Professional Documents

Culture Documents

Rbi Hard

Uploaded by

vmktptOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Rbi Hard

Uploaded by

vmktptCopyright:

Available Formats

RBI AND ITS REGULATORY MECHANISM

The Reserve Bank of India (RBI) is India's central banking institution, which controls the monetary policy of the Indian rupee. It was established on 1 April 1935 during the British Raj in accordance with the provisions of the Reserve Bank of India Act, 1934. The share capital was divided into shares of 100 each fully paid which was entirely owned by private shareholders in the beginning. Following India's independence in 1947, the RBI was nationalised in the year 1949. The RBI plays an important part in the development strategy of the Government of India. It is a member bank of the Asian Clearing Union. The general superintendence and direction of the RBI is entrusted with the 21member-strong Central Board of Directorsthe Governor (currently Duvvuri Subbarao), four Deputy Governors, two Finance Ministry representative, ten Government-nominated Directors to represent important elements from India's economy, and four Directors to represent Local Boards headquartered at Mumbai, Kolkata, Chennai and New Delhi. Each of these Local Boards consist of five members who represent regional interests, as well as the interests of co-operative and indigenous banks. The bank is also active in promoting financial inclusion policy and is a leading member of the Alliance for Financial Inclusion (AFI). View the bank on AFI's member map or read RBI financial inclusion-related news. . History 19351950

The old RBI Building in Mumbai The Reserve Bank of India was founded on 1 April 1935 to respond to economic troubles after the First World War. It came into picture according to the guidelines laid down by Dr. Ambedkar. RBI was conceptualized as per the guidelines, working style and outlook presented by Dr Ambedkar in front of the Hilton Young Commission. When this commission came to India under the name of Royal Commission on Indian Currency & Finance, each and every member of this commission were holding Dr Ambedkars book named The Problem of the Rupee Its origin and its solution.[4] The Bank was set up based on the recommendations of the 1926 Royal Commission on Indian Currency and Finance, also known as the HiltonYoung Commission. The original choice for the seal of RBI was The East India Company Double Mohur, with the sketch of the Lion and Palm Tree. However it was decided to replace the lion with the tiger, the national animal of India. The Preamble of the RBI describes its basic functions to regulate the issue of bank notes, keep reserves to secure monetary stability in India, and generally to operate the currency and credit system in the best interests of the country. The Central Office of the RBI was initially established in Calcutta (now Kolkata), but was permanently

moved to Bombay (now Mumbai) in 1937. The RBI also acted as Burma's central bank, except during the years of the Japanese occupation of Burma (194245), until April 1947, even though Burma seceded from the Indian Union in 1937. After the Partition of India in 1947, the Bank served as the central bank for Pakistan until June 1948 when the State Bank of Pakistan commenced operations. Though originally set up as a shareholders bank, the RBI has been fully owned by the Government of India since its nationalization in 1949. 19501960 In the 1950s, the Indian government, under its first Prime Minister Jawaharlal Nehru, developed a centrally planned economic policy that focused on the agricultural sector. The administration nationalized commercial banks and established, based on the Banking Companies Act of 1949 (later called the Banking Regulation Act), a central bank regulation as part of the RBI. Furthermore, the central bank was ordered to support the economic plan with loans. 19601969 As a result of bank crashes, the RBI was requested to establish and monitor a deposit insurance system. It should restore the trust in the national bank system and was initialized on 7 December 1961. The Indian government founded funds to promote the economy and used the slogan Developing Banking. The Government of India restructured the national bank market and nationalized a lot of institutes. As a result, the RBI had to play the central part of control and support of this public banking sector. 19691985 In 1969, the Indira Gandhi-headed government nationalized 14 major commercial banks. Upon Gandhi's return to power in 1980, a further six banks were nationalized. The regulation of the economy and especially the financial sector was reinforced by the Government of India in the 1970s and 1980s. The central bank became the central player and increased its policies for a lot of tasks like interests, reserve ratio and visible deposits. These measures aimed at better economic development and had a huge effect on the company policy of the institutes. The banks lent money in selected sectors, like agri-business and small trade companies. The branch was forced to establish two new offices in the country for every newly established office in a town. The oil crises in 1973 resulted in increasing inflation, and the RBI restricted monetary policy to reduce the effects. 19851991 A lot of committees analyses the Indian economy between 1985 and 1991. Their results had an effect on the RBI. The Board for Industrial and Financial Reconstruction, the Indira Gandhi Institute of Development Research and the Security & Exchange Board of India investigated the national economy as a whole, and the security and exchange board proposed better methods for more effective markets and the protection of investor interests. The Indian financial market was a leading example for so-called "financial repression" (Mackinnon and Shaw).[14] The Discount and Finance House of India began its operations on the monetary market in April 1988; the National Housing Bank, founded in July 1988, was forced to invest in the property market and a new financial law improved the versatility of direct deposit by more security measures and liberalization. 19912000 The national economy came down in July 1991 and the Indian rupee was devalued. The currency lost 18% relative to the US dollar, and the Narsimahmam Committee advised restructuring the financial sector by a temporal reduced reserve ratio as well as the statutory liquidity ratio. New guidelines were published in 1993 to establish a private banking sector. This turning point should reinforce the market and was often called neo-

liberal.[17] The central bank deregulated bank interests and some sectors of the financial market like the trust and property markets.[18] This first phase was a success and the central government forced a diversity liberalization to diversify owner structures in 1998. The National Stock Exchange of India took the trade on in June 1994 and the RBI allowed nationalized banks in July to interact with the capital market to reinforce their capital base. The central bank founded a subsidiary companythe Bharatiya Reserve Bank Note Mudran Limitedin February 1995 to produce banknotes.[20] Since 2000 The Foreign Exchange Management Act from 1999 came into force in June 2000. It should improve the foreign exchange market, international investments in India and transactions. The RBI promoted the development of the financial market in the last years, allowed online banking in 2001 and established a new payment system in 20042005 (National Electronic Fund Transfer). The Security Printing & Minting Corporation of India Ltd. , a merger of nine institutions, was founded in 2006 and produces banknotes and coins. The national economy's growth rate came down to 5.8% in the last quarter of 20082009 and the central bank promotes the economic development. Structure

RBI runs a monetary museum in Mumbai Central Board of Directors The Central Board of Directors is the main committee of the central bank. The Government of India appoints the directors for a four-year term. The Board consists of a governor, four deputy governors, fifteen directors to represent the regional boards, one from the Ministry of Finance and ten other directors from various fields. The Government nominated Arvind Mayaram, as a director of the Central Board of Directors with effect from August 7, 2012 and vice R Gopalan, RBI said in a statement on August 8, 2012. The Central Government has nominated Shri Rajiv Takru, Secretary, Department of Financial Services, Ministry of Finance, New Delhi as a director on the Central Board of Directors of the Reserve Bank of India vice Shri D. K. Mittal. Shri Takru's nomination is with effect from February 4, 2013 and until further orders. Governors The current Governor of RBI is Duvvuri Subbarao. The RBI extended the period of the present governor up to 2013. There are four deputy governors, Deputy Governor K C Chakrabarty, Urjit Patel, Shri Anand Sinha, and Shri H.R. Khan . Deputy Governor K C Chakrabarty's term has been extended further by 2 years. Subir Gokarn was replaced by Mr. Urjit Patel in january 2013. Supportive bodies

The Reserve Bank of India has ten regional representations: North in New Delhi, South in Chennai, East in Kolkata and West in Mumbai. The representations are formed by five members, appointed for four years by the central government and servebeside the advice of the Central Board of Directorsas a forum for regional banks and to deal with delegated tasks from the central board.[28] The institution has 22 regional offices. The Board of Financial Supervision (BFS), formed in November 1994, serves as a CCBD committee to control the financial institutions. It has four members, appointed for two years, and takes measures to strength the role of statutory auditors in the financial sector, external monitoring and internal controlling systems. The Tarapore committee was set up by the Reserve Bank of India under the chairmanship of former RBI deputy governor S. S. Tarapore to "lay the road map" to capital account convertibility. The five-member committee recommended a three-year time frame for complete convertibility by 19992000. On 1 July 2007, in an attempt to enhance the quality of customer service and strengthen the grievance redressal mechanism, the Reserve Bank of India created a new customer service department. Offices and branches The Reserve Bank of India has 4 zonal offices. It has 19 regional offices at most state capitals and at a few major cities in India. Few of them are located in Ahmedabad, Bangalore, Bhopal, Bhubaneswar, Chandigarh, Chennai, Delhi, Guwahati, Hyderabad, Jaipur, Jammu, Kanpur, Kolkata, Lucknow, Mumbai, Nagpur, Patna, and Thiruvananthapuram. Besides it has 09 sub-offices at Agartala, Dehradun, Gangtok, Kochi, Panaji, Raipur, Ranchi, Shillong, Shimla and Srinagar. The bank has also two training colleges for its officers, viz. Reserve Bank Staff College at Chennai and College of Agricultural Banking at Pune. There are also four Zonal Training Centers at Mumbai, Chennai, Kolkata and New Delhi. Main functions

Reserve Bank of India regional office, Delhi entrance with the Yakshini sculpture depicting "Prosperity through agriculture".

The RBI Regional Office in Delhi.

The regional offices of GPO (in white) and RBI (in sandstone) at Dalhousie Square, Kolkata. Bank of Issue Under Section 22 of the Reserve Bank of India Act, the Bank has the sole right to issue bank notes of all denominations. The distribution of one rupee notes and coins and small coins all over the country is undertaken by the Reserve Bank as agent of the Government. The Reserve Bank has a separate Issue Department which is entrusted with the issue of currency notes. The assets and liabilities of the Issue Department are kept separate from those of the Banking Department. Monetary authority The Reserve Bank of India is the main monetary authority of the country and beside that the central bank acts as the bank of the national and state governments. It formulates, implements and monitors the monetary policy as well as it has to ensure an adequate flow of credit to productive sectors. Regulator and supervisor of the financial system The institution is also the regulator and supervisor of the financial system and prescribes broad parameters of banking operations within which the country's banking and financial system functions.Its objectives are to maintain public confidence in the system, protect depositors' interest and provide cost-effective banking services to the public. The Banking Ombudsman Scheme has been formulated by the Reserve Bank of India (RBI) for effective addressing of complaints by bank customers. The RBI controls the monetary supply, monitors economic indicators like the gross domestic product and has to decide the design of the rupee banknotes as well as coins. Managerial of exchange control

The central bank manages to reach the goals of the Foreign Exchange Management Act, 1999. Objective: to facilitate external trade and payment and promote orderly development and maintenance of foreign exchange market in India. Issuer of currency The bank issues and exchanges or destroys currency notes and coins that are not fit for circulation. The objectives are giving the public adequate supply of currency of good quality and to provide loans to commercial banks to maintain or improve the GDP. The basic objectives of RBI are to issue bank notes, to maintain the currency and credit system of the country to utilize it in its best advantage, and to maintain the reserves. RBI maintains the economic structure of the country so that it can achieve the objective of price stability as well as economic development, because both objectives are diverse in themselves. Banker of Banks

Nagpur branch holds most of India's gold deposits RBI also works as a central bank where commercial banks are account holders and can deposit money.RBI maintains banking accounts of all scheduled banks. Commercial banks create credit. It is the duty of the RBI to control the credit through the CRR, bank rate and open market operations. As banker's bank, the RBI facilitates the clearing of cheques between the commercial banks and helps inter-bank transfer of funds. It can grant financial accommodation to schedule banks. It acts as the lender of the last resort by providing emergency advances to the banks. It supervises the functioning of the commercial banks and take action against it if need arises. Detection of fake currency In order to curb the fake currency menace, RBI has launched a website to raise awareness among masses about fake notes in the market.www.paisaboltahai.rbi.org.in provides information about identifying fake currency. Developmental role The central bank has to perform a wide range of promotional functions to support national objectives and industries. The RBI faces a lot of inter-sectoral and local inflation-related problems. Some of this problems are results of the dominant part of the public sector Related functions The RBI is also a banker to the government and performs merchant banking function for the central and the state governments. It also acts as their banker. The National Housing Bank (NHB) was established in 1988 to promote private real estate acquisition. The institution maintains banking accounts of all scheduled banks, too.

RBI on 7 August 2012 said that Indian banking system is resilient enough to face the stress caused by the drought like situation because of poor monsoon this year. Policy rates and reserve ratios Policy rates, Reserve ratios, lending, and deposit rates as of 30, October, 2012 Bank Rate 7.75%(29/1/2013) Repo Rate 7.75% Reverse Repo Rate 6.75% Cash Reserve Ratio (CRR) 4% Statutory Liquidity Ratio (SLR) 23.0% Base Rate 9.75%10.50% Reserve Bank Rate 4% Deposit Rate 8.50%9.00% Bank Rate RBI lends to the commercial banks through its discount window to help the banks meet depositors demands and reserve requirements for long term. The Interest rate the RBI charges the banks for this purpose is called bank rate. If the RBI wants to increase the liquidity and money supply in the market, it will decrease the bank rate and if RBI wants to reduce the liquidity and money supply in the system, it will increase the bank rate. As of 25 June 2012 the bank rate was 8.0%.latest bank rate is 7.75% as on 29/01/2013. Reserve requirement cash reserve ratio (CRR) Every commercial bank has to keep certain minimum cash reserves with RBI. Consequent upon amendment to sub-Section 42(1), the Reserve Bank, having regard to the needs of securing the monetary stability in the country, RBI can prescribe Cash Reserve Ratio (CRR) for scheduled banks without any floor rate or ceiling rate, [Before the enactment of this amendment, in terms of Section 42(1) of the RBI Act, the Reserve Bank could prescribe CRR for scheduled banks between 5% and 20% of total of their demand and time liabilities]. RBI uses this tool to increase or decrease the reserve requirement depending on whether it wants to effect a decrease or an increase in the money supply. An increase in Cash Reserve Ratio (CRR) will make it mandatory on the part of the banks to hold a large proportion of their deposits in the form of deposits with the RBI. This will reduce the size of their deposits and they will lend less. This will in turn decrease the money supply. The current rate is 4.75%. ( As a Reduction in CRR by 0.25% as on Date- 17 September 2012). -25 basis points cut in Cash Reserve Ratio (CRR) on 17 September 2012. It will release Rs 17,000 crore into the system/Market. The RBI lowered the CRR by 25 basis points to 4.25% on 30 October 2012, a move it said would inject about 175 billion rupees into the banking system in order to pre-empt potentially tightening liquidity. The latest CRR as on 29/01/13 is 4% Statutory Liquidity ratio (SLR) Apart from the CRR, banks are required to maintain liquid assets in the form of gold, cash and approved securities. Higher liquidity ratio forces commercial banks to maintain a larger proportion of their resources in liquid form and thus reduces their capacity to grant loans and advances, thus it is an anti-inflationary impact. A higher liquidity ratio diverts the bank funds from loans and advances to investment in government and approved securities. In well-developed economies, central banks use open market operationsbuying and selling of eligible securities by central bank in the money marketto influence the volume of cash reserves with commercial banks and thus influence the volume of loans and advances they can make to the commercial and industrial

sectors. In the open money market, government securities are traded at market related rates of interest. The RBI is resorting more to open market operations in the more recent years. Generally RBI uses three kinds of selective credit controls: 1. Minimum margins for lending against specific securities. 2. Ceiling on the amounts of credit for certain purposes. 3. Discriminatory rate of interest charged on certain types of advances. Direct credit controls in India are of three types: 1. Part of the interest rate structure i.e. on small savings and provident funds, are administratively set. 2. Banks are mandatory required to keep 23% of their deposits in the form of government securities. 3. Banks are required to lend to the priority sectors to the extent of 40% of their advances

MONETARY POLICY MEANING OF MONETRAY POLICY Monetary policy is the process by which the monetary authority of a country controls the supply of money, often targeting a rate of interest to attain a set of objectives oriented towards the growth and stability of the economy. These goals usually include stable prices and low unemployment. Monetary theory provides insight into how to craft optimal monetary policy. Monetary policy rests on the relationship between the rates of interest in an economy, that is the price at which money can be borrowed, and the total supply of money. Monetary policy is referred to as either being an expansionary policy, or a contractionary policy, where an expansionary policy increases the total supply of money in the economy rapidly, and a contractionary policy decreases the total money supply or increases it only slowly. Expansionary policy is traditionally used to combat unemployment in a recession by lowering interest rates, while contractionary policy involves raising interest rates to combat inflation. Monetary policy is contrasted with fiscal policy, which refers to government borrowing, spending and taxation. A policy is referred to as contractionary if it reduces the size of the money supply or increases it only slowly, or if it raises the interest rate. An expansionary policy increases the size of the money supply more rapidly, or decreases the interest rate. Furthermore, monetary policies are described as follows: accommodative, if the interest rate set by the central monetary authority is intended to create economic growth; neutral, if it is intended neither to create growth nor combat inflation; or tight if intended to reduce inflation. Monetary policy is the process by which the government, central bank, or monetary authority of a country controls (i) the supply of money, (ii) availability of money, and (iii) cost of money or rate of interest to attain a set of objectives oriented towards the growth and stability of the economy. Monetary theory provides insight into how to craft optimal monetary policy. OBJECTIVES OF MONETARY POLICY

The main objectives of monetary policy are: Price stability Exchange stability Full employment and maximum growth High rate of growth.

The objectives are to maintain price stability and ensure adequate flow of credit to the productive sectors of the economy. Stability for the national currency (after looking at prevailing economic conditions), growth in employment and income are also looked into. The monetary policy affects the real sector through long and variable periods while the financial markets are also impacted through short-term implications. There are four main 'channels' which the RBI looks at: Quantum channel: money supply and credit (affects real output and price level through changes in reserves money, money supply and credit aggregates). Interest rate channel. Exchange rate channel (linked to the currency). Asset price

TOOLS OF MONETARY POLICY

Monetary policy tools

Monetary base Reserve requirements Discount window lending Interest rates Currency board Unconventional monetary policy at the zero bound

Monetary base Monetary policy can be implemented by changing the size of the monetary base. This directly changes the total amount of money circulating in the economy. A central bank can use open market operations to change the monetary base. The central bank would buy/sell bonds in exchange for hard currency. When the central bank disburses/collects this hard currency payment, it alters the amount of currency in the economy, thus altering the monetary base.

Reserve requirements The monetary authority exerts regulatory control over banks. Monetary policy can be implemented by changing the proportion of total assets that banks must hold in reserve with the central bank. Banks only maintain a small portion of their assets as cash available for immediate withdrawal; the rest is invested in illiquid assets like mortgages and loans. By changing the proportion of total assets to be held as liquid cash, the Federal Reserve changes the availability of loanable funds. This acts as a change in the money supply. Central banks typically do not change the reserve requirements often because it creates very volatile changes in the money supply due to the lending multiplier. Discount window lending Discount window lending is where the commercial banks, and other depository institutions, are able to borrow reserves from the Central Bank at a discount rate. This rate is usually set below short term market rates (Tbills). This enables the institutions to vary credit conditions (i.e., the amount of money they have to loan out), there by affecting the money supply. It is of note that the Discount Window is the only instrument which the Central Banks do not have total control over. By affecting the money supply, it is theorized, that monetary policy can establish ranges for inflation, unemployment, interest rates, and economic growth. A stable financial environment is created in which savings and investment can occur, allowing for the growth of the economy as a whole. Interest rates The contraction of the monetary supply can be achieved indirectly by increasing the nominal interest rates. Monetary authorities in different nations have differing levels of control of economy-wide interest rates. In the United States, the Federal Reserve can set the discount rate, as well as achieve the desired Federal funds rate by open market operations. This rate has significant effect on other market interest rates, but there is no perfect relationship. In the United States open market operations are a relatively small part of the total volume in the bond market. One cannot set independent targets for both the monetary base and the interest rate because they are both modified by a single tool open market operations; one must choose which one to control. In other nations, the monetary authority may be able to mandate specific interest rates on loans, savings accounts or other financial assets. By raising the interest rate(s) under its control, a monetary authority can contract the money supply, because higher interest rates encourage savings and discourage borrowing. Both of these effects reduce the size of the money supply. Currency board A currency board is a monetary arrangement that pegs the monetary base of one country to another, the anchor nation. As such, it essentially operates as a hard fixed exchange rate, whereby local currency in circulation is backed by foreign currency from the anchor nation at a fixed rate. Thus, to grow the local monetary base an equivalent amount of foreign currency must be held in reserves with the currency board. This limits the

possibility for the local monetary authority to inflate or pursue other objectives. The principal rationales behind a currency board are threefold: 1. 2. To import monetary credibility of the anchor nation; To maintain a fixed exchange rate with the anchor nation;

3. To establish credibility with the exchange rate (the currency board arrangement is the hardest form of fixed exchange rates outside of dollarization). In theory, it is possible that a country may peg the local currency to more than one foreign currency; although, in practice this has never happened (and it would be a more complicated to run than a simple single-currency currency board). A gold standard is a special case of a currency board where the value of the national currency is linked to the value of gold instead of a foreign currency. The currency board in question will no longer issue fiat money but instead will only issue a set number of units of local currency for each unit of foreign currency it has in its vault. The surplus on the balance of payments of that country is reflected by higher deposits local banks hold at the central bank as well as (initially) higher deposits of the (net) exporting firms at their local banks. The growth of the domestic money supply can now be coupled to the additional deposits of the banks at the central bank that equals additional hard foreign exchange reserves in the hands of the central bank. The virtue of this system is that questions of currency stability no longer apply. The drawbacks are that the country no longer has the ability to set monetary policy according to other domestic considerations, and that the fixed exchange rate will, to a large extent, also fix a country's terms of trade, irrespective of economic differences between it and its trading partners. Currency boards have advantages for small, open economies that would find independent monetary policy difficult to sustain. They can also form a credible commitment to low inflation. Unconventional monetary policy at the zero bound Other forms of monetary policy, particularly used when interest rates are at or near 0% and there are concerns about deflation or deflation is occurring, are referred to as unconventional monetary policy. These include credit easing, quantitative easing, and signaling. In credit easing, a central bank purchases private sector assets, in order to improve liquidity and improve access to credit. Signaling can be used to lower market expectations for future interest rates. For example, during the credit crisis of 2008, the US Federal Reserve indicated rates would be low for an extended period, and the Bank of Canada made a conditional commitment to keep rates at the lower bound of 25 basis points (0.25%) until the end of the second quarter of 2010.

ROLE AND BENEFITS OF MONETARY POLICY IN INDIA

The role of monetary policy A summary of the role that monetary policy plays is provided in this quote from the Government of the Bank of England, Mervyn King. The role of monetary policy the Governors views what is the mechanism by which monetary policy contributes to a more stable economy? I would argue that monetary policy is now more systematic and predictable than before. Inflation expectations are anchored to the 2% target. Businesses and families expect that monetary policy will react to offset shocks that are likely to drive inflation away from target. In the jargon of economists, the policy reaction function of the Bank of England is more stable and predictable than was the case before inflation targeting, and easier to understand. More simply, monetary policy is not adding to the volatility of the economy in a way that it did in earlier decades. Adapted from The Inflation Target Ten Years on, Mervyn King in October 2002 Monetary Policy and the Exchange Rate There is no official exchange rate target for the British economy. The UK operates within a floating exchange rate system and has done ever since we suspended our membership of the European exchange rate mechanism (the ERM) in September 1992. The Monetary Policy Committee has occasionally discussed the relative merits and de-merits of intervening in the current markets to influence the external value of the pound but no official intervention has occurred for over a decade. There are in any case doubts about the effectiveness of direct intervention in the foreign exchange markets as a means of achieving a desired exchange rate. Monetary policy and the money supply There are currently no targets for the growth of the money supply measured by MO and M4. Data on the growth of the stock of money provides useful information for the MPC on the strength of aggregate demand but interest rates are not determined with reference to specific targets for the money supply. In addition the UK no longer imposes supply-side controls on the growth of bank lending and consumer credit. Instead monetary policy in the UK is designed to control the growth in the demand for money through changing the cost of loans and influencing the incentive to save via changes in interest rates. Fundamentals of Monetary Policy: Monetary policy rests on the idea that to expand the economy, one must increase the money supply. This is done by either printing more money, lending more money to banks, lowering the interest rate to encourage borrowing and discourage savings, and by the central bank buying bonds from the market and paying with cash, which enters the economy. To slow or contract the economy, the opposite approach is pursued. Advantages of Monetary Policy:

Inflation: Monetary policy, though often strongest when used in coordination with fiscal policy, has several advantages to fiscal policy. For one, fiscal policy has a tendency to cause massive inflation. Government infusion of money into the economy through spending can cause massive increases in inflation. To slow inflation, it is hard to cut spending and raise taxes politically, thereby contracting

the economy, and thus it rarely works as an effective way to contract the economy. Monetary policy, by contrast, can cause inflation, but raising and lowering interest rates, and increasing and decreasing the money supply tend to be effective ways of economic control that aren't excessively inflationary. Speed of Results: The speed that policies enacted produce results is another contrast. Fiscal policy is slowly enacted. Congress must debate legislation, and any action may take months to pass through Congress and be signed into law. Monetary policy, however, can be acted on immediately to respond quickly to economic circumstances. Monetary policy is primarily controlled by economists, while fiscal policy is often subject to politics .

You might also like

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- Measurement and Functions of Money: Macro Topic 4.3Document2 pagesMeasurement and Functions of Money: Macro Topic 4.3Preksha Borar100% (2)

- National IncomeDocument14 pagesNational Incomevmktpt100% (1)

- Hinds - Playing Monopoly With The DevilDocument296 pagesHinds - Playing Monopoly With The DevilAndres MallcottNo ratings yet

- Project Report On LICDocument60 pagesProject Report On LICcoolvats70% (37)

- Global Money Notes #6: QE, Basel III and The Fed's New Target RateDocument12 pagesGlobal Money Notes #6: QE, Basel III and The Fed's New Target RatePARTHNo ratings yet

- Econjn-0060-PremCh 11 (24) Measuring The Cost of LivingDocument30 pagesEconjn-0060-PremCh 11 (24) Measuring The Cost of LivingLauren SerafiniNo ratings yet

- Exchange Rate Overshooting Model in International MacroeconomicsDocument12 pagesExchange Rate Overshooting Model in International MacroeconomicseljosetobarNo ratings yet

- CE22 - 15 - InflationDocument51 pagesCE22 - 15 - InflationNathan TanNo ratings yet

- Cooperative BankingDocument8 pagesCooperative BankingvmktptNo ratings yet

- Sources of FinanceDocument8 pagesSources of FinancevmktptNo ratings yet

- Macroeconomic Principles and Theories ExplainedDocument1 pageMacroeconomic Principles and Theories ExplainedvmktptNo ratings yet

- TeachingDocument4 pagesTeachingvmktptNo ratings yet

- Commerce Paper - IIDocument8 pagesCommerce Paper - IIvmktptNo ratings yet

- PomDocument24 pagesPomvmktptNo ratings yet

- Cost ConceptsDocument35 pagesCost ConceptsvmktptNo ratings yet

- SumiDocument1 pageSumivmktptNo ratings yet

- Amdocs PPT FinalDocument14 pagesAmdocs PPT FinalvmktptNo ratings yet

- EmiDocument6 pagesEmivmktptNo ratings yet

- SBI's Role in Financial Inclusion InitiativesDocument5 pagesSBI's Role in Financial Inclusion InitiativesvmktptNo ratings yet

- New Industrial PolicyDocument3 pagesNew Industrial PolicyMadhu Mahesh RajNo ratings yet

- MosquitoesDocument6 pagesMosquitoesvmktptNo ratings yet

- Nature of Managerial EconomicsDocument12 pagesNature of Managerial EconomicsArap RuttoNo ratings yet

- World Trade OrganizationDocument21 pagesWorld Trade OrganizationvmktptNo ratings yet

- Advantages For LicenseeDocument1 pageAdvantages For LicenseevmktptNo ratings yet

- Credit Rating Agency CraDocument46 pagesCredit Rating Agency CravmktptNo ratings yet

- Surveying Professor Bharat Lohani Department of Civil Engineering Indian Institute of Technology, KanpurDocument25 pagesSurveying Professor Bharat Lohani Department of Civil Engineering Indian Institute of Technology, KanpurvmktptNo ratings yet

- 8 Characterization of Air Emissions PDFDocument6 pages8 Characterization of Air Emissions PDFvmktptNo ratings yet

- International Bank For Reconstruction and DevelopmentDocument4 pagesInternational Bank For Reconstruction and DevelopmentvmktptNo ratings yet

- 13mba 224a IfmDocument3 pages13mba 224a IfmvmktptNo ratings yet

- Surveying Professor Bharat Lohani Department of Civil Engineering Indian Institute of Technology, KanpurDocument25 pagesSurveying Professor Bharat Lohani Department of Civil Engineering Indian Institute of Technology, KanpurvmktptNo ratings yet

- Credit Rating Is The Opinion of The Rating Agency On The Relative Ability and Willingness of The Issuer of A Debt Instrument To Meet The Debt Service Obligations As and When They AriseDocument5 pagesCredit Rating Is The Opinion of The Rating Agency On The Relative Ability and Willingness of The Issuer of A Debt Instrument To Meet The Debt Service Obligations As and When They ArisePrince VargheseNo ratings yet

- International Development AssociationDocument8 pagesInternational Development AssociationvmktptNo ratings yet

- Questionnaire On Shareholders Feelings in Stock MKTDocument3 pagesQuestionnaire On Shareholders Feelings in Stock MKTvmktptNo ratings yet

- Union Budget of IndiaDocument5 pagesUnion Budget of IndiavmktptNo ratings yet

- Bhaskar - POWERDocument35 pagesBhaskar - POWERvmktptNo ratings yet

- What Is ProductivityDocument21 pagesWhat Is ProductivityvmktptNo ratings yet

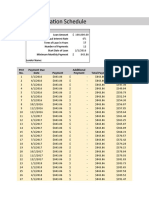

- Loan Amortization Schedule TemplateDocument12 pagesLoan Amortization Schedule TemplateIfeOluwaNo ratings yet

- Eco ch4Document2 pagesEco ch4fatema hosseiniNo ratings yet

- 4Document24 pages4Kevin HaoNo ratings yet

- Ch02 Questions and Problems AnswersDocument2 pagesCh02 Questions and Problems AnswersjwbkunNo ratings yet

- AP Macroeconomics Assignment: Apply Concepts of Banking and Money CreationDocument2 pagesAP Macroeconomics Assignment: Apply Concepts of Banking and Money CreationSixPennyUnicorn0% (2)

- Calculate CPI, inflation rates, and exchange ratesDocument8 pagesCalculate CPI, inflation rates, and exchange ratesNguyễn Long VũNo ratings yet

- The Monetary System: © 2008 Cengage LearningDocument31 pagesThe Monetary System: © 2008 Cengage LearningLuthfia ZulfaNo ratings yet

- International FinanceDocument207 pagesInternational FinanceAnitha Girigoudru50% (2)

- The International University (Iu) - Vietnam National University - HCMCDocument15 pagesThe International University (Iu) - Vietnam National University - HCMCPham Hoang NhiNo ratings yet

- Different Types OF: Loans and AdvancesDocument19 pagesDifferent Types OF: Loans and Advancesharesh KNo ratings yet

- Financial Markets and Institutions 8Th Edition Full ChapterDocument41 pagesFinancial Markets and Institutions 8Th Edition Full Chapterjessica.walsh233100% (25)

- Econ6049 Economic Analysis, S1 2021: Week 7: Unit 10 - Banks, Money and The Credit MarketDocument27 pagesEcon6049 Economic Analysis, S1 2021: Week 7: Unit 10 - Banks, Money and The Credit MarketTom WongNo ratings yet

- ABM - Unit 3 - 1652952854Document1 pageABM - Unit 3 - 1652952854MOHAMED FAROOKNo ratings yet

- Full Download International Monetary Financial Economics 1st Edition Daniels Solutions ManualDocument36 pagesFull Download International Monetary Financial Economics 1st Edition Daniels Solutions Manualholmebuddy2411s100% (36)

- International Arbitrage and Interest Rate Parity Chapter 7 Flashcards - QuizletDocument11 pagesInternational Arbitrage and Interest Rate Parity Chapter 7 Flashcards - QuizletDa Dark PrinceNo ratings yet

- Globalization Module 3 (Monetary Policy and Currencies)Document29 pagesGlobalization Module 3 (Monetary Policy and Currencies)Angel BNo ratings yet

- Money Market - Components in Islamic FinanceDocument22 pagesMoney Market - Components in Islamic FinanceNajm ADdin100% (2)

- Causes of Financial Crisis: Bubble, A Financial Bubble, A Speculative Mania or A Balloon) Is "Trade in High Volumes atDocument7 pagesCauses of Financial Crisis: Bubble, A Financial Bubble, A Speculative Mania or A Balloon) Is "Trade in High Volumes atyohannes kindalemNo ratings yet

- ENSURING POSITIVE GROWTH WITH MONETARY POLICY TOOLSDocument10 pagesENSURING POSITIVE GROWTH WITH MONETARY POLICY TOOLSlanana02zaniaNo ratings yet

- Money and Banking NotesDocument5 pagesMoney and Banking NotesNikhilGuptaNo ratings yet

- FDB101 Course OutlineDocument4 pagesFDB101 Course OutlineMorelate KupfurwaNo ratings yet

- MQ13 13 b-1Document13 pagesMQ13 13 b-1Jona ResuelloNo ratings yet

- Monetary Theory NotesDocument12 pagesMonetary Theory NotesChanie WashingtonNo ratings yet

- Asian CrisisDocument21 pagesAsian CrisisShreshtha DasNo ratings yet