Professional Documents

Culture Documents

FAQs open offers

Uploaded by

Anjulika SinghOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

FAQs open offers

Uploaded by

Anjulika SinghCopyright:

Available Formats

Frequently Asked Questions on Buyback/Delisting/Takeover open offers 1.

I havent received the offer document/ acceptance/ tender form for open take over offer. How can I apply? In case of open offer, the acquirer will publish an announcement in the newspapers. The announcement, letter of offer along with form of acceptance are also made available on SEBI website at www.sebi.gov.in. In case of non- receipt of the letter of offer, you can still tender your shares by making an application on plain paper and giving the details as given below. If you are holding shares in physical form, following details shall be given: Name & address (es) of 1st named person and of joint holder(s) if any Number of shares held, Number of shares offered. Registered folio number, Share certificate numbers, distinctive number

Also enclose documents i.e. valid transfer deeds and the original contact notes issued by the broker through whom you acquired shares If you are holding shares in demat form, Name & address (es) of 1st named person and joint holder(s) if any Number of shares held, Number of shares offered. DP name, DP ID, Beneficiary account number

Also enclose photo copy of the delivery instruction in Off Market mode, or counterfoil of the delivery instruction in Off Market mode, duly acknowledged by Depository Participant in favor of the special depository account. It is advisable to send the application at the earliest so as to reach the Registrar to the offer on or before the closing of the offer. 2. I havent received the offer document/ acceptance/ tender form for buyback offer. How can I apply? Please see the reply given to query (1). The process is more or less the same. You can see the Public Announcement for exact details and procedure for tendering your shares.

Page 1 of 2

3. I havent received the offer document/ acceptance/ tender form for delisting offer. How can I apply? Please see the reply given to query (1). The process is more or less the same. You can see the Public Announcement for exact details and procedure for tendering your shares. In accordance with the (Delisting of Equity shares) Regulations, 2009, even if you have not participated in delisting offer, you will still be able to tender your shares to the acquirer at the same price (i.e. the price which was offered during the delisting offer to all the shareholders) for a period of one year from the date of delisting of shares from the concerned stock exchange. The details of the delisting of the companies are available with stock exchanges. 4. I had tendered my shares in the takeover offer. I have not received the payment. What should I do? Will I be compensated for the delay in receipt of payment of consideration? The acquirer is required to send the payment to all the share holders whose shares are accepted in the offer. Non compliance with the same will attract penal interest as specified by SEBI from time to time. If you have not received payment, you may approach Merchant Banker or Registrar to offer, if any. If you have not got a proper response, you may approach SEBI. 5. Is it compulsory to tender my shares in Buyback/Delisting/Takeover Open offers? No. It is not mandatory to tender your shares in any open offer. If you chose not to tender your shares, you will continue to be a shareholder of the company and entitled for all the benefits of the shareholders. However, in case of delisting offers it is advisable to tender your shares to the acquirer. After delisting, the company may not fall under the purview of SEBI and you may not be able to trade your shares on the exchange(s) from which it is delisted. 6. I filed my grievance with Merchant Banker or Registrar to offer. No response from them. What should I do? You may approach SEBI with the relevant documents. ****************************

Page 2 of 2

You might also like

- Faqs On Buyback: Prof - Chandan Kumar TripathyDocument2 pagesFaqs On Buyback: Prof - Chandan Kumar TripathyChandan Kumar TripathyNo ratings yet

- BuybackDocument3 pagesBuybackroutraykhushbooNo ratings yet

- 4 5817600036418093605 PDFDocument4 pages4 5817600036418093605 PDFNaga ChandraNo ratings yet

- Sebi guidelines on open offer price determinationDocument6 pagesSebi guidelines on open offer price determinationSalman ShaikhNo ratings yet

- Faqs On Buyback 2022 Buyback Details:: Page 1 of 10Document10 pagesFaqs On Buyback 2022 Buyback Details:: Page 1 of 10jeevan gangavarapuNo ratings yet

- Payout RequestDocument2 pagesPayout RequestInfopedia OnlinehereNo ratings yet

- Cbi-Annexure - II & IIIDocument2 pagesCbi-Annexure - II & IIILokesh KonganapalleNo ratings yet

- Baroda Pioneer Transaction FormDocument2 pagesBaroda Pioneer Transaction FormAjith MosesNo ratings yet

- Tender OfferDocument5 pagesTender OfferkiranaishaNo ratings yet

- Grivance and Redraisals Unit 4Document16 pagesGrivance and Redraisals Unit 4Harsh ThakurNo ratings yet

- Everlof PDocument56 pagesEverlof PBhavneesh ShuklaNo ratings yet

- Buyback Letter of OfferDocument3 pagesBuyback Letter of OfferNarNo ratings yet

- FAQ On ESOPDocument8 pagesFAQ On ESOPayushgmailNo ratings yet

- Guide For InvestorsDocument11 pagesGuide For InvestorsSeerat JangdaNo ratings yet

- Quiz Securities LawDocument7 pagesQuiz Securities LawSevastian jedd EdicNo ratings yet

- Application For Surrender of MembershipDocument13 pagesApplication For Surrender of MembershipSagar NagbhujangeNo ratings yet

- Final Exam Law200Document6 pagesFinal Exam Law200Md. Sabbir Sarker 1611386630100% (1)

- Auction Bid Form - Updated As On Dec-22Document5 pagesAuction Bid Form - Updated As On Dec-22krishnaNo ratings yet

- Lesson 16 - HDB Eligibility To SellDocument46 pagesLesson 16 - HDB Eligibility To SellmariesharmilaravindranNo ratings yet

- Draft Letter of Offer SummaryDocument30 pagesDraft Letter of Offer SummaryjayNo ratings yet

- FaqsDocument6 pagesFaqsavi_jain8No ratings yet

- Text CorretorDocument4 pagesText CorretorARUNAVA SAMANTANo ratings yet

- Process For Cancellation of NACH MandateDocument2 pagesProcess For Cancellation of NACH MandateSumit PandeyNo ratings yet

- 6 Ways Not To Get Duped by An IPODocument4 pages6 Ways Not To Get Duped by An IPONitin PanaraNo ratings yet

- Starting a Business in the Philippines and Bankruptcy ProcessDocument3 pagesStarting a Business in the Philippines and Bankruptcy Processjohnny johnnyNo ratings yet

- Bid Form and Acceptance DetailsDocument8 pagesBid Form and Acceptance Detailsanand kumar rathiNo ratings yet

- Investor Grievances & Arbitration (Stock Exchanges) : Complaints Taken Up at The ExchangeDocument11 pagesInvestor Grievances & Arbitration (Stock Exchanges) : Complaints Taken Up at The ExchangeBeing Indian100% (1)

- PNBHFL Auction Bid FormDocument11 pagesPNBHFL Auction Bid Formankit chauhanNo ratings yet

- IPODocument10 pagesIPO483-ROHIT SURAPALLINo ratings yet

- Lavanya Tirumala Olatpur Phase 2 Application FormDocument4 pagesLavanya Tirumala Olatpur Phase 2 Application FormSusantKumarNo ratings yet

- Note On Buy BackDocument6 pagesNote On Buy BacksravyaNo ratings yet

- 02 PPT-2-Law of Contract - IDocument58 pages02 PPT-2-Law of Contract - Ix23siddharthnaNo ratings yet

- Online Bidding Application for Auction PropertyDocument10 pagesOnline Bidding Application for Auction Propertyriju nairNo ratings yet

- Demat Benefits ExplainedDocument3 pagesDemat Benefits ExplainedMohsin KhanNo ratings yet

- Expression of Interest - ImperiaDocument3 pagesExpression of Interest - ImperiacubadesignstudNo ratings yet

- Tender Response TemplateDocument17 pagesTender Response TemplateJames prickly100% (1)

- De ListingDocument5 pagesDe ListingniteshnanNo ratings yet

- Policy Withdrawal or Surrender ApplicationDocument5 pagesPolicy Withdrawal or Surrender ApplicationSunil Kumar VishwakarmaNo ratings yet

- L1 - Evict For Non-Payment of RentDocument8 pagesL1 - Evict For Non-Payment of RentRockwellNo ratings yet

- Allotment of Shares PDFDocument19 pagesAllotment of Shares PDFAyman KhalidNo ratings yet

- Form HBL4Document3 pagesForm HBL4klerinetNo ratings yet

- Chirig ApplicationformDocument9 pagesChirig Applicationformbarnana jeevanraoNo ratings yet

- Nomination Facility for Bank Accounts Simplifies Claim ProcessDocument4 pagesNomination Facility for Bank Accounts Simplifies Claim ProcessS.s.SubramanianNo ratings yet

- Theme 2 Study unit 2.1.1 Consensus and formation of a contract FEFDocument28 pagesTheme 2 Study unit 2.1.1 Consensus and formation of a contract FEFu22706799No ratings yet

- IPO and Its ProcessDocument4 pagesIPO and Its ProcessNaveen JohnNo ratings yet

- Investor Guide: A Y N T K (Vol: II)Document15 pagesInvestor Guide: A Y N T K (Vol: II)Jaleel AhmadNo ratings yet

- Distributor Application and AgreementDocument2 pagesDistributor Application and Agreementapi-300687941No ratings yet

- Unit I NotesDocument16 pagesUnit I Notesmn nandaniNo ratings yet

- Lyka - LOF Post SEBI Observations - PDocument40 pagesLyka - LOF Post SEBI Observations - P136NIKHIL BIRAJDARNo ratings yet

- What Is Secondary Market?Document25 pagesWhat Is Secondary Market?Gaurav GuptaNo ratings yet

- Basic of Stock MarketDocument5 pagesBasic of Stock MarketAnkit ChauhanNo ratings yet

- Bharti AXA Payout RequestDocument2 pagesBharti AXA Payout RequestSATHISHLATEST2005100% (11)

- Voluntary Acquisition of Shares: Purchase vs SubscriptionDocument4 pagesVoluntary Acquisition of Shares: Purchase vs SubscriptionCleinJonTiuNo ratings yet

- PlainPaper - 04-10-2021 11 - 42 - 39Document3 pagesPlainPaper - 04-10-2021 11 - 42 - 39Nilay KumarNo ratings yet

- Em Notes 1,2Document48 pagesEm Notes 1,2Sri VarshiniNo ratings yet

- Investor Grievance Complaint & Arbitration ProceedingDocument44 pagesInvestor Grievance Complaint & Arbitration ProceedingMohit GuptaNo ratings yet

- Consent for Margin Trading FundingDocument11 pagesConsent for Margin Trading FundingGemini PatelNo ratings yet

- Allotment of SharesDocument17 pagesAllotment of SharesHimanshu Premani100% (1)

- Options Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsFrom EverandOptions Trading For Beginners: Tips, Formulas and Strategies For Traders to Make Money with OptionsNo ratings yet

- Cfpmodule1 Introductiontofinancialplanning 120815101244 Phpapp01Document167 pagesCfpmodule1 Introductiontofinancialplanning 120815101244 Phpapp01Anjulika SinghNo ratings yet

- 1.define Project Management and Its Features?Document3 pages1.define Project Management and Its Features?Anjulika SinghNo ratings yet

- Reserve Bank of India Act, 1934: Repo Rate: 7.25%Document10 pagesReserve Bank of India Act, 1934: Repo Rate: 7.25%Anjulika SinghNo ratings yet

- Transactional AnalysisDocument4 pagesTransactional AnalysisAnjulika SinghNo ratings yet

- MKTGHDocument7 pagesMKTGHAnjulika SinghNo ratings yet

- Unit 1Document2 pagesUnit 1Anjulika SinghNo ratings yet

- Revival of 23 Low Admissions MBA Institutes in Rural Areas of Gujarat Under Gujarat Technological University'Document6 pagesRevival of 23 Low Admissions MBA Institutes in Rural Areas of Gujarat Under Gujarat Technological University'Anjulika SinghNo ratings yet

- International Bond Markets GuideDocument16 pagesInternational Bond Markets GuideAnjulika SinghNo ratings yet

- Corporate BondsDocument17 pagesCorporate BondsSaurabh BhagatNo ratings yet

- International Bond Markets GuideDocument16 pagesInternational Bond Markets GuideAnjulika SinghNo ratings yet

- International Bond Markets GuideDocument16 pagesInternational Bond Markets GuideAnjulika SinghNo ratings yet

- PE Fund Raising ProcessDocument42 pagesPE Fund Raising ProcessNitin VermaNo ratings yet

- Transactional AnalysisDocument4 pagesTransactional AnalysisAnjulika SinghNo ratings yet

- This Code of Business Conduct and EthicsDocument4 pagesThis Code of Business Conduct and EthicsAnjulika SinghNo ratings yet

- Heidegger - Nietzsches Word God Is DeadDocument31 pagesHeidegger - Nietzsches Word God Is DeadSoumyadeepNo ratings yet

- College Wise Form Fillup Approved Status 2019Document4 pagesCollege Wise Form Fillup Approved Status 2019Dinesh PradhanNo ratings yet

- MW Scenario Handbook V 12 ADocument121 pagesMW Scenario Handbook V 12 AWilliam HamiltonNo ratings yet

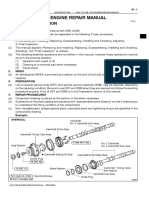

- How To Use This Engine Repair Manual: General InformationDocument3 pagesHow To Use This Engine Repair Manual: General InformationHenry SilvaNo ratings yet

- CH 19Document56 pagesCH 19Ahmed El KhateebNo ratings yet

- Consumer Behavior Paper PLDTDocument6 pagesConsumer Behavior Paper PLDTAngeline Santiago100% (2)

- Classen 2012 - Rural Space in The Middle Ages and Early Modern Age-De Gruyter (2012)Document932 pagesClassen 2012 - Rural Space in The Middle Ages and Early Modern Age-De Gruyter (2012)maletrejoNo ratings yet

- ROCKET STOVE DESIGN GUIDEDocument9 pagesROCKET STOVE DESIGN GUIDEfrola5100% (2)

- February / March 2010Document16 pagesFebruary / March 2010Instrulife OostkampNo ratings yet

- 11th AccountancyDocument13 pages11th AccountancyNarendar KumarNo ratings yet

- A Review On Translation Strategies of Little Prince' by Ahmad Shamlou and Abolhasan NajafiDocument9 pagesA Review On Translation Strategies of Little Prince' by Ahmad Shamlou and Abolhasan Najafiinfo3814No ratings yet

- Inline check sieve removes foreign matterDocument2 pagesInline check sieve removes foreign matterGreere Oana-NicoletaNo ratings yet

- Supreme Court declares Pork Barrel System unconstitutionalDocument3 pagesSupreme Court declares Pork Barrel System unconstitutionalDom Robinson BaggayanNo ratings yet

- Developing An Instructional Plan in ArtDocument12 pagesDeveloping An Instructional Plan in ArtEunice FernandezNo ratings yet

- DLL - Science 6 - Q3 - W3Document6 pagesDLL - Science 6 - Q3 - W3AnatasukiNo ratings yet

- Adic PDFDocument25 pagesAdic PDFDejan DeksNo ratings yet

- Amway Health CareDocument7 pagesAmway Health CareChowduru Venkat Sasidhar SharmaNo ratings yet

- Labov-DIFUSÃO - Resolving The Neogrammarian ControversyDocument43 pagesLabov-DIFUSÃO - Resolving The Neogrammarian ControversyGermana RodriguesNo ratings yet

- LLB 1st Year 2019-20Document37 pagesLLB 1st Year 2019-20Pratibha ChoudharyNo ratings yet

- Codilla Vs MartinezDocument3 pagesCodilla Vs MartinezMaria Recheille Banac KinazoNo ratings yet

- Independent Study of Middletown Police DepartmentDocument96 pagesIndependent Study of Middletown Police DepartmentBarbara MillerNo ratings yet

- Preparation For Exercise1-1 CompleteDocument28 pagesPreparation For Exercise1-1 CompleteSimon GranNo ratings yet

- Belonging Through A Psychoanalytic LensDocument237 pagesBelonging Through A Psychoanalytic LensFelicity Spyder100% (1)

- Revolutionizing Via RoboticsDocument7 pagesRevolutionizing Via RoboticsSiddhi DoshiNo ratings yet

- Introduction To Computing (COMP-01102) Telecom 1 Semester: Lab Experiment No.05Document7 pagesIntroduction To Computing (COMP-01102) Telecom 1 Semester: Lab Experiment No.05ASISNo ratings yet

- Get 1. Verb Gets, Getting Past Got Past Participle Got, GottenDocument2 pagesGet 1. Verb Gets, Getting Past Got Past Participle Got, GottenOlga KardashNo ratings yet

- MBA Third Semester Model Question Paper - 2009: Management and Organization Development-MU0002 (2 Credits)Document11 pagesMBA Third Semester Model Question Paper - 2009: Management and Organization Development-MU0002 (2 Credits)ManindersuriNo ratings yet

- Passive Voice Exercises EnglishDocument1 pagePassive Voice Exercises EnglishPaulo AbrantesNo ratings yet

- Legal validity of minor's contracts under Indian lawDocument8 pagesLegal validity of minor's contracts under Indian lawLakshmi Narayan RNo ratings yet

- SLE Case Report on 15-Year-Old GirlDocument38 pagesSLE Case Report on 15-Year-Old GirlDiLa NandaRiNo ratings yet