Professional Documents

Culture Documents

Abstract Vit

Uploaded by

Shalini SrivastavOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Abstract Vit

Uploaded by

Shalini SrivastavCopyright:

Available Formats

FOREIGN INVESTMENT IN INDIA: RISKS AND RETURNS

By

Prof.Shalini Srivastav Research Scholar Email : shalini_77@sify.com Mobile : 9873965507

ABSTRACT

With a control free economy, supported by expert banking facilities, Indian capital market offers a plethora of investment options both for residents and NRIs. As per the investment plan an investor should thoughtfully select the best option available in the capital market that meets his requirements. Foreign investments are always risk oriented. There are several risk factors that affect your investment through some way or the other. To name a few: Currency Risk, Political Risk, Government Policies, Local Tax Policies, Environmental Uncertainities etc. are the risks associated with international investments. The major of all is Exchange Rates Fluctuations as the investor has to convert the return into domestic currency before actually enjoying the profit. Foreign Direct Investment (FDI) is the outcome of the mutual interest of multinational firms and host countries. While multinational firms with the expectation of earning relatively higher rate of return on their investments, invest in foreign markets, such investments have proved to be playing an important role in the development of economy. This paper examines the various aspects of FDI from investing firms as well as from receiving countries' point of views. The paper mainly focuses on the risk and return from firms' perspective and on the strategies to attract FDI from host countries' point of view.

KEYWORDS

Foreign direct investment , globalization, , return , currency risk , political risk.

INTRODUCTION

Foreign direct investment (FDI) is a direct investment into production or business in a country by a company in another country, either by buying a company in the target country or by expanding operations of an existing business in that country. Foreign direct investment is in contrast to portfolio investment which is a passive investment in the securities of another country such as stocks and bonds. Foreign direct investment has many forms. Broadly, foreign direct investment includes "mergers and acquisitions, building new facilities, reinvesting profits earned from overseas operations and intercompany loans" In a narrow sense, foreign direct investment refers just to building new facilities. The numerical FDI figures based on varied definitions are not easily comparable. (1)FDI is defined as the net inflows of investment (inflow minus outflow) to acquire a lasting management interest (10 percent or more of voting stock) in an enterprise operating in an economy other than that of the investor. [2] FDI is the sum of equity capital, other long-term capital, and short-term capital as shown the balance of payments. FDI usually involves participation in management, joint-venture, transfer of technology and expertise. There are two types of FDI: inward and outward, resulting in a net FDI inflow (positive or negative) and "stock of foreign direct investment", which is the cumulative number for a given period. Direct investment excludes investment through purchase of shares. [3] FDI is one example of international factor movements. Types of FDI:

Horizontal FDI arises when a firm duplicates its home country-based activities at the

same value chain stage in a host country through FDI. Platform FDI Vertical FDI takes place when a firm through FDI moves upstream or downstream in different value chains i.e., when firms perform value-adding activities stage by stage in a vertical fashion in a host country

Horizontal FDI decreases international trade as the product of them is usually aimed at host country; the two other types generally act as a stimulus for it.

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- Budget in Parliament of IndiaDocument6 pagesBudget in Parliament of IndiaT-12No ratings yet

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- Employability Skills Workshop 18, 19, 20 OCTOBER 2012: PGDM 11-13 BatchDocument5 pagesEmployability Skills Workshop 18, 19, 20 OCTOBER 2012: PGDM 11-13 BatchShalini SrivastavNo ratings yet

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- Case Studies of Cost and Works AccountingDocument17 pagesCase Studies of Cost and Works AccountingShalini Srivastav50% (2)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Smita Mankad Bio Apr13Document2 pagesSmita Mankad Bio Apr13Shalini SrivastavNo ratings yet

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Present Value TablesDocument2 pagesPresent Value TablesFreelansir100% (1)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- Accman: Integrating Knowledge and PracticeDocument6 pagesAccman: Integrating Knowledge and PracticeShalini SrivastavNo ratings yet

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Guidelines On Implementation ofDocument4 pagesGuidelines On Implementation ofShalini SrivastavNo ratings yet

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Annexure 2Document13 pagesAnnexure 2Shalini SrivastavNo ratings yet

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

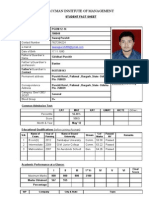

- Prasenjit Fact SheetDocument3 pagesPrasenjit Fact SheetShalini SrivastavNo ratings yet

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- FDI Book FinalDocument100 pagesFDI Book FinalShalini SrivastavNo ratings yet

- Prasenjit Fact SheetDocument3 pagesPrasenjit Fact SheetShalini SrivastavNo ratings yet

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

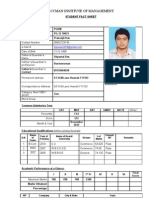

- Accman Institute of Management: Student Fact SheetDocument3 pagesAccman Institute of Management: Student Fact SheetShalini SrivastavNo ratings yet

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

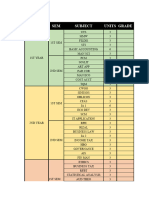

- Summary of Grades Gwa CalculatorDocument4 pagesSummary of Grades Gwa CalculatorRenelyn FiloteoNo ratings yet

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Chapter 10 - Financial Markets PDFDocument4 pagesChapter 10 - Financial Markets PDFKelrina D'silvaNo ratings yet

- IDEX 2022 Q4 Interim ReportDocument26 pagesIDEX 2022 Q4 Interim ReportMaria PolyuhanychNo ratings yet

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- Banking Law and PracticeDocument89 pagesBanking Law and Practicethangarajbala123No ratings yet

- Course Outline Financial Markets & InstitutionsDocument6 pagesCourse Outline Financial Markets & Institutionskonica chhotwaniNo ratings yet

- Statement 932073059 20221025 112113 56Document1 pageStatement 932073059 20221025 112113 56hari tejaNo ratings yet

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- Mcom Exam Form Acknowledgment - Sem 3 PDFDocument2 pagesMcom Exam Form Acknowledgment - Sem 3 PDFMansi KotakNo ratings yet

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Andleeb Abbas - Declaration of Assets Liabilities - Dec 2013Document4 pagesAndleeb Abbas - Declaration of Assets Liabilities - Dec 2013PTI Official100% (1)

- Q4 2022 PitchBook Analyst Note 2023 US Private Equity OutlookDocument14 pagesQ4 2022 PitchBook Analyst Note 2023 US Private Equity Outlookmayowa odukoyaNo ratings yet

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Mathematics in Financial Risk ManagementDocument10 pagesMathematics in Financial Risk ManagementJamel GriffinNo ratings yet

- EBS Payment Gateway ProposalDocument8 pagesEBS Payment Gateway ProposalBarun SahaNo ratings yet

- Chapter 6 - Money MarketsDocument47 pagesChapter 6 - Money MarketsBeah Toni PacundoNo ratings yet

- ReviewerDocument3 pagesReviewergirlNo ratings yet

- YONODocument105 pagesYONOmalarkurinji78No ratings yet

- Loan Contract OrnopiaDocument5 pagesLoan Contract OrnopiaaizhelarcipeNo ratings yet

- MBBsavings - 164017 212412 - 2022 08 31 PDFDocument4 pagesMBBsavings - 164017 212412 - 2022 08 31 PDFAdeela fazlinNo ratings yet

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- ch13 Fin303Document31 pagesch13 Fin303Bui Thi Thu Hang (K13HN)No ratings yet

- 2nd Mini Case StudyDocument4 pages2nd Mini Case StudyMarga GuilaranNo ratings yet

- D Mercer - Private Client Case Study-V1Document5 pagesD Mercer - Private Client Case Study-V1kapoor_mukesh4uNo ratings yet

- Quiz 1 Matbis Revised Without Key AnswerDocument18 pagesQuiz 1 Matbis Revised Without Key AnswerNadya Estefania Brenaita SurbaktiNo ratings yet

- Bbse3009 1415 EnggEcon 01Document60 pagesBbse3009 1415 EnggEcon 01Jeff MedinaNo ratings yet

- Bloomberg Businessweek - 27 January-2 February 2014.bakDocument72 pagesBloomberg Businessweek - 27 January-2 February 2014.bakMichael MihaiNo ratings yet

- Grade 5 English Module 1 FinalDocument19 pagesGrade 5 English Module 1 FinalAlicia Nhs100% (4)

- FAR-1stPB 10.22Document8 pagesFAR-1stPB 10.22Harold Dan AcebedoNo ratings yet

- Financial Statement Analysis and Security Valuation: Stephen H. PenmanDocument24 pagesFinancial Statement Analysis and Security Valuation: Stephen H. PenmanodvutNo ratings yet

- Inclusive Growth GS 3 Economy - Adil BaigDocument19 pagesInclusive Growth GS 3 Economy - Adil BaigArav-வும் Sri-யும்No ratings yet

- Scrip Bitcoin v1Document5 pagesScrip Bitcoin v1Mostafa KamjooNo ratings yet

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- Working of Depositary System 110820104758 Phpapp02Document76 pagesWorking of Depositary System 110820104758 Phpapp02harsh royNo ratings yet

- Sumit Sarkar, Tanika Sarkar - Caste in Modern India - A Reader (2014, Permanent Black)Document1,177 pagesSumit Sarkar, Tanika Sarkar - Caste in Modern India - A Reader (2014, Permanent Black)Dhruv Aryan KundraNo ratings yet

- NorQuant Multi-Asset Fund White Paper 2023Document24 pagesNorQuant Multi-Asset Fund White Paper 2023oscar.haukvikNo ratings yet