Professional Documents

Culture Documents

Chapter 13 Finance

Uploaded by

api-168415683Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Chapter 13 Finance

Uploaded by

api-168415683Copyright:

Available Formats

Chapter 13 Finance Notes

To finance something means to raise money for something Households need finance for: Businesses need finance for: Paying Bills Paying wages, other bills and expenses Paying back loans For expansion Living expenses To buy stock and raw materials Households and Businesses need to know Their sources of finance i.e. where it comes from Their expenditure i.e. where there money goes Their cash flow i.e. when they spend and receive money. Finance can be offset by income: Household Income Wages/salaries/Social Welfare Savings Interest Share Dividends

Business Income Sales Revenue Return on Investments Grants

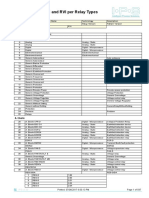

Sources of Finance Short Term Less than 1 year Bank Overdraft Trade Credit Accrued Expenses Credit Card Factoring Medium Term 1 5 years Medium Term Bank Loan Hire Purchase Leasing Long Term Over 5 years Long Term Bank Loan Share Capital Owners Capital Reserves Govt. Finance

Short Term Sources of Finance

1 - Bank Overdraft The current account holder gets permission from the bank to withdraw more money from their account than they have in it (up to a certain limit). Interest is charged on the amount outstanding every quarter (i.e. every three months) and this interest is calculated on a daily basis. The Interest is High. eg. you have 10,000 in your account. You have an overdraft of 2,000. You withdraw 10,700. You have to repay 700 to the bank as well as interest on this 700 at approx. 18% per annum (18/12 per month) No security (collateral) is needed to obtain an overdraft. Banks retain the right to recall the overdraft at any time. There are penalties for those who exceed their overdraft. Overdrafts should only be obtained when they are required and they are thus a flexible source of finance. They cover temporary cash shortfalls Why do households need overdrafts? Many bills might be incurred at once (in September with kids going back to school or at Christmas time with presents, decorations, light and heat, etc.). Income received in later months allows households to pay off the overdraft. Why do businesses need overdrafts? It may allow businesses to pay suppliers if their own customers delay payment to them. Their own customers pay them later and the income received from these customers can be used to pay off the overdraft 2 - Trade Credit A Creditor is someone who we buy goods or services from now but who we pay later - buying on credit.

A Debtor is someone who we sell goods or services to now, but who we receive payment from later - called selling on credit. Business allow a certain period of time to their customers between buying goods and services and paying for them (usually 0-3 months) If we buy goods on credit, we can use the money owed to the creditor in the business until it has to be paid the money can be deposited for two months and can earn interest. Alternatively we can sell these goods and collect the income before it is due to be paid. Firms that over use this source of finance are leaning on the trade. Their credit worthiness and financial reputation may suffer. They may lose out on discounts offered for prompt payment of debts.

3 - Accrued Expenses Accruals are services which we have the use of now but which we pay for later o eg.: telephone, electricity, tax o i.e. we pay these expenses in arrears No costs are attached to these expenses. Tax is an accrual as there is a time delay between deducting tax or P.R.S.I., collecting V.A.T., calculating tax on a businesses profits and paying the money onto the Government. This money can be used to benefit the business in some way before it is passed on to the government. 4 - Factoring A Debtor is someone who we sell goods or services to now, but who we receive payment from later. Debtors pay us at different times, some in two weeks, some in a months, some in two months; this makes it difficult to plan expenditure and increases the risks of Bad Debts. Firms can thus sell their debtors to a factoring firm. The factoring firm pays 80% of the debt off now and the rest when the debt is due to be paid. The factoring firm in turn gets paid by the debtor

Medium Term Sources of Finance 1 - Medium Term Loans Loans given to houses for up to five years are called Personal Loans. Loans given to businesses for up to five years are called medium term loans. Features of Term Loans 1) Agreed period of time 2) Agreed amount 3) Repayment of loan by instalment agreed in advance 4) Interest rate in line with general interest rates and the category of borrower Interest The Loan must disclose the APR Annual Percentage Rate of the interest on the loan. The APR is the true rate of interest paid per annum on the loan taking into account the frequency of repayments, the duration of the loan and any additional charges involved Interest Rates vary between banks The higher the risk category of the borrower, the higher the interest rate charged Repayments The borrower obtains a loan and can purchase, own and utilise assets. Repayment of the loan will should suit the ability of the borrower to repay the loan. Instalments dont have to be equal. Car Sales are slow in summer months, toyshops sell more toys at Christmas. In these cases loan repayments can be adjusted to suit the cash flows of the respected firms Most loans require collateral (i.e. security for a loan) Land, buildings, other Assets

1. 2. 3. 4.

2 - Hire Purchase (HP) This is a form of credit which allows customers to have immediate use of goods while paying for them over an agreed period of time in instalments. The customer has to pay an initial deposit and an agreed number of instalments. The customer only owns the asset when the last instalment has been made. Hire Purchase is available from retailers or specialist finance companies It is used to buy asset such as motor vehicles, equipment, etc. It carries a high rate of interest and is thus an expensive form of finance. Goods cannot be repossessed by the hire purchase company without going through a legal process, so the purchaser of an asset has certain legal rights. A Contract will include: The amount of the initial deposit The number of deposits and there due date The amount of APR involved The amount of each deposit

Advantages of Hire Purchases o Immediate use of the good o Sales and profits increase o Commission paid increases thus raising employees income and standard of living o The firms capacity to expand increases 3 - Leasing Leasing is like renting. The asset acquired is at all times owned by the lessor who rents it to the lessee over an agreed period of time in return for regular payments. Ownership thus never passes to the person renting it (the lessee). Leasing is a popular source of medium term finance for both individuals and businesses. Leasing is cheaper than hire purchase as no change of ownership is involved. A lease agreement involves the payment of a deposit and a number of deposits being paid (the number of which is agreed in advance. Repayments are fixed - At the end of the agreement the asset is returned to the seller. Leasing is a flexible source of finance. Advantages of Leasing 1. Leasing is cheaper than Hire Purchase 2. Repayments are regular over a period of time so businesses can thus plan expenditure. 3. Leasing can be used by firms which find it difficult to obtain a loan 4. No security is needed. Long-Term Sources of Finance 1 Long term bank Loan Mortgage/Debenture Mortgage (20-40 years) are used by households to finance the purchase of a house. The Mortgage is paid back with interest in agreed monthly repayments. It can be fixed, variable or tracked to ECB rates. A Debenture is a Long Term Business Loan secured on a Businesses Assets such as Buildings or Land. The business pays monthly interest repayments only and pays back the borrowed amount in a lump sum in the future A Long Term Business loan acts just like a mortgage and is used to finance Fixed Assets 2 - Share Capital Equity is the funds that have invested in the business by its owners and not loaned to the business by other individuals or financial institutions. It is any security or stock representing ownership of the business.

It is provided by shareholders who purchase ordinary shares in the hope of a future dividend. A dividend is a share of a businesss profits which shareholders receive as repayment to them for investing in the company. Share Capital is not repaid. It can be repaid when the business winds up, but this is not compulsory. Dividends are not paid if there are insufficient profits or if the business decides to use all profits for expansion Preference Shares Preference shareholders receive payment BEFORE ordinary shareholders They receive their capital on the winding-up of a company BEFORE ordinary shareholders They have no voting rights Preference shareholders receive a fixed dividend regardless of the profit. Eg The Government is a preference shareholder in AIB as they bailed them out Ordinary Shares Ordinary shareholders receive payment AFTER preference shareholders They receive their capital on the winding-up of a company AFTER preference shareholders. This places them at risk, because the capital they invested may be used to pay other debts or other shareholders and they may lose their investment. They do have voting rights. They have one vote per share. This vote can be used to decide on company policy or to elect directors at an A.G.M. Ordinary shareholders are risk takers. The dividends they receive vary and may not be paid at all.

1. 2. 3. 4.

1. 2.

3. 4.

Advantages of Share Capital 1. Flexibility due to payment of dividends 2. It acts as a signal to banks and credit institutions about the commitment of its owners 3. It doesnt have to be repaid which eases the strain on the business 4. A successful company will find it easier to raise more capital 3 - Owners Capital This refers to the money put into the business by the individual setting up the business. This money is left in the business for as long as the business stays in operation or until the individual decides to leave the business. This is a cheap source of finance and signals the owners commitment to the business 4 - Retained Earnings These can be known as reserves and mean that profits are ploughed back into the business to assist its growth. It may cause conflict with shareholders When a business makes profit, these profits dont have to be paid to the directors or p aid to the shareholders; they can be put on deposit or invested. These profits build up over a period of time, and are effectively the same as savings for a household. If the business keeps reserves, this means that profits are not being paid to shareholders in the form of dividends and thus needs permission from its shareholders to do this. 5 - Government Finance Government grants are non-repayable amounts of money given to enterprises by state agencies for specific purposes. Grants are given by Forbairt, the County Enterprise Boards, EU agencies, and encourage certain activities that help develop the business. Examples of Grants 1) Capital Grants - These help with the purchase of fixed assets 2) Feasibility Study Grants - These enable market research to be conducted on new products 3) Training Grants - These help meet the training needs of staff

6 - Venture Capital This is provided as start-up (seed) capital for new business enterprises and as development capital for existing businesses in which there is a higher than average degree of risk. Finance is provided by venture capital companies through a direct loan, through the purchase of shares in a company or through a mixture of both. The venture capital company will usually want to place members of its own staff on the board of directors to oversee the new firms progress. This is known as a partnership approach and raises the image of the business with customers, suppliers and banks. Eg Dragons Den investors Factors Considered by lenders when applying for Loans/Finance Character are you trustworthy and reliable Capacity Will you be able to pay back the loan Collateral have you any assets to provide security in the event the loan is not repaid. Credit Rating have you a good credit history what is your level of risk Factors to consider when choosing a source of Finance: 1 - Costs Households and businesses should shop around for the cheapest source of finance. The interest charged is the cost of borrowing and it can vary widely from lender to lender. Also factor in number of years the longer the term the lower the monthly repayment will be but the higher the overall repayment will be. 2 Purpose A business should match the source of finance to the Item it is buying. The term of the loan should not exceed the lifespan of the asset (not applicable to short term). If you borrow 50000 for a car and pay it back over 20 years at 10% interest p.a. you will pay back 624 per month for 240 months totalling 149760 which makes the finance arrangement very very expensive! Therefore: Short Term Day to Day running expenses Medium Term for assets of life span of 5-10 years Long Term for assets with life span of 20 years or more 3 Security Collateral - What collateral is needed to acquire that asset? Could my home be re-possessed? 4 Tax Implications Are there any tax incentives? Is there any tax relief for mortgage or debenture interest? 5 Control Loans do not require giving away any control of the business but share capital and venture capital will? How much are you prepared to give away? Cash Flow Forecasting and Cash Flow Management Used to predict and manage the flow of cash in a business in the future (short and medium term). It will allow you to plan for future deficits or surpluses of cash which may arise. If you can plan for them they should not cause you any trouble. Dealing with an Expected future Deficit 1. Increase cash receipts tighten credit control and ensure debtors pay on time. You could also sell an investment or asset if the need arose 2. Reduce cash payments reduce expenses such as wages and spread loan repayments. Make cutbacks to other expenses such as energy, fuel and advertising. Reduce dividends paid to shareholders.

Dealing with a future surplus 1. Pay off debts pay off loans with banks, expenses due to creditors as this will reduce interest costs and incur credit discounts 2. Reinvest reinvest the money into the business by upgrading technology and equipment this improves efficiency. Banking Facilities for Households and Businesses A. Current Accounts These allow customers to lodge (put money in) and withdraw (take money out) funds on a regular basis 1. ATM - Automated Teller Machines 2. Laser Card/Debit Card Money is effectively transferred from your account into the account of the retailer/supplier that you are paying. Customers can withdraw money from their account using the same method i.e. cash back. These are very popular. They are cheaper and more convenient than writing a cheque. 3. Cheques A cheque is an order by the current account holder, to the bank to pay a stated amount of money to a named person or order (or order means that one can pass ownership of the cheque on to someone else). 4. Direct Debit This is an arrangement that authorises a firm, such as Eircom/Vodafone/ESB, to make regular withdrawals of variable amounts from a specified account. 5. Standing Orders This is an arrangement with the bank to pay a regular, fixed amount out of an accouns eg.: mortgage repayments, rent, etc. Characteristics of Current Accounts 1. Money can be withdrawn in a number of ways a. Over the counter b. ATM c. Cheque d. Laser 2. Overdrafts can be obtained on accounts 3. Direct payments can be made into and out of these accounts by using standing orders and direct debit 4. Regular statement are received showing the state of the account 5. Inters is normally not earned on money in these accounts 6. Fees are charged for using these accounts

Businesses applying for a Loan They must submit a loan application form This is more complicated than the application submitted by a householder. The business manager usually has to meet with the bank manager. It gives o Details of the business what does it do? Where is it based? Where is its primary market? What are its assets? etc. o Details of the owners of the business their age, the management capability o Prospects for the business supported by research what is the economic climate? o Accounts of the business showing the existing financial commitments of the business, its performance over the past number of years this indicates the businesses ability to repay the loan

You might also like

- Chapter 22 Community DevelopmentDocument3 pagesChapter 22 Community Developmentapi-168415683No ratings yet

- CHPT 19 AlternativesDocument45 pagesCHPT 19 Alternativesapi-168415683No ratings yet

- Chapter 22 Social and Ethical BehaviourDocument5 pagesChapter 22 Social and Ethical Behaviourapi-168415683No ratings yet

- Chapter 21 Business The Economy and The GovernmentDocument30 pagesChapter 21 Business The Economy and The Governmentapi-168415683No ratings yet

- Introduction To Working LifeDocument5 pagesIntroduction To Working Lifeapi-168415683No ratings yet

- Unit 4 PlanDocument1 pageUnit 4 Planapi-168415683No ratings yet

- Business Report of Spoon BuddiesDocument25 pagesBusiness Report of Spoon Buddiesapi-168415683No ratings yet

- Unit 6 PlanDocument2 pagesUnit 6 Planapi-168415683No ratings yet

- Chapter 20 Industry CategoriesDocument25 pagesChapter 20 Industry Categoriesapi-168415683No ratings yet

- Unit 1 PlanDocument2 pagesUnit 1 Planapi-168415683No ratings yet

- Chapter 18 ExpansionDocument31 pagesChapter 18 Expansionapi-168415683No ratings yet

- Unit 5 PlanDocument2 pagesUnit 5 Planapi-168415683No ratings yet

- Action Plan Calvin SwartDocument3 pagesAction Plan Calvin Swartapi-168415683No ratings yet

- Unit 2 PlanDocument1 pageUnit 2 Planapi-168415683No ratings yet

- Chapter 21 Business and The GovernmentDocument17 pagesChapter 21 Business and The Governmentapi-168415683No ratings yet

- Career Investigation Calvin SwartDocument3 pagesCareer Investigation Calvin Swartapi-168415683No ratings yet

- Unit 3 PlanDocument1 pageUnit 3 Planapi-168415683No ratings yet

- Work Experience - CalvinDocument7 pagesWork Experience - Calvinapi-168415683No ratings yet

- Chapter 12 Taxation NotesDocument3 pagesChapter 12 Taxation Notesapi-168415683No ratings yet

- Chapter 12 Notes InsuranceDocument3 pagesChapter 12 Notes Insuranceapi-168415683No ratings yet

- CV Calvin SwartDocument3 pagesCV Calvin Swartapi-168415683No ratings yet

- Chapter 11 Accounting and Performance AnalysisDocument4 pagesChapter 11 Accounting and Performance Analysisapi-168415683No ratings yet

- Chapter 9 HRDocument5 pagesChapter 9 HRapi-168415683No ratings yet

- Chapter 10 Change ManagementDocument3 pagesChapter 10 Change Managementapi-168415683No ratings yet

- Evaluation Methods - Candy CanesDocument1 pageEvaluation Methods - Candy Canesapi-168415683No ratings yet

- Chapter 8 PlanningDocument3 pagesChapter 8 Planningapi-168415683No ratings yet

- Chapter 7 Communications Notes 2012Document6 pagesChapter 7 Communications Notes 2012api-168415683No ratings yet

- Chapter 8 OrganisingDocument4 pagesChapter 8 Organisingapi-168415683No ratings yet

- Chapter 6 Management Skills 1 2012Document5 pagesChapter 6 Management Skills 1 2012api-168415683No ratings yet

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5782)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (587)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (72)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (119)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- ECC Chemical Process Pumps GuideDocument84 pagesECC Chemical Process Pumps GuideIwan KurniawanNo ratings yet

- FAO - Industrial Charcoal ProductionDocument33 pagesFAO - Industrial Charcoal ProductionFabiano de Souza0% (1)

- IPS-ENERGY - Available Relay ModelsDocument597 pagesIPS-ENERGY - Available Relay Modelsbrahim100% (2)

- Business Letters Writing PresentationDocument19 pagesBusiness Letters Writing PresentationHammas khanNo ratings yet

- CT ES 072 RFID and GPS Combination Approach Implementation in Fisher Boat TrackingDocument2 pagesCT ES 072 RFID and GPS Combination Approach Implementation in Fisher Boat TrackingkbsmalliNo ratings yet

- Project Portfolio Management (PPM) : The Natural Evolution of Project ManagementDocument4 pagesProject Portfolio Management (PPM) : The Natural Evolution of Project ManagementStudy Study100% (1)

- ISO 26262 for Functional Safety Critical ProjectsDocument24 pagesISO 26262 for Functional Safety Critical ProjectsZidane Benmansour100% (1)

- Streeter v. Secretary, Department of Corrections Et Al - Document No. 3Document2 pagesStreeter v. Secretary, Department of Corrections Et Al - Document No. 3Justia.comNo ratings yet

- PT. NURMAN MITRA SENTOSA HSE REPORTDocument4 pagesPT. NURMAN MITRA SENTOSA HSE REPORTSigit WiyonoNo ratings yet

- 900 Old Koenig Package - Vertical PDFDocument30 pages900 Old Koenig Package - Vertical PDFmichael zNo ratings yet

- Grove GMK6350Document20 pagesGrove GMK6350cornel_lupuNo ratings yet

- Cle Esp 9 Quarter 3Document15 pagesCle Esp 9 Quarter 3jonalyn obinaNo ratings yet

- Cultural Impacts of Tourism in VietnamDocument4 pagesCultural Impacts of Tourism in VietnamBùi Thanh Ngọc BíchNo ratings yet

- Tkinter Cheat SheetDocument2 pagesTkinter Cheat Sheetphanina01No ratings yet

- Chapter 2 and 3 Exam HintsDocument16 pagesChapter 2 and 3 Exam HintsNga PhuongNo ratings yet

- Electric Bike ReportDocument33 pagesElectric Bike ReportGautham M A100% (1)

- Tools and Techniques of Cost ReductionDocument27 pagesTools and Techniques of Cost Reductionপ্রিয়াঙ্কুর ধর100% (2)

- HRD Plan. AigDocument25 pagesHRD Plan. Aigminhhr2000No ratings yet

- Scrum Developer AssessmentDocument11 pagesScrum Developer Assessmentmohannad44% (9)

- 26 - Submission of Calibration Certificate of Relative Testing EquipmentsDocument18 pages26 - Submission of Calibration Certificate of Relative Testing EquipmentsUgrasen ChaudharyNo ratings yet

- Detecting Improvements in Forecast Correlation SkiDocument15 pagesDetecting Improvements in Forecast Correlation SkiDiki ZulfahmiNo ratings yet

- Parent/Guardian Permission For ExcursionDocument2 pagesParent/Guardian Permission For Excursionm1i7No ratings yet

- (Studies in Critical Social Sciences) Elizabeth Humphrys - How Labour Built Neoliberalism (2018)Document281 pages(Studies in Critical Social Sciences) Elizabeth Humphrys - How Labour Built Neoliberalism (2018)Angularity AngularityNo ratings yet

- Afl Fact SheetDocument1 pageAfl Fact Sheetapi-257609033No ratings yet

- Model Operator'S Manual: Non Contact TonometerDocument100 pagesModel Operator'S Manual: Non Contact TonometerRitesh GuptaNo ratings yet

- OBLICON REVIEWER Article 1162Document1 pageOBLICON REVIEWER Article 1162Oh SeluringNo ratings yet

- Pixar EssayDocument2 pagesPixar Essayapi-523887638No ratings yet

- India BG check formDocument4 pagesIndia BG check formPrasanth IglesiasNo ratings yet

- Configure IP Tunnels GuideDocument12 pagesConfigure IP Tunnels GuideAril Muhammad Fauzan MuslimNo ratings yet