Professional Documents

Culture Documents

Comparision. Between HBL and Standard Chartered Bank

Uploaded by

Hira MahvishOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comparision. Between HBL and Standard Chartered Bank

Uploaded by

Hira MahvishCopyright:

Available Formats

COMPARATIVE STUDY BETWEEN LOCAL AND FOREIGN BANKS:

PVT. ( LOCAL ) ORGANIZATION : BANK AL -HABIB PVT. LTD: MULTINATIONAL ORGANIZATION: STANDARD CHARTERED BANK.:

1:SWOT ANALYSIS:

STRENGHTS:

STRENGTHS: has very effective and efficient

HBL

Support

bank.

of its parent company and

network of branches all over the country.

promoters viz. Standard chartered

HBL is a well set upped bank enjoying

long history of over 65 years of experience and profitable action.

Every

HBL.

10th Pakistani is A/C holder of

It has made huge investment in almost

all the economic region of Pakistan.

HBL

not only has made investment in

Competitive rates. Good and diverse products. Network of branches. Flexible spread Margin. Highly qualified research team. Strong network through out India and

Strong presence in WEST, NORTH and SOUTH

industry but also in small level industry as well.

HBL was the first privatized bank that

gives it a border over other nationalized banks as it can develop any plan consistent with the demand of market and free from any political or technical influence.

HBL

high.

is the largest private bank in

Pakistan now and people belief is very

HBL is the market leader in introduction

of e-banking and it has the foremost ATM network in the country.

HBL was charged the best conjugal bank

for two Consecutive years of 2000 and 2001 by Euro money, A leading international publication.

WEAKNESSESS:

Account access problems of customers. RM doesnt give much importance on

small companies.

HBL has the ability to bring innovative

products and services like personalized service, electronic funds Transfer, sophisticated fiscal products such as electronic banking, auto-teller OPPORTUNITIES: machines and evening banking. WEAKNESSES: No consumer banking has offered by the HBL to its patrons like phone banking, evening banking etc Bad debt rate is very high; no special effort has been made to recuperate the bad amount. No marketing set up or structure is there. Most of people do not know how they have to endorse there activities. Mission of HBL is not well definite. Now as it is a privatize bank that is why GOVERNAMENT support to HBL decreased as it was in past. Most of the employees lack executive training as they are not properly educated. Due to superiority, they have moved up on the hierarchy line to GradeI, II or III positions having hardly bachelor degrees. This type of senior staff cannot apply the modern and pioneering techniques of management in decision making. HBL is not rapid to give loans and cards. Not straightforward application is for applying for a credit card. THREATS:

The

growing interest of people in the and foreign exchange

derivative market.

Recovery of indian stock market

Competition

from major players like

ICICI BANK, KOTAC MAHINDER BANK, HDFC, SBI BANK, HSBC, AXIS BANK etc.

The downfall in the export market due

to global recession.

Speculation in derivative market.

OPPORTUNITIES: It can introduce debit card system or may alter the existing ATM cards into a complete debit card. New products like personal loans, advance and auto hiring and cash management which diversify credit risk and add to revenue generating products, are presently provided in big cities like Lahore, Islamabad, Karachi, and Rawalpindi, these products may be tested for success in other small areas of PAKISTAN in different provinces. HBL may develop its Rupee Travelers Cheques (RTCs) sales by searching for new market niches. The opportunities accessible for HBL are financing to SMEs (Small and Medium Enterprises) in Pakistan. Attractive salary encloses should be awarded. Marketing department should be started in order to endorse the name of HBL. On the job training & instruction sessions can be conducted. THREATS: The Rupee Travelers Cheque (RTC) sales volumes may be exaggerated on account of regulatory constraint imposed by SBP on issuance of large value denominations. The recurrent reduction on 6-month and 12-month Treasury Bills discount rates

by SBP may create strain on the banks profitability. The low discount rates are also negatively influencing the proceeds rates which may influence the banks profits from the other side. Day by day antagonism is increasing not only of the growth of the banks but also due to the launching of the new bank in the market e.g. Barclays. Circumstances of Pakistan are a great threat for the survival of the HBL. More and more banks are launching there operations in Pakistan which is increasing competition for the HBL.

CONCLUSION:

1: HUMAN RESOURCE MANAGEMENT:

The HRM department plays an important role in value of HBL. HBL has very active and one of the best HR department in Pakistan as well as world wide. The existence of a HR department is vital to overall productivity and efficiency of the strong workforce in HBL. HR manual contains five processes: Selecting and Recruiting Training and Development Performance Appraisal Compensation Employee relation. Performance management at HBL is a forward looking process for setting goals and regularly checking progress towards achieving those goals. At HBL it is a continual feedback process whereby the observed outputs are measured and compared with the consistently being met in an effective and efficient manner. Performance management at HBL is a system of evaluating employees to help them reach reasonable goals and thus ensure that the company performs better. In HBLs performance management model employees are given opportunities to work on harder projects, paired less-skilled employees with expert employees and employees can direct and make decisions. desired goals. Performance management includes activities to ensure that goals are

1. 2. 3. 4. 5.

HRM practices have shown to be valuable to any companys success. Thus to besuccessful in a global market place, the challenge for all businesses regardless of s i z e i s t o i n v e s t i n human resources. They need to select a n d r e t a i n t a l e n t e d employees, undertake employee training and development programs and dismantletraditional bureaucratic structures that limit employees ability to be innovativeand creative.The commonly practices HR activities include the following: HR PlanningRecruitingSelectionTraining and DevelopmentCompensationPerformance ManagementEmployee Relations S tandard Chartered is the worlds leading emerging markets bank. It employs30,000 people in over 500 offices in more than 50 countries in the Asia Pacific Region, South Asia, the Middle East , Africa , United Kingdom and America HR planning is a process, Which anticipates and maps out the t h e consequences of business strategy on an organizations human resources. This isreflected in planning of skill and competence needs as well as total headcounts.E v e r y organization needs to be able to forecast and plan for its future p e o p l e requirements.At Standard Chartered Bank , human resource planning involves forecasting thenumbers of people which will needed by the bank , and then working out the bestway of obtaining then as and when they are needed As Standard Chartered , training is a partnership between the employee andthe Bank. The Bank provides a framework within which the employee cani d e n t i f y t h e t r a i n i n g and development needs. Such t r a i n i n g p r o v i d e s a consistent standard of management learning throughout Standard

At HBL growth is not a function of time but rather of performance. Tools used by HBL for performance management are: o Developmental goal setting o Ongoing performance monitoring o Ongoing feedback o Coaching and support o Performance appraisal o Rewards, recognition, and compensation

Chartered .I t a l s o e n a b l e s t h e employees to take all of the p r o g r a m s o r s t u d y f o r individual modules according to their particular development needs

CONCLUSION:

3.SERVICES AND FUNCTIONS OF BANKS:

PRODUCTS OF HBL

Auto finance Home finance Habib bank value debit card Loans Habib bank master card Habib bank lifestyle

It also offers deposit products to individual customers such as

PRODUCTS OF SCB

Credit cards Mortgages Personal loans Auto loans Deposit account Wealth management products Foreign exchange Spot and forward Asset and liability management Internet rate / liquidity management Short terms loans/ deposits

Foreign currency accounts Car financing and loans Credit and debit cards

Banc assurance Phone banking Money transfer Mutual funds.

SERVICE LINE

Consumer banking services Cash management services Utilities services Transferring of money

To fulfill the basic objective that is socioeconomic nature HBL perform following important function.

Economics research and analysis Customer risk management Non deliverable forwards Fx option Internet rate derivations Internet rate swaps FRAs Internet rate options Financial engineering.

FUNCTION OF SCB

Consumer banking Personal banking Priority and international banking Preferred banking Private banking SME banking Wholesale banking Islamic banking Online banking Mobile banking

FUNCTION OF HBL

Commercial banking Corporate banking Investment banking Retail banking Islamic banking

CONCLUSION:

You might also like

- HRM Assignment On Hbl.Document11 pagesHRM Assignment On Hbl.Saad JaveedNo ratings yet

- Planning of HBLDocument18 pagesPlanning of HBLAsad Ullah0% (1)

- BRMDocument30 pagesBRMRushali KhannaNo ratings yet

- Human Resource Management: Habib Bank LimitedDocument14 pagesHuman Resource Management: Habib Bank Limitedarif134No ratings yet

- The History:: Performance Management and Appraisal at Bank Al Habib LimitedDocument6 pagesThe History:: Performance Management and Appraisal at Bank Al Habib Limitedamta nadeemNo ratings yet

- HRM Report Bank AlfalahDocument31 pagesHRM Report Bank AlfalahMirza MunirNo ratings yet

- HRM Report: Bank AlfalahDocument24 pagesHRM Report: Bank Alfalahsaleemzaffar84_42042No ratings yet

- Thesis On Recruitment and Selection of HFC BankDocument5 pagesThesis On Recruitment and Selection of HFC Bankkrystalgreenglendale100% (1)

- Name: Huzaifa Siddique Sap Id:20187 Bs (A&F) 3 Semester: Human Resource ManagementDocument6 pagesName: Huzaifa Siddique Sap Id:20187 Bs (A&F) 3 Semester: Human Resource ManagementSufyan RanjhaNo ratings yet

- Human Resource Management Practices in Janata Bank LTD JBLDocument56 pagesHuman Resource Management Practices in Janata Bank LTD JBLNoyan SokalNo ratings yet

- Strategic Management & Business Policy With Reference To State Bank of IndiaDocument17 pagesStrategic Management & Business Policy With Reference To State Bank of IndiaKunal RathodNo ratings yet

- Strategic Management Final Report Bank Al HabibDocument20 pagesStrategic Management Final Report Bank Al HabibBrave Ali KhatriNo ratings yet

- HDFC BankDocument11 pagesHDFC Banklove gumberNo ratings yet

- BRACDocument38 pagesBRACMahmudur Rahman100% (3)

- Job Analysis On Axis BankDocument54 pagesJob Analysis On Axis BankAmit PasiNo ratings yet

- HBLDocument4 pagesHBLniceandfineNo ratings yet

- Sales Process of HDFC BankDocument78 pagesSales Process of HDFC Bankmohitnonu100% (1)

- HBL Vision Mission Analysis ReportDocument18 pagesHBL Vision Mission Analysis Reportsabihuddin100% (1)

- HDFC: Bank's Focus Area, Marketing or OperationsDocument48 pagesHDFC: Bank's Focus Area, Marketing or OperationsShubham SinghalNo ratings yet

- CBL HRDocument17 pagesCBL HROmor Sahariar PolashNo ratings yet

- Internship Report On RBBDocument32 pagesInternship Report On RBBAmrit sanjyalNo ratings yet

- Habib Bank Limited, Final Report (Abid)Document6 pagesHabib Bank Limited, Final Report (Abid)Ansab KhanNo ratings yet

- City Bank Ltd.Document14 pagesCity Bank Ltd.Alrazi ArmanNo ratings yet

- SWOT AnalysisDocument11 pagesSWOT Analysistania abdullahNo ratings yet

- Union BankDocument7 pagesUnion BankChoice MyNo ratings yet

- Internship MBADocument14 pagesInternship MBAYash PatilNo ratings yet

- Ife Efe CPMDocument7 pagesIfe Efe CPMNaveed Noor MemonNo ratings yet

- UBLDocument41 pagesUBLShoaib AliNo ratings yet

- Assignment On HRM PracticeDocument24 pagesAssignment On HRM PracticeSnowboy Tusher50% (2)

- Project Report: School of Business Oct 2012Document29 pagesProject Report: School of Business Oct 2012aman7190hunkNo ratings yet

- Bank Asia HRM360 ReportDocument15 pagesBank Asia HRM360 ReportProbortok Somaj67% (3)

- Literature Review HDFC BankDocument5 pagesLiterature Review HDFC Bankc5r9j6zj100% (1)

- Final Report of Strategic ManagementDocument5 pagesFinal Report of Strategic ManagementMuhammad ShakeelNo ratings yet

- DiruDocument84 pagesDirudhiru_hadiaNo ratings yet

- Habib BankDocument26 pagesHabib BankShahbaz AhmedNo ratings yet

- Roll Number: F15025 Name: Joanne O'Connor: Strategic Management AssignmentDocument28 pagesRoll Number: F15025 Name: Joanne O'Connor: Strategic Management AssignmentJoanne O'ConnorNo ratings yet

- Historical Background of SEBLDocument8 pagesHistorical Background of SEBLSina KhNo ratings yet

- Final)Document23 pagesFinal)sajiatrishaNo ratings yet

- Abn Ambro Bank Final 19-09-2007Document85 pagesAbn Ambro Bank Final 19-09-2007Gaurav NathaniNo ratings yet

- BankIslami Brand ManagementDocument40 pagesBankIslami Brand ManagementBilawal ShabbirNo ratings yet

- Internship ReportDocument65 pagesInternship ReportPakassignmentNo ratings yet

- Strategies For Branch DevelopmentDocument26 pagesStrategies For Branch Developmentprem75% (4)

- HBL HRM ReportDocument17 pagesHBL HRM ReportZaid AhmedNo ratings yet

- Edit ProjectDocument43 pagesEdit ProjectAnand ShrivastavaNo ratings yet

- Financial Statement Analysis Internship Report Format Sample PDF FilesDocument4 pagesFinancial Statement Analysis Internship Report Format Sample PDF FilesPik PokNo ratings yet

- HR Policy UBI & Yes BankDocument20 pagesHR Policy UBI & Yes BankGaurav Kumar97% (34)

- Summer Training Report Trends and Practices of HDFC Bank:-Retail Abnking Conducted at HDFC BANK, Ambala CityDocument104 pagesSummer Training Report Trends and Practices of HDFC Bank:-Retail Abnking Conducted at HDFC BANK, Ambala Cityjs60564No ratings yet

- Ntroduction: Ead Office Gulshan Avenue Gulshan DhakaDocument20 pagesNtroduction: Ead Office Gulshan Avenue Gulshan DhakaMd. Thasin Hassan Shifat 2031495630No ratings yet

- Table of Content: HDFC BankDocument23 pagesTable of Content: HDFC BankSyedNo ratings yet

- Bharat SharmaDocument19 pagesBharat SharmaG2BPLNo ratings yet

- HDFC Bank ProfileDocument6 pagesHDFC Bank ProfileARDRA VASUDEVNo ratings yet

- Account Opening DepartmentDocument24 pagesAccount Opening DepartmentSarfraz AliNo ratings yet

- SWOT Analysis of NIB BankDocument6 pagesSWOT Analysis of NIB BankAbdul Waheed83% (35)

- A Term Paper On Jamuna Bank Ltd.Document64 pagesA Term Paper On Jamuna Bank Ltd.Rozina Akter Rea50% (2)

- Research Project Report: To Study The Retial Banking in Present ScenarioDocument94 pagesResearch Project Report: To Study The Retial Banking in Present Scenariodiwakar0000000No ratings yet

- Investment Analysis of Jamuna Bank Ltd.Document53 pagesInvestment Analysis of Jamuna Bank Ltd.SharifMahmud50% (6)

- Successful Hiring for Financial Planners: The Human Capital AdvantageFrom EverandSuccessful Hiring for Financial Planners: The Human Capital AdvantageNo ratings yet

- Public CorporationDocument13 pagesPublic CorporationHira MahvishNo ratings yet

- Role Relate To I.BDocument24 pagesRole Relate To I.BHira MahvishNo ratings yet

- HBL REPORT Most FinalDocument83 pagesHBL REPORT Most FinalHira Mahvish82% (11)

- Standard Charted Bank Project ReportDocument31 pagesStandard Charted Bank Project ReportHira MahvishNo ratings yet

- FM Cia 3Document14 pagesFM Cia 3MOHAMMED SHAHIDNo ratings yet

- Chapter 8Document74 pagesChapter 8Liyana AzizNo ratings yet

- Bookkeeping Exercises 2022Document6 pagesBookkeeping Exercises 2022Anne de GuzmanNo ratings yet

- First MassDocument28 pagesFirst Masstrixie lavigne65% (23)

- Configuration of VIO On Power6 PDFDocument39 pagesConfiguration of VIO On Power6 PDFchengabNo ratings yet

- Install HelpDocument318 pagesInstall HelpHenry Daniel VerdugoNo ratings yet

- Account STDocument1 pageAccount STSadiq PenahovNo ratings yet

- Barandon Vs FerrerDocument3 pagesBarandon Vs FerrerCorina Jane Antiga100% (1)

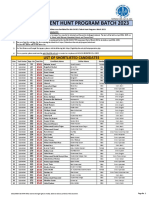

- Iba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesDocument30 pagesIba Ogdcl Talent Hunt Program Batch 2023: List of Shortlisted CandidatesSomil KumarNo ratings yet

- POLITICAL SYSTEM of USADocument23 pagesPOLITICAL SYSTEM of USAMahtab HusaainNo ratings yet

- MOM StatusDocument7 pagesMOM StatusReynaldi Be TambunanNo ratings yet

- Sex Trafficking Statistics 2022 Worldwide (Bedbible - Com Reveals)Document4 pagesSex Trafficking Statistics 2022 Worldwide (Bedbible - Com Reveals)PR.comNo ratings yet

- Atok-Big Wedge Assn. v. Atok-Big Wedge Co.,97 Phil, 294 '1995Document6 pagesAtok-Big Wedge Assn. v. Atok-Big Wedge Co.,97 Phil, 294 '1995Daniela Sandra AgootNo ratings yet

- CLASS XI Business - Studies-Study - MaterialDocument44 pagesCLASS XI Business - Studies-Study - MaterialVanshNo ratings yet

- MSDS - Dispersant SP-27001 - 20200224Document4 pagesMSDS - Dispersant SP-27001 - 20200224pratikbuttepatil52No ratings yet

- 2.7 Industrial and Employee RelationDocument65 pages2.7 Industrial and Employee RelationadhityakinnoNo ratings yet

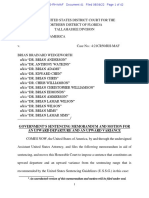

- Wedgeworth Sentencing MemorandumDocument218 pagesWedgeworth Sentencing MemorandumActionNewsJaxNo ratings yet

- Chapter 1 - Electricity and MagnetismDocument41 pagesChapter 1 - Electricity and MagnetismDarwin Lajato TipdasNo ratings yet

- Anatolia Cultural FoundationDocument110 pagesAnatolia Cultural FoundationStewart Bell100% (3)

- Candlestick Charting: Quick Reference GuideDocument24 pagesCandlestick Charting: Quick Reference GuideelisaNo ratings yet

- Borderless Alliance, A Crash Course, by Ziad HamouiDocument17 pagesBorderless Alliance, A Crash Course, by Ziad HamouiwatradehubNo ratings yet

- DENTAL JURIS - Dental Legislation PDFDocument2 pagesDENTAL JURIS - Dental Legislation PDFIsabelle TanNo ratings yet

- ASME - Lessens Learned - MT or PT at Weld Joint Preparation and The Outside Peripheral Edge of The Flat Plate After WDocument17 pagesASME - Lessens Learned - MT or PT at Weld Joint Preparation and The Outside Peripheral Edge of The Flat Plate After Wpranav.kunte3312No ratings yet

- Proposed St. Charles, Mo., Midtown Neighborhood Historic District PresentationDocument55 pagesProposed St. Charles, Mo., Midtown Neighborhood Historic District PresentationPatch_JaredGrafman100% (1)

- Instant Download Ebook PDF A Synoptic History of Classical Rhetoric 4th Edition PDF ScribdDocument41 pagesInstant Download Ebook PDF A Synoptic History of Classical Rhetoric 4th Edition PDF Scribdandrew.lints179100% (39)

- UOK-Ph.D. Fee StructureDocument2 pagesUOK-Ph.D. Fee StructureNeeraj MeenaNo ratings yet

- Motor Insurance - Proposal Form Cum Transcript Letter For Miscellaneous Carrying ComprehensiveDocument2 pagesMotor Insurance - Proposal Form Cum Transcript Letter For Miscellaneous Carrying ComprehensiveSantosh JaiswalNo ratings yet

- Punjab National BankDocument28 pagesPunjab National Bankgauravdhawan1991No ratings yet

- The Life of CardoDocument7 pagesThe Life of CardoBlessie Arabe100% (3)

- White Collar Crime Fraud Corruption Risks Survey Utica College ProtivitiDocument41 pagesWhite Collar Crime Fraud Corruption Risks Survey Utica College ProtivitiOlga KutnovaNo ratings yet