Professional Documents

Culture Documents

Cash Flow Statements II

Uploaded by

Chris RessoCopyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Cash Flow Statements II

Uploaded by

Chris RessoCopyright:

Available Formats

Kids n caboodle clothing Enterprises had following receipts and payments for it's first year of operations Receipts

Cash sales 155,000 Loan proceeds 21,000 total receipts 176,000 Payments/disbursements Merchndise purchase (all sold this year) 84,000 wages 33,000 rent and lease payments 22,000 other operating expenses 7,900 Purchse equipments 10,500 total payments/disbursement 157,400 Increase in cash balance 18,600 there was no a/c receivables, emplyee had earned wages of 200 yet to be paid. Store had not paid utilities bill of 150. Prepare a cash flow statement for the year satement of Cash Flow of Kids n Caboodle Cash Flow from operating activities cash receipts from sale of goods payment to suppliess payment of wages payment of rent and lease payment of other operaing exp Cashflow from investing activities purhcase of equipments Cash flow from financing activities loan proceeds

8,100 155,000 84,000 33,000 22,000 7,900 10,500 18,600 21,000 18,600

146,900 10,500

Since company follow all cash basis transactions a/c payables and receiables are not considered

of operations

ot paid utilities bill of 150.

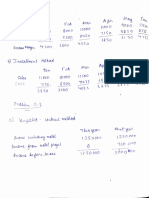

Balance Sheet as on 31st Dec year 1 Year 2 net change during the year Assets increase decrease Cash 10,000 15,000 5,000 receivables 20,000 25,000 5,000 inventory 20,000 35,000 15,000 Plant & machinery cost 85,000 85,000 0 less dep -15,000 -10,000 5000 Total Assets 120,000 150,000 Liabiliites & capital sundry Creditors Outstanding expenses debenture payable long term loans capital Retained earnings

8000 7000 10,000 5000 50,000 40,000 120000

10,000 10,000 5000 25000 50,000 50,000 150,000

2,000 3,000 5000 20000 0 10000

Net profit for the period after charging rs.5000 on account of dep was rs. 20,000. A piece of equipment costing Rs.25000 on in the amount of Rs.10,000.00 was sold for Rs.10,000. dividends paid during the year amounted to Rs.10,000.00 show the sources and uses of funds nd change in working capital: cost of Mac 25,000 dep 10,000 soures of funds book value 15,000 operations 30,000 sold 10,000 Net income 20,000 loss 5,000 add loss on sale of machinery 5000 add dep 5000 sale of equpment 10,000 long term loans 20000 Totl source of funds 60,000 Uses of funds equipment repayment of debentures payment of dividends working capital change Total uses of funds

25000 5000 10,000

40,000 20,000 60,000

Working Capital change current assets Cash receivables inventory Total Current liabilities

year 1 10,000 20,000 20,000 50,000 15,000 25,000 35,000 75,000

year 2

sundry Creditors Outstanding expenses

8000 7000

10,000 10,000 20,000 55,000

tOTaLl 15000 Change in working capital 35,000 Current assets - current liabilities

20,000

quipment costing Rs.25000 on which dep accumlated d to Rs.10,000.00 80 75

Balance sheet cash other current asset equipemnt accumlated dep - equipment land toal assets current LiabILITI long term debt common stock retained earnining Additional information; a.Dividends of 10,000 were paid during the year b.No equipment was sold during the year

2001 12000 25000 108,000 -20,000 30,000 155000 26,000 50,000 50,000 29,000 155,000

2000 Increase/ decrease 15000 -3000 22000 3000 50,000 58000 -16,000 -4000 30,000 0 101000 54000 22,000 25,000 40,000 14,000 101,000 4,000 25,000 10,000 15,000 54,000

source

4000 25000 10000

What was the net cash provided by (used in) financing activities during 2001? What was the net cash provided by(used in) investing activities during 2001/ NET Income = Retained Earning Ending Balance - Retained Earning Beginning Balance+Dividend paid Net Income =29000-14000+10000 25000 INDIRECT METHOD Net income A.Operating Acitivities Decreases Depreciation Inrease in Current Liability Decreases increase in current assets Net Cash Flow from Operating activities B. Investing Activities Incerase Decreases purchase of equipment Net Cash provided from Investing acivities C.Financing Activities Increases Increase in common stock Long Term Debt Decreases Payment of Dividend Net Cash provided from Finncing acivities Net 'cash flow during the year

25000 8000 4000 4000 -3000 -3000 5000 30000

-58000 -58000 -58000 35,000 10,000 25,000 -10,000 -10,000 25,000 A+B+C -3,000

use -3000 -58000 -4000

You might also like

- Case Study 4 3 Copies ExpressDocument7 pagesCase Study 4 3 Copies Expressamitsemt100% (2)

- Chapter 5 ProblemsDocument7 pagesChapter 5 Problemsanu balakrishnanNo ratings yet

- Income Statements 2010Document10 pagesIncome Statements 2010Shivam GoelNo ratings yet

- Problem CH 11 Alfi Dan Yessy AKT 18-MDocument4 pagesProblem CH 11 Alfi Dan Yessy AKT 18-MAna Kristiana100% (1)

- Project Phases and The Project Life CycleDocument4 pagesProject Phases and The Project Life CycleChris RessoNo ratings yet

- Bill French - Write Up1Document10 pagesBill French - Write Up1Nina EllyanaNo ratings yet

- Too Soon To IPO? Case Study AnalysisDocument13 pagesToo Soon To IPO? Case Study Analysispratz1996100% (1)

- Financial Statement Analysis: Amerbran Company (BDocument37 pagesFinancial Statement Analysis: Amerbran Company (BZati Ga'in100% (1)

- Analyzing Cost Savings of Upgrading US Distribution Network to Include LA Distribution CenterDocument3 pagesAnalyzing Cost Savings of Upgrading US Distribution Network to Include LA Distribution CenterRIJu KuNNo ratings yet

- CPAREVIEW-CORPORATE LIQUIDATIONDocument21 pagesCPAREVIEW-CORPORATE LIQUIDATIONMariella Antonio-NarsicoNo ratings yet

- AEC 12 Application 4 - Group 4 ACBDocument55 pagesAEC 12 Application 4 - Group 4 ACBPRINCESS JUDETTE SERINA PAYOTNo ratings yet

- Delaney Motors Case SolutionDocument13 pagesDelaney Motors Case SolutionParambrahma Panda100% (2)

- Case14-62 Vonderweidt Sportway CorpDocument5 pagesCase14-62 Vonderweidt Sportway CorpRdj JaureguiNo ratings yet

- Analysis of Home Depot's Financial Performance:: Current RatioDocument4 pagesAnalysis of Home Depot's Financial Performance:: Current RatioDikshaNo ratings yet

- Case 11-1 2004Document2 pagesCase 11-1 2004Bitan BanerjeeNo ratings yet

- 17-2 Lipman Bottle CompanyDocument6 pages17-2 Lipman Bottle CompanyYJ26126100% (1)

- Financial Statement Framework for Evaluating Financial PerformanceDocument9 pagesFinancial Statement Framework for Evaluating Financial PerformanceMalik Fahad YounasNo ratings yet

- FM09-CH 24Document16 pagesFM09-CH 24namitabijweNo ratings yet

- Management Accounting - I (Section A, B &H) Term I (2021-22)Document3 pagesManagement Accounting - I (Section A, B &H) Term I (2021-22)saurabhNo ratings yet

- New Product Development ProcessDocument7 pagesNew Product Development ProcessChris RessoNo ratings yet

- Harlan Foundation: Company BackgroundDocument4 pagesHarlan Foundation: Company BackgroundPrachiNo ratings yet

- Import Distributors, Inc. : Case 26-1Document2 pagesImport Distributors, Inc. : Case 26-1NishaNo ratings yet

- AkuntansiDocument3 pagesAkuntansier4sallNo ratings yet

- Forest City Tennis Club General Ledger and Financial StatementsDocument9 pagesForest City Tennis Club General Ledger and Financial StatementsAhmedNiaz100% (1)

- Notes To Financial StatementsDocument3 pagesNotes To Financial StatementsJohn Glenn100% (1)

- CBSE Class 12 Accountancy - Cash Flow StatementDocument14 pagesCBSE Class 12 Accountancy - Cash Flow StatementVandna Bhaskar38% (8)

- Other Percentage TaxDocument3 pagesOther Percentage TaxHafi DisoNo ratings yet

- Davey Brothers Watch Co. SubmissionDocument13 pagesDavey Brothers Watch Co. SubmissionEkta Derwal PGP 2022-24 BatchNo ratings yet

- Lipman Bottle CompanyDocument20 pagesLipman Bottle CompanySaswata BanerjeeNo ratings yet

- Assignment Iii Mansa Building Case Study: Submitted by Group IVDocument14 pagesAssignment Iii Mansa Building Case Study: Submitted by Group IVHeena TejwaniNo ratings yet

- Latihan UTS AKUNDocument32 pagesLatihan UTS AKUNchittamahayantiNo ratings yet

- Case 11-2 SolutionDocument2 pagesCase 11-2 SolutionArjun PratapNo ratings yet

- Chemalite Cash Flow StatementDocument2 pagesChemalite Cash Flow Statementrishika rshNo ratings yet

- Solman 12 Second EdDocument23 pagesSolman 12 Second Edferozesheriff50% (2)

- CVPDocument3 pagesCVPRajShekarReddyNo ratings yet

- Marvin Co Financial StatementsDocument4 pagesMarvin Co Financial StatementsVaibhav KathjuNo ratings yet

- AHM13e Chapter - 01 - Solution To Problems and Key To CasesDocument19 pagesAHM13e Chapter - 01 - Solution To Problems and Key To CasesGaurav ManiyarNo ratings yet

- Autumn 2011 - Midterm Assessment (25089)Document8 pagesAutumn 2011 - Midterm Assessment (25089)Marwa Nabil Shouman0% (1)

- Basic Concepts of Accounting (Balance Sheet)Document12 pagesBasic Concepts of Accounting (Balance Sheet)badtzmaru0506No ratings yet

- This Study Resource Was: Forner CarpetDocument4 pagesThis Study Resource Was: Forner CarpetLi CarinaNo ratings yet

- EVALUATION OF BANK OF MAHARASTRA-DevanshuDocument7 pagesEVALUATION OF BANK OF MAHARASTRA-DevanshuDevanshu sharma100% (2)

- Stern Corporation (B)Document3 pagesStern Corporation (B)Rahul SinghNo ratings yet

- 2 Manas BuildingDocument6 pages2 Manas BuildingSandhali JoshiNo ratings yet

- CASE SUMMARY Waltham Oil and LubesDocument2 pagesCASE SUMMARY Waltham Oil and LubesAnurag ChatarkarNo ratings yet

- Final Exam Paper (C) 2020.11 OpenDocument3 pagesFinal Exam Paper (C) 2020.11 OpenKshitiz NeupaneNo ratings yet

- Garanti Payment Systems:: Digital Transformation StrategyDocument12 pagesGaranti Payment Systems:: Digital Transformation StrategySwarnajit SahaNo ratings yet

- Case Study 4 - 3 Copies ExpressDocument8 pagesCase Study 4 - 3 Copies ExpressJZ0% (1)

- Dispensers of California, IncDocument9 pagesDispensers of California, IncHimanshu PatelNo ratings yet

- Group 4 Home DepotDocument2 pagesGroup 4 Home DepotnikhilNo ratings yet

- Lean Production Required: Variable Costing vs Absorption CostingDocument3 pagesLean Production Required: Variable Costing vs Absorption CostingKathleen Wellman HerberNo ratings yet

- ARS Waltham Case TransactionsDocument2 pagesARS Waltham Case TransactionsRajnikaanth SteamNo ratings yet

- ABC QuestionsDocument14 pagesABC QuestionsLara Lewis Achilles0% (1)

- Case Background: - Mrs. Santha - Owner Small Assembly Shop - Production Line ADocument12 pagesCase Background: - Mrs. Santha - Owner Small Assembly Shop - Production Line AAbhishek KumarNo ratings yet

- Maria HernandezDocument2 pagesMaria HernandezUjwal Suri100% (1)

- Amaranth Disaster: How One Trader Lost $6B in 30 DaysDocument15 pagesAmaranth Disaster: How One Trader Lost $6B in 30 DaysRani ZahrNo ratings yet

- Hazel Day Yedra (Case 1)Document2 pagesHazel Day Yedra (Case 1)DayNo ratings yet

- 29 Purity Steel Compensation Plan AnalysisDocument7 pages29 Purity Steel Compensation Plan Analysisfajarina ambarasariNo ratings yet

- Merrimack Tractors and Movers IncDocument2 pagesMerrimack Tractors and Movers IncPranav MehtaNo ratings yet

- Problem 13-1 - Chapter 13 - SolutionDocument6 pagesProblem 13-1 - Chapter 13 - Solutionppdisme100% (1)

- Pradeep MA3 SirDocument6 pagesPradeep MA3 SirPradeep Elavarasan0% (1)

- Hospital SupplyDocument3 pagesHospital SupplyJeanne Madrona100% (1)

- Unitron CorporationDocument7 pagesUnitron CorporationERika PratiwiNo ratings yet

- Accy 517 HW PB Set 1Document30 pagesAccy 517 HW PB Set 1YonghoChoNo ratings yet

- 2nd Class Cash Flow StatementDocument18 pages2nd Class Cash Flow StatementprakashNo ratings yet

- Trabajo Zarate FinishDocument17 pagesTrabajo Zarate FinishDavidFloresNo ratings yet

- New AFU 07407 CF Slides 2022Document73 pagesNew AFU 07407 CF Slides 2022janeth pallangyoNo ratings yet

- Job Description: Position: Account Executive Location: Toronto, Canada Area Brief DescriptionDocument1 pageJob Description: Position: Account Executive Location: Toronto, Canada Area Brief DescriptionChris RessoNo ratings yet

- Esc-36m-80 Esc-36m-85 Esc-36m-90Document2 pagesEsc-36m-80 Esc-36m-85 Esc-36m-90Chris RessoNo ratings yet

- Case I: AC Off DC Off: Acdb Solar PanelDocument1 pageCase I: AC Off DC Off: Acdb Solar PanelChris RessoNo ratings yet

- Components of A Strategy StatementDocument3 pagesComponents of A Strategy StatementChris RessoNo ratings yet

- Administered PriceDocument1 pageAdministered PriceChris RessoNo ratings yet

- Data Communication and NetworkingDocument28 pagesData Communication and NetworkingRahul SharmaNo ratings yet

- MergerDocument7 pagesMergerChris RessoNo ratings yet

- MDocument87 pagesMKaran SinghNo ratings yet

- VISION, Mission, Objectives of BusinessDocument15 pagesVISION, Mission, Objectives of BusinesssjanseerNo ratings yet

- Job Description: Position: Account Executive Location: Toronto, Canada Area Brief DescriptionDocument1 pageJob Description: Position: Account Executive Location: Toronto, Canada Area Brief DescriptionChris RessoNo ratings yet

- R&D Management: Project Types, Portfolios, Assessment & SelectionDocument40 pagesR&D Management: Project Types, Portfolios, Assessment & SelectionChris RessoNo ratings yet

- MergerDocument1 pageMergerChris RessoNo ratings yet

- Process Improvement Project GuideDocument19 pagesProcess Improvement Project GuideChris RessoNo ratings yet

- Corporate Profile: Safety - Effectiveness - Value - Quality Scientific LeadershipDocument2 pagesCorporate Profile: Safety - Effectiveness - Value - Quality Scientific LeadershipChris RessoNo ratings yet

- MS-94 Q2Document3 pagesMS-94 Q2Chris RessoNo ratings yet

- 2010 01 11Document4 pages2010 01 11kedirabduriNo ratings yet

- Esc-36m-80 Esc-36m-85 Esc-36m-90Document2 pagesEsc-36m-80 Esc-36m-85 Esc-36m-90Chris RessoNo ratings yet

- Total Productive MaintenanceDocument5 pagesTotal Productive MaintenanceChris RessoNo ratings yet

- Esc-36m-80 Esc-36m-85 Esc-36m-90Document2 pagesEsc-36m-80 Esc-36m-85 Esc-36m-90Chris RessoNo ratings yet

- Reference MaterialDocument18 pagesReference MaterialChris RessoNo ratings yet

- The Modern Approach To Industrial Maintenance ManagementDocument12 pagesThe Modern Approach To Industrial Maintenance ManagementRanjith KumarNo ratings yet

- Total Productive MaintenanceDocument29 pagesTotal Productive MaintenanceChris RessoNo ratings yet

- Computer Communications Software DesignDocument24 pagesComputer Communications Software DesignChris RessoNo ratings yet

- Data Communication and NetworkingDocument28 pagesData Communication and NetworkingRahul SharmaNo ratings yet

- Presentation 1Document1 pagePresentation 1Chris RessoNo ratings yet

- MS 10-OD-Dev and Change Unit 4 Organizational DesignDocument47 pagesMS 10-OD-Dev and Change Unit 4 Organizational DesignChris RessoNo ratings yet

- MS10-OD, Dev and Change - Unit 5 - Book 3Document61 pagesMS10-OD, Dev and Change - Unit 5 - Book 3Chris Resso100% (1)

- Book 4 OD Unit 8Document56 pagesBook 4 OD Unit 8Chris RessoNo ratings yet

- FORMATION OversoulDocument2 pagesFORMATION OversoulMaximillianous GideonNo ratings yet

- Indian Accounting Standards OverviewDocument12 pagesIndian Accounting Standards OverviewREHANRAJNo ratings yet

- Unit - 5 B Mergers & AcquisitionDocument37 pagesUnit - 5 B Mergers & AcquisitionShivam PalNo ratings yet

- Muthoot Finance Gold Loans Leader IndiaDocument5 pagesMuthoot Finance Gold Loans Leader IndiaVaibhav BhatiaNo ratings yet

- CHAPTER 2 Statement of Comprehensive IncomeDocument13 pagesCHAPTER 2 Statement of Comprehensive IncomeJM MarquezNo ratings yet

- Cost accounting and financial analysis problemsDocument6 pagesCost accounting and financial analysis problemssecret studentNo ratings yet

- Other Percentage Taxes: Sec. 116. Persons Exempt From VATDocument22 pagesOther Percentage Taxes: Sec. 116. Persons Exempt From VATMakoy BixenmanNo ratings yet

- 1 BTAXREV Week 2 Income TaxationDocument48 pages1 BTAXREV Week 2 Income TaxationgatotkaNo ratings yet

- F2-08 Absorption and Marginal CostingDocument16 pagesF2-08 Absorption and Marginal CostingJaved ImranNo ratings yet

- Analyze Financial StatementsDocument7 pagesAnalyze Financial StatementsJianne Ricci GalitNo ratings yet

- Ceylon Beverage Holdings PLC - Notice & Form of Proxy - 6108338117833530-8Document4 pagesCeylon Beverage Holdings PLC - Notice & Form of Proxy - 6108338117833530-8safdfefNo ratings yet

- May 23 G1 RTPDocument122 pagesMay 23 G1 RTPMeet BaradNo ratings yet

- Arti - LT 2020Document194 pagesArti - LT 2020Ayu NingsihNo ratings yet

- ACA Case Study Plan For ExamsDocument16 pagesACA Case Study Plan For ExamsSadiya BodhyNo ratings yet

- 2307 For EBS Private Individual Percenateg TaxDocument4 pages2307 For EBS Private Individual Percenateg TaxAGrace MercadoNo ratings yet

- Ratio Analysis 3Document4 pagesRatio Analysis 3Vinay ChhedaNo ratings yet

- Accounts Previous Year PapersDocument37 pagesAccounts Previous Year PapersAlankritaNo ratings yet

- Kelompok 5 Akl 2Document4 pagesKelompok 5 Akl 2Khansa AuliaNo ratings yet

- Common Size Income Statements 2Document7 pagesCommon Size Income Statements 2Aniket KedareNo ratings yet

- Problems On Balance Sheet of A Company As Per Revised Schedule VI of The Companies ActDocument7 pagesProblems On Balance Sheet of A Company As Per Revised Schedule VI of The Companies ActNithyananda PatelNo ratings yet

- The Basic Accounting Equation: Assets Liabilities + EquityDocument16 pagesThe Basic Accounting Equation: Assets Liabilities + EquityangeliNo ratings yet

- ICDRDocument32 pagesICDRrohitjpatel786100% (1)

- 1575048558619Document37 pages1575048558619Manepalli SaikiranNo ratings yet

- PICPA - 1st Year QuestionsDocument1 pagePICPA - 1st Year QuestionsVincent Larrie MoldezNo ratings yet

- Akyim ch12Document12 pagesAkyim ch12kevin echiverriNo ratings yet

- VOUCHER NO: 410741 VOUCHER NO: 410741: Admission Form Fee Rs. 3000/ Admission Form Fee Rs. 3000Document1 pageVOUCHER NO: 410741 VOUCHER NO: 410741: Admission Form Fee Rs. 3000/ Admission Form Fee Rs. 3000karim mawazNo ratings yet