternalControl NotesDocument5 pages05GeneralInternalControl Notesjhaeus enajNo ratings yet

- ExamDocument8 pagesExamahmed arfanNo ratings yet

- Bsa 2101 Cfas Finals PDFDocument11 pagesBsa 2101 Cfas Finals PDF수지No ratings yet

- Finals Audit Theory 2023Document8 pagesFinals Audit Theory 2023Bea Tepace PototNo ratings yet

- Audit Risk and MaterialityDocument28 pagesAudit Risk and MaterialityMarian Grace DelapuzNo ratings yet

- Which of The Following Statements Concerning Evidential Matter Is True?Document10 pagesWhich of The Following Statements Concerning Evidential Matter Is True?JehannahBaratNo ratings yet

- m1 ExerciseDocument33 pagesm1 ExerciseWillowNo ratings yet

- Drill 1Document4 pagesDrill 1Mark Angelo BustosNo ratings yet

- Transaction CyclesDocument2 pagesTransaction CyclesJade100% (1)

- Seatwork No.1 PPEDocument2 pagesSeatwork No.1 PPEJanesene SolNo ratings yet

- AC211 Sophomore Reviewer (Finals)Document9 pagesAC211 Sophomore Reviewer (Finals)Ray-Mart SumilangNo ratings yet

- Republic of The Philippines Manila en BancDocument24 pagesRepublic of The Philippines Manila en BancbluemajaNo ratings yet

- Summary - El Fili EnglishDocument2 pagesSummary - El Fili EnglishbluemajaNo ratings yet

- General KnowledgeDocument3 pagesGeneral KnowledgebluemajaNo ratings yet

- Investment in AssociateDocument2 pagesInvestment in AssociatebluemajaNo ratings yet

- Joint Venture & Co-Ownership - HandoutsDocument1 pageJoint Venture & Co-Ownership - HandoutsbluemajaNo ratings yet

- Financial Assets at Amortized CostDocument8 pagesFinancial Assets at Amortized CostbluemajaNo ratings yet

- CHAPTER 5 Effective Interest MethodDocument4 pagesCHAPTER 5 Effective Interest MethodbluemajaNo ratings yet

- Case 3 - 1 Hotel ContinentalDocument6 pagesCase 3 - 1 Hotel Continentalbluemaja100% (2)

- Extraordinary Gazette - Commission of Inquiry Appointed To Look Into Alleged Human Rights and IHL Violations in Sri LankaDocument3 pagesExtraordinary Gazette - Commission of Inquiry Appointed To Look Into Alleged Human Rights and IHL Violations in Sri LankaAdaderana OnlineNo ratings yet

- United States Court of Appeals Tenth CircuitDocument6 pagesUnited States Court of Appeals Tenth CircuitScribd Government DocsNo ratings yet

- A Project On A Detailed Study On The Concept of Legal PersonsDocument20 pagesA Project On A Detailed Study On The Concept of Legal PersonsharshalNo ratings yet

- 166147-2011-Yap v. Thenamaris Ship S ManagementDocument9 pages166147-2011-Yap v. Thenamaris Ship S ManagementAlexandra Nicole CabaelNo ratings yet

- Civil Procedure Class Notes Ruescher 2014Document78 pagesCivil Procedure Class Notes Ruescher 2014jal2100No ratings yet

- United States v. Villanueva, 1st Cir. (1994)Document10 pagesUnited States v. Villanueva, 1st Cir. (1994)Scribd Government DocsNo ratings yet

- MNLU Mumbai LL.M. Professional RegulationsDocument7 pagesMNLU Mumbai LL.M. Professional RegulationsSheldon DsouzaNo ratings yet

- Amusement Park LawDocument5 pagesAmusement Park LawkuroshitsujiNo ratings yet

- Lecture 01Document31 pagesLecture 01nghaNo ratings yet

- Secretary Certificate FormatDocument2 pagesSecretary Certificate FormatElvira AbogadoNo ratings yet

- By Regd Post With Ac1 To The Tahsildar of GaliveeduDocument2 pagesBy Regd Post With Ac1 To The Tahsildar of GaliveeduHemeswarareddy KarimireddyNo ratings yet

- Johnson v. Commissioner, 1st Cir. (1993)Document28 pagesJohnson v. Commissioner, 1st Cir. (1993)Scribd Government DocsNo ratings yet

- People v. SolisDocument12 pagesPeople v. SolisRodney AtibulaNo ratings yet

- 22 - Amicus Brief For Mark Ridley-Thomas Appeal by Former California Public OfficialsDocument26 pages22 - Amicus Brief For Mark Ridley-Thomas Appeal by Former California Public OfficialsCeleste FremonNo ratings yet

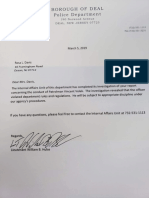

- Deal Police Department LetterDocument1 pageDeal Police Department LetterAsbury Park PressNo ratings yet

- Albior vs. AuguisDocument14 pagesAlbior vs. Auguiskyla_0111No ratings yet

- BUSA 3000 Final Study GuideDocument13 pagesBUSA 3000 Final Study GuideKhadija MemonNo ratings yet

- Federalist 2.0 05 Article Chapter 1.0 V04Document6 pagesFederalist 2.0 05 Article Chapter 1.0 V04publius_federalistNo ratings yet

- Airtel CocDocument20 pagesAirtel CocAsim KhanNo ratings yet

- Lee Kuang Guat (Suing As The Father of The Decased, Lee Chu Ling) V Chiang Woei Chien (Practicing As Chiang Chambers, Advocates and Solicitors)Document44 pagesLee Kuang Guat (Suing As The Father of The Decased, Lee Chu Ling) V Chiang Woei Chien (Practicing As Chiang Chambers, Advocates and Solicitors)TulasiNo ratings yet

- ELEC4100 Complete NotesDocument150 pagesELEC4100 Complete NotesShittyUsername2013No ratings yet

- Labatagos Vs Sandiganbayan, 183 SCRA 415Document4 pagesLabatagos Vs Sandiganbayan, 183 SCRA 415AddAllNo ratings yet

- Youtube ComplaintDocument74 pagesYoutube ComplaintPete Santilli100% (3)