Professional Documents

Culture Documents

V Summary & Concluding Observations 5.1 Summary

Uploaded by

mokshgoyal2597Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

V Summary & Concluding Observations 5.1 Summary

Uploaded by

mokshgoyal2597Copyright:

Available Formats

CHAPTERV SUMMARY & CONCLUDING OBSERVATIONS 5.

1 Summary

The theory of capital structure is important for firms as they are constantly making investment decisions driven by financing decisions. Corporate decisions on capital structure policy have long been a subject of debate and still remain an unresolved issue. This decision typically involves the decision of raising debt and equity. It is important to note that factors or determinants that affect the capital structure of a firm exhibit different impact according to different theories. It is important to carry out the study for Indian firms and not rely on the results from other economies. Literature has identified four main theories of capital structure: the MM proposition, the Trade off theory, the Pecking order theory and the Agency theories. Of these the trade off and the pecking order theory is widely accepted and hence studied here. The trade off theory is based on balancing the advantages and disadvantages of the debt and equity. This theory suggests existence of an optimal debt level at which the value of the firm is maximum. The pecking theory says that firms prefer internal fund over the external and if external resource is required, firms rely on debt more than equity. The optimal debt and debt capacity are unobservable and have to be imputed from other observed variables like size, profitability growth options, asset structure, maturity etc. The trade off theory predicts that debt level should increase with asset size, maturity, tangible assets and profitability; it decreases with intangible assets, risk, non debt tax shields and growth options. According to the pecking order theory, leverage is positively related to intangible assets, growth options, dividends, capital expenditure and it is negatively related to the tangible assets, maturity, firm size and profitability. Further, while testing the trade off and the pecking order theory, no agency control variables have been used. There have been no previous attempts to compare capital structure of the firm across industries and capital structure across different economic scenarios. Based on the literature review and research gap, the following questions have been identified to be carried out as the part of the proposed project:

67

What explains the behavior of Indian firms capital structure behavior: the trade off theory or the pecking order? Does the behavior of the Indian firms remain same or vary across the industries in terms of the capital structure theory followed? Does the behavior of the Indian firms remain same or vary across the industries?

Due to the cross sectional and time series nature of the data under study, least square panel regression method has been used. The proposed research has been carried out on the firms from five industries (automobiles, pharmaceuticals, Consumer durables or electronics, information technology, and FMCG) for the period 2003-2011.

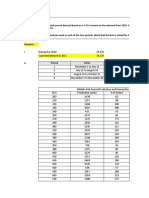

5.2 Main Findings

As expected, the level of significance of different variables and their impact on capital structure has come out to be different across various industries. Table 5.1 - Industry wise comparison

FMCG

=

.05

=

.10

Automobile = .05 .10

Consumer Durables

IT

Pharmaceuticals

= .05

Not Significant

= .10

Trade off theory

= .05

= .10

= .05

= .10

Size

Pecking order theory Not Significant Not Significant Not Significant Not Significant Not Significant Opp. To trade off theory

Pecking order theory Not Significant Pecking order theory Trade off theory Trade off theory Not Significant Trade off theory

Pecking order theory

Not Significant Pecking order theory

Profitability

Pecking order theory

Trade off theory

Growth

Not Significant

Not Significant Not Significant Trade off theory

Not Significant

Tangibility

Not Significant Pecking order theory

Not Significant

Age

Trade off theory Not Significant Trade off theory

Not Significant

Depreciation

Not Significant

Not Significant Opp. To trade off theory

Risk

Not Significant

Not Significant

68

The Size variable is primarily in conformance with pecking order theory for FMCG, Automobile and IT industry implying that firms belonging to these industries prefer to use equity or internal funds with higher sales. This variable is non significant for Consumer durables and pharmaceuticals at 95% confidence interval whereas it has contrarily complied with trade off theory at 90% confidence interval for consumer durable sector suggesting the presence of optimal capital structure. There is a surprising observation for profitability variable as it is in agreement with pecking order theory for Consumer Durables and Pharmaceuticals for which Size Variable was insignificant. Also, it is reflecting insignificant impact on capital structure of FMCG & Automobile for which Size Variable was significant. One more interesting observation is that IT firms with higher profitability prefer higher debt-equity ratio to take advantage of financial leverage to increase the return to shareholders. The Growth variable has shown insignificant impact on capital structure of FMCG, Consumer Durables, IT and Pharmaceutical industry where as it follows pecking order theory for Automobile sector implying that the capital intensive assets of automobile industry are primarily financed with equity capital. The asset structure measured by the Tangibility variable confirms trade off theory for Automobile and IT firms implying utilization of higher debt raising capacity with capital intensive assets for Automobile industry. It is insignificant for other industries at 95% confidence level. The maturity of the firm is non significant for FMCG & Pharmaceuticals where as it confirms with trade off theory for Automobile and IT sector implying established firms in these sector taking advantage of financial leverage due to their increased credibility. The non-debt tax shield measured by depreciation does not have significant influence on capital structure of any industry at 95% confidence level. The Risk variable which has been measured by variation in earnings suggests exactly opposite to trade off theory for FMCG and Pharmaceutical sector showed a higher debtequity ratio for higher variation in earnings. As the future performance of pharmacy firms are characterized by R&D capability of the pharmacy firm, success of which yield high return with a major breakthrough in medical field, the pharmacy sector is high risk high return investment opportunity. It might be due to the variation

69

of earning on the positive side which suggest that creditors are ready to take higher risk by investing in such firms to earn higher return. Economic scenario wise comparison As per our empirical study conducted, only the Maturity variable has shown consistent significant impact on capital structure of the companies considered for both the economic slowdown (2007-11) and economic boom period (2003-07) There are two variables size and profitability supporting trade off theory for the economic boom period which is in contrast with the above industry wise results. These variables have shown insignificant impact on capital structure during economic slowdown (2008-11). Table 5.2 Comparison across diverse underlying Economic scenarios

Size Profitability Growth Tangibility Age Depreciation Risk

Economic Boom Period, 2003-07 = .05 = .10 Trade off theory Trade off theory Not Significant Not Significant Pecking order theory Not Significant Not Significant

Economic Slowdown Period, 2008-11 = .05 = .10 Not Significant Not Significant Not Significant Not Significant Pecking order theory Opp. To trade off theory Not Significant

The study has given some interesting observations from the results. As observed that, firms with greater sales and profitability follow trade off theory during bullish economic phase, it implies that these firms want to take maximum advantage of financial leverage to multiply the return to shareholders by using higher debt compared to equity to fund their projects during the bullish phase of the economy. As the maturity attribute of the firms measured with Age variable converges with pecking order theory (Table 5.2) irrespective of the underlying economic situation it can be concluded that firms with greater maturity on an average prefer to use internal funds compared to debt to fund their projects during the bullish phase. This gives a redeeming signal about the Indian corporate behavior which is found out to show more dependence on their

70

internally generated funds than on external sources of finance. Two positive effects can come out of it. Firstly, from macroeconomic point of view this can signify more investments with the household savings getting supplemented by corporate savings. Secondly, this implies that the firms are not exposed to the vagaries of interest rates and thus volatility in interest rates and liquidity in the market may not have lethal impact on the corporate investment. This gives another clue that the mature firms may be less exposed to credit uncertainty. Low leverage can help the firms to avoid second agency conflict between shareholders and debt holders as well. But at the same time it can increase the conflict between managers and shareholders. As per the empirical results shown above in table 5.1 & 5.2, few variables support pecking-order theory and few support trade-off theory (refer Table 1, Appendix). So it is concluded that behavior of the Indian corporate sector regarding capital structure is eclectic. This is what is expected. Real life situation does not totally match with only one theory. But some interesting observations, as discussed above, from results have been made.

As a concluding note, a few limitations of this study includes the limitation of the scope of the study to only five industrial sectors, viz. Automobile, Information Technology, FMCG,

Consumer Durables and Pharmaceuticals. The other limitation is of short time series for research. The empirical study for economy wise comparison consist of very short period but it is uncontrollable as the economic conditions have changed over the short period of four or five years in the recent past. One more limitation is that Only public listed companies were included in the study as the private limited companies do not have access to the capital markets so they cannot raise finance from the secondary market. The empirical study is limited to Indian companies and does not give a holistic picture of global trend in capital structure. The capital structure of a company can have many other determinants like management style, kind of product, ownership structure etc. but only the prominent ones like profitability, size etc. are considered. The inclusion of these parameters in the study can be very illuminating to identify their any impact on the capital structure during the bullish phase of the economy. This should be a future research agenda to build upon the present study.

71

You might also like

- Degree of Leverage: Empirical Analysis from the Insurance SectorFrom EverandDegree of Leverage: Empirical Analysis from the Insurance SectorNo ratings yet

- A Usa Grenee Sfa 2004Document33 pagesA Usa Grenee Sfa 2004ridwanbudiman2000No ratings yet

- Interindustry Dividend Policy Determinants in The Context of An Emerging MarketDocument6 pagesInterindustry Dividend Policy Determinants in The Context of An Emerging MarketChaudhary AliNo ratings yet

- Aksujomas 03 01 05Document20 pagesAksujomas 03 01 05Rasaq MojeedNo ratings yet

- Thesis On Determinants of Capital StructureDocument4 pagesThesis On Determinants of Capital Structuredwbeqxpb100% (2)

- Mean Reversion and TurnaroundsDocument5 pagesMean Reversion and Turnaroundspjs15100% (1)

- Impact of Capital Structure On The Operating PerfoDocument7 pagesImpact of Capital Structure On The Operating PerfovtrzerafpsNo ratings yet

- Optimum Capital Structure of BSRMDocument22 pagesOptimum Capital Structure of BSRMKolaNo ratings yet

- Determinants of Capital Structure ThesisDocument8 pagesDeterminants of Capital Structure Thesisgbwygt8n100% (1)

- 43-Article Text-272-1-10-20211015Document11 pages43-Article Text-272-1-10-20211015Saima MehzabinNo ratings yet

- Thesis Capital Structure and Firm PerformanceDocument8 pagesThesis Capital Structure and Firm Performancelaurasmithkansascity100% (2)

- Chapter 4 CompleteDocument4 pagesChapter 4 CompleteDanyalNo ratings yet

- Assnmnt1Document12 pagesAssnmnt1Tashrique ShahabNo ratings yet

- Determinants of Dividend Policy in Saudi Listed CompaniesDocument10 pagesDeterminants of Dividend Policy in Saudi Listed CompaniesChickenrock TangerangNo ratings yet

- Determinants of Cash Holding in German Market: Abbas Ali, Samran YousafDocument7 pagesDeterminants of Cash Holding in German Market: Abbas Ali, Samran YousafAdv Ch SkyNo ratings yet

- Overview of The IndustryDocument3 pagesOverview of The IndustrygourikeshriNo ratings yet

- Measuring The Moat PDFDocument70 pagesMeasuring The Moat PDFFlorent CrivelloNo ratings yet

- Redefining Financial Constraints: A Text-Based Analysis: Research ObjectiveDocument7 pagesRedefining Financial Constraints: A Text-Based Analysis: Research ObjectiveKaranveer SinghNo ratings yet

- Firm's Environment, Governance and Strategy: Strategic Financial ManagementDocument14 pagesFirm's Environment, Governance and Strategy: Strategic Financial ManagementAnish MittalNo ratings yet

- Relationship Between Financial Leverage and Profitability Research PaperDocument16 pagesRelationship Between Financial Leverage and Profitability Research PaperDaksh BhandariNo ratings yet

- SSRN Id2603248Document7 pagesSSRN Id2603248vera maulithaNo ratings yet

- Financial Analysis Dissertation PDFDocument8 pagesFinancial Analysis Dissertation PDFProfessionalCollegePaperWritersUK100% (1)

- Impact of Financial Leverage On Firms' Profitability: An Investigation From Cement Sector of PakistanDocument7 pagesImpact of Financial Leverage On Firms' Profitability: An Investigation From Cement Sector of PakistanUma Maheswar KNo ratings yet

- Financial Management - Assignment 1Document5 pagesFinancial Management - Assignment 1Manish Kumar GuptaNo ratings yet

- iJARS 520Document16 pagesiJARS 520Sasi KumarNo ratings yet

- CH 20 Designing Capital StructureDocument21 pagesCH 20 Designing Capital StructureN-aineel DesaiNo ratings yet

- Determinants of Capital Structure and Dividend Policy - A Systematic ReviewDocument15 pagesDeterminants of Capital Structure and Dividend Policy - A Systematic ReviewMichael GregoryNo ratings yet

- Impact of Capital Structure On ProfitabilityDocument9 pagesImpact of Capital Structure On ProfitabilityMehmood MuradNo ratings yet

- The Relationship Between Economic Growth and Capital Structure of Listed Companies: Evidence of Japan, Malaysia, and PakistanDocument22 pagesThe Relationship Between Economic Growth and Capital Structure of Listed Companies: Evidence of Japan, Malaysia, and PakistanFayz Al FarisiNo ratings yet

- Valuation Q&A McKinseyDocument4 pagesValuation Q&A McKinseyZi Sheng NeohNo ratings yet

- Chapter - 3 Research Methodology 3.1 Research MethodologyDocument10 pagesChapter - 3 Research Methodology 3.1 Research MethodologySovin ChauhanNo ratings yet

- Equity Research-Measuring The MoatDocument117 pagesEquity Research-Measuring The MoatproxygangNo ratings yet

- A Research ProposalDocument5 pagesA Research Proposalshahzad akNo ratings yet

- Abhinav: International Monthly Refereed Journal of Research in Management & TechnologyDocument6 pagesAbhinav: International Monthly Refereed Journal of Research in Management & TechnologymgajenNo ratings yet

- Corporate Finance ProjectDocument6 pagesCorporate Finance ProjectInsha GhafoorNo ratings yet

- Auto Industry Research For FCGC 2011Document18 pagesAuto Industry Research For FCGC 2011bhundofcbmNo ratings yet

- Capital Structure and Firm PerformanceDocument15 pagesCapital Structure and Firm PerformanceAcademicNo ratings yet

- The Effect of Sales Growth On The Determinants of Capital Structure of Listed Companies in Tehran Stock ExchangeDocument6 pagesThe Effect of Sales Growth On The Determinants of Capital Structure of Listed Companies in Tehran Stock ExchangeJonathan SangimpianNo ratings yet

- FIN701 Finance AS1744Document17 pagesFIN701 Finance AS1744anurag soniNo ratings yet

- Critical Competitive Strategies Every Entrepreneur Should ConsiderDocument11 pagesCritical Competitive Strategies Every Entrepreneur Should ConsiderrasanavaneethanNo ratings yet

- The Impact of Dividend Policy On Firm Performance Under High or Low Leverage Evidence From PakistanDocument34 pagesThe Impact of Dividend Policy On Firm Performance Under High or Low Leverage Evidence From PakistanDevikaNo ratings yet

- Fim ArDocument7 pagesFim ArDuke GlobalNo ratings yet

- Financing Pattern of Companies in India: IjitkmDocument6 pagesFinancing Pattern of Companies in India: IjitkmDevraj JosephNo ratings yet

- Research Paper Dividend PolicyDocument5 pagesResearch Paper Dividend Policyl1wot1j1fon3100% (3)

- 3616 5658 1 PBDocument7 pages3616 5658 1 PBKingston Nkansah Kwadwo EmmanuelNo ratings yet

- Evidence From Emerging EconomyDocument12 pagesEvidence From Emerging EconomyNguyễn Trịnh Ngọc HồngNo ratings yet

- 00.debtliq-Cekrezi 135-148Document14 pages00.debtliq-Cekrezi 135-148e learningNo ratings yet

- Profit Impact of Market StrategyDocument13 pagesProfit Impact of Market Strategyrasesh_gohilNo ratings yet

- What Is 'Fundamental Analysis': Intrinsic Value Macroeconomic Factors Current PriceDocument9 pagesWhat Is 'Fundamental Analysis': Intrinsic Value Macroeconomic Factors Current Pricedhwani100% (1)

- Assignment 1Document29 pagesAssignment 1ALLAHISGREAT100No ratings yet

- Inversión y CrecimientoDocument40 pagesInversión y CrecimientommmmmNo ratings yet

- Investment Framework Chirag DagliDocument21 pagesInvestment Framework Chirag DagliTheMoneyMitraNo ratings yet

- Nature and Scope of Managerial EconomicsDocument4 pagesNature and Scope of Managerial EconomicsCymah Nwar RAo100% (2)

- Literature Review Capital StructureDocument4 pagesLiterature Review Capital Structureea793wsz100% (1)

- Delgado - Forex: The Fundamental Analysis.Document10 pagesDelgado - Forex: The Fundamental Analysis.Franklin Delgado VerasNo ratings yet

- Literature Review On Optimal Capital StructureDocument6 pagesLiterature Review On Optimal Capital Structureafmzaoahmicfxg100% (2)

- Working Capital - Overall ViewDocument6 pagesWorking Capital - Overall ViewLokamNo ratings yet

- How Important Is Capital Structure Policy To Firm SurvivalDocument21 pagesHow Important Is Capital Structure Policy To Firm Survivalcafe0sugarNo ratings yet

- Analysis of Profitability of Selected Two Major Two-Wheeler Automobile Companies in IndiaDocument9 pagesAnalysis of Profitability of Selected Two Major Two-Wheeler Automobile Companies in IndiabhaveshjadavNo ratings yet

- The Capital Budgeting Decisions of Small BusinessesDocument21 pagesThe Capital Budgeting Decisions of Small BusinessesKumar KrisshNo ratings yet

- 2002 3irDocument43 pages2002 3irmokshgoyal2597No ratings yet

- 1 IntroductionDocument9 pages1 Introductionmokshgoyal2597No ratings yet

- Ao3e Resolving DisputesDocument9 pagesAo3e Resolving Disputesmokshgoyal2597No ratings yet

- MitDocument13 pagesMitmokshgoyal2597No ratings yet

- GanttDocument13 pagesGanttmokshgoyal2597No ratings yet

- Cause and EffectDocument10 pagesCause and Effectmokshgoyal2597100% (1)

- MitDocument13 pagesMitmokshgoyal2597No ratings yet

- Appendices - 1: Companies Chosen For FMCG Sector (As Per BSE FMCG Index)Document6 pagesAppendices - 1: Companies Chosen For FMCG Sector (As Per BSE FMCG Index)mokshgoyal2597No ratings yet

- Equivalent Annual Annuity (EAA) The Model: The EAA Method Is An Alternative To The Replacement Chain Method, ForDocument1 pageEquivalent Annual Annuity (EAA) The Model: The EAA Method Is An Alternative To The Replacement Chain Method, Formokshgoyal2597No ratings yet

- Ebay Inc.: Case Analysis ofDocument8 pagesEbay Inc.: Case Analysis ofmokshgoyal2597No ratings yet

- ProductDocument3 pagesProductmokshgoyal2597No ratings yet

- 3.research MethodologyDocument10 pages3.research Methodologymokshgoyal259750% (2)

- CaseDocument2 pagesCasemokshgoyal25970% (1)

- Target Costing and Life Cycle CostingDocument47 pagesTarget Costing and Life Cycle CostingPriti Sharma100% (1)

- Stock OptionsDocument5 pagesStock Optionsmokshgoyal2597No ratings yet

- Commercial Papers Repurchase AgreementsDocument6 pagesCommercial Papers Repurchase Agreementsmokshgoyal2597No ratings yet

- RichaDocument10 pagesRichamokshgoyal2597No ratings yet

- Analysis of CRM Strategies: Customer Relationship ManagementDocument8 pagesAnalysis of CRM Strategies: Customer Relationship Managementmokshgoyal2597No ratings yet

- Article 8Document14 pagesArticle 8mokshgoyal2597No ratings yet

- Stock OptionsDocument5 pagesStock Optionsmokshgoyal2597No ratings yet

- Financial Instruments Gdrs & P-Notes: Nilotpal DasDocument10 pagesFinancial Instruments Gdrs & P-Notes: Nilotpal Dasmokshgoyal2597No ratings yet

- Financial Instruments: Zero - Coupon Bonds EsopsDocument5 pagesFinancial Instruments: Zero - Coupon Bonds Esopsmokshgoyal2597No ratings yet

- Financial Instruments: Interest Rate Caps Currency SwapsDocument12 pagesFinancial Instruments: Interest Rate Caps Currency Swapsmokshgoyal2597No ratings yet

- FEDocument12 pagesFEmokshgoyal2597No ratings yet

- Sales ForecastDocument32 pagesSales Forecastmokshgoyal2597100% (2)

- Financial Instruments: Priya Tiku MBA-FinanceDocument17 pagesFinancial Instruments: Priya Tiku MBA-Financemokshgoyal2597No ratings yet

- Futures and Options:: Emerging TrendsDocument48 pagesFutures and Options:: Emerging Trendsmokshgoyal2597No ratings yet

- Recruitment and Selection of Sales ForceDocument26 pagesRecruitment and Selection of Sales Forcemokshgoyal2597No ratings yet

- Sales Force TrainingDocument22 pagesSales Force Trainingmokshgoyal2597100% (1)

- S1-TITAN Overview BrochureDocument8 pagesS1-TITAN Overview BrochureصصNo ratings yet

- FINS1612 Capital Markets and Institutions S12016Document15 pagesFINS1612 Capital Markets and Institutions S12016fakableNo ratings yet

- Decemeber 2020 Examinations: Suggested Answers ToDocument41 pagesDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNo ratings yet

- Musical Notes and SymbolsDocument17 pagesMusical Notes and SymbolsReymark Naing100% (2)

- Indian Retail Industry: Structure, Drivers of Growth, Key ChallengesDocument15 pagesIndian Retail Industry: Structure, Drivers of Growth, Key ChallengesDhiraj YuvrajNo ratings yet

- Computer Awareness: Special Edition E-BookDocument54 pagesComputer Awareness: Special Edition E-BookTanujit SahaNo ratings yet

- Abb PB - Power-En - e PDFDocument16 pagesAbb PB - Power-En - e PDFsontungNo ratings yet

- 1classic Greek SaladDocument6 pages1classic Greek SaladEzekiel GumayagayNo ratings yet

- Athletic KnitDocument31 pagesAthletic KnitNish A0% (1)

- W1 MusicDocument5 pagesW1 MusicHERSHEY SAMSONNo ratings yet

- Gmail - Payment Received From Cnautotool - Com (Order No - Cnautot2020062813795)Document2 pagesGmail - Payment Received From Cnautotool - Com (Order No - Cnautot2020062813795)Luis Gustavo Escobar MachadoNo ratings yet

- Articles of Incorporation 2Document5 pagesArticles of Incorporation 2Marcos DmitriNo ratings yet

- VVP Engg. CollegeDocument32 pagesVVP Engg. Collegechotaimanav17No ratings yet

- LPP-Graphical and Simplex MethodDocument23 pagesLPP-Graphical and Simplex MethodTushar DhandeNo ratings yet

- Leading A Multi-Generational Workforce:: An Employee Engagement & Coaching GuideDocument5 pagesLeading A Multi-Generational Workforce:: An Employee Engagement & Coaching GuidekellyNo ratings yet

- Pam ApplicationDocument3 pagesPam Applicationapi-534834656No ratings yet

- Chapter 11 Towards Partition Add Pakistan 1940-47Document5 pagesChapter 11 Towards Partition Add Pakistan 1940-47LEGEND REHMAN OPNo ratings yet

- Meter BaseDocument6 pagesMeter BaseCastor JavierNo ratings yet

- The Library PK - Library of Urdu BooksDocument8 pagesThe Library PK - Library of Urdu Bookszamin4pakNo ratings yet

- Gprs/Umts: IAB Workshop February 29 - March 2, 2000 Jonne Soininen NokiaDocument34 pagesGprs/Umts: IAB Workshop February 29 - March 2, 2000 Jonne Soininen NokiaSajid HussainNo ratings yet

- Gothic Fiction Oliver TwistDocument3 pagesGothic Fiction Oliver TwistTaibur RahamanNo ratings yet

- Blood Rage Solo Variant v1.0Document6 pagesBlood Rage Solo Variant v1.0Jon MartinezNo ratings yet

- SCI1001 Lab 7 MarksheetDocument2 pagesSCI1001 Lab 7 Marksheetnataliegregg223No ratings yet

- Reinforcing Steel and AccessoriesDocument4 pagesReinforcing Steel and AccessoriesTheodore TheodoropoulosNo ratings yet

- Solar SystemDocument3 pagesSolar SystemKim CatherineNo ratings yet

- Past Paper1Document8 pagesPast Paper1Ne''ma Khalid Said Al HinaiNo ratings yet

- Sound Culture: COMS 350 (001) - Winter 2018Document12 pagesSound Culture: COMS 350 (001) - Winter 2018Sakshi Dhirendra MishraNo ratings yet

- U.S. Individual Income Tax Return: Miller 362-94-3108 DeaneDocument2 pagesU.S. Individual Income Tax Return: Miller 362-94-3108 DeaneKeith MillerNo ratings yet

- Generator Faults and RemediesDocument7 pagesGenerator Faults and Remediesemmahenge100% (2)

- 21 and 22 Case DigestDocument3 pages21 and 22 Case DigestRosalia L. Completano LptNo ratings yet