Professional Documents

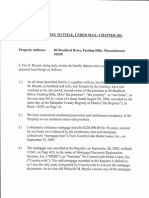

Culture Documents

Transcript of VA House Testimony in Reference To HB 1506 by MERS General Counsel William Hultman

Uploaded by

Tim BryantOriginal Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Transcript of VA House Testimony in Reference To HB 1506 by MERS General Counsel William Hultman

Uploaded by

Tim BryantCopyright:

Available Formats

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

ROUGH TRANSCRIPT

COMMITTEE MEMBER: relation to that? MR. HULTMAN: agent of the lender. We're the beneficiary, but we're an So instead of having two -- one party be Can you explain what you are in

both the payee on the note and the beneficiary in deed of trust, we're the beneficiary as their agent. In other words,

we're holding title to the mortgage lien on their behalf. COMMITTEE MEMBER: nominee? MR. HULTMAN: agent. COMMITTEE MEMBER: MR. HULTMAN: Okay. So the actual record -Well, nominee is just another word for Through this process called

And the mortgage gets recorded or the

deed of trust gets recorded so the world is on notice that there is a lien against the property, which is what the purpose of land records are. COMMITTEE MEMBER: MR. HULTMAN: Right.

History, even before MERS, it was never

the role of the land records to tell anybody who the owner of the indebtedness was. COMMITTEE MEMBER: MR. HULTMAN: I don't disagree.

And -- I'm sorry? I don't disagree with that.

COMMITTEE MEMBER:

1 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

MR. HULTMAN:

Oh, okay.

Fair enough.

Just in response to something else that I heard you ask the people from the Banker's Association. One of the other

reasons why I think some of the states have not gone down this path about having the certificate of title for the indebtedness is because the federal law already provides a lot of protection for the borrowers. Under RESPA, any borrower is entitled to

write a letter to the servicer and the servicer is obligated under federal law in RESPA to give -- disclose the person who holds their note. Also, last year from the federal legislation that got passed in May, and this is the (inaudible) amendment, I forget the name, but the statute, but it amended the Truth and Lending Act and added a section, 404, that requires now that every time the note is transferred, the transferee or the purchaser of the note is required under federal law to give notice to the borrower that they now own the note. So this notion somehow that we have to put another record in the land record, and one of the reasons that MERS exists today is because prior to MERS all these assignments were not getting recorded or they were being done improperly, they would get rejected, and there would be breaks in the chain of title. MERS (inaudible) the title to the mortgage lien in

MERS so that from the beginning to the end, the loan, period, is never going to be a break of title because the assignments

2 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

were recorded. COMMITTEE MEMBER: Let me ask this question. So as I

understand it, actually there never is an assignment made ever because you from the beginning are the beneficiary -MR. HULTMAN: That's correct. So for purposes of recording in

COMMITTEE MEMBER:

our courthouses, there is never an assignment that's ever made. The assignment, if there is one, would be a change in the actual underlying promissory note. MR. HULTMAN: And that's where I think some of the They

confusion comes up with people when they talk about MERS.

use the word assignment and mortgage and mortgage loan and note interchangeably when there are two distinct instruments and -COMMITTEE MEMBER: there's a note. MR. HULTMAN: When -- I use mortgage, deed of trust. (Inaudible.) (Inaudible) deed of trust and

COMMITTEE MEMBER: MR. HULTMAN: perspective.

They're interchangeable from our

We're really a holder of the mortgage -Right, but in Virginia you have

COMMITTEE MEMBER:

deed of trust that deals with the ownership of the property, and then you have a promissory note which is never recorded, which deals with the obligation on the debt. MR. HULTMAN: That's correct. What you're saying is, is this

COMMITTEE MEMBER:

3 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

language in this bill that talks about assignments really doesn't affect you anyway because -MR. HULTMAN: I think it would cause more confusion I mean, a lot of what we see -Borrowers call me

than it solves any problems.

and frankly, I talk to borrowers everyday. up.

I mean, we heard the story from one of the lawyers here

about how these things went in wrong places and did things. Well, people make mistakes. You know, if somebody called me up and asked me, which they didn't, we would have helped them sort out that problem. We would have gone to -- and I do this everyday.

Borrowers call us up and they say, I don't know who my noteholder is. Because if they go on our website or if they go

into the toll-free number that they can call, we'll tell them the identity of the current servicer and we'll also -- for 97 percent of our members who haven't opted out, we'll give them the name of the noteholder, and sometimes I'll even give them the noteholder's name if they have a compelling reason for it even when they -COMMITTEE MEMBER: MR. HULTMAN: And their contact information? I mean, we'll give

Contact in -- yeah.

that information up to the people.

Now, again, that's a more That was

-- the owner -- we always show who the servicer was. our purpose.

Now, since all of this activity has gone on,

we've been able to convince our members that, for most of them

4 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

at least, that we'll be willing to disclose the -- who holds the note on their -- who (inaudible.) COMMITTEE MEMBER: COMMITTEE MEMBER: Anything else? (Inaudible.) This section

I have a question.

404 you were just talking about -MR. HULTMAN: Section 404. Yeah, section 404, it requires

COMMITTEE MEMBER: what now? MR. HULTMAN:

When the note is transferred or sold,

the federal legislation requires a notice be delivered to the borrower from the purchaser or the transferee of the note. whoever has acquired that note for whatever reason, doesn't actually have to be a sale, but it could be -- as long as they're the subsequent holder of the note or the owner of the loan, they're -COMMITTEE MEMBER: MR. HULTMAN: (Inaudible) company? They're required to deliver So

Right.

this notice to the borrower, and on it, it says who the owner of the note is. It also tells the borrower who they have to So, for

contact to -- if they have questions about the note.

example, a bank is using a servicer or a trustee is using a servicer to collect the payments for that, which is what most professional investors do today. So, for example, you know,

right now 98 percent of the loans are done by Freddie (inaudible) -- purchased by Freddie (inaudible). And, you

5 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

know, they all use professional services because they're not in that business. They're in the business of owning notes and So

making sure they get distributed to investors world-wide. they'll tell you who to contact and they'll give specific

contact information in that notice to let them know who they need to talk to if they have problems with their loan. COMMITTEE MEMBER: This is just a follow-up. So

you're saying that the recordation part here that's in this bill, it wouldn't affect you anyway? MR. HULTMAN: Well, I think it would cause confusion

and it would up end up -COMMITTEE MEMBER: it would not affect you -MR. HULTMAN: Yeah, that's right. -- because you're on the original So it would be your position that

COMMITTEE MEMBER: (inaudible). MR. HULTMAN: to us has not changed. COMMITTEE MEMBER:

We're on the deed, and the conveyance

So in other words, where the

change is coming is in the promissory notes? MR. HULTMAN: Exactly. And then what you're doing is

COMMITTEE MEMBER:

you're acting sort of after the -- you're acting as a clearing house for determining -- I mean, that -- but you know that's not very well advertised. I mean, I don't think there are a

6 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

lot of people that know -MR. HULTMAN: I would say that there's a lot of -I --

COMMITTEE MEMBER: MR. HULTMAN:

-- misunderstanding about MERS in the You go to our

press and in the Internet stories about MERS.

website, and maybe our website is not the most user-friendly website, but we're a very transparent company. Everything

about MERS is pretty much on our website, and as I said, we disclose who we're acting for. The fact that we're acting as this nominee or agent is disclosed in the instrument. The fact that the instrument

and the borrower agrees in the deed of trust that if the investor or servicer so desires, MERS may actually conduct the foreclosure process in the states. And there is no state that

has said that we're doing anything in contravention to state law in any of the 50 states so far. There's a lot of noise.

And you've heard about cases where they say MERS got kicked out of court. Well, that may be true, but it's not

because MERS is not legal or MERS is not within compliance with state law. It's because there was a defect in the process, and

the party who is bringing the prosecution had not done all of the paperwork that they needed to be done, and those cases are usually dismissed without prejudice and they can go back and remedy those positions. But a lot of times that gets recorded

as MERS got kicked out of court or MERS loses a case.

7 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

COMMITTEE MEMBER: COMMITTEE MEMBER: COMMITTEE MEMBER:

Mr. Chairman -Any other questions? Mr. Chairman, I was going to ask a

question about how I find my mortgage on the website, but I went on their website and I (inaudible) found my mortgage in about ten seconds (inaudible). MR. HULTMAN: Now, I would say this, MERS only has 60 There are some people who chose not They buy

percent of the mortgages.

to use MERS for -- because they don't sell the loan.

the loan and they hold the service and they hold the mortgage note or they secure -- so, you know, not everybody will find their mortgage on the system because we don't have a hundred percent of the marketshare. COMMITTEE MEMBER: -MR. HULTMAN: I think it was May 2009. Well, what I'm showing is that it Mr. Chair, when was this section

COMMITTEE MEMBER: was passed December 18, 2010. COMMITTEE MEMBER: MR. HULTMAN:

It was approved. I may be off.

Could have been. Yeah.

COMMITTEE MEMBER:

So, I guess, what your

position would be based on that is you now have to provide notice to everybody whenever you transfer -MR. HULTMAN: If history shows anything, adding

additional requirements to record documents with a county or

8 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

clerk will result in more problems, not less problems. costs.

It adds

People will forget to do it, because people are human,

and then there's a question about what happens if we don't file it, what impact does it have on the process other than just trying to foreclose. Part of the problem with the statute can also be looked at is it's only requiring the assignments and these transfer notices to be effective if it's only to prosecute the foreclosure. You know, I get a lot of people who call me up

and say, I can't find who has -- I want my lien released, and we'll sign the lien release if we're satisfied that the note has been paid off. We can go to the title company and they'll

give us the information and we can actually do that on behalf of borrowers. We probably do this a dozen times where we help

borrowers release their liens when they're not there. If the statute, you know, it doesn't -- it doesn't -it's not going to change human nature. make mistakes. get filed. forward. People are going to

Assignments and these transfer notices will not

It will cause further problems for borrowers going (Inaudible) foreclosure process. COMMITTEE MEMBER: COMMITTEE MEMBER: COMMITTEE MEMBER: Mr. Chairman. (Inaudible). Thank you.

Sir, you've been here most of the afternoon; have you not?

9 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

MR. HULTMAN: yes.

I have listened to the whole testimony,

COMMITTEE MEMBER:

And you heard a lot of the stories

where folks are saying they couldn't find out who owned the note or anything like that. Do I understand that if their note

were, in fact, being held by your company, that they should have been able to find that out? MR. HULTMAN: If -- first of all, just -- just to be

clear, MERS doesn't hold the notes except in the limited sense that if they're foreclosing, our rules require us to have possession of the note to foreclose. But if the note had been registered on MERS, it would certainly have been easier for a borrower to find out who owned this loan, and one of the problems, and I'll be frank with you, one of the problems is that, you know, I think that because the investor community have -- they're not servicers and they're not mortgage companies. They're investors. They have

delegated the authority to modify loans and make deals with borrowers to their servicer. And there's a lot of confusion

with the borrower community about who is the right person to talk to. You can call up the bank in New York if they're the trustee. But that's twelve guys in an office in Washington or

New York City or Chicago who have delegated that authority to people who know how to deal with mortgages, which are the

10 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

mortgage companies, the servicers who are doing these things. So they can call up -- they can call the investors up, but the investors are just going to tell them they need to go back to the servicer because that's the party that they've empowered to make those -COMMITTEE MEMBER: MR. HULTMAN: Who are the servicers? I mean,

They're mostly national banks.

the five biggest servicers hold probably 80 percent of the servicing in the country today. COMMITTEE MEMBER: So your role is, is if they

contact MERS, you're the one who tells them who the servicer is to do their loan modification for a -MR. HULTMAN: Exactly. -- short sale --

COMMITTEE MEMBER: MR. HULTMAN: Yes.

COMMITTEE MEMBER:

-- and in the event that loan

modification or short sale does not happen, you are the entity that acts as the agent for the deed of trust beneficiary to foreclose on the deed of trust? MR. HULTMAN: If the investor chooses to do that. I think

Most people today do not foreclose in (inaudible).

they have decided because of a lot of the adverse publicity and a lot of the noise in the press and just in general and the uncertainty in their minds in the courts, they have chosen to not do that, in which case an assignment of the beneficial

11 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

interest would be made and recorded in the land record. So if, for example, if we're serving the land records for Fannie Mae as the investor and Chase is the servicer and they want to foreclose, typically today they will actually assign the beneficial interest probably to Chase, and that assignment must be recorded, and our rules require that it get recorded before the assignment -- before the foreclosure process is started. Because, you know, a lot of times, there

have been people who have not done that and done it after the fact and they've been kicked out of court and rightly so. So our rules actually require that if they're going to foreclose in the servicer's name, they need to do the assignment of the beneficial interest out of our -- out of the MERS name. COMMITTEE MEMBER: witness? COMMITTEE MEMBER: COMMITTEE MEMBER: COMMITTEE MEMBER: Just one follow-up, if I may? Go right ahead. Sir, you -- it sounds like you've Any other questions for this

appreciated the fact that there is a problem here; is that right? MR. HULTMAN: calls every -COMMITTEE MEMBER: My question then is this: What I get -- like I said, I get dozens of

could you tell this panel, I mean, this committee, that would

12 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

help us understand -- help these people that have talked about these stories that they've given us this afternoon? What would

you suggest we could do by way of legislation that would help? MR. HULTMAN: I'm not -- I think anything that you

can do to help enhance the modification process is probably where the focus ought to be, because that's really what borrowers are looking for. They're calling me up and saying --

you know, I think you heard that theme throughout the borrowers. So it's really focusing on the modification process, which means that you have to engage the investor community because ultimately they're the ones who -- and servicers really are limited and the banks are limited when their net capacity. Only when they own the loan do they have the ability to make those modifications, because most of the modifications are -those provisions are already in -- baked into the servicing agreements that they have with the investors. So it's really the focus should be on the investor community, and know that in the federal level that's where a lot of the activity is, trying to figure out programs that will enhance the ability for people to get modifications, and more importantly, be able to successfully modify. I mean, one of the problems we see today is loans get modified and they're still not able -- still unable to make payments. So I think focusing on the underlying economics and

13 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

not the structural procedural things is really where the focus of the legislature ought to be. COMMITTEE MEMBER: COMMITTEE MEMBER: Mr. Chairman? I do want to add one thing before

we move on to more questions, and that is, I think you're correct. May 2009 is when the legislation went into place that

said that you have to provide notice to the homeowner about any (inaudible). MR. HULTMAN: Thank you. You were right on that. (Inaudible). I want to build on a question that

COMMITTEE MEMBER: COMMITTEE MEMBER: COMMITTEE MEMBER:

Delegate Cleveland -- really, when we heard the testimony from these other folks today, it seemed there were two things. One

is connecting the investor and the homeowner, which they would claim is not possible given the lack of information that flows through the system. They don't know who these people are, so So they can't modify, because they

they can't get to them. don't know.

And by the time they get to them, it's too late.

And that gets to the second point of the bill that they're trying to argue for, and that is extended time, to give some more time for them to find the investors. So I guess my question builds on his, and that is, what do you do if -- I'm hearing you say, yeah, we've got to work with the investor community, and I'm hearing proponents of

14 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

the bill saying, we can't find them and we don't have enough time to get to them so we can work something out. the answer? MR. HULTMAN: Well, I think -- first of all, I think I think So what's

it's not correct to say that they can't find them.

sometimes what happens is, is that the investors will tell them you need to deal with the servicer. And -- because I get this They'll call me up and I'll tell

conversation with borrowers every week.

say, can you tell me who the investor of my note is.

them and I'll say, but, you know, they're going to just refer you back to the servicer. And the servicer is the one who

really has -- the infrastructure that is prepared to deal with these things. I mean, trustees are a small group of people who are really required to -- and investors, are really -- all they're doing is transmitting the payments from the people who made -who take out these loans to the people who invested in them, who could be doctors in Singapore, for all we know. They've delegated that to the mortgage companies because the mortgage companies admittedly are stressed with the amount of work that they have to do given the extent of the prices here. But they're the ones that have the They're the ones who actually have the loan

infrastructure. files.

Investors typically do not have the loan files in their Those loan files are with the servicers who are

possession.

15 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

collecting the payments every day. So they're really the only party who is into the land record -- or, excuse me, in position to actually understand what the loan is and how -- and what's the payments that the borrower could make given their current circumstances. know how to judge credit. things. They know how to do all those That's why They

The investors are not prepared to do that.

they delegated all of this to the servicer community to do all of that work. So, and, again, you know, I don't have -- I'm not really -- I don't really have an opinion on whether 45 days or 12 days or 15 days, but there's -- that's not the only part where they have a chance to do things. process. This is an elongated

I think somebody testified who said that it takes at That -- and

least a year, and I think that's probably right. it's probably longer right now.

I think -- we've seen -- and because we're the mortgagee or we're the beneficiary, we get service of process on foreclosures when we're being foreclosed on. So in other

words, MERS can also be in a subordinate or junior position or senior position, and if a loan is being foreclosed, we'll get that service of process. COMMITTEE MEMBER: -MR. HULTMAN: Exactly. (Inaudible) second deed of trust

16 ROUGH TRANSCRIPT

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25

COMMITTEE MEMBER: (inaudible) -MR. HULTMAN: (inaudible)

(Inaudible) first deed of trust

And we'll get that notice and we

So we see every day how much mail is coming I mean, I think

through, and I think the system is strained.

we're at capacity how many things we can do, and I think that's causing a lot of problems that you heard today. COMMITTEE MEMBER: witness? COMMITTEE MEMBER: to speak against it? MR. HULTMAN: Thank you. Thank you. All right. Does anybody else want Any other questions for this

COMMITTEE MEMBER:

17 ROUGH TRANSCRIPT

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (895)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (73)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Notarial PracticeDocument21 pagesNotarial PracticeRon AceroNo ratings yet

- GSMSC Certificate - Involuntary RevokationDocument2 pagesGSMSC Certificate - Involuntary RevokationTim BryantNo ratings yet

- Print Over SignatureDocument2 pagesPrint Over SignatureTim Bryant100% (2)

- MWG GuidanceDocument73 pagesMWG Guidancejordimon1234No ratings yet

- Extracting Signatures From Bank Checks - 2003Document10 pagesExtracting Signatures From Bank Checks - 2003Tim BryantNo ratings yet

- Harmon Notice of Foreclosure Sale - 05 22 2015 - HIGHLIGHTEDDocument10 pagesHarmon Notice of Foreclosure Sale - 05 22 2015 - HIGHLIGHTEDTim BryantNo ratings yet

- EFF - DocuColor Tracking Dot Decoding GuideDocument6 pagesEFF - DocuColor Tracking Dot Decoding GuideTim BryantNo ratings yet

- Mortgages Notes Deeds and Loans in Crime-Gary MichaelsDocument15 pagesMortgages Notes Deeds and Loans in Crime-Gary MichaelsTim Bryant100% (2)

- FRB Report - 100517-Clearing Banks As Loan Funders-BONYDocument43 pagesFRB Report - 100517-Clearing Banks As Loan Funders-BONYTim BryantNo ratings yet

- Mortgage Page 10 - Line Through SignatureDocument1 pageMortgage Page 10 - Line Through SignatureTim BryantNo ratings yet

- Note and Rider 2005Document8 pagesNote and Rider 2005Tim BryantNo ratings yet

- Affidavits of Title - EXECUTED - 06 26 2015Document10 pagesAffidavits of Title - EXECUTED - 06 26 2015Tim BryantNo ratings yet

- MA OCR - Mortgage Lending in Licensed Name Only-Summary of Selected Opinion 99-026Document1 pageMA OCR - Mortgage Lending in Licensed Name Only-Summary of Selected Opinion 99-026Tim BryantNo ratings yet

- Pinti V Emigrant 2015-Sjc-11742Document44 pagesPinti V Emigrant 2015-Sjc-11742Tim BryantNo ratings yet

- MERS To BAC Assignment 05 11 2011Document1 pageMERS To BAC Assignment 05 11 2011Tim BryantNo ratings yet

- Bryant Mortgage PG 2Document1 pageBryant Mortgage PG 2Tim BryantNo ratings yet

- BofA To Nationstar 07 30 2013-80 BradfordDocument1 pageBofA To Nationstar 07 30 2013-80 BradfordTim BryantNo ratings yet

- 2015 Copy of Note - HarmonLaw - BryantDocument6 pages2015 Copy of Note - HarmonLaw - BryantTim Bryant100% (2)

- 2013 Copy of Note - HarmonLaw - BryantDocument6 pages2013 Copy of Note - HarmonLaw - BryantTim BryantNo ratings yet

- GSAA Home Equity Trust 2005-15 / Received Mortgage Assignment 7 Yrs After Closing Date of The Trust.Document1 pageGSAA Home Equity Trust 2005-15 / Received Mortgage Assignment 7 Yrs After Closing Date of The Trust.Tim BryantNo ratings yet

- Nationstar Poa For HSBC Gsaa Het 2005-15-2014 HcrodDocument7 pagesNationstar Poa For HSBC Gsaa Het 2005-15-2014 HcrodTim BryantNo ratings yet

- Paths of Notes and Mortgages - Loan 114726037Document24 pagesPaths of Notes and Mortgages - Loan 114726037Tim BryantNo ratings yet

- Bryant Mortgage 2005 - RODDocument16 pagesBryant Mortgage 2005 - RODTim BryantNo ratings yet

- DBNT Not Registered To Do Business in NYDocument1 pageDBNT Not Registered To Do Business in NYTim BryantNo ratings yet

- GSAA HET 2005 15 Not Registered To Do Business in NYDocument1 pageGSAA HET 2005 15 Not Registered To Do Business in NYTim BryantNo ratings yet

- Closing Version Mortgage-Rider 2005 BryantDocument16 pagesClosing Version Mortgage-Rider 2005 BryantTim BryantNo ratings yet

- GS Mortgage Securities Corp Not Authorized To Do Business in NYDocument1 pageGS Mortgage Securities Corp Not Authorized To Do Business in NYTim BryantNo ratings yet

- Deutsche Bank National Trust Is Not Registered To Do Business in MADocument1 pageDeutsche Bank National Trust Is Not Registered To Do Business in MATim BryantNo ratings yet

- GSAA HET 2005 15 Not Registered To Do Business in MADocument2 pagesGSAA HET 2005 15 Not Registered To Do Business in MATim BryantNo ratings yet

- A0T0CZ - GSAA Home Equity Trust 2005-15 Bond - 0.437% Until 01-25-2036 - FinanzenDocument3 pagesA0T0CZ - GSAA Home Equity Trust 2005-15 Bond - 0.437% Until 01-25-2036 - FinanzenTim BryantNo ratings yet

- Tolentino and Mojica V COMELEC GR. 148334Document3 pagesTolentino and Mojica V COMELEC GR. 148334sabethaNo ratings yet

- Binder 1 LSTDocument123 pagesBinder 1 LSTkonark singhNo ratings yet

- Tomas Claudio Memorial College V CADocument2 pagesTomas Claudio Memorial College V CAMay RMNo ratings yet

- Up 2023 Civil-Law LMTDocument20 pagesUp 2023 Civil-Law LMTShelvin EchoNo ratings yet

- Torrez v. McKee, Et Al - Document No. 3Document2 pagesTorrez v. McKee, Et Al - Document No. 3Justia.comNo ratings yet

- 036 - Maersk Line v. CA, 222 SCRA 108, (1993)Document2 pages036 - Maersk Line v. CA, 222 SCRA 108, (1993)Law StudentNo ratings yet

- US VS., BustosDocument4 pagesUS VS., BustosAldrinmarkquintanaNo ratings yet

- RENT AGREEMENT AtrDocument4 pagesRENT AGREEMENT AtrakashsattwikeeNo ratings yet

- "Children's Rights": Republic Act 7610: Special Protection of ChildrenDocument4 pages"Children's Rights": Republic Act 7610: Special Protection of ChildrenPIT ad Rodelito TrasporteNo ratings yet

- Mensa Test Application FormDocument2 pagesMensa Test Application FormDavid TurnerNo ratings yet

- Calderon Vs CaraleDocument3 pagesCalderon Vs CaralePatricia Denise Emilio-Del PilarNo ratings yet

- Trustee of The Summers Family Trust TA Neak Products Buff WA Pty v. National Distib. Ctr. - ComplaintDocument25 pagesTrustee of The Summers Family Trust TA Neak Products Buff WA Pty v. National Distib. Ctr. - ComplaintSarah BursteinNo ratings yet

- SolPals v. Handstands Promo - ComplaintDocument48 pagesSolPals v. Handstands Promo - ComplaintSarah BursteinNo ratings yet

- Agra Case DigestDocument4 pagesAgra Case DigestArdenNo ratings yet

- SOG 2.1 Transfer of PropertyDocument32 pagesSOG 2.1 Transfer of Propertyyashovardhan rathoreNo ratings yet

- AffidavitDocument5 pagesAffidavitAKSHAY GUTKANo ratings yet

- BL Idssi 73161122060037 2022062306370908231319Document1 pageBL Idssi 73161122060037 2022062306370908231319Fitri FitrianahNo ratings yet

- Garcia, Alexandra G. JD 1-1Document2 pagesGarcia, Alexandra G. JD 1-1Alexandra GarciaNo ratings yet

- Transpo Cases - Final CoverageDocument23 pagesTranspo Cases - Final CoverageRoger RanigoNo ratings yet

- (Reviewer) UP 2020 BOC Reviewer in Insurance LawDocument61 pages(Reviewer) UP 2020 BOC Reviewer in Insurance LawAlena Icao-Anotado100% (1)

- Hermoso v. CADocument3 pagesHermoso v. CAClyde Tan100% (2)

- G.R. No. 228000Document6 pagesG.R. No. 228000Hannah VictoriaNo ratings yet

- Pale ExamDocument4 pagesPale ExamPatrick Tan100% (1)

- Republic v. EbradaDocument2 pagesRepublic v. Ebradaclaire beltranNo ratings yet

- Jurisprudence (Aishwarya)Document17 pagesJurisprudence (Aishwarya)Aishwarya MathewNo ratings yet

- Hulst v. PR BuildersDocument2 pagesHulst v. PR BuildersMark CoNo ratings yet

- LEonen CAse-CSCDocument11 pagesLEonen CAse-CSCDanielle Edenor Roque PaduraNo ratings yet

- #1 Gercio vs. Sun LifeDocument1 page#1 Gercio vs. Sun LifeJosiebethAzueloNo ratings yet

- Constitution 2 Case Assignment NR 6-04-04 2021Document19 pagesConstitution 2 Case Assignment NR 6-04-04 2021Cecilia Alexandria GodoyNo ratings yet