Professional Documents

Culture Documents

Checklist of Key Figures: Kieso Intermediate Accounting: IFRS Edition

Uploaded by

Kean Christopher GandalalOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Checklist of Key Figures: Kieso Intermediate Accounting: IFRS Edition

Uploaded by

Kean Christopher GandalalCopyright:

Available Formats

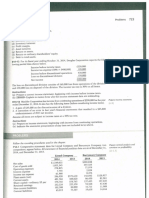

CHECKLIST OF KEY FIGURES

to accompany

Kieso Intermediate Accounting: IFRS Edition,

Volume I

John Wiley & Sons, Inc.

Chapter 3

3-1

(c) Net income for September, 6,007.

(e) Post-closing trial balance, total debits, 36,975.

3-2

(b) Net income, $36,450.

Total assets, $67,000.

3-4

(b) Adjusted trial balance total 1,004,700.

(c) Net loss (5,600).

Total assets, 202,900.

(e) Post-closing trial balance total, 241,900.

3-6

(b) Net income, $50,620.

Total assets, $101,400.

3-7

(b) Net income, 25,500.

Total assets, 57,250.

3-8

(c) Adjusted trial balance total, $839,660.

(d) Net income credited to Retained Earnings,

$31,640.

3-9

(c) Retained Earnings credit, $45,790.

3-10

(a) Net loss, cash basis, 31,500.

Net income, accrual basis, 13,900.

(b) Total assets, cash basis, 58,500.

Total assets, accrual basis, 108,900.

3-11

(a) Total debits, adjustments column, $59,200.

(b) Total assets, $203,500.

(e) Post-closing trial balance total, $245,500.

C.A.C. (a) Cadburys percentage increase, (21.5%).

(c) Nestles PPE & IA, 27,964,000,000.

F.S.A.C. (a) 2009 % change in: revenues, 15.61%; profit

(loss), (54.41%).

Chapter 4

4-2

Income from operations, $3,200,000

Net income, $1,356,000

4-3

Net income, 86,100.

4-4

Net income $443,450

4-5

Net income, $221,525.

Retained earnings, June 30, $494,825.

4-7

(a) Net income for year, $52,300.

4-8

Income from continuing operations, $1,060,000.

C.A.C. (d) minority interest (Nestle), 5.3%.

F.S.A.C. 2 (b) Addidass PSR, .49.

P.S.

Net income, 476,000.

Chapter 5

5-2

Total assets, 4,504,850.

5-3

Total assets, $1,154,200.

5-4

Total assets, 3,046,000.

5-5

Total assets, $3,115,000.

5-6

(a) Net cash provided by operating activities,

$19,200.

(b) Total assets, $252,000.

5-7

(a) Net cash provided by operating activities,

41,200.

(b) Total assets, 289,200.

F.R.P. (e) (2) Cash debt coverage ratio, .24:1.

C.A.C. (f) Free cash flow (Cadbury), (326).

F.S.A.C.4(a) Free cash flow-08, W1,368.

Chapter 6

6-1

(b) Combined present value (purchase price),

26,466,321.

(d) Cost of tractor, 4,483,820.

6-2

(a) R=$8,461.33.

6-3

PV of outflows (Bid A), $129,881.13.

6-4

PV of annuity, $286,297.20.

6-5

PV of option (c), $64,314.61.

6-6

PV of net cash inflows, $66,935.58.

6-7

(c) Amount received on sale of note,

$738,223.36.

6-8

Total cost from Vendor A, $175,602.26.

6-9

(b) Fair value of note, $83,055.75.

6-10

1. Net purchase costs, $2,151,396.

6-11

(c) Annual deposit, $9,419.

6-13

Total estimated liability, $12,810.51.

6-14

Estimated fair value, 9,672.52.

6-15

(a) PV of annuity, $64,269.

F.S.A.C. (b) Present value of net cash flows, $298,422.

P.S.

Combined PV (Proceeds) at i=8%, $107,985.10.

Chapter 7

7-1

(b) Current ratio after adjustment, 1.75 to 1.

7-2

4. Accounts receivable balance, $1,010,000.

7-3

(a) Allowance for Doubtful Accounts, $45,000.

7-4

Balance adjusted, 12/31/10, 263,600.

7-5

Adjustment to allowance for doubtful accounts,

$7,279.64.

7-7

(a) August 31 cash collected, $9,550.

7-9

(a) Discounted notes receivable, $62,049.

(b) Interest revenue for 2011, $6,825.

7-10

(a) Total long-term receivables, $1,097,148.

(c) Total interest income, $151,873.

7-11

Total expenses, 52,320.

7-12

(b) Correct cash balance, $8,918.

7-13

Corrected balance, June 30, $5,403.95.

7-14

Correct cash balance, $51,478.69.

7-15

(d) Impairment loss, $317,535.

C.A.C. (c) Receivables turnover (Cadbury), 4.8.

F.S.A.C. 2 Receivables turnover, 7.01.

P.S.

Total current assets, $182,550.

Chapter 8

8-1

4. Inventoriable cost, $908,100.

8-2

Adjusted inventory, $1,715,000.

8-4

(b) Ave. Cost inventory, $1,917.33.

8-5

(b) Ave. Cost inventory, 3,463.

8-6

(d) Perpetual FIFO cost of goods sold, 87,100.

Moving average inventory balance, 28,600.

8-7

(b) LIFO inventory, $1,915.

8-8

(b)2 LIFO inventory, $3,350.

8-9

(d) Perpetual LIFO cost of goods sold, $92,000.

(f) Moving average inventory balance, $28,600..

8-10

New amount for retained earnings at 12/31/11

$226,400.

8-11

(a) 6. Cost of goods sold, $11,799,080.

8-12

(b) Inventory at 12/31/10 $766,500.

8-13

Inventory at 12/31/10 $73,192.

8-14

(a) Inventory at 12/31/10, $110,600.

F.S.A.C. 1 (a) Income before taxes, $15,306,000.

F.S.A.C. 3 FIFO cost of sales-07, $29,249.

Chapter 9

9-2

(a)2 Gain to be recorded $(12,300).

9-3

(b) 12/31/11 Loss due to market decline, $7,000.

9-4

(d) Total effect on income 50,000.

9-5

Fire loss on inventory, 58,250.

9-6

Inventory fire loss, 50,700.

9-7

(b) Inventory at LCNRV, HK$52,290.

9-8

Ending inventory at cost, $305,000.

9-9

(a) Ending inventory at LCNRV, 64,588.

9-10

(a) Raw materials inventory, $237,400.

9-11

(a) Loss due to market decline, 790.

F.R.P. (d) Inventory turnover 12.23.

C.A.C. (d) Days to sell inventory (Nestle), 72 days.

P.S.

Loss due to market decline, $4,000.

Chapter 10

10-1

(a) Land balance- 12/31/10, 1,614,000.

10-2

(a) Machinery and equipment balance- 12/31/10,

$1,295,000.

10-3

(a) 1. Land, $188,700.

Building, $136,250.

10-5

(b) Cost of building, $3,423,000.

10.6

(b) Building balance- 12/31/11, $682,248.

10.7

(b) Avoidable interest, $140,000.

10-8

3. Gain recognized-Liston, $10,000.

10-9

(b) Gain deferred-Wiggins, $12,000.

10-10 (c) Gain recognized-Marshall, 8,000.

10-11 (b) Transaction 1, asset cost, $23,115.

F.S.A.C. (d) Free cash flow, 643,000,000.

P.S.

Pretax loss, $1,000.

Chapter 11

11-1

(a) Depreciation base (SL), $86,400.

11-2

Depreciation expense-2011 (SYD method), 19,250.

11-3

(d) Depreciation expense-Asset E, $5,600.

11-4

(a) Semitrucks balance, 12/31/11, 152,000.

(b) Depreciation expense adjustment in 2011 credit

of 14,000.

11-5

(b) 2011Depreciation expense (Bldg.), 9,900.

11-6

(13) $52,000.

11-7

(b) Depreciation expense - 2009 (SYD method),

$23,800.

11-8

11-9

11-10

11-11

11-12

11-13

11-14

(a) Accumulated depreciation (DDB method),

12/31/10, $806,400.

Loss on impairment, $1,900,000.

(a) Impairment loss $33,581.

Recovery of impairment loss $20,149.

(b) Current year profit 2,094,400.

(b) Total depreciation $5,250.

Unrealized gain on revaluation land $500.

(b) Other comprehensive income 12/31/12 $2,500.

C.A.C. (c) (3) Rate of return on assets (Nestle), 17.2%.

P.S.

Gain on sale, $29,000.

Chapter 12

12-1

Patent amortization for 2010, $10,777.

12-2

(c) Carrying value, 12/31/11, $48,000.

12-3

(b) Total expenses for 2010, $61,288.

12-4

(b) Patent, $72,600.

12-5

(c) Impairment loss, $200,000.

12-6

(a) Total intangibles, 203,700.

F.R.P. (b) Percentage of sales revenue-2007, 20.7%.

C.A.C. (a) (2) Percentage of total assets (Nestle), 35.3%.

P.S.

Impairment loss, $16,250.

Chapter 13

13-3

Total income tax withholding for month, $104.

13-4

(a) Total income tax withholding, $3,350.

13-5

(b) Warranty expense, $136,000.

13-7

(a) (3) Warranty expense, $117,000.

13-8

Cost of estimated claims outstanding, 23,100.

13-9

(b) Premium expense for 2011, $78,000.

13.12 (3) Premium expense for 2010, $54,000.

13-14 1. Liability balance, $224,300.

F.R.P. (b) Acid-test ratio, .35.

C.A.C. (b) Acid-test ratio (Cadbury), .54.

Chapter 14

14-1

(e) Bond interest expense -2004, $11,322.

14.2

(c) Loss on redemption, $41,945.

14.3

(c) Quarterly payments, 4,503.

14-5

(b) Depreciation expense-2011, $67,961.20.

(c) Interest expense-2012, $45,078.66.

14-6

(b) Interest expense, 12/31/10, $10,598.82.

(d) Interest Expense-2012, $5,706.46.

14-7

(a) Loss on bond redemption, 1/2/11, 3,042,888.

14-8

1. Proceeds from sale of bonds (Sanford Co.),

3/1/10, $472,090.

Bonds Payable credited 12/31/10, $2,350.

2. Bonds Payable debited 12/1/10, $2,707.

14-9

12/31/10 Interest expense credited $351.45.

1/2/11 Gain on redemption $61,847.82

14-10 (d) Loss on extinguishment of bonds, Rs602,104.

14-11 (b) Gain on extinguishment of debt $301,123.

14-12 Gain on extinguishment of debt $1,712,400.

14-13 (b) Gain on extinguishment of debt $47,411.

14-14 (a) Interest expense for 2010 $65,699.

F.R.P. (b) Times interest earned, 8.70 times.

C.A.C. (a) Times interest earned (Cadbury), 8.92 times.

P.S.

Bond price, $5,307,228.36.

You might also like

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- Checklist of Key Figures: Kieso Intermediate Accounting, Twelfth EditionDocument4 pagesChecklist of Key Figures: Kieso Intermediate Accounting, Twelfth EditionEdi F SyahadatNo ratings yet

- Checklist of Key Figures: Kieso Intermediate Accounting: IFRS EditionDocument3 pagesChecklist of Key Figures: Kieso Intermediate Accounting: IFRS EditionstillwinmsNo ratings yet

- The Investor's Dilemma Decoded: Recognize Misinformation, Filter the Noise, and Reach Your GoalsFrom EverandThe Investor's Dilemma Decoded: Recognize Misinformation, Filter the Noise, and Reach Your GoalsNo ratings yet

- Checklist of Key Figures: Inancial Ccounting Ools FOR Usiness Ecision Aking Eventh DitionDocument15 pagesChecklist of Key Figures: Inancial Ccounting Ools FOR Usiness Ecision Aking Eventh Ditionkindergarten tutorialNo ratings yet

- Modern Portfolio Management: Moving Beyond Modern Portfolio TheoryFrom EverandModern Portfolio Management: Moving Beyond Modern Portfolio TheoryNo ratings yet

- ChecklistDocument5 pagesChecklistDedra CoxNo ratings yet

- The Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeFrom EverandThe Gone Fishin' Portfolio: Get Wise, Get Wealthy...and Get on With Your LifeNo ratings yet

- Solutions CH 1 and 3Document3 pagesSolutions CH 1 and 3payalkhndlwlNo ratings yet

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosFrom EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosNo ratings yet

- ChecklistDocument5 pagesChecklistfitriamanNo ratings yet

- Principles of Cash Flow Valuation: An Integrated Market-Based ApproachFrom EverandPrinciples of Cash Flow Valuation: An Integrated Market-Based ApproachRating: 3 out of 5 stars3/5 (3)

- Checklist of Key Figures Vol IDocument5 pagesChecklist of Key Figures Vol IvivienNo ratings yet

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioFrom EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioNo ratings yet

- Checklist of Key Figures Chapter 5 Accounting For Merchandising OperationsDocument4 pagesChecklist of Key Figures Chapter 5 Accounting For Merchandising OperationsalmamunduthmNo ratings yet

- Checklist of Key Figures Managerial Accounting Seventh EditionDocument8 pagesChecklist of Key Figures Managerial Accounting Seventh EditionEloiza EvansNo ratings yet

- Checklist of Key Figures Managerial Accounting Second EditionDocument8 pagesChecklist of Key Figures Managerial Accounting Second EditionashibhallauNo ratings yet

- Check Figures PLL3e FinalDocument23 pagesCheck Figures PLL3e FinalTrần Tuấn AnhNo ratings yet

- CH 5 Answers To Homework AssignmentsDocument13 pagesCH 5 Answers To Homework AssignmentsJan Spanton100% (1)

- Appendix C Answers To Selected End-Of-Chapter ProblemsDocument9 pagesAppendix C Answers To Selected End-Of-Chapter Problemstonicors_806375834No ratings yet

- ACC 620 WK 3Document21 pagesACC 620 WK 3ToddHurstNo ratings yet

- Check List of Key Figures Chapter OneDocument6 pagesCheck List of Key Figures Chapter OneRonnelson PascualNo ratings yet

- Bethesda Mining: Input AreaDocument15 pagesBethesda Mining: Input AreaJenkins Qing100% (1)

- 50 50 15e Check FiguresDocument25 pages50 50 15e Check FiguresAlAshNo ratings yet

- 3int 2004 Dec ADocument7 pages3int 2004 Dec AFloyd DaltonNo ratings yet

- Series 4 2013Document7 pagesSeries 4 2013Apollo YapNo ratings yet

- Mci 292737Document11 pagesMci 292737ReikoNo ratings yet

- Tugas AKM II Minggu 10 E24.2 Dan E24.3 - Clarissa Nastania (441354)Document2 pagesTugas AKM II Minggu 10 E24.2 Dan E24.3 - Clarissa Nastania (441354)Clarissa NastaniaNo ratings yet

- Tugas AKM II Minggu 10 E24.2 Dan E24.3 - Clarissa Nastania (441354)Document2 pagesTugas AKM II Minggu 10 E24.2 Dan E24.3 - Clarissa Nastania (441354)Clarissa NastaniaNo ratings yet

- FSA - Class 15 - 13 October 2023 - RevSess2 - ExDocument15 pagesFSA - Class 15 - 13 October 2023 - RevSess2 - Exmhmdgholami0939No ratings yet

- Chapter 07 9E Problem SolutionsDocument23 pagesChapter 07 9E Problem Solutionsjames50% (2)

- CH 5 HW Solutions-1Document41 pagesCH 5 HW Solutions-1Jan SpantonNo ratings yet

- MGT Chap 6Document5 pagesMGT Chap 6tomNo ratings yet

- ASE3003209MADocument11 pagesASE3003209MAHein Linn Kyaw100% (1)

- AAHamlen 3e - Solutions Manual - Ch05Document48 pagesAAHamlen 3e - Solutions Manual - Ch05JimboWine100% (4)

- Chapter 11 SolutionsDocument22 pagesChapter 11 SolutionsChander Santos Monteiro100% (3)

- Lecture 5 - SolutionDocument7 pagesLecture 5 - SolutionIsyraf Hatim Mohd TamizamNo ratings yet

- CH 07Document3 pagesCH 07eagle1965No ratings yet

- EE - Assignment Chapter 7 SolutionDocument7 pagesEE - Assignment Chapter 7 SolutionXuân ThànhNo ratings yet

- Total Assets Total Liabilities Net IncomeDocument3 pagesTotal Assets Total Liabilities Net IncomeAllen BabasaNo ratings yet

- Solution Assignment 4 Chapter 7Document9 pagesSolution Assignment 4 Chapter 7Huynh Ng Quynh NhuNo ratings yet

- FIN-AW4 AnswersDocument14 pagesFIN-AW4 AnswersRameesh DeNo ratings yet

- Practical Financial Management Appendix BDocument16 pagesPractical Financial Management Appendix Bitumeleng10% (1)

- Review of Pakistan's Balance of Payments July 2008 - June 2009Document8 pagesReview of Pakistan's Balance of Payments July 2008 - June 2009Nauman-ur-RasheedNo ratings yet

- Chad-Cameroon Case AnalysisDocument15 pagesChad-Cameroon Case AnalysisPooja TyagiNo ratings yet

- Gitman IM ch08 PDFDocument17 pagesGitman IM ch08 PDFdmnque pileNo ratings yet

- Gitman IM Ch08Document17 pagesGitman IM Ch08Ahmad RahhalNo ratings yet

- C 14Document14 pagesC 14Hanuma GonellaNo ratings yet

- 5 +Modern+Macrame+Business+ModelDocument93 pages5 +Modern+Macrame+Business+ModelSnehaNo ratings yet

- Solutions Ch07Document15 pagesSolutions Ch07KyleNo ratings yet

- Chapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Document9 pagesChapter 11 Supplemental Questions: E11-3 (Depreciation Computations-SYD, DDB-Partial Periods)Dyan Novia67% (3)

- Financial and Managerial Accounting 15Th Edition Warren Solutions Manual Full Chapter PDFDocument67 pagesFinancial and Managerial Accounting 15Th Edition Warren Solutions Manual Full Chapter PDFclitusarielbeehax100% (12)

- ACCT 3110 CH 6 Homework E 1 2 3 7 8 11 12 14Document6 pagesACCT 3110 CH 6 Homework E 1 2 3 7 8 11 12 14John JobNo ratings yet

- Bank A and B - Bank XDocument4 pagesBank A and B - Bank XSoleil SierraNo ratings yet

- HW Git Man 10 Solution CH 08Document21 pagesHW Git Man 10 Solution CH 08Latifah MunassarNo ratings yet

- Escalante Water District: 2 Escalante City, Negros Occidental Telefax (034) 454-0563Document4 pagesEscalante Water District: 2 Escalante City, Negros Occidental Telefax (034) 454-0563adalcayde2514No ratings yet

- Preparation of Accounting Statements: VA (18) JDDocument39 pagesPreparation of Accounting Statements: VA (18) JDpenguinpowerrrrNo ratings yet

- InvestmentDocument9 pagesInvestmentgoerginamarquezNo ratings yet

- Week 10&11 Assignment-HernandezDocument3 pagesWeek 10&11 Assignment-HernandezDigna HernandezNo ratings yet

- Non-Financial Performance IndicatorsDocument5 pagesNon-Financial Performance IndicatorsMike WarrelNo ratings yet

- SKILLS - Project ManagerDocument1 pageSKILLS - Project ManagerMike WarrelNo ratings yet

- Mix and Yield VariancesDocument3 pagesMix and Yield VariancesMike WarrelNo ratings yet

- Performance Risk NotesDocument3 pagesPerformance Risk NotesMike WarrelNo ratings yet

- Membership Form: (An Official Body of Uok)Document1 pageMembership Form: (An Official Body of Uok)Mike WarrelNo ratings yet

- Semester Examinations Section University of KarachiDocument2 pagesSemester Examinations Section University of KarachiMike WarrelNo ratings yet

- IndustriesDocument3 pagesIndustriesMike WarrelNo ratings yet

- CoverDocument2 pagesCoverMike WarrelNo ratings yet

- Productivity and The Economics of Regulatory Compliance in Pharmaceutical ProductionDocument25 pagesProductivity and The Economics of Regulatory Compliance in Pharmaceutical ProductionMike WarrelNo ratings yet

- Common Stock Valuation: Jones, Investments: Analysis and ManagementDocument23 pagesCommon Stock Valuation: Jones, Investments: Analysis and ManagementMike WarrelNo ratings yet

- CH 08Document1 pageCH 08Mike WarrelNo ratings yet

- Faculty of Arts/Islamic Studies/Management Sciences Faculty of Science / PharmacyDocument86 pagesFaculty of Arts/Islamic Studies/Management Sciences Faculty of Science / PharmacyMike WarrelNo ratings yet

- Strategic Doing: The Art and Practice of Strategic Action in Open NetworksDocument14 pagesStrategic Doing: The Art and Practice of Strategic Action in Open NetworksMike WarrelNo ratings yet

- Exemption PipfaDocument1 pageExemption PipfaMike WarrelNo ratings yet

- Himsat 1Document4 pagesHimsat 1Mike WarrelNo ratings yet

- Saudi Cement Sector - February 2023 - Riyadh CapitalDocument4 pagesSaudi Cement Sector - February 2023 - Riyadh Capitalikhan809No ratings yet

- Group Action Learning Project: Financial Statement Analysis of HindalcoDocument13 pagesGroup Action Learning Project: Financial Statement Analysis of HindalcoRahul BaranwalNo ratings yet

- Accounting Group Assignment 1Document7 pagesAccounting Group Assignment 1Muntasir AhmmedNo ratings yet

- A) B) C) D) E) F) G) : Introduction To The TopicDocument3 pagesA) B) C) D) E) F) G) : Introduction To The TopicSaira KhanNo ratings yet

- Capital Structure Decisions in A Period of Economic Intervention Empirical Evidence of Portuguese Companies With Panel DataDocument31 pagesCapital Structure Decisions in A Period of Economic Intervention Empirical Evidence of Portuguese Companies With Panel Dataclelia jaymezNo ratings yet

- Homework 4Document5 pagesHomework 4Mawin S.No ratings yet

- E2 CH2 Alternative Approaches To Business ModelsDocument9 pagesE2 CH2 Alternative Approaches To Business ModelstutorbritzNo ratings yet

- Topic 6 MFRS 110 3 Event - After - Reporting PeriodDocument14 pagesTopic 6 MFRS 110 3 Event - After - Reporting Perioddini sofia100% (1)

- Tega Chap2Document16 pagesTega Chap2victor wizvikNo ratings yet

- Gat Subject Management - Sciences Finance mcqs51 100 PDFDocument5 pagesGat Subject Management - Sciences Finance mcqs51 100 PDFSamia Khalid0% (1)

- Chapter 1 - Income TaxDocument30 pagesChapter 1 - Income TaxKhanh LinhNo ratings yet

- CBL Performance AnalysisDocument7 pagesCBL Performance AnalysisJannatun NayeemaNo ratings yet

- Manual For Finance QuestionsDocument55 pagesManual For Finance QuestionsMShoaibUsmani100% (1)

- Quiz 5 Problems Second Semester AY2223 With AnswersDocument4 pagesQuiz 5 Problems Second Semester AY2223 With AnswersManzano, Carl Clinton Neil D.No ratings yet

- Parcor LawDocument21 pagesParcor LawKatrina PaquizNo ratings yet

- The Currency Trader's Handbook: by Rob Booker, ©2002-2006Document23 pagesThe Currency Trader's Handbook: by Rob Booker, ©2002-2006Pandelis NikolopoulosNo ratings yet

- New Chapter 17 - Cash FlowDocument17 pagesNew Chapter 17 - Cash FlowCheyenne Dawhitegurl GuillNo ratings yet

- Case Study - BCVE and Preacquistion EntriesDocument3 pagesCase Study - BCVE and Preacquistion EntriesHuỳnh Minh Gia HàoNo ratings yet

- Yield Curve What Is It Predicting YardeniDocument28 pagesYield Curve What Is It Predicting YardenisuksesNo ratings yet

- LS7&8Document9 pagesLS7&8JOJONo ratings yet

- SEBI - Guidance To General Public About Effective Ways To Redress TheirDocument10 pagesSEBI - Guidance To General Public About Effective Ways To Redress Theirrajit tillaniNo ratings yet

- Hamdani HannesDocument30 pagesHamdani HannesOwm Close CorporationNo ratings yet

- FM UnitDocument11 pagesFM Unitcharidham companyNo ratings yet

- Ratio Analysis-1Document4 pagesRatio Analysis-1Ramakrishna J RNo ratings yet

- Financial Ratio AnalysisDocument8 pagesFinancial Ratio AnalysisrapsisonNo ratings yet

- Principles of Cost Accounting. Chief Examiner's Reportfor Wassce (SC) 2023Document14 pagesPrinciples of Cost Accounting. Chief Examiner's Reportfor Wassce (SC) 2023abrahabrima4No ratings yet

- Account Application Booklet: Please Retu RN Entire Book LETDocument15 pagesAccount Application Booklet: Please Retu RN Entire Book LETibadwonNo ratings yet

- Capstone Project On REITS Dhara Badiani KHR2009PGDMF012Document67 pagesCapstone Project On REITS Dhara Badiani KHR2009PGDMF012puja bhatNo ratings yet

- SEATWORK-ASSIGNMENT EssayDocument1 pageSEATWORK-ASSIGNMENT Essaykwakie park100% (1)

- Chapter 16Document48 pagesChapter 16AudreyMae100% (1)

- Getting to Yes: How to Negotiate Agreement Without Giving InFrom EverandGetting to Yes: How to Negotiate Agreement Without Giving InRating: 4 out of 5 stars4/5 (652)

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)From EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Rating: 4.5 out of 5 stars4.5/5 (15)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindFrom EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindRating: 5 out of 5 stars5/5 (231)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)From EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Rating: 4.5 out of 5 stars4.5/5 (5)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsFrom EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsNo ratings yet

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!From EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Rating: 4.5 out of 5 stars4.5/5 (14)

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineFrom EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineNo ratings yet

- Overcoming Underearning(TM): A Simple Guide to a Richer LifeFrom EverandOvercoming Underearning(TM): A Simple Guide to a Richer LifeRating: 4 out of 5 stars4/5 (21)

- Purchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsFrom EverandPurchasing, Inventory, and Cash Disbursements: Common Frauds and Internal ControlsRating: 5 out of 5 stars5/5 (1)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesFrom EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesNo ratings yet

- The Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)From EverandThe Accounting Game: Learn the Basics of Financial Accounting - As Easy as Running a Lemonade Stand (Basics for Entrepreneurs and Small Business Owners)Rating: 4 out of 5 stars4/5 (33)

- Start, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookFrom EverandStart, Study and Pass The CPA Exam FAST - Proven 8 Step CPA Exam Study PlaybookRating: 5 out of 5 stars5/5 (4)

- Ratio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetFrom EverandRatio Analysis Fundamentals: How 17 Financial Ratios Can Allow You to Analyse Any Business on the PlanetRating: 4.5 out of 5 stars4.5/5 (14)

- Financial Accounting For Dummies: 2nd EditionFrom EverandFinancial Accounting For Dummies: 2nd EditionRating: 5 out of 5 stars5/5 (10)

- Warren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageFrom EverandWarren Buffett and the Interpretation of Financial Statements: The Search for the Company with a Durable Competitive AdvantageRating: 4.5 out of 5 stars4.5/5 (109)

- Accounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCFrom EverandAccounting For Small Businesses QuickStart Guide: Understanding Accounting For Your Sole Proprietorship, Startup, & LLCRating: 5 out of 5 stars5/5 (1)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsFrom EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsRating: 4 out of 5 stars4/5 (7)

- The Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyFrom EverandThe Big Four: The Curious Past and Perilous Future of the Global Accounting MonopolyNo ratings yet

- Your Amazing Itty Bitty(R) Personal Bookkeeping BookFrom EverandYour Amazing Itty Bitty(R) Personal Bookkeeping BookNo ratings yet

- Attention Pays: How to Drive Profitability, Productivity, and AccountabilityFrom EverandAttention Pays: How to Drive Profitability, Productivity, and AccountabilityNo ratings yet

- Contract Negotiation Handbook: Getting the Most Out of Commercial DealsFrom EverandContract Negotiation Handbook: Getting the Most Out of Commercial DealsRating: 4.5 out of 5 stars4.5/5 (2)

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItFrom EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItRating: 4.5 out of 5 stars4.5/5 (14)