Professional Documents

Culture Documents

Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)

Uploaded by

api-173610472Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)

Uploaded by

api-173610472Copyright:

Available Formats

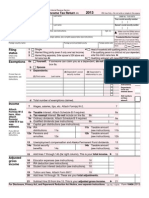

Form

2441

Child and Dependent Care Expenses

.......... ..........

1040

OMB No. 1545-0074

1040A

Attach to Form 1040, Form 1040A, or Form 1040NR.

1040NR

Department of the Treasury Internal Revenue Service (99) Name(s) shown on return

Information about Form 2441 and its separate instructions is at www.irs.gov/form2441.

2441

2012

Attachment Sequence No. 21 Your social security number

Part I

1

Persons or Organizations Who Provided the CareYou must complete this part. (If you have more than two care providers, see the instructions.)

(b) Address (number, street, apt. no., city, state, and ZIP code) (c) Identifying number (SSN or EIN) (d) Amount paid (see instructions)

(a) Care providers name

Complete only Part II below. No Did you receive dependent care benefits? Complete Part III on the back next. Yes Caution. If the care was provided in your home, you may owe employment taxes. If you do, you cannot file Form 1040A. For details, see the instructions for Form 1040, line 59a, or Form 1040NR, line 58a.

Part II

2

Credit for Child and Dependent Care Expenses

(a) Qualifying persons name First Last (b) Qualifying persons social security number (c) Qualified expenses you incurred and paid in 2012 for the person listed in column (a)

Information about your qualifying person(s). If you have more than two qualifying persons, see the instructions.

Add the amounts in column (c) of line 2. Do not enter more than $3,000 for one qualifying person or $6,000 for two or more persons. If you completed Part III, enter the amount from line 31 . . . . . . . . . . . . . . . . . . . . . . . . . . Enter your earned income. See instructions . . . . . . . . . . . . . . . If married filing jointly, enter your spouses earned income (if your spouse was a student or was disabled, see the instructions); all others, enter the amount from line 4 . . . . Enter the smallest of line 3, 4, or 5 . . . . . . . Enter the amount from Form 1040, line 38; Form 1040A, line 22; or Form 1040NR, line 37. . . . .

If line 7 is: But not over Over $015,000 15,00017,000 17,00019,000 19,00021,000 21,00023,000 23,00025,000 25,00027,000 27,00029,000

4 5 6 7 8

3 4 5 6

7 Enter on line 8 the decimal amount shown below that applies to the amount on line 7

If line 7 is: Decimal amount is .35 .34 .33 .32 .31 .30 .29 .28 Over But not over Decimal amount is .27 .26 .25 .24 .23 .22 .21 .20

$29,00031,000 31,00033,000 33,00035,000 35,00037,000 37,00039,000 39,00041,000 41,00043,000 43,000No limit

X.

9 10 11

Multiply line 6 by the decimal amount on line 8. If you paid 2011 expenses in 2012, see the instructions . . . . . . . . . . . . . . . . . . . . . . . . . Tax liability limit. Enter the amount from the Credit Limit Worksheet in the instructions. . . . . . . 10 Credit for child and dependent care expenses. Enter the smaller of line 9 or line 10 here and on Form 1040, line 48; Form 1040A, line 29; or Form 1040NR, line 46 . . . .

11

Form 2441 (2012)

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 11862M

Form 2441 (2012)

Page 2

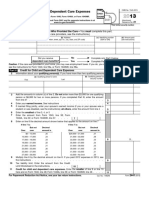

Part III

Dependent Care Benefits

12 Enter the total amount of dependent care benefits you received in 2012. Amounts you received as an employee should be shown in box 10 of your Form(s) W-2. Do not include amounts reported as wages in box 1 of Form(s) W-2. If you were self-employed or a partner, include amounts you received under a dependent care assistance program from your sole proprietorship or partnership . . . . . . . . . . . . . . . . . . 13 Enter the amount, if any, you carried over from 2011 and used in 2012 during the grace period. See instructions . . . . . . . . . . . . . . . . . . . . . . . 14 Enter the amount, if any, you forfeited or carried forward to 2013. See instructions 15 Combine lines 12 through 14. See instructions . . . . . . . . . . . . 16 Enter the total amount of qualified expenses incurred in 2012 for the care of the qualifying person(s) . . . 16 17 Enter the smaller of line 15 or 16 . . . . . . . . 18 Enter your earned income. See instructions . . . . 19 Enter the amount shown below that applies to you. If married filing jointly, enter your spouses earned income (if your spouse was a student or was disabled, see the instructions for line 5). If married filing separately, see instructions. 17 18 . . . . . .

12 13 14 ( 15

All others, enter the amount from line 18. 20 Enter the smallest of line 17, 18, or 19 . . . . . . 20 21 Enter $5,000 ($2,500 if married filing separately and you were required to enter your spouses earned income on line 19) . . . . . . . . . . . . . 21 22 Is any amount on line 12 from your sole proprietorship or partnership? (Form 1040A filers go to line 25.) No. Enter -0-. Yes. Enter the amount here . . . . . . . . . . . . . . . . . . . . 23 23 Subtract line 22 from line 15 . . . . . . . . . 24 Deductible benefits. Enter the smallest of line 20, 21, or 22. Also, include this amount on the appropriate line(s) of your return. See instructions . . . . . . . . . . . . . 25 Excluded benefits. Form 1040 and 1040NR filers: If you checked "No" on line 22, enter the smaller of line 20 or 21. Otherwise, subtract line 24 from the smaller of line 20 or line 21. If zero or less, enter -0-. Form 1040A filers: Enter the smaller of line 20 or line 21 . . 26 Taxable benefits. Form 1040 and 1040NR filers: Subtract line 25 from line 23. If zero or less, enter -0-. Also, include this amount on Form 1040, line 7; or Form 1040NR, line 8. On the dotted line next to Form 1040, line 7; or Form 1040NR, line 8, enter DCB. Form 1040A filers: Subtract line 25 from line 15. Also, include this amount on Form 1040A, line 7. In the space to the left of line 7, enter DCB . . . . . . . . . . . . . . 22

19

24

25

26

To claim the child and dependent care credit, complete lines 27 through 31 below.

27 Enter $3,000 ($6,000 if two or more qualifying persons) . . . . . . . . . . . . 28 Form 1040 and 1040NR filers: Add lines 24 and 25. Form 1040A filers: Enter the amount from line 25 . . . . . . . . . . . . . . . . . . . . . . . . . . . 29 Subtract line 28 from line 27. If zero or less, stop. You cannot take the credit. Exception. If you paid 2011 expenses in 2012, see the instructions for line 9 . . . . . 30 Complete line 2 on the front of this form. Do not include in column (c) any benefits shown on line 28 above. Then, add the amounts in column (c) and enter the total here. . . . . 31 Enter the smaller of line 29 or 30. Also, enter this amount on line 3 on the front of this form and complete lines 4 through 11 . . . . . . . . . . . . . . . . . . . . 27 28 29 30 31

Form 2441 (2012)

You might also like

- Child and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Document2 pagesChild and Dependent Care Expenses: (If You Have More Than Two Care Providers, See The Instructions.)Sarah KuldipNo ratings yet

- Amended Tax Return Form 1040X ExplainedDocument2 pagesAmended Tax Return Form 1040X ExplainedKel TranNo ratings yet

- F 1040 SaDocument1 pageF 1040 SaPrekelNo ratings yet

- Form 1040A Tax Credit DetailsDocument3 pagesForm 1040A Tax Credit DetailsYosbanyNo ratings yet

- Itemized Deductions Schedule ADocument2 pagesItemized Deductions Schedule Aljens09No ratings yet

- 1040x2 PDFDocument2 pages1040x2 PDFolddiggerNo ratings yet

- Alternative Minimum Tax IndividualsDocument2 pagesAlternative Minimum Tax IndividualshujiNo ratings yet

- Itemized Deductions: Medical and Dental ExpensesDocument1 pageItemized Deductions: Medical and Dental ExpensesnuseNo ratings yet

- Individual Tax Return Problem 2 Form 1040 Schedule ADocument1 pageIndividual Tax Return Problem 2 Form 1040 Schedule AHenry PhamNo ratings yet

- U.S. Nonresident Alien Income Tax Return: Please Print or TypeDocument5 pagesU.S. Nonresident Alien Income Tax Return: Please Print or TypepdizypdizyNo ratings yet

- Itemized Deductions: Medical and Dental ExpensesDocument1 pageItemized Deductions: Medical and Dental Expensesapi-173610472No ratings yet

- FTF1301242185129Document3 pagesFTF1301242185129Donna SchatzNo ratings yet

- Form 1040 Tax ReturnDocument2 pagesForm 1040 Tax ReturnHamzah B ShakeelNo ratings yet

- Example Tax ReturnDocument6 pagesExample Tax Returnapi-252304176No ratings yet

- F 1040 SaDocument1 pageF 1040 Sahgfed4321No ratings yet

- Foreign Tax Credit: A B C D eDocument2 pagesForeign Tax Credit: A B C D eSamer Mira BazziNo ratings yet

- Casualties and Thefts: or Business or For Income-Producing Purposes.)Document2 pagesCasualties and Thefts: or Business or For Income-Producing Purposes.)Marco Áureo ParraNo ratings yet

- F1040sa 2013Document2 pagesF1040sa 2013Sarah KuldipNo ratings yet

- M 1 PRDocument2 pagesM 1 PRAndy KrogstadNo ratings yet

- U.S. Individual Income Tax ReturnDocument2 pagesU.S. Individual Income Tax Returnapi-173610472No ratings yet

- Self-Employment Tax: Schedule SeDocument2 pagesSelf-Employment Tax: Schedule SeFahad Khan SaqibiNo ratings yet

- US Internal Revenue Service: f2441 - 1991Document2 pagesUS Internal Revenue Service: f2441 - 1991IRSNo ratings yet

- Household Employment Taxes: Schedule H (Form 1040) 44Document2 pagesHousehold Employment Taxes: Schedule H (Form 1040) 44api-253299751No ratings yet

- Additional Child Tax Credit: Schedule 8812Document1 pageAdditional Child Tax Credit: Schedule 8812Ishfaq Ali KhanNo ratings yet

- Schauer 2013 Tax ReturnDocument3 pagesSchauer 2013 Tax ReturnDetroit Free Press0% (1)

- 2011 Irs Tax Form 1040 A Individual Income Tax ReturnDocument3 pages2011 Irs Tax Form 1040 A Individual Income Tax ReturnscribddownloadedNo ratings yet

- U.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Document2 pagesU.S. Individual Income Tax Return: John Public 0 0 0 0 0 0 0 0 0 Jane Public 0 0 0 0 0 0 0 0 1Renee Leon100% (1)

- 1040 Tax Form SummaryDocument2 pages1040 Tax Form SummaryKevin RowanNo ratings yet

- Taxes Are FunDocument2 pagesTaxes Are Funlfoirirjrkjbghghg999No ratings yet

- 1040 Tax Return SummaryDocument2 pages1040 Tax Return SummaryLinda100% (2)

- Worksheet 1. Figuring Your Taxable Benefits: Keep For Your RecordsDocument1 pageWorksheet 1. Figuring Your Taxable Benefits: Keep For Your RecordsKelly Phillips ErbNo ratings yet

- Foreign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyDocument3 pagesForeign Earned Income: 34 For Use by U.S. Citizens and Resident Aliens OnlyballsinhandNo ratings yet

- 2441 PDFDocument2 pages2441 PDFCatalina GrigoreNo ratings yet

- FTF1327867575806Document3 pagesFTF1327867575806erzahler0% (1)

- 1040 Form Filing Status and DependentsDocument2 pages1040 Form Filing Status and DependentsAU Sharma0% (1)

- US Internal Revenue Service: F1040as2 - 1992Document2 pagesUS Internal Revenue Service: F1040as2 - 1992IRSNo ratings yet

- Form 1040Document3 pagesForm 1040Peng JinNo ratings yet

- Additional Child Tax Credit: Schedule 8812Document1 pageAdditional Child Tax Credit: Schedule 8812Jack MiguelNo ratings yet

- Schedule CB For Tax Year 2012Document2 pagesSchedule CB For Tax Year 2012Scott LieberNo ratings yet

- FTF1302745105156Document5 pagesFTF13027451051562sly4youNo ratings yet

- Chapter 12 TR Assignment Kelsey EwellDocument22 pagesChapter 12 TR Assignment Kelsey Ewellapi-272863459No ratings yet

- Individual Tax Return Problem 2 Form 4684Document3 pagesIndividual Tax Return Problem 2 Form 4684Henry PhamNo ratings yet

- f1040 Draft 2015Document3 pagesf1040 Draft 2015Anonymous IpryXQAKZNo ratings yet

- FD-Schedule C-Profit or Loss From Business (Sole Prop)Document2 pagesFD-Schedule C-Profit or Loss From Business (Sole Prop)Anthony Juice Gaston BeyNo ratings yet

- F 1040Document2 pagesF 1040Sue BosleyNo ratings yet

- Income Averaging For Farmers and Fishermen: Schedule J (Form 1040) 20Document2 pagesIncome Averaging For Farmers and Fishermen: Schedule J (Form 1040) 20pdizypdizyNo ratings yet

- US Internal Revenue Service: F1040as2 - 1994Document2 pagesUS Internal Revenue Service: F1040as2 - 1994IRSNo ratings yet

- Mikeandjennykelly@Gmail - Com 2011Document6 pagesMikeandjennykelly@Gmail - Com 2011Melanie RoseNo ratings yet

- f1040 PDFDocument3 pagesf1040 PDFjc75aNo ratings yet

- F 1040 NRDocument5 pagesF 1040 NRsrao_919525No ratings yet

- US Internal Revenue Service: f6251 - 2000Document2 pagesUS Internal Revenue Service: f6251 - 2000IRSNo ratings yet

- Tax Return ScribdDocument5 pagesTax Return ScribdYvonne TanNo ratings yet

- File Self-Employment Tax Schedule SEDocument2 pagesFile Self-Employment Tax Schedule SEpdizypdizyNo ratings yet

- Tax Return ProjectDocument62 pagesTax Return ProjectGiovaniPerez100% (1)

- 2013 Form IL-1040: Personal InformationDocument2 pages2013 Form IL-1040: Personal Informationvimal_pro222-scribdNo ratings yet

- Profit or Loss From Business: Schedule C (Form 1040) 09Document2 pagesProfit or Loss From Business: Schedule C (Form 1040) 09Dunk7No ratings yet

- US Internal Revenue Service: f8801 - 2001Document4 pagesUS Internal Revenue Service: f8801 - 2001IRSNo ratings yet

- Senior Circuit Breaker 2014Document2 pagesSenior Circuit Breaker 2014Scott LieberNo ratings yet

- 1040 Exam Prep: Module I: The Form 1040 FormulaFrom Everand1040 Exam Prep: Module I: The Form 1040 FormulaRating: 1 out of 5 stars1/5 (3)

- Super Bowl - New American Lecture - 2015-2016Document23 pagesSuper Bowl - New American Lecture - 2015-2016api-173610472No ratings yet

- Marketing - Swot Notes - Guided NotesDocument3 pagesMarketing - Swot Notes - Guided Notesapi-173610472No ratings yet

- Chap 4 - Section 3 - Power PointDocument19 pagesChap 4 - Section 3 - Power Pointapi-173610472No ratings yet

- 8 2 Guided NotesDocument2 pages8 2 Guided Notesapi-173610472No ratings yet

- Cause Branding Its Impact On Coporate Reputation - Guided NotesDocument5 pagesCause Branding Its Impact On Coporate Reputation - Guided Notesapi-173610472No ratings yet

- Chap 3 - Understanding The Marketplace and Consumers - JeopardyDocument51 pagesChap 3 - Understanding The Marketplace and Consumers - Jeopardyapi-173610472No ratings yet

- Chapter 3 Discussion Questions Review - BlankDocument4 pagesChapter 3 Discussion Questions Review - Blankapi-173610472No ratings yet

- Chap 3 - Understanding The Marketplace and Consumers - JeopardyDocument51 pagesChap 3 - Understanding The Marketplace and Consumers - Jeopardyapi-173610472No ratings yet

- Lowry - OrganizerDocument2 pagesLowry - Organizerapi-173610472No ratings yet

- Credit VocabularyDocument2 pagesCredit Vocabularyapi-173610472No ratings yet

- Jeopardy Answer Sheet - Chapter 3 - MarketingDocument2 pagesJeopardy Answer Sheet - Chapter 3 - Marketingapi-173610472No ratings yet

- 8 1 Guided NotesDocument3 pages8 1 Guided Notesapi-173610472No ratings yet

- Simple and Compound InterestDocument13 pagesSimple and Compound Interestapi-173610472No ratings yet

- 401k - 403b Presentation - 2012-2013Document17 pages401k - 403b Presentation - 2012-2013api-173610472No ratings yet

- 8 Powerpoint Guided NotesDocument79 pages8 Powerpoint Guided Notesapi-173610472No ratings yet

- Bank Reconciliation QuestionsDocument1 pageBank Reconciliation Questionsapi-173610472No ratings yet

- Cause Branding and Its Impact On Corporate Reputation 97 - 2003Document6 pagesCause Branding and Its Impact On Corporate Reputation 97 - 2003api-173610472No ratings yet

- Chapter 8 Terms On InvestingDocument2 pagesChapter 8 Terms On Investingapi-173610472No ratings yet

- Super Bowl Guided Organizer - 2013-2014Document7 pagesSuper Bowl Guided Organizer - 2013-2014api-173610472No ratings yet

- Compound Interest - PracticeDocument2 pagesCompound Interest - Practiceapi-173610472No ratings yet

- Simple and Compound Interest Review ActivityDocument5 pagesSimple and Compound Interest Review Activityapi-173610472No ratings yet

- Rule of 72Document1 pageRule of 72api-173610472No ratings yet

- Compound InterestDocument2 pagesCompound Interestapi-173610472No ratings yet

- Bank Reconciliation Questions KeyDocument2 pagesBank Reconciliation Questions Keyapi-173610472No ratings yet

- Simple InterestDocument4 pagesSimple Interestapi-173610472No ratings yet

- Bank Reconciliation - Lawrence - AnnaDocument2 pagesBank Reconciliation - Lawrence - Annaapi-173610472No ratings yet

- Simple InterestDocument2 pagesSimple Interestapi-173610472No ratings yet

- Bank Reconciliation - Chris - JordanDocument2 pagesBank Reconciliation - Chris - Jordanapi-173610472No ratings yet

- Bank Reconciliation - Johnny JonesDocument1 pageBank Reconciliation - Johnny Jonesapi-173610472No ratings yet

- Bank Reconciliation - Seymour - DarceyDocument2 pagesBank Reconciliation - Seymour - Darceyapi-173610472No ratings yet

- AC & Crew Lists 881st 5-18-11Document43 pagesAC & Crew Lists 881st 5-18-11ywbh100% (2)

- 6.variable V Variable F Control - Braking, Closed Loop ControlDocument25 pages6.variable V Variable F Control - Braking, Closed Loop ControlJanani RangarajanNo ratings yet

- Analyzing Transactions To Start A BusinessDocument22 pagesAnalyzing Transactions To Start A BusinessPaula MabulukNo ratings yet

- A Review Article On Integrator Circuits Using Various Active DevicesDocument7 pagesA Review Article On Integrator Circuits Using Various Active DevicesRaja ChandruNo ratings yet

- Managing Director Insurance M&A Advisory in Hong Kong Resume John SpenceDocument3 pagesManaging Director Insurance M&A Advisory in Hong Kong Resume John SpenceJohnSpence2No ratings yet

- DPS Chief Michael Magliano DIRECTIVE. Arrests Inside NYS Courthouses April 17, 2019 .Document1 pageDPS Chief Michael Magliano DIRECTIVE. Arrests Inside NYS Courthouses April 17, 2019 .Desiree YaganNo ratings yet

- Perilaku Ramah Lingkungan Peserta Didik Sma Di Kota BandungDocument11 pagesPerilaku Ramah Lingkungan Peserta Didik Sma Di Kota Bandungnurulhafizhah01No ratings yet

- Case Study - Succession LawDocument2 pagesCase Study - Succession LawpablopoparamartinNo ratings yet

- E Purjee (New Technology For The Sugarcane Farmers)Document4 pagesE Purjee (New Technology For The Sugarcane Farmers)Mohammad Shaniaz IslamNo ratings yet

- Amadora V CA Case DigestDocument3 pagesAmadora V CA Case DigestLatjing SolimanNo ratings yet

- Latest Ku ReportDocument29 pagesLatest Ku Reportsujeet.jha.311No ratings yet

- Reading and Writing Skills: Quarter 4 - Module 1Document16 pagesReading and Writing Skills: Quarter 4 - Module 1Ericka Marie AlmadoNo ratings yet

- How To Download Gateways To Democracy An Introduction To American Government Book Only 3Rd Edition Ebook PDF Ebook PDF Docx Kindle Full ChapterDocument36 pagesHow To Download Gateways To Democracy An Introduction To American Government Book Only 3Rd Edition Ebook PDF Ebook PDF Docx Kindle Full Chapterandrew.taylor131100% (22)

- Comparing and contrasting inductive learning and concept attainment strategiesDocument3 pagesComparing and contrasting inductive learning and concept attainment strategiesKeira DesameroNo ratings yet

- Onkyo TX NR555 ManualDocument100 pagesOnkyo TX NR555 ManualSudhit SethiNo ratings yet

- 001 Joseph Vs - BautistacxDocument2 pages001 Joseph Vs - BautistacxTelle MarieNo ratings yet

- Unitrain I Overview enDocument1 pageUnitrain I Overview enDragoi MihaiNo ratings yet

- Whois contact details list with domainsDocument35 pagesWhois contact details list with domainsPrakash NNo ratings yet

- NAME: - CLASS: - Describing Things Size Shape Colour Taste TextureDocument1 pageNAME: - CLASS: - Describing Things Size Shape Colour Taste TextureAnny GSNo ratings yet

- Effective Instruction OverviewDocument5 pagesEffective Instruction Overviewgene mapaNo ratings yet

- All About Linux SignalsDocument17 pagesAll About Linux SignalsSK_shivamNo ratings yet

- Business Data Communications and Networking 13Th Edition Fitzgerald Test Bank Full Chapter PDFDocument40 pagesBusiness Data Communications and Networking 13Th Edition Fitzgerald Test Bank Full Chapter PDFthrongweightypfr100% (12)

- Rainin Catalog 2014 ENDocument92 pagesRainin Catalog 2014 ENliebersax8282No ratings yet

- USP 11 ArgumentArraysDocument52 pagesUSP 11 ArgumentArraysKanha NayakNo ratings yet

- HLT42707 Certificate IV in Aromatherapy: Packaging RulesDocument2 pagesHLT42707 Certificate IV in Aromatherapy: Packaging RulesNilamdeen Mohamed ZamilNo ratings yet

- Shilajit The Panacea For CancerDocument48 pagesShilajit The Panacea For Cancerliving63100% (1)

- Intermediate Unit 3bDocument2 pagesIntermediate Unit 3bgallipateroNo ratings yet

- APP Eciation: Joven Deloma Btte - Fms B1 Sir. Decederio GaganteDocument5 pagesAPP Eciation: Joven Deloma Btte - Fms B1 Sir. Decederio GaganteJanjan ToscanoNo ratings yet

- Presentations - Benefits of WalkingDocument1 pagePresentations - Benefits of WalkingEde Mehta WardhanaNo ratings yet